#financial advice for 20s

Explore tagged Tumblr posts

Text

Avoid This Hidden But Very Costly Investment Mistake (Financial Advice For 20s)

youtube

0:00 Introduction 0:07 Financial instability. 0:23 Limited flexibility. 0:42 High debt burden: 0:56 Maintenance costs. 1:14 Missing investment opportunities. 1:38 Market volatility. 1:55 Summary and Conclusion

Buying a dream home in your 20s might not always be the best financial decision to make. Avoid This Costly Investment Trap (Financial Advice For 20s) due to these reasons: Financial instability. In your 20s, you might not have stable income or job security. Committing to a large mortgage for your dream home can be financially burdensome if your income isn't steady or expected to increase significantly in the near future. Limited flexibility. Your 20s are often a time of change. You might be exploring career opportunities, considering further education, or even contemplating moving to a different city or country. Owning a home can tie you down and limit your flexibility to embrace these changes. High debt burden: Taking on a substantial mortgage at a young age can result in significant debt. This might restrict your ability to invest in other opportunities, such as starting a business or furthering your education. Maintenance costs. Homeownership comes with various expenses beyond the mortgage. These may include property taxes, maintenance, repairs, and insurance. These costs can be unexpected and can strain your finances, especially if you're unprepared for them. Missing investment opportunities. Instead of sinking money into a property at an early age, you could consider investing in more liquid and diversified assets like stocks, bonds, or starting a business. These investments might yield higher returns in the long term compared to real estate, especially considering the opportunity cost of tying up a significant portion of your savings in a property. Market volatility. Real estate markets can fluctuate. Buying a dream home in your 20s might expose you to the risk of property value depreciation if the market changes unfavorably. This situation could leave you financially underwater. Ultimately, the decision to buy a home in your 20s should be based on careful consideration of your financial situation, long-term goals, and personal circumstances. It's essential to weigh the pros and cons before making such a significant financial commitment. #wealth #property #moneymistakes #investment

WEBSITE

YOUTUBE

YOUTUBE PLAYLIST

FACEBOOK

X (TWITTER)

TUMBLR

QUORA

LinkedIn

Mix

FLIPBOARD

#investment#realestate#savings#investments#investing#mortgage#moneymistakes#investingtips#Homeownership#investingmistakes#SustainableInvesting#PersonalFinance#FinancialPlanning#FinancialLiteracy#DebtFree#FinancialAdvisor#mortgagebroker#luxuryhomes#makememove#homesforsale#homesweethome#realestateinvesting#RealEstateExpert#financial planning for 25 year old#financial advice for 20s#real estate market 2024#personal finance tips for beginners#personal finance tips for college students

0 notes

Text

Maybe I did this to myself but it does irk me when people see me knitting and they ask who it’s for and I say it’s for me and the immediate reaction is “you should sell it” yeah… let me spend at least a week’s worth of my free time making an item I like, want, and would wear just to sell it on etsy, making at most a £2 profit on materials and not being compensated for my time whatsoever 👍🏻

#i say maybe i did this to myself because historically i have gifted most of the items i have knitted#because the venn diagram of things i like to knit vs things i like to wear is actually 2 circles that don’t touch#i looove making hats. i HATE wearing hats#also i love making baby clothes but i don’t have a baby and i’m not going to have a baby#however lately i’ve gotten really into knitting socks and i really like to wear knit socks. it’s like the most affordable way for me to get#quality wool socks. and i’m going to be watching my shows anyway. the time will pass anyways#but it feels like people are deliberately making me feel weird for wanting to make stuff for myself and not profit off my hobby#and like i’ve made 3 pairs of socks to gift already because ‘tis the season or whatever. and i’ve started another pair for a friend whose#birthday is in january#genuinely it’s very weird to hear ‘you should sell it’ or ‘oh i want one!!’ about an item i’m making for myself. after 18 years of gifting#or donating basically everything i’ve ever knitted. like i’ve gifted 2 double bed size crochet blankets#everyone i’ve known who’s had a baby has gotten a cardigan or a blanket or hats or all of the above#i spent october making poppies for the church. i’ve never even stepped foot in my village church mind you. my neighbour asked me to help#do you know what i own? that i’ve knitted? a pair of mittens and a pair of socks.#you want some socks from me? alright. that’s anywhere between £6 and £10 for the yarn and that’s optimistic#i’m currently making myself a pair with hand-dyed yarn that cost me £18 including delivery#the needles i use cost me more than £10. time… let’s call it 24 hours per sock#i don’t know anyone with 18 years experience who makes minimum wage so let’s call it an even 600 for my time. tbh#DO YOU SEE how this isn’t a viable side hussle??? i physically cannot charge what my socks are worth#if i like you and you’re willing to wait; socks are free or cost whatever the yarn costs#if i don’t like or know you venmo me £620. and you’re still going to have to wait.#just pisses me OFF when people suggest i make an etsy page and they say it like they’re doing me a favour or giving me great financial#advice. like you’ve seen me sitting here all evening and i’m barely done with the cuff.. do you actually think selling these for £20 maximum#is going to help me out. i’m not selling them. they’re FOR me. i’m making them because i want them#also when my friend’s family was saying this to me and i was like ‘well the yarn cost a fiver’ and they got quiet and i was thinking yeah…#a fiver is the maximum you cheapskates would pay isn’t it. a fiver is cheap sock yarn bought on sale. or yarn that probably isn’t actually#good for socks. like don’t presume to give me financial advice when you’re this out of touch with the market please#next person who asks when i’m going to start selling socks is getting this whole rant in entirety tbh i don’t care anymore#personal#edited to add that i didn’t even get into etsy fees or whether i would even be noticed among the mountain of dropshippers LOL

7 notes

·

View notes

Text

(well, might have just sold the house! i don’t breathe til we actually are inside the one we want to move to, but…!)

