#medical debt

Explore tagged Tumblr posts

Text

Such timing.

Goes to show the insurance companies don't need the money.

28K notes

·

View notes

Text

The NYPD is offering a $10,000 reward for info on the guy who shot the UHC CEO. On the same day he was shot, I received a $45,000 bill from UHC. That reward money wouldn't even cover a quarter of it. I hope my man never gets caught. Fuck Brian, fuck UHC, and fuck the entire U.S. healthcare system.

6K notes

·

View notes

Text

Piece of financial advice, because I've seen too many people make this mistake: never pay off medical debt on a credit card unless you are 100% sure you will be able to pay the credit card balance off in full as soon as you get the first bill. Why? It is ALWAYS better to have medical debt than credit card debt. There is a long list of reasons why.

State and federal laws severely restrict medical debt in ways that credit card debt is not restricted.

Credit card debt can charge much higher interest rates, and in general it IS much higher in rate. Medical debt sometimes charges no interest, at least for a certain period of time. When it does charge interest, the rate is lower, and in some states it is capped as low as 5%, always at 20% or lower. Credit card interest rates are almost never below 15% and are sometimes MUCH higher than 20%.

Medical debt is less damaging to your credit history than credit card debt. And it is easier to eliminate in bankruptcy.

Medical debt also does not affect your spending limits on a credit card. If you use a credit card for monthly expenses, adding medical debt to it can bring you closer to your credit limit which might make you unable to use the card for expenses (even ones you could afford to pay off immediately.) This negatively affects your credit rating through increasing your credit utilization, it can reduce your potential to earn rewards, and it can reduce your spending power in an emergency.

Also, the penalties and fees for deliquency on medical debt are much milder and those for credit card debt are more severe. Again, laws are more restrictive on medical debt. You will have far fewer fees or penalties going delinquent on medical debt.

Also it is often easier to get medical debt forgiven or negotiated down, than credit card debt,

If you ever end up with medical debt, keep it as medical debt and keep paying it as medical debt. Go delinquent on your medical debt before switching it to a credit card. Once you put it on a credit card, you can't go back.

By keeping your medical debt as medical debt, you save money, protect your credit history, and increase your chances of having the debt forgiven, negotiated down, or eliminated through bankruptcy.

NEVER CONVERT MEDICAL DEBT TO CREDIT CARD DEBT.

3K notes

·

View notes

Text

“…no society can legitimately call itself civilised if a sick person is denied medical aid because of lack of means.” ~ Nye Bevan

33K notes

·

View notes

Text

Legendary U Washington bookseller Duane Wilkins is drowning in medical debt

Nearly every sf writer who's ever toured the west coast knows Duane - he's the encyclopedically knowledgeable sf buyer for the U Washington Bookseller, who has organized some of the best sf signings in Seattle history. He's a force of nature.

He's also broke. A two-week hospital stay left him drowning in medical debt - despite being insured! - and now he's being threatened by a collection agency.

Now, Duane is forced into participating in one of the most barbaric of contemporary American rituals, fundraising to cover his medical debt. He's raised $6k of the $10k he needs (I just pitched in $100).

If you can afford to help out someone who's done so much for our community, please kick Duane whatever you can spare.

6K notes

·

View notes

Text

For information leading to the capture of the insurance CEO’s killer, the NYPD is offering a $10,000 reward; or less than half of the mean medical bills of American debtors.

1K notes

·

View notes

Text

"In a major change that could affect millions of Americans' credit scores, the Consumer Financial Protection Bureau on Tuesday [January 7, 2025] finalized a rule to remove medical debt from consumer credit reports.

The rule would erase an estimated $49 billion in unpaid medical bills from the credit reports of roughly 15 million Americans, the CFPB said.

That could help boost those borrowers' credit scores by an average of 20 points, helping them qualify for mortgages and other loans.

"No one should be denied economic opportunity because they got sick or experienced a medical emergency," Vice President Kamala Harris said in a statement touting the new rule.

She announced the proposal for the rule last June alongside CFPB Director Rohit Chopra.

"This will be life-changing for millions of families, making it easier for them to be approved for a car loan, a home loan or a small-business loan," Harris added.

Major credit reporting agencies have already announced voluntary steps to remove medical debt from their reports.

The final rule is set to take effect in March [2025] – but that timeline could be delayed by legal challenges."

-via ABC News, January 7, 2025

#united states#north america#us politics#medical debt#public health#american healthcare#us healthcare#debt#debt relief#credit score#good news#hope

995 notes

·

View notes

Text

Vice President Kamala Harris announced this week that the Biden administration is looking to lessen the burden medical debt has on people by purging it from their credit report. This means that even if people have piles of medical debt — one in five Americans say they do — it’s not going to affect their ability to get a mortgage or a car loan. So they will at least have a place to rest their head and a car they can drive to work every day while paying off their medical bills.

