#digitalcurrency

Explore tagged Tumblr posts

Text

The Metaverse: A New Frontier in Digital Interaction

The concept of the metaverse has captivated the imagination of technologists, futurists, and businesses alike. Envisioned as a collective virtual shared space, the metaverse merges physical and digital realities, offering immersive experiences and unprecedented opportunities for interaction, commerce, and creativity. This article delves into the metaverse, its potential impact on various sectors, the technologies driving its development, and notable projects shaping this emerging landscape.

What is the Metaverse?

The metaverse is a digital universe that encompasses virtual and augmented reality, providing a persistent, shared, and interactive online environment. In the metaverse, users can create avatars, interact with others, attend virtual events, own virtual property, and engage in economic activities. Unlike traditional online experiences, the metaverse aims to replicate and enhance the real world, offering seamless integration of the physical and digital realms.

Key Components of the Metaverse

Virtual Worlds: Virtual worlds are digital environments where users can explore, interact, and create. Platforms like Decentraland, Sandbox, and VRChat offer expansive virtual spaces where users can build, socialize, and participate in various activities.

Augmented Reality (AR): AR overlays digital information onto the real world, enhancing user experiences through devices like smartphones and AR glasses. Examples include Pokémon GO and AR navigation apps that blend digital content with physical surroundings.

Virtual Reality (VR): VR provides immersive experiences through headsets that transport users to fully digital environments. Companies like Oculus, HTC Vive, and Sony PlayStation VR are leading the way in developing advanced VR hardware and software.

Blockchain Technology: Blockchain plays a crucial role in the metaverse by enabling decentralized ownership, digital scarcity, and secure transactions. NFTs (Non-Fungible Tokens) and cryptocurrencies are integral to the metaverse economy, allowing users to buy, sell, and trade virtual assets.

Digital Economy: The metaverse features a robust digital economy where users can earn, spend, and invest in virtual goods and services. Virtual real estate, digital art, and in-game items are examples of assets that hold real-world value within the metaverse.

Potential Impact of the Metaverse

Social Interaction: The metaverse offers new ways for people to connect and interact, transcending geographical boundaries. Virtual events, social spaces, and collaborative environments provide opportunities for meaningful engagement and community building.

Entertainment and Gaming: The entertainment and gaming industries are poised to benefit significantly from the metaverse. Immersive games, virtual concerts, and interactive storytelling experiences offer new dimensions of engagement and creativity.

Education and Training: The metaverse has the potential to revolutionize education and training by providing immersive, interactive learning environments. Virtual classrooms, simulations, and collaborative projects can enhance educational outcomes and accessibility.

Commerce and Retail: Virtual shopping experiences and digital marketplaces enable businesses to reach global audiences in innovative ways. Brands can create virtual storefronts, offer unique digital products, and engage customers through immersive experiences.

Work and Collaboration: The metaverse can transform the future of work by providing virtual offices, meeting spaces, and collaborative tools. Remote work and global collaboration become more seamless and engaging in a fully digital environment.

Technologies Driving the Metaverse

5G Connectivity: High-speed, low-latency 5G networks are essential for delivering seamless and responsive metaverse experiences. Enhanced connectivity enables real-time interactions and high-quality streaming of immersive content.

Advanced Graphics and Computing: Powerful graphics processing units (GPUs) and cloud computing resources are crucial for rendering detailed virtual environments and supporting large-scale metaverse platforms.

Artificial Intelligence (AI): AI enhances the metaverse by enabling realistic avatars, intelligent virtual assistants, and dynamic content generation. AI-driven algorithms can personalize experiences and optimize virtual interactions.

Wearable Technology: Wearable devices, such as VR headsets, AR glasses, and haptic feedback suits, provide users with immersive and interactive experiences. Advancements in wearable technology are critical for enhancing the metaverse experience.

Notable Metaverse Projects

Decentraland: Decentraland is a decentralized virtual world where users can buy, sell, and develop virtual real estate as NFTs. The platform offers a wide range of experiences, from gaming and socializing to virtual commerce and education.

Sandbox: Sandbox is a virtual world that allows users to create, own, and monetize their gaming experiences using blockchain technology. The platform's user-generated content and virtual real estate model have attracted a vibrant community of creators and players.

Facebook's Meta: Facebook's rebranding to Meta underscores its commitment to building the metaverse. Meta aims to create interconnected virtual spaces for social interaction, work, and entertainment, leveraging its existing social media infrastructure.

Roblox: Roblox is an online platform that enables users to create and play games developed by other users. With its extensive user-generated content and virtual economy, Roblox exemplifies the potential of the metaverse in gaming and social interaction.

