#Finance Blogs

Explore tagged Tumblr posts

Text

Payday shouldn’t mean overspending and regret. This blog shows how the Dollarbook app helps you dodge common financial traps like impulse buying, payday loans, and missed savings. With features like custom budgeting, visual expense tracking, and goal-setting, Dollarbook is more than just an expense tracker app-it’s your personal guide to smarter money habits.

Whether you're trying to break free from debt or build an emergency fund, this powerful money budget app keeps your finances in check. Learn practical tips, relatable user stories, and discover how to make every payday a step closer to financial freedom.

Start strong-read the full guide now: https://dollarbook.app/blog/2025/06/06/avoiding-payday-spending-traps-tips-to-stay-on-budget/

0 notes

Text

OneNorthStar: Navigating Financial Success

OneNorthStar, a reputable financial advisory firm, is dedicated to guiding individuals and businesses toward financial prosperity. With a commitment to personalized service and a team of seasoned financial advisors, OneNorthStar strives to meet the diverse needs of its clients.

Comprehensive Financial Planning:��At the core of OneNorthStar's offerings is comprehensive financial planning. The firm works closely with clients to understand their unique financial goals, risk tolerance, and time horizon. This collaborative approach allows for the creation of tailored strategies that encompass investment planning, retirement planning, risk management, tax optimization, and wealth preservation.

Investment Planning Expertise: OneNorthStar's team of experienced financial advisors excels in crafting investment portfolios that align with clients' objectives. By assessing risk tolerance and financial circumstances, the firm constructs diversified portfolios incorporating stocks, bonds, mutual funds, and other instruments. The goal is to optimize returns while managing risk, ensuring a solid foundation for long-term financial growth.

Wealth Management Beyond Investments: The firm goes beyond traditional investment planning, offering comprehensive wealth management services. This encompasses a holistic approach to financial well-being, including estate planning, tax strategies, and ongoing portfolio monitoring. OneNorthStar understands that financial success extends beyond investment returns, incorporating a broader perspective to safeguard and enhance clients' wealth.

Client-Centric Approach: OneNorthStar prides itself on its client-centric philosophy. The firm values open communication, transparency, and building long-lasting relationships. Client testimonials underscore the positive impact of the firm's guidance on financial outcomes, reinforcing OneNorthStar's reputation for reliability and excellence.

Educational Resources: Recognizing the importance of financial literacy, OneNorthStar provides educational resources to empower clients in making informed decisions. Whether through articles, webinars, or one-on-one consultations, the firm aims to enhance clients' financial knowledge and confidence.

Fascinated by the power of money

Vikram is fascinated by the power of money and deeply believes that everyone should have lots of it. That’s why he started onenorthstar to transform people’s financial future. Supported by his amazing family, today Vikram shoulders the challenges in people’s journeys to financial freedom through ONS. So that every person experiences financial well-being, and has the opportunity to create more of their life.

Contact US

Need financial advice from Vikram?

Connect today!!

Advice Session available in: 1 on 1 in person. Online video meetings.

T: +1 203-343-0880 E: [email protected] A: 80 Fourth St, Stamford, CT 06905

#Portfolio Manager#Financial Planning#Retirement Planning#Roth 401K#401K#IRA#403B#Investment Management#529 plan#brokerage account#Tax efficiency#Legacy Creation#Financial Planning Services#Financial Advisors#Financial Planning Firm#Finance Blogs#Post Retirement Plans

1 note

·

View note

Text

JUPITER IN HOUSES AND WEALTH

Jupiter, known as the Guru or Brihaspati in Vedic astrology, is the planet of abundance, expansion, and higher wisdom. When analyzing wealth and finances in a natal chart, Jupiter plays a key role—not just in material prosperity, but in the attitude and karma toward money.

1st House Money comes through you—your name, your light, People trust you, and life feels bright.

2nd House Your voice, your values, how you spend— Wealth grows when you don’t pretend.

3rd House Skills, siblings, words you write, Money flows through thoughts in flight.

4th House Family roots and land may give, A quiet home where wealth can live.

5th House Art, children, joy, and play— Luck finds you in a golden way.

6th House Work and service, slow but true, Helping others brings wealth to you.

7th House Partnerships may open the door, Love or business can bring more.

8th House Through others’ money or deep change, Wealth appears a bit more strange.

9th House Travel, teaching, faith, and law— You earn when you inspire awe.

