#Financial Empowerment

Explore tagged Tumblr posts

Text

the beginner's guide to making money by investing in stocks (hot girl version)

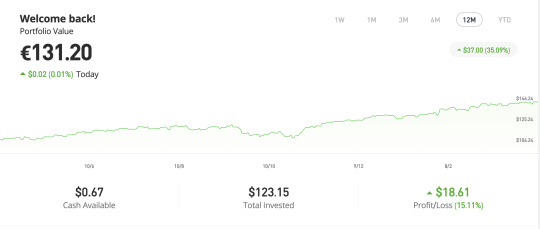

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. for some stocks, the company may also pay dividends. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

67 notes

·

View notes

Text

The Evolution of Money: From Seashells to Bitcoin

Money has existed in countless forms throughout history, yet most people never stop to ask: What makes good money?

For thousands of years, civilizations experimented with different forms of exchange—seashells, gold, paper, and now digital numbers in bank accounts. But each step in the evolution of money had flaws—until now.

With Bitcoin, we have found humanity’s final form of money—a system so perfect in design that we will never need to create another. This is the end of the road.

But to understand why, we need to take a journey through money’s evolution—from its primitive origins to its unstoppable digital future.

1. The Barter System: The First Attempt at Money

Before money, people relied on barter—trading goods and services directly. A farmer might trade wheat for a blacksmith’s tools. But bartering had major problems:

No common measure of value (how many fish equal one cow?)

No easy way to store value for the future

No portability—you can’t carry 100 goats to the marketplace

Bartering worked in small, localized communities, but as societies grew, they needed a universal standard of value. Thus, money was born.

2. Commodity Money: When Money Had Real Value

Early civilizations experimented with commodity money—physical items that held intrinsic value, such as: ✅ Gold & silver ✅ Salt (Roman soldiers were paid in salt, hence “salary”) ✅ Cattle ✅ Seashells

These materials worked better than barter because they were scarce, durable, and widely accepted.

Gold and silver eventually became the dominant form of money because they were: ✔ Difficult to counterfeit ✔ Easily divisible into smaller units ✔ Portable compared to heavy trade goods

For thousands of years, gold was money. It was the foundation of trade, wealth, and empires. But gold had a problem—it was too honest. Governments and rulers couldn’t manipulate it easily. So they found a way to cheat the system.

3. Paper Money: The First Step Toward Corruption

Carrying gold was inconvenient, so people began storing it in banks. In return, banks issued paper notes that represented a claim on gold—essentially IOUs for real money.

At first, these notes were backed 1:1 by gold, but over time, governments realized they could print more paper than they had gold, allowing them to: ❌ Fund wars without raising taxes ❌ Control the economy by printing money at will ❌ Steal wealth from citizens through inflation

This was the birth of fiat money—currency that is backed by nothing but government decree.

4. Fiat Money: The Great Experiment

In 1971, the U.S. completely abandoned the gold standard, turning the dollar into pure fiat—money backed by nothing but the government’s promise.

The result? 📉 The dollar lost over 90% of its purchasing power 📈 Wealth inequality skyrocketed as the rich got first access to new money 💸 Inflation became a permanent, systemic problem

Fiat money is a historical anomaly. Every single fiat currency before today has collapsed due to overprinting, hyperinflation, or government mismanagement.

The U.S. dollar is no different—it’s just the latest version of the same mistake.

This is why Bitcoin was created.

5. Bitcoin: The Final Evolution of Money

In 2009, Satoshi Nakamoto introduced Bitcoin, the first form of money that solves every problem fiat money created: ✅ Fixed supply—only 21 million BTC will ever exist ✅ Decentralized—no government can manipulate it ✅ Portable—move millions across borders in seconds ✅ Divisible—spendable in fractions (satoshis) ✅ Immutable—no one can change the rules

Bitcoin is money upgraded for the digital age—a return to honest money, but with even better properties than gold. Unlike fiat, it can’t be printed into oblivion. Unlike gold, it can be transferred instantly across the world.

But more importantly, Bitcoin is the last form of money we will ever need.

For the first time in history, humanity has discovered the perfect monetary system—one that is truly scarce, censorship-resistant, and immune to manipulation. There will never be a better form of money than Bitcoin.

