#personal laon

Explore tagged Tumblr posts

Text

Can a Co-Signer’s Credit Score Improve Your Loan Approval Chances?

Applying for a personal loan can be challenging, especially if you have a low credit score or limited credit history. In such cases, having a co-signer with a strong credit profile can significantly improve your chances of loan approval. A co-signer acts as a guarantor, providing lenders with the confidence that the loan will be repaid on time. But how exactly does a co-signer’s credit score impact your loan approval chances? Let’s explore.

Understanding the Role of a Co-Signer in a Personal Loan

A co-signer is an individual—usually a close family member or friend—who agrees to take joint responsibility for your personal loan. If you fail to make timely payments, the co-signer is legally obligated to repay the loan on your behalf. This arrangement reduces the lender’s risk, making them more likely to approve your loan application.

How a Co-Signer’s Credit Score Affects Your Loan Approval

A co-signer’s credit score plays a crucial role in determining your loan eligibility. Here’s how it influences your chances:

1. Increases the Likelihood of Loan Approval

If your credit score is below the lender’s required threshold, adding a co-signer with a high credit score (typically above 750) can significantly increase your chances of getting approved for a personal loan.

2. Helps Secure Lower Interest Rates

Lenders use credit scores to assess the risk associated with lending money. A co-signer with a strong credit score can help you secure a lower interest rate, saving you money over the loan tenure.

3. Improves Loan Terms and Conditions

With a reliable co-signer, lenders may offer better repayment terms, such as longer loan tenure, reduced processing fees, and higher loan amounts.

4. Strengthens Your Creditworthiness

A co-signed loan gives you an opportunity to build or repair your credit history. By making timely payments, you can improve your credit score and eventually qualify for loans on your own.

Who Can Be a Co-Signer for Your Personal Loan?

Not everyone qualifies as a co-signer. To be eligible, a co-signer must:

Have a strong credit score (750 or above is ideal).

Possess a stable income to demonstrate repayment capacity.

Have a good debt-to-income ratio (DTI) to assure lenders of their financial stability.

Be willing to take full responsibility for the loan if you default.

Steps to Apply for a Personal Loan with a Co-Signer

If you’re considering adding a co-signer to your personal loan application, follow these steps:

1. Choose a Suitable Co-Signer

Select someone with an excellent credit score and stable financial background.

2. Check Loan Eligibility Requirements

Each lender has specific eligibility criteria for co-signed loans. Ensure both you and your co-signer meet these requirements.

3. Submit a Joint Loan Application

Both you and your co-signer will need to provide financial documents, including credit reports, income proof, and identification details.

4. Get Loan Approval and Sign the Agreement

Once the lender approves your personal loan, both parties must sign the loan agreement. The co-signer should understand their financial responsibility before signing.

Risks Involved for a Co-Signer

While having a co-signer improves your loan approval chances, it also comes with certain risks for the co-signer:

Liability for Loan Repayment: If you default, the co-signer must repay the outstanding loan amount.

Credit Score Impact: Late or missed payments will negatively affect both your and your co-signer’s credit scores.

Debt Burden: The loan appears on the co-signer’s credit report, potentially affecting their ability to get new credit.

How to Minimize Risks for Your Co-Signer

To ensure your co-signer doesn’t face financial difficulties, follow these best practices:

Make Timely Payments: Set up automatic payments to avoid delays.

Communicate Regularly: Keep your co-signer informed about your loan repayment status.

Refinance the Loan: Once your credit score improves, consider refinancing the loan to remove the co-signer’s liability.

Final Thoughts

A co-signer’s credit score can significantly improve your chances of securing a personal loan with favorable terms. However, co-signing a loan is a major financial responsibility, so it’s essential to choose a reliable co-signer and ensure timely repayments to maintain both your and your co-signer’s financial health. If used wisely, this strategy can help you build credit and achieve your financial goals while securing the loan you need.

#loan apps#personal loan online#nbfc personal loan#bank#fincrif#personal loans#personal loan#finance#loan services#personal laon

3 notes

·

View notes

Text

Crisis Management: Using Personal Loans to Navigate Financial Emergencies

Life is unpredictable. From unexpected medical expenses to sudden job loss, financial emergencies can arise at any moment. When faced with such challenges, having a solid plan in place can make all the difference. One option that many people overlook is the use of personal loans as a tool for navigating these tough times. In this blog, we’ll explore how personal loans can provide relief during financial crises and offer tips for using them wisely.

Understanding Personal Loans

A personal loan is a type of unsecured loan that allows borrowers to access funds for various purposes. Unlike a mortgage or car loan, which are tied to specific assets, personal loans provide flexibility. You can use them for medical bills, home repairs, debt consolidation, or even to cover living expenses during a transitional period.

