#Management of personal finance

Explore tagged Tumblr posts

Text

Management of personal finance

Introduction:In today's fast-paced world, managing your personal finances is more important than ever. Personal financial management refers to the process of effectively managing your financial resources to achieve your financial goals and secure your future. Whether it's saving for retirement, buying a home, or simply living comfortably, sound financial management practices can make a big difference.The Importance of Managing Personal Finances:Effective personal financial management is critical for a number of reasons.Financial Stability: It provides stability by helping you budget, manage debt and build an emergency fund for unexpected situations. Expense Goals Attainment: With the right management, you can set and achieve financial goals, whether they are short-term goals like buying a new car or long-term goals like a comfortable retirement.Less stress: Good financial management reduces stress by providing control over finances and peace of mind about the future.Wealth Building: It lays the foundation for building wealth through smart investing, saving and spending habits.Tips for effective personal finance management:Budgeting:Track your income and expenses to understand where your money is going.Set aside money for essentials like housing, groceries and services, as well as discretionary spending and savings.Review your budget regularly and adjust it according to changes in income or expenses.Manage debt wisely:Prioritize paying off high-interest debt, such as credit card balances, to avoid accumulating unnecessary interest.Consider debt consolidation or negotiating with creditors to lower interest rates or payment amounts.Avoid taking on new debt unless absolutely necessary and make sure it fits your budget.Build an emergency fund:Try to save enough to cover 3-6 months of living expenses in the event of job loss, medical emergencies or other contingencies.Keep your emergency fund in a separate, easily accessible account, such as a high-quality savings account.Save and invest regularly:Make a habit of saving a portion of your income every month, even if it is a small amount.Take advantage of employer-sponsored retirement plans like 401(k)s and IRAs to save for retirement in a tax-efficient way.Diversify your investment portfolio to spread risk and maximize long-term returns.Live within your means:Avoid overspending by distinguishing between wants and needs and prioritizing spending on essentials.Look for ways to cut costs, such as cooking at home, shopping or eliminating unnecessary orders.Practice delayed gratification by saving for big purchases instead of relying on credit.Stay informed:Educate yourself on personal finance topics such as investing, taxes and insurance so you can make informed decisions.Stay informed about changes in financial laws and regulations that may affect the economy.Consider consulting a financial professional, such as a Chartered Financial Planner, for personal guidance.Conclusion:Mastering personal finance management isn't just about making money; it's about making smart choices with the money you have. By budgeting, managing debt, saving and investing regularly, and living within your means, you can take control of your financial future and work towards your goals. Remember, financial freedom is attainable with the right knowledge and discipline. Start managing your personal finances effectively today and pave the way for a brighter tomorrow.

#personal finance management#personal finance tips#Management of personal finance#Importance of personal finance management

2 notes

·

View notes

Text

₊˚⊹ ᰔ a guide to maintaining financial wellness ᝰ.ᐟ

having good money habits can be insanely difficult. i know i personally struggle with impulsive spending, and i’m sure we’ve all fallen victim to the “i’m just treating myself” mindset. financial stress and even financial depression can feel so daunting and overwhelming, so i’m here to help you guys (and myself as well) manage your money better!

let’s begin !!

ᝰ.ᐟ set aside funds

it’s important that when every paycheck hits your bank account to immediately set aside some funds into your savings account. whether it’s 10-20% of your paycheck or even $20-$100, set aside some money into your savings!

it also might help to have that savings account be locked so that you can still put money in, but you can’t take money out. let that savings amount pile up and don’t touch it until you’re absolutely ready to make that big purchase!

ᝰ.ᐟ set aside any cash

get a piggybank or even one of those money organizing binders to set aside any cash that may come your way! keep that cash away from your wallet so you won’t be tempted to use it in any outside purchases. and, same as the first point, that cash will start to pile up!

ᝰ.ᐟ purchase needs rather than wants

let’s start getting out of that “i’m gonna treat myself” mindset!! while it’s nice to treat yourself, we really should only be doing it every once in a while. we can also find different ways of treating/rewarding ourselves that don’t require spending any money! (i can make a separate blog post on this if you guys would like!)

especially when you’re trying to save up for school, a new apartment, a new car, or whatever it may be, it’s really important to keep your purchases to only things that are absolutely necessary.