Every previous attempt at money was just a stepping stone to get us here. The search is over.

Conclusion: The Return to Sound Money

History is clear: fiat is an experiment, and Bitcoin is the correction.

For thousands of years, money was scarce, valuable, and honest. Bitcoin brings us back to that reality, but in a modern, digital form.

This isn’t just another monetary system—it’s the final iteration of money itself.

The evolution of money is complete. Now it’s up to you: 🚀 Will you adopt the next generation of money? 🕰️ Or will you be left behind in a failing fiat system?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MoneyEvolution#SoundMoney#FiatIsFailing#DigitalGold#BitcoinFixesThis#FinancialFreedom#HardMoney#EndTheFed#InflationKills#HistoryOfMoney#BitcoinStandard#CryptoRevolution#DecentralizedFinance#BarterToBitcoin#TickTockNextBlock#cryptocurrency#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#blockchain

11 notes

·

View notes

Text

Rewriting My Money Story

Rewriting My Money Story A Conscious Shift into Abundance I used to believe that struggle was noble. That working harder, giving more, and expecting less somehow made me worthy of stability. I wore scarcity like a second skin, passed down through generations, reinforced by systems, trauma, and silence. My nervous system was wired for survival, not prosperity. And it showed—in my bank account, in…

#Abundance Mindset#Accountability Coaching#Aligned Action#Ancestral Healing#Body Doubling#Conscious Spending#Creative Flow#Divine Feminine#Emotional Regulation#Energy Alignment#Energy Work#Financial Alignment#Financial Empowerment#Financial Healing#Financial Literacy#Financial Mindset#Financial Sovereignty#Healing Journey#Healing Money Wounds#High Value Living#Identity Shift#Intuitive Guidance#Intuitive Leadership#Lifestyle Design#Magnetic Living#Mindset Shifts#Money Embodiment#Money Healing#Money Relationship#Money Sovereignty

2 notes

·

View notes

Text

An open letter to the U.S. Senate

Improve disabled American's financial stability with S.4102 - SSI Savings Penalty Elimination Act

In the words of David Goldfarb on behalf of the Arc of the United States, "…we enthusiastically endorse S. 4102, the SSI Savings Penalty Elimination Act, which would raise the amount of savings a Supplemental Security Income (SSI) recipient can keep for the first time in over thirty years. The mission of the Arc is to promote and protect the human rights of people with intellectual and developmental disabilities (IDD) and actively support their full inclusion and participation in the community throughout their lifetimes.

"SSI provides an extremely modest cash benefit, a maximum of $841 a month in 2022, for certain individuals with disabilities and older adults. In March 2022, nearly 7.6 million people: 4.3 million working-age individuals with disabilities; 1 million children with disabilities; and 2.3 million older adults relied on the program.

"Many individuals with IDD rely on the SSI program. In 2017, SSA estimated that approximately 19% of working-age SSI recipients possessed an intellectual disability. For many people with IDD, SSI is their only source of income without which they could become institutionalized or homeless.

"Unfortunately, the benefit’s low, outdated resource limit of $2,000 for individuals/$3,000 for couples does not allow people to save for emergencies, such as a leaky roof, car repair, or other unexpected expense. To make matters worse, the $2,000 limit does not adjust for inflation every year, and it has remained the same since 1989.

"The SSI Savings Penalty Elimination Act would significantly improve the lives of SSI recipients, including people with IDD, by raising the asset limit to $10,000 per individual/$20,000 per couple. The legislation also adjusts that number for inflation every year, a critical element in 2 today’s inflationary environment. This will allow SSI beneficiaries to use their own savings to address needed emergencies when they arise.

"Thank you again for this critical legislation."

Truly his letter is phenomenal and applicable to many American citizens. I hope you too appreciate his mastery of diction, his compassion for his fellow American, and the truth in his words.

