#tax advisor cost

Explore tagged Tumblr posts

Text

tax advisor cost

Accurate Account & Taxes provides best tax advisor cost. We are here to help. After 25 years of commitment, quality, and trust. Accurate Account & Taxes was established to better assist Kent businesses and individuals with their accounting and tax preparation needs. We've discovered that working as a team can be an effective way to help clients with a variety of needs navigate the complex world of financial services. We invite you to learn about and use our services. We believe that obtaining opinions from people with diverse backgrounds, education, and experience benefits our clients greatly. Because no single strategy works for everyone, we give each client our undivided attention, from planning to execution to follow-up. We take a proactive approach to assisting you in developing a strategy to address your financial goals and objectives in the most efficient way possible. Recognizing that everyone encounters difficulties along the way, we strive to anticipate and address these situations as they arise. We want to keep you on track toward a financially meaningful and purposeful future. Please look over our website. If you have any questions, please contact (253) 520-8886 as soon as possible. We'd love to talk with you.

#best tax filing service#tax filing sites#tax advisor cost#financial planner and tax advisor#top 5 consulting firms

0 notes

Text

Financial planning for truckers

Financial planning is something a lot of folks in the industry overlook, but it’s super important if you want to stay afloat and keep your wheels rolling. First, let’s talk about budgeting. It might sound like a boring topic, but think of it as your roadmap. Without a clear budget, it’s like driving without a GPS. You know your income can be pretty unpredictable, especially with fluctuating fuel…

View On WordPress

#401(k) for truckers#budgeting for truckers#business#cash flow management#compound interest#debt management#disability insurance#financial advisor#financial planning#financial security for truckers#Freight#freight industry#Freight Revenue Consultants#health insurance#insurance for truckers#investing#IRA for truckers#life insurance#logistics#managing trucker income#owner-operator finances#rainy-day fund#retirement planning#savings#small carriers#tax tips for truckers#Transportation#Truck Maintenance Costs#trucker budget tips#trucker finances

0 notes

Text

financial knowledge for the girlies 🤍🍓💸

Develop a budget: Creating and sticking to a budget can help you better understand your income and expenses, and learn how to prioritize your spending.

Save regularly: Saving money is crucial for achieving financial stability. You can set up automatic transfers to a savings account so you won't be tempted to spend the money.

Pay off debt: High-interest debt can hinder your financial progress. Make a plan to pay off your debts and focus on high-interest debts first.

Invest wisely: Investing can help your money grow over time. Look for low-cost index funds, which can give you broad exposure to the market at a low cost.

Understand compound interest: Compound interest is the interest you earn on interest. By investing consistently, the power of compound interest can help you build wealth over time.

Research before making big financial decisions: Before making a major decision, such as buying a house or car, research different options and weigh the costs and benefits.

Learn from your mistakes: Every failure or setback can teach you something valuable. Use these experiences to inform your future financial decisions.

Get professional advice: Seek advice from a financial advisor if you're unsure about your financial decisions. They can provide guidance on investments, retirement planning, and tax strategies.

Be aware of scams: Scammers can take advantage of financial illiteracy. Be cautious when someone offers an investment that's too good to be true.

Continuous learning: Financial knowledge is constantly changing, so stay informed by regularly reading financial news, books, and attending classes or webinars.

#money#hyper feminine#light feminine#pink moodboard#pink pilates princess#soft moodboard#that girl#beautytips#confidence#beauty#fashion#old money#strategies#job#budget#management#businesses#girlblogger#this is a girlblog#girlblogging#gaslight gatekeep girlboss#girlblog aesthetic#wonyoungism#it girl energy#becoming that girl#glow up#rich aesthetic#eat the rich#wealth#rich life

2K notes

·

View notes

Text

Soooo first post ever and it is because i have gone down the #humansarespaceorcs rabbit hole, and my train of thought was:

Yes humans are weird and do strange things to survive. But more specifically we do weird things to our surroundings to survive, many different things.

What if, it has been a decade or two since the humans joined what ever coalition or council of aliens that work together and as a species they are mostly well known for their ability to grow crops under the worst circumstances (soil, climate anything) ofcourse the other deathworld apex predator human traits make the rounds but over time they seem to assume we cannot surprise them anymore.

Everyone knows that if a planet is ‘owned’ by a certain species they have to pay tax to the coalition, so planets that aren’t particularly useful are undesirable.