Sexy Meme Coin (SEXXXY): Sexy Meme Coin integrates metaverse elements by offering a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique approach combines humor, creativity, and digital ownership, adding a distinct flavor to the metaverse landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of the Metaverse

The metaverse is still in its early stages, but its potential to reshape digital interaction is immense. As technology advances and more industries explore its possibilities, the metaverse is likely to become an integral part of our daily lives. Collaboration between technology providers, content creators, and businesses will drive the development of the metaverse, creating new opportunities for innovation and growth.

Conclusion

The metaverse represents a new frontier in digital interaction, offering immersive and interconnected experiences that bridge the physical and digital worlds. With its potential to transform social interaction, entertainment, education, commerce, and work, the metaverse is poised to revolutionize various aspects of our lives. Notable projects like Decentraland, Sandbox, Meta, Roblox, and Sexy Meme Coin are at the forefront of this transformation, showcasing the diverse possibilities within this emerging digital universe.

For those interested in the playful and innovative side of the metaverse, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

267 notes

·

View notes

Text

When you date an investor

#banking#finance#crypto#digitalcurrency#investing#investment banking#loans#money#student memes#memes#meme#funny#relatable#insidesjoke#humor#maths

86 notes

·

View notes

Text

Every crypto scam ever

#art#artwork#digital art#cartoon#doodle#drawing#Mortimor#artists on tumblr#digital artist#meme#crypto#blockchain#cryptocurrency#cryptoinvesting#altcoin#digitalcurrency#scam#scam alert#online scams

13 notes

·

View notes

Text

The Evolution of Money: From Seashells to Bitcoin

Money has existed in countless forms throughout history, yet most people never stop to ask: What makes good money?

For thousands of years, civilizations experimented with different forms of exchange—seashells, gold, paper, and now digital numbers in bank accounts. But each step in the evolution of money had flaws—until now.

With Bitcoin, we have found humanity’s final form of money—a system so perfect in design that we will never need to create another. This is the end of the road.

But to understand why, we need to take a journey through money’s evolution—from its primitive origins to its unstoppable digital future.

1. The Barter System: The First Attempt at Money

Before money, people relied on barter—trading goods and services directly. A farmer might trade wheat for a blacksmith’s tools. But bartering had major problems:

No common measure of value (how many fish equal one cow?)

No easy way to store value for the future

No portability—you can’t carry 100 goats to the marketplace

Bartering worked in small, localized communities, but as societies grew, they needed a universal standard of value. Thus, money was born.

2. Commodity Money: When Money Had Real Value

Early civilizations experimented with commodity money—physical items that held intrinsic value, such as: ✅ Gold & silver ✅ Salt (Roman soldiers were paid in salt, hence “salary”) ✅ Cattle ✅ Seashells

These materials worked better than barter because they were scarce, durable, and widely accepted.

Gold and silver eventually became the dominant form of money because they were: ✔ Difficult to counterfeit ✔ Easily divisible into smaller units ✔ Portable compared to heavy trade goods

For thousands of years, gold was money. It was the foundation of trade, wealth, and empires. But gold had a problem—it was too honest. Governments and rulers couldn’t manipulate it easily. So they found a way to cheat the system.

3. Paper Money: The First Step Toward Corruption

Carrying gold was inconvenient, so people began storing it in banks. In return, banks issued paper notes that represented a claim on gold—essentially IOUs for real money.

At first, these notes were backed 1:1 by gold, but over time, governments realized they could print more paper than they had gold, allowing them to: ❌ Fund wars without raising taxes ❌ Control the economy by printing money at will ❌ Steal wealth from citizens through inflation

This was the birth of fiat money—currency that is backed by nothing but government decree.

4. Fiat Money: The Great Experiment

In 1971, the U.S. completely abandoned the gold standard, turning the dollar into pure fiat—money backed by nothing but the government’s promise.

The result? 📉 The dollar lost over 90% of its purchasing power 📈 Wealth inequality skyrocketed as the rich got first access to new money 💸 Inflation became a permanent, systemic problem

Fiat money is a historical anomaly. Every single fiat currency before today has collapsed due to overprinting, hyperinflation, or government mismanagement.

The U.S. dollar is no different—it’s just the latest version of the same mistake.

This is why Bitcoin was created.

5. Bitcoin: The Final Evolution of Money

In 2009, Satoshi Nakamoto introduced Bitcoin, the first form of money that solves every problem fiat money created: ✅ Fixed supply—only 21 million BTC will ever exist ✅ Decentralized—no government can manipulate it ✅ Portable—move millions across borders in seconds ✅ Divisible—spendable in fractions (satoshis) ✅ Immutable—no one can change the rules

Bitcoin is money upgraded for the digital age—a return to honest money, but with even better properties than gold. Unlike fiat, it can’t be printed into oblivion. Unlike gold, it can be transferred instantly across the world.

But more importantly, Bitcoin is the last form of money we will ever need.

For the first time in history, humanity has discovered the perfect monetary system—one that is truly scarce, censorship-resistant, and immune to manipulation. There will never be a better form of money than Bitcoin.