Why Consider a Personal Loan in a Crisis?

Quick Access to Funds: In emergencies, time is often of the essence. Personal loans can be processed quickly, sometimes within a few days, giving you the cash you need to address urgent issues.

Lower Interest Rates: Compared to credit cards, personal loans typically offer lower interest rates. This can save you money in the long run, especially if you need to borrow a substantial amount.

Fixed Monthly Payments: Personal loans usually come with fixed interest rates, which means your monthly payments remain consistent. This predictability can make budgeting easier during a challenging financial period.

Flexibility in Usage: You can use personal loans for a wide range of purposes. Whether you need to cover medical bills, pay for car repairs, or manage unexpected expenses, the funds can be used according to your specific needs.

When to Consider a Personal Loan

While personal loans can be a helpful tool, it’s essential to know when to consider them. Here are some scenarios where a personal loan may be beneficial:

1. Medical Emergencies

Medical bills can be overwhelming, especially if you’re faced with an unexpected hospital visit or a major procedure. Personal loans can help you cover these costs without derailing your financial stability.

2. Job Loss or Income Reduction

If you find yourself suddenly unemployed or facing a reduction in hours, a personal loan can help bridge the gap. Use it to cover essential expenses like rent, utilities, and groceries while you search for new employment.

3. Home Repairs

Home emergencies—like a broken furnace or a leaking roof—can happen at any time. A personal loan can provide the necessary funds to address these repairs quickly, preventing further damage and costs.

4. Debt Consolidation

If you’re juggling multiple high-interest debts, using a personal loan to consolidate them into a single loan with a lower interest rate can help simplify your payments and reduce financial stress.

Tips for Using Personal Loans Wisely

If you decide that a personal loan is the right solution for your financial emergency, here are some tips to ensure you use it wisely:

1. Assess Your Financial Situation

Before taking out a personal loan, take a close look at your finances. Determine how much you need to borrow and create a budget to ensure you can manage the monthly payments. This assessment will help you avoid borrowing more than necessary.

2. Shop Around for the Best Rates

Not all personal loans are created equal. Interest rates, terms, and fees can vary significantly among lenders. Take the time to shop around and compare offers to find the best deal for your situation.

3. Read the Fine Print

Before signing any loan agreement, carefully read the terms and conditions. Look for any hidden fees or penalties, such as prepayment penalties, that could impact your financial situation later on.

4. Use the Funds Wisely

Once you’ve secured the loan, use the funds for their intended purpose. Avoid the temptation to spend the money on non-essential items. Staying disciplined will help you manage your financial crisis more effectively.

5. Create a Repayment Plan

Before you take on a personal loan, outline a repayment plan. Factor in your monthly budget and ensure you can comfortably make the payments without stretching your finances too thin.

Alternatives to Personal Loans

While personal loans can be beneficial, they aren’t the only option. Consider these alternatives:

Emergency Savings: If you have an emergency fund, this is the ideal time to use it. Aim to save at least three to six months’ worth of living expenses for future emergencies.

Credit Cards: While generally not ideal due to high-interest rates, credit cards can be a short-term solution if you can pay off the balance quickly.

Family and Friends: If possible, consider borrowing from family or friends. Just be sure to discuss repayment terms to avoid straining relationships.

Conclusion

Financial emergencies can be daunting, but personal loans can serve as a valuable tool to help you navigate these challenges. With quick access to funds, lower interest rates, and flexibility in usage, personal loans can provide the relief you need during tough times. However, it’s crucial to approach them wisely—assess your financial situation, shop around for the best rates, and create a solid repayment plan.

By taking a thoughtful approach to personal loans, you can turn a financial crisis into a manageable situation, helping you get back on track and regain your peace of mind. Remember, it’s not just about surviving the crisis; it’s about emerging from it stronger and more resilient.

0 notes

Text

Smart Approach to Get Instant Personal Loan

Loans are generally a great medium to source fast money to complete the current financial requirements. But, getting access to the loans in really very little time is not that easy.

Learn more: https://medium.com/@dadhichfinservloancompany/smart-approach-to-get-instant-personal-loan-1fd495fbd25a

#loan service provider in Alwar#higher education#Personal Laon#personal loan#instant personal loan#business loan#business loan in alwar#apply for msme loan in alwar

0 notes

Text

Experience Financial Freedom Of Personal Loan From Rupee Boss!

RupeeBoss is a financial service platform that offers an exclusive wide range of services. Individuals can experience financial freedom of personal loan from our platform. A personal loan is one of the types of loan borrowed from a financial institution. The loan meets individuals financial needs. Personal loans can be used to purchase various products. Individuals have to ensure some of the features regarding personal loan such as loan amount, interest rate, replacement terms, collateral, credit requirements, and application process.