Via AP:

Harris said that would make it easier for them to obtain an auto loan or a home mortgage. Roughly one in five people report having medical debt. The vice president said the Consumer Financial Protection Bureau is beginning the rulemaking process to make the change. The agency said in a statement that including medical debt in credit scores is problematic because “mistakes and inaccuracies in medical billing are common.” “Access to health care should be a right and not a privilege,” Harris told reporters in call to preview the action. “These measures will improve the credit scores of millions of Americans so that they will better be able to invest in their future.”

It only seems fair that high medical bills for an emergency or serious illness shouldn’t affect one’s credit rating anyway. It’s not like we’re talking about someone irresponsibly dropping several grand at Versace and then never paying off the credit card bill. Fifty-seven percent of Americans could not afford a surprise $1000 emergency, so the inability to pay off massive amounts of medical debt is hardly a fair reflection of an inclination to default on normal payments — payments you can budget for — on something like a mortgage or auto loan. “Way to be irresponsible by getting cancer, lady! You should definitely be punished for that by not being able to find any place to live!” seems pretty harsh, no?

6K notes

·

View notes

Text

Source

Good

#politics#us politics#government#the left#progressive#current events#news#bernie sanders#medical debt#health#health care#public health

2K notes

·

View notes

Text

#private healthcare#for profit healthcare#corporate greed#ceo greed#corporations and oligarchs are killing us#medical debt#medical bankruptcy#republican assholes#maga morons#oligarchs control the Republican Party

681 notes

·

View notes

Text

Commissions are open again! Six spots are free atm!

Please help me spread the word and feel free to contact me if you want art from me💖

Emergency commissions!

Because of my death near experience back in February I ended up with bad health, expensive treatment, different type of tests and more. My health is better now but I still have a huge medical debt to pay, so emergency commissions have been updated✨

Sketches are now included next to regular and ns*fw art. Also slots for both types are available again.

All updated info can be found at my carrd: https://lemonhitsu.carrd.co/

Any help would be highly appreciated. And if you can't commission me atm please help me spread the word and reblog!

Thank you all💖

Prices and some personal info under the cut. Any questions feel free to send me a dm!

I had blood clots on my right knee and lungs discovered at February 14th. I was lucky enough to get the proper treatment that saved me from something worse. My health has being slowly improving at home but healthcare isn't free where I live and I need to solve the costs of everything.

Prices and more info at: https://lemonhitsu.carrd.co/#samples

#personal post#lemonhitsu#emergency commisions open#emergency commissions#commissions#commissions open#art commissions#digital artist#ko fi commissions#donate a kofi#commissions 2024#open commissions#commission information#kofi commission#buy me a kofi#ko fi page#ko fi support#please boost#emergency boost#artist on tumblr#art on tumblr#medical debt#medical bills#boost#signal b00st#signal boost#reblog boost#sketch commissions

131 notes

·

View notes

Text

#happy new year#capitalism#us politics#late stage capitalism#luigi mangione#uhc ceo#uhc shooter#free luigi#medical debt

716 notes

·

View notes

Text

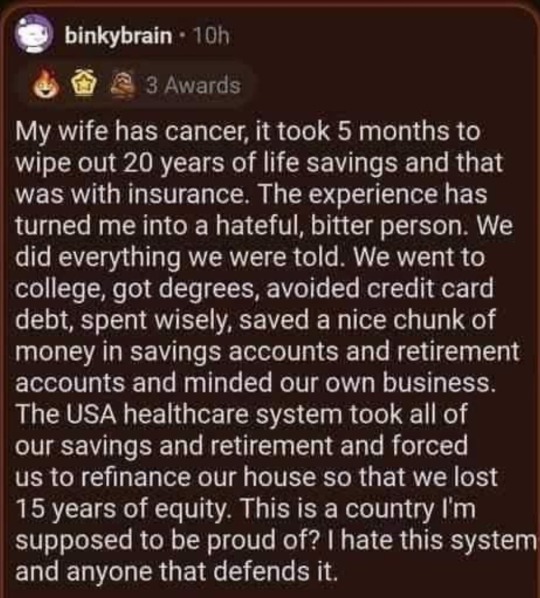

What radicalized you?

Cancer treatment will steal life savings and inflict medical bankruptcies.

The out-of-pocket expenses are criminal.

You will never see a Congress person with their government health care get cancer and go bankrupt.

4K notes

·

View notes

Text

Dandelion News - January 1-7

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles!

1. Homes built with clay, grass, plastic and glass: How a Caribbean island is shying away from concrete

“[… Clay] traps moisture which then evaporates and pulls heat from the surface as it goes. […] The roof is covered in old recycled advertising banners and piece of a water tank, the other half of which is used to house some of Rahaman-Noronha's fish [… and] multi-coloured glass bottles inset into walls provide an avenue for streams of light and colour.”