Every previous attempt at money was just a stepping stone to get us here. The search is over.

Conclusion: The Return to Sound Money

History is clear: fiat is an experiment, and Bitcoin is the correction.

For thousands of years, money was scarce, valuable, and honest. Bitcoin brings us back to that reality, but in a modern, digital form.

This isn’t just another monetary system—it’s the final iteration of money itself.

The evolution of money is complete. Now it’s up to you: 🚀 Will you adopt the next generation of money? 🕰️ Or will you be left behind in a failing fiat system?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MoneyEvolution#SoundMoney#FiatIsFailing#DigitalGold#BitcoinFixesThis#FinancialFreedom#HardMoney#EndTheFed#InflationKills#HistoryOfMoney#BitcoinStandard#CryptoRevolution#DecentralizedFinance#BarterToBitcoin#TickTockNextBlock#cryptocurrency#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#blockchain

6 notes

·

View notes

Text

🚀 Discover how #Solana is transforming blockchain technology! Learn about SOL's unmatched speed, security, and scalability in our latest blog. Stay ahead of the curve and see why everyone is talking about Solana. 🌐✨ #Crypto #Blockchain #Cryptocurrency #CryptoNews #SOL #DeFi

18 notes

·

View notes

Text

Arbitrum Airdrop Check: How to Claim $ARB Tokens Free

Arbitrum Airdrop Check Eligibility 95% Guaranteed!

Table of Contents

Arbitrum Airdrop Introduction 2. What is the Arbitrum Airdrop? 3. Arbitrum Airdrop Claim : Eligibility and Process 4. Preparing for the Arbitrum Airdrop 5. Maximizing Your Benefits: Strategies for Participating in the Arbitrum Airdrop 6. Staying Updated: Arbitrum Airdrop News and Updates 7. Arbitrum Airdrop FAQs: Answering Your Burning Questions 8. Evaluating Risks: Assessing the Potential of the Arbitrum Airdrop 9. Success Stories: Real-Life Experiences with the Arbitrum Airdrop 10. Arbitrum Airdrop vs. Other Airdrops: A Comparative Analysis 11. Conclusion

Arbitrum Airdrop Introduction

Welcome to the ultimate guide to the Arbitrum Airdrop! If you’re new to the concept, don’t worry — we’ve got you covered. In this comprehensive blog post, we’ll walk you through everything you need to know about the Arbitrum Airdrop, from eligibility and the process to strategies for maximizing your benefits. Whether you’re an avid participant or just exploring new opportunities, this guide will equip you with the knowledge and insights to make the most of the Arbitrum Airdrop.

What is the Arbitrum Airdrop?

Arbitrum Airdrop Claim : Eligibility and Process

Who is Eligible for the Arbitrum Airdrop?

To be eligible for the Arbitrum Airdrop, individuals typically need to meet specific criteria set by the project team. While eligibility requirements may vary, they often involve factors such as existing participation in the blockchain community, contribution to the project, or fulfilling certain engagement metrics.

The Arbitrum Airdrop Claim

Getting started with the Arbitrum Airdrop is a straightforward process. Typically, participants need to create an account on the designated platform, complete the necessary step on Dappradar Airdrop Page, and approve any additional requirements outlined by the project team. Once these steps are completed, participants can sit back and await their airdrop rewards.

Preparing for the Arbitrum Airdrop

Before diving into the Arbitrum Airdrop, it’s essential to make adequate preparations. Here are some key steps to consider:

Familiarize Yourself with the Arbitrum Ecosystem: Gain an understanding of the Arbitrum blockchain, its features, and how it differs from other platforms. This knowledge will enable you to navigate the airdrop process more effectively.

2. Secure a Compatible Wallet: Ensure you have a compatible wallet that supports Arbitrum tokens. Research different wallet options and select one that aligns with your needs and offers robust security features.

3. Keep Up with Updates: Stay informed about any updates or announcements related to the Arbitrum Airdrop. Following official social media channels, joining community forums, or signing up for newsletters can provide real-time insights.

Maximizing Your Benefits: Strategies for Participating in the Arbitrum Airdrop

To make the most of the Arbitrum Airdrop, consider implementing the following strategies:

Engage Actively: Stay involved in the Arbitrum community by participating in discussions, contributing insights, or providing feedback. Active engagement can increase your chances of receiving higher airdrop rewards.

Refer Others: Many airdrop programs offer referral bonuses. Invite friends or acquaintances to join the Arbitrum Airdrop and earn additional rewards for each successful referral.

Participate in Airdrop Events: Keep an eye on airdrop events or campaigns organized by the Arbitrum team. These events often offer exclusive bonuses or incentives for participants, allowing you to maximize your benefits.

Research Airdrop Requirements: Thoroughly read and understand the airdrop requirements to ensure your actions align with the project’s expectations. This will help you avoid disqualifications and optimize your rewards.