10th House Your career holds fortune’s spark, Respect and wealth go hand in heart.

11th House Big dreams and friends bring gain, Community brings the golden rain.

12th House Quiet gifts and secret streams, Money comes through soul and dreams.

LET ASTROLOGY CHOOSE YOU!

I offer personalized paid consultations, email at [email protected] Join us on our instagram and Quora for more astrology updates!

#astro community#astro observations#astrologer#astrology blog#astro notes#astro tumblr#astrology#vedic astro notes#vedic astro observations#vedic astrology#zodiacsigns#jupiter in astrology#jupiter#finance#wealth

210 notes

·

View notes

Text

financial literacy⋆.ೃ࿔*:・✍🏽🎀

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

WHAT IS FINANCIAL LITERACY ;

financial literacy is handling ur money wisely. the google definition of financial literacy is the ability to understand and apply different financial skills effectively, including personal financial management, budgeting, and saving.

ALL ABOUT BUDGETING ;

when u hear the word "budget" its rly easy to think "omg limiting belief" or think of it in a negative light but a budget is just a plan on how u manage ur money. its not always constrictive and negative like u may or may not think of it to be.

budgeting : keeping track of how much $ ur bringing in and how much ur spending…💬🎀

planning a budget is ez pz. you can use some paper and sparkly pink gel pens to create an adorable budget, or u can download different sheets online and just have your budget digitally. theres a plethora of resources out there so just choose whichever is easier for u.

something else that i learned about during this course was the 50:30:20 rule. its called the 50:30:20 rule because 50% of ur money goes towards ur needs, 30% goes towards wants and 20% goes towards ur savings. and this isnt concrete, its just a good framework and u can adjust to ur own specific needs and goals.

for example if u manifested $4000. ur 50% would be $2000, ur 30% would be $1200 and ur 20% would be $800…💬🎀

HOW DO U KNOW WHAT UR NEEDS/WANTS ARE ;

things like ur rent and groceries are ur needs and things like vacations and going out with ur girls are wants. and to apply the 50:30:20 rule you first have to...

♡ calculate ur needs, wants and savings budget

♡ compare ur expenses to ur budget

the way u do this is to subtract your expenses from your budget. this is your budget balance. if your budget balance is zero or positive, that means you are living within your means and have some extra money. if your budget balance is negative, that means you are spending more than you should and may have a budgeting problem.

let me know if u guys want more content about this cuz i had a lot of fun writing this…💬🎀

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

692 notes

·

View notes

Text

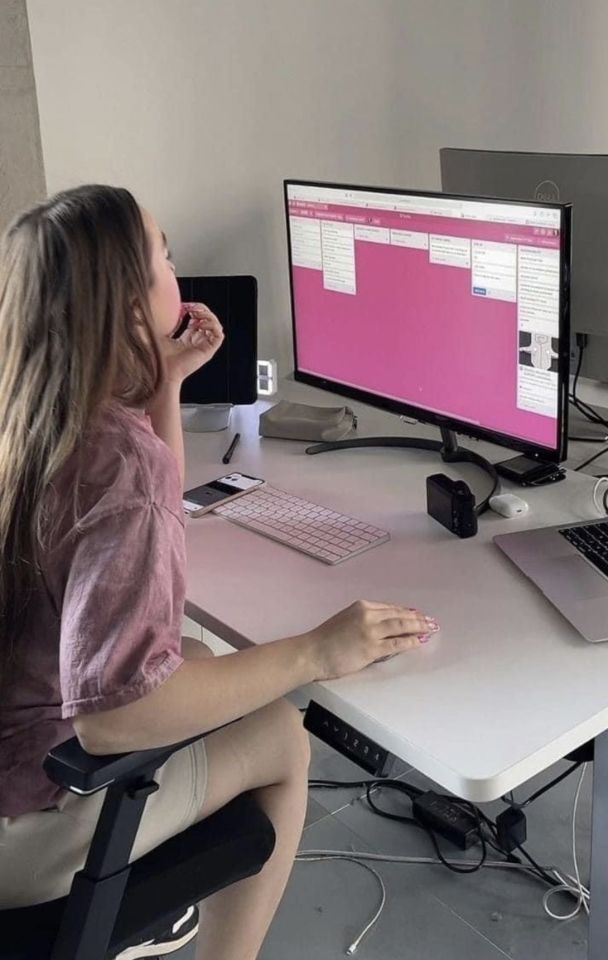

corporate barbie 👩💼💄💗📈

gonna be starting my full-time job soon, i'm looking forward to being the newbie who's on top of things & surprise everyone with how much i know 💅

#it girl#becoming that girl#pink pilates princess#glow up#self care#that girl#wonyoungism#girl blogger#pink pilates girl#motivation#corporate barbie#working#business woman#business#entrepreneur#finance#accounting#girlblogging#girlblog#pink moodboard#pink aesthetic#pink blog

641 notes

·

View notes

Text

Study Trick That No One Told Me.