#inshallah#we had 9 offers so even if worst comes to worst…#sorry my only financial advice is marry up which is bad advice#or alternatively become extremely skilled in one (1) area#and hope someone shits the bed on their government contract#and they pay you big bucks to clean up the mess#so long as you work 20 hour days 7 days a week for a few months#i’m so happy cody might get a garden he can just run out to#without taking his poor hips down the stairs every time

10 notes

·

View notes

Text

Every now and then I remember the times I would mention to my flatmate that I was thinking of buying myself something reasonably expensive (that I had been eyeing up for months and had budgeted for) and she'd tell me that I shouldn't spend that much money on something I didn't need and it would be stupid etc etc while she regularly impulse bought things that cost at least as much and she would use once (while complaining that she was under a lot of financial stress and couldn't afford <$3/week for 2 months for a rental washing machine when ours broke). She is... perhaps not my first call for financial advice

#like I get that you're financially stressed but also it feels a bit rich to complain about it when you're on student allowance (not loan)#and your parents still contribute to things for you even though allowance is supposed to be for people whose parents can't afford to help#and you get multiple scholarships a year even though you're technically not eligible for half of them anymore but then as soon as the money#comes in from those you spend it all on a brand new dress for your sister's hen's do picnic because you can't wear the same dress as you#will for the actual hen's night or the wedding. Better buy a full price one at an expensive store instead of looking in a single op shop or#borrowing one from one of your three sisters who are all roughly the same size#god life must be so tough for you getting the same amount of money as the rest of us on student loan except you only have to pay back half#like the only money you have to live off is the same as what the rest of us get + scholarships (plural) plus what you earnt in your summer#internship? how could you possibly survive??#anyway I am NOT a fan of people who are like 'oh you say you have no money for rent but you have a phone?' because that's bullshit#and the whole 'millenials need to stop eating avocado toast so they can buy a house' thing is also bullshit#however. If you pay $60/week for a gym when you have access to the free uni one (or any other gym in the country is like $20)#and you buy uber eats multiple times a week for like $30+ each time despite having a premade meal in the fridge. and you get multiple#scholarships which mean you are arguably among the more well off students. AND you impulse buy things that cost over $100 regularly#then maybe the problem is not that you don't have enough money to split the rental costs of a washing machine (<$3 each/week)#maybe you are just bad with money#which is fine like it's not like it's unfixable it's just annoying when you act like you're worse off than people whose only money is what#they get from student loan each week so they eat beans on rice for dinner for a week#because that's all they could afford (yes I know people who did this. Yes she complained more than them)#so no I don't think I'm gonna be taking financial advice from you babes because one of us has entertained the idea of a budget to help with#finances and it's not you xx#(she turned down offers of financial help/advice/books to borrow from multiple people multiple times. I 100% get that you might not want to#talk to people about it especially your friends but we had multiple books on finances lying around the flat which she always said she didn't#need. And then she'd continue to complain that she didn't have enough money#god forbid you suggest something like going to a cheaper gym (or worse. The perfectly fine free uni gym!)#again. Her gym cost $60/week for most of last year until they brought in a student discount which was 'only' $45/week#the next most expensive gym chain I can find costs maybe $30/week for the highest membership level#to get what she was getting she would only need like a $20 membership#BUT to be fair she wouldn't get such strong culty vibes at any other gym#lol anyway sorry for the rant. I could keep going but apparently you can only have 30 tags and this is the last one

2 notes

·

View notes

Text

Piece of financial advice, because I've seen too many people make this mistake: never pay off medical debt on a credit card unless you are 100% sure you will be able to pay the credit card balance off in full as soon as you get the first bill. Why? It is ALWAYS better to have medical debt than credit card debt. There is a long list of reasons why.

State and federal laws severely restrict medical debt in ways that credit card debt is not restricted.

Credit card debt can charge much higher interest rates, and in general it IS much higher in rate. Medical debt sometimes charges no interest, at least for a certain period of time. When it does charge interest, the rate is lower, and in some states it is capped as low as 5%, always at 20% or lower. Credit card interest rates are almost never below 15% and are sometimes MUCH higher than 20%.

Medical debt is less damaging to your credit history than credit card debt. And it is easier to eliminate in bankruptcy.

Medical debt also does not affect your spending limits on a credit card. If you use a credit card for monthly expenses, adding medical debt to it can bring you closer to your credit limit which might make you unable to use the card for expenses (even ones you could afford to pay off immediately.) This negatively affects your credit rating through increasing your credit utilization, it can reduce your potential to earn rewards, and it can reduce your spending power in an emergency.

Also, the penalties and fees for deliquency on medical debt are much milder and those for credit card debt are more severe. Again, laws are more restrictive on medical debt. You will have far fewer fees or penalties going delinquent on medical debt.

Also it is often easier to get medical debt forgiven or negotiated down, than credit card debt,

If you ever end up with medical debt, keep it as medical debt and keep paying it as medical debt. Go delinquent on your medical debt before switching it to a credit card. Once you put it on a credit card, you can't go back.

By keeping your medical debt as medical debt, you save money, protect your credit history, and increase your chances of having the debt forgiven, negotiated down, or eliminated through bankruptcy.

NEVER CONVERT MEDICAL DEBT TO CREDIT CARD DEBT.

2K notes

·

View notes

Text

How To Become A Brand New Person ✨✨

Self Reflect:

Journal daily.

Think about past decisions and how they impacted your life.

Meditate regularly.

Create a vision board to visualize your goals.

Review your strengths and weaknesses.

Identify your core values and beliefs.

Figure out your passions and interests.

Think about your childhood dreams and aspirations.

Evaluate your current state of happiness and fulfillment.

Set Clear Goals:

Define specific career goals, like "Get promoted within two years."

Set health goals, like "Lose 20 pounds in six months."

Create financial goals such as "Save $10,000 for a vacation."

Establish personal development goals, like "Read 24 books in a year."

Set relationship goals, such as "Improve communication with my partner."

Define education goals, like "Complete a master's degree in three years."

Set travel goals, like "Visit five new countries in the next two years."

Create hobbies and interests goals, such as "Learn to play a musical instrument."

Set community or volunteer goals, like "Volunteer 100 hours this year."

Establish mindfulness or self-care goals, such as "Practice meditation daily."

Self Care:

Exercise for at least 30 minutes a day.

Follow a balanced diet with plenty of fruits and vegetables.

Prioritize getting 7-9 hours of quality sleep each night.

Practice in relaxation techniques like deep breathing or yoga.

Take regular breaks at work to avoid burnout.

Schedule "me time" for activities you enjoy.

Limit exposure to stressors and toxic people.

Practice regular skincare and grooming routines.

Seek regular medical check-ups and screenings.

Stay hydrated by drinking enough water daily.

Personal Development:

Read a book every month from various genres.

Attend workshops or seminars on topics of interest.

Learn a new language or musical instrument.

Take online courses to acquire new skills.

Set aside time for daily reflection and self improvement.

Seek a mentor in your field for guidance.

Attend conferences and networking events.

Start a side project or hobby to expand your abilities.

Practice public speaking or communication skills.

Do creative activities like painting, writing, or photography.

Create a Support System:

Build a close knit group of friends who uplift and inspire you.

Join clubs or organizations aligned with your interests.

Connect with a mentor or life coach.

Attend family gatherings to maintain bonds.

Be open and honest in your communication with loved ones.

Seek advice from trusted colleagues or supervisors.

Attend support groups for specific challenges (e.g., addiction recovery).

Cultivate online connections through social media.

Find a therapist or counselor for emotional support.

Participate in community or volunteer activities to meet like minded people.

