#Financial independence tips

Explore tagged Tumblr posts

Text

Essential Wealth Building Techniques Every Woman Should Embrace for Financial Success

View On WordPress

#Financial Independence Tips#Long-Term Investing Strategies#Passive Income for Women#Personal Development and Finance#wealth building techniques

0 notes

Text

Self-Employment: What I Wish I Knew About the Risks, Benefits, & Essential Facts

Are you open-minded and can take calculated risks? I wrote this article to raise awareness because recently, I came across an interesting story on Medium.com. As the author my mentor and the person who invited me there as a writer, content curator, and editor, I read many of his insightful articles. This eye-opening and exceptional piece is titled I Wish I Had Gone Self-Employed 40 Years Ago…

#calculated risks for self-employment#Career advice for professionals#Career advice for self-employment#Challenges of entrepreneurship#Corporate vs self-employment#Financial independence tips#Health and well-being in self-employment#Inspiration and motivation for self-employment#Long-term impact of corporate jobs#Professional development for young people#Self Improvement#Self-employment benefits#Starting your own business advice#Transition from corporate to self-employed#Work-life balance and self-employment

0 notes

Text

Time gone never returns.

#financial freedom#financial literacy#moneyquotes#personal finance#budgeting#finance#money mindset#money management#financial education#happylife#moneytips#financial independence#financial tips#financialfreedom

158 notes

·

View notes

Text

100 Ways to Make Extra Money for Your Family

Hi guys, I’m back today with tips for your Personal Finance journey. Life is becoming more expensive everywhere, with pricing going up like the fastest rabbit of the forest and the salaries moving so slow, like the lazy turtle. But, life is too short to wait for the salary to grow enough to cover for extra costs, or having the money for so-needed holidays in your To Travel List Countries, and for…

#CashFlow#Earn Extra Cash#Earning Opportunities#Entrepreneur Life#Extra Earnings#Extra Income#Financial Freedom#financial goal#Financial Independence#Financial Security#Gig Economy#how to make money#Hustle Culture#Income Opportunities#Income Streams#Make Money#monetize assets#monetize experience#monetize extra time#monetize knowledge#monetize skills#monetize technology skills#Money Hacks#Money Making#Money Making Ideas#Money Tips#Multiple Income Streams#Online Income#Part Time Work#Passive Income

5 notes

·

View notes

Text

youtube

Achieve Financial Freedom: Your Path to Wealth & Independence"

Are you ready to take control of your finances and unlock the path to true financial freedom? In this video,we dive into the essential steps you can take to build wealth, eliminate debt, and secure long-term financial independence. Whether you're just starting out or looking to refine your strategies, this guide will give you actionable advice on budgeting, investing, and creating passive income streams. Don't wait—begin your journey to financial freedom today!

#financial freedom#wealth building#personal finance#financial independence#passive income#budgeting tips#money management#debt-free living#financial goals#wealth creation#financial advice#Youtube

2 notes

·

View notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

33 notes

·

View notes

Text

10 Money Rules to Learn by the Age of 25 – Fastlane Freedom

Financial literacy is a crucial life skill that often doesn’t receive the attention it deserves in traditional education. Age 25 is a big deal because it’s when many people finish school, start working, and have to make important choices about their jobs, money, and relationships. It’s a time when taking care of your money becomes really important, and you should start saving and planning for the…

View On WordPress

#investing for beginners#wealth building#money#budgeting tips#debt management#money laws#emergency fund#income diversification#investing money#spending money#habit of saving money#money management#financial independence#credit score#money makes money#money rules#financial goals#money tips#financial literacy

9 notes

·

View notes

Text

The Rich Rule Over the Poor!

In today’s culture, debt is often viewed as a normal part of life. Whether it’s taking out student loans, financing a car, or relying on credit cards to cover expenses, many people are accustomed to borrowing money. But financial expert Dave Ramsey warns against this mindset, drawing from a biblical principle found in Proverbs 22:7: “The rich rule over the poor, and the borrower is servant to the lender.” For Ramsey, this verse serves as a profound warning about the dangers of debt and a call to pursue financial freedom.

Debt as Modern-Day Slavery

When discussing debt, Ramsey doesn’t mince words. He often refers to debt as a form of modern-day slavery. Just as a servant is bound to their master, someone in debt is bound to their lender. Each month, a portion of their hard-earned income is already spoken for—sent off to pay for past purchases, often with interest. This, according to Ramsey, is a form of bondage.

People in debt often lose their ability to make decisions based on what’s best for their future because their past borrowing controls their present and future income. As Ramsey puts it, being in debt means you’ve sold your freedom to the lender. The greater the debt, the less freedom you have to make choices that align with your goals and dreams. Instead, you’re working to satisfy the demands of the creditor.