Division of subjects:

Every subject is learnt and graded in a different way. You can't use the same study techniques for every subject you have. You have mostly 3 types of subjects:

Memorization based

Practical/Question based

Theory/Essay based

Memorization based:

Mostly Biology, Sciences, Geography etc are fully based on memorization and so you'll use memory study techniques like flash cards and active recall.

Practical/Question based:

Maths, Physics, Chemistry, Accountancy etc are practice subjects. The more you do your questions and understand how a sum is done, the better you can score.

Theory/Essay based:

English, history, business studies etc are theory based. The more you write, the way you write and the keywords you use are the only things that will get you your grades. So learn the formats and the structure on how to write your answers

Note: Some subjects are a combination of the three. Like Economics etc

The reason we divide the subjects is because you can adopt the right study methods for the right subject. Like ex: business studies is mostly based on how you write your answer and the keywords, if you're gonna spend your time memorizing in this, it's a waste of time and energy.

Hope this helps :)

#studyblr introduction#studyblr#study motivation#school#study blog#student#studyspo#studying#study aesthetic#high school#study tips#study buddy#studybrl#study break#study goals#goals#academic goals#academic girly#it girl#senior year#self improvement#student life#studyblr community#high school studyblr#high school tips#study hard#study#accounting#finances#economics

491 notes

·

View notes

Text

₊˚⊹ ᰔ a guide to maintaining financial wellness ᝰ.ᐟ

having good money habits can be insanely difficult. i know i personally struggle with impulsive spending, and i’m sure we’ve all fallen victim to the “i’m just treating myself” mindset. financial stress and even financial depression can feel so daunting and overwhelming, so i’m here to help you guys (and myself as well) manage your money better!

let’s begin !!

ᝰ.ᐟ set aside funds

it’s important that when every paycheck hits your bank account to immediately set aside some funds into your savings account. whether it’s 10-20% of your paycheck or even $20-$100, set aside some money into your savings!

it also might help to have that savings account be locked so that you can still put money in, but you can’t take money out. let that savings amount pile up and don’t touch it until you’re absolutely ready to make that big purchase!

ᝰ.ᐟ set aside any cash

get a piggybank or even one of those money organizing binders to set aside any cash that may come your way! keep that cash away from your wallet so you won’t be tempted to use it in any outside purchases. and, same as the first point, that cash will start to pile up!

ᝰ.ᐟ purchase needs rather than wants

let’s start getting out of that “i’m gonna treat myself” mindset!! while it’s nice to treat yourself, we really should only be doing it every once in a while. we can also find different ways of treating/rewarding ourselves that don’t require spending any money! (i can make a separate blog post on this if you guys would like!)

especially when you’re trying to save up for school, a new apartment, a new car, or whatever it may be, it’s really important to keep your purchases to only things that are absolutely necessary.

ᝰ.ᐟ keep track of automatic payments

especially if you have a subscription of any kind, keep track of when those automatic deductions from your account are happening. make note of when your next billing date is and how much you’re being charged for each month/year.

this would also be a good way to determine what subscriptions you really need/want to keep and which ones you can do without and unsubscribe to! i did a full cleanse of my subscriptions list and kept the ones i definitely wanted to keep. sometimes you never really realize how much money your losing when you’re subscribed to things that have no use to you anymore!

ᝰ.ᐟ plan accordingly

when your paycheck comes in and you have all these payments that are coming up yet you still need to buy groceries or get gas or whatever, make sure to plan your funds ahead of time! this way, it’ll help you budget for your groceries & any other necessities as well as help you determine how much money you can set aside into your savings and even calculate how much extra funds you might have to spend on for more personal things!

