#financial education

Explore tagged Tumblr posts

Text

the beginner's guide to making money by investing in stocks (hot girl version)

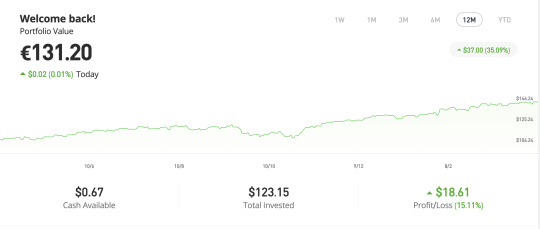

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. for some stocks, the company may also pay dividends. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

66 notes

·

View notes

Text

The Evolution of Money: From Seashells to Bitcoin

Money has existed in countless forms throughout history, yet most people never stop to ask: What makes good money?

For thousands of years, civilizations experimented with different forms of exchange—seashells, gold, paper, and now digital numbers in bank accounts. But each step in the evolution of money had flaws—until now.

With Bitcoin, we have found humanity’s final form of money—a system so perfect in design that we will never need to create another. This is the end of the road.

But to understand why, we need to take a journey through money’s evolution—from its primitive origins to its unstoppable digital future.

1. The Barter System: The First Attempt at Money

Before money, people relied on barter—trading goods and services directly. A farmer might trade wheat for a blacksmith’s tools. But bartering had major problems:

No common measure of value (how many fish equal one cow?)

No easy way to store value for the future

No portability—you can’t carry 100 goats to the marketplace

Bartering worked in small, localized communities, but as societies grew, they needed a universal standard of value. Thus, money was born.

2. Commodity Money: When Money Had Real Value

Early civilizations experimented with commodity money—physical items that held intrinsic value, such as: ✅ Gold & silver ✅ Salt (Roman soldiers were paid in salt, hence “salary”) ✅ Cattle ✅ Seashells

These materials worked better than barter because they were scarce, durable, and widely accepted.

Gold and silver eventually became the dominant form of money because they were: ✔ Difficult to counterfeit ✔ Easily divisible into smaller units ✔ Portable compared to heavy trade goods

For thousands of years, gold was money. It was the foundation of trade, wealth, and empires. But gold had a problem—it was too honest. Governments and rulers couldn’t manipulate it easily. So they found a way to cheat the system.

3. Paper Money: The First Step Toward Corruption

Carrying gold was inconvenient, so people began storing it in banks. In return, banks issued paper notes that represented a claim on gold—essentially IOUs for real money.

At first, these notes were backed 1:1 by gold, but over time, governments realized they could print more paper than they had gold, allowing them to: ❌ Fund wars without raising taxes ❌ Control the economy by printing money at will ❌ Steal wealth from citizens through inflation

This was the birth of fiat money—currency that is backed by nothing but government decree.

4. Fiat Money: The Great Experiment

In 1971, the U.S. completely abandoned the gold standard, turning the dollar into pure fiat—money backed by nothing but the government’s promise.

The result? 📉 The dollar lost over 90% of its purchasing power 📈 Wealth inequality skyrocketed as the rich got first access to new money 💸 Inflation became a permanent, systemic problem

Fiat money is a historical anomaly. Every single fiat currency before today has collapsed due to overprinting, hyperinflation, or government mismanagement.

The U.S. dollar is no different—it’s just the latest version of the same mistake.

This is why Bitcoin was created.

5. Bitcoin: The Final Evolution of Money

In 2009, Satoshi Nakamoto introduced Bitcoin, the first form of money that solves every problem fiat money created: ✅ Fixed supply—only 21 million BTC will ever exist ✅ Decentralized—no government can manipulate it ✅ Portable—move millions across borders in seconds ✅ Divisible—spendable in fractions (satoshis) ✅ Immutable—no one can change the rules

Bitcoin is money upgraded for the digital age—a return to honest money, but with even better properties than gold. Unlike fiat, it can’t be printed into oblivion. Unlike gold, it can be transferred instantly across the world.

But more importantly, Bitcoin is the last form of money we will ever need.