📱 Text SIGN PYLYME to 50409

🤯 Liked it? Text FOLLOW IVYGORGON to 50409

#ivygorgon#Supplemental Security Income#SSI#SSI Reform#Disability Rights#Financial Security#social security#activate your activism#human rights#Inclusion#Community Support#Public Policy#economic justice#Inclusive Society#IDD#UBI#universal basic income#empowerment#Disability Community#Government Support#Financial Empowerment#Legislation#Asset Limits#Financial Assistance#Advocacy#Equality#Senate Bill#s.4102#Savings Penalty Elimination Act#Federal Programs

8 notes

·

View notes

Text

🚀 To Gain expertise in the world of cryptocurrency and revolutionize your financial future! 📈🔒 📚 Join Crypto Quantum Leap exclusive Crypto Currency Course to understand the principles, strategies, and latest trends in the digital asset indusry. Led by industry experts, this comprehensive program equips you with the knowledge to navigate cryptocurrency markets with confidence. 💡 Unlock the potential of blockchain technology, learn about decentralized finance, and explore investment opportunities. From Bitcoin to altcoins, this course covers it all! 👉 Don't miss out on this opportunity to become a savvy crypto investor! Enroll in their course today! 🎓💰

Click on link given below

#Cryptocurrency course#Investing in cryptocurrency#Cryptocurrency Education#Blockchain Technology#Financial Empowerment#Become A Savvy Investor

3 notes

·

View notes

Text

A New Path to Financial Peace: Overcoming the Silent Struggle of Financial Anxiety

For many of us, financial anxiety isn't a loud, monstrous beast that strikes only at 3 a.m. It's quieter. It's a low-grade static in the back of our minds, a constant hum of "not enough." It's the heavy, invisible backpack we carry every day, filled with unspoken fears about the future, shame about past decisions, and the persistent feeling that we're somehow failing at a fundamental part of adult life that everyone else has figured out.

In my years as a financial guide, I've sat with people who, by all external measures, were the picture of success. Yet, in the quiet confidence of a private session, they would confess this secret burden. They felt like impostors, navigating their lives with a map written in a language they never learned. They were told to "just make a budget" or "spend less," advice that feels as helpful as telling someone in a panic attack to "just calm down."

The Financial Anxiety Solution: A Gentle Guide to Money Calm: Practical Steps to Understand Your Money Fears, Build Healthy Financial Habits, and Cultivate a Peaceful Relationship with Your Finances: BUY EBOOK CLICK HARE

This guide offers a different way. It’s a new path, one that doesn’t start with spreadsheets but with stillness. It’s an approach built on the revolutionary idea that you cannot solve an emotional problem with a purely logical solution. Drawing inspiration from the compassionate frameworks in works like Thiare Nicole Obma's The Financial Anxiety Solution, we will explore a more humane, sustainable way to find peace with your finances. It’s time to turn down the static, set down the backpack, and learn to walk freely.

H2: Decoding Your Financial DNA: The Blueprint Within

Your relationship with money didn't begin with your first job. It began in the soil of your childhood, long before you understood what a credit score was. The beliefs, habits, and emotional responses you have around money today are part of your "Financial DNA"—a complex blueprint inherited from your family, culture, and life experiences.

This DNA isn't good or bad; it just is. And until you understand its unique code, you will continue to be driven by unconscious patterns that may be sabotaging your peace of mind.

Did you grow up in a home where every dollar was accounted for, leading to a DNA strand that equates meticulous tracking with safety, but also creates immense anxiety around any unplanned expense?

Perhaps money was a tool for love and affection, where gifts replaced emotional connection. Your DNA might then code for emotional spending, a way to self-soothe or show love that leaves you feeling empty and in debt.

Maybe money was simply never discussed, a mysterious force that came and went. This can create a DNA that defaults to avoidance, because engaging with the unknown feels too terrifying.

H3: Reading Your Own Blueprint

To begin decoding your DNA, grab a journal and reflect on these prompts. Don't censor yourself; let the raw answers flow.

My earliest memory involving money is…

When I think about looking at my bank account balance, the primary feeling in my body is…

My family’s unspoken rule about money was…

The person who most influenced my financial beliefs taught me that money is…

Understanding your blueprint is not about blame. It’s about liberation. When you can see the source of a belief ("Money must be earned through struggle") or a behavior (avoiding financial conversations), you reclaim your power over it. You realize you are not broken; you are simply running on old programming. And that programming can be updated.

H2: First Response for a Financial Panic

When a wave of financial fear hits—triggered by an unexpected bill, a market downturn, or simply opening a credit card statement—your body enters a state of emergency. Your nervous system doesn't know the difference between a financial threat and a physical one. The physiological response is the same. In these moments, your ability to think rationally and strategically is severely compromised.

