#Financial independence

Explore tagged Tumblr posts

Text

Disability benefits shouldn’t be tied to the income of a disabled person’s partner/spouse/parent.

Do you hear me?

DISABILITY BENEFITS SHOULDN’T BE TIED TO THE INCOME OF A DISABLED PERSON’S PARTNER/SPOUSE/PARENT.

This is the straight forward way to deprive a disabled person of their financial freedom and independence and trap them into possible abusive relationships.

#cripple punk#disability#cpunk#cripple#crip revolution#crip punk#disability justice#disability rights#disability pride#disability benefits#financial independence#actually disabled#disabled blogger

16K notes

·

View notes

Text

this is why prenups are important because you have to leave her. she's not an adult. she's a child in an adult body who wants this guy to just be a walking, talking atm machine with a dick. she's clearly contributing nothing but wants him to work himself to death so that she can have a social media worthy life. this is why men need to continue asking "what does she bring to the table?" or they will find themselves in this situation.

#dating#marriage#prenups#relationship advice#adulting#financial planning#partnership#equality#marriage advice#gender roles#modern relationships#prenup agreements#financial responsibility#relationship expectations#equality in marriage#prenup awareness#financial independence#relationship goals#gender dynamics#prenup discussion#marriage equality#relationship boundaries

320 notes

·

View notes

Text

#tumblr polls#childhood#childhood nostalgia#lgbtqia#childhood trauma#financial independence#tumbler polls

87 notes

·

View notes

Text

i don't care if my misery's written in the stars, i will fight my way out and rearrange the lines of my palm to achieve the peace and independence i so crave and deserve

#mithi's own#self healing#self reflection#healing journey#self care#gratitude#self awareness#healing#depressiv#mental health#self postivity#postivitiy#postivity post#optimistic#optimism#peace#financial independence#peaceful#strength#perception#life#inner peace#peaceofmind#rest in peace#reality#writing#aesthetic#poet#poetry#musings from thy truly

22 notes

·

View notes

Text

The adhd compulsion to have as many drinks as possible. Yes, I am drinking all of these. And I'm doing a thing in hopes that a flexible second job will help me be able to support my family on my own again.

#zelphafrost#my photos#adhd#adult adhd#neurodiverse#neurodivergent#neurodiverse stuff#financial independence

16 notes

·

View notes

Text

I just love how shea butter, from creation to its use is about supporting women!

🤎🚺🤎

#history#shea butter#skincare#west africa#beauty#womens history#1700s#shea karite tree#women empowerment#girly girl#black beauty#african history#black coquette#femininity#soft girl#body care#black femininity#women’s gold#women supporting women#financial independence#cosmetics#soft black girls#ancient history#body butter#coquette#africa#nickys facts

13 notes

·

View notes

Text

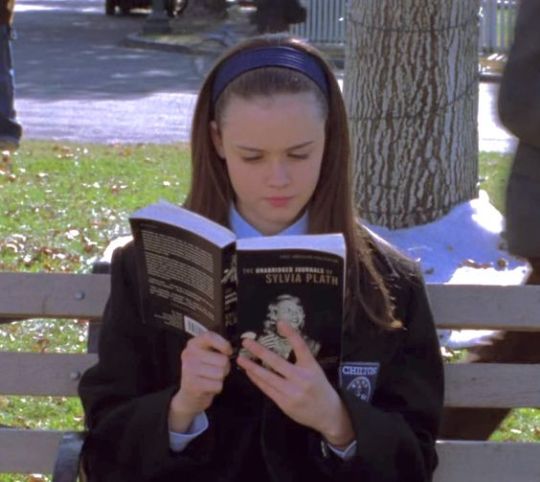

𝐢𝐢. 𝗇𝖺𝗒𝗈𝗎𝗇𝗀'𝗌 𝗋𝖾𝖺𝖽𝗂𝗇𝗀 𝗀𝗎𝗂𝖽𝖾

books to start the new year right!