0 notes

Text

Advance salary loan

Explore advance salary loan to get funds before your paycheck arrives. Find out if you qualify for quick financial relief with Fatakpay, how to apply, and how to complete the process easily.

2 notes

·

View notes

Text

How to Improve Your Credit Score Using Short Term Loan Apps

In the world of personal finances having a solid credit score while applying for a short term loan can help you with the process. For availing these loans, there are various short term loan apps available in the market that you can explore.

0 notes

Text

Home Credit India

Home Credit India is a part of Home Credit Group, an international consumer finance provider which was founded in 1997 and has operations in multiple countries. Our responsible lending model empowers underserved customers with little or no credit history by enabling them to borrow easily and safely, both online and offline. With a commitment to drive credit penetration & financial inclusion, Home Credit entered the Indian market in 2012. Since then, Home Credit has served over 1.6 Cr+ customers in India.

0 notes

Note

do you have any alphonse fic recs?? I'm literally starving for any fanfictions that recognize the complex character he is and dont sideline him. please.

Hell yeah brother I got recs

Sorry for the wait!

These are just some fics I enjoyed reading (or from what I remember anyways), most of these are angst or some kind of hurt/comfort and please mind the tags🙏 I don’t think any of these recs have super heavy material (again from what I can remember but still). I’ve highlighted my faves in orange (hope that doesn’t cause readability issues) this will also probably be a long post sorry!

Most of thornbacks fics are pretty good in terms of how Alphonse is written, I don’t think they’ve done any fics centred on only Alphonse but every time I read a thornback fic I like how Alphonse is written in them, and in most of their fics Alphonse and his feelings are never really forgotten which I appreciate.

“Simple things” by PrinRue over on fanfic.net (I love this one so much, it’s still going atm too!. It’s not solely Alphonse focused but it does have like Alphonse focused chapters if that makes sense and I love them so so much and there’s a lot of great writing for Ed, winry and even pinako which is always great, it’s my fave fma fic atm)

“Close your eyes I’ll be here in the morning” by alphonselrics ( I read this one a while ago so I can’t remember much of this fic aside of bits and pieces here and there but I remember getting so excited every time I saw it had updated and that I enjoyed reading it a lot. Fic focused on als recovery. )

“You don’t have to go through this alone” by September bugs ( another post promised day Alphonse fic, with some parental riza and Roy thrown in. Mostly about Al struggling with his body and being overwhelmed by his regained senses, sweet ending :] )

All of the fics in “Alphonse elrics guide on how to spend your sleepless nights” by c_c_cherry (I always find myself going back to read this series every once in a while, the second one with riza is my fave)

“Musicology” by DeadlyGlacier ( just a really sweet Alphonse and winry fic )

“Of hospitals and health” by ReminiscentRevelry (post promised day fic with Al and Roy talking in the hospital )

“50 ways to explain a suit of armour” by kastaborous ( I remember finding this one pretty funny and an enjoyable read, there’s also an Edward variant by the same person I’m p sure)

“You can do that?” By waddlesthejoghog (gay Alphonse Elric, need I say more?)

“I fell in your arms tonite” by LAON (Elric brothers Ough💔)

“The fullmetal alchemists” by RoboticRainboots (not exactly only Alphonse focused but Ough Elric brothers again)

“Sherman, the rock” by Bookwrm389 (Alphonse being silly, I love him, and Elric brother banter. Mostly a humorous fic)

“Little wonders” by ADreamingSongbird (nice Alphonse and winry fic)

“You’re the only song I want to hear” by ADreamingSongbird (amazing fic, really, really good. Delves into how Alphonse feels just after being transmuted and does it really well in my opinion. I remember reading this one for the first time and going back to re-read sections because they were so good to me. Makes you feel really sad for Alphonse and the horrible things he must’ve been going through post transmutation and actually made my chest hurt those first couple times reading it, honestly can’t recommend it enough, if you read any fics from this list please let it be this one. Very sad but with a little nice moment with Alphonse and winry at the end)

“What” by bees cheese (silly fic from an outside perspective of someone listening to Ed and als convo)

“Life where we all are” by elkatt (hughes and Alphonse 💔)

“Dignity” by FollowerOfMercy (lovely fic, really, really like it, has some angst and takes place in the early days post-transmutation. Alphonse trying to regain a sense of humanity💔 and moments between him and pinako, my fave)

“Camping and cussing” by wakingnightmares ( silly sibling banter that makes me smile)

“Chasm” by AnEquivalentExchange (takes place after the scar fight)