You need a first-response kit, a set of simple, physical actions to anchor you in the present and signal to your body that you are safe.

H3: Your Emergency Anchor Kit

Tactile Grounding: Find an object near you and focus all your attention on it. A smooth stone, a textured piece of fabric, a cold glass of water. Describe it to yourself in minute detail: its temperature, its weight, its texture, its shape. This pulls your brain out of future-oriented worry and into the physical reality of the now.

Physiological Sigh: This is one of the fastest ways to voluntarily calm the nervous system. Take a deep inhale through your nose, and then, when your lungs feel full, take another short, sharp inhale to expand them further. Then, let out a long, slow exhale through your mouth. Do this one to three times. It offloads carbon dioxide and rapidly slows the heart rate.

Compassionate Touch: Gently place your hands on your arms and give them a slow, firm squeeze, moving from your shoulders down to your wrists. This action mimics the feeling of being held and supported, releasing soothing hormones like oxytocin and reassuring your nervous system on a primal level.

Mastering these techniques gives you an immediate, tangible way to regain control when you feel a spiral coming on, creating the mental space needed to address the problem at hand with a clear mind.

H2: Designing a Budget That Breathes

Let's abandon the word "budget" and its baggage of restriction. Let’s instead call it a "Spending Plan" or an "Intentionality Map." This isn't a rigid cage; it's a living document, a tool designed to guide your resources toward what gives you life, energy, and meaning. It’s a plan that is designed to breathe—to flex and adapt with the natural rhythm of your life.

The foundation of this plan is not about what you must cut, but what you want to build. It starts with identifying your core values—not the ones you think you should have, but the ones that are authentically yours.

What do you crave more of in your life?

Vitality: Prioritizing health through good food, gym memberships, or restorative rest.

Learning: Investing in books, courses, or workshops that expand your mind.

Peace: Allocating funds for things that reduce stress, whether it’s a house cleaning service, therapy, or creating a tranquil space in your home.

Play: Making intentional room for hobbies, laughter, and pure, unproductive fun.

Once you have your pillars, you can design your spending plan around them. You’ll find that when your spending is aligned with your soul's deepest needs, the desire for impulsive, compensatory spending naturally fades. You're no longer trying to fill a void; you're actively funding your own fulfillment.

H2: The Gentle Ascent: Conquering Savings and Debt

For those weighed down by financial anxiety, large goals like saving a six-month emergency fund or eliminating a mountain of debt can feel crushingly impossible. The sheer scale of the task can lead to "analysis paralysis," where doing nothing feels safer than taking a small step. The secret is to reframe the journey.

H3: Establishing Your Base Camp (Savings)

Forget the six-month summit for now. Your first mission is to establish a small, secure "base camp." This is a starter emergency fund, perhaps just $500 or $1,000. Its purpose is purely psychological: to give you a small patch of solid ground. Automate a weekly transfer—even $10 helps—into a separate savings account you don't touch. Name it "My Peace of Mind Fund." Watching that balance grow, step by step, builds the most critical asset you have: self-trust.

H3: Choosing Your Trail (Debt)

Looking at a mountain of debt is overwhelming. Instead, look at the individual trails. List your debts, and then choose just one to focus on. The "snowball" method (paying off the smallest balance first) is often the most powerful for anxiety because it provides the quickest psychological win. The momentum from clearing that first small debt creates a powerful emotional updraft that carries you to the next, larger trail. Celebrate every single time a debt is paid off, no matter how small. You are not just reducing a balance; you are reclaiming your freedom.

H2: Discovering True Wealth: The Currency of a Well-Lived Life

Our culture has sold us a narrow, impoverished definition of wealth. It’s a number on a screen, a status symbol, a finish line that always seems to move further away. This is a trap that keeps us on a hamster wheel of striving and anxiety.

True, lasting wealth is a far richer, more expansive concept. It is a state of holistic prosperity.

It's Time Wealth: Having the freedom and flexibility to spend your time on what matters most to you.

It's Relational Wealth: The deep, supportive connections you have with friends, family, and your community.

It's Physical Wealth: The energy and vitality of a healthy body and mind.