Change Habits:

Cut back on sugary or processed foods.

Reduce screen time and increase physical activity.

Practice gratitude by keeping a daily journal.

Manage stress through mindfulness meditation.

Limit procrastination by setting specific deadlines.

Reduce negative self-talk by practicing self-compassion.

Establish a regular exercise routine.

Create a budget and stick to it.

Develop a morning and evening routine for consistency.

Overcome Fear and Self Doubt:

Face a specific fear head-on (example: public speaking).

Challenge your negative thoughts with positive affirmations.

Seek therapy to address underlying fears or traumas.

Take small, calculated risks to build confidence.

Visualize success in challenging situations.

Surround yourself with supportive and encouraging people.

Journal about your fears and doubts to gain clarity.

Celebrate your accomplishments, no matter how small.

Focus on your strengths and accomplishments.

Embrace failure as a valuable learning experience.

Embrace Change:

Relocate to a new city or country.

Switch careers or industries to pursue your passion.

Take on leadership roles in your workplace.

Volunteer for projects outside your comfort zone.

Embrace new technologies and digital tools.

Travel to unfamiliar destinations.

Start a new hobby or creative endeavor.

Change your daily routine to add variety.

Adjust your mindset to see change as an opportunity.

Seek out diverse perspectives and viewpoints.

Practice Gratitude:

Write down three things you're grateful for each day.

Express gratitude to loved ones regularly.

Create a gratitude jar and add notes of appreciation.

Reflect on the positive aspects of challenging situations.

Show gratitude by volunteering or helping others in need.

Send thank-you notes or messages to people who've helped you.

Keep a gratitude journal and review it regularly.

Share your gratitude openly during family meals or gatherings.

Focus on the present moment and appreciate the little things.

Practice gratitude even in times of adversity.

Be Patient:

Set realistic expectations for your progress.

Accept that personal growth takes time.

Focus on the journey rather than the destination.

Learn from setbacks and view them as opportunities to improve.

Celebrate small milestones along the way.

Practice self-compassion during challenging times.

Stay committed to your goals, even when progress is slow.

Keep a journal to track your personal growth.

Recognize that patience is a valuable skill in personal transformation.

Celebrate Small Wins:

Treat yourself to your favorite meal or dessert.

Reward yourself with a spa day or self-care activity.

Share your achievements with friends and loved ones.

Create a vision board to visualize your successes.

Acknowledge and congratulate yourself in a journal.

Give yourself permission to take a break and relax.

Display reminders of your accomplishments in your workspace.

Take a day off to celebrate a major milestone.

Host a small gathering to mark your achievements.

Set aside time to reflect on how far you've come.

Maintain Balance:

Set clear boundaries in your personal and work life.

Prioritize self care activities in your daily routine.

Schedule regular breaks and downtime.

Learn to say "no" when necessary to avoid overcommitment.

Evaluate your work life balance regularly.

Seek support from friends and family to avoid burnout.

Be kind to yourself and accept imperfections.

Practice mindfulness to stay present and grounded.

Revisit your priorities and adjust them as needed.

Embrace self love and self acceptance as part of your daily life.

#personal improvement#personal development#personal growth#self help#self awareness#self reflection#self improvement#level up journey#self love journey#dream girl guide#dream girl journey#dream girl tips#becoming that girl#that girl#it girl#glow up tips#glow up#clean girl#pink pilates girl#divine feminine#femininity#femme fatale#feminine journey

7K notes

·

View notes

Text

The CFPB is genuinely making America better, and they're going HARD

On June 20, I'm keynoting the LOCUS AWARDS in OAKLAND.

Let's take a sec here and notice something genuinely great happening in the US government: the Consumer Finance Protection Bureau's stunning, unbroken streak of major, muscular victories over the forces of corporate corruption, with the backing of the Supreme Court (yes, that Supreme Court), and which is only speeding up!

A little background. The CFPB was created in 2010. It was Elizabeth Warren's brainchild, an institution that was supposed to regulate finance from the perspective of the American public, not the American finance sector. Rather than fighting to "stabilize" the financial sector (the mission that led to Obama taking his advisor Timothy Geithner's advice to permit the foreclosure crisis to continue in order to "foam the runways" for the banks), the Bureau would fight to defend us from bankers.

The CFPB got off to a rocky start, with challenges to the unique system of long-term leadership appointments meant to depoliticize the office, as well as the sudden resignation of its inaugural boss, who broke his promise to see his term through in order to launch an unsuccessful bid for political office.

But after the 2020 election, the Bureau came into its own, when Biden poached Rohit Chopra from the FTC and put him in charge. Chopra went on a tear, taking on landlords who violated the covid eviction moratorium:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

Then banning payday lenders' scummiest tactics:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Then striking at one of fintech's most predatory grifts, the "earned wage access" hustle:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Then closing the loophole that let credit reporting bureaus (like Equifax, who doxed every single American in a spectacular 2019 breach) avoid regulation by creating data brokerage divisions and claiming they weren't part of the regulated activity of credit reporting:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Chopra went on to promise to ban data-brokers altogether:

https://pluralistic.net/2024/04/13/goulash/#material-misstatement

Then he banned comparison shopping sites where you go to find the best bank accounts and credit cards from accepting bribes and putting more expensive options at the top of the list. Instead, he's requiring banks to send the CFPB regular, accurate lists of all their charges, and standing up a federal operated comparison shopping site that gives only accurate and honest rankings. Finally, he's made an interoperability rule requiring banks to let you transfer to another institution with one click, just like you change phone carriers. That means you can search an honest site to find the best deal on your banking, and then, with a single click, transfer your accounts, your account history, your payees, and all your other banking data to that new bank:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

Somewhere in there, big business got scared. They cooked up a legal theory declaring the CFPB's funding mechanism to be unconstitutional and got the case fast-tracked to the Supreme Court, in a bid to put Chopra and the CFPB permanently out of business. Instead, the Supremes – these Supremes! – upheld the CFPB's funding mechanism in a 7-2 ruling:

https://www.scotusblog.com/2024/05/supreme-court-lets-cfpb-funding-stand/

That ruling was a starter pistol for Chopra and the Bureau. Maybe it seemed like they were taking big swings before, but it turns out all that was just a warmup. Last week on The American Prospect, Robert Kuttner rounded up all the stuff the Bureau is kicking off:

https://prospect.org/blogs-and-newsletters/tap/2024-06-07-window-on-corporate-deceptions/

First: regulating Buy Now, Pay Later companies (think: Klarna) as credit-card companies, with all the requirements for disclosure and interest rate caps dictated by the Truth In Lending Act:

https://www.skadden.com/insights/publications/2024/06/cfpb-applies-credit-card-rules

Next: creating a registry of habitual corporate criminals. This rogues gallery will make it harder for other agencies – like the DOJ – and state Attorneys General to offer bullshit "delayed prosecution agreements" to companies that compulsively rip us off:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-creates-registry-to-detect-corporate-repeat-offenders/

Then there's the rule against "fine print deception" – which is when the fine print in a contract lies to you about your rights, like when a mortgage lender forces you waive a right you can't actually waive, or car lenders that make you waive your bankruptcy rights, which, again, you can't waive:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-warns-against-deception-in-contract-fine-print/

As Kuttner writes, the common thread running through all these orders is that they ban deceptive practices – they make it illegal for companies to steal from us by lying to us. Especially in these dying days of class action suits – rapidly becoming obsolete thanks to "mandatory arbitration waivers" that make you sign away your right to join a class action – agencies like the CFPB are our only hope of punishing companies that lie to us to steal from us.