The Stress and Anxiety of Borrowed Money

Debt isn’t just a financial burden; it’s also an emotional one. Ramsey frequently highlights the stress that debt can cause. The fear of missing a payment, the anxiety of mounting interest, and the constant juggling of bills can take a heavy toll on a person’s mental and emotional well-being. This stress doesn’t just stay confined to finances; it often spills over into relationships, health, and overall life satisfaction.

In fact, studies show that financial stress is one of the leading causes of marital conflict. When debt becomes overwhelming, it can lead to arguments, resentment, and even divorce. Ramsey is quick to point out that eliminating debt can significantly reduce stress and create a more peaceful home life.

Achieving Financial Independence

One of Ramsey’s core messages is that avoiding debt is key to achieving financial independence. When you live debt-free, your income is yours to control, rather than being obligated to a creditor. This financial freedom allows you to save, invest, and plan for the future in ways that aren’t possible when you’re tied down by debt.

Ramsey advocates for a lifestyle of living within your means, which is the opposite of the “buy now, pay later” mentality that’s so prevalent today. He encourages people to delay gratification, save for major purchases, and build an emergency fund to avoid going into debt when life’s unexpected expenses arise. By doing so, individuals can protect themselves from falling into the debt trap and remain in control of their financial future.

Biblical Wisdom for Modern Money Management

Dave Ramsey’s teachings are deeply rooted in biblical principles, and Proverbs 22:7 is one of the cornerstones of his philosophy. Ramsey believes that the Bible offers timeless wisdom on money management, and that following these teachings can lead to a more peaceful and prosperous life.

In addition to avoiding debt, Ramsey emphasizes other biblical principles like generosity, wise stewardship, and contentment. He believes that by applying these principles, individuals can achieve both financial peace and spiritual fulfillment. For Ramsey, financial success isn’t just about accumulating wealth—it’s about using money in a way that honors God and benefits others.

From Borrowing to Building Wealth

One of the most powerful shifts that can occur when you move from borrowing to building wealth is the change in mindset. Ramsey teaches that wealth-building begins once you stop borrowing money. When you’re not sending payments to creditors every month, you have the freedom to invest in your future.

This is where Ramsey’s famous Baby Steps come into play. He encourages people to start by building a small emergency fund, then aggressively paying off all their debt (except for their mortgage), and finally moving on to saving for the future and giving generously. These steps are designed to help people break free from debt and begin building lasting wealth.

Conclusion: Choosing Freedom Over Bondage

Proverbs 22:7 serves as a powerful reminder of the dangers of debt. Dave Ramsey’s teachings on this verse challenge the cultural norm that debt is inevitable or even desirable. Instead, Ramsey encourages us to choose financial freedom over financial bondage.

By avoiding debt, living within our means, and applying biblical principles to our finances, we can break free from the slavery of debt and achieve true financial independence. It’s not an easy journey, but as Ramsey often says, “If you live like no one else, later you can live like no one else.”

#Debt-Free Living#Financial Freedom#Dave Ramsey#Proverbs 22:7#Money Management#Biblical Finance#Financial Independence#Personal Finance#Avoid Debt#Wealth Building#Debt Slavery#Living Debt-Free#Financial Peace#Budgeting Tips#Debt Relief#Emergency Fund#Financial Stress#Christian Finance#Money and Faith#Baby Steps#new blog#today on tumblr

1 note

·

View note

Text

The FIRE Movement: A Comprehensive Guide to Financial Independence and Early Retirement

Introduction In recent years, a revolutionary concept has emerged in the realm of personal finance, captivating the imagination of young adults worldwide. Known as the FIRE movement, which stands for Financial Independence, Retire Early, this philosophy offers more than just financial advice—it proposes a radical shift in lifestyle. This in-depth guide explores the intricacies of the FIRE…

View On WordPress

#asset allocation#budgeting tips#Compound interest#early retirement#financial autonomy#financial freedom#financial independence#Financial planning#FIRE movement#frugality#lifestyle choices#lifestyle inflation#living below means#passive income#personal finance#retire early#retirement planning#Risk management#savings strategies#side hustles#smart investing#Wealth Management

6 notes

·

View notes

Text

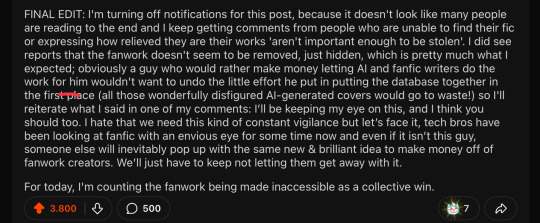

SO HERE IS THE WHOLE STORY (SO FAR).