This particular planet p-jx-5£2 has been moved around endlessly, given with trade deals to get rid of it. P-jx-5£2 is 97% water, with a very high salt level so inhabitable for all developed aliens. Even though the atmosphere is a nice oxygen base and the gravitational pull allright most for the coalition members the fast spinning moon and the planets quick pace around its sun make the water move and tides switch every 2.5 hours keeping no land dry outside of low tide.

~~~~~~~~

The tall Avian alian il’trexz was elated this day was going to be great, a trade deal with the hardy humans and getting rid of a useless money drain, they didn’t have a clue what they were signing up for!

Turning towards the much smaller bipedal species standing in front of the window looking down on the blue planet that just came into their possession the strange creature mumbled something to them selves, frowning Il’trezx asks ‘im sorry what did you say, you spoke but the translator didn’t pick it up?’ The human (Steve) turned to him away from the window ‘my apologies, i was talking to myself, i said that we had to send the dutch.’ Il’trezx looked befuddled ‘the dutch? Is that some kind of animal?’

Steve threw his head back and made a series of sounds that ruffled the Avians feathers and had he not known it was a laugh it would have made him run for the hills ‘HA I’m going to tell Andreas you said that, no the Dutch is what call people from a country on earth that specialise in these kinds of climates, they’ve been begging for a challenge since they stopped the flooding on the umavi home world.’ With feathers puffed up Il’trezx wonders ‘and they are going to do what? This is an impossible planet’ immediately clasping his beak he looks a the human to see if he seemed angry at being swindled, but to his surprise Steve just looks at him ‘hm so you believe we can’t use this planet. Allright let’s make a bet.’ Interested Il’trezx leans in closer ‘what kind of bet?’ A predatory grin spreads on the bipedal aliens face ‘if we make less of this planet than the amount of tax we have to pay over it we will cover all trade costs for this quarter, insurance, travel all of it.’ Eagerly Il’trezx starts nodding ‘but’ Steve keeps going ‘if we do make more of this planet you will do the same.’

The bet is put onto paper and the higher ups of both parties also agree. In 5 years the Avians would be back and they would balance the costs to the benefits. When they departed Il’trezx says too Steve ‘you must have a lot of faith in these “dutch” ‘ the man grins teeth bared ‘ofcourse, after all they conquered water before’

The five years pass and stories have been going around of a new energy supplier from the humans, producing enough energy to run 78% of their ships and several facilities. Nobody seems to know where it is coming from but no new pollution is measured in any of these facilities. None of this bothers the Avians, after all humans come up with new things all the time.

The five years are up and Il’trezx is invited to the planet with a group of advisors and other officials, the planet which apparently they have renamed to ‘posy’ which is supposed to be short for some kind of sea god from their olden days.

On arrival the amount of coming and going baffles them massive groups of ships docking or docked and all somehow attached to wires that run into machines.

The planets change alone was awe inspiring, two cities on opposite sides of the planet and what seems like millions of weird blades attached to high poles every where. Strange wheels and long walls between towers rising from the rapidly moving waters.

This… this was their new energy source. They somehow made a battery of this uninhabitable planet and then built a home.

On the meeting place Steve is waiting with a man slightly taller than him. Spreading his arms the smaller human says ‘welcome to Poseidon, this is Andreas our main mechanic here. He has been here with planning since orbit 1.’

After the introductions were done Andreas led the group through what they called the Northern city and showed on his device the steps it took to get a foothold and how they proceeded from there, mentioning that many of these steps his home country had used thousands of year ago to gain land from sea, and energy from the movement of water and air. They specialised in this form of terra forming and it showed.

The Avians were astounded, not having realised that there was more than one kind of way the Humans had battled their environment even beating back the waters of their world.

Without a doubt the humans had won the bet and had another legend added to their name. More and more humans showed that with the right motivation they could settle right about anywhere.

********

So yea… my stupid little idea. Hopefully someone will enjoy it. I just liked the idea of specific cultures and stuff. specialising in certain things.

Edit: im amazed people seem to like it! If people have ideas or other cultures they think would baffle aliens, im certainly willing to try and write something

992 notes

·

View notes

Note

in the spirit of prosperity have you ever considered eloping with royal physician shoko

wait she'd treat you so well actually,,, even in the best scenarios, king!satoru and advisor!suguru would be too busy making out with each other behind tapestries to treat you right, and while shoko might be married to her work, she's not above taking a mistress in you, the neglected bride-to-be who seems to come to her so often with illness only her touch will heal. her sweet kisses soothe your worried mind, her steady hands your constant panic, and best of all, her honeyed words your doubts that she may feel anything but love towards you. she's loyal to her king, sure, but if you were a prize he truly sought to keep, then it would've been more difficult for her to ferry you away to the cottage she keeps in the forest beyond his castle walls, then it would not have been so easy to slip a tonic into his advisor's wine - one just strong enough and just hurtful enough to bring him back to his senses and steer his jealous king in more fruitful directions, towards dragons not so intent on guarding their damsels.

her work may be taxing, but there's no cost she wouldn't pay for your lovely smile, for the way you tuck yourself into her arms each and every night. her ruler, her kingdom, her profession - they mean the world to her, of course, but even the world comes to nothing placed into comparison with you.

87 notes

·

View notes

Text

Biden wants to ban ripoff “financial advisors”

I'll be at the Studio City branch of the LA Public Library on Monday, November 13 at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

Once, American workers had "defined benefits pensions," where their employers promised to pay them a certain amount every year from their retirement to their death. Jimmy Carter swapped that out for 401(k)s, "market" pensions where you have to guess which stocks will be valuable or starve in your old age:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The initial 401(k) rollout had all kinds of pot-sweeteners that made them seem like a good deal, like heavy employer matching that doubled or even tripled the value of every dollar you put into the market for your retirement. But over the years, as Reaganomics took hold and workers' power ebbed away, all these goodies were clawed back. In the end, the market-based pension makes you the sucker at the poker table, flushing your savings into a rigged casino that is firmly tilted in favor of finance barons and other eminently guillotineable plutocrats.

Neoliberalism is many things, but most of all it is a cult of individualism. The fact that three generations of workers are nows facing down retirement without pensions that will provide them with secure housing and food – let alone money to see the odd movie, buy birthday gifts for their grandkids, or enjoy a meal out now and then – is framed as millions of individual failures, not a systemic one.

In other words, if you are facing food insecurity and homelessness after a lifetime of hard work, it's because you saved wrong. Perhaps you didn't save enough (through a 40-year run of wage stagnation and skyrocketing housing, health and education costs). Or perhaps you saved wrong, making the wrong bets on the stock market. If you can't afford to run your air conditioner during a heat dome, that's on you: you should have been better at stocks.

Apologists for this system will say that you don't have to be good at stocks – you just have to pay an Independent Financial Advisor to pick the stocks for you and you'll be fine. But IFAs don't work for free! What if you can't afford one?

Enter "predatory inclusion" – the practice of offering scammy, overpriced and substandard products to poor people and declaring it to be a good deed, because otherwise, those poor people would have to do without. The crypto bubble relied heavily on this: think of Spike Lee and others shilling for pump-and-dump scams as a way of "building Black wealth":

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

