#Investment-Tips

Explore tagged Tumblr posts

Text

youtube

https://tradegenie.com/ - Welcome to a comprehensive journey of mastering the art of trading and investment! In this video, we delve into a treasure trove of invaluable knowledge and strategies designed to elevate your trading game to the next level.

"Mastering the Principles of Abundance" sets the stage, as we discuss the fundamental concepts that underpin success in the financial markets.

Learn the art of "Creating Waves in the Market," and discover how to spot emerging trends that can propel your investments to new heights.

"Developing Low-Risk Trade Ideas" is a key theme, as we unravel the secrets of making calculated moves to protect your capital while maximizing potential gains.

"Crafting Your Low-Risk Trading Game Plan" is a must-watch segment, providing you with a blueprint for success in trading and investment.

"Advanced Trading Strategies - Techniques & Patterns" uncovers the sophisticated tactics and patterns used by seasoned traders to stay ahead of the curve.

Explore the "Your Trading Candidates" section, where we discuss trading opportunities among "Horsemen," "Kings," "Queens," "Financials," and "Oil," offering insights into diverse market sectors.

Learn the importance of "Price & Volume Filters" to refine your trading decisions, ensuring you're well-prepared to seize the right opportunities.

"Opening a New Trade" and "Using Limit Orders Intelligently" are essential techniques that can make or break your trading success, and we provide expert guidance on these critical aspects.

Whether you're a seasoned trader looking to sharpen your skills or a newcomer eager to embark on a successful trading journey, this video has something for everyone. Don't miss out on the chance to master excellence in trading and investing. Hit that play button and get ready to take your financial journey to the next level!

Limited-Time Offer: Join Swing Options Service

Join our Swing Options Service monthly at a trial price of $97 instead of the regular price of $197.

Use promo code "SAVE100" to get an incredible $100 OFF!

For more information and resources, visit our coaching page: https://tradegenie.com/coaching/

Connect with us on Facebook: / therealtradegenie

Head Office:

Trade Genie Inc.

315 South Coast Hwy 101,

Encinitas, CA 92024

Phone Number: 212-930-2245

Email: [email protected]

#TradingStrategies

#InvestmentTips

#MarketAnalysis

#FinancialEducation

#AdvancedTrading

#LowRiskTrading

#TradeIdeas

#MarketTrends

#TradingPatterns

#AbundancePrinciples

#LimitOrders

#PriceandVolume

#FinancialMarkets

#InvestmentStrategy

#TradingGamePlan

#TradeExecution

#TradingTechniques

#Trading-Strategies#Investment-Tips#Market-Analysis#Financial-Education#Advanced-Trading#LowRisk-Trading#Youtube

0 notes

Text

Basic Financial Rules To Live By 💰✨

Create a plan that shows how much money you get and how much you spend. This helps you see where your money goes.

Set aside a part of your money as savings. Try to save at least 10-20% of what you earn.

Be careful with borrowing money, especially if you have to pay back a lot of extra money (interest).

Save some money for unexpected things like medical bills or losing your job. Aim to have enough to cover your living costs for a few months.

Put your saved money into different things that can make it grow, like stocks or real estate. Be patient, as it takes time.

Don't spend more money than you make. Stick to buying what you really need, not just what you want.

Decide what you want to do with your money, both in the short term (like a vacation) and long term (like retirement).

Set up automatic transfers to your savings and bills so you don't forget to save or pay your bills on time.

Make saving money a top priority before spending on other things.

Regularly look at your money situation, adjust your plan as needed, and see how your investments are doing.

Pay your bills on time and use credit wisely (like credit cards) to keep a good credit score, which can help you get better deals on loans.

Save money for when you're older and don't work anymore. Use retirement accounts to help with this.

Think before you buy things. Don't buy something just because you want it; think if it's necessary.

Keep learning about how money works and how to make smart money choices.

Only use your emergency fund for real unexpected problems, not for things you just want to buy.

#financial planning#finance#investing#money#girl math#wealth#level up journey#it girl#dream girl#dream girl guide#dream girl tips#dream girl journey#that girl#becoming that girl#educate yourself#wealth mindset#growth mindset#success mindset

3K notes

·

View notes

Text

financial literacy⋆.ೃ࿔*:・✍🏽🎀

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

WHAT IS FINANCIAL LITERACY ;

financial literacy is handling ur money wisely. the google definition of financial literacy is the ability to understand and apply different financial skills effectively, including personal financial management, budgeting, and saving.