𝜗𝜚 final notes 𝜗𝜚

don’t let these tips make you feel like you can’t treat yourself to something! as i mentioned earlier, you can still treat yourself to nice things, but it might be best to do it once in a while! i know most of us associate success with money, and to reach success with money we have to learn to be more mindful about how we spend our money and how we manage it.

live and love, babe.

sincerely, juno ⭑.ᐟ

#milkoomis#girlblogger#girlblogging#it girl#that girl#girl blog aesthetic#it girl tips#becoming that girl#finance#money#money management#money manifestation#money saving#spending habits#personal growth#self improvement

212 notes

·

View notes

Text

#money#bank#bitcoin#btc#charity#donations#finance#uk#usa#tumblr milestone#beautiful women#bullion#bunny#blogging#blog#by#beautiful#basketball#books#black and white#beauttiful girls#natural body#bikni girls#amazing body#curvy body#great body#jirai kei#jayce x viktor#jewels sparkles#jiraiblogging

75 notes

·

View notes

Text

Eric Minisode #1

Parts 1 & 2 from Eric’s perspective. I drafted this before my hiatus and while it’s now discontinued …. Figured this deserved to leave the drafts.

She’s in my mother’s drawing room…. And I can’t say I’m upset. I watched her peek into a couple of rooms, curious to see my betrothed outside our usual hours. She seems…. Different than usual. More lively and curious. But then I suppose the only times we interact are at opposing ends of the grand hall, or at balls and social events where we must host and entertain. I know small details about her- like she loves to ride horses, spends her days in her personal drawing room working on embroidery and other ladylike things…. But they’re generic details I could guess at from any lady of the court.

It’s fascinating watching her when she’s in her own element… I can’t help but slip into the drawing room after her. She’s examining mother’s pottery with a small smile, seemingly lost in thought. I’m glad someone’s admitting mothers work- as a child, I’d often watch as she carefully worked the clay, teaching me how to mold it just right, and then watched in amazement as she would glaze it a few days later in intricate designs.

I watch my betrothed giggle to herself and I can’t resist revealing myself,

“What’s so amusing dearest?”

Oh…. Well this is fascinating. She always speaks with such careful measure, as if each word is thought out. She gets flustered on occasion, I have noticed that much, but she responds by stopping to collect herself before carrying on with the same careful grace.

This current version of my beloved is much more…. Open. I’m not sure she even notices how easily I can read her like a book- is this what she’s like when caught off guard? Perhaps I have misjudged my beautiful bride…. I can’t help the thrill the runs through me knowing I’ve surprised her, caused this shift. This thrill turns to shock as she asks to spend the day with me in the library. I see I’m not the only one who can catch the other off guard….

I can’t help but stare at her as she reads. This feels like a dream. I assumed we would have a polite yet distanced relationship, this is, after all, a marriage of convenience. But in the past several months I couldn’t help but admire her poise, the way she commands a room, and couldn’t help but latch onto the little details I’d been able to learn from her. Now, she’s here, in my library, curled up in my favorite chair, so enthralled by her reading that I can see who she truly is under her noble lady facade. And I suddenly find it rather hard to focus on my work. This feels so natural, so right, I wonder why we’ve limited ourselves to such formal meetings this far if what we both seem to crave is simply companionship? How have I not noticed how much she, too, wanted this?

With that thought… I invite her to luncheon and a stroll. I noticed her admiring a painting of a rose garden and I couldn’t get the picture of her under the rose pavilion out of my head… so that’s where I plan to take her. And that’s where we were heading until a rather unpleasant interruption arrived.

I recognized her, the ambassadors daughter. What was more important, however, was the sight of my intended, sprawled on the ground, skirts pooled around her, pushing herself up on her arms, face crinkled in slight pain, and throwing out a blind insult... yet another layer beneath that porcelain mask… my love is a spitfire. I lifted her to her feet, admiring the way it felt so natural to have her in my arms, before letting her go.

The offensive rodent who caused my dearest to go flying was simpering at me, and I couldn’t help the disgust that ran through me- she was completely ignoring the one she had offended, instead was directing her apologies towards me. I exchanged looks with the princess and she spoke before I had the chance.

What a tongue that woman has on her… I know it is my role as the gentleman to defend her honor, but I’ve realized my new favorite hobby is simply observing her. She so easily defended her honor, reminding the lower class woman of her station, and I couldn’t help the thrill that when through me as she referred to herself as the soon to be crown princess. So easily asserted her claim on the throne, on me.