More recently, Intuit and other scammy tax-prep services have argued against the IRS's plan to offer free tax preparation as bad for Black and brown people, because it will deny them the chance to be deceived and ripped off with TurboTax:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

Back in 2018, Trump won the predatory inclusion Olympics, when his Department of Labor let the Fifth Circuit abolish the "Fiduciary Rule" for Independent Financial Advisors:

https://www.investopedia.com/updates/dol-fiduciary-rule/

What was the Fiduciary Rule? It said that your IFN had to put your interests ahead of their own. Like, if there were two different funds you could bet on, and one would pay your IFN a big commission, while the other would be a better bet for you, the IFN couldn't put your retirement savings into the fund that offered them a bribe.

When Trump killed the Fiduciary Rule, he proclaimed it a victory for poor people, especially Black and brown people. After all, if IFNs weren't allowed to accept bribes for giving you bad financial advice, then they would have to make up the difference by charging you for good advice. If you couldn't afford that advice, well, you'd have to make bad retirement investments on your own, without the benefit of their sleazy self-dealing.

The Biden Administration wants to change that. Biden's Acting Labor Secretary is Julie Su, and she's very good at her job. Last spring, she forced west coast dockworkers' bosses to cough up the contract they'd stalled on for a year, with 8-10% raises for every worker, owed retroactively:

https://pluralistic.net/2023/06/16/that-boy-aint-right/#dinos-rinos-and-dunnos

Su has proposed a way to reinstate the Fiduciary Rule, as part of the Biden Administration's war on junk fees, estimating that this will increase retirees' net savings by 20%:

https://prospect.org/labor/2023-11-07-julie-su-labor-retirement-savers/

The new rule will force advisors who cheat their clients to pay restitution, and will require them to deliver all their advice in writing so that this cheating can be detected and punished.

The industry is furious, of course. They claim that "The Market (TM)" will solve this: if you get bad retirement savings advice and end up homeless and starving, then you will choose a different advisor in your next life, after you are reincarnated (I guess?).

And of course, they're also claiming that forcing IFNs to stop cheating their clients will deny poor people access to expert (bad) advice. As the Financial Services Institute's Dale Brown says, this will have a "negative impact on Main Street Americans’ access to financial advice":

https://www.fa-mag.com/news/legal-challenge-predicted-for-new-dol-fiduciary-proposal-75257.html

Here's that rule – read it for yourself, then submit a comment expressing your views on it. The government wants to hear from you, and administrative law requires them to act on the comments they receive:

https://www.federalregister.gov/documents/2023/11/03/2023-23782/proposed-amendment-to-prohibited-transaction-exemptions-75-1-77-4-80-83-83-1-and-86-128

Su is part of a wave of progressive, technically skilled regulators in the Biden administration that resulted from a horse-trading exercise called the Unity Task Force, which divvied up access to top appointments among the progressive wing and the finance wing of the Democratic Party. The progressive appointments are nothing short of incredible – the most competent and principled agency leaders America has seen in half a century:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

But then there's the finance wing's appointments, like Judge Jacqueline Scott Corley, who ruled against Lina Khan's attempt to block the rotten Microsoft/Activision merger (don't worry, Khan's appealing):

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

Perhaps the worst, though, is Biden's Secretary of Commerce Gina Raimondo, a private equity ghoul who did a stint for the notorious wreckers Bain Capital before founding her own firm. Raimondo has stuffed her department full of Goldman Sachs alums, and has sidelined labor and civil society groups as she sets out to administer everything from the CHIPS Act to regulating ChatGPT.

As Henry Burke writes for the Revolving Door Project and The American Prospect, Raimondo's history as a corporate raider, her deference to the finance sector, and she and her husband's conflicts of interest from their massive stakes in companies she's regulating all serve to undermine Biden's agenda:

https://prospect.org/economy/2023-11-08-commerce-secretary-gina-raimondo-undercutting-bidenomics/

When the administration inevitably complains that its popular economic programs aren’t breaking through the media coverage, they’ll have no one to blame but themselves.

The Unity Task Force gave us generationally important policymakers, but ultimately, it's a classic "pizzaburger." If half your family wants pizza, and the other half wants burgers, and you serve them something halfway in between that makes none of them happy, you haven't made a wise compromise – you've just made an inedible mess:

https://pluralistic.net/2023/06/17/pizzaburgers/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/08/fiduciaries/#but-muh-freedumbs

#pluralistic#julie su#fiduciary rule#intergenerational warfare#aging#retirement#401ks#old age#pensions#finance#pizzaburgers#Gina Raimondo

273 notes

·

View notes

Text

de Adder

* * * *

LETTERS FROM AN AMERICAN

November 8, 2024

Heather Cox Richardson

Nov 09, 2024

Social media has been flooded today with stories of Trump voters who are shocked to learn that tariffs will raise consumer prices as reporters are covering that information. Daniel Laguna of LevelUp warned that Trump’s proposed 60% tariff on Chinese imports could raise the costs of gaming consoles by 40%, so that a PS5 Pro gaming system would cost up to $1,000. One of the old justifications for tariffs was that they would bring factories home, but when the $3 billion shoe company Steve Madden announced yesterday it would reduce its imports from China by half to avoid Trump-promised tariffs, it said it will shift production not to the U.S., but to Cambodia, Vietnam, Mexico, and Brazil.

There are also stories that voters who chose Trump to lower household expenses are unhappy to discover that their undocumented relatives are in danger of deportation. When CNN’s Dana Bash asked Indiana Republican senator-elect Jim Banks if undocumented immigrants who had been here for a long time and integrated into the community would be deported, Banks answered that deportation should include “every illegal in this country that we can find.” Yesterday a Trump-appointed federal judge struck down a policy established by the Biden administration that was designed to create an easier path to citizenship for about half a million undocumented immigrants who are married to U.S. citizens.

Meanwhile, Trump’s advisors told Jim VandeHei and MIke Allen of Axios that Trump wasted valuable time at the beginning of his first term and that they will not make that mistake again. They plan to hit the ground running with tax cuts for the wealthy and corporations, deregulation, and increased gas and oil production. Trump is looking to fill the top ranks of the government with “billionaires, former CEOs, tech leaders and loyalists.”

After the election, the wealth of Trump-backer Elon Musk jumped about $13 billion, making him worth $300 billion. Musk, who has been in frequent contact with Russian president Vladimir Putin, joined a phone call today between President-elect Trump and Ukraine president Volodymyr Zelensky.

In Salon today, Amanda Marcotte noted that in states all across the country where voters backed Trump, they also voted for abortion rights, higher minimum wage, paid sick and family leave, and even to ban employers from forcing their employees to sit through right-wing or anti-union meetings. She points out that 12% of voters in Missouri voted both for abortion rights and for Trump.

Marcotte recalled that Catherine Rampell and Youyou Zhou of the Washington Post showed before the election that voters overwhelmingly preferred Harris’s policies to Trump’s if they didn’t know which candidate proposed them. An Ipsos/Reuters poll from October showed that voters who were misinformed about immigration, crime, and the economy tended to vote Republican, while those who knew the facts preferred Democrats. Many Americans turn for information to social media or to friends and family who traffic in conspiracy theories. As Angelo Carusone of Media Matters put it: “We have a country that is pickled in right-wing misinformation and rage.”

In The New Republic today, Michael Tomasky reinforced that voters chose Trump in 2024 not because of the economy or inflation, or anything else, but because of how they perceived those issues—which is not the same thing. Right-wing media “fed their audiences a diet of slanted and distorted information that made it possible for Trump to win,” Tomasky wrote. Right-wing media has overtaken legacy media to set the country’s political agenda not only because it’s bigger, but because it speaks with one voice, “and that voice says Democrats and liberals are treasonous elitists who hate you, and Republicans and conservatives love God and country and are your last line of defense against your son coming home from school your daughter.”