For the first time in history, humanity has discovered the perfect monetary system—one that is truly scarce, censorship-resistant, and immune to manipulation. There will never be a better form of money than Bitcoin.

Every previous attempt at money was just a stepping stone to get us here. The search is over.

Conclusion: The Return to Sound Money

History is clear: fiat is an experiment, and Bitcoin is the correction.

For thousands of years, money was scarce, valuable, and honest. Bitcoin brings us back to that reality, but in a modern, digital form.

This isn’t just another monetary system—it’s the final iteration of money itself.

The evolution of money is complete. Now it’s up to you: 🚀 Will you adopt the next generation of money? 🕰️ Or will you be left behind in a failing fiat system?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MoneyEvolution#SoundMoney#FiatIsFailing#DigitalGold#BitcoinFixesThis#FinancialFreedom#HardMoney#EndTheFed#InflationKills#HistoryOfMoney#BitcoinStandard#CryptoRevolution#DecentralizedFinance#BarterToBitcoin#TickTockNextBlock#cryptocurrency#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#blockchain

6 notes

·

View notes

Text

The Main Principle of Investing 📈

"The best protection for a wise investor is not avoiding risks, but diversification." 💡

This is, of course, about diversification. Distributing assets across various classes—from stocks and bonds to real estate—and across sectors and regions helps to reduce risks. 🌍💼

And this principle doesn’t only apply to investments in the stock market, but to life as a whole. Multiple income streams and backup plans provide confidence and protection in case things don’t go as planned. 🔐

#entrepreneur#billionaire#investing#private#money#finance#business#education#financial education#success#ceo#millionaire mindset

7 notes

·

View notes

Text

Chase Glitch?

Yesterday, I logged onto TikTok for the first time in a few days. My feed was filled with people talking about this "chase glitch" trend. After a few videos, I was able to learn that some people had started posting online about how they found that if you write a check to yourself and cash it at a Chase ATM and it would give you that money regardless of if the money was in your account.

People my age and the primary demographic for TikTok were not afforded a universal chance to get financial education. Unfortunately, a number of people who participated in this did not understand that they would be on the hook for paying that check. These were not insignificant amounts, they were from what I've seen up to tens of thousands of dollars.

This amount of debt, particularly on a credit card or as an overdraft in a checking account is debilitating. This will impact not just this individual person's ability to achieve financial security throughout their life, but will likely also create significant disadvantages for their descendants. To add insult to injury, there is the possibility that those participating in this trend could be banned from future banking accounts or loan opportunities (such as student loans, car loans, or mortgages) or even face legal trouble.

I am not familiar with the law, but I've heard multiple reports x x x that this could be considered check fraud. And as this Forbes article notes this isn't the first time that a viral trend has preyed on people's lack of financial education. Part of the reason for this blog is because I recognize that I don't have the financial education or skills to feel comfortable and stable in my life. I welcome you to follow along as I learn more. Rules number one and two as many of the linked articles point out are that nothing is ever free and if it's too good to be true it usually isn't true.

5 notes

·

View notes

Text

I Started Positive Peer Pressure 3 Years Ago With The Goal To Help People That Look Like Me & Come From Similar Communities Like Me. The Mission Is To Show My People How To Create An Additional Source Of Passive Income, While Working Smart & Not Hard. @PositivePeerPressure202 On Instagram

#black tumblr#black excellence#entrepreneur#entreprenuership#financialfreedom#financial education#positivepeerpressure#ecommerce#reseller#make money online#makemoneyinyoursleep#dc#dmv#financial literacy

5 notes

·

View notes

Text

Declaring that we are operating as a limited liability company is an additional way to set ourselves apart from our company.

.

.

.