ᝰ.ᐟ keep track of automatic payments

especially if you have a subscription of any kind, keep track of when those automatic deductions from your account are happening. make note of when your next billing date is and how much you’re being charged for each month/year.

this would also be a good way to determine what subscriptions you really need/want to keep and which ones you can do without and unsubscribe to! i did a full cleanse of my subscriptions list and kept the ones i definitely wanted to keep. sometimes you never really realize how much money your losing when you’re subscribed to things that have no use to you anymore!

ᝰ.ᐟ plan accordingly

when your paycheck comes in and you have all these payments that are coming up yet you still need to buy groceries or get gas or whatever, make sure to plan your funds ahead of time! this way, it’ll help you budget for your groceries & any other necessities as well as help you determine how much money you can set aside into your savings and even calculate how much extra funds you might have to spend on for more personal things!

𝜗𝜚 final notes 𝜗𝜚

don’t let these tips make you feel like you can’t treat yourself to something! as i mentioned earlier, you can still treat yourself to nice things, but it might be best to do it once in a while! i know most of us associate success with money, and to reach success with money we have to learn to be more mindful about how we spend our money and how we manage it.

live and love, babe.

sincerely, juno ⭑.ᐟ

#milkoomis#girlblogger#girlblogging#it girl#that girl#girl blog aesthetic#it girl tips#becoming that girl#finance#money#money management#money manifestation#money saving#spending habits#personal growth#self improvement