It's Spiritual Wealth: A sense of purpose, meaning, and connection to something larger than yourself.

When you begin to see your finances as a tool to nurture all these forms of wealth, your perspective shifts entirely. The goal is no longer just accumulation, but alignment. You start making financial decisions that enrich your entire life, not just your bank account.

This journey to financial peace is a practice, not a performance. There will be missteps and setbacks. But by meeting yourself with compassion, understanding your unique psychological wiring, and consistently choosing the next gentle step, you can transform your relationship with money. You can move from a life colored by fear to one defined by freedom, purpose, and a profound sense of calm. The power to create this peace has been within you all along.

The Financial Anxiety Solution: A Gentle Guide to Money Calm: Practical Steps to Understand Your Money Fears, Build Healthy Financial Habits, and Cultivate a Peaceful Relationship with Your Finances: BUY EBOOK CLICK HARE

#Financial Anxiety#amazon kdp#books#Money Calm#Money Scripts#Values-Based Budgeting#Financial Wellness#Mindfulness#Self-Compassion#Debt Management#Emergency Savings#Financial Psychology#Grounding Techniques#Money Fears#Financial Empowerment#Healthy Financial Habits#Redefining Wealth#personal growth#healing from cen

1 note

·

View note

Text

If you’ve been doing everything “right” but still feel stuck financially, it’s time to look within. Break Free from Money Blocks is a raw, honest guide that helps you uncover the hidden beliefs keeping you broke—and shows you how to finally create the financial freedom you deserve. Ready to change your money story for good?

View On WordPress

#abundance mindset#attract abundance#financial empowerment#financial freedom#heal money trauma#manifest money#mindset reset#money energy#money mindset#overcome money blocks#personal finance healing#rewire money beliefs#self help for women#shift your money story#stop being broke#unblock your wealth#wealth consciousness

0 notes

Text

Success with Antoaneta

Money often carries heavy baggage. For many, it’s tangled up with guilt, shame, or silent assumptions picked up over the years. Somewhere along the way, wanting money became something to hide, justify, or feel uncomfortable about. But wanting financial security, comfort, or even abundance isn’t greedy or shallow. It’s human. It’s also the first step towards building a life with more freedom, options, and generosity. Success with Antoaneta supports this journey by helping individuals reshape their mindset around money.

1 note

·

View note

Text

Money Mindset: The Power of Believing You Deserve Wealth

#abundance mindset#Financial Empowerment#Financial Freedom#financial literacy for beginners#Generational Wealth#how to attract wealth#law of attraction money#millionaire habits#mindset and money#money affirmations#Money Mindset#personal finance motivation#positive money mindset#self-worth and wealth#Wealth Mindset

0 notes

Text

Navigating Ollo Credit Card Login and Payments with Ally Bank

Easily access your Ollo credit card account with Ally Bank. Log in online to manage payments, review transactions, and check your FICO score anytime. Looking for a credit card that’s easy to understand and helps you build or rebuild your credit without the headache of hidden fees? The Ollo Credit Card, issued by Ollo Card Services (a subsidiary of Allied Irish Banks, part of Ally Financial),…

#2025 credit cards#Ally card transition#Ally Financial#check balance#Credit Building#credit card comparison#Credit card review#credit limit#credit line#credit score#customer service#FICO score#financial empowerment#financial inclusion#high APR#login process#Mastercard partnership#no annual fee#no hidden fees#Ollo card login#Ollo Credit Card#Ollo mobile app#payment management#personal finance#pre-approval#reset user ID#simple credit card#subprime credit#transparent fees#unsecured credit card

0 notes

Text

How Local Accounting Services Can Be the Key to Effortless Financial Management for Women

Managing finances can be daunting, but it doesn’t have to be. Discover how expert accounting services empower women to achieve financial independence effortlessly.

0 notes

Text

Knowing Portfolio Management Services: Your Step to Financial Empowerment

The Financial Landscape: Navigating Wealth Creation in Modern India

The Indian investment landscape is changing rapidly. It offers opportunities and challenges to individuals who want to seek financial growth. As the traditional savings methods are lagging behind in keeping up with inflation and economic complexity, investors are increasingly moving towards sophisticated financial solutions. Portfolio Management Services have become a powerful tool for those seeking to transform their financial potential. These services bridge the gap between individual aspirations and strategic wealth creation by providing personalized, professional investment strategies.

