#Manage finances

Explore tagged Tumblr posts

Text

Mastering Your Finances: Practical Tips for Winning the Game of Money!

Money is an important aspect of our lives and can have a significant impact on our well-being. The ability to manage finances effectively is crucial for achieving financial success and maintaining a high quality of life. However, managing money can be a challenging task, and many people struggle to achieve financial stability.

we will discuss some practical tips for winning the game of money and achieving financial success.

1. Set Financial Goals

2. Create a Budget

3. Control Your Spending

4. Maximize Your Income

For more depth research and reference you can visit our blog click here

#money#finance#personal finance#financialfreedom#financial goals#manage money#Manage finances#financial advisor#financial stability#Game of money

6 notes

·

View notes

Text

From Financial Learning to Life Long Learning

For the longest time I’ve struggled with managing my personal finances and have searched for different ways to balance between earning, spending and saving. I was on facebook a few months ago reading through posts from groups I’m in and one of the group members mentioned the Financial Peace university and that she’s enrolled in a class and learning how to manage her personal finances. I didn’t…

View On WordPress

0 notes

Text

Thinking again about how many disabled people end up getting shunted into art/craft work because like. You can technically do it. Sometimes. Yeah you make a pittance at best and are almost certainly going to make your physical health worse by pushing yourself to get things done, but what else are you gonna do? You're too sick for anyone to hire you. You're "not sick enough" to qualify for benefits. Just devote every scrap of time and energy you have to a chronically underpaid, low-prestige, incredibly labor-intensive industry. A few people manage to make it work with luck and help and the right skills. Many people don't. Everyone gets pressured to monetize their hobbies, but it's especially insidious if you're disabled because any tiny thing you manage to accomplish to bring yourself joy gets twisted into proof that you should somehow be able to work.

#curseblogging#the thing is like#i went to bookbinding school#i saw what it was like to try to make a living as a craft worker for able-bodied people with significant starting resources#and the answer is: fucking hard!#people generally being like well if you work long hours and never allow yourself a break#and do a bunch of events and shows and teaching#and are good at not just the work but at finances and marketing and every other aspect of business management#(and ideally have a spouse with a regular job so you don't have to pay for your own healthcare. because this is America)#then maybe#MAYBE#you can make a reasonable living as a craftsperson#but this same VERY DIFFICULT PROFESSION#gets pushed on disabled people as something obvious and easy#and a lot of people do try their best to make it work because what other choice do they have?!

444 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

819 notes

·

View notes

Text

headcannon that albus is a math genius he just never knew because they don’t teach fucking math at hogwarts

#scorbus#scorpius malfoy#albus severus potter#harry potter#hpcc#headcannon as well that after mcgonagall retires the new headmaster implements normal fucking classes like MATH and english#how u gonna teach only magic these kids are going to be dumb asf#HOW ARE YOU NOT GOING TO TEACH MATH AT HOGWARTS???? whoooooo is managing the finances of wizarding companies because it sure as hell is not#goblins

637 notes

·

View notes

Text

life lately: studying for the cpa exam 📕🧠📝💗

some motivational pics for myself b/c i'm deep into studying for the cpa exam and the light at the end of the tunnel for me is passing scores 😅🥹🤞

#academia barbie#academic validation#pink academia#pretty academia#that girl#girl blogger#motivation#becoming that girl#glow up#it girl#business student#business studies#accounting student#pink moodboard#study blog#study aesthetic#study motivation#studyblr#studyspo#student life#studying#cpa exam#tax#management#finance#certified public accountant

283 notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

74 notes

·

View notes

Text

₊˚⊹ ᰔ a guide to maintaining financial wellness ᝰ.ᐟ

having good money habits can be insanely difficult. i know i personally struggle with impulsive spending, and i’m sure we’ve all fallen victim to the “i’m just treating myself” mindset. financial stress and even financial depression can feel so daunting and overwhelming, so i’m here to help you guys (and myself as well) manage your money better!

let’s begin !!