2. To Combat Phoenix’s Extreme Heat, a New Program Provides Sustainable Shade

“The neighborhood workshops allow residents to get a shade plan tailored to their community’s needs and identify the locations where officials can plant trees. Meanwhile, the workforce-development side of the program creates the jobs needed to keep the trees alive for generations[….]”

3. Conservation corridors provide hope for Latin America’s felines

“[… S]cience has shown that to maintain healthy populations there needs to be connection between individuals. [… A] protected area that is close to another has more species and more potential for their survival.”

4. Social program cuts tuberculosis cases among Brazil's poorest by more than half

“The decrease [“in TB cases and deaths”] was over 50% in extremely poor people and more than 60% among the Indigenous populations. […] "We know that the program improves access to food [… and healthcare…] and strengthens people's immune defenses as a result.””

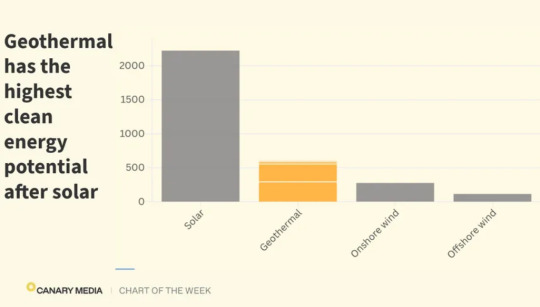

5. Geothermal has vast potential to meet the world’s power needs

“New geothermal systems could technically provide as much as 600 terawatts of carbon-free power capacity by 2050[…. C]ountries could cost-effectively deploy over 800 GW of geothermal power capacity using technology that’s in development today[….]”

6. New D.C. Catholic archbishop is pro-LGBTQ+ and anti-Trump

“In 2018, he objected to the blaming of gay priests for the clergy sexual abuse crisis, “saying that such abuse was a matter of power, not sexual orientation[….]” “We must disrupt those who portray refugees as enemies [… and] seek to rob our medical care, especially from the poor.””

7. Chesapeake Bay Will Gain New Wildlife Refuge

“The Chesapeake Bay area will have a new wildlife refuge for the first time in a quarter century. […] “This new refuge offers an opportunity to halt and even reverse biodiversity loss in this important place, and in a way that fully integrates and respects the leadership and rights of Indigenous peoples and local communities.””

8. Inside Svalbard seed vault’s critical mission to stop our favourite fruit and veg from going extinct

“[… T]he world’s largest secure seed storage […] sits proudly in a massive former coal mine[….] Right now, there are over 1,331,458 samples of 6,297 crop species. […] “During 2024, 61 seed genebanks deposited 64,331 seed samples, including 21 from institutes that deposited seeds for the first time this year[….]””

9. Medical debt will be erased from credit reports for all Americans under new federal rule

“The rule will affect more than 15 million Americans, raising their credit scores by an estimated average of 20 points. [… S]tates and localities have already utilized American Rescue Plan (ARP) funds to support the elimination of over $1 billion in medical debt for more than 700,000 Americans[….]”

10. 'Forgotten' water harvesting system transforms 'barren wasteland' into thriving farmland

“"The process started with the community-based participatory planning[….]” 10% to 15% of the water will actually soak into the ground to replenish the water table, creating a more sustainable agricultural process.”

December 22-28 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#recycling#upcycling#climate change#climate action#trees#habitat restoration#habitat#big cats#cats#latin america#brazil#tuberculosis#poverty#geothermal#clean energy#renewableenergy#catholic#lgbt+#lgbt#lgbtq#religion#christianity#wildlife refuge#wildlife#seed saving#seed bank#medical debt#anti capitalism

301 notes

·

View notes

Text

Hay guys. I’m $6,500 in medical/personal debt. I had surgery this past September to remove fibroids from my uterus and my insurance refused to cover multiple things. So I changed the uncovered items to my credit card. Any help will go towards my medical/personal debt. Funds can also be sent to $SophiaChes, PayPal- [email protected] and my venmo Sophia-Chester-1. Any help would be greatly appreciated!

1K notes

·

View notes

Text

The federal Consumer Financial Protection Bureau on Tuesday issued new regulations barring medical debts from American credit reports, enacting a major new consumer protection just days before President Joe Biden is set to leave office.

The rules ban credit agencies from including medical debts on consumers' credit reports and prohibit lenders from considering medical information in assessing borrowers.

Shots - Health News

The fight against medical debt is pivoting to the states after Trump's election

These rules, which the federal watchdog agency proposed in June, could be reversed after President-elect Donald Trump takes office Jan. 20. But by finalizing the regulations now, the CFPB effectively dared the incoming Trump administration and its Republican allies in Congress to undo rules that are broadly popular and could help millions of people who are burdened by medical debt.

Medical debt will soon be wiped off credit reports for millions of Americans https://one.npr.org/i/nx-s1-5251328:nx-s1-5316379-1

151 notes

·

View notes