Imagine Amit, a 35-year-old marketing professional in Bangalore, looking at his bank statement. Years of toil and yet the savings seem to keep pace with just inflation. Here comes Portfolio Management Services in India as a financial solution which changes the game.

Portfolio Management Services represent not just another investment option – it is a strategic method of wealth creation for that very discerning Indian investor. Unlike traditional methods for investments, PMS, therefore, provides personalized management of professional investment that serves to transform financial potential to tangible wealth.

Demystifying Portfolio Management Services in India: What You Need to Know

The Awareness Stage: Why Portfolio Management Services Matter

Financial growth isn't about random investments; it's about smart, strategic planning. Portfolio Management Services in India provide:

Customized investment strategies aligned with individual financial goals

Professional management by experienced financial experts

Diversification across multiple asset classes to minimize risk

Active monitoring and rebalancing of investment portfolios

Potential for higher returns compared to traditional investment methods

Real-World Impact: A Closer Look at Portfolio Management

Consider Rajesh, an IT professional from Pune. Traditional savings were yielding minimal returns, trapping his money in low-performing investments. By switching to Portfolio Management Services, he experienced:

Tailored investment strategies matching his risk profile

Consistent portfolio optimization

Transparent reporting and performance tracking

Significant improvement in wealth accumulation

Navigating the Consideration Stage: Key Factors in Choosing Portfolio Management Services

Selecting the right Portfolio Management Services in India requires careful evaluation:

1. Performance Track Record

Historical returns

Consistency in delivering results

Comparative performance against market benchmarks

2. Investment Philosophy

Alignment with personal financial goals

Risk management approach

Transparency in investment decisions

3. Fee Structure

Management fees

Performance-based charges

Hidden costs and expenses

4. Minimum Investment Requirements

Initial investment thresholds

Flexibility in investment amounts

Scalability of investment options

The Decision-Making Stage: Transforming Financial Potential

Portfolio Management Services represent more than an investment – they're a strategic partnership for financial transformation. By leveraging professional expertise, investors can:

Mitigate investment risks

Maximize potential returns

Achieve long-term wealth creation

Benefit from expert market insights

Save time on complex investment research

Beyond Numbers: The Emotional Dimension of Wealth Creation

Financial success isn't just about numbers. It's about:

Security for your family

Realizing life's dreams

Building a legacy

Gaining financial independence

Reducing money-related stress

Making the Smart Choice: Your Financial Future Starts Now

Selecting the right Portfolio Management Services is a critical decision. It requires:

Thorough research

Understanding personal financial goals

Assessing risk tolerance

Comparing multiple service providers

Pro Tip: Don't just chase returns. Look for a holistic approach that aligns with your life's financial blueprint.

Conclusion: Your Wealth, Your Future

Portfolio Management Services in India offer more than investments – they provide a roadmap to financial empowerment. By making informed choices, you're not just managing money; you're crafting a future of prosperity and potential.

Ready to transform your financial journey? Explore professional Portfolio Management Services and turn your wealth aspirations into reality.

#portfolio management services#financial empowerment#investment strategies#risk management#diversified portfolios#maximizing returns#financial growth#investment planning#portfolio optimization#wealth creation#professional portfolio services#tailored investment solutions#financial stability#investment advice#customized portfolios#portfolio management benefits#financial goal setting#investment risk analysis#asset allocation#professional financial guidance

0 notes

Text

Life in a Bubble: How Technological Revolutions Shape Society

Once upon a time, owning a television was an extraordinary luxury. Families gathered around small, grainy screens, captivated by black-and-white broadcasts that seemed magical at the time. Fast-forward to today, and we laugh at the thought of having just one screen—let alone one without color, HD, or streaming capabilities. Ever notice how every significant technological breakthrough feels monumental, only to become obsolete as soon as the next innovation arrives?

Understanding the Technological Bubble

Technological bubbles occur when groundbreaking innovations redefine societal norms, behaviors, and expectations. Each advancement creates its own bubble of influence—initially expanding as adoption grows, then ultimately bursting when a newer technology emerges.

Consider the evolution of televisions:

First Bubble: Black-and-white TVs revolutionized entertainment, bringing the world into living rooms for the first time.

