#Managing a budget

Explore tagged Tumblr posts

Text

Ten Ways to Bulletproof Your Budget

Managing personal finances can be challenging in today’s fast-paced world. However, you can bulletproof your budget with a few strategic moves and ensure financial stability. Here are ten ways to fortify your financial plan: 1. **Embrace the 50/30/20 Rule**: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. 2. **Track Your Spending**: Keep an eye on…

#Budget#budgeting#Bulletproofing a budget#Bulletproofing your budget#Fortifying a budget#Fortifying personal finances#Fortifying your budget#Managing a budget#Managing personal finances#Managing your budget

0 notes

Text

Heyo! I'm accepting a couple of pokemon ko-fi commissions again!

Pricing is 15 USD per pokemon & you can request up to 3 pokes together in one drawing :) Backlog of commission requests can be found here!

Please consider supporting if you can 🥹🙏 Thank you so much!! ✨

#commissions#ko-fi commissions#btw I updated the style for the doodles!#wanted to do something diff. this time ;w;#also was hoping I could finish my backlog soon but i've been feeling a lil under the weather lately so I had to slow down for a bit u_u#BUT once I get better I think i'll be able to pick up the pace 💪#I have the lineart ready for most of them sooo I think it should be good :)#i'm just opening the comms again so I could extend my budget early#I usually do it when i'm about to run out sooo I always end up being under too much pressure#w/c then makes it more difficult for me to work on the requests#but since the amount of work I have is a bit more manageable now#I think I could afford to open a few more slots (just a few!) in advance#anyways!! i'm getting a bit rambly now so i'm gonna stop but!!#thank u sm for the support as always ;_;

276 notes

·

View notes

Text

#columbo#season 2#requiem for a falling star#can you read? No ma'am#this is why mrs columbo does their taxes and manages the budget#columbo's idea of a budget is Never Buy Anything Again unless it's chili or dog food or can't be repaired#his wife has been silently throwing out and replacing his 30 year old pairs of holey underwear and she fears the day he finally grows wise

238 notes

·

View notes

Text

financial knowledge for the girlies 🤍🍓💸

Develop a budget: Creating and sticking to a budget can help you better understand your income and expenses, and learn how to prioritize your spending.

Save regularly: Saving money is crucial for achieving financial stability. You can set up automatic transfers to a savings account so you won't be tempted to spend the money.

Pay off debt: High-interest debt can hinder your financial progress. Make a plan to pay off your debts and focus on high-interest debts first.

Invest wisely: Investing can help your money grow over time. Look for low-cost index funds, which can give you broad exposure to the market at a low cost.

Understand compound interest: Compound interest is the interest you earn on interest. By investing consistently, the power of compound interest can help you build wealth over time.

Research before making big financial decisions: Before making a major decision, such as buying a house or car, research different options and weigh the costs and benefits.

Learn from your mistakes: Every failure or setback can teach you something valuable. Use these experiences to inform your future financial decisions.

Get professional advice: Seek advice from a financial advisor if you're unsure about your financial decisions. They can provide guidance on investments, retirement planning, and tax strategies.

Be aware of scams: Scammers can take advantage of financial illiteracy. Be cautious when someone offers an investment that's too good to be true.

Continuous learning: Financial knowledge is constantly changing, so stay informed by regularly reading financial news, books, and attending classes or webinars.

#money#hyper feminine#light feminine#pink moodboard#pink pilates princess#soft moodboard#that girl#beautytips#confidence#beauty#fashion#old money#strategies#job#budget#management#businesses#girlblogger#this is a girlblog#girlblogging#gaslight gatekeep girlboss#girlblog aesthetic#wonyoungism#it girl energy#becoming that girl#glow up#rich aesthetic#eat the rich#wealth#rich life

2K notes

·

View notes

Text

#trump#donald trump#kamala harris#trump 2024#democrats#vote kamala#kamala 2024#kamala for president#vp kamala harris#republicans#mortgage#special interest#interest rates#housing#gas prices#economy#money management#money#budgeting#budget#food and beverages#foodporn#foodie#food#salary#paycheck#paypal#debt relief#debt#credit cards

466 notes

·

View notes

Text

Executive Order on Education Part 1: Treatment of Trans Students (01/29/25)