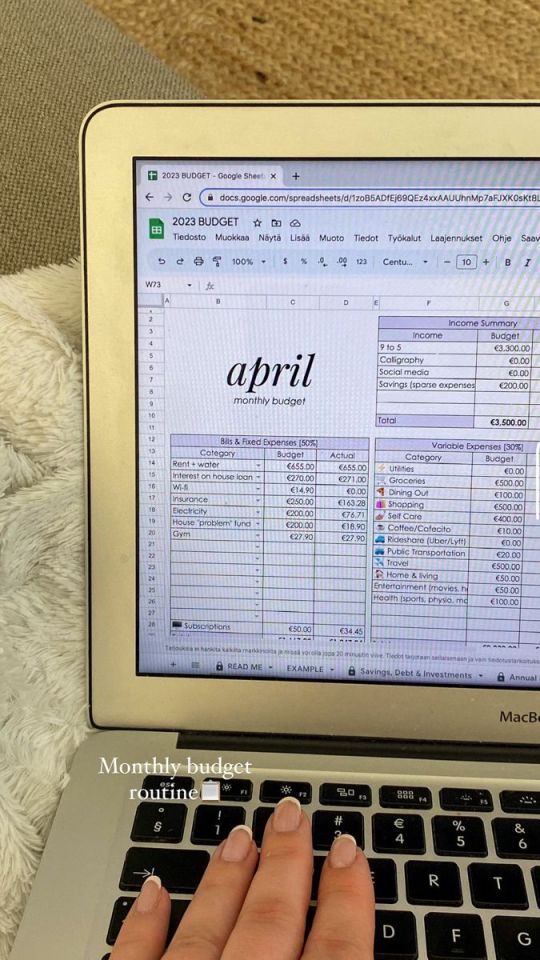

ALL ABOUT BUDGETING ;

when u hear the word "budget" its rly easy to think "omg limiting belief" or think of it in a negative light but a budget is just a plan on how u manage ur money. its not always constrictive and negative like u may or may not think of it to be.

budgeting : keeping track of how much $ ur bringing in and how much ur spending…💬🎀

planning a budget is ez pz. you can use some paper and sparkly pink gel pens to create an adorable budget, or u can download different sheets online and just have your budget digitally. theres a plethora of resources out there so just choose whichever is easier for u.

something else that i learned about during this course was the 50:30:20 rule. its called the 50:30:20 rule because 50% of ur money goes towards ur needs, 30% goes towards wants and 20% goes towards ur savings. and this isnt concrete, its just a good framework and u can adjust to ur own specific needs and goals.

for example if u manifested $4000. ur 50% would be $2000, ur 30% would be $1200 and ur 20% would be $800…💬🎀

HOW DO U KNOW WHAT UR NEEDS/WANTS ARE ;

things like ur rent and groceries are ur needs and things like vacations and going out with ur girls are wants. and to apply the 50:30:20 rule you first have to...

♡ calculate ur needs, wants and savings budget

♡ compare ur expenses to ur budget

the way u do this is to subtract your expenses from your budget. this is your budget balance. if your budget balance is zero or positive, that means you are living within your means and have some extra money. if your budget balance is negative, that means you are spending more than you should and may have a budgeting problem.

let me know if u guys want more content about this cuz i had a lot of fun writing this…💬🎀

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

587 notes

·

View notes

Text

BUDGETING + SAVING MONEY FOR TEENS 𐙚

For many of us, we are entering an age when we can work casual jobs such as retail or fast food. It’s not a lot of money that we receive, depending on how often you get paid, but it can go a long way in the long term.

In this post, I’ll be discussing how to budget for your needs/wants and save money for future goals.

CREATING GOALS, you may want to save a certain amount of money in a time frame, want to make a big purchase (like a car) or buy everything off your wishlist. It is entirely up to you what your goals are, so I can’t say too much. However, the more specific it is, the better.

HOW MUCH? Determine how much money you need to save to achieve your goal. In total, and monthly.

There are three types of saving goals that may apply to you;

Short-term goals >1 year (outings, latest gadget, buying your cart)

Medium-term goals 1-2 years (road trips, shopping spree)

Long-term goals 2-4 years (higher education, car)

It’s very important to set a realistic time frame, as teens we don’t get paid much and we also don’t work as much. You don’t want to overwhelm yourself as well, as it takes patience and self-control to achieve these goals.