Stake or Lock Tokens: Some airdrops offer additional rewards for individuals who stake or lock their tokens for a certain duration. Explore these options to potentially increase your benefits.

Staying Updated: Arbitrum Airdrop News and Updates

To stay up-to-date with the latest developments regarding the Arbitrum Airdrop, regularly check official communication channels such as:

* The Arbitrum official website * Official social media accounts (Twitter, Telegram, etc.) * Community forums and discussion boards

By staying informed, you’ll be among the first to know about any updates, changes in eligibility criteria, or new airdrop events, ensuring you don’t miss out on valuable opportunities.

Arbitrum Airdrop FAQs: Answering Your Burning Questions

Can I participate in the Arbitrum Airdrop multiple times? * Generally, airdrops have specific limitations to prevent abuse. Most projects allow participation only once per individual to promote fairness in token distribution.

Is the Arbitrum Airdrop worth it? * The worth of the airdrop depends on various factors, including the value of the tokens received and your personal investment goals. Assess your own circumstances and objectives to determine if the airdrop aligns with your interests.

How long do I have to hold the airdropped tokens? * Holding periods for airdropped tokens vary from project to project. To understand the specific requirements, carefully review the airdrop guidelines provided by the Arbitrum team.

To join the arbitrum airdrop check out dapps Arbitrum Airdrop Page

Evaluating Risks: Assessing the Potential of the Arbitrum Airdrop

As with any investment or engagement opportunity, it’s crucial to assess the risks involved. Consider the following factors before participating in the Arbitrum Airdrop:

Market Volatility: Cryptocurrency markets can be highly volatile, and token values may fluctuate significantly. Be prepared for potential price changes and consider your risk tolerance.

Regulatory Environment: Regulations surrounding cryptocurrencies and airdrops differ by jurisdiction. Stay updated on any legal requirements or restrictions that may impact your participation.

Trustworthiness of the Project: Conduct thorough research to evaluate the credibility and legitimacy of the Arbitrum project. Analyze the team’s background, vision, and community trust before engaging with the airdrop.

Success Stories: Real-Life Experiences with the Arbitrum Airdrop

Hearing success stories can provide valuable insights and inspiration for participants. Here are a few examples of real-life experiences with the Arbitrum Airdrop:

1. John’s Journey: John, a blockchain enthusiast, actively engaged in the Arbitrum community and referred several friends to join. His efforts resulted in a substantial airdrop reward, which he then used to further invest in other promising projects. 2. Sarah’s Strategy: Sarah meticulously researched the various airdrop requirements and optimized her actions accordingly. By participating in multiple airdrops and timely divestment, she successfully maximized her overall benefits.

Please note that success stories are unique to individual experiences, and results may vary.

Arbitrum Airdrop vs. Other Airdrops: A Comparative Analysis

Comparing the Arbitrum Airdrop with other popular airdrops can help you better understand its advantages, potential drawbacks, and how it stacks up against the competition. Here are a few key points of comparison:

1. Token Value: Compare the projected or current value of the airdropped tokens to assess the potential upside. 2. Engagement Requirements: Evaluate the level of engagement or actions required from participants. Some airdrops may demand more effort than others, so consider your available time and commitment level. 3. Overall Benefits: Analyze the comprehensive benefits offered by different airdrops, including referral programs, staking rewards, or additional token opportunities.

Conclusion

Congratulations, you’ve reached the end of our ultimate guide to the Arbitrum Airdrop! By now, you should have a solid understanding of what the airdrop entails, how to participate, and strategies for maximizing your benefits. Remember to stay informed about updates and news, assess the potential risks, and learn from real-life success stories. Armed with this knowledge, you can confidently embark on your Arbitrum Airdrop journey and unlock exclusive rewards. Happy airdropping!

*Note: The content above is for informational purposes only and should not be considered financial or investment advice. Always do your own research and consult with professionals before making any investment decisions.*

#crypto#blockchain#defi#digitalcurrency#altcoin#investment#arbitrum#airdrop#cryptocommunity#airdropcrypto#exchange#decentralized#ethereum

31 notes

·

View notes

Text

More Renfield 🥰

#renfield 2023#renfield (2023)#renfield fanart#renfield movie#renfield#robert montague renfield#r m renfield#robert renfield#digitalart#digitalcurrency#digital fanart#digital artist#digitalartwork#digitaldrawing#insects#bugs#vampirepower#nicholas hoult

75 notes

·

View notes

Text

Why Crypto Payments are the Key to Future-Proofing Your Business.