Sec. 2. Definitions. As used herein: (a) The definitions in the Executive Order “Defending Women from Gender Ideology Extremism and Restoring Biological Truth to the Federal Government” (January 20, 2025) shall apply to this order. (b) “Discriminatory equity ideology” means an ideology that treats individuals as members of preferred or disfavored groups rather than as individuals and minimizes agency, merit, and capability in favor of immoral generalizations, including that:

(e) “Social transition” means the process of adopting a “gender identity” or “gender marker” that differs from a person’s sex. This process can include psychological or psychiatric counseling or treatment by a school counselor or other provider; modifying a person’s name (e.g., “Jane” to “James”) or pronouns (e.g., “him” to “her”); calling a child “nonbinary”; use of intimate facilities and accommodations such as bathrooms or locker rooms specifically designated for persons of the opposite sex; and participating in school athletic competitions or other extracurricular activities specifically designated for persons of the opposite sex. “Social transition” does not include chemical or surgical mutilation.

Sec. 3. Ending Indoctrination Strategy. (a) Within 90 days of the date of this order, to advise the President in formulating future policy, the Secretary of Education, the Secretary of Defense, and the Secretary of Health and Human Services, in consultation with the Attorney General, shall provide an Ending Indoctrination Strategy to the President, through the Assistant to the President for Domestic Policy, containing recommendations and a plan for:

This Order is forcing Teachers to Dead-Name students while calling out wildly untrue ideas of how apparently teachers are allowing for students to "mutilate themselves." Should Schools not comply with this order they will lose Federal Funding. They can also lose funding if they even just have Gender Neutral Bathrooms too. Schools with Gender Neutral Bathrooms already could be subject to investigations anyway.

TRANS RIGHTS ARE FUCKING HUMAN RIGHTS, PROTECT TRANS KIDS!!!!!!!!

#trans rights#american politics#executive orders#donald trump#protect trans kids#protect trans lives#education#office of management and budget#luigi mangione

125 notes

·

View notes

Text

Multiple groups call on Senate to reject Vought nomination

Groups oppose Trump's nominee for OMB director

105 notes

·

View notes

Text

My hottest take: if we must continue to make shows with Empress Elisabeth, I want a long series in the style and spirit of The Crown about Franz Joseph.

I think freeing Sisi from being a girlboss critic-of-monarchy main character would actually be much better.

#historian consumes media#netflix would never give me a budget#but i have ideas#i think a lot of sisi media suffers from making her the voice of criticism for the monarchy because shes the main character#but something like the crown managed to communicate that 'this institution breaks people' through its structure#and Franz Joseph tends to have to be a romantic lead in Sisi driven shows#whereas i think spending time establishing him as a complicated person who embadies the monarchy would help

104 notes

·

View notes

Text

20.12.23, wednesday

My main hobby is just procrastinating in any way I can. The plan was to make a cup of coffee and then start working. What actually happened is that I watched a 3 part video series (by james hoffmann ofc) on Aeropress coffee and made a few cups with different variables. Still not sure if I found The Recipe for me, but it’s getting better (tho I don’t love the coffee beans I have)

#altho i’m not sure I agree that inverted method is not worth the risks#maybe I just pour my water in too slow (bc I get nervous abt pouring too much) but there’s a fair bit of liquid that manages to get through#before I can place the vacuum on there#so I did it with inverted method#what I took from his recipe was the swirling instead of stirring and letting it rest for 30secs after to get a more even bed of coffee#I did 14g of coffee & 200g of water with a 5min brew -> swirl -> another 30seconds of letting it rest before pressing gentlyy for like 20-3#seconds#but idk it’s a bit ’’one note’’#which could be the beans#I have medium roast rn and I prefer light roast but the light roast beans have been no where to be found lately idk why#(there aren’t many actual light roast beans and the other ones are waay out of my budget)#(or at least good ones; there’s the one affordable light roast that’s everywhere but I don’t like it that much (but tbf should’ve still#bought that instead of these ones I got))#like this is still way better than what the drip coffee of those beans are#and the achilles heel is that I don’t have a thermometer of any kind so my water temperature is guesswork every time#so tweaking variables is always a bit sketchy bc idk if I just had a better water temperature that time#studyblr#booklr#aesthetic#bookblr#books#study#reading#read#book#coffee#2023#december 2023