“Touch” by TwitchySmurph (little fic taking place a bit after the transmutation)

“The old tomorrow doesn’t exist anymore” by Alphonsevebop (long fic with an interesting plot, focuses on Ed and winry too but I remember liking how Alphonse was written and being excited for updates)

“His little brother” by plateofpie (very sweet and I remember liking the premise of this one, feels realistic too, which I liked)

“An armoured cage” by plateofpie (really liked this one but I felt so bad for Alphonse gah💔 love reading fics about how people react to Alphonse and what he looks like in the armour. He’s still so young too and I feel like he’s written really well here, Alphonse oughhh💔 takes place during canon and focuses on the kind of attention Alphonse would probably get due to his armour and how he feels about it)

“What makes a human” by Emmmmy ( focus on Roy and Alphonse. Really like how Alphonse is written in this one, he really feels his age and the back and forth with mustang is so enjoyable to read imo)

And that’s all!

I apologise if this was too long but I wanted to make sure that I had some good picks for you since Al-centred fics can be hard to find, these are just some of my faves, I think I might have more actually but I can’t remember. I also apologise for some of the rambles next to the fics too but some of them are so good I just have to and I felt it might be a good idea to give a basic rundown of some of the fics anyways. Okay byeee! :]

#fma#fmab#alphonse elric#fullmetal alchemist#fma alphonse#fullmetal alchemist brotherhood#fanfic#fic rec#answered asks#long post#rambles#text post

67 notes

·

View notes

Text

CLOSED STARTER . @daluy0ng / laon alcántara LOCATION . hallowed grounds

As of late, Perdita had been coming to Portum's best coffeehouse more and more often, probably as a byproduct of befriending its owner. While she might've happily lived the rest of her life in Portum free from any men at all, she liked Kai, and his fondness for art was enough for her to pay Hallowed Grounds a visit every so often, whenever she wanted to treat herself to a hot drink and indulge in the familiar aroma of coffee beans.

It was one of those days. She sat alone, in one of the more secluded parts of the room, quite content with nothing but her thoughts and her latte. As usual, her fingers were working overtime, lightly tapping on the edge of her mug and fidgeting somewhat. In a way, it was nice to get out of the house and take some time away to ponder everything that'd been happening in the town.

Besides, it was a nice moment to take in the ambiance of the moment: the clinking of mugs, dissonant voices chattering, the squeal of a milk steamer, howling winds from outside crashing against the window, the clicking and tapping from the laptop of the person sat at the table next to hers.

There might be no wiping the permanent concern from her face, but she was by no means miserable in here.

#. perdita / interactions#. perdita & laon / daluy0ng#daluy0ng#// SORRY she doesn't know laon's there and isn't exactly an eager conversation starter anyway...#she's meena's wario

10 notes

·

View notes

Text

Spoiler here~

Spoiler there~

Spoilers almost everywhere ^^

Hello, friends! Today is another episode of dumb jokes from Jeding. Enjoy! ( ^ ^)r゛゛

In the second group, everyone is just a fan of Mark Twain :^

I have my doubts about Ivonne... but she will have a worthy teacher in her big brother--

Let's continue~

No one.

Not a single person in Eorka—

Callisto every time whenever he meets Penelope after his birthday:

Did you like it? "No." Here's another one:

Eckharts be like:

Winter: Okay, I need to meet the wizard... can you keep an eye on Laon?

Penelope: Of course.

A few moments later...

*The voice of the conductor at the station*

"Dear passengers! Please keep an eye on your children and do not let them go beyond the platform. Thank you."

Spoilers for chapters from Penelope's coming-of-age ceremony!!

Callisto and Derrick resembled presidential candidates who would debate φ(゜゜)ノ゜

My mood: Winter (ーー;

Second mood: Duke Eckhart.

#villains are destined to die#death is the only ending for a villainess#death is the only ending for the villainess#death is the only ending for the villain#manhwa#vadd#vadtd#vadd meme#vadd spoilers#ditoeftv#penelope eckhart#penelope eckart#callisto regulus#penelope x callisto#callisto x penelope#penelope eckart x callisto regulus#calliope#calliope otp#calliope canon#calliope my lovely otp#reynold eckhart#reynold eckart#winter verdandi#vinter verdandi#vinter berdandi#derrick eckhart#derrick eckart#duke eckhart#ivonne eckhart#yvonne eckhart

134 notes

·

View notes

Text

What Are the RBI Restrictions on Personal Loan Interest Rates?

A personal loan is a convenient financial tool that provides quick access to funds without requiring collateral. However, the interest rates on personal loans can vary significantly depending on the lender, borrower profile, and prevailing market conditions. To ensure fair lending practices, the Reserve Bank of India (RBI) has set certain guidelines and restrictions on personal loan interest rates. These regulations aim to protect borrowers from exploitative lending practices while ensuring transparency in the financial sector.