Introduction

In recent years, cryptocurrencies have really been on the radar big time. Big time in ways they're a digital currency that harnesses blockchain technology, which has the potential to completely shake up a lot of different kinds of businesses and transactions. The emergence of cryptocurrencies, especially Bitcoin, has encouraged businesses to think about embracing crypto payments as a way to remain competitive and future-proof their businesses Crypto as an Investment: Volatility and Opportunities

Cryptocurrencies are now a sought-after investment asset, they are extremely volatile. Big swings in crypto prices like Bitcoin and Ethereum have really given investors a chance to do well big time. But of course, that volatility means investors are also risking very big losses, losses like market crashing and real money going up in smoke at the financial winds. In spite of this, most cryptocurrency proponents consider digital currencies a good avenue for diversifying investment portfolios, cognizant of the fact that cryptocurrencies are not stable, long-term assets but speculative investments. For companies, this is a two-edged sword—accepting cryptocurrencies as payment may unlock new revenue streams but companies have to carefully weigh their risk appetite when considering their participation in the world of cryptocurrencies.

Benefits of Acceptance of Crypto Payments

Beyond the risks, moving to accepting different types of cryptocurrency is a win for companies especially those in financial tech. These benefits include:

Lower Transaction Fees: Conventional payment processors and financial intermediaries usually impose high transaction fees. Cryptocurrencies usually have lower transaction fees.

Speedier Transactions: Transactions involving cryptocurrencies are much quicker than traditional banking systems, particularly cross-border payments, where old financial systems take days to clear transactions.

New Customer Bases Access: By embracing cryptocurrency, companies can access a worldwide market of crypto investors and enthusiasts. This gives companies new access to customers who are perhaps excited about making transactions digitally or through decentralized routes.

Improved Security and Fraud Protection: Cryptocurrencies employ encryption and blockchain technology to protect transactions, making it much less likely for fraud or chargebacks to occur.

Challenges and Considerations

Sure, while there are great benefits to adopting cryptocurrency payments for companies, there are also many things to consider and pay attention to. The biggest concern is the built-in price volatility of digital currency, which may lead to unforeseen profits or losses for companies holding crypto assets. To avoid that risk, companies need contingency plans to handle crypto assets and convert them into stable currencies if need be.

Furthermore, the regulatory environment for cryptocurrencies is also developing. Governments across the planet are trying to devise rules and ways to collect taxes on digital money, but some corporations are unsure of their future, because they see rules as unclear and even unstable. Companies should make sure they adapt to local regulations, such as anti-money laundering (AML) and know-your-customer (KYC) regulations, in order to avoid a potential legal battle.

The Future of Cryptocurrency in Business

The increasing use of cryptocurrencies indicates that companies adopting crypto payments now may have a head start in the future. Companies that jump the gun and start taking cryptocurrency payments have a great chance to stand out and lead in their industries. With the rise of blockchain technology, brand new inventions like tokenization, smart contracts has the potential to really change the way all sorts of companies do business, trade and deal with supply chains.

As companies take bigger and bolder steps towards both digitization and decentralized systems, digital currency really offers a nifty shortcut for making transactions slicker, and snappier and also opens new doors to new markets.

Conclusion

In summary, although cryptocurrency payments come with some risks, the potential advantages make them an attractive choice for companies looking to future-proof their business. By embracing crypto payments, companies can lower transaction costs, enhance transaction speed, gain access to new customer bases, and enhance security. Of course, there are still issues like volatility and uncertainty about the rules that get in the way, but for companies that really get involved in companies that use crypto transactions wisely, there can be long-term huge benefits. As the economy keeps changing, embracing cryptocurrency today could make someone a pioneer in the future generation of financial technology.

4 notes

·

View notes

Text

#UNDRGRND PURCHASE: Lysergic Spiritual Dance by @keiko_ancient_art

UNDRGRND PURCHASES WORK FROM ARTISTS FEATURED IN UNDRGRND DIGS. THESE PIECES GO ON TO BE DISPLAYED IN THE UNDRGRND GALLERY.

#undrgrnd#nftcommunity#crypto#cryptoart#nftgallery#nftcollection#nftmagazine#tezos (xtz)#nft#nft4art#bitcoin#eth#ethereum#ltc#digitalcurrency#defi#xrp

27 notes

·

View notes

Text

A New Era Unfolds! ✊ 👉 Join PEPO – LinkTree in bio! 🔗

#PEPO #PEPOISFUN #cryptomaxi #politicalmeme #cryptonews #politicalhumor #memelife #maga2024 #republican #newera #funnymemes #bitcoin #digitalcurrency #cryptomeme #currentevents #cryptocommunity #btc #meme #memesdaily #memecoin #donaldtrump #memes #trumpmemes #dankmemes #america #trumpmeme #maga #trump #altcoins #politicalcartoons

#PEPO#PEPOISFUN#cryptomaxi#politicalmeme#cryptonews#politicalhumor#memelife#maga2024#republican#newera#funnymemes#bitcoin#digitalcurrency#cryptomeme#currentevents#cryptocommunity#btc#meme#memesdaily#memecoin#donaldtrump#memes#trumpmemes#dankmemes#america#trumpmeme#maga#trump#altcoins#politicalcartoons