Tomasky noted how the work of Matthew Gertz of Media Matters shows that nearly all the crazy memes that became central campaign issues—the pet-eating story, for example, or the idea that the booming economy was terrible—came from right-wing media. In those circles, Vice President Kamala Harris was a stupid, crazed extremist who orchestrated a coup against President Joe Biden and doesn’t care about ordinary Americans, while Trump is under assault and has been for years, and he’s “doing it all for you.”

Investigative reporter Miranda Green outlined how “pink slime” newspapers, which are AI generated from right-wing sites, turned voters to Trump in key swing state counties. Republican strategist Sarah Longwell, who studies focus groups, told NPR, “When I ask voters in focus groups if they think Donald Trump is an authoritarian, the #1 response by far is, ‘What is an authoritarian?’”

In a social media post, Marcotte wrote: “A lot of voters are profoundly ignorant. More so than in the past.” That jumped out to me because there was, indeed, an earlier period in our history when voters were “pickled in right-wing misinformation and rage.”

In the 1850s, white southern leaders made sure that voters did not have access to news that came from outside the American South, and instead steeped them in white supremacist information. They stopped the mail from carrying abolitionist pamphlets, destroyed presses of antislavery newspapers, and drove antislavery southerners out of their region.

Elite enslavers had reason to be concerned about the survival of their system of human enslavement. The land boom of the 1840s, when removal of Indigenous peoples had opened up rich new lands for settlement, had priced many white men out of the market. They had become economically unstable, roving around the country working for wages or stealing to survive. And they deeply resented the fabulously wealthy enslavers who they knew looked down on them.

In 1857, North Carolinian Hinton Rowan Helper wrote a book attacking enslavement. No friend to his Black neighbors, Helper was a virulent white supremacist. But in The Impending Crisis of the South: How to Meet It, he used modern statistics to prove that slavery destroyed economic opportunity for white men, and assailed “the illbreeding and ruffianism of the slaveholding officials.” He noted that voters in the South who did not own slaves outnumbered by far those who did. "Give us fair play, secure to us the right of discussion, the freedom of speech, and we will settle the difficulty at the ballot-box,” he wrote.

In the North the book sold like hotcakes—142,000 copies by fall 1860. But southern leaders banned the book, and burned it, too. They arrested men for selling it and accused northerners of making war on the South. Politicians, newspaper editors, and ministers reinforced white supremacy, warned that the end of slavery would mean race war, and preached that enslavement was God’s law.

When northern voters elected Abraham Lincoln in November 1860 on a platform of containing enslavement in the South, where the sapped soil would soon cut into production, southern leaders decided—usually without the input of voters—to secede from the Union. As leaders promised either that there wouldn’t be a fight, or that if a fight happened it would be quick and painless, poor southern whites rallied to the cause of creating a nation based on white supremacy, reassured by South Carolina senator James Chesnut’s vow that he would personally drink all the blood shed in any threatened civil war.

When Confederate forces fired on Fort Sumter in April 1861, poor white men set out for what they had come to believe was an imperative cause to protect their families and their way of life. By 1862 their enthusiasm had waned, and leaders passed a conscription law. That law permitted wealthy men to hire a substitute and exempted one man to oversee every 20 enslaved men, providing another way for rich men to keep their sons out of danger. Soldiers complained it was a “rich man’s war and a poor man’s fight.”

By 1865 the Civil War had killed or wounded 483,026 men out of a southern white population of about five and a half million people. U.S. armies had pushed families off their lands, and wartime inflation drove ordinary people to starvation. By 1865, wives wrote to their soldier husbands to come home or there would be no one left to come home to.

Even those poor white men who survived the war could not rebuild into prosperity. The war took from the South its monopoly of global cotton production, locking poor southerners into profound poverty from which they would not begin to recover until the 1930s, when the New Deal began to pour federal money into the region.

Today, when I received a slew of messages gloating that Trump had won the election and that Republican voters had owned the libs, I could not help but think of that earlier era when ordinary white men sold generations of economic aspirations for white supremacy and bragging rights.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#deAdder#Political Cartoons#Letters From An American#Heather Cox Richardson#american history#history#The American south#the Civil War#misinformation#disinformation#crazy memes

43 notes

·

View notes

Photo

“A Macigian never reveals their secrets. A Witch even less so.”

Well, you had a good run. For the last 70 or so years that you've had your little shop in Esmar's capital, nothing overly exciting happened. Apart from the occasional political changes and economical shifts, you could mostly carry on business as usual. But when the Fae calling herself your "best and only friend" invites you to pull a heist on your rival's home you didn't realize what effect that stunt would have on your immortal life. But damn, you really wanted that statue back.

Play Demo

Witch Blood is an upcoming urban fantasy interactive fiction story where you take on the role of one of the last proper witches of Esmar, hoping to resolve a very time-sensitive mystery that might cost you your own life if you don’t get on with the investigation soon.

Does it have to do with random people’s head exploding?

Is this the reason you seem to have more prophetic dreams than usual?

Why are there so many strangers storming into your shop demanding answers you couldn’t possibly know?

And why does your familiar keep eating your receipts? You need those for your taxes!

Create your very own witch. Appearance, personality, gender and sexuality... All that Jazz

Choose a furry (or non-furry) companion for your immortal life

Become a master of 5 witchy skills that may or may not help you along the road

Keep your business afloat (you got bills to pay, after all)

Solve a mystery, save a bunch of people, and meet the Gods (???)

Find love, friendship, or rivalry (or maybe all three of them at the same time) with 5 different people who will. Not. Leave. You. Alone.

And for the love of the Gods: please stop spitting coins

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

So far it will probably be a 16+ kind of rating for:

Mentions of violence, blood and gore

Strong language, cursing

Suggestive language

but things might change. I’ll keep you updated in any case.

The Best Friend: Faith (f)

Flirty and flighty, Faith is certainly living her best life. And while she’s not always the most reliable of friends, she always shows up for your weekly tea and gossip session (and more often than not with baked goods as well). If you’re looking for a fun night out: Faith is your gal. Don’t ask how she pays for all of it without having a job though.

- - - - - - - - - - - - - - - - - - - - - - - -

The Knight in Shining Armor: Isaac (m)

A stranger visiting your shop and ... flirting with you? Thankfully you’ve lived long enough to see through his ploy and stay unaffacted to his charms. Mostly. With a quick smile, a stance almost too relaxed and some really suspicious questions you can’t quite get a read on him. And you have the feeling he is also not really a tourist interested in your special sale items.

- - - - - - - - - - - - - - - - - - - - - - - -

The Loyal Advisor: Eli (f/m/nb)

Another stranger. This one seems much more honest than the last one but somehow you haven’t decided yet if you appreciate that or not. They say there is a problem their employer has sent them to hopefully solve and after some extensive research you seemed to be the least untrustworthy person of your craft to potentially help. You can’t quite tell from their stoic face if that sentence was supposed to be a compliment, a joke or very subtle sarcasm. But the pay they offer is nothing to turn your nose up at and you’ve worked for way shadier people.

- - - - - - - - - - - - - - - - - - - - - - - -

The Crazy Mushroom: Mezilkree (f/m/nb)