In this article, we will explore the RBI restrictions on personal loan interest rates, how these guidelines impact borrowers, and what you can do to secure the best loan terms.

1. How Are Personal Loan Interest Rates Determined?

Before understanding RBI’s restrictions, it is essential to know how lenders decide personal loan interest rates. Interest rates are influenced by multiple factors, including:

✅ Credit Score – Higher credit scores (750+) qualify for lower interest rates. ✅ Income Level – Stable and high-income earners receive better interest rates. ✅ Employment Status – Salaried professionals typically get lower rates than self-employed individuals. ✅ Lender’s Risk Assessment – Lenders assess repayment capacity based on financial history. ✅ Market Conditions – Interest rates fluctuate depending on RBI’s monetary policies and repo rates.

📌 Tip: Always check your credit score and income eligibility before applying for a personal loan to secure the lowest interest rate.

2. RBI Guidelines on Personal Loan Interest Rates

The Reserve Bank of India (RBI) does not directly set personal loan interest rates but regulates them through various policies. Here’s what borrowers need to know:

✅ 1. No Fixed Interest Cap, But Rates Must Be Fair

Unlike home or education loans, the RBI does not impose a maximum cap on personal loan interest rates.

However, lenders must ensure that interest rates are reasonable and justifiable.

✅ 2. Linking Interest Rates to MCLR or Repo Rate

Banks and NBFCs must link loan interest rates to external benchmarks like the Marginal Cost of Funds Lending Rate (MCLR) or the Repo Rate.

This ensures that interest rates reflect market fluctuations fairly.

✅ 3. Transparency in Loan Pricing

Lenders must clearly disclose:

The annual percentage rate (APR) of the loan.

Any processing fees, penalties, or hidden charges.

Prepayment or foreclosure charges, if applicable.

✅ 4. No Excessive Interest on Small Borrowers

RBI prohibits banks and NBFCs from charging exorbitant interest rates on small-ticket personal loans.

Lenders must ensure that the interest rate is not discriminatory based on the borrower’s profession or financial status.

✅ 5. Protection Against Predatory Lending

Digital lenders and NBFCs must follow fair lending practices.

Lenders cannot use aggressive recovery tactics or apply hidden charges to increase the effective loan cost.

📌 Tip: Always review your loan agreement and clarify any additional charges before signing the loan document.

3. How Do RBI’s Interest Rate Guidelines Benefit Borrowers?

RBI’s restrictions on personal loan interest rates help borrowers in multiple ways:

✅ Prevents Exploitation by Lenders – Ensures that banks and NBFCs offer fair and competitive rates. ✅ Promotes Transparency – Requires lenders to disclose the total cost of borrowing upfront. ✅ Ensures Flexible Loan Repayment – Guidelines prevent unreasonably high foreclosure penalties. ✅ Encourages Responsible Borrowing – Borrowers can make informed decisions based on clear terms.

📌 Tip: Compare multiple lenders before finalizing a personal loan to ensure you get the best deal.

4. RBI’s Impact on NBFCs and Digital Lenders

With the rise of fintech lending platforms and NBFC-backed personal loans, the RBI has introduced additional rules to regulate interest rates:

✅ 1. Interest Rate Ceiling for NBFCs

While NBFCs can set their own interest rates, they must ensure that rates are non-exploitative.

RBI regularly monitors NBFC interest rates to prevent unfair lending practices.

✅ 2. Regulations for Digital Lending Apps

All digital lenders must be registered with RBI and follow fair lending guidelines.

Apps that offer personal loans with misleading interest rates face strict penalties.

✅ 3. Guidelines on Processing Fees and Hidden Charges

RBI prohibits excessive processing fees and hidden charges in personal loans.

Borrowers must receive a clear breakup of loan costs before signing an agreement.

📌 Tip: Avoid unregulated loan apps and always verify whether the lender is RBI-registered.

5. How to Secure the Best Personal Loan Interest Rate?

Borrowers can take the following steps to secure the lowest personal loan interest rate:

✅ 1. Maintain a High Credit Score

A CIBIL score of 750+ helps secure lower interest rates.

Pay existing loan EMIs and credit card bills on time.

✅ 2. Compare Interest Rates from Multiple Lenders

Use online platforms to compare bank and NBFC interest rates before applying.

Check for lenders offering special rates for salaried professionals or loyal customers.

✅ 3. Choose a Shorter Loan Tenure

Shorter loan tenures attract lower interest rates.

A longer tenure may reduce EMI but increase the total interest paid.