The thrill only continued as she surprised me yet again, grabbing my hand and leading me away. I couldn’t help the look I sent toward the ambassador’s daughter, despite being enamored all the more by my soon to be wife, I can’t overlook that she was hurt and insulted. I’d be remembering this. But, that was for another time. For now, I was being dragged down the hall by my beautiful rose. When she finally released me, the blush on her cheeks was so divine…. I couldn’t help but think of all the ways I might fluster her more so I might see it again.

In one day I have discovered that the woman who has sat across from me each dinner for the last several months, is in fact, my soulmate. Just like I pictured, she looked divine under the roses- admitting they were her favorite. I noted which foods she gravitated towards as well- and realized we shared several favorites, and that she was unbearably adorable trying to hide how much she was enjoying herself.

I don’t believe I’ve ever been in such high spirits as when I returned to my quarters after an afternoon of memorizing the way her smile crinkled her eyes, laughing alongside her as she told me all about her novel, and receiving her rapt attention as I spoke of my day in return.

When I go down to dine with her I find myself flustered… I’ve never before felt this strongly about a woman, and now all I can think of is how the wedding couldn’t come sooner. My mood is dampened, however, we begin to eat, and I see that porcelain mask of hers creeping back up. I realize it now, how our arrangement thus far has actively hindered our relationship. Sitting this far from one another feels like miles of agony, I feel as if I’m addressing a crowd each time I speak, my voice carrying across the vast expanse. The quiet intimacy of the rose pavilion and our two chairs around the tea table, the sound of her pages and subtle inhales as she became engrossed in a new turn in her book, the feel of her arm in mine as we strolled. These things, and the cold, formal way we were currently dining, did not match.

She excused herself to bed, and I imagine she felt the same disappointment I did- I longed to see her face clearer as she sampled the roast pork- did her eyes flutter the way they had when she took a bite of that lemon desert earlier today? Or did her nose crinkle as she disguised her distaste? These are details I cannot know from afar. These are details I must learn.

I meet with the head waitstaff and fix this immediately. From now on, my dearest love and I shall hardly be apart if I can help it.

Discontinues series

#yandere blog#yandere#obsessive yandere#obsessive love#yandere x darling#yandere blurb#soft yandere#yandere imagine#yandere scenarios#tw yandere#yandere prince#darling blog#irl darling#yandere stories#yandere oc#yandere imagines#yandere oc x reader#yandere x you#yandere x reader#Yandere finance

288 notes

·

View notes

Text

I am Nadi Hamad from Gaza, I am 25 years old, and my house, my dream, my loved ones, and my life have been destroyed, and because I only have a tent without a cover and clothes, and I have a job as a men’s barber, and people do not have money to shave, and I help them with a free shave, and I want you to support me in being able to help diamonds and children get a free shave, and thank you to everyone who helps me.

I shave for the sad children of Gaza who have tasted fear, hunger and destruction, and shave for them free of charge and draw a beautiful smile on their faces and make them forget the deadly pain. I want you to support me and thank you.

The children of Gaza need help to make them happy and put a smile on their faces. Help me

#accounting#black art#book blog#finance#marketing#reading#book photography#poster#spilled thoughts#stock market#gaza#free gaza

146 notes

·

View notes

Text

The aftermath of depression

We don't talk enough about the aftermath of depression, and even less about the aftermath of severe depression.

Depression is not something you easily grow out of. It leaves a scar so deeply ingrained in every aspect of your life that it becomes your “normality.”

In my case, my past severe depression destroyed my ability to build new friendships; I only feel comfortable with the friends who were in my life before all of this.

It also destroyed my discipline. I’m not trying to brag, but before my depressive episode, I had the kind of discipline that helped me reach the top academically in my country.

Now, I only see glimpses of that past discipline, and I rely heavily on the strengths I had before the depression.

But you know what? I’ve had enough of this. I let my depression define who I was for almost four years. Sure, there was a recovery period, but I’ve had it with the aftermath.

I think it’s time to claim my life back.

I beat depression when I lost weight. I beat depression when I still excelled academically. I beat depression when I managed to stay creatively engaged in my work. I beat depression when I began caring more about myself and regained some confidence.

Isn’t it time I reclaim my discipline and my social life?

After all, I still have what it takes to be “ranked number one in my class” and to rebuild my social abilities.