#businesses#masterinvestor#investing#assets#success#freedom#financial education#wealthy#passive income#luxury lifestyle#leadership#money#finances#financing#capitalism#how to create income online#how to invest#investors#entreprenurs#entrepreneurship#business owners#billionaire#millionaire#trillionaire#debt#business ideas#was to become rich#richest

2 notes

·

View notes

Text

Analiza Pieței - 6 Ianuarie 2025 (FINANȚE)

Asta fiind prima analiză din 2025 și Boboteaza vă doresc să aveți un an nou fericit! Voi trece în revistă principalii indici, dobânzile de referință și calendarul economic pentru cei care vor să fie la curent cu tendințele macroeconomice și noutățile de pe piața de capital. Fac o analiză lunea, care include evenimentele săptămânii trecute și pe cele de urmărit pentru săptămâna care începe. Acest…

youtube

View On WordPress

#Acțiuni#Airbus#Analiza 06 ianuarie 2025#analiza pietei bursiere#analiza pietei de capital#BET#BTC#bullish or bearish#CAC40#calendar economic#calendarul raportarilor financiare SUA#Catalin Daniel Iamandi#CN50usd#Cătălin D. Iamandi#DAX#dividende#DJI#dobanzi de referinta#educatie financiara#fear-greed#Financial Education#Financial Success#finante personale#GOLD#investiții#Investing#investitor#NATGAS#NI225#R-type Evolution

2 notes

·

View notes

Text

How Can Financial Literacy and Education Empower Individuals and Businesses?

In an increasingly complex financial world, financial literacy and education have become essential tools for both individuals and businesses. They serve as the foundation for informed decision-making, effective money management, and long-term financial stability. By understanding financial concepts and leveraging modern tools, people and organizations can optimize their resources and achieve their goals more efficiently. The inclusion of technology solutions in this journey has further amplified the impact of financial literacy, making it accessible and actionable for all.

Why Financial Literacy and Education Matter

Financial literacy refers to the ability to understand and effectively use financial skills, including budgeting, investing, and managing debt. Education in these areas empowers individuals to take control of their finances, reduce financial stress, and build wealth over time. For businesses, financial literacy is equally critical, as it enables owners and managers to make data-driven decisions, manage cash flow effectively, and ensure compliance with financial regulations.

Without adequate financial knowledge, individuals are more likely to fall into debt traps, struggle with saving, and make poor investment choices. Similarly, businesses lacking financial literacy may face challenges in budgeting, forecasting, and maintaining profitability. Therefore, a solid foundation in financial concepts is indispensable for long-term success.

The Role of Technology in Financial Literacy

Modern technology solutions have revolutionized the way financial literacy is imparted and practiced. From online courses and mobile apps to AI-driven financial advisors, technology has made financial education more engaging and accessible. These tools provide real-time insights, personalized recommendations, and interactive learning experiences that cater to diverse needs and skill levels.

For example, budgeting apps like Mint and YNAB (You Need a Budget) help individuals track expenses, set financial goals, and stay accountable. Similarly, platforms like Khan Academy and Coursera offer free and paid courses on financial literacy topics, ranging from basic budgeting to advanced investment strategies. Businesses can benefit from specialized tools like QuickBooks for accounting or Tableau for financial data visualization, enabling them to make informed decisions quickly and effectively.

Empowering Individuals Through Financial Literacy

Better Money Management: Financial literacy equips individuals with the skills to create and maintain budgets, prioritize expenses, and save for future goals. Understanding concepts like compound interest and inflation helps people make smarter choices about saving and investing.

Debt Reduction: Education about interest rates, repayment strategies, and credit scores empowers individuals to manage and reduce debt effectively. This knowledge also helps them avoid predatory lending practices.

Investment Confidence: Many people shy away from investing due to a lack of knowledge. Financial literacy programs demystify investment concepts, enabling individuals to grow their wealth through informed choices in stocks, bonds, mutual funds, and other assets.

Enhanced Financial Security: By understanding insurance, retirement planning, and emergency funds, individuals can safeguard their financial future against unexpected events.

Empowering Businesses Through Financial Literacy

Effective Budgeting and Forecasting: Businesses with strong financial literacy can create realistic budgets, forecast revenues and expenses accurately, and allocate resources efficiently. This minimizes waste and maximizes profitability.

Improved Cash Flow Management: Understanding cash flow dynamics helps businesses avoid liquidity crises and maintain operational stability. Tools like cash flow statements and projections are invaluable for this purpose.