NO LOOONG-TERM GOALS! This may sound aggressive, but any money that just sits in your account for years on end is dead money. Even though the amount of money is increasing, its value is slowly decreasing. Keep your goals achievable within a time frame of less than four years. It's much more useful if this money is put into some type of investment instead.

CREATING A BUDGET

Calculate how much money you receive every month, and how much money you spend every month.

You have two types of expenses. Fixed and variable. Fixed are any expenses required in your day-to-day life or it’s an amount of money that doesn’t change e.g. subscriptions or transportation costs. Variable costs are expenses that may fluctuate, like food, or any other recreational activities.

Record the average you’re spending monthly with these two categories.

There are many ways people choose to budget, but you have to choose a system that works for you.

Work out how much money you need to save each month to achieve your goal.

However, for anyone who’s starting in budgeting, I would say to allocate your costs using a percentage system. Your percentages for each category are going to differ from mine; e.g. 60% = savings, 20% = wants, 20% needs. Make sure it reflects the end goal.

Track your progress. This is the major part of budgeting, you want to be recording and regularly reviewing how much money you’re spending and comparing it to how much you’re earning. It allows for space to reflect on the flow of your money like if some purchases are worth it, if you’re impulsively spending, or if you’re frequently withdrawing money from your savings.

Adjust if needed. Maybe you want to put more money in savings and less into wants, or you want to put more into wants and less into needs.

SAVING TIPS

SAY NO! This is probably my biggest struggle at the moment, but say no to things that will cause you to go off track. Whether its outings, getting fast-food or anything similar, say no. You have to be firm with your financial boundaries, as these opportunities will always arise again.

RESTRICT IMPULSIVE SPENDING. We all have our moments when we see a product and we instantly think ‘I’ve got to have this’. Giving in once or twice is okay, but it shouldn’t become a habit at all. Its unnecessary spending (most of the time!) and leads to buyers remorse.

IS IT WORTH IT? Always remember to work out which products you’re getting the most value out of.

PAYING FOR THE NAME, a lot of brands will cut down on quality to save a few dollars, so essentially the customer is only paying for the name of that brand. Just because a store is more expensive, doesn’t mean its better.

#prettieinpink#becoming that girl#that girl#clean girl#green juice girl#dream girl#dream girl tips#it girl#vanilla girl#glow up#pink pilates princess#dream girl journey#dream girl life#dream girl vibes#dream life#wealth#old money#money#finances#invest#wonyoungism#it girl tips#it girl energy#winter arc#abundance#becoming her#that girl lifestyle#that girl routine#glow up era#feminine journey

304 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

440 notes

·

View notes

Text

I need to keep reminding myself that im making the comic for me. That im telling this story because im a little crazy about it.

Im making all of this on my free time after work so I shouldnt feel guilty about not pumping out artwork after artwork.

I know so many people are waiting excitedly, so am I, but making a comic takes time and work. This whole thing is probably going to take so much longer than I think it will.

Nobody is pressuring me either so taking time for myself is not a bad thing. Even if people forget about my stuff and it doesnt get engagement its not the end of the world.

I am making this for myself. Just because I like it. Just because I enjoy creating.

#just keep repeating#until the guilt goes away#its ok if people start to get uninterested in it#it will be ok if no body sees the end of it#i will be ok#this isnt work#im making it just because#other people joining in is a very nice bonus#i didnt expect people to even get invested in this silly little thing#i didnt make big plans for it#my main focus isnt to get something from it#its not to use it so i can have money#im happy that people like it so much that they are willing to tip me#im not doing this to make money#its just a product of it#do not lose your sight#do not lose your way#just tell your silly story and move on#just because you can create it#aychama talks