Mezilkree has been a frequent visitor of yours for quite some years. Mostly they just hang out at your shop and try to scare potential customers. When you try to make them leave they declare they are a customer, throw a bottle cap on your counter and shove a handful of candy from the jar you keep for kids in their mouth. Sometimes they even do buy something if they’re on an errand for their family, but as their community grows more and more resentful of non-mushrooms this occasion becomes rarer and rarer. In the many years of botherment, you have found Mezilkree to be a mischievous but sweet troublemaker. Some of the time, at least.

- - - - - - - - - - - - - - - - - - - - - - - - -

The Other Witch: Levan (nb)

An Enemy. A Fiend. Your Immortal Rival. Most of the time you and Levan stay clear of each other, as is agreed upon in your Contract of Geniality. But now they have decided to steal a very valuable artifact you have spent months on locating. At least you’re pretty sure it was them, who else would be skilled enough to enter your home. Even though you don’t particularly get along, Levan is a witch you have known for the longest of time. But because of their spiteful nature and (admittedly somewhat deserved) arrogance you have long decided to avoid them, lest you burn down the whole town in a fit of anger. They really know how to push your buttons.

ROs Physical Appearance

Witch Types

Demo

#ro ask ----> Scenarios and asks including all ROs

#ros ----> unspecific general info about ROs

#ch: [name] ----> info about that RO, often paired with #ros

#ch: carter ----> facts and info and rambling about the author

#mc ----> anything to do with your character, customization and so on

#lore and #lore ask ----> anything that’s about worldbuilding

#story and story ask ----> anything to do with plot

#lovely ocs ----> readers showing off their ocs

#lovely readers ----> lovely words from lovely people

-----------------------------------------------------------------------------------------------------------

Hello my lovelies! This is a first attempt at Interactive Fiction, and on an even more important to note: a first real attempt at writing. I hope it doesn’t suck too much! Also please forgive orthographic and grammatical errors, English isn’t my first language :) (if you see something, say something tho)

Currently the prologue is in the works and will face some editing and expanding.

Until then,

Love, Carter

#if#interactive fiction#intro#intro post#if: submission#if: intro#it's witchy time#choicescript#Witch Blood#csript game#status: wip#fantasy#urban fantasy#mystery#16+#witchblood-if

507 notes

·

View notes

Text

So, I talked to my financial advisor, which I only have bc of my Inherited IRA. Even though I inherited various assets, I have a 2% CHANCE OF RETIRING at 67 if I have a job that pays less than 35k/year and only put $100/month into my new Roth IRA.

Even though I got a big leg up from those in my age bracket and below me, I'm STILL in red, to put that in perspective.

Now, the stocks and things I invest into can accrue and that percentage will fluctuate, but, if they were to stay the same, it's a 2% chance. It went up to 3% this week, yeehaw, but until it hits like 75%, it's like a drop in the bucket. It can also change drastically if I were to get married because your retirement is also based on your spouse's assets. Like, my mom gets $800/month, but when my dad retires, it will go up to 1.2k. But I don't want to assume I'm gonna get married, I want to do things based on the worst case financial scenario.

I wanted to bring this up because a lot of my generation and younger aren't even being offered 401ks or pensions anymore, but you can start one yourself and put what you can in it. I do not pay my guy, he takes 1% of the gains from the IRA itself. It's actually less than that because my whole family is with him. I'm getting Silo in on it, so my whole family and him will get that deal. I can recommend my guy if you want in on the family/friends deal. It does NOT cost anything to start with him other than the initial amount you want to invest. I cannot say for other businesses, unfortunately.

But I really want to make sure y'all get a start on it because I'm considered late. They really recommend starting in your 20s since, if you start by your mid-30s, it gets significantly harder each year because you have to invest a higher percentage of your income into it. Thus why he recommended investing $500 / month for me because he projects the monthly costs for when I retire to be 4.5-6.5k/month. If you start earlier, you have a longer period of time for your investments to accrue, and you only have to put $100 or whatever you can. So, please, get at least a Roth IRA going. SPECIFICALLY A ROTH. It gets taxed going in, but when you take it out later in life when it's worth more, it won't be.

I cannot say for a brokerage, as I have not started that yet, but he does recommend one of those as well. Make sure to do your own research on that one.

I know some don't have the opportunity to talk to a Financial Advisor, because it may/may not cost money depending on who you go to, so I wanted to share what I was told. So, that's the general idea or scope of things, at least here in the States, so I hope this helps!

26 notes

·

View notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

93 notes

·

View notes

Text

Nuanceddddd news gamers

WIN Attended cost accounting for the first time in weeks and it is MANAGEABLE !!!!!

LOSS Attended excel class for the first time in weeks and i am FUCKED !!!!! Visiting my advisor this afternoon to see if i can drop it and take it in the summer!!! This means i will be working nonstop for the next two years but we will ball!! Minimester in december then internship jan-mar 2025 then class mar thru may then study abroad may 2025 then summer school then fall then spring semester then GRADUATION!!!!!!

WIN Saw beautiful amy my tax professor from last semester in the halls on my way to excel class and she is still so beautiful and warm!!!!!

LOSS The line for lunchie is longggg and im scared about what my mommy will think about me dropping a class but ??? I should be okay GYAAAAHHH ?????

Maybe i will spin this as “taking this semester to take care of myself and develop healthy habits”

#say hi say words#2024#WHEW#They werent kidding That two week depressive episode can kick my ass and fuck me over a little

14 notes

·

View notes

Text

November 8, 2024

HEATHER COX RICHARDSON

NOV 9

Social media has been flooded today with stories of Trump voters who are shocked to learn that tariffs will raise consumer prices as reporters are covering that information. Daniel Laguna of LevelUp warned that Trump’s proposed 60% tariff on Chinese imports could raise the costs of gaming consoles by 40%, so that a PS5 Pro gaming system would cost up to $1,000. One of the old justifications for tariffs was that they would bring factories home, but when the $3 billion shoe company Steve Madden announced yesterday it would reduce its imports from China by half to avoid Trump-promised tariffs, it said it will shift production not to the U.S., but to Cambodia, Vietnam, Mexico, and Brazil.

There are also stories that voters who chose Trump to lower household expenses are unhappy to discover that their undocumented relatives are in danger of deportation. When CNN’s Dana Bash asked Indiana Republican senator-elect Jim Banks if undocumented immigrants who had been here for a long time and integrated into the community would be deported, Banks answered that deportation should include “every illegal in this country that we can find.” Yesterday a Trump-appointed federal judge struck down a policy established by the Biden administration that was designed to create an easier path to citizenship for about half a million undocumented immigrants who are married to U.S. citizens.

Meanwhile, Trump’s advisors told Jim VandeHei and MIke Allen of Axios that Trump wasted valuable time at the beginning of his first term and that they will not make that mistake again. They plan to hit the ground running with tax cuts for the wealthy and corporations, deregulation, and increased gas and oil production. Trump is looking to fill the top ranks of the government with “billionaires, former CEOs, tech leaders and loyalists.”

After the election, the wealth of Trump-backer Elon Musk jumped about $13 billion, making him worth $300 billion. Musk, who has been in frequent contact with Russian president Vladimir Putin, joined a phone call today between President-elect Trump and Ukraine president Volodymyr Zelensky.

In Salon today, Amanda Marcotte noted that in states all across the country where voters backed Trump, they also voted for abortion rights, higher minimum wage, paid sick and family leave, and even to ban employers from forcing their employees to sit through right-wing or anti-union meetings. She points out that 12% of voters in Missouri voted both for abortion rights and for Trump.

