#retirement planning

Explore tagged Tumblr posts

Text

#type o negative#peter steele#peter ratajczyk#music video#my girlfriend's girlfriend#1996#october rust#goth#gothic#metal#90s#gothic metal#ton#green man#steeleheads#💚#type o negative forever#meme#humor#retirement planning#lol

58 notes

·

View notes

Text

Hey everyine great news! My drop shiopping courses have been enough of a scusess tbat the

33 slurp juices remain. Your mission is to eliminate all of them before they can combine with an astro ape and mint a new astro ape

NFT game is back on! And there’s even better news!!!

Just ship a dead rat to 38.89679° N, 77.03601° W for a big surprise!!! Send me a pic of the surprise and you’ll even get a jared leto joker nft valued at 10 million billion dogecoin on us!!!

But hurry! This once in a lifetime opportunity is going away flr goot in just [function.timne+1]!!! Be sure to get in on the ground floor because forget the moon, we’re going all the way to freaking mars!!!

Did YOU seee the hiddem nessage??? Be sure to read the post thoroughly for any clues you might have missed!!!

#to the moon#nft#bitcoin#blockchain#crypto#cryptocurrency#web 3.0#binance#cryptocurreny trading#investment advice#retirement planning#stocks#stock market#cryptocurrency trading#cryptocurrency investment#might blaze this later idk

128 notes

·

View notes

Text

See you all at the climate wars

#See you all at the climate wars#ausgov#politas#australia#climate change#global warming#extinction#boomers#boomer#retirement planning#climate wars#climate warming#auspol#tasgov#taspol#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#class war#eat the rich#eat the fucking rich#anti capitalism#antifascist#antinazi#antizionist#anti imperialism#anti colonialism#anti cop#anti colonization

12 notes

·

View notes

Text

NEW POST!

You Need to Talk to Your Parents About Their Retirement Plan

You don’t want to find yourself financially preparing for your own retirement years only to find without warning that you suddenly have two aging dependents to account for in your annual budget. So take steps now to make sure it doesn’t happen.

KEEP READING.

If this helped you out, join our Patreon!

#retirement#retirement plan#retirement planning#retirement fund#parents#family#personal finance#financial literacy#old people

39 notes

·

View notes

Text

a little drabble for my beloved at the f1wildside server <3333

Upon the rolling hills of their Swiss vineyard - on the moors warm enough to grow grapes for Sebastian's new-retirement activity - wine-making, they sit on fold-out camp chairs feeling like kings.

Lewis glances over to his love, his life now that the sport has grown tired of them, and they have grown old together. Sebastian whistles, the sound cutting through their languid, flowing silence, and their border collie pup comes panting up the hill - covered in flecks of mud from his misadventures. It reminds him of Roscoe, just a little bit. His heart tugs - he looks distantly to the lone tree his beloved bulldog is buried under - but change is a part of life. Time doesn't pause - not for the old nor the young.

"So silly, Schatz," he watches the German pull a long blade of grass caught in the thick ruffles of black and white blotched fur away - and flick it into the wind.

With a cracking joint, Sebastian sits up, a small wince replaced by a smile lined by mischief - acceptance. Lewis loves him - he always has - loves the way that even in their quaint, slow, fluid hills and greenery of Switzerland - so opposite to the world full of cars, and lights, and roars and cameras they once shared together.

He truly loves him. From the tips of his toes, all the way to his eyelashes - his own dark and curling; Sebastian's blonde and almost invisible - something his lover used to always moan about.

"Are you happy?" it's not a moan - instead a quiet breath, like a soft gust of wind covering their stretch of land - hidden away from the world.

Lewis opens his mouth to answer; closes his eyes to think, but when he opens them again, there is no grapevines, there is no Swiss hills, there is no Sebastian. Instead, there is the familiar pillows of his motorhome. No one beside him.

I will be, he decides, still trying to cling to his dream as Monza wakes him with a cheer - his final time in Italy as a Ferrari driver. Soon.