72 notes

·

View notes

Text

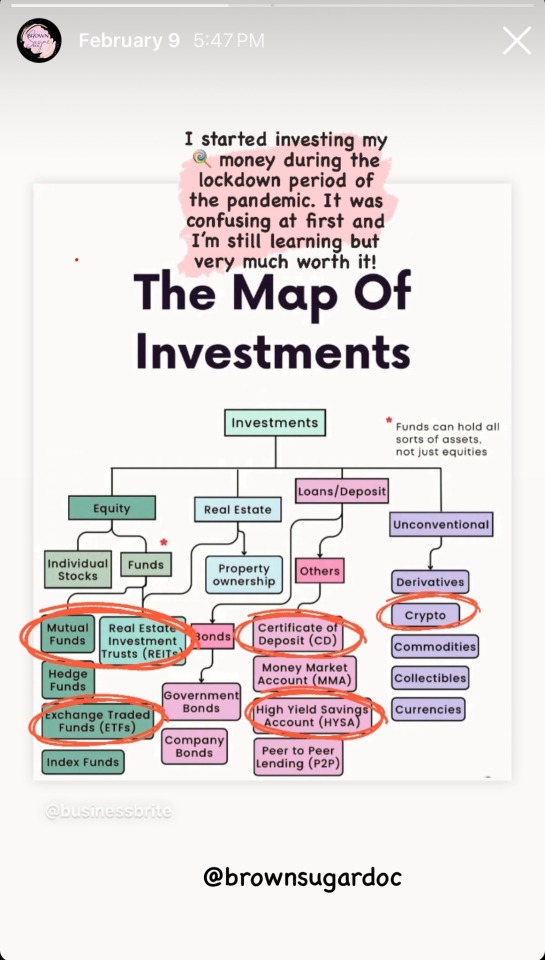

How are you investing 🍬 or extra money? I started trying to learn about stock investments during the panorama. I lost just under $5k playing around with crypto 😭 but I learned (and still learning) a lot about financial management. I recently moved $10k from my HY savings account to a CD. I was dating a finance guy and he told me to open up a CD because it’s a higher interest rate and he matched my initial deposit 🥰 There’s so much to learn but it’s much better than letting money sit & collect dust! I’ve been wanting to hop on live & share my experiences with sugar investments 🤔

#sugar lifestyle#sugar blog#levelup#money mindset#finance#extra money#sugar bowl#sugar baby tips#sugar dating#heaux tips#hypergamy#black women in luxury#dating#levelingup#sugar life#investing

123 notes

·

View notes

Text

money saving tips

here are some ways you can save your money ! i hope this helps!

transfer 4/5 of your money into your bank account (if you need cash on hand)

if you are looking to save cash, use two piggy banks; one for your savings and the other one for money you are going to spend

dont buy (unnecessary) things if you can't buy them 3x

ask yourself if the thing you want to buy is something you need or something you want

it's more than okay to spend money on things that you want but leave some wishes for a time when you are more financially stable

find other things to do instead of shopping

see if the thing you want to buy is available for a cheaper price

make an emergency fund

make a grocery list and follow it (don't buy things that aren't listed)

save up coupons and buy things on sale

find hobbies that make you money instead of costing money

cancel unnecessary subscriptions

make your drink/food at home instead of buying it in shops

invest in things that last longer (so you don't have to buy them over and over again)

#saving#saving tips#saving money#money#investing#self care#manifestation#healing#self healing#self love#self improvement#manifest#clean girl#it girl#self concept#self worth#it girl energy#that girl#affirmations#manifesting#motivation#positive thinking#self help#health#wealth#health is wealth#glow up#becoming that girl#i aspire to be her#health and lifestyle

117 notes

·

View notes

Text

financial literacy continued⋆.ೃ࿔*:・👛💵

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

HOW TO SAVE MONEY ;

automatically deposit a certain percentage of ur income into ur savings account so that u dont even have to think about it

to do something more FUN tho, (at least in my opinion) is to make a challenge where u have to save every $10 dollar bill, or $20 dollar bill or whatever. just something to make saving money seem like a game if u wanna have some fun with it.

EMERGANCY FUND ;

most experts will tell u that ur emergency fund should be 3-6 months of ur needed expenses. so calculate ur needed expenses and multiply that by 6 to figure out how much you'd need to have in ur emergency fund.

PAYING YOURSELF FIRST ;

you should always put urself first in every single situation including financially. so to pay urself first simply means to put ur future and needs before anything else. FOR EXAMPLE... let's say u wanna buy an ipad by the end of the year, an ipad is $345.

lets also say that u get paid weekly, so you'd divide $345 by the number of weeks in a year (52) you'd get 6.6. so you'd have to save roughly $6-$6.50 a week which isnt a lot at all. and you'd be getting what u want.