ᝰ.ᐟ set aside funds

it’s important that when every paycheck hits your bank account to immediately set aside some funds into your savings account. whether it’s 10-20% of your paycheck or even $20-$100, set aside some money into your savings!

it also might help to have that savings account be locked so that you can still put money in, but you can’t take money out. let that savings amount pile up and don’t touch it until you’re absolutely ready to make that big purchase!

ᝰ.ᐟ set aside any cash

get a piggybank or even one of those money organizing binders to set aside any cash that may come your way! keep that cash away from your wallet so you won’t be tempted to use it in any outside purchases. and, same as the first point, that cash will start to pile up!

ᝰ.ᐟ purchase needs rather than wants

let’s start getting out of that “i’m gonna treat myself” mindset!! while it’s nice to treat yourself, we really should only be doing it every once in a while. we can also find different ways of treating/rewarding ourselves that don’t require spending any money! (i can make a separate blog post on this if you guys would like!)

especially when you’re trying to save up for school, a new apartment, a new car, or whatever it may be, it’s really important to keep your purchases to only things that are absolutely necessary.

ᝰ.ᐟ keep track of automatic payments

especially if you have a subscription of any kind, keep track of when those automatic deductions from your account are happening. make note of when your next billing date is and how much you’re being charged for each month/year.

this would also be a good way to determine what subscriptions you really need/want to keep and which ones you can do without and unsubscribe to! i did a full cleanse of my subscriptions list and kept the ones i definitely wanted to keep. sometimes you never really realize how much money your losing when you’re subscribed to things that have no use to you anymore!

ᝰ.ᐟ plan accordingly

when your paycheck comes in and you have all these payments that are coming up yet you still need to buy groceries or get gas or whatever, make sure to plan your funds ahead of time! this way, it’ll help you budget for your groceries & any other necessities as well as help you determine how much money you can set aside into your savings and even calculate how much extra funds you might have to spend on for more personal things!

𝜗𝜚 final notes 𝜗𝜚

don’t let these tips make you feel like you can’t treat yourself to something! as i mentioned earlier, you can still treat yourself to nice things, but it might be best to do it once in a while! i know most of us associate success with money, and to reach success with money we have to learn to be more mindful about how we spend our money and how we manage it.

live and love, babe.

sincerely, juno ⭑.ᐟ

#milkoomis#girlblogger#girlblogging#it girl#that girl#girl blog aesthetic#it girl tips#becoming that girl#finance#money#money management#money manifestation#money saving#spending habits#personal growth#self improvement

59 notes

·

View notes

Text

modern au laios would 100% be a zookeeper. i feel like they'd start him with mucking out the monkey pits but hes so good with kids that they eventually just let him do shows and demonstrations. actually where's the dungeon meshi we bought a zoo au

#dungeon meshi#laios touden#senshi runs the hot dog stand but theres a million menu items that arent hotdogs and they all take 30 minutes#marcille is a volunteer receptionist shes doing this for an essay for her university course and then falls in love with falin#falins a vet (she dropped out of med school to become a vet work at the zoo)#izutsumi well. shes a middle school kid who comes to visit the panther exhibit everyday because thats her#who when in high school despite her best efforts and how lame she thinks the crew is (teenager) starts working the summers there#chilchuck is the guy who used to take his kids there and then got in an argument with marcille about ticket pricing and profits so#he started doing their finances because he solemnly believes the zoo would go under the original financial management (not wrong)

181 notes

·

View notes

Text

#Three Reasons Why You Shouldn’t Give Money to Ghosts (And One Why You Should)#ghost#ghosts#pony rides#money#money management#finance#unreality