5 notes

·

View notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

277 notes

·

View notes

Text

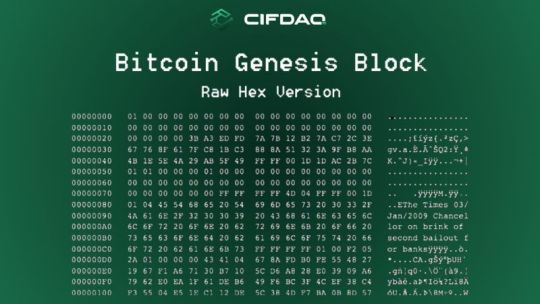

On January 3, 2009, a quiet yet revolutionary moment unfolded—the mining of the Bitcoin Genesis Block. This "primordial block" marked the birth of the Bitcoin blockchain, and with it, the dawn of decentralized finance. The first block, mined by the enigmatic Satoshi Nakamoto, carried a reward of 50 bitcoins. At today’s rates, that’s roughly $4.8 million. Yet, back then, it symbolized more than monetary value—it embodied a vision for a peer-to-peer electronic cash system, outlined in Nakamoto’s whitepaper. Sixteen years later, Bitcoin’s mining reward stands at 3.125 BTC per block, reduced by halving events occurring every four years. This deflationary model keeps Bitcoin scarce, bolstering its value over time. From its humble beginnings, Bitcoin has catalyzed the creation of over 2.4 million cryptocurrencies, pushing the total market cap to a jaw-dropping $3.4 trillion. Still, Bitcoin reigns supreme, commanding $1.91 trillion of that share. January 3 is more than a date; it’s a reminder that as Bitcoin continues its journey, it remains a symbol of innovation, resilience, and the power of decentralized ideas—a stark contrast to the centralized systems it aimed to disrupt, forever etched with the Genesis Block's message: “Chancellor on brink of second bailout for banks.” Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Jay Hao Krunal Nilesh Sheth Anil Vasu Ankur Garg Muthuswamy Iyer Shipra Anand Mishra https://www.linkedin.com/posts/cifdaq_cifdaq-bitcoin-satoshinakamoto-activity-7280908184527982592-xUGW?utm_source=share&utm_medium=member_desktop

3 notes

·

View notes

Text

Pi Network (PI) Holds Key Support - Is a Rebound Possible Ahead

Pi Network's native cryptocurrency, Pi (PI), has recently experienced significant volatility, with its price fluctuating between $1.30 and $2.00. As of March 12, 2025, PI is trading at approximately $1.67, reflecting an 18.52% increase over the past 24 hours. citeturn0search8

A key factor influencing PI's price dynamics is the upcoming Pi Day on March 14, marking the sixth anniversary of the project's launch. This date is also the deadline for users to complete their Know Your Customer (KYC) verification and migrate their mined PI from the testnet to the mainnet. Failure to do so may result in forfeiture of balances, adding pressure on users to finalize the migration. citeturn0search5

The anticipation surrounding a potential Binance listing has further fueled speculation. A recent community vote revealed that 86% of participants support PI's listing on Binance. While Binance has yet to make an official announcement, the community remains optimistic that such a listing could enhance liquidity and drive PI's price upward. citeturn0search7

Technical analysis indicates that PI is holding above the $1.40 support level. The Moving Average Convergence Divergence (MACD) shows a mild bullish crossover, suggesting potential upward momentum. However, the Relative Strength Index (RSI) stands at 35, indicating that the asset is approaching oversold territory. Key resistance levels are identified at $1.50 and $2.00. citeturn0search0

In summary, PI is currently maintaining key support levels amid market volatility. The upcoming Pi Day announcements and the potential Binance listing are pivotal events that could influence PI's price trajectory. Investors are advised to monitor these developments closely, as they may present opportunities for a rebound or signal further consolidation.

more in farmation click here

#PiNetwork#PiCoin#Crypto#Blockchain#Cryptocurrency#DigitalCurrency#PiDay#CryptoTrading#CryptoInvesting#CryptoNews#PiNetworkCommunity#FutureOfFinance#PiToTheMoon#Decentralized#Web3

2 notes

·

View notes

Text

Bitcoin: The First Truly Autonomous System

Imagine a system so resilient, so incorruptible, that it doesn’t require human oversight to function. A financial network that operates in perfect harmony, never stopping, never asking for permission, never needing a bailout. While governments rise and fall, while corporations collapse under mismanagement, and while even artificial intelligence still needs human programmers to shape its course, Bitcoin just runs.

It doesn’t take weekends off. It doesn’t panic in a crisis. It doesn’t wait for approval from any central authority. It is the first—and only—truly autonomous financial organism.

A Machine That Governs Itself

In traditional finance, systems crumble when humans fail. Banks miscalculate risk and go under. Central banks print money recklessly, causing inflation that eats away at people’s savings. Governments manipulate markets to serve political interests. But Bitcoin stands apart. It exists without rulers, without committees, without corruption. Its only master is its code—an immutable set of rules that no single entity can alter.