INTEREST AND CREDIT ;

interest is like a reward that the bank gives you for trusting them to look after your money. the more money you have in your account, and the longer you keep it there, the more interest you can earn…💬🎀

so the bank calculates interest as a percentage of the total amount in a bank account. so if the bank pays a 1% interest you'll earn $1 for every $100 in ur bank account over the course of a year. so if u have $500 in ur account you'll get $5. its not a lot, but interest builds on itself.

credit is the ability of the consumer to acquire goods or services prior to payment with the faith that the payment will be made in the future…💬🎀

for example missing payment deadlines can negatively affect ur credit score. why is this important? if u wanna go to college and wanna use student loans, u might not be able to if ur credit history is bad. as ur credit history grows you'll get a credit score. the higher ur score, the better ur credit is.

BUILDING CREDIT ;

get a secured card. a secured credit card is a special type of credit card with a down payment. when you open the card, you will give the credit card company a deposit to hold. it can be as little as $100. the company holds the money for you and gives you a credit card with a line of credit equal to your deposit

sign up for victoria's secret direct paper mailers. you'll get a coupon each month for 1 free panty for every purchase. when u go to the mall, get urself a panty and a sweet treat 🧁 (DO NOT PUT ANYTHING ON THE CARD THAT U CANT IMMEDIATELY PAY OFF)

and then go home and pay ur credit card bill off, and then dont use it again until the next month.

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

799 notes

·

View notes

Text

Want to learn how to invest?

ATTENTION CITIZENS OF BITCH NATION.

Our beloved comrade, Dumpster Doggy aka Amanda Holden, is teaching an investing workshop starting THIS SUNDAY, FEB 4. Dumpster Doggy designed this workshop as your first step toward financial freedom, and it is perfect for beginners and those who just want to understand the reasoning and mechanics behind investing.

This workshop is for you if you:

Have debt — yes, you should consider investing even if you have debt now

Don't know where to start

Want to be certain that your educational foundation is absolutely solid

Understand that investing is the key to building wealth, and know that a paycheck alone is not wealth

Don't want to work forever

Want your money to start working for you

Know that you just need to get started—no matter how small the dollar amount!

Know that education must be your foundation and that investing without knowledge is dangerous

Have a workplace retirement account

Don't have a workplace retirement account

The course costs $15. We wouldn't recommend something paid like this if we didn't believe in it, so this endorsement does NOT come lightly. Amanda is one of our ride-or-dies, and she left Wall Street so she could teach investing through a feminist lens.

But if $15 is too rich for your blood, we are offering Amanda's course FOR FREE to our Patreon donors. Sign up at the $5 level or higher and it's yours ($15-$5=$10 SAVINGS HOLY CANNOLI). We'll have the information for Patreon donors up tomorrow.

Lastly, if you can't make it live, you'll still get a recording of the workshop. So don't worry if you're not available this Sunday. Ok here are those links again:

Investing for Freedom Workshop with Dumpster Doggy

Bitches Get Riches Patreon for free access to workshop

#investing#stock market#how to invest#how to invest in the stock market#stocks#trading stocks#investors#investments#personal finance#money#money advice#money tips#making money#investing stocks#stockmarket

117 notes

·

View notes

Text

youtube

Iris coming through once again!

#personal growth#money tips#personal finance#economy#investing#glow up#level up#that girl#becoming that girl#becoming her#it girl energy#rich girl#old money#level up journey#self improvement#self development#self confidence#self growth#it girl#hypergamy#high value woman#high maintenance#leveling up#feminine journey#femininity#Youtube

12 notes

·

View notes

Note

Like a Dragon Ishin Goromi exists and I can prove it !

Before the fight against Shinpachi, there is a discussion between two NPCs ;

"So I heard that Okita the Shinsengumi captain is quite the looker. So much so that a woman allegedly snuck into the barracks to see him. But no one know what happened to her"

Someone has seen Goromi !

I saw that!!!!

100% adding it to my headcanon...

#WIFE REAL#ryoma calling okita ugly sorry boo you're fated to touch tips with him and I will make sure that happens by the powers invested in me

105 notes

·

View notes

Text

"Let’s have a look now at stock tips.

There are many ways to be successful at stocks. For instance, you can be lucky, or you can cheat. Those are the two ways.