Marcotte recalled that Catherine Rampell and Youyou Zhou of the Washington Post showed before the election that voters overwhelmingly preferred Harris’s policies to Trump’s if they didn’t know which candidate proposed them. An Ipsos/Reuters poll from October showed that voters who were misinformed about immigration, crime, and the economy tended to vote Republican, while those who knew the facts preferred Democrats. Many Americans turn for information to social media or to friends and family who traffic in conspiracy theories. As Angelo Carusone of Media Matters put it: “We have a country that is pickled in right-wing misinformation and rage.”

In The New Republic today, Michael Tomasky reinforced that voters chose Trump in 2024 not because of the economy or inflation, or anything else, but because of how they perceived those issues—which is not the same thing. Right-wing media “fed their audiences a diet of slanted and distorted information that made it possible for Trump to win,” Tomasky wrote. Right-wing media has overtaken legacy media to set the country’s political agenda not only because it’s bigger, but because it speaks with one voice, “and that voice says Democrats and liberals are treasonous elitists who hate you, and Republicans and conservatives love God and country and are your last line of defense against your son coming home from school your daughter.”

Tomasky noted how the work of Matthew Gertz of Media Matters shows that nearly all the crazy memes that became central campaign issues—the pet-eating story, for example, or the idea that the booming economy was terrible—came from right-wing media. In those circles, Vice President Kamala Harris was a stupid, crazed extremist who orchestrated a coup against President Joe Biden and doesn’t care about ordinary Americans, while Trump is under assault and has been for years, and he’s “doing it all for you.”

Investigative reporter Miranda Green outlined how “pink slime” newspapers, which are AI generated from right-wing sites, turned voters to Trump in key swing state counties. Republican strategist Sarah Longwell, who studies focus groups, told NPR, “When I ask voters in focus groups if they think Donald Trump is an authoritarian, the #1 response by far is, ‘What is an authoritarian?’”

In a social media post, Marcotte wrote: “A lot of voters are profoundly ignorant. More so than in the past.” That jumped out to me because there was, indeed, an earlier period in our history when voters were “pickled in right-wing misinformation and rage.”

In the 1850s, white southern leaders made sure that voters did not have access to news that came from outside the American South, and instead steeped them in white supremacist information. They stopped the mail from carrying abolitionist pamphlets, destroyed presses of antislavery newspapers, and drove antislavery southerners out of their region.

Elite enslavers had reason to be concerned about the survival of their system of human enslavement. The land boom of the 1840s, when removal of Indigenous peoples had opened up rich new lands for settlement, had priced many white men out of the market. They had become economically unstable, roving around the country working for wages or stealing to survive. And they deeply resented the fabulously wealthy enslavers who they knew looked down on them.

In 1857, North Carolinian Hinton Rowan Helper wrote a book attacking enslavement. No friend to his Black neighbors, Helper was a virulent white supremacist. But in The Impending Crisis of the South: How to Meet It, he used modern statistics to prove that slavery destroyed economic opportunity for white men, and assailed “the illbreeding and ruffianism of the slaveholding officials.” He noted that voters in the South who did not own slaves outnumbered by far those who did. "Give us fair play, secure to us the right of discussion, the freedom of speech, and we will settle the difficulty at the ballot-box,” he wrote.

In the North the book sold like hotcakes—142,000 copies by fall 1860. But southern leaders banned the book, and burned it, too. They arrested men for selling it and accused northerners of making war on the South. Politicians, newspaper editors, and ministers reinforced white supremacy, warned that the end of slavery would mean race war, and preached that enslavement was God’s law.

When northern voters elected Abraham Lincoln in November 1860 on a platform of containing enslavement in the South, where the sapped soil would soon cut into production, southern leaders decided—usually without the input of voters—to secede from the Union. As leaders promised either that there wouldn’t be a fight, or that if a fight happened it would be quick and painless, poor southern whites rallied to the cause of creating a nation based on white supremacy, reassured by South Carolina senator James Chesnut’s vow that he would personally drink all the blood shed in any threatened civil war.

When Confederate forces fired on Fort Sumter in April 1861, poor white men set out for what they had come to believe was an imperative cause to protect their families and their way of life. By 1862 their enthusiasm had waned, and leaders passed a conscription law. That law permitted wealthy men to hire a substitute and exempted one man to oversee every 20 enslaved men, providing another way for rich men to keep their sons out of danger. Soldiers complained it was a “rich man’s war and a poor man’s fight.”

By 1865 the Civil War had killed or wounded 483,026 men out of a southern white population of about five and a half million people. U.S. armies had pushed families off their lands, and wartime inflation drove ordinary people to starvation. By 1865, wives wrote to their soldier husbands to come home or there would be no one left to come home to.

Even those poor white men who survived the war could not rebuild into prosperity. The war took from the South its monopoly of global cotton production, locking poor southerners into profound poverty from which they would not begin to recover until the 1930s, when the New Deal began to pour federal money into the region.

Today, when I received a slew of messages gloating that Trump had won the election and that Republican voters had owned the libs, I could not help but think of that earlier era when ordinary white men sold generations of economic aspirations for white supremacy and bragging rights.

—

Today, when I received a slew of messages gloating that Trump had won the election and that Republican voters had owned the libs, I could not help but think of that earlier era when ordinary white men sold generations of economic aspirations for white supremacy and bragging rights.

6 notes

·

View notes

Text

In My Shadows. 2

Ateez Fanfiction

To understand the enigma that is Aurora, one must first understand the history behind it.

The beginning of the 1800s was a tumultuous and violent time for the country. The people had no other hobby than killing their leaders and destroying public property. Violence was the order of the day and it seemed nothing could stop it. Anarchy was creeping near. sniffing around.

Enter Kim Haejoong. A man with a solution.

The people had simple demands; Down with the government and class system, equal distribution of wealth and taxes.

Kim Haejoong had a simple solution; Kill them all.

Very simple.

Haejoong was the Supreme leader, and he had no intention of ever letting go. Equal distribution? Bullshit, down with the government? He WAS THE GOVERNMENT, and he sure as hell wasn't ready to die. Down with the class system? How about down with you! But he needed help. The upper-class supported him, of course. He was saving their gold plated asses. But it wasn't enough, the people still outnumbered them. He needed help. And fast.

Enter Selyse Nightengale.

A slim woman with a beauty that made her look deadly. Like a lion, ready to pounce and devour. Her black hair, pale skin, and blood red lips unnerved everyone she came across.

Selyse had a plan. The shadow Cult. She claimed she had spiritual ways to solve the countries issues.

Haejoong called bullshit. He had never believed in spirituality. It was war and victory that got him here, not God or angels.

But Selyse pressed, she wasn't asking him to become a priest or fast. "Conquer.blood with blood" she said.

Haejoong thought she had gone mad, but he was running desperate. The army was loosing to the people, and the violence was getting close to the capital.

Haejoong decided to give the mad woman a chance. It wouldn't cost him anything. If he failed, she died. No biggie.

June 5th, 1870

All the upper-class families gathered in the dead of night, Selyse stood in front of them in a dark red dress holding a bowl.

"We begin"

They all stepped forward to pierce their fingers on a blade and let the blood drip into the bowl.

When the last man was done, selyse began to sing in a shrill voice. The night seemed to get sing in response.

After a while, she covered the bowl.

"It is done."

In a month, all the revolutionary leaders had died strange, violent deaths. Just like that. The people grew scared and Haejoong grew happier. He found it easier to do what he did best.

Surpress and opress.

Selyse was granted riches, and she became a main advisor to Haejoong... Some upperclassmen even whispered lover.

Finally, the country was stabilised, and all thought it was over.