There's a lot of bad stuff going on in the world right now, and much of it – including an active genocide – is coming from the Biden White House.

But there are people in the Biden Administration who care about the American people and who are effective and committed fighters who have our back. What's more, they're winning. That doesn't make all the bad news go away, but sometimes it feels good to take a moment and take the W.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

#pluralistic#cfpb#consumer finance protection board#rohit chopra#scotus#bnpl#buy now pay later#repeat corporate offenders#fine print deception#whistleblowing#elizabeth warren

1K notes

·

View notes

Note

what happens to charlotte lucas if mr. collins dies early (before he inherits longbourne)?

That is the worst possible scenario for her, basically.

Mr Collins's living with regard to Hunsford only lasts for the duration of his life, so she gets nothing from it. Unless her child (she's implied to be pregnant at the end of P&P) is a son and, iirc, falls within a set number of generations as laid out by the original entailment, she also gets nothing with regard to Longbourn (and if the child is a girl, she now has another dependent to worry about and provide for; I think Mr Bennet's daughters would receive preference over Charlotte's if Mr Collins never inherits and there's no son).

There would have been legal documents accompanying their betrothal that laid out exactly how much property or money Charlotte and her potential children would receive during and after the marriage (this is what is meant by references to pin money and jointure; pin money is what the woman will regularly receive for her private expenses during the marriage, and jointure is what she gets if she survives her husband). There's a straightforward example of this with Mr and Mrs Bennet, for instance.

Mrs Bennet brought a dowry of four thousand pounds to the marriage. Mr Bennet or his family settled an additional one thousand pounds on her at the time (23 years earlier). So there's five thousand pounds attached to Mrs Bennet and her children specifically that is essentially secure—the income from it can only go to her or her children. Since her children are all daughters, however, this pretty much automatically includes her daughters' husbands as well, since women were legally and financially subsumed into their husbands' identities upon marriage and it took some legal shenanigans to protect their resources. Lydia's share of Mrs Bennet's fortune, one thousand pounds, effectively goes to Wickham as part of the marriage arrangements, and it's not clear if Lydia's money is legally secured to her in the same way since it was part of bribing Wickham to marry her at all.

(Tangent: a lot of analysis tends to assume that income from a lump sum of this kind would generate an income of 5% of the principal via low-risk, low-reward government investments. Mr Collins himself explicitly estimates that Elizabeth's portion of Mrs Bennet's settlement would generate an income at a 4% rate, leaving her with a mere 40 pounds a-year. This might seem Mr Collins-style negging, but in reality these kinds of safe government investments could and did drop to rates closer to 3% due to various economic upheavals at the time.)

Returning to Charlotte's situation, eighteenth-century advice urged men (even much less affluent men) to set aside a significant portion of their incomes every year to add to what was settled on their wives/children, so that if they died, their children and widows would have more to live on. The original settlement, as in Mrs Bennet's case, could be pretty small, especially for multiple people to live on. Mr Collins is enough of a rules guy that he might set aside the suggested percentages of his income, especially if Lady Catherine considers it proper. But even if we assume he's setting aside, say, 20% of his income, I doubt that would amount to very much if he dies soon; the Hunsford living is good, but not that good, and he's only 25, so there just hasn't been much time. Charlotte would essentially be a poor cousin by marriage of the Bennets and dependent on her own family (already in straitened circumstances) for anything more than her settlement, which given the circumstances wouldn't amount to much.

People often kill Mr Collins young to given Charlotte a chance at a better life, but in reality, this would likely be a disaster for her.

#anon replies#respuestas#austen blogging#charlotte lucas#william collins#long post#anghraine's meta#mr bennet#mrs bennet

272 notes

·

View notes

Text

Numbers Game ~ Masterlist

Please enjoy this smutty one shot that got insanely out of hand.

Last Updated: 1/7/25

Pairings: Cross Guild x Fem!Reader x Special Guests

Ao3 Link

Series Playlist: Youtube Music Link | Youtube Link

Summary: You left your stable/boring life as an investment banker to have some adventure. Unfortunately, that sweet Warlord of the Sea didn't follow your financial advice, and now you and your clown are at the mercy of his biggest lender and his new business partner.

Rating/Warnings: Explicit Sexual Content, 18+, MDNI, AFAB!Reader, She/Her Pronouns for Reader, Reader-Insert, Use of Y/N, Dark Content, Trauma, Panic Attacks, Dissociation, PTSD, Threats, Alcohol, Cigars, Blood and Violence, Swearing, Angst, Smut, Fluff, Guilt, Manipulation, Humiliation, Degradation, Teasing, Pet Names, Power Imbalance, Possessive Behavior, Jealousy, Daddy Kink, Masturbation, Vaginal Fingering, Cunnilingus, Choking, PIV Sex, Unprotected Sex, Cuckolding, Biting, Face Slapping, Dom/Sub Undertones, Praise Kink, Size Difference, Overstimulation, Blow Jobs, Hair Pulling, Dacryphilia, Orgasm Control, Large Cock, Anal, Double Penetration, Knifeplay, Pain Kink, Blood Kink, Aftercare, Bondage, Spanking, Punishments, Orgies, Fights, Brat Handling, Gangbang, Scratching, Body Worship, Cock Warming, Comeplay, Relationship Drama, Inappropriate Use of Akuma no Mi | Devil Fruit Powers, Cross Guild boys are VILLAINS, Additional tags listed on each post

A/N: I'm obsessed. What do I have to do to get my butt onto that green couch?