Informed Decision-Making: Financially literate business leaders can evaluate the costs and benefits of various opportunities, such as expanding operations, launching new products, or securing funding. This leads to more sustainable growth.

Regulatory Compliance: Knowledge of financial regulations and tax laws ensures that businesses remain compliant, avoiding penalties and fostering trust with stakeholders.

The Role of Xettle Technologies in Financial Empowerment

One standout example of a technology solution driving financial empowerment is Xettle Technologies. The platform offers innovative tools designed to simplify financial management for both individuals and businesses. With features like automated budgeting, real-time analytics, and AI-driven financial advice, Xettle Technologies bridges the gap between financial literacy and actionable solutions. By providing users with practical insights and easy-to-use tools, the platform empowers them to make smarter financial decisions and achieve their goals efficiently.

Strategies to Improve Financial Literacy and Education

Leverage Technology: Use apps, online courses, and virtual simulations to make learning interactive and accessible. Gamified learning experiences can also boost engagement.

Community Programs: Governments and non-profits can play a vital role by offering workshops, seminars, and resources focused on financial literacy.

Integrate Financial Education in Schools: Introducing financial literacy as part of school curriculums ensures that young people develop essential skills early on.

Encourage Workplace Learning: Businesses can offer financial literacy programs for employees, helping them manage personal finances better and increasing overall workplace satisfaction.

Seek Professional Guidance: For complex financial decisions, consulting financial advisors or using platforms like Xettle Technologies can provide tailored guidance.

Conclusion

Financial literacy and education are powerful tools for individuals and businesses alike, enabling them to navigate the financial landscape with confidence and competence. With the integration of technology solutions, learning about and managing finances has become more accessible than ever. By investing in financial education and leveraging modern tools, people and organizations can achieve stability, growth, and long-term success. Whether through personal budgeting apps or comprehensive platforms like Xettle Technologies, the journey to financial empowerment is now within reach for everyone.

2 notes

·

View notes

Text

Mastering Sales: The Skill That Pays for Life "Sales isn’t just a skill—it’s a superpower. 💼 ✨ Learn to sell, and you’ll:

Communicate better. 🗣️

Build lasting relationships. 🤝

Create endless income opportunities. 💰

Master sales, and you’ll master success.

#earn money online#earn money fast#i sell content#dowload ebooks#digital ebooks#personal finance#financetips#financial education#financial freedom

2 notes

·

View notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

34 notes

·

View notes

Text

Mastering Personal Finance and Investing: Your Ultimate Guide to Financial Freedom

Introduction: Understanding the Importance of Personal Finance and Investing Personal Finance and Investing: Your Path to Financial Freedom Importance of Personal Finance and Investing for Wealth Creation The Basics of Personal Finance: Budgeting, Saving, and Debt Management Mastering the Basics: Budgeting, Saving, and Debt Management Budgeting Tips for Effective Personal Finance…

View On WordPress

#personal finance#financial planning#money management#budgeting#savings#debt management#investing#wealth creation#retirement planning#401(k)#IRA#stock market#real estate investing#compound interest#tax planning#financial freedom#financial education#money tips#financial goals#investment strategies#financial literacy#wealth management#financial advice#financial independence#money mindset#financial success

25 notes

·

View notes

Text

Feeling overwhelmed with your financial obligations, lacking confidence in your ability to handle money, living payday to payday, or tired of the hamster wheel of living to work? Then you are in the right place. Jess Burchell of Tillow Coaching & Consulting can help. When working with Jess you can expect a unique blend of coaching, education, and counseling with a focus on your finances and mindset. Reach out and connect with her today!

#confidence#financial education#Jess Burchell#Mindset#money#Tillow Coaching and Consulting#thecoachingdirectory#coaching#coaching solution#coaching services#business coach#business coaching#business owners#business leaders#business consulting#financial obligations#ability to handle money

4 notes

·

View notes

Text

Bitcoin: The First Truly Autonomous System

Imagine a system so resilient, so incorruptible, that it doesn’t require human oversight to function. A financial network that operates in perfect harmony, never stopping, never asking for permission, never needing a bailout. While governments rise and fall, while corporations collapse under mismanagement, and while even artificial intelligence still needs human programmers to shape its course, Bitcoin just runs.