186 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

853 notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

77 notes

·

View notes

Text

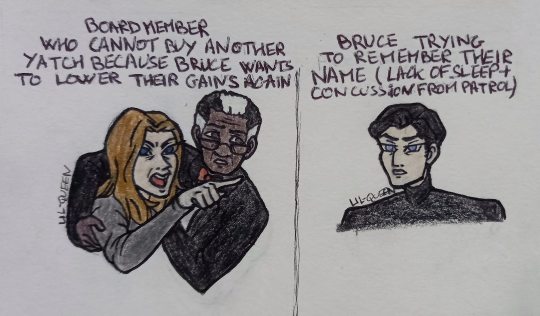

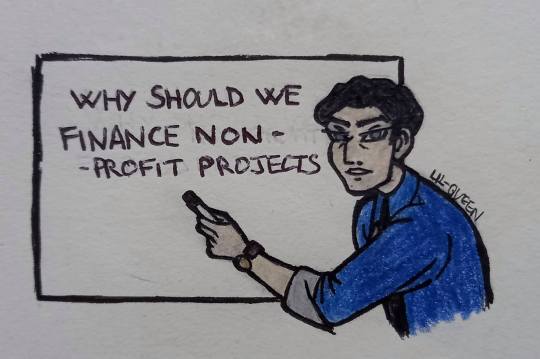

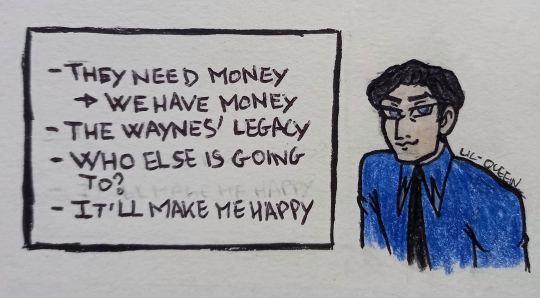

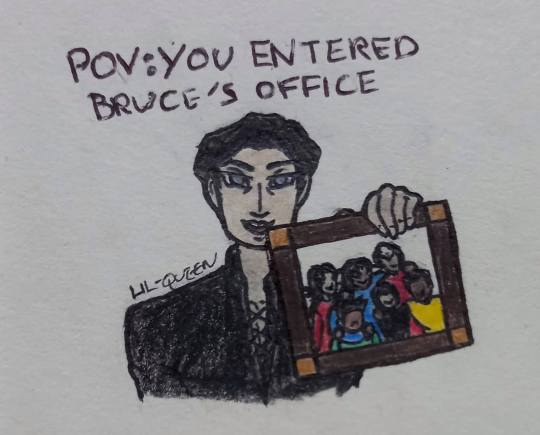

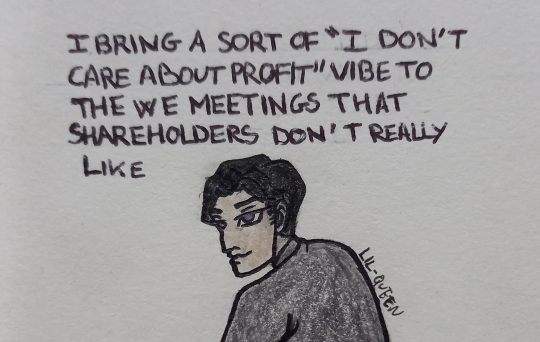

Bruce: The most Nepo Baby of the Nepo Babies

Type of day when he pretends he has a hangover to not deal with their bs. The peace inside the company is all Lucius works.

He does not accept criticism.

The Gotham Knights' hoodie is Dick's or Jason's, and was in the kitchen that morning when Bruce ran late for the meeting.

Rip to the (paid) intern that was terrified to bring documents to THE Bruce Wayne and found themselves stuck in his office, listening to him telling stories about his kids for hours.

"I don't understand why we need to make more money, we're already rich." (he's talking about the highers up)

Just a bunch of doodled memes of how I believe Bruce Wayne acts with his company. He is not a capitalist, he doesn't care about making more profit and doesn't understand finance.

If you think Brucie Wayne is just an act, talk to Lucius Fox, who has to endure Bruce' antics at WE. The man whines like a child about having to speak to any shareholders, he has to be dragged to meetings. In Bruce's eyes, his job is "using the company's money to improve the people's life", "talking about his kids" and "being a pain in the ass of the highers up". If someone is trying to kill Bruce Wayne, 50% of chances some WE shareholder or board member ordered the kill because they are tired of him stopping them from playing the game of capitalism. His other employees love him, tho. There aren't janitors as well treated than the ones working for Wayne.

#bruce wayne#batman#lucius fox#batfam#dc comics#fanart#my art#doodle#traditional art#colored pencils#do not criticize as the effort put in this is minimum it's for fun#also my knowledge of how managing a company and shareholders is nonexistent#but anyway#promoting my “corporate goth” bruce wayne agenda#I'm treating him like a dress up doll#I want to put him in so many outfit boo dc for making him dress boringly#who is playing a tree? It's up to you#also yes the Gotham Knights symbol have bat ears gothamites are proud of being the city of the bat#also promoting my “Bruce dislikes and doesn't understand finance” agenda he would not be in charge of a company if he wasn't a nepo baby#personally I think he would work with kids but that's another subject

93 notes

·

View notes

Text

I won't trauma dump, but I will let myself lore dump a little as a treat.

The man who hurt me thought he was so important in the grand scheme of things that he was convinced that he, a Midwestern small-city police chief and mayor, had a lot of Enemies, he absolutely needed a full-time personal policeman bodyguard/driver from the city's police force, and also he was on Al Qaeda's targeted hit list. Al Qaeda, to no one's surprise, neither confirmed nor denied.

He made them install x-ray and metal detector machines in our tiny little city hall that, despite being the mayor of, he couldn't manage to come in to for reliable work hours ever. For years, he was making over 16,000 dollars more per year than the mayor of St. Louis, not counting the city car or other benefits. Bonkers yonkers McGee over here

#shh katie#personal#there. none of this is anything too terrible#the mayor of our town is basically a solo ruler almost because of the charter/etc.#so it was wild.#and that's why he could do a lot of what he did#there was a lot of flagrant finance and nepotism and other issues going on that i wil not be going into#but you can imagine#let's just say the city council even had to manage to change laws after some of the things he did to make it so he couldn't again lol#uhhhh just to be safe#tw: terrorism#I guess?

29 notes

·

View notes

Note

Wait, wait, do you think Killer would be amazing at piker or gambling in general? The poker face, his smarts, his way to manipulate?