197 notes

·

View notes

Text

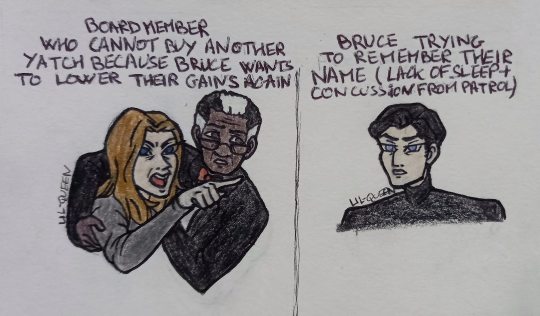

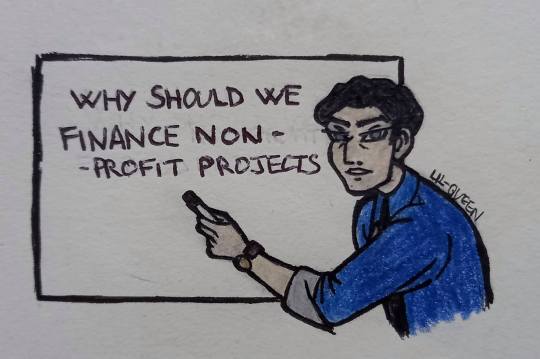

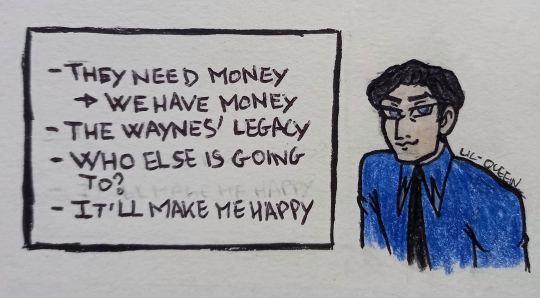

Bruce: The most Nepo Baby of the Nepo Babies

Type of day when he pretends he has a hangover to not deal with their bs. The peace inside the company is all Lucius works.

He does not accept criticism.

The Gotham Knights' hoodie is Dick's or Jason's, and was in the kitchen that morning when Bruce ran late for the meeting.

Rip to the (paid) intern that was terrified to bring documents to THE Bruce Wayne and found themselves stuck in his office, listening to him telling stories about his kids for hours.

"I don't understand why we need to make more money, we're already rich." (he's talking about the highers up)

Just a bunch of doodled memes of how I believe Bruce Wayne acts with his company. He is not a capitalist, he doesn't care about making more profit and doesn't understand finance.

If you think Brucie Wayne is just an act, talk to Lucius Fox, who has to endure Bruce' antics at WE. The man whines like a child about having to speak to any shareholders, he has to be dragged to meetings. In Bruce's eyes, his job is "using the company's money to improve the people's life", "talking about his kids" and "being a pain in the ass of the highers up". If someone is trying to kill Bruce Wayne, 50% of chances some WE shareholder or board member ordered the kill because they are tired of him stopping them from playing the game of capitalism. His other employees love him, tho. There aren't janitors as well treated than the ones working for Wayne.

#bruce wayne#batman#lucius fox#batfam#dc comics#fanart#my art#doodle#traditional art#colored pencils#do not criticize as the effort put in this is minimum it's for fun#also my knowledge of how managing a company and shareholders is nonexistent#but anyway#promoting my “corporate goth” bruce wayne agenda#I'm treating him like a dress up doll#I want to put him in so many outfit boo dc for making him dress boringly#who is playing a tree? It's up to you#also yes the Gotham Knights symbol have bat ears gothamites are proud of being the city of the bat#also promoting my “Bruce dislikes and doesn't understand finance” agenda he would not be in charge of a company if he wasn't a nepo baby#personally I think he would work with kids but that's another subject

89 notes

·

View notes

Text

I won't trauma dump, but I will let myself lore dump a little as a treat.