The Shadows had not gotten the memo, though, the murders continued. Violent, evil, and sadistic.

Haejoong couldn't care less, all the deaths were common people.

The families that shed blood that night would never be affected.

Aurora Academy was set up in 1876 to cater to the elites of the capital and as a show of wealth and power.

But there was more to it.

Aurora was created for protection. Why? The families that pleged to the Shadows didn't even know. All they knew is their descendants must attend Aurora or die.

And so it was. Generation after generation. Until it became tradition.

Haejoong was content. He had secured his dynasty. Now his descendants will rule just as he had. Strong and unbreakable.

* * * * * * * * * * * * * * * * *

Hongjoong felt like puking. The bodies were so mutilated you almost couldn't see their faces. But he couldn't break in public, he was a future leader. He had to be strong. Unbreakable. A warrior. A Victor. Just like- Just like Kim Haejoong.

His brain started to fail him. His vision becoming blurry. Be strong. Strong. Unbreakable. Victorious.

"Hongjoong-a."

A hand gently held him. He looked up, Seonghwa.

"I'm fine." He couldn't afford to say anything else.

"Stop lying."

Thanks for reading this also. I promise it will come together. Trust the process😉. Luv youuu❤️

#ateez x oc#ateez x reader#ateez fanfic#ateez#school#paranormal#dystopian#not very realistic#hongjoong#seonghwa#yeosang#yunho#choi san#mingi#wooyoung#choi jongho

8 notes

·

View notes

Note

Hi

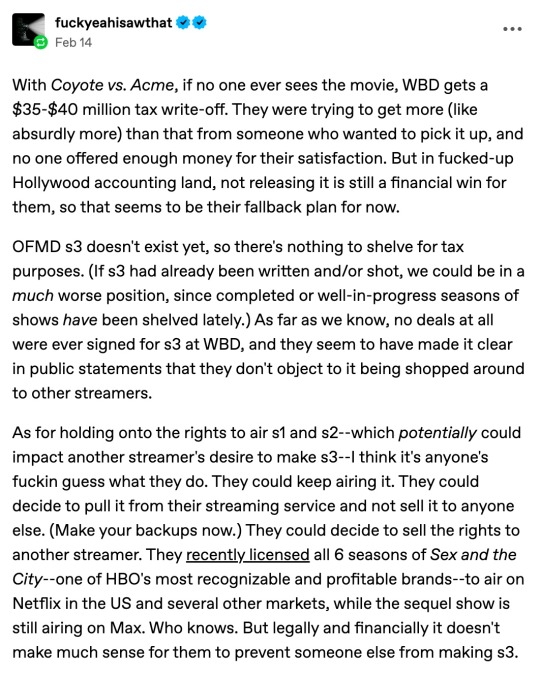

Not OFMD specific but might be of interest

(copied without permission given to reproduce)

Found in Private Eye 16-29th Feb

Warner Gloss:

Labour's business charm offensive continued last week, as Keir Starmer proudly posted that he had met with David Zaslav, CEO of Warner Bros Discovery, aiming to "work in partnership with the creative industries to drive growth".

Named by the New York Times as the man who "blew up Hollywood", Zaslav in fact seems to be doing everything he can to prevent growth in the industry. Having merged hi cable TV company, Discovery with entertainment conglomerate Warner Bros in 2022, Zaslav took on $56bn in debt and enacted cost cuts of £3bn.

To achieve this he set about binning TV shows and films that had already been completed in order to claim large tax write-offs - most notoriously superhero caper Batgirl - and removing shows from streaming services to avoid paying residuals fees.

In a move that might have had more appeal for St

armer, Zaslov also hired Chris Licht as CEO of CNN in 2022 to make the news service more appealing to conservative viewers - but then fired him within a year after ratings hit rock bottom. Under Zaslav's watch, the stock price of Warner Bros Discovery Inc has fallen by nearly 60% - probably not quite the growth Starmer would hope to discover!

END

Firstly thank you for your round-ups, much appreciated!

"make the new service more appealing to conservative viewers" Why am I not surprised.....

Secondly I am disturbed that the possible future leader of the UK or his advisors didn't do more investigating before agreeing to or asking for this meeting, very disappointing.

Thirdly "removing shows from streaming services to avoid paying residuals fees" Should we be concerned by this for series 1 and 2?

best wishes

Susannah

Hey omg I'm like 3 days behind on messages/replies/asks I'm sorry! This weekend was crazy! Hi Susannah!

Oh interesting! I've never read Private Eye, I'll go check them out now! Oh darn- looks like a paywall, thank you for pasting the text! (And no problem about the recaps! Thanks so much for reading them!)

To address your second point: I wish I knew more about Keir Starmer! I'm in the US so I only know tangentially about him. You would think someone would have vetted the situation a bit more though (although you know Zaslav has been a bit of a sneaky little fucker about everything until he was outed more recently). Sorry I don't have much to say on that point!

To address your third point:

Yeahhhhhh, my hope is that it won't affect OFMD too much because it's a bit more of it's own thing (and not a WB proprety like the Coyote movie). I think they could actually make money selling S1 and S2 as opposed to loss since there's such a demand for it, so personally I don't think it's going to be much of an issue, but I have no real authority or reason to believe that except common sense (which we all know hollywood doesn't always have).

@fuckyeahisawthat had a good take though, it's kind of anything goes unfortunately.

I have faith though... because like a lot of my tumblr colleagues have said, David Jenkins would have probably told us by now if in fact, there was literally no hope. He's been pretty good about putting out hints and letting us know where to focus our efforts, and as of yet he hasn't flat out said "Thanks anyway guys, but its not going to happen.

That in itself gives me hope for s1, s2 and s3.

Anyway, thanks for the write in Susannah! I'm really sorry again it took me so long to answer, and then I doubt I gave you anything of real substance @_@. I hope you're having a lovely day, and would love to chat more!

Take care, sending love!

Abby

23 notes

·

View notes

Note

Do you have any advice or tips for saving and budgeting?

Live below your means. Basically don't try to spend more than what you should in things that are pointless and vain, especially not if it's with the intent of impressing others on social media and the likes.

I live in Canada, the cost of living in this country is through the roof, and I oftentimes can't help but feel flabbergasted that many people my age don't have any investments (or at least plans to), or a savings account, mostly due to imbalanced priorities. Many people choose to rent places that take up over half of their monthly income and go every weekend to party and spend money on alcohol and Ubers. They pay $80 bucks each month on a phone plan and $40 on their iPhone bill, when they could get a cheaper plan and refurbished phone and save much more money.

There should be no reason why any grown adult should prioritize leisure over basic necessities, especially when their finances are strained. Investments and/or savings are a necessity. You will not be able to leave the money rat race unless you cement the foundations for your life in the future, and financial literacy is key to this. Sure, you only live once and our 20s shouldn't be used solely to work without taking times to relax and enjoy life, but one has to be mindful that every action has a consequence and nobody will come to rescue us from our bad habits and choices.

Some practical tips on budgeting and savings:

* Don't spend more than 40% of you post-taxed income on rent. Get roommates or stay with relatives if you must. Save as much as you can on rent.

* Some people may be triggered by this but I honestly don't care. Don't waste your money on alcohol or drugs.

* Look into opening a tax free savings accounts in your country of residency and put at least 10-20% of your monthly income there if you can. If you can't, any small percentage can help.

* Place your tax free savings on long-term, low-risk investments that can compound in the future. The S&P500 is a famous and safe bet, but I would consult and partner with a financial advisor for this as each person's particular financial situation will vary. As an adult independent woman, having a financial advisor should be a priority.

* Download a good Excel spread sheet with charts and fields to populate and track your monthly spending. These are easily found in many places online and are not hard to use. Give yourself a baseline of how much you wish to spend on a particular item monthly and try to stick to it as much as you can. This will also give you a rough idea of how much money you will have left to save and invest into your portfolio.

* Stop trying to compete with people's highlight reals and quit the superficial rate race of social media. The dumbest way to go broke is to do it trying to impress people who don't like you and who are not worth it.

* Finally, consume as much content as you can on financial literacy. There are tons of books and podcasts out there to help you with this. Having the right mindset when it comes to managing your money will be one of the best things you can do for yourself and your future self with thank you in the future.

188 notes

·

View notes

Text

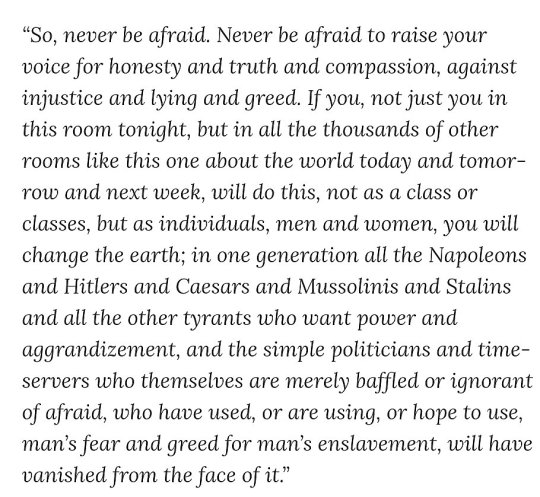

William Faulkner, "Never be afraid" :: [(From a speech delivered May 28, 1951 at Fulton Chapel, University of Mississippi)]

* * * *

LETTERS FROM AN AMERICAN

September 25, 2024

Heather Cox Richardson

Sep 26, 2024

In 2004 a senior advisor to President George W. Bush famously told journalist Ron Suskind that people like Suskind lived in “the reality-based community.” They believed people could find solutions to problems through careful study of discernible reality. But, the aide continued, Suskind’s worldview was obsolete. “That’s not the way the world really works anymore,” the aide said. “We are an empire now, and when we act, we create our own reality. And while you’re studying that reality— judiciously, as you will—we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out. We’re history’s actors…and you, all of you, will be left to just study what we do.”