Or do you think he's smart enough to not do it? Only asking because I'm listening to a song about gambling...

Killer would definitely gamble. Why? Because why not. Why would he care. He doesn’t get paid, it’s not his money he’s losing lmao. He wants to try something new. And it’s not like he cares about consequences.

He wouldn’t care about losing or winning money, I don’t think. He just cares about either getting to fuck someone over by losing their money, or taking someone else’s money. It’s a new game to win, and a way to develop and sharpen useful skills.

{ @undertale-person }

#howlsasks#undertale-person#killer sans#utmv#sans au#sans aus#killer!sans#killertale#bad sanses#bad sans gang#nightmare’s gang#nightmares gang#utmv headcanons#utmv hc#killertale sans#undertale something new#undertalesomethingnew#something new sans#something new#something new au#cw gambling#I have no actual idea how poker or gambling work lmao#but killer likely hasnt placed any value in g or money in who knows how long#he just steals what he wants or needs or manipulates or used someone else’s g/money#he’s gonna have such a hard time with money in his good ending probably#color would probably have to manage their finances cuz killer doesn’t care#color spectrum duo#color sans#color!sans#colour sans

28 notes

·

View notes

Text

important part of my relationship is that my girlfriend isn't subscribed to money stuff, so when we walk to work together i can just describe really good money stuff bits to them

#Real Big Computer Has Never Been Tried.#then in return they explain facts they learned from the odd lots episodes i found too boring to listen to#you can really understand our fundamentally different natures this way#my girlfriend likes things in proportion to how useful and helpful they are which is why they do vaccine design research#and read about cobalt exports and climate energy policy as their personal economics information hobby#i mostly like things in proportion to how conceptually satisfying and fun they are to think about#which is why im studying an application-free cell bio question that is essentially 'Wouldnt It Be Cool If This Worked'#and the finance-related things i read about r hilarious crypto exploits and the fact that everything is securities fraud.#now of course my girlfriend also possesses gr8 aesthetic sensibilities and i guess i managed to have useful practical outputs#when i was a union contract writer that one time#but these are our respective instinctual tendencies.#box opener#girlfriend tag

10 notes

·

View notes

Text

So I used a personal finance management app that aggregates all the accounts I have in one place. The company that owns it shut it down at the end of the last year and transitioned it to another site they own. It does absolutely fucking nothing that I need it to do, which includes:

show me balances from all my connected accounts

track spending

sort/recategorize/tag transactions

set budgets

Literally the only functionality it retains is the ability to sell me shit. Which I was fine with (lights gotta stay on somehow) when I got use out of the site, but now it has been enshittified.

The other thing this experience has reminded me of is you should find a service that aggregates all your bank accounts. Empower is the one I'm using because it's got the same functionality as Mint, but there are other options*. Your bank/credit union might also offer a similar service.

It's a lot like using a password manager--it's a giant pain to set up initially, but it will ultimately make your life so much easier. All your account balances in one place** so you don't have to log in to each individual site to check! A unified view of your finances!

It is, of course, not a solution for not having enough money, but clarity on your purchases and subscriptions can help you identify things you don't want/need, as well as overcharges and discrepancies.

I know better money management is a popular new year's resolution, and this is a pretty easy step towards that. You don't have to add all your accounts at once. But I find it satisfying to see the picture become clearer. Also, graphs.

--

* Search "mint pfm alternatives" if you want to know more. Most options I found were paid but maybe you're a person who would shell out for useful features. Monarch looks amazing for people with shared finances.

** It's totally safe. I deal with this shit for a living. I can explain more if you want but it's boring.

26 notes

·

View notes

Text

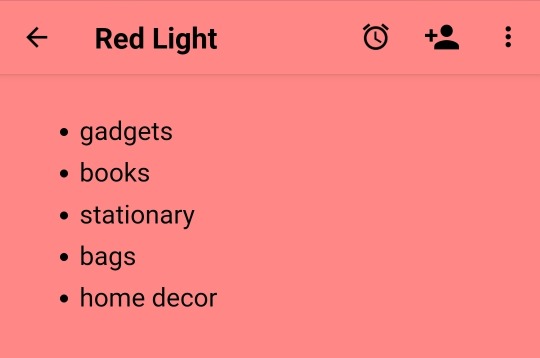

My low buy 2024 rules.