Ch. 1 ~ You Won't Be Bored With Us ~ (2.8k+) | Ch. 2 ~ Isn't That Right, Little Rabbit? ~ (2.1k+) | Ch. 3 ~ Think of Nothing Else ~ (3k+) | Ch. 4 ~ I Wonder If I Can Do Both ~ (2.2k+) | Ch. 5 ~ Would You Rather ~ (1.9k+) Ch. 6 ~ Some Kind of Death Wish ~ (2.8k+) | Ch. 7 ~ Selling Your Soul ~ (2.3k+) | Ch. 8 ~ I Should Be Afraid ~ (2k+) | Ch. 9 ~ Anything? ~ (4.5k+) | Ch. 10 ~ All You Gotta Do is Ask ~ (3.9k+) | Ch. 11 ~ Now We Can Have Some Real Fun ~ (4.1k+) | Ch. 12 ~ Maybe a Cage Wouldn't Be So Bad ~ (2.8k+) | Ch. 13 ~ Not Known for My Patience ~ (5.3k+) | Ch. 14 ~ Pretty Little Pieces ~ (5.3k+) | Ch. 15 ~ Play Nice ~ (4.5k+) | Ch. 16 ~ Anything for a Friend ~ (9.6k+) | Ch. 17 ~ Let Me Help You With That ~ (3.9k+) | Ch. 18 ~ The Only Thing in the World ~ (9.5k+) | Ch. 19 ~ Not a Sound ~ (3.8k+) | Ch. 20 ~ Those Lovely Things ~ (7.3k+) | Ch. 21 ~ For Now ~ (4.8k+) | Ch. 22 ~ Do What You Always Do ~ (4.3k~) | Ch. 23 ~ Here They Come ~ (4k+) | Ch. 24 ~ Just a Little More Pretending ~ (4.2k+) | Ch. 25 ~ The Delightful and Dangerous Show ~ (4.8k+) | Ch. 26 ~ I'll Follow You ~ (7.2k+) | Ch. 27 ~ I've Got You ~ (8.7k+) | Ch. 28 ~ Just Daydreams Now ~ (6.9k+) | Ch. 29 ~ Don't Say Anything ~ (7k+) | Ch. 30 ~ I'm Coming for You ~ (7.2k+) | Ch. 31 ~ Could Never Stop ~ (7.8k+) | Ch. 32 ~ Make Your Bets Now! ~ (12.6k+) | Ch. 33 ~ Keep Me Warm ~ (10.6k+) | Ch. 34 ~ Can You Pretend? ~ (11.3k+) | Ch. 35 ~ Lady Luck by My Side ~ (10.2k+) | Ch. 36 ~ Maybe I Have Gone Mad ~ (7.3k+) | Part 37

Extra Scenes

| Rabbit's Fur ~ (654) |

Asks, Author's Notes, and Sillies

| Party Attire ~ Reader ~ (Author's Version of Numbers Girl's Party Dress) | Party Attire ~ The Boys ~ (Author's Version the of the Boys' Party Clothes) | Suitor Dossiers ~ (Get to Know the Hunters ~ Read Part 31 First!) |

| masterlist | about me | rules | ao3 | ko-fi |

#cross guild x reader#buggy x reader#mihawk x reader#sir crocodile smut#cross guild polycule#crocodile x reader#mihawk smut#buggy smut#cross guild smut#sir crocodile x reader#dracule mihawk x reader#reader Insert#fem!reader#one piece x reader#fic requests#x reader#one piece fanfic#buggy fanfiction#smut#one piece smut#fic masterlist#numbersgame~turtletaubfics#shuggy smut#shanks smut#mihawk x shanks#use of y/n#turtletaub fics#cw dark content#tw knives#cw blood

557 notes

·

View notes

Text

pluto into aquarius (for the long haul!)

none of us now living will ever see pluto in capricorn again (unless you stick with sidereal astrology or, perhaps, if modern medicine grants us immortality which, frankly, is a quite aquarian thing actually...)

a sign change like this is a big deal. pluto in capricorn began with the recession and financial crises of 2008 and those greedy corporate entities, reflecting capricorn's darkest side, who profited from these manipulative actions in the last almost 20 years will not relinquish what they have gotten (or taken) easily. pluto in aquarius has very revolutionary connotations, historically as well as in the methodology of astrology. the advice of pluto in aquarius is to align yourself with what you believe/know to be right and good and honest, not merely with what benefits you materially. there are also rumblings of changes to the internet, the communications system, the power grids, and space travel.

this change is already reflected in a haka in parliament, the crowdstrike outage (when pluto last popped into/out of aquarius), and various threats to power systems of all kinds all over the world.

don't get lost in personal meanings in this passage. this is a global effect. nothing can ever be quite the same.

160 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Repairing Our Busted-Ass World

On poverty:

Starting from nothing

How To Start at Rock Bottom: Welfare Programs and the Social Safety Net

How to Save for Retirement When You Make Less Than $30,000 a Year

Ask the Bitches: “Is It Too Late to Get My Financial Shit Together?“

Understanding why people are poor

It’s More Expensive to Be Poor Than to Be Rich

Why Are Poor People Poor and Rich People Rich?

On Financial Discipline, Generational Poverty, and Marshmallows

Bitchtastic Book Review: Hand to Mouth by Linda Tirado

Is Gentrification Just Artisanal, Small-Batch Displacement of the Poor?

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Developing compassion for poor people

The Latte Factor, Poor Shaming, and Economic Compassion

Ask the Bitches: “How Do I Stop Myself from Judging Homeless People?“

The Subjectivity of Wealth, Or: Don’t Tell Me What’s Expensive

A Little Princess: Intersectional Feminist Masterpiece?

If You Can’t Afford to Tip 20%, You Can’t Afford to Dine Out

Correcting income inequality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

One Reason Women Make Less Money? They’re Afraid of Being Raped and Killed.

Raising the Minimum Wage Would Make All Our Lives Better

Are Unions Good or Bad?

On intersectional social issues:

Reproductive rights

On Pulling Weeds and Fighting Back: How (and Why) to Protect Abortion Rights

How To Get an Abortion

Blood Money: Menstrual Products for Surviving Your Period While Poor

You Don’t Have to Have Kids

Gender equality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

The Pink Tax, Or: How I Learned to Love Smelling Like “Bearglove”

Our Single Best Piece of Advice for Women (and Men) on International Women’s Day

Bitchtastic Book Review: The Feminist Financial Handbook by Brynne Conroy

Sexual Harassment: How to Identify and Fight It in the Workplace

Queer issues

Queer Finance 101: Ten Ways That Sexual and Gender Identity Affect Finances

Leaving Home before 18: A Practical Guide for Cast-Offs, Runaways, and Everybody in Between

Racial justice

The Financial Advantages of Being White

Woke at Work: How to Inject Your Values into Your Boring, Lame-Ass Job

The New Jim Crow, by Michelle Alexander: A Bitchtastic Book Review

Something Is Wrong in Personal Finance. Here’s How To Make It More Inclusive.