427 notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

86 notes

·

View notes

Text

Jennifer Scholtes at Politico:

One week in, the Trump administration is broadening its assault on the functions of government and shifting control of the federal purse strings further away from members of Congress. President Donald Trump’s budget office on Monday ordered a total freeze on “all federal financial assistance” that could be targeted under his previous executive orders that pausing funding for a wide range of priorities – from domestic infrastructure and energy projects to diversity-related programs and foreign aid. In a two-page memo obtained by POLITICO, the Office of Management and Budget announced all federal agencies would be forced to temporarily suspend payments, while making clear that Social Security and Medicare would not be affected. “The use of Federal resources to advance Marxist equity, transgenderism, and green new deal social engineering policies is a waste of taxpayer dollars that does not improve the day-to-day lives of those we serve,” according to the memo, which three people authenticated.

The new order could affect billions of dollars in grants to state and local governments, while also creating disruptions to programs that benefit U.S. households. But in the immediate aftermath there was also widespread confusion over how the memo would be implemented and whether it may face legal challenges. While the memo says the funding pause does not include assistance “provided directly to individuals,” for instance, it does not clarify whether that includes money sent first to states or organizations and then provided to households. The brief memo also does not detail all payments that will be halted. However, it broadly orders federal agencies to “temporarily” stop sending all federal financial assistance that could be affected by Trump’s executive actions.

That includes the president’s orders to freeze all funding from Democrats’ signature climate and spending law called the Inflation Reduction Act and the bipartisan infrastructure package enacted in 2021, along with a 90-day freeze of all foreign aid. Senate Minority Leader Chuck Schumer in a statement decried the announcement as an example of “more lawlessness and chaos in America as Donald Trump’s Administration blatantly disobeys the law by holding up virtually all vital funds that support programs in every community across the country.”

The OMB under Tyrant 47’s misadministration puts out a “temporary” freeze to most federal aid and grants, including food assistance, Medicaid, farm aid, Head Start, and rent assistance. Social Security and Medicare are exempted.

This is dangerous and dictatorial, and must be resisted.

See Also:

HuffPost: Donald Trump Orders Freeze On All Federal Grants And Loans In Huge Power Grab

The Hill: Trump administration directs widespread pause of federal loans and grants

Reuters: White House pauses federal grant, loan, and other assistance programs

NOTUS: Trump Administration Orders Sudden Freeze on Federal Aid

#Federal Aid#Donald Trump#Trump Administration II#Food Assistance#Grants#Matthew Vaeth#Office of Management and Budget#OMB#Foreign Aid#Farm Aid#Head Start#Rent Assistance#Federal Funding Freeze

63 notes

·

View notes

Text

getting lore drops for FBC field offices during Oldest House lockdown has me foaming at the mouth for information. yes I need to know all the tedious details about how the bureaucracy continues to shamble along like a zombie. are they still embezzling from the US government

#*posts#alan wake 2#the lake house#control game#does anyone at the fbc know how to manage a real budget

71 notes

·

View notes

Note

Hey Bitches! Long-time reader, first time asker :)

I have a budgeting question!

I'm a 21 year old student living with my (employed) partner independent from both our families. I'm unemployed at the moment, but will be starting a (min wage, limited hours, career-benefiting, year-long-contracted) job starting next month. I'll also be looking into selling plasma and/or picking up a gig app to supplement the pay

I find that a lot of what makes budgets useful doesn't really work for me because most of my spending areas that can be minimized have already been minimized, and I limit and track myself so much already because I know I don't have a lot of wiggle room to spend frivolously. So most of the time, I use a spending tracker spreadsheet

However, my credit union has a built-in budget feature I like to poke around on sometimes, too. It can be nice to have a goal in mind and to feel like I did a good job at the end of the month when (most) everything is green (I was over-budget for my cat by 11 cents last month)

BUT! I can only set a budget for one month's length. This seems to be the norm and is pretty common when I look at budgeting examples

This is great for things that happen on a monthly basis (like gas, for example), where, after years of tracking my spending data, I have a solid idea of how much I can realistically expect to spend in that time. But it really sucks for things that aren't as frequent, but do happen on a regular basis (like car registration or tuition, which come once a year and every few months, respectively)