✅ 4. Negotiate with Your Lender

If you have a good credit history, negotiate for a lower rate or processing fee waiver.

Existing customers of banks may receive special discounts on interest rates.

📌 Tip: Use a personal loan EMI calculator to estimate your monthly payments before applying.

Final Thoughts: Borrow Smart, Stay Informed

Understanding RBI’s restrictions on personal loan interest rates can help borrowers make informed decisions and avoid falling into debt traps. While RBI does not cap interest rates, it enforces fair lending practices to ensure that borrowers are not overcharged or misled.

🚀 Key Takeaways: ✔ RBI mandates fair and transparent loan pricing. ✔ Banks and NBFCs must link interest rates to external benchmarks. ✔ Digital lenders must follow ethical lending practices. ✔ Compare multiple lenders to secure the best personal loan rate. ✔ Maintain a good credit score for better loan offers.

By staying informed about RBI’s personal loan regulations, you can make smarter borrowing decisions and avoid unnecessary financial burdens.

For the latest updates on personal loan interest rates and best borrowing practices, visit www.fincrif.com today!

#finance#nbfc personal loan#fincrif#personal loans#personal loan online#personal loan#loan apps#loan services#bank#personal laon#personal loan interest rates#RBI guidelines on personal loans#personal loan EMI calculation#loan interest rate regulation#RBI rules for personal loans#how RBI controls loan interest rates#personal loan borrowing limits#impact of RBI repo rate on personal loans#NBFC personal loan interest rates#how banks set personal loan rates#minimum interest rate on personal loan#maximum personal loan interest rate India#RBI benchmark rates for loans#fixed vs floating personal loan rates#loan tenure and interest rate relation#how to get the lowest personal loan rate#hidden charges in personal loans#RBI fair lending practices#how digital lenders set loan rates#bank personal loan rate comparison

2 notes

·

View notes

Text

How to Negotiate Better Terms on Your Personal Loan

Securing a personal loan can be a game-changer for your financial situation, but did you know that you can negotiate better terms? Many borrowers miss out on this opportunity, settling for the first offer they receive. Whether you’re looking for a lower interest rate, better repayment terms, or reduced fees, advocating for yourself can lead to significant savings. Let’s dive into how you can effectively negotiate better terms on your personal loan.

Understanding the Basics

Before diving into negotiation tactics, it’s essential to understand what you’re negotiating for. Personal loans typically come with various terms, including:

Interest Rate: The cost of borrowing money, expressed as a percentage.

Loan Amount: The total sum you’re borrowing.

Repayment Term: The duration over which you’ll repay the loan.

Fees: Any additional costs, such as origination fees or prepayment penalties.

Having a clear understanding of these terms will empower you to negotiate effectively.

1. Do Your Homework

Knowledge is power when it comes to negotiation. Research current market rates for personal loans to know what’s reasonable. Websites like Bankrate or NerdWallet can provide insights into average interest rates based on your credit score and loan amount. This data will give you a benchmark to reference when discussing terms with lenders.

2. Know Your Credit Score

Your credit score plays a significant role in determining the terms of your loan. A higher score often translates to lower interest rates. Before approaching lenders, check your credit report for any errors and understand your score. If you’ve recently improved your credit score (e.g., by paying down debt), use this as a leverage point in negotiations.

3. Be Prepared to Shop Around

Don’t settle for the first offer you receive. Approach multiple lenders to get quotes. Having competing offers allows you to leverage one lender against another, giving you more power in negotiations. If one lender offers you a better rate, use that information to negotiate with others.

4. Highlight Your Financial Stability

When negotiating, it’s important to present yourself as a responsible borrower. Highlight your financial stability, such as:

A steady income

Low debt-to-income ratio

A strong payment history on past loans or credit cards

Demonstrating your reliability can encourage lenders to offer you more favorable terms.

5. Ask for Discounts or Promotions

Many lenders offer promotional rates or discounts for specific conditions. For example, some may offer lower rates for automatic payments or for being a loyal customer. Don’t hesitate to ask if there are any discounts available that you could qualify for.

6. Be Clear About Your Needs

Communicate your expectations and needs clearly. If you’re looking for a specific interest rate or repayment term, express that directly. For example, you might say, “I’ve seen offers for lower interest rates; is there any flexibility in your terms?” Being straightforward can often yield surprising results.

7. Consider a Co-Signer

If you have a friend or family member with a strong credit history, consider asking them to co-sign your loan. This can improve your chances of getting better terms, as lenders view co-signers as added security. Be sure both parties understand the responsibilities involved.

8. Stay Calm and Professional

Negotiation can feel intimidating, but it’s important to remain calm and professional. Approach the conversation with a positive attitude. Remember, lenders deal with negotiations daily, so being respectful and composed can leave a good impression.