The Biggest Threat to Black Wealth Is White Terrorism

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

10 Rad Black Money Experts to Follow Right the Hell Now

Youth issues

What We Talk About When We Talk About Student Loans

The Ugly Truth About Unpaid Internships

Ask the Bitches: “I Just Turned 18 and My Parents Are Kicking Me Out. How Do I Brace Myself?”

Identifying and combatting abuse

When Money is the Weapon: Understanding Intimate Partner Financial Abuse

Are You Working on the Next Fyre Festival?: Identifying a Toxic Workplace

Ask the Bitches: “How Do I Say ‘No’ When a Loved One Asks for Money… Again?”

Ask the Bitches: I Was Guilted Into Caring for a Sick, Abusive Parent. Now What?

On mental health:

Understanding mental health issues

How Mental Health Affects Your Finances

Stop Recommending Therapy Like It’s a Magic Bean That’ll Grow Me a Beanstalk to Neurotypicaltown

Bitchtastic Book Review: Kurt Vonnegut’s Galapagos and Your Big Brain

Ask the Bitches: “How Do I Protect My Own Mental Health While Still Helping Others?”

Coping with mental health issues

{ MASTERPOST } Everything You Need to Know about Self-Care

My 25 Secrets to Successfully Working from Home with ADHD

Our Master List of 100% Free Mental Health Self-Care Tactics

On saving the planet:

Changing the system

Don’t Boo, Vote: If You Don’t Vote, No One Can Hear You Scream

Ethical Consumption: How to Pollute the Planet and Exploit Labor Slightly Less

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

Season 1, Episode 4: “Capitalism Is Working for Me. So How Could I Hate It?”

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

Shopping smarter

You Deserve Cheap Toilet Paper, You Beautiful Fucking Moon Goddess

You Are above Bottled Water, You Elegant Land Mermaid

Fast Fashion: Why It’s Fucking up the World and How To Avoid It

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

6 Proven Tactics for Avoiding Emotional Impulse Spending

Join the Bitches on Patreon

#poverty#economics#income inequality#wealth inequality#capitalism#working class#labor rights#workers rights#frugal#personal finance#financial literacy#consumerism#environmentalism

557 notes

·

View notes

Note

Dating advice for girls in their twenties without much experience?

Start by dating HENRYs.

A Henry is a man who’s High Earning but Not Rich Yet and he’ll usually be no more than 5 years older than you. Henrys usually work in finance or tech, and they’re also going to actively be looking for relationships. When I was in Chicago, actively going on Hinge dates after work and interested in getting to know more people, I went out on a series of dates with Henrys. They worked as associates for the major legal, financial, and consulting firms (they hadn’t made partner yet); they tended to be recent graduates with minimal student loans, and it was easy for me to connect with them offline through the activities I did.

If you’re between the ages of 20-25, you should be focused on meeting and going out on dates with Henrys close to your age. It’s easier to make connections and gain dating experience that way; there’s less pressure, and I think it’s much easier to relate to men who have had similar life experiences and aren’t that much older than you, and there’s more variety with less baggage. If you’re short on time, I’d recommend trying Hinge (avoid Bumble, The League, or Raya), but if you want to make friends at the same time, look at run and supper clubs, go to bars around the major firms with friends, go to sporting events, and get yourself around groups of people your age.

#richarlotte x#hypergamy#leveling up advice#leveling up tips#hypergamy advice#hypergamy tips#hypergamous heaux#hypergamous woman#black women in leisure#black women in luxury#spoiled black women#spoiled gf#spoiled girlfriend#social climbing#hypergamous

137 notes

·

View notes

Text

Hate me all you want, but I would never pay someone to coach me when there’s free information everywhere. Once you get used to using the law in your favour, you’ll realize how ridiculous it is to pay someone to help you manifest what you want.

I remember being desperate to manifest something and almost paying someone for help, but then I realized it’s YOU who’s gonna give the desire to yourself, not the money you spend, and definitely not the person who coached you.

At the end of the day, you’re the one making the decisions.

I can’t imagine charging someone just to give them a simple answer. I don’t need money from anyone, and you don’t need to spend your last $20 just to manifest what you want.

Like I cant see myself charging someone who might be struggling financially. Imagine they can’t even afford food or clothes, and you’re over here charging.

It’s so ridiculous I’m sorry

but I needed to get this off my chest. I don’t like seeing people on Twitter and Tumblr charging for LOA advice. No offense this is just my opinion.

Take it or leave it idc..

Anyways thank you guys for sending me asks I will try my best to answer them when I have the actual time 🫶🏾

#law of assumption#manifesting#how to manifest#manifestation#affirm and persist#dream life#self concept#instant manifestation#desired reality#manifest

118 notes

·

View notes

Text

CARSALESMENİNFO - GOLD

Exploring Car Salesman Earnings: Understanding the Salary Statistics If you've ever wondered about the financial side of the automotive sales industry, you're not alone. Car salesmen play a crucial role in the vehicle purchasing process, and understanding their earnings can provide valuable insights. In this article, we'll delve into the world of car sales salary statistics, covering their average income, salary statistics, and factors that influence their compensation. 1) How much do car salesmen make The income of car salesmen can vary based on several factors, including experience, location, dealership size, and individual sales performance. On average, a car salesman's earnings typically consist of a base salary plus commissions. The base salary serves as a steady income, while commissions are tied to the number of vehicles sold. New or less-experienced car salesmen may start with a lower base salary, while seasoned professionals or those working at high-end dealerships may command a higher base. Commissions, often calculated as a percentage of the vehicle's sale price, can significantly boost earnings, especially if the salesman meets or exceeds sales targets. 2) Car Salesman Earnings: Breaking Down the Numbers To provide a general overview, the average base salary for a car salesman in the United States ranges from $20,000 to $40,000 per year. However, the potential for additional income through commissions can substantially increase overall earnings. Commissions typically range from 20% to 25% of the gross profit per vehicle sold. With the average profit per vehicle hovering around $1,000 to $1,500, successful salesmen have the potential to earn significant commissions. Top performers who consistently meet or exceed sales targets may enjoy additional bonuses and incentives. 3) Car Sales Salary Statistics: Influencing Factors Several factors influence the salary statistics of car salesmen: Location: The cost of living and demand for vehicles in a specific area can impact earnings. Salesmen in regions with a higher cost of living or strong demand for cars may earn more. Experience: Seasoned car salesmen who have honed their skills and built a client base over the years often command higher salaries and commissions. Dealership Size and Reputation: Salesmen working at larger, well-established dealerships or those specializing in luxury vehicles may have access to a broader customer base and potentially higher commissions. Sales Performance: The number of vehicles sold directly correlates with earnings. High sales performance and exceeding targets can result in increased commissions and bonuses. In conclusion, car salesman earnings are dynamic and influenced by various factors. Aspiring car sales professionals should consider these elements when entering the industry and be prepared for a compensation structure that rewards hard work, sales acumen, and customer satisfaction. Visit CarSalesMenInfo for more in-depth insights into the world of car sales, including tips for success, industry trends, and advice for both aspiring and experienced car salesmen.