Green Light - buy when you run out

Yellow Light- when money is saved up or will need to replace

Red Light - non-negotiable not allowed

30 notes

·

View notes

Text

Asset Amity: Your Partner in Financial Growth

At Asset Amity, we believe that financial knowledge is the key to unlocking a prosperous future. Our goal is to provide people and organizations with the knowledge and resources necessary to make wise financial decisions. Our content is made to be easily accessible, educational, and entertaining, regardless of your level of expertise with investing or where you are in your financial journey.

#Asset Amity#wealth management#financial planning#investment strategies#asset growth#financial consulting#portfolio management#personal finance#retirement planning#asset allocation#financial advice#trust and integrity

4 notes

·

View notes

Text

I see a disturbing number of people, mostly millennials, these days, who have significant incomes and are starting to amass significant savings, who have terrible financial management skills. People who live at home with parents and get a full time job can accumulate money really fast. A lot of people are letting huge amounts of money, like sometimes as much as $20,000 or more, accumulate in checking accounts where it is earning either no interest or negligible interest.

Because inflation is high (over 3% these days), you are effectively losing money when it sits there. Also you're allowing the bank to profit off it; it's lending your money out to other people, often at interest rates as high as 6-7% or more, and it's not paying you for it.

If you have more than maybe around $3000 dollars in an account, you want that money earning interest. Here are things you can do to earn more from your money:

Open a savings account at a higher yield. Go to a different bank if necessary. CIT Bank has rates around 5% these days.

Pay off high interest rate debt but not low-interest rate debt. If the interest rate is above about 7-8% definitely make it a priority to pay it off ASAP. If it is above 5% it is still better to pay it off than to sit on your money. If it is much below 5%, pay it off as slowly as possible (minimum payment only) because there are risk-free ways to earn more interest on your money.

If you don't need the money in the short-term, consider a CD (Certificate of Deposit) which offers a fixed interest rate over a certain time. Often you can get a slightly higher rate by tying your money up for 3 months or 6 months or sometimes even longer. These are good options if you have a specific expenditure in your future, like perhaps moving or buying a home, but you know it won't happen until after a certain date.

Open a brokerage account. Brokerage accounts allow you to buy and sell investments such as stocks, mutual funds, or bonds, which include CD's from banks as well as treasury and municipal bonds and corporate bonds. You get more options for buying CD's (i.e. you can compare many different banks side-by-side, buy CD with the best rate, and manage multiple CD's within a single interface.) Most brokerage accounts have no fees and typically no or very low minimum investments. There is no reason not to have one if you have a few thousand dollars.

In a brokerage account, buy a money market mutual fund. Look for one with no load and no transaction fee, a high yield, and a low expense ratio, and a fixed share price of $1 per share. My two favorite are SWVXX and SNSXX. SWVXX has a higher yield (about 5.19%) whereas SNSXX has a lower yield (just over 5%) but is non-taxable on state income taxes, so SNSXX is a better choice if you have a high state tax rate, otherwise SWVXX is better.

Consider opening a Roth IRA if you haven't, and then, if able, contribute the maximum amount each year. You are allowed to make a contribution that counts towards the previous year, up until the tax filing deadline of the current year. So for example today it is Mar. 14th, 2024, so you can open a Roth IRA today and contribute the max ($6,500) for the 2023 year and also the max ($7,000) for 2024, for a total of $13,500. The main advantage of a Roth IRA is that the money in them can grow tax-free. Roth IRA's benefit anyone able to have one (the richest people are not allowed to contribute to them) and are especially important for people who are self-employed, change jobs a lot, or never work full-time, so they don't have a consistent employee-provided retirement plan.