The man who hurt me thought he was so important in the grand scheme of things that he was convinced that he, a Midwestern small-city police chief and mayor, had a lot of Enemies, he absolutely needed a full-time personal policeman bodyguard/driver from the city's police force, and also he was on Al Qaeda's targeted hit list. Al Qaeda, to no one's surprise, neither confirmed nor denied.

He made them install x-ray and metal detector machines in our tiny little city hall that, despite being the mayor of, he couldn't manage to come in to for reliable work hours ever. For years, he was making over 16,000 dollars more per year than the mayor of St. Louis, not counting the city car or other benefits. Bonkers yonkers McGee over here

#shh katie#personal#there. none of this is anything too terrible#the mayor of our town is basically a solo ruler almost because of the charter/etc.#so it was wild.#and that's why he could do a lot of what he did#there was a lot of flagrant finance and nepotism and other issues going on that i wil not be going into#but you can imagine#let's just say the city council even had to manage to change laws after some of the things he did to make it so he couldn't again lol#uhhhh just to be safe#tw: terrorism#I guess?

29 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Credit and Credit Cards

Understanding credit

Dafuq Is Credit and How Do You Bend It to Your Will?

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Ask the Bitches: What’s the Difference Between Credit Checks and Credit Monitoring?

When (And How) To Try Refinancing or Consolidating Student Loans

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Using credit

How to Instantly Increase Your Credit Score…For Free

How to Build Good Credit Without Going Into Debt

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Season 1, Episode 3: “My Parents Have Bad Credit. Should I Help by Co-signing Their Mortgage?”

Season 3, Episode 2: “I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?”

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

Credit cards

A Hand-holding Guide To Getting Your First Credit Card

63% of Millennials Are Making a Big Mistake With Credit Cards

Let’s End This Damaging Misconception About Credit Cards

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Here’s What to Do With Those Credit Card Pre-approval Offers You Get in the Mail

We’ll periodically update this masterpost as we continue to write tutorials and answer questions on credit. So if there’s anything you’re confused about, keep the questions coming!

And if we’ve helped you increase your credit score or pay off your credit card debt, consider tossing a coin to your Bitches through our PayPal. It ensures we can pay our lovely assistant and keep bringing you free articles and episodes like those above.

Toss a coin to your Bitches on PayPal

#credit#credit score#credit history#credit report#credit card#credit card debt#good credit#personal finance#money tips#debt management#debt consolidation#debt

282 notes

·

View notes

Text

Hi everyone,

I got an inbox asking to share some tips for financing when you’re autistic. I found a helpful guid from the National Autistic Society:

Budgeting

The first step to managing your money is to work out a budget and stick to it. Budgeting will help you:

* keep track of what you are spending

* help you to avoid going overdrawn on your bank account by spending money that you don't have

* decide whether you can afford to buy something that you would like

* deal with debt by planning repayments that you can manage

* work out how much money you may have to save.

Bank, building society or post office accounts

Most people now have one of these types of account. The benefits of these are:

* it will keep your money safe

* you can pay bills more simply by direct debits or standing orders

* internet banking is now widely available. This reduces the need to visit banks and other services that autistic people may find difficult

* benefit payments can only be paid into an account

* you can have a debit card, making it easier to pay for purchases and you can shop online

* you may be able to earn interest on the money you have

* you can pay bills by direct debit or standing order, which are sometimes rewarded by a reduction in what you pay for services

* you can use your cashpoint card to access money easily from cash machines in the UK and sometimes abroad

* your bank or building society may be able to give you an overdraft or loan.

Debit, credit and store cards

There are a number of different cards that you can use to make a payment. These include:

* cashpoint and debit cards

* credit cards

* store cards.

Borrowing money, making payments and debt

It's easy to think of a loan or overdraft as free money, but it’s actually expensive as you have to pay back the original amount plus interest. Try to only borrow money when you need to and repay it as soon as you can. There are many ways of borrowing money, including:

* borrowing money from family or friends

* having an overdraft

* taking out a personal loan or secured loan

* applying for a credit card.