#self care#self discipline#self development#self improvement#self love#that girl#it girl#girlhood#dark academia#green juice girl#pink pilates princess#wonyoungism#wizardliz#that girl energy#becoming her#becoming that girl#stuydblr#study blog#studyblr#discipline#healthy diet#divine feminine#high value woman#high value mindset#financial health#finance#manifest your dream life#studyspo#manifest your dreams#study motivation

89 notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

85 notes

·

View notes

Text

overconsumption isn’t cute. you don’t need 47 foundations to feel beautiful. late-stage capitalism just wants you to think you do.

#economy#economic#finance#overconsumption#advice blog#financial advice#budget#money#current events#makeup#consumerism#capitalism#anti capitalism#economics#late stage capitalism#mintconditioned#overconsumption is not normal#this is not normal

24 notes

·

View notes

Text

financial literacy continued⋆.ೃ࿔*:・👛💵

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

HOW TO SAVE MONEY ;

automatically deposit a certain percentage of ur income into ur savings account so that u dont even have to think about it

to do something more FUN tho, (at least in my opinion) is to make a challenge where u have to save every $10 dollar bill, or $20 dollar bill or whatever. just something to make saving money seem like a game if u wanna have some fun with it.

EMERGANCY FUND ;

most experts will tell u that ur emergency fund should be 3-6 months of ur needed expenses. so calculate ur needed expenses and multiply that by 6 to figure out how much you'd need to have in ur emergency fund.

PAYING YOURSELF FIRST ;

you should always put urself first in every single situation including financially. so to pay urself first simply means to put ur future and needs before anything else. FOR EXAMPLE... let's say u wanna buy an ipad by the end of the year, an ipad is $345.

lets also say that u get paid weekly, so you'd divide $345 by the number of weeks in a year (52) you'd get 6.6. so you'd have to save roughly $6-$6.50 a week which isnt a lot at all. and you'd be getting what u want.

INTEREST AND CREDIT ;

interest is like a reward that the bank gives you for trusting them to look after your money. the more money you have in your account, and the longer you keep it there, the more interest you can earn…💬🎀

so the bank calculates interest as a percentage of the total amount in a bank account. so if the bank pays a 1% interest you'll earn $1 for every $100 in ur bank account over the course of a year. so if u have $500 in ur account you'll get $5. its not a lot, but interest builds on itself.

credit is the ability of the consumer to acquire goods or services prior to payment with the faith that the payment will be made in the future…💬🎀

for example missing payment deadlines can negatively affect ur credit score. why is this important? if u wanna go to college and wanna use student loans, u might not be able to if ur credit history is bad. as ur credit history grows you'll get a credit score. the higher ur score, the better ur credit is.

BUILDING CREDIT ;

get a secured card. a secured credit card is a special type of credit card with a down payment. when you open the card, you will give the credit card company a deposit to hold. it can be as little as $100. the company holds the money for you and gives you a credit card with a line of credit equal to your deposit

sign up for victoria's secret direct paper mailers. you'll get a coupon each month for 1 free panty for every purchase. when u go to the mall, get urself a panty and a sweet treat 🧁 (DO NOT PUT ANYTHING ON THE CARD THAT U CANT IMMEDIATELY PAY OFF)

and then go home and pay ur credit card bill off, and then dont use it again until the next month.

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

839 notes

·

View notes

Text

fall lookbook: business casual🍂💼🎀👩💻

if you can't tell, my business casual style icons include lorelai gilmore, rachel zane, elle greenaway, rachel green, etc. 💌

#it girl#becoming that girl#pink pilates princess#glow up#self care#that girl#wonyoungism#girl blogger#pink pilates girl#motivation#corporate barbie#working#business woman#business#entrepreneur#finance#accounting#girlblogging#girlblog#pink moodboard#pink aesthetic#pink blog#business casual#work outfits#office attire#office aesthetic#work aesthetic#lawyer#law student#law studyblr

349 notes

·

View notes

Text

🇫🇴🇺🇷 🇴🇫 🇸🇼🇴🇷🇩🇸

ᴍᴇᴀɴɪɴɢ ʀᴏᴍᴀɴᴄᴇ ᴄᴀʀᴇᴇʀ/ꜱᴄʜᴏᴏʟ ꜰᴜᴛᴜʀᴇ ꜰɪɴᴀɴᴄᴇ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ꜰᴇᴇʟꜱ ᴀʙᴏᴜᴛ ʏᴏᴜ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ᴡᴏᴜʟᴅ ᴛʀᴇᴀᴛ ʏᴏᴜ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ᴘᴇʀᴄᴇɪᴠᴇꜱ ʏᴏᴜ ᴛʜᴇ ᴄᴀʀᴅ ᴀꜱ ᴀ ᴘᴇʀꜱᴏɴ ꜱᴇx