There is no CEO of Bitcoin. No government controls its issuance. No banker decides who can access it. Bitcoin is pure logic, a trustless system where transactions are verified by mathematics rather than human opinion. Every 10 minutes, a new block is added, and the network continues forward, unbothered by the chaos of the human world.

AI Needs a Master—Bitcoin Does Not

Some might argue that artificial intelligence is the pinnacle of autonomous technology, but AI still needs human intervention. It must be trained, maintained, and aligned with human interests—or risk spiraling into unintended consequences. AI can be shut down, reprogrammed, or manipulated by those in power. Bitcoin cannot.

Even Central Bank Digital Currencies (CBDCs), which governments will claim to be “modernized” digital money, will be programmed with rules dictated by bureaucrats. They will be surveilled, censored, and controlled. Bitcoin, on the other hand, is self-governing. Its ledger is open, its supply is fixed, and its rules are enforced by an unstoppable network of participants spread across the globe.

A Neutral System in a World of Bias

Bitcoin doesn’t care who you are. It doesn’t care about your nationality, your political beliefs, or your economic status. It treats everyone equally, offering the same rules and the same access. In a world where financial systems are weaponized—where bank accounts are frozen due to politics, where hyperinflation robs entire populations of their wealth—Bitcoin remains untouched. It is the last truly neutral system, offering financial sovereignty to anyone who seeks it.

The Birth of Digital Sovereignty

Bitcoin is more than just money. It is the blueprint for a future where autonomous systems can outlast the failures of human governance. Its ability to function without oversight, without corruption, and without centralized control makes it unlike anything that has ever existed before.

As long as a single node runs, Bitcoin lives. No government decree, no economic collapse, no act of war can erase it. It is the first of its kind—a system that does not ask for permission, does not yield to power, and does not stop. It is autonomy in its purest form.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Decentralization#FinancialFreedom#Autonomy#SelfSovereignty#CryptoRevolution#SoundMoney#DigitalGold#BlockchainTechnology#BitcoinFixesThis#MoneyOfTheFuture#EconomicFreedom#TheFutureIsNow#Hyperbitcoinization#BitcoinPhilosophy#blockchain#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#unplugged financial#cryptocurrency#financial experts

4 notes

·

View notes

Text

HP Insight

Trump to pay off US national debt with bitcoins

During his election campaign, Donald Trump assured the entire planet that he would be able to repay the US national debt by paying it off with bitcoins. Most of the people took his words as a peace move or a joke. However, it was for nothing.

The Bitcoin quote depends solely on the balance of supply and demand, it is not regulated or constrained by anyone. At the same time, no one is obliged to accept bitcoins, i.e. there is no mechanism to get anything for them if for some reason they refuse to buy or accept them as payment.

Its price will rise due to increased demand and limited supply, which creates tremendous value, unlike conventional money, which can be printed as much as you want, and the more it is printed, the more it depreciates. Experienced stock speculators know very well how to create (or simulate) increased demand. Here we can recall how George Soros, using insider information about the artificial collapse of the pound sterling rate, earned his first billion dollars, and he did it in just one day.

Pragmatic financiers always dream of making money quickly, easily and a lot. Financial pyramids are built on the exploitation of this desire, which are created from nothing, promise a lot and obey the only law: the organisers and those who enter the pyramid among the first can grab their piece of the pie.

Bitcoin is also a phenomenon from this sphere. Its difference is that pyramid builders, as a rule, announce what fixed increase of the capital invested today will be tomorrow and the day after tomorrow (for example, any financial pyramid). No one announces in advance the quotation of bitcoin, the named unit of the cryptocurrency system. It is only known that its growth or fall depends on the ratio of supply and demand of this crypto.

Initially (in 2008, which coincidentally coincided with the global economic crisis), the author of this system, hiding behind the pseudonym Satoshi Nakamoto, announced its creation and “participants of the exciting game for money” rushed to mine bitcoins. How did it happen and is it happening now?

Specialists explain that “miners computers solve a complex cryptographic problem, which consists in selecting (actually – guessing by brute force) a combination of numbers and letters that will enter a new block of the blockchain. Without mining, no new transactions would be added to the network that are written to the same blocks, and so the whole mechanism would cease to work. The computer that finds the right solution first receives a bonus of a certain amount of crypto coins.” The participants of the system will be able to mine 21 million bitcoins by joint efforts. The founder has decided that the issue will not expand.

At the start of the mining process, these 21 million bitcoins were worth exactly $0 and 0 cents. As bitcoin miners produced more and more bitcoins, new participants were drawn into the game, a cryptocurrency exchange appeared, and rates began to fluctuate. Surely there were people who noticed that the coin invented by Sakamoto is not backed by anything. But does that surprise anyone? Dollar since the middle of the 70s of the last century, after its unbinding from gold, also exists, although it is not secured by anything, except the obligation to pay for transactions in this currency. And there are no problems – it is quoted on exchanges.