9. Be Ready to Walk Away

If the terms don’t meet your expectations, be prepared to walk away. Sometimes, showing that you’re not afraid to seek alternatives can motivate lenders to improve their offer. This doesn’t mean you should be confrontational; rather, it’s about knowing your worth and being willing to pursue other options.

10. Get Everything in Writing

Once you’ve successfully negotiated better terms, ensure that everything is documented. Review the loan agreement carefully, confirming that the terms discussed are reflected accurately. This protects you and helps prevent any misunderstandings down the line.

Conclusion

Negotiating better terms on your personal loan is not just possible; it’s a smart financial strategy. By doing your homework, understanding your credit score, and presenting yourself as a reliable borrower, you can advocate for more favorable terms that fit your needs.

Remember, the power of negotiation lies in your willingness to ask for what you deserve. With the right approach, you can secure a personal loan that not only meets your financial needs but also saves you money in the long run. Happy negotiating!

0 notes

Text

@daluy0ng

LOCATION: envy, outside FOR: laon alcántara

EVEN IF REGINA WASN’T working — she found it quite difficult to stay away from the club for very long. as much as she hated to attach importance to any person or place, it was a home away from home. ever the creature of the night, she thrived in environments like this. where people felt like they could be free, while the rest of the world was sleeping. thus, she found herself watching with delight from the elevated portion of the club like a queen watching over her subjects as laon underwent her set. the new character in envy’s story was a mysterious one — one whom the club manager had yet to get to know. thus, she couldn’t help but smile in delight when the new dj breeched the doors of the club after the vampire had slipped outside for a cigarette. perfect timing.

“ quite the electrifying set, darling. it’s clear you’re already beloved. “ regina hums, emerging from the blackness that somehow naturally surrounded her. it followed wherever she went, ever since the moment she was turned. the manager would occasionally engage in sets of her own — but it was always a beautiful thing to see fresh talent that felt natural. raw. exhaling, the smoke curled around her in a dance that seemed almost choreographed. “ nothing like being a good dj to have the people worshiping at your feet. “

2 notes

·

View notes

Text

who: maren & laon @ren0wned where: club envy

maren didn't really know what to think. she wasn't sure she should be there at all , but the loud , deafening music coming from the dance floor was as beckoning as a siren luring in the water , singing for you to follow them. she'd cautiously approached , making sure that she had a way to leave if need be. so far she'd counted three fire escapes as well as the entrance. she felt terribly out of place. kiyan had told her that they were the owner and the idea of going clubbing was such a strange concept that she had to check it out. she'd just not been prepared for the noise. "excuse me ," she said , shouted really , carefully tapping the nearest person. "do you ... what do i do here." it sounded so ridiculous it made her laugh. "i've never been to a club before."

2 notes

·

View notes

Text

Instant Personal Loan

We are living in a fast-paced world, where everything is turning digital and is supposed to be done within minutes. All the processes are transformed into digital processes, making it convenient for the users. These digital processes can be observed in almost all sectors and industries such as banking

0 notes

Text

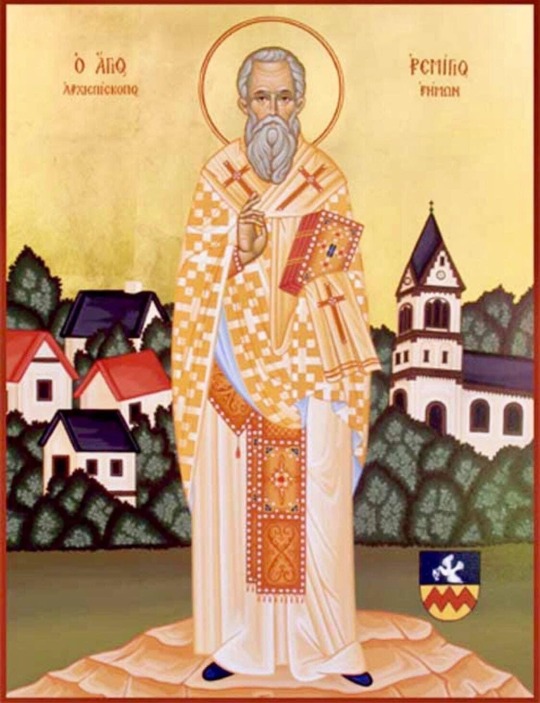

Today, the Church remembers Saint Remigius (Remy or Remi), Bishop of Reims and called the Apostle of the Franks, (c. 437 – January 13, AD 533). On 25 December 496 he baptised Clovis I, King of the Franks. This baptism, leading to the conversion of the entire Frankish people to Christianity, was a momentous success for the Church and a seminal event in European history.