I'm kind of at a loss for how to represent or calculate these kinds of items on a budget/spending tracker (like when I'm pulling for an average over a length of time, or categorizing my spending when one value is superbly high in a sea of much smaller numbers)

Gas is about $50/month, car registration is about $100/year. I think it's a poor representation to say I need $150/month for auto expenses. I'm not spending that $100 most of the time, but I'm not expecting to pay it most of the time, so it feels wrong to say I'm saving a ton of money every month. But it also isn't great to have only $50 budgeted when registration month rolls around and I'm in the red by $100 (not to mention inconsistent maintenance of wildly varying cost)

Likewise, I wouldn't say I'm under-budget by $2,000 on the months I don't have tuition due, but it can't be correct to have a $0 budget that gets super red every three months. Dividing it up to $666 a month gets the same problem where I'm either super green, not spending anything, "saving" a ton, or very in the red, very over-budget when my tuition actually comes due. There is an option to split up payments, but it adds a $50 payment plan fee, which (in addition to generally being shitty by punishing anyone who doesn't make the lump sum) doesn't feel worth it just to make my books look nice

I've seen some recommendations to use a sinking fund for these expenses, putting money aside each month in preparation for the big expense, but

A. where exactly do you put that portion "aside" into? I have a checking, savings, (secured) credit card, and a CD account (the latter two of which I can't easily move money around in). Besides putting money into my savings account from my checking (which, when employed and receiving income, I already do), I don't understand how this works. Do people just open and have several accounts going for each expense that isn't on a monthly pattern?

And B. I'm in a fortunate enough position that I'm (just barely! Job is coming with amazing timing!) able to make single payments on these expected bigger expenses without having to meticulously save up for them. It doesn't fix my budget being wonky on months with/out these non-monthly expenses, and I would like to actually have a working budget, but do I even need to make a sinking fund if I can afford it with the habits/systems I already have?

I've also seen people using different budgets for different times. Most often, this is seasonal: a winter budget with higher heating expenses planned, a summer budget with lower heating expenses planned kind of deal. This feels closer to what I'm looking for than a sinking fund, but making a different monthly budget around each varying expense and overlapping occurrences (or lack thereof) feels cumbersome and tedious (to make, keep track of, alter, and change every month)

I could have a yearly budget, but it feels risky to go such a long time without knowing how on-track I am and my life is so in flux right now that I don't know what to expect that far into the future. Plus, like I said, I only have the option for monthly budgets in my credit union.

I expect having a more stable and higher income will help a lot (assuming I can get there). As will not having to pay for huge-stressful-chunks-of-savings-every-three-months-except-for-summertime tuition (I'll be done next year almost to the day!). I know there will still be yearly and bi-yearly expenses (and surprises) that I'll have to be ready to pay for, but I'm hoping I'll have more staggering control.

So, I've come to you, Bitches, if there is a better way to address these big, non-monthly expenses, or if I'm just missing something in one of the suggestions above, I'd be jazzed to hear about it and not have to wait to better grasp this part of my finances.

Thank you, Bitches!!

THIS IS EXACTLY WHY WE DON'T THINK BUDGETS ARE RIGHT FOR EVERYONE.

My first instinct is to tell you to ignore your bank's budgeting software. It doesn't matter. You're doing great with your personal spending tracker and you seem to have a very good hold of your expenses. So that's an option.

The other option is combining the budget with a sinking fund. Some banks will include "buckets" within your account that you can access through their online portal. For example, my Ally HYSA allows me to set up buckets within the account so I can budget for what I'm saving for our kitchen renovation, for example. It makes using a sinking fund real easy.

But not every bank has that functionality! So again, I can't stress enough how much a budget just might not be right for your situation right now.

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

Ask Not How Much You Should Save, Ask How Much You Should Spend

Did we just help you out? Join our Patreon!