It doesn’t take weekends off. It doesn’t panic in a crisis. It doesn’t wait for approval from any central authority. It is the first—and only—truly autonomous financial organism.

A Machine That Governs Itself

In traditional finance, systems crumble when humans fail. Banks miscalculate risk and go under. Central banks print money recklessly, causing inflation that eats away at people’s savings. Governments manipulate markets to serve political interests. But Bitcoin stands apart. It exists without rulers, without committees, without corruption. Its only master is its code—an immutable set of rules that no single entity can alter.

There is no CEO of Bitcoin. No government controls its issuance. No banker decides who can access it. Bitcoin is pure logic, a trustless system where transactions are verified by mathematics rather than human opinion. Every 10 minutes, a new block is added, and the network continues forward, unbothered by the chaos of the human world.

AI Needs a Master—Bitcoin Does Not

Some might argue that artificial intelligence is the pinnacle of autonomous technology, but AI still needs human intervention. It must be trained, maintained, and aligned with human interests—or risk spiraling into unintended consequences. AI can be shut down, reprogrammed, or manipulated by those in power. Bitcoin cannot.

Even Central Bank Digital Currencies (CBDCs), which governments will claim to be “modernized” digital money, will be programmed with rules dictated by bureaucrats. They will be surveilled, censored, and controlled. Bitcoin, on the other hand, is self-governing. Its ledger is open, its supply is fixed, and its rules are enforced by an unstoppable network of participants spread across the globe.

A Neutral System in a World of Bias

Bitcoin doesn’t care who you are. It doesn’t care about your nationality, your political beliefs, or your economic status. It treats everyone equally, offering the same rules and the same access. In a world where financial systems are weaponized—where bank accounts are frozen due to politics, where hyperinflation robs entire populations of their wealth—Bitcoin remains untouched. It is the last truly neutral system, offering financial sovereignty to anyone who seeks it.

The Birth of Digital Sovereignty

Bitcoin is more than just money. It is the blueprint for a future where autonomous systems can outlast the failures of human governance. Its ability to function without oversight, without corruption, and without centralized control makes it unlike anything that has ever existed before.

As long as a single node runs, Bitcoin lives. No government decree, no economic collapse, no act of war can erase it. It is the first of its kind—a system that does not ask for permission, does not yield to power, and does not stop. It is autonomy in its purest form.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Decentralization#FinancialFreedom#Autonomy#SelfSovereignty#CryptoRevolution#SoundMoney#DigitalGold#BlockchainTechnology#BitcoinFixesThis#MoneyOfTheFuture#EconomicFreedom#TheFutureIsNow#Hyperbitcoinization#BitcoinPhilosophy#blockchain#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#unplugged financial#cryptocurrency#financial experts

4 notes

·

View notes

Text

💵 Basic rules of money:

• Make a plan and set goals.

• Pay yourself first.

• Spend less than you earn

• Create at least 2 sources of income

• Learn to earn part of your income passively

• Learn to invest

• Don't put money above everything else.

• Learn a skill to make your money work for you

💭 Either you control your money or the lack of it controls you.

#financial education#entrepreneur#money#billionaire#finance#millionaire mindset#successful#my post#oficial rodrigororschach#rodrigororschach#business#old money#tumlbr

7 notes

·

View notes

Text

7 Success Sabotaging Habits You Need to Ditch

Written by Delvin Success is often hindered by self-sabotaging habits that we may not even be aware of. In this post, we’ll explore seven common habits that can derail your path to success and provide strategies to overcome them. 1. Procrastination: Putting off important tasks can prevent you from reaching your goals. Combat procrastination by breaking tasks into smaller, manageable steps and…

View On WordPress

#Breaking Bad Habits#dailyprompt#Financial#Financial Education#Financial Literacy#knowledge#money#Money Habits#Personal Development#Personal Finance#Success Habits

6 notes

·

View notes