570 notes

·

View notes

Note

Success story

Hello dear,it's me it's been we have already chat before i dmed you,and I'm so happy to tell you I have entered the void through lucid dream.

I have finally manifested a great life for me and my sons also didn't wanted to trauma dump on you until and unless i manifest my dream. So,I'm a lady in my late 20s,and after my husband died and I start having financial crisis,my teaching career wasn't going great and i end up loosing my job,everything was getting worse for me,there was a point when I thought to give my twins for adoption and my pet shih tzu to some dog adoption center because I just couldn't provide them enough,we were living in our car but I didn't give up.

So,I took your advice and start saturating non stop for 3 days straight,I think would've entered on the first day but I kept going back in my old mindset,but I persisted first day was hard to saturate all day,eventhough you recommended me to affirm for an hour,I still affirmed from the moment I woke up,till I fell asleep,I read through Taylor's tweets and some other loa accounts tweet and it motivated me to affirm for more then 5 hours,and I also watched a video by Rita Kaminski where she was telling to robotically affirm as we fall asleep and I did exactly that. But my sons and pet played a huge role and you too.

I have manifested being a model,earning upto 2000k a month,moved from Turkey to America and a living husband,I also got to provide better treatment for my dog's health and good schooling for my sons,and i have aldo changed my religion maybe controversial but it just felt like I didn't have much freedom.

And as for affirming i just affirmed "I'm a lucid dreamer,I can control my dreams" that's it.

I'm gonna delete this app for forever thanks alot,I must say affirming and saturating will be my favorite now.

ANOTHER SUCCESS STORYYYY🫠I'm so happy for you,you are truly an inspiration for all those who think their circumstances matters,and you not telling me your struggle touch my heart💓,I could tell you were depress when we first texted abd I'm so happy you persisted through your hard circumstances I'm happy you could give your son's and dog the better life they deserve.

331 notes

·

View notes

Text

₊‧°𐐪♡𐑂°‧₊ Tips for Managing a Shopping Addiction ₊‧°𐐪♡𐑂°‧₊

Shopping addictions or impulsive overspending is a really hard habit to break out of, and depending on your financial situation you can end up in really tough spots because of it.

As a general disclaimer: I am not a doctor or therapist, I'm just a mentally ill 24-year-old on the internet who's had issues with overspending (like a lot >-<) but hopefully, these tips can be of some use to you! I would also recommend looking for advice in other areas as well! Don't use this post as your only resource ^-^

♡ Overarching tips ♡

♡ Identify why you might have a shopping addiction. There are many different reasons for this! One thing that can help you identify the reasoning behind it is to analyze the emotions you feel when shopping. Do you feel frantic? Stressed? Really overly-excited? After you make the purchase how do you feel? Do you feel guilt? Shame? Regret? Relief? Super happy? Really analyze your feelings through the process and get a vibe for how it's making you feel. A lot of times shopping addiction develops as a way to cope with negative feelings. If you're feeling sad, stressed, or anxious, it's really tempting to buy yourself a "little treat" to make yourself feel better! But that can spiral into situations where any time you feel those negative emotions you feel a strong urge to go out and buy something to make those feelings go away, and a lot of times they'll come back even worse after the fact. If this is something that you think plays into your shopping addiction, you'll have to build up your resources for healthy coping mechanisms to give yourself alternatives to shopping when you feel down or anxious. Shopping addiction can also develop as a reaction to being in a poor financial situation. You can see this a lot with food and toiletries, but it can happen with other items as well. It makes sense that if someone has experienced food insecurity, once they have extra cash, they'll overstock on food to ensure they never run out again. That same logic applies to other aspects of life as well. If this is something that is playing into your shopping addiction you'll need to do some work into identifying places in your life that you feel the need to overstock on, why you feel that way, and how you can help minimize those feelings to help yourself feel secure without needing to overspend and overstock on those items.

♡ Identify what you are spending your money on. What is it that you're overspending on? Toiletries like skincare products and soaps? Food? Cookware? Clothing? Stuffed animals? Identifying what it is that you impulse buy the most can help you pick up on some of the reasons for your overspending, and can help you know what areas of purchases you need to be more aware of.

♡ Avoid browsing. Especially with online shopping, browsing for items to buy is way too easy. It is so tempting to log onto your favourite shopping websites and just browse for hours, even if you don't need anything! You can open Amazon without the intention of buying anything in particular and the website will shove products into your face until you convince yourself that you absolutely need something T-T so avoid browsing these websites.

♡ Identify when you need something or truly want something vs when you’re experiencing a Fear Of Missing Out (FOMO). There are multiple parts to this. The first one is SALES. 20% off! Free shipping! Buy one get one 50% off! IGNORE THAT!!!! If you did not want to buy it before you saw the sale, do not let the sale influence you into buying it! That's what the corporations want! These sales are designed to create a false sense of urgency so that you feel a stronger need to purchase the product, even if you didn't really want it that much before. Another part of this is trends. This is really easy to see in fashion but it applies to other things as well. Do you really need the new skirt that everyone is talking about? Do you REALLY like the item or do you just want it because everyone else has it and you want to be cool? Would you wear it if no one else was wearing it? Do you already have items to style it with? How often would you actually wear it? Do you already own something similar? These are really important questions to ask when you're shopping for fashion because it is SO EASY to see everyone else wearing something and then just go buy it because everyone else has it, and then they all move on to something else and it just sits in your closet for the next few months never to see the light of day again.

♡ Take note of what you already have. When you're out shopping for something, ask yourself "Do I already have something similar" or "Do I already have something that can serve this same purpose". This works for a lot of things. If you see a new cardigan you really like, think about if you already have a cardigan you can style in the same way. If you're looking at new cookware, ask yourself if you really need another pot or if you have one that can do the same thing. And if you're not sure, go home and check! It is so much better to make sure that you really need the thing that you're buying before you buy it, than to buy it and then realize that you don't need it or you aren't going to use it.

♡ Don’t view shopping as a hobby. Ask yourself... truly, do you treat shopping as though it is a hobby? If you spend multiple hours on shopping websites, it is a hobby. If you get dressed up just to go walk around Target without any specific thing that you need to buy in mind, it is a hobby. Try to replace this with something else that doesn't involve spending money. If you're spending a lot of time on shopping websites, try playing a video game with customizable elements where you can sort of get the feeling that you're buying and building things without spending money (Animal Crossing is really good for this, making Picrews is another good and free option). If it's more of a way to get yourself out of the house try going to places that don't involve shopping instead, there's a surprisingly large number of free or really cheap little art galleries and museums around where you can go walk around and look at cool stuff without really being sold things. Look on your town's website and see if there are any events going on, you'll be really surprised to see how much stuff people organize and do ESPECIALLY around winter-time there are usually loads and loads of free tree-lighting ceremonies and light shows. Talk to your friends too! If meeting up with friends to go shopping is a big part of your friendship dynamic tell them that you're trying to save money and ask if there are other things that you guys can do instead. (Also just as a note I know this is a lot harder in rural areas than cities T-T I do apologise).