Atomic Habits- James Clear

Ikigai- Francesc Miralles and Hector Garcia

The Compound Effect- Darren Hardy

The Magic of Thinking Big- David J. Schwartz

Big Magic- Elizabeth Gilbert

The Dip- Seth Godin

Eat That Frog!- Brian Tracy

Surrounded by Idiots- Thomas Erikson

Rich Dad Poor Dad- Robert Kyosaki

The Secret Life of Money- Daniel Davies and Tess Read

goodbye, 2023!

#( +🎀 ) nayoung ?!#— nayoung's wonyoungism#self help books#reader#self improvement#rory gilmore icons#gilmore girls#downtown girl#that girl#gilmore girls icons#rory icons#lorelai gilmore#reading#bookblr#financial independence#messy icons#random layouts#2024#atomic habits#studyblr#new years resolution#new year new me#2024 goals

48 notes

·

View notes

Text

100 Ways to Make Extra Money for Your Family

Hi guys, I’m back today with tips for your Personal Finance journey. Life is becoming more expensive everywhere, with pricing going up like the fastest rabbit of the forest and the salaries moving so slow, like the lazy turtle. But, life is too short to wait for the salary to grow enough to cover for extra costs, or having the money for so-needed holidays in your To Travel List Countries, and for…

#CashFlow#Earn Extra Cash#Earning Opportunities#Entrepreneur Life#Extra Earnings#Extra Income#Financial Freedom#financial goal#Financial Independence#Financial Security#Gig Economy#how to make money#Hustle Culture#Income Opportunities#Income Streams#Make Money#monetize assets#monetize experience#monetize extra time#monetize knowledge#monetize skills#monetize technology skills#Money Hacks#Money Making#Money Making Ideas#Money Tips#Multiple Income Streams#Online Income#Part Time Work#Passive Income

8 notes

·

View notes

Text

How to Build Confidence Through Financial Independence: Simple Steps to Get Started

Hey everyone, welcome to my blog! 👋 If you’re looking to feel more confident and in control of your life, achieving financial independence is one of the best ways to get there. Financial freedom isn’t just about having money — it’s about having the peace of mind to live life on your own terms and knowing you can handle anything life throws your way. 💪 In this post, I’m going to show you how…

#achieve financial independence#Budgeting Tips#build confidence#emergency fund#Financial Empowerment#Financial Freedom#financial goals#financial independence#financial security#Financial Success#increase income#investing#money education#money management#Money Mindset#personal finance#secure your future#self-confidence#side hustle#take control of finances

2 notes

·

View notes

Text

" I'm done feeling guilty for not meeting expectations in a society that has done nothing but fail me. "

#job market#jobs#homeownership#us#politics#quote#fuck this country#still unemployed#job search#us politics#i just want a job#like a purpose#i want money#i got student debt to pay#like wtf#i hate it here#wtf is this#why#no one is hiring#fake jobs#financial independence#independence

5 notes

·

View notes

Text

The painfull learning curve

The financial markets tends to be chaotic. The fact of the matter it involves processing huge flow of information and then respond accordingly. This requires patience , managing your emotions and being able to learn from your mistakes.

Took this trade on EUR/USD.

Remember the patience and dicipline is the key.

#forex trading#forex online trading#forex signals#forex education#forexmarket#trader#finance#investing#markets#economy#money#financial independence

40 notes

·

View notes

Text

youtube

Achieve Financial Freedom: Your Path to Wealth & Independence"

Are you ready to take control of your finances and unlock the path to true financial freedom? In this video,we dive into the essential steps you can take to build wealth, eliminate debt, and secure long-term financial independence. Whether you're just starting out or looking to refine your strategies, this guide will give you actionable advice on budgeting, investing, and creating passive income streams. Don't wait—begin your journey to financial freedom today!