Ora pro nobis.

Remigius was born, traditionally, at Cerny-en-Laonnois, near Laon, Picardy, into the highest levels of Gallo-Roman society. He is said to have been son of Emilius, count of Laon (who is not otherwise attested) and of Celina, daughter of the Bishop of Soissons, which Clovis had conquered in 486. He studied at Reims and soon became was noted for his learning and sanctity, as well as his and his high status. He left France to go to the Holy Lands for a period of years to seek out the Desert Fathers, and to learn from them. While in monastic seclusion, news was sent to him that he was elected Archbishop of Reims in his 22nd year, though still a layman. At first he refused, but he had to consent, as heaven itself had confirmed the choice by a ray of light with which his head was surrounded in the presence of a multitude of people. It is well known that by God’s grace, through his prayers God gave sight to a blind man; cast the devil out of one possessed, extinguished a raging conflagration with the sign of the holy cross, and, after a short prayer, recalled a dead maiden to life.

He was able to develop friendly relations with Clovis, King of the Franks, on account of his high status and because of Clothilde, the Queen, who was a Christian. Even before he embraced Christianity, Clovis had showered benefits upon Remigius and the Christians of Reims.

On the eve of a fateful battle, Clothilde and Clovis struck an agreement, that if Clovis would pray to the Christian God and the battle was won, Clovis would be baptized and become a Christian. As a battle was to be fought, on the issue of which the welfare of the whole kingdom depended, she exhorted him to call on the God of the Christians for aid. Clovis won the decisive battle, but not without a miracle. Victory seemed for a long time to be on the side of the enemy, and Clovis thought that all was lost, when he suddenly remembered the admonition of his queen and exclaimed: “God of Clothildis! if thou art the true God, save me, and I will become a Christian and serve Thee faithfully.” No sooner had he pronounced these words, than the tide of battle turned in his favor, and the enemy was completely routed, most likely the Alamanni in the battle of Tolbiac (496 AD).

The king, not to delay the fulfilment of his promise, called St. Remigius immediately to be instructed in the Christian faith and be prepared for baptism. Clovis requested Remigius to baptize him at Reims Cathedral on Christmas 496 AD in the presence of a large company of Franks and Alamanni; according to Saint Gregory of Tours, 3,000 Frankish nobles and their families were baptized with Clovis. Before St. Remigius baptized the king, he addressed to him these memorable words: “Bow down thy head, O king, and submit to the mild yoke of Christ. Worship what thou hast hitherto burned; and burn what thou hast hitherto worshipped!”

King Clovis granted Remigius stretches of territory, in which Remigius established and endowed many churches. He established bishoprics at Tournai; Cambrai; Thérouanne, where he personally ordained the first bishop in 499; Arras, where he installed St. Vedast; and Laon, which he gave to his niece's husband Gunband. In 530 he consecrated Medardus, Bishop of Noyon. Remigius' brother Principius was Bishop of Soissons and also corresponded with Sidonius Apollinaris, whose letters give a sense of the highly cultivated courtly literary Gallo-Roman style all three men shared.

The chroniclers of "Gallia Christiana" record that numerous donations were made to Remigius by the Frankish nobles, which were presented to the cathedral at Reims.

Though Remigius never attended any of the church councils, in 517 he held a synod at Reims, at which after a heated discussion he converted a bishop of Arian views. Although St Remigius's influence over people and prelates was extraordinary, upon one occasion his condoning of the offences of one Claudius, a priest whom Remigius had consecrated, brought upon him the rebukes of his episcopal brethren, who deemed Claudius deserving of losing his status as a priest. The reply of Remigius, still extant, is able and convincing.Few authentic works of Remigius remain: his "Declamations" were elaborately admired by Sidonius Apollinaris, in a finely turned letter to Remigius, but are now lost. Four letters survive: one containing his defence in the matter of Claudius, two written to Clovis, and a fourth to Bishop Falco of Tongeren.

Remigius died in the 96th year of his age in 533 AD, of which 75 years had been spent in his episcopal functions.

St Remigius' relics were kept in the Cathedral of Reims, from whence Hincmar had them translated to Épernay during the Viking invasions and thence, in 1099 to the Abbey of Saint-Rémy. His feast is celebrated on October 1.

O God, by the teaching of your faithful servant and bishop Remigius you turned the nation of the Franks from vain idolatry to the worship of you, the true and living God, in the fullness of the catholic faith: Grant that we who glory in the name of Christian may show forth our faith in worthy deeds; through Jesus Christ our Lord, who lives and reigns with you and the Holy Spirit, one God, forever and ever.

Amen.

2 notes

·

View notes