We appear to be in a moment when the reality-based community is challenging the ability of the MAGA Republicans to create their own reality.

Central to the worldview of MAGA Republicans is that Democrats are socialists who have destroyed the American economy. Trump calls Harris a “radical-left. Marxist, communist, fascist” and insists the economy is failing.

In Pittsburgh, Pennsylvania, today, Harris laid out her three-pillar plan for an “opportunity economy.” She explained that she would lower costs by cutting taxes for the middle class, cutting the red tape that stops housing construction, take on corporate landlords who are hiking rental prices, work with builders and developers to construct 3 million new homes and rentals, and help first-time homebuyers with $25,000 down payment assistance. She also promised to enact a federal ban on corporate price gouging on groceries and to cap prescription drug prices by negotiating with pharmaceutical companies.

Harris said she plans to invest in innovation by raising the deduction for startup businesses from its current $5,000 to $50,000 and providing low- or no-interest loans to small businesses that want to expand. Her goal is to open the way for 25 million new small businesses in her first four years, noting that small businesses create nearly 50% of private sector jobs in the U.S.

Harris plans to create manufacturing jobs of the future by investing in biomanufacturing and aerospace, remaining “dominant in AI, quantum computing, blockchain, and other emerging technologies, and expand[ing] our lead in clean energy innovation and manufacturing.” She vowed to see that the next generation of breakthroughs—“from advanced batteries to geothermal to advanced nuclear—are not just invented, but built here in America by American workers.” Investing in these industries means strengthening factory towns, retooling existing factories, hiring locally, and working with unions. She vowed to make jobs available for skilled workers without college degrees and to cut red tape to reform permitting for innovation.

“I am a capitalist,” she said. “I believe in free and fair markets. I believe in consistent and transparent rules of the road to create a stable business environment. And I know the power of American innovation.” She said she would be pragmatic in her approach to the economy, seeking practical solutions to problems and taking good ideas from wherever they come.

“Kamala Harris, Reagan Democrat!” conservative pundit Bill Kristol posted on social media after her speech.

For his part, Trump has promised an across-the-board tariff of 10% to 20% that billionaire Mark Cuban on the Fox News Channel called “insane” and Quin Hillyer of the Washington Examiner warned “would almost certainly cause immense price hikes domestically, goad other countries into retaliating, and perhaps set off an international trade war” that could “wreck the economy.” Cuban then told Jake Tapper of CNN that Trump’s promise to impose 10% price controls on credit card interest rates and price caps is “Socialism 101.”

Yesterday, more than 400 economists and high-ranking U.S. policymakers endorsed Harris, and today, the members of former South Carolina governor Nikki Haley’s presidential leadership teams in Michigan, Iowa, and Vermont announced they would be supporting Harris, in part because of Trump’s economic policies.

While Trump insisted yet again today that “the economy is doing really, really badly,” the stock market closed at a record high today for the fourth day in a row.

In other economic news, for nine years, Trump has said he will find a cheaper and better way to provide healthcare to Americans than the Affordable Care Act, although on September 10 he admitted he has only the “concepts of a plan.” Today the Treasury Department released statistics showing that 4.2 million small business owners have coverage through the ACA. Losing that protection would impact 618,590 small business owners in Florida, 450,010 in California, 423,790 in Texas, and 168,070 in Georgia.

Trump has made a claim that crime has risen dramatically under President Joe Biden and Vice President Kamala Harris central to his campaign rhetoric. The opposite is true. Two days ago, on September 23, the Federal Bureau of Investigation released its official report on crime statistics from 2023 compared with 2022. Those statistics showed that murder and non-negligent manslaughter fell by 11.6%. Rape fell by 9.4%. Aggravated assault fell by 2.8%. Robbery fell by 0.3%. Hate crimes fell by 0.6%.

Central to the worldview of MAGA Republicans is that immigration weakens a nation and that immigrants increase crime and disease. First Republican vice presidential nominee Ohio senator J.D. Vance and then Trump himself repeatedly advanced the lie that Haitian immigrants in Springfield, Ohio, are eating their neighbors’ pets and bringing disease.

Clergy members from multiple faiths have asked politicians to stop their lies about Haitian immigrants, and today the leader of Haitian Bridge Alliance, a nonprofit organization that represents the Haitian community, filed a charges against Trump and Vance for disrupting public services, making false alarms, telecommunications harassment, and aggravated menacing and complicity.

Immediately, Representative Clay Higgins (R-LA), who in the past supported Ku Klux Klan leader David Duke and filmed a selfie inside a gas chamber at Auschwitz, posted on social media: “Lol. These Haitians are wild. Eating pets, vudu, nastiest country in the western hemisphere, cults, slapstick gangsters…but damned if they don’t feel all sophisticated now, filing charges against our President and VP. All these thugs better get their mind right and their *ss out of our country before January 20th.”

After an outcry, Higgins took the post down. According to House speaker and fellow Louisiana Republican Mike Johnson, who called Higgins a “very principled man,” Higgins took it down after he “prayed about it.” Johnson seemed unconcerned about his colleague’s racism, saying, “we believe in redemption around here.”

But in a statement, House minority leader Hakeem Jeffries (D-NY) called Higgins’s statement “vile, racist and beneath the dignity of the United States House of Representatives. He must be held accountable for dishonorable conduct that is unbecoming of a Member of Congress. Clay Higgins is an election-denying, conspiracy-peddling racial arsonist who is a disgrace to the People’s House. This is who they have become. Republicans are the party of Donald Trump, Mark Robinson, Marjorie Taylor Greene, Clay Higgins and Project 2025. The extreme MAGA Republicans in the House are unfit to govern.”

On Monday, Dan Gooding of Newsweek reported that although Trump said on September 18 he would go to Springfield, he will not. Republican Ohio governor Mike DeWine had warned that the local community would not welcome a visit from the former president.

Republican politicians and candidates, including Trump, embraced North Carolina gubernatorial candidate and current lieutenant governor Mark Robinson, who trumpeted the extremists’ MAGA narrative. The September 19 revelation by CNN reporters Andrew Kaczynski and Em Steck that Robinson had boasted on a pornography website that he considers himself a “black NAZI!”, would like to reinstate slavery, and would like to own some people himself, and shared the sexual kinks in which he engaged with his wife’s sister prompted most of his campaign staff to resign.

Andrew Egger of The Bulwark reported today that on a different online forum, Robinson called for a political assassination as well as making racist attacks on entertainer Oprah Winfrey and former president Barack Obama. Robinson has called all the information released about him “false smears” and has said “[n]ow is not the time for intra-party squabbling and nonsense,” but declined help tracking down those he claims falsified his online comments. Today, multiple media outlets reported that top staff in Robinson’s government office are stepping down.

Reality hit hard this week in Texas, too, where U.S. Bankruptcy Judge Christopher Lopez yesterday approved the auctioning off of conspiracy theorist Alex Jones’s media business, the aptly-named InfoWars. Jones insisted that the 2012 Sandy Hook Elementary School shooting was a “hoax” designed to whip up support for gun restrictions, and that the grieving parents were played by “crisis actors.” Juries found Jones guilty of defaming the families of the murdered children and causing them emotional distress.

The auction of his property will enable the families to begin to collect on the more than $1 billion the jurors determined Jones owed them for his reprehensible and harmful behavior.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#election 2024#William Faulkner#quotes#MAGA poison#racism#Mark Robinson#Clay Higgins#the economy#the middle class

20 notes

·

View notes