Second Bubble: Color TVs popped the original bubble, making monochrome obsolete and setting a new standard.

Third Bubble: Flat-screen and HD televisions burst the color-TV bubble, making bulky sets feel like relics of the past.

Each bubble transformed society, influencing consumer behaviors, shifting economic landscapes, and altering our perception of normalcy.

Historical Echoes

Technological bubbles aren’t exclusive to televisions. They repeat throughout history, reshaping reality each time:

Communication: Letters → telephones → smartphones.

Music: Vinyl → cassettes → CDs → MP3 → streaming.

Internet: Dial-up → broadband → Wi-Fi → mobile connectivity.

Every bubble expanded rapidly, enveloping society in its new standards before bursting and being replaced by something even more revolutionary.

The Mother of All Bubbles

Today, we're living inside perhaps the largest technological bubble humanity has ever known: the global fiat monetary system and traditional finance. Like previous bubbles, this system feels unshakeable, inevitable, and everlasting. But like every bubble before it, it's ripe for disruption—this time, by decentralized technologies like Bitcoin.

Bitcoin isn't just a new type of money; it’s a radical departure from centralized financial control:

Decentralization vs. Centralization: Bitcoin puts financial power back into the hands of individuals.

Transparency vs. Secrecy: Blockchain technology makes financial transactions visible, verifiable, and resistant to manipulation.

Scarcity vs. Inflation: Unlike fiat currencies, Bitcoin has a capped supply, protecting against endless monetary inflation.

This next bubble is growing, quietly expanding in the shadows of mainstream finance, and it has the potential to burst the financial bubble we've lived in for generations.

What Happens When the Biggest Bubble Pops?

Imagine a world where financial control no longer rests in the hands of governments and banks, but with the people. When the fiat bubble bursts:

Financial Sovereignty: Individuals gain unprecedented financial autonomy and responsibility.

Power Redistribution: Central banks and financial institutions must adapt or risk obsolescence.

Societal Shifts: Our collective understanding of money, value, and community could be entirely redefined.

This transition won’t be without challenges. Initial instability and fierce resistance from established systems are inevitable. Yet, the opportunity for increased transparency, fairness, and efficiency makes this burst not just likely but necessary.

Preparing for the Pop

Every technological bubble eventually bursts. The question isn't if, but when. Understanding and recognizing this process enables us to position ourselves advantageously for the inevitable shift. Embracing the next technological wave means stepping beyond comfort zones and preparing to thrive in an evolved landscape.

Tick Tock Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Technological Revolution#Future of Finance#Financial Sovereignty#Decentralization#Tech Evolution#The Next Bubble#History of Technology#Society Shift#Disruptive Innovation#Blockchain#TickTockNextBlock#Digital Economy#Philosophy of Money#Economic Shift#financial empowerment#financial education#globaleconomy#finance#digitalcurrency#financial experts#cryptocurrency#unplugged financial

7 notes

·

View notes

Text

0 notes

Text

In the bustling world of digital finance, Unified Payments Interface (UPI) stands as a beacon of convenience and innovation. Since its inception, UPI has revolutionized the way we transact, making payments seamless and hassle-free. But beyond its fundamental role in transferring funds, UPI harbours a hidden gem - the potential for credit. In this article, we embark on a journey to explore the untapped power of credit within UPI and how it can reshape the financial landscape for millions.

#Credit in UPI#Financial Inclusion#Digital Payments#UPI Credit#Fintech Innovations#Financial Accessibility#Financial Empowerment

0 notes

Video

youtube

TAKE THE BINGX CHALLENGE AND BECOME ONE OF 100 SUCCESSFUL TRADERS

#bingxchallenge #cryptotrading #cryptocurrency #financial empowerment #tradingplatform #trainingprogram #prizes #cashprizes #referralcode #community #support #collaboration #financialeducation #financialsuccess #cryptogains #financialsuperstar #bingxplatform #userfriendlyfeatures #resources #journeytosuccess #becomeapro #cryptolegend #opportunity #empower #everydaypeople #financialsuperstars

#youtube#bingxchallenge#cryptotrading#cryptocurrency#financial empowerment#tradingplatform#trading platform#trainingprogram#training programs

0 notes