Consider investing in stocks. Stocks are riskier (in that their price changes, and you can lose money when investing in them), but tend to have a higher yield than savings and money market accounts and funds. The simplest way to buy stocks is to buy an ETF (exchange-traded-fund). I recommend buying one that follows the S&P 500 and has a low expense ratio like SPY or VOO. Whatever you buy, reinvest the dividends and let it grow, contribute a little money every year so are putting in money even in years the market is down. On average you get about a 10% return in the market but it is unpredictable and you will lose in some years, but that's okay, you're not retiring for many decades and the money will have grown a lot by then.

There are options regardless of your risk profile. It is throwing your money away to let a lot of money sit in a checking account. At a bare minimum, go for a high-yield savings account, CD, or better yet get a brokerage account, put it in high-yield money market funds like SWVXX, shop around for CD's or other bonds with the highest rates, and if you are able to tolerate some risk and want a higher return, consider putting some money in more aggressive investments like stocks.

I am 100% for tax reform and other reform to curb the extreme concentration of wealth in the hands of a few, but it's also important to take your financial situation into your own hands. Get financially comfortable. Get a stake in the US economy. Empower yourself so you can live better and help your family, friends, and the causes you care about.

13 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

524 notes

·

View notes

Text

Personal Loan Pitfalls to Avoid in 2025

A personal loan can be a great financial tool when used wisely, offering quick access to funds for emergencies, home renovation, education, or debt consolidation. However, many borrowers make avoidable mistakes that lead to higher costs, financial stress, and repayment issues.

To ensure you make the most of a personal loan in 2025, let’s explore the common pitfalls to avoid and the best strategies to manage your loan effectively.

🔗 Looking for a Personal Loan? Apply Here: Check Personal Loan Options

1. Borrowing More Than You Can Afford

One of the biggest mistakes borrowers make is taking a loan amount higher than their repayment capacity.

✔ Solution: Always assess your finances and ensure your EMIs do not exceed 30-40% of your monthly income.

🔗 Check Affordable Loan Options:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

2. Ignoring Interest Rates & Loan Terms

Many borrowers overlook the actual cost of borrowing by not comparing interest rates, fees, and loan tenures.

✔ Solution: Compare interest rates, processing fees, and hidden charges before finalizing a lender.

🔗 Best Personal Loans with Low Interest Rates:

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

3. Overlooking the Impact of a Low Credit Score

Your credit score directly affects your loan approval and interest rates. A low credit score can lead to loan rejection or higher interest costs.

✔ Solution: Maintain a credit score of 700+ by making timely payments and avoiding unnecessary debt.

4. Falling for Pre-Approved Loan Scams

Many fraudsters send fake pre-approved loan offers that require advance payments before disbursing the loan.

✔ Solution: Always apply for loans through official bank websites or verified financial institutions.

🔗 Apply for a Personal Loan from Trusted Lenders:

Axis Finance Personal Loan

5. Not Reading Loan Terms & Hidden Fees

Many borrowers focus only on the interest rate and ignore charges such as: ✔ Processing Fees ✔ Prepayment Penalties ✔ Late Payment Charges

✔ Solution: Read the loan agreement carefully and ask about hidden charges before signing.

6. Choosing a Longer Tenure Without Considering Interest Costs

A longer loan tenure reduces your EMI, but it significantly increases the total interest paid over time.

✔ Solution: Choose the shortest tenure possible that allows comfortable EMI payments.

7. Defaulting on EMI Payments

Missing EMIs can lead to: ❌ Penalty charges ❌ A lower credit score ❌ Legal action in extreme cases

✔ Solution: Set up auto-debit for EMIs and maintain an emergency fund for loan repayments.

🔗 Learn How to Set Up Auto-Debit for Loan EMIs: Check Loan Repayment Options

8. Using Personal Loans for Non-Essential Expenses

Avoid using personal loans for: ❌ Luxury vacations ❌ Gambling or risky investments ❌ Unplanned shopping sprees

✔ Solution: Use personal loans only for necessary expenses like medical emergencies, home improvement, or debt consolidation.

9. Not Exploring Balance Transfer Options

If you already have a high-interest personal loan, you can transfer it to another lender offering a lower interest rate.

✔ Solution: Consider a personal loan balance transfer to reduce your EMI burden.