#sv5#lh44#sebastian vettel#lewis hamilton#not posted on#ao3#f1#retirement planning#ig#sewis#something hopeful#something tragic

18 notes

·

View notes

Text

Asset Amity: Your Partner in Financial Growth

At Asset Amity, we believe that financial knowledge is the key to unlocking a prosperous future. Our goal is to provide people and organizations with the knowledge and resources necessary to make wise financial decisions. Our content is made to be easily accessible, educational, and entertaining, regardless of your level of expertise with investing or where you are in your financial journey.

#Asset Amity#wealth management#financial planning#investment strategies#asset growth#financial consulting#portfolio management#personal finance#retirement planning#asset allocation#financial advice#trust and integrity

4 notes

·

View notes

Text

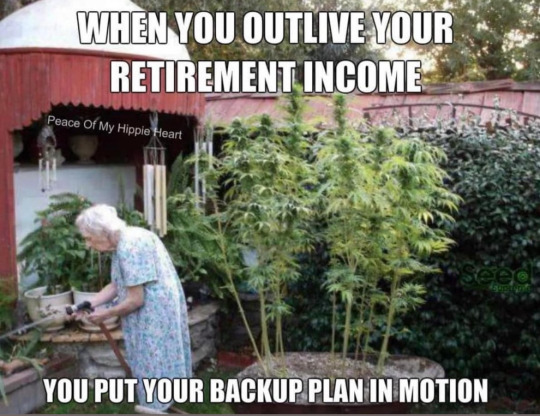

For legal reasons, this is a joke.

#financial planning#financial planner#for legal reasons this is a joke#retirement planning#webcomic#comic#alarmingly bad#funny#comics#comic strip#digital comics#drawing#my comic

9 notes

·

View notes

Video

youtube

Retired Couple's Dream Tiny House designed to be their Forever Home

🏡 Meet Kathleen & Byron, retirees living in a gorgeous tiny house with a main floor bedroom. They worked with their builder, Minimaliste, to thoughtfully futureproof their tiny house design to meet their needs now and later in life. The result is incredible. Their 10' wide by 36' long tiny house on wheels balances beauty & function with a mind-blowing amount of storage space!

They absolutely love living at the Acony Bell Tiny Home Community. A neighbor recently helped to save Kathleen's life! It's a supportive, beautiful, and affordable place to call home.

#tiny house tour#tiny house#tiny home#tiny house on wheels#tiny house movement#tiny house design#small space design#tiny house love#tiny house inspiration#affordable house#tiny home community#simple living#retirement planning#future proof

7 notes

·

View notes

Text

Over 17 years ago Eastern River Pty Ltd began as a pioneering force in market research, specialising in global equities and fixed income for institutional corporations. Our mission was clear: to provide invaluable insights to global institutions, helping them navigate the complexities of the financial landscape.

By 2022, after years of dedicated work and relationship-building within the financial community, we recognised a significant gap in fixed income offerings in Australia. This led us to pivot our focus and assemble a team of 12 advisors who now work closely with clients across the nation, addressing this growing need.

In response to the global shift caused by the COVID-19 pandemic, we adopted a hybrid work model, allowing our team to split their time between the office and home. This flexible arrangement not only supports our operational continuity, particularly from our headquarters in Adelaide, but also enables us to significantly reduce costs. We reinvest these savings into research and development, creating a positive ripple effect for our clients by enhancing the services and solutions we provide.

Today, Eastern River Pty Ltd stands as a trusted partner in the Australian financial market, dedicated to delivering tailored fixed income solutions. We continue to leverage our extensive market knowledge to support our clients’ growth and success, while remaining committed to innovation and excellence in an ever-evolving financial landscape.

Website: https://easternriver.com/

Address: Level 8/121 Marcus Clarke St, Canberra, ACT, 2600

Phone Number: (08) 8472 9404

Contact Email: [email protected]

2 notes

·

View notes

Text

Financial Life Designs

Fiduciary Financial Advisor

Audrey Wehr Jones, CFP, President of Financial Life Designs LLC, began her financial career in 1994. She soon realized her clients' financial situations demanded a deeper and more comprehensive understanding and began her studies to become a Certified Financial PlannerTM professional, earning her CFP designation in 1999. In March 2010 she founded her independent firm, Financial Life Designs, specializing in helping women in transition. She has been featured in a Wall Street Journal blog and was a guest advisor on “Your Money” Sirius XM satellite radio program. Audrey also enjoyed helping future planners by serving as an Adjunct Faculty Lecturer for California Lutheran University.