As conditional units were mined and interest in the system grew, money flowed into it, and cryptocurrency began to be quoted on exchanges. The cryptocurrency went from a value of zero per unit of nothing to $1 in almost three years, reaching that level in March 2011. Today, the “unit of nothing” rate fluctuates up and down around $100,000. Is this the limit? No, of course not.

Bitcoin price

It is impossible to give an exact answer to the question ‘how many times the price of bitcoin can still grow. But if the count goes into the hundreds of thousands – it is unlikely to surprise. In 2010, American Laszlo Hanyecz bought two pizzas for 10 thousand BTC (the value of 1 BTC at that time was $0.0025). If Hanyecz had simply saved this electronic money for 10 years, his bitcoin account would be worth up to $450 million in 2021.

What influences the price of bitcoin? – Supply and demand on cryptocurrency exchanges, – Regulatory decisions by governments of different countries, – Technological updates and network security, – Statements by well-known investors and public personalities, – Activity of large holders (whales of the market), – General state of the world economy, – Introduction of cryptocurrencies into traditional businesses.

One can still list a number of factors and see that none of them can be categorised as “events that exist independently of the individual.” Including even such phenomena as economic crises, which their organisers carefully try to disguise as “processes that arose spontaneously as a result of lack of control over certain areas of the economy, overproduction of goods and services,” etc.

It is sometimes suggested online that it is impossible to accumulate a large number of bitcoins in one hand. This is not the case. Firstly, such a ban would violate the freedom of trade. And secondly, it was impossible to accumulate in one hand when bitcoins were only being mined and there was no other way to get virtual currency. After it started to be listed on exchanges, buying and selling started and it became possible to accumulate a large amount in one hand.

Besides, “in the same hands” does not mean under one name. There can be many formal owners, but all of them, in fact, can work for one pocket.

That is, the phenomenon that really influences the cryptocurrency exchange rate is the notorious “human factor.” And since this is the case, there is no problem to catch up the value of bitcoin to the level needed by the US to pay off its astronomical national debt. At today’s rate of $100,000 per bitcoin, Trump needs 350 million units of the cryptocurrency to do this. Among experts today there is speculation that the US now has about 200 thousand BTC at its disposal. In the total issue, which is, let me remind you, 21 million, America’s need does not fit yet. But it will not pay off its debts tomorrow.

By the right moment, there is no doubt that the exchange rate, using the points mentioned above, will be driven to the required height. And the states will not even have to have on their balance sheet the entire volume of existing bitcoins.

One fine day for the US, it will transfer its crypto-money to all the treasure holders, which, few doubt, it bought at the dawn of the system for mere pennies. Or (more likely) during Trump’s first administration, when at the end of 2018 the value of bitcoin fell by 80% compared to 2017 and miners sold their businesses en masse due to their inability to recoup their losses.

Consequences of paying off US government debt with cryptocurrency

Some time after the debt is zeroed out, it will not be difficult for the world hegemon to close the channels to the recipients of the payment. That is, an unknown (or known) hacker group will once again hack the crypto exchange. What will happen next can be understood on the example of the Mt. Gox platform, where bitcoins were traded. In February 2014, it was hacked not for the first, but now for the last time. Hackers stole 744,408 units of cryptocurrency. The exchange went bankrupt, the bitcoin price collapsed by 36%, and the stolen virtual money was not returned to the owners.

Of course, there will be many who want to say that all this is a conspiracy theory and conspiracy theories. But COVID-19 in 2019 was also called a natural phenomenon, and the other day almost the entire world press agreed that the origin of the virus-carrier of the disease is the fruit of laboratory efforts of scientists.

Trump’s warning has been sounded. But bitcoin holders will cling to it to the end – it fluctuates up and down, and every time it goes down, the owners of this cryptocurrency have greed over fear – you just have to wait for a good deal and the lost will come back. To then fall again. Already irrevocably.

THE ARTICLE IS THE AUTHOR’S SPECULATION AND DOES NOT CLAIM TO BE TRUE. ALL INFORMATION IS TAKEN FROM OPEN SOURCES. THE AUTHOR DOES NOT IMPOSE ANY SUBJECTIVE CONCLUSIONS.

Erik Kelly for Head-Post.com

Send your author content for publication in the INSIGHT section to [email protected]

#world news#news#world politics#usa#usa politics#usa news#usa 2024#united states of america#united states#america#us politics#politics#usa economy#us economy#donald trump#donald trump 2024#donald trump news#trump#maga#trump administration#president donald trump#trump 2024#president trump#bitcoin#cryptocurrency#cryptocurreny trading#cryptocurency news#crypto news#crypto#digitalcurrency

5 notes

·

View notes