The full article will be below, as it goes into more detail. I hope this helps many of you.

National Autistic Society

#autism#actually autistic#autism and finance#how to manage financial issues#tips on financing#how to save money#feel free to share/reblog#National Autistic Society

159 notes

·

View notes

Text

OK, so good news(?); either the temple is so dilapidated that it isn't worth taxing (considering its in a part of the city that's so old the modern city is built on top of it: fair) or else Durge will be going to jail for tax evasion... Oh dear, it looks like it's time for the apocalypse! What a shame that will interfere with the court date!

Also they seem to expect the bank to still be standing once they're done razing the city and they are a fucking terrible employer:

Player: "Fine. I'll open an account." Head Clerk Meadhoney: "Splendid! New coin and customers always welcome. We need only settle the matter of Waukeen's Wage." Player: "I've recently come into a large estate. Could I sign it against that as a guarantee instead?" Head Clerk Meadhoney: "Naturally. We serve the Gate's oldest families - not all have cash in hand. What kind of establishment would we be if we saw value in coin alone? Could you provide the address of your property?" Player: "It's in the Undercity." Head Clerk Meadhoney: "Oh, by the Coinmaiden! How, er, quaint. And the name of the manor?" Player: "Erm, the Bhaal Temple." Head Clerk Meadhoney: "Is that B-H-A-A-L or B-A-L-L?" Player: "Bhaal. As in, the Lord of Murder." Head Clerk Meadhoney: "Silly me - of course! Let me check our records..." Head Clerk Meadhoney: "I'm afraid your estate is not registered on the Sword Coast customs censuses - have you been paying your mansion taxes? Or perhaps it isn't valued highly enough to be above the threshold." Player: "It is an illustrious household. We employ paid help!" Narrator: *You wonder how many years ago it was you last gave Sceleritas so much as a table scrap of your dinner, let alone any paycoin.*

Hey, he's a fiend! He has no biological needs to pay for, and I dread to think what he'd spend money on.

And more of Durge being a hilariously entitled brat:

Player: "The indignity! I'm heir to one of the oldest families in this city!" Head Clerk Meadhoney: "Then why not bring the gold for the account? Father not given out your allowance yet?"

Good question!

BHAAL. WHERE THE FUCK IS MY POCKET MONEY.

That said, I don't think Bhaal has ever had estate in the city whose existence he predates and I don't think that they have any claim on the Anchev's stuff (assuming they weren't nouveau-riche). Then again, the temple is technically Bhaal's house, has been there forever, and as a god he does outrank the nobility, so... they're kind of right?

"I am a god and an honorary Patriar, you peasants."

Player: "Fool! I will soon hold the treasures of the world over, as all tremble in stricken awe." Head Clerk Meadhoney: "Do come back when you do!"

#I'm keeping my original headcanon though#Durge did you basically just fucking try and pawn your father's temple to the bank#Waukeenar: “Yes the Bhaalists are all serial killers but more importantly: have they been paying their taxes?”#I will never get tired of Durge being a brat and nobody taking them seriously#All that said the temple still involves finances employee management networking and all that stuff#So my “Orin did all the paperwork and hates you all” headcanon stands#babbling#/durge

92 notes

·

View notes

Text

some of y'all taking this Viu thing hella personally lmao, as if BOC rolled up to your house and threw eggs on the door while laughing like the joker as they skedaddle away gleefully

when in reality they probably went with Viu cause it's a big streaming platform in Asia and helped foot the big fat price tag of the production since it's a "Viu Original"

#4 minutes the series#bible wichapas#chaos pikachu speaks#idk i'm so unbothered by this#like it's disappointing but like manageable?#I'm so used to this for other stuff like it's so chill bro#i'm just happy boc was able to finance the damn show fr#boc is able to put out like 1 singular production a year they ain't rolling in moneys#anyway i'm listening to otaku hot girl whatcha y'all listening to

52 notes

·

View notes