🔗 Best Lenders for Balance Transfers:

InCred Personal Loan

10. Applying for Multiple Loans Simultaneously

Multiple loan applications can: ❌ Lower your credit score ❌ Make lenders view you as a high-risk borrower

✔ Solution: Compare lenders carefully and apply for only one loan at a time.

11. Not Checking Prepayment & Foreclosure Charges

Some lenders charge high penalties for prepayment or foreclosure, making early repayment expensive.

✔ Solution: Choose a lender that offers low or no prepayment penalties.

12. Relying on Unverified Lenders or Loan Apps

There are many fraudulent loan apps that charge excessive interest rates and misuse borrower data.

✔ Solution: Apply only through recognized banks, NBFCs, or verified fintech platforms.

🔗 Apply Safely for a Personal Loan Here: Check Verified Loan Options

Final Thoughts: Avoid These Mistakes for a Smart Borrowing Experience

A personal loan is a valuable financial tool when used responsibly. Avoiding these common pitfalls will help you save money, protect your credit score, and reduce financial stress in 2025.

Key Takeaways:

✔ Borrow within your repayment capacity ✔ Compare interest rates & hidden charges before applying ✔ Pay EMIs on time to avoid penalties ✔ Beware of loan scams and fake lenders ✔ Use personal loans only for essential needs

🔗 Looking for a Reliable Personal Loan? Apply Here: Check Personal Loan Offers

By following these tips, you can make smarter financial decisions and ensure a hassle-free borrowing experience in 2025!

#Personal loan pitfalls to avoid in 2025#Common mistakes when taking a personal loan#Personal loan mistakes borrowers make#How to avoid personal loan scams in 2025#Things to check before taking a personal loan#finance#personal loan online#loan services#personal loans#nbfc personal loan#bank#fincrif#personal loan#personal laon#loan apps#fincrif india#Personal loan repayment mistakes#Hidden charges in personal loans#Best practices for personal loan management#Why personal loans get rejected#Personal loan EMI management tips#How to compare personal loan interest rates#Personal loan default consequences#Loan balance transfer benefits#How to reduce personal loan EMI burden#Personal loan credit score impact#Fake loan approval scams#Should you prepay a personal loan?#Personal loan tenure selection tips#Loan agreement hidden clauses

2 notes

·

View notes

Text

hahaha no i see leftist influencers saying "poor immigrants didn't vote for these policies, it was the rich ones who won't be affected"

babes, i know what the dem ground game in nyc (specifically bk/queens) saw at least with the chinese american community, cause when i was talking to two local reps who were chinese/taiwanese american, they were basically frothing at the mouth asking for me to exchange personal contacts when i mentioned my husband is fluent in fuzhounese not just mandarin and is willing to canvass locally in asian neighborhoods

the sheer amount of misinformation going on in those areas of the city (that people fell for most importantly, out of greed) is the problem.....

the working poor immigrants were told a bunch of lies about other races immigration to make each other swing rightward like crabs in a bucket, so they... can bite each other's dicks off?

#personal#i love the poorly educated ....as he said#husband tried explaining the tariffs to his parents cause he's an IMPORTS MANAGER????????#and the propaganda told them ''he's not using his finance degree and doesn't know what he's saying#cause if he was he'd be able to afford gifting u 2 lv's a month in filial payments and you'd live rich''#YOU CAN'T FIX ''IM OWED STIMMIES'' being the fucking political ideology of the /RIGHT/ ??????

4 notes

·

View notes

Text

youtube

Achieve Financial Freedom: Your Path to Wealth & Independence"

Are you ready to take control of your finances and unlock the path to true financial freedom? In this video,we dive into the essential steps you can take to build wealth, eliminate debt, and secure long-term financial independence. Whether you're just starting out or looking to refine your strategies, this guide will give you actionable advice on budgeting, investing, and creating passive income streams. Don't wait—begin your journey to financial freedom today!

#financial freedom#wealth building#personal finance#financial independence#passive income#budgeting tips#money management#debt-free living#financial goals#wealth creation#financial advice#Youtube

2 notes

·

View notes