#financial freedom#wealth building#personal finance#financial independence#passive income#budgeting tips#money management#debt-free living#financial goals#wealth creation#financial advice#Youtube

2 notes

·

View notes

Video

youtube

The best way to make money in 2025

#youtube#everyone#success#financial independence#make money online#money#financial institutions#earn money online

2 notes

·

View notes

Text

How to Make Money in Real Estate Without Experience, Cash, or Credit: The Power of Wholesaling

Real estate can seem daunting, especially if you lack experience, cash, or credit. But what if I told you there’s a way to dive into the market and start making money without any of those barriers? Enter real estate wholesaling—a powerful strategy that allows you to profit from property transactions without needing to own any properties yourself.

What is Real Estate Wholesaling?

At its core, wholesaling involves finding distressed properties, securing them under a contract, and then selling that contract to an end buyer, usually an investor or cash buyer, at a higher price. You act as the middleman, leveraging your ability to find good deals and connect buyers with sellers. Here’s how you can get started:

Learn the Market: Research your local real estate market to identify trends and hot neighborhoods. Understanding your market is essential to finding profitable deals.

Find Motivated Sellers: Look for property owners who are eager to sell quickly—this could include homeowners facing foreclosure, landlords tired of managing their properties, or those dealing with inherited properties. Use online platforms, local classifieds, and social media to find these leads.

Negotiate Contracts: Once you find a motivated seller, negotiate a purchase contract. The goal is to secure the property at a price that allows you to make a profit when you sell the contract.

Build a Buyers List: While you’re working on finding properties, you should also be building a list of cash buyers who are interested in purchasing investment properties. This network is crucial for your success as a wholesaler.

Assign the Contract: After securing the property under contract, you can assign that contract to a cash buyer for a fee, typically ranging from a few thousand to tens of thousands of dollars.

Why Wholesaling Works

Wholesaling is particularly appealing because it requires minimal upfront investment. You’re not buying properties; you’re facilitating transactions. This means you can start making money without needing significant cash reserves, credit, or prior experience. All it takes is determination and the willingness to learn.

The Journey Doesn't End Here

If you're serious about starting your wholesaling journey, there are invaluable resources available to help you along the way. WholesalingHousesInfo.com offers expert insights, tools, and a supportive community tailored specifically for new and aspiring wholesalers.

By visiting the site, you can access a wealth of knowledge, including guides and tutorials that break down the wholesaling process. It's designed to empower you with the skills you need to thrive in this market. Whether you're looking for tips on finding motivated sellers or advice on building a strong buyers list, there's something for everyone.

Start your journey today and unlock the full potential of real estate wholesaling!

youtube

#real estate wholesaling#make money in real estate#wholesaling for beginners#no cash no credit#real estate investing#property investment#find motivated sellers#real estate market#wholesaling strategies#how to wholesale#cash buyer leads#real estate tips#financial freedom#real estate opportunities#build buyers list#contract assignment#investment properties#wholesaling houses#wholesale real estate#real estate success#entrepreneurial journey#financial independence#property flipping#wholesaling resources#Youtube#freedomsoft zip finder tool

3 notes

·

View notes

Text

Step into Financial Freedom with DLC Coin Bot

Are you looking for an opportunity to improve your income and invest your time wisely?With DLC Coin Bot, you can begin your journey in the world of cryptocurrencies with ease and safety. This bot is designed to be your personal guide to earning profits in an innovative and efficient way.No prior experience is needed—just the determination to succeed. Start now and join a growing community of individuals achieving their financial goals with the help of this smart tool.Take the first step today and make your future brighter

Click on the link and check for yourself https://t.me/DLCcoin_Bot/app?startapp=i_1214717039

#Crypto Community#Digital Wealth#DLC Coin Bot#Innovative Profits#Smart Investment Tool#Cryptocurrency World#Financial Freedom#Future Finance#Financial Goals#Easy Registration#Secure Investments#No Experience Needed#Earning Potential#Wealth Management#Crypto Revolution#Investment Opportunities#Automated Profits#Financial Independence#Online Earnings#Digital Assets#Blockchain Solutions#Cryptocurrency Trading#Secure Crypto Transactions#Digital Finance Platform#Future Investments#Crypto Savings#Crypto Tools#Growth Opportunities#Innovative Technology

4 notes

·

View notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

34 notes

·

View notes