Lucky is difficult. Not impossible, but it does require some spells. You have to wear a small bag around your neck stuffed with thistle and rosemary, and burn the one thing in your life most precious to you. And even then, half the time you just end up with your sourdough turning out perfect, or getting Wordle in two, which if you think about it is actually much more impressive than getting it in one, you will say to everyone you know even though they extremely do not care. What I’m saying is it’s hard to aim luck.

So your best bet is to cheat. Fortunately, there are a TON of ways to cheat. For instance, you can do some corporate espionage, find out information before it hits the open market, and then invest accordingly. Or you can manipulate the markets, causing untold suffering and wiping out the entire economy for the sake of buying your third house. If history tells us anything, and I hope it doesn’t, you won’t ever get punished.

But the absolute best way to cheat, and doctors hate this one weird trick, is to join congress. Because there is no law against actively investing while in congress despite the fact that you will be constantly told secret information that will radically affect the markets. And you can just make a ton of money on that info without any consequences because who is going to pass a law against that? You? Don’t make me laugh. Please don’t make me laugh. It hurts so terribly when I laugh. Ow. Ouch. Oh man. I miss laughing. I miss it so much.

This has been stock tips."

- Joseph Fink and Jeffrey Cranor, from Welcome to Night Vale, ep. 220.

#joseph fink#jeffrey cranor#quote#quotations#welcome to night vale#wtnv#stock market#trading stocks#stock trading#eat the rich#greed#stock tips#investing stocks#corruption#capitalism

158 notes

·

View notes

Text

Tips for any and all ladies following me.

Invest in stocks (plenty of apps allow you to purchase small percentages of a stock or crypto. So if you can only do $50 a month.. do it)

Invest in your 401k (if this option makes sense. especially if your employer is matching you)

Take care of your credit. (I don't care what anyone says, in the U.S. it matters. Even if you're at a 500 score, you can get it up. Make arrangements and pay what you owe. If there's an error or if you don't owe it, report a claim with the credit agencies. Don't just ignore it.)

Ask for the promotion/raise. (A lot of times people feel like they should be grateful just to have a job. Nope. If you're putting in the work respectfully ask for the compensation. 🤷🏽♀️ Worst case you stay right where you are. A lot of places will work with you to move up. 🚩 Just don't let them take advantage either. )

If you can invest in actual tangible assets. ( Buy some silver/gold. Save up for that down payment for some land or that house. Diversifying your assets is never a bad thing.)

Being kept is cute & if that's for you, I support your journey. 💛

For me, there is nothing better than having your own shit. Everything else someone brings to the table is a bonus.

Remember if you got $ for your vices, you have money to allocate for your own future.

💰🪙🫰🏽

& of course don't just take my opinions as facts. Do your own research and find what works for you sis. There are so many resources out there.

#personal#tips#life#investment#invest in yourself#for my ladies#note to self#financial security#random thoughts

24 notes

·

View notes

Text

my python course is trying to indoctrinate me

#m#15% i swear every time i see this number it goes up#i should invest in desired tip quantities at this point

6 notes

·

View notes

Note

I want to FIRE! Do you have any tips for that ;)

Hi love! While I'm not committed to their FIRE movement per se, here are some of my best tips to set yourself up for financial success:

Diligently keep track of your income and expenses. Audit every week or month to give yourself an honest look at your financial activity

Create financial goals and a realistic budget to help you achieve them

Prioritize saving up a 6-month emergency fund, maxing out your Roth IRA (or backdoor Roth IRA) and HSA account (if in the U.S.)

Purchase high-quality, timeless items that are built to last; It's cheaper in the long run to maintain items vs. constantly repurchasing items if you have the option

Create multiple sources of income: A 9-5 job, investments, side hustle, digital products, etc. Find ways to monetize activities you would enjoy doing without earning a dime

Focus on building a strong network and high-value, transferable skills: Even if you plan on working as an employee forever (no shame in that – it's a great way to get a steady paycheck), always strategize your career in a way that would leave you equipped to make it on your own. You need to be in the driver's seat of your career and financial life at all times

Make food at home, take care of your health, and take advantage of preventative medical testing, screenings, and procedures. Losing your health (physical and mental) is the easiest way to ruin your life satisfaction and your finances

Hope this helps xx

#finance#moneymindset#financial planning#savings tips#personal investments#female entrepreneurs#femme fatale#dark femininity#dark feminine energy#successhabits#success mindset#goal setting#it girl#queen energy#dream girl#female excellence#female power#femmefatalevibe#fire movement

76 notes

·

View notes