♡ In-Store Tips ♡

♡ Don’t go shopping just to go shopping. If you are going shopping make sure that you are shopping for something that you actually need or truly want and have the financial means of getting. Before you walk into the store identify what these things are. Buy only those things. Additionally if you’re looking for something specific but can’t find that item, don’t settle for something else, instead wait until you can find either the specific item you wanted or a really close alternative. Remember that it’s okay to leave a store without buying anything! If you didn’t find what you wanted or needed, you don’t have to buy anything!

♡ Set a reasonable budget. Sometimes it's okay to just go shopping for fun, but you want to make sure that before you go shopping you set a reasonable budget for yourself. You need it to be enough that you'll actually be able to stick to it (like I would not set the budget to $20, that's unreasonably low), but you also want to make sure that it is not SO much that it is going to financially stress you (for example $200 is usually too high for me). For most people, this is going to land you somewhere in the $50-$150 range depending on your income, expenses, and current financial situation. If at any point you find yourself saying "I can spend a little more if I don't do XYZ" STOP. If you start taking money away from other expenses for "fun shopping", STOP. Make sure that all of your essential bills and expenses can be comfortably covered before you start spending fun money.

♡ Wait before you buy. Don't feel rushed or like you have to buy something right now. Identify things in the store that you like, leave the store, and come back later if you can. If you forget anything that you wanted in the time between you leaving the store and coming back, then you don't really need it. If you cant leave the store, step away from your basket for a second. See if you can remember everything in your basket then come back. If there is anything in your basket that you did not remember, put it back. If it’s online do the same thing. Close the page and see if you can remember everything. If you can’t, delete what you didn’t remember. Even better if you wait 1 week before purchasing. You can leave the items in the cart, just wait a few days and see if you still want to buy them after those few days are up. The general idea is that if you do not remember and want the item when it is not in your immediate vicinity, then you likely don't need it. And especially if you leave the store and come back a few days later, if you really really wanted it on day one, but when you come back two days later you don't really want it anymore, then you likely don't need it.

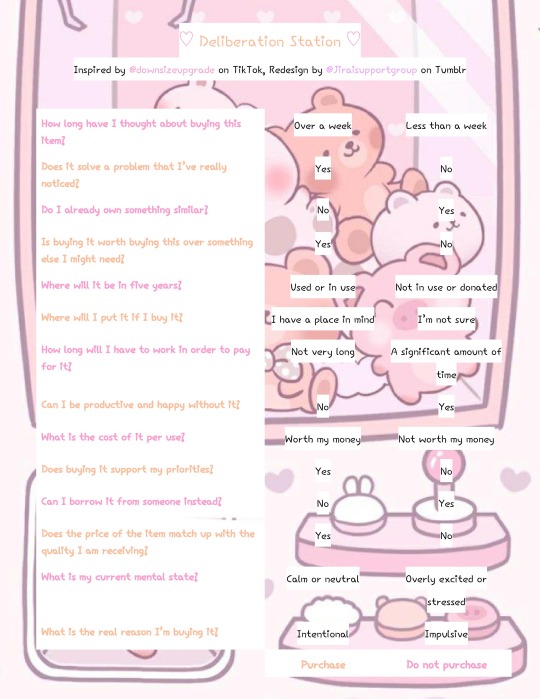

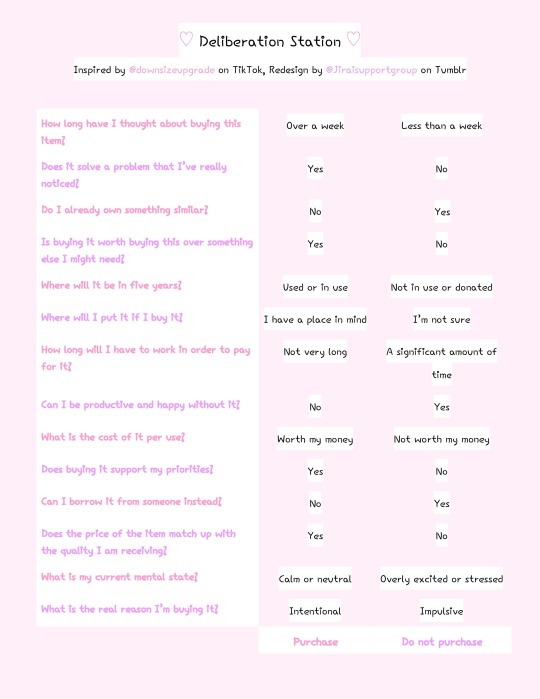

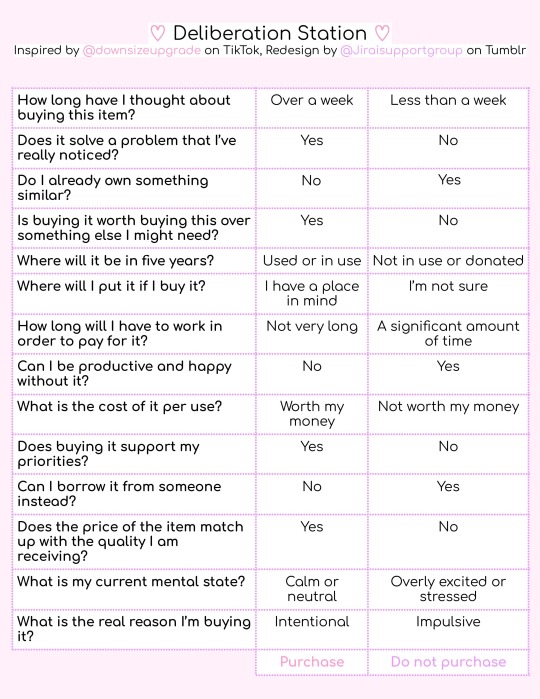

♡ Think critically about each of your purchases. Below is a little chart that @.downsizeupgrade on TikTok uses when she makes a purchase to weigh out if she really needs it or not that I like quite a bit. I did make a few small changes. There are three versions ranging from super cute over the top layout to very simple and easy-to-read layout so that if any of them are hard to read you have options for which one is the easiest for you to use. It is super important to try and be AS HONEST as you can when you’re answering these questions.

62 notes

·

View notes