⟶ 🇫🇴🇺🇷 ᴏꜰ ꜱᴡᴏʀᴅꜱ ᴜᴘᴛᴜʀɴᴇᴅ

ʚїɞ ᴍᴇᴀɴɪɴɢ ⟶ the meaning of the four of swords is about connecting with your inner-self, inner-guides. praying and involving yourself in rituals. though the four of swords has various of meanings as it could also speak of having fear, anxiety and the deep feeling of being overwhelmed. depending what other cards are around it, it could speak of sleeping on your problems.

ʚїɞ ʀᴏᴍᴀɴᴄᴇ ⟶ there could be conflict within the couple or even breaking up to protect your emotions. in romance the four of swords is about avoiding issues happening between the two of you. feeling distant or if this is about crushes it could be about one of you being too anxious to speak to the other party.

ʚїɞ ᴄᴀʀᴇᴇʀ/ꜱᴄʜᴏᴏʟ ⟶ depending what other cards are about, the four of swords is about taking a break with school, needing time away or the projects that'll be happening for you could make you feel anxious. this card can advise you to ask for help not only for your mental health it can be about not understanding the module.

ʚїɞ ꜰᴜᴛᴜʀᴇ ⟶ in a future reading, the four of swords does imply of someone taking a break or taking a spiritual path. though the two can happen at the same time. it speaks of being more connected to your guides and trying to handle your anxiety and being hesitant. this card also can manifest into your future involving you over-whelming yourself [and you might sleep on your responsibilities].

ʚїɞ ꜰɪɴᴀɴᴄᴇ ⟶ when reading a finance reading and you stumble upon the four of swords it can speak of you taking a break of spending money [or your guides advising you to do so]. dont spend your money if you're broke because you will over-think about it. on the other hand it could speak of you spending money on things to take care of yourself.

ʚїɞ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ꜰᴇᴇʟꜱ ᴀʙᴏᴜᴛ ʏᴏᴜ ⟶ this is another moment when a card needs to be accompanied by other cards because it can mean someone is stressed about you, healing from you or they're someone who really wants your connection with them to work out. you could be someone's sanctuary, someone's safe space. majority of the time it is being about someone's safe space.

ʚїɞ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ᴡᴏᴜʟᴅ ᴛʀᴇᴀᴛ ʏᴏᴜ ⟶ this can either be a toxic or positive meaning. because it means someone could treat you like you're not much or they're someone who would be very caring, they would want to connect to you for support and help you move along with your problems [especially if the six of swords is there], they're someone who can see through you and sometimes this can make them smothering.

ʚїɞ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ᴘᴇʀᴄᴇɪᴠᴇꜱ ʏᴏᴜ ⟶ if this card pops up in terms of how someone perceives you. they could think of you as someone who is avoidant or someone who doesn't really bother connecting with other people. however this can also manifest into them seeing you as someone who is shy. someone who goes through much but would rather hold in their emotions than let it out.

ʚїɞ ᴛʜᴇ ᴄᴀʀᴅ ᴀꜱ ᴀ ᴘᴇʀꜱᴏɴ ⟶ as a person, the four of swords is someone who is kept to themselves, they could be religious or someone who just likes moments of solitude. it can also be both. they're someone other people can find safety in, they could be someone who might get hurt/sick easily, but they definitely like to protect themselves. for their own mental health they would be the type to put themselves before you if it ever got to that.

ʚїɞ ꜱᴇx ⟶ for sex, the four of swords is about being tired after the intimacy shared with someone. or having sex with this person you're going to be intimate with someone is going to be very healing towards your sex life. missionary could be a position favoured and even prone bone. the sex will likely be quiet and slow, depending on what other cards there is the emotions and energy can be distant or they could be lost in the moment.