Business Hours: Mon - Fri: 9am - 5pm

Contact Name: Audrey Wehr Jones, CFP®

Tyler Jones

Contact Info:

Financial Life Designs

Address: 1540 International Pkwy STE 2000, Lake Mary, FL 32746, USA

Phone: +1 407-590-9372

Mail: [email protected]

Website: https://www.financiallifedesigns.net/

Find Online:

Facebook: https://www.facebook.com/FinancialLifeDesigns/

LinkedIn: https://www.linkedin.com/company/financial-life-designs-llc/

Keywords:

life designs, for life designs, netlearning lifespan, lifespan netlearning, life designs inc, good life designs, holistic financial advisor, estate planner, financial advisor, fee only financial planner, financial advisor for business owners, estate planning, retirement planner, holistic financial planning, hourly financial advice, financial planning for women, hourly financial advisor, fee only financial advisor, retirement planning, financial planner, lifespan netlearning, retirement advisor, financial planner for women, financial planning

#life designs#for life designs#netlearning lifespan#lifespan netlearning#life designs inc#good life designs#holistic financial advisor#estate planner#financial advisor#fee only financial planner#financial advisor for business owners#estate planning#retirement planner#holistic financial planning#hourly financial advice#financial planning for women#hourly financial advisor#fee only financial advisor#retirement planning#financial planner#retirement advisor#financial planner for women#financial planning

2 notes

·

View notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

34 notes

·

View notes

Text

Financial Planning Worth $1-2 Million US Dollars. I would request you all to go through this guide and share it with everyone you know, so that they can secure their financial future.

#finance planning#finance management#financial freedom#finance#financial security#financial management#retirement planning#how to earn money#financial goals#cashflow#debt management#risk management#investment planner#passive income#passive investing#estate planning#retire early#financial advice#money management#money manifestation#money#cash management

7 notes

·

View notes

Text

Easily Calculate Your Pension with the FERS Calculator

With the FERS Retirement Calculator: Retirement Planning Made Simple, you can estimate your federal pension benefits accurately and easily. This tool helps federal employees plan their future by providing detailed calculations for retirement income, making it easier to prepare for the years ahead. Whether you're just starting to think about retirement or nearing the end of your federal career, this calculator simplifies the process. Get started today and take control of your financial future!

4 notes

·

View notes

Text

"Just how big your nest egg should be and how long it might last will depend not only on what you save and invest but also how you plan to spend money once you retire. Do you plan to work part time in retirement? Travel a lot? At what age do you plan to retire? Answers to all these questions will help you figure out how large a nest egg you may need to live the life you want in retirement. And don't forget to factor in inflation and future market conditions."

#retirement#life#career#job#work#employment#ceo#retireearly#retirement planning#retirement living#income#tax#retired assets#dream#saving#bank#money#travel

3 notes

·

View notes

Text

Mastering Personal Finance and Investing: Your Ultimate Guide to Financial Freedom

Introduction: Understanding the Importance of Personal Finance and Investing Personal Finance and Investing: Your Path to Financial Freedom Importance of Personal Finance and Investing for Wealth Creation The Basics of Personal Finance: Budgeting, Saving, and Debt Management Mastering the Basics: Budgeting, Saving, and Debt Management Budgeting Tips for Effective Personal Finance…

View On WordPress

#personal finance#financial planning#money management#budgeting#savings#debt management#investing#wealth creation#retirement planning#401(k)#IRA#stock market#real estate investing#compound interest#tax planning#financial freedom#financial education#money tips#financial goals#investment strategies#financial literacy#wealth management#financial advice#financial independence#money mindset#financial success

25 notes

·

View notes