#budget#budgeting#spending money#saving money#personal finance#money#money tips#adulting#frugal#finance#money management#cash

45 notes

·

View notes

Text

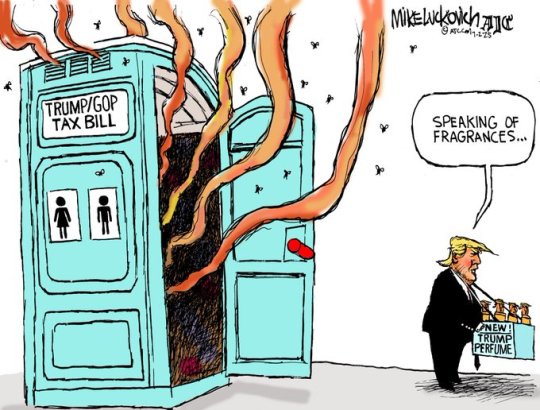

mike.luckovich

* * * *

The Budget as Battlefield: What the 2025 Agenda Bill Tells Us About Who Counts

How the 2025 budget transforms abandonment into law—and turns survival into a test of endurance

James B. Greenberg

Jun 30, 2025

A budget is never just a financial document. It is a cultural artifact—one that reveals how a society organizes care, distributes risk, and decides whose lives are worth sustaining. It encodes a vision of the future, but also a judgment about the present: who will be protected, who will be burdened, and who can be left behind.

The 2025 budget bill now advancing through Congress—aligned with Trump’s second-term agenda and the Project 2025 blueprint—is more than fiscal policy. It is a redesign of governance itself. Not through declaration, but through attrition. Not by reforming broken systems, but by withdrawing the expectation that they exist at all.

The language used to sell this bill speaks of balance, discipline, and responsibility. But beneath that language is a different logic: one shaped not by stewardship, but by managed neglect. What it proposes is not just disinvestment, but a recalibration of who the state is for—and who it can afford to discard.

From an anthropological perspective, this is not simply a shift in policy. It is a transformation of the state’s relationship to life and death. Public institutions that once existed to extend care are being retooled to manage decay. Where governance once sought to mitigate vulnerability, it now redistributes it. This is not benign neglect. It is necropolitics—the use of policy and bureaucracy to determine whose lives are allowed to deteriorate, and whose deaths are rendered acceptable.

Medicaid, Medicare, and the Affordable Care Act are not just programs. They are lifelines that sustain millions. To gut them is not just to save money—it is to engineer exposure. It means letting chronic illnesses go untreated, allowing conditions to worsen, delaying access to care until it arrives too late. This is death by policy, not by accident.

And it is not evenly distributed. The logic of abandonment is racialized, classed, and geographically mapped. Rural communities will lose their only hospitals. Black, Indigenous, and low-income neighborhoods will see life expectancy drop. Disabled people will lose services. Families on the edge will fall through. This is not a side effect. It is the design.

Political ecology shows us that social policies reverberate through material landscapes. When healthcare collapses, it’s not just the body that suffers. It’s the water that goes untested, the air that goes unregulated, the landlord who neglects the mold, the factory that dumps with impunity. Austerity doesn’t just thin budgets—it sickens environments. It renders people and places equally disposable.

What this bill envisions is not a smaller government, but a more selective one—concentrating its power where it protects capital, and withdrawing it where it once protected life. Surveillance, policing, and border control remain intact. It’s the infrastructures of care that are being decommissioned.

We’ve seen this logic before—in colonial governance, in forced migration, in the abandonment of public housing, in the delayed responses to hurricanes, pandemics, and poisoned water. But what was once exceptional is now being normalized. What was once reserved for the margins is being extended to the center.

And all of it is made to sound inevitable. The story told is one of scarcity, of hard choices. But that story collapses under scrutiny. There is always enough for tax cuts, for military contracts, for fossil fuel subsidies. Scarcity is invoked only when the benefit is collective. It is not economics—it is political will.

This is necropolitics embedded in spreadsheets. It doesn’t look like violence. It looks like a closed clinic. A denied claim. An empty chair at the dinner table. A body that doesn’t make it through the winter because the heat was shut off. This is how death is made to look like data.

Anthropology teaches us to pay attention not just to what systems claim to do, but to what they actually produce. This bill does not produce security, prosperity, or cohesion. It produces delay, exposure, exhaustion, and attrition. It governs by letting go, then punishes those who fall.