⟶ 🇫🇴🇺🇷 ᴏꜰ ꜱᴡᴏʀᴅꜱ ʀᴇᴠᴇʀꜱᴇᴅ

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ᴍᴇᴀɴɪɴɢ ⟶ in reverse the reading is about being exhausted but recovering. the card speaks of coming out of isolation or not taking care of yourself, like i said prior, this is a card that has to be backed up with other cards. overall, it is about being kept to yourself, it could also be about a push and pull situation where your mind wants something and your heart wants another.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ʀᴏᴍᴀɴᴄᴇ ⟶ this in a romance reading is not necessarily the best card to get as it speaks about it being unrequited, a break-up or someone losing faith within the connection. someone could feel pressured within the connection, only being in the relationship because you feel pushed into it and thinking its the right thing to do. i would advise you to focus on yourself.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ᴄᴀʀᴇᴇʀ/ꜱᴄʜᴏᴏʟ ⟶ it shows that your career or your school is going to make you fee exhausted, i would tell you to get help from the people around you because there is a chance of you receiving help from other people. though you could also be too prideful to accept help from other people, lower your ego because it'll work to your benefit if you allow team-work.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ꜰᴜᴛᴜʀᴇ ⟶ very slow-moving future. as it speaks about coming out of isolation but still being tired. like it's similar to the nine of wands but the four of swords is complete mental exhaustion, if person does not help themselves or receive help from other people, said person will feel their mind and body shutting down. though if it is around other cards like strength or the chariot, it speaks of someone finding strength within themselves.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ꜰɪɴᴀɴᴄᴇ ⟶ finances could be improving. being helped by other people, bills are being paid. though if it's around a card like four of cups, it can be about not accepting help from other people. being too prideful. the four of swords in reverse in a finance reading is about having to learn how to take care of your finances, if you're stable it can be telling you to pay for things that help your self-love and care.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ꜰᴇᴇʟꜱ ᴀʙᴏᴜᴛ ʏᴏᴜ ⟶ they might feel exhausted about you, might be finding the mental strength to deal with you. if it's someone you used to be in a relationship with they might be losing faith about the idea of the two of you reconciling. and they might feel like being around you could bring you too much pressure.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ᴡᴏᴜʟᴅ ᴛʀᴇᴀᴛ ʏᴏᴜ ⟶ this card shows that someone might use you as their own therapist, so make sure that they do not get dependent on you all the time. they might not really take care of you, i would advise to have other cards support the four of swords in reverse because it could mean that they could be very needy, and not in a cute way. more like in a they cannot do anything themselves way. you would feel like a parent in this connection. on the other hand it can manifest into someone thinking that they can heal all your life and trauma.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ʜᴏᴡ ꜱᴏᴍᴇᴏɴᴇ ᴘᴇʀᴄᴇɪᴠᴇꜱ ʏᴏᴜ ⟶ in reverse, the four of swords shows that someone could mean someone could think of you as someone who is kept to themselves, struggling but trying to be better. still not the best card to get in terms of how someone sees you. it could mean someone might consider you to be mentally broken or someone who is not in the circumstance to get out in the world or have healthy bonds.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ᴛʜᴇ ᴄᴀʀᴅ ᴀꜱ ᴀ ᴘᴇʀꜱᴏɴ ⟶ as a person, the four of swords in reverse is someone who attempts to find their mental strength, but they can be too independent and prideful to allow the help of other people. its someone who might be indecisive pacing between wanting what is the best for themselves or being complacent of not doing what is best for them. they're someone who falls into the habit of not taking care of themselves.

ʚїɞ ʀᴇᴠᴇʀꜱᴀʟ ꜱᴇx ⟶ for sex this is not the best card to get at all. it would feel one-sided and might even be a bit painful because someone wants to feel good but not care about who they're having sex with. if the four of swords in reverse is paired with a card like the lovers it could mean the sex could be exhausting for the both of you and the intimacy could be healing.

ʚїɞ ɴᴇxᴛ ⟶ ꜰɪᴠᴇ ᴏꜰ ꜱᴡᴏʀᴅꜱ

ʚїɞ ʙᴇꜰᴏʀᴇ ⟶ ᴛʜʀᴇᴇ ᴏꜰ ꜱᴡᴏʀᴅꜱ

ꜱᴜɪᴛ ᴏꜰ ꜱᴡᴏʀᴅꜱ ᴍᴀꜱᴛᴇʀʟɪꜱᴛ

ɢᴏᴛʜɪᴄᴀᴅᴀ'ꜱ ᴍᴀꜱᴛᴇʀʟɪꜱᴛ

#tarot reading#tarotblr#tarotcommunity#tarot cards#future partner#future spouse#love reading#tarot#tarot community#future boyfriend#four of swords#suit of swords#spiritual community#loa#loa tumblr#loa community#loa blog#advice#love#romance#finance

32 notes

·

View notes