The budget becomes a sorting mechanism. Not everyone is meant to survive. Not everyone is expected to. And the fewer who complain, the more efficient the system appears to be.

We are told this is responsibility. But real responsibility means maintaining the structures that make survival possible—not rationing them to the point of collapse. A government that forgets how to care is not smaller. It is colder, and more dangerous.

This is a turning point. The line between public service and structural abandonment is being crossed, not with fanfare, but with signatures, edits, and procedural language.

The necrostate thrives not just on cruelty—but on our distraction. On our belief that suffering is technical, unfortunate, inevitable. It isn’t. It’s being designed.

Let’s not mistake silence for consent. Or spreadsheets for truth.

+

B Benjamin, Ruha. Race After Technology: Abolitionist Tools for the New Jim Code. Cambridge: Polity Press, 2019.

Berlant, Lauren. Cruel Optimism. Durham, NC: Duke University Press, 2011.

Case, Anne, and Angus Deaton. Deaths of Despair and the Future of Capitalism. Princeton, NJ: Princeton University Press, 2020.

Centers for Disease Control and Prevention (CDC). “Chronic Disease and the Economic Burden of Poor Health.” U.S. Department of Health and Human Services. https://www.cdc.gov/chronicdisease/about/costs/index.htm

Geronimus, Arline T. Weathering: The Extraordinary Stress of Ordinary Life in an Unjust Society. New York: Little, Brown Spark, 2023.

Heyman, Josiah McC. “Constructing ‘Illegality’: Critiques, Experiences, and Responses.” In Illegal Immigration in America: A Reference Handbook, edited by David W. Haines and Karen E. Rosenblum. Westport, CT: Greenwood Press, 1999.

Mbembe, Achille. Necropolitics. Translated by Steven Corcoran. Durham, NC: Duke University Press, 2019.

National Academies of Sciences, Engineering, and Medicine. High and Rising Mortality Rates Among Working‑Age Adults in the United States: The Role of Socioeconomic and Behavioral Factors. Washington, DC: National Academies Press, 2021.

Vélez‑Ibáñez, Carlos G. The Rise of Necro/Narco Citizenship: Belonging and Dying in the Southwest North American Region. Tucson: University of Arizona Press, 2025.

#Mike Luckovich#James Greenberg#budget battle#who matters?#necropolitics#anthropology#budget as sorting mechanism#language#managed neglect

23 notes

·

View notes

Text

#trump#donald trump#trump 2024#democrats#president trump#kamala harris#donald j. trump#fuck trump#time magazine#man of the year#zelensky#ukrainian#ukraine#russia#russian#nato#illegal immigration#immigration#immigrants#spending#economy#debt#budget#money management#middle east#syria#israel#gaza#gaza strip#iran

79 notes

·

View notes

Text

ways to actually save money

stop buying animal products ($10 for a single meal vs $10 for months worth of beans) + benefit of saving planet

use wash cloths for wiping urine + benefit of saving planet.

get a menstrual cup or panties. yes, even if you have a heavy flow.. the chemicals in tampons and pads leads to heavier, more painful, and smellier periods. +benefit of saving planet.

shampoo bars, lasts way longer + benefit of saving planet.

stop buying name brand

stop buying makeup + benefit of saving planet

stop buying nail polish + benefit of saving planet

stop buying synthetic clothes. + benefit of saving planet

reuse (soap free) tub and shower water for plants, laundry. + benefit of saving planet.

hang clothes to dry, even if you don't have an outdoor area. hang in the windows, by fireplaces, by heaters and ac units. + benefit of saving planet

stop buying niche chemical products. for almost every single cleaning situation you only need soap, baking soda, vinegar, rubbing alcohol, and bleach. this goes for gout removal, rust removal, urine removal, window cleaner, sanitizing wipes, literally every single thing. + benefit of saving planet

repurpose old clothes and towels by making them into wash cloths and oven mitts.

stop buying from shein, temu, amazon, and using afterpay. (im not demonizing pay later. i utilize it all the time. I've just found a lot of people who do use these payment methods treat it like a 'buy now, pay NEVER' option and are surprised when it fucks them over)

remember this any time someone tries to tell you being eco friendly isn't affordable.

know what really isnt affordable? buying disposable products every week.

52 notes

·

View notes