I am on my knees begging you to reblog this post and to stop reblogging the original ones I sent out yesterday. This is the complete account with all the most recent info; the other one is just sending people down senselessly panicked avenues that no longer lead anywhere.

IN SHORT

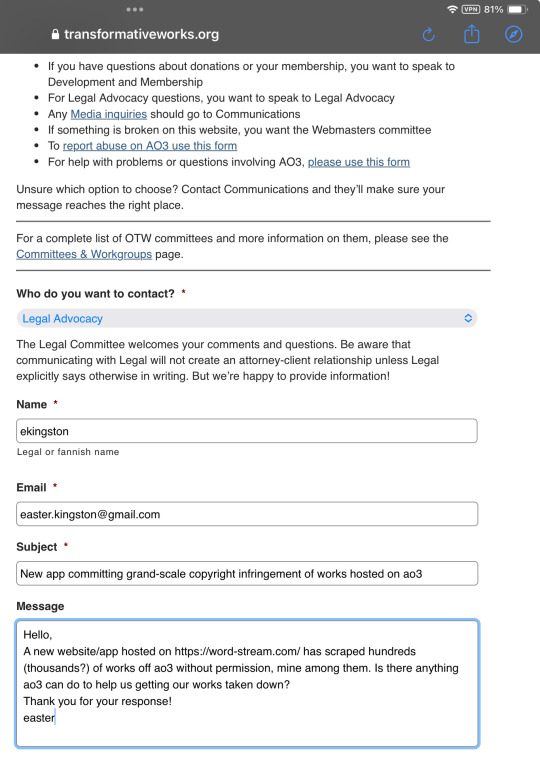

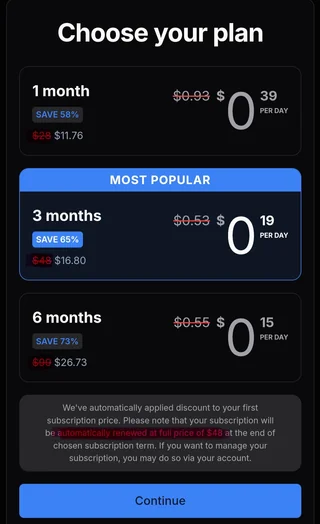

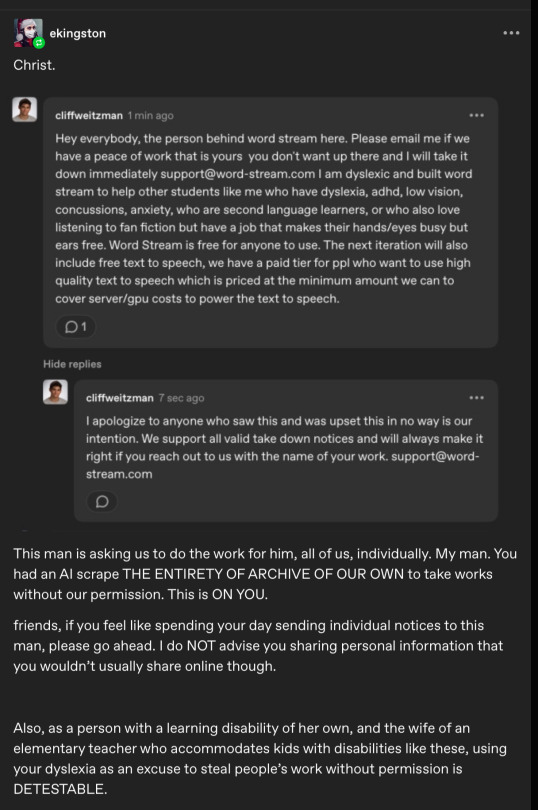

Cliff Weitzman, CEO of Speechify and (aspiring?) voice actor, used AI to scrape thousands of popular, finished works off AO3 to list them on his own for-profit website and in his attached app. He did this without getting any kind of permission from the authors of said work or informing AO3. Obviously.

When fandom at large was made aware of his theft and started pushing back, Weitzman issued a non-apology on the original social media posts—using

his dyslexia;

his intent to implement a tip-system for the plagiarized authors; and

a sudden willingness to take down the work of every author who saw my original social media posts and emailed him individually with a ‘valid’ claim,

as reasons we should allow him to continue monetizing fanwork for his own financial gain.

When we less-than-kindly refused, he took down his ‘apologies’ as well as his website (allegedly—it’s possible that our complaints to his web host, the deluge of emails he received or the unanticipated traffic brought it down, since there wasn’t any sort of official statement made about it), and when it came back up several hours later, all of the work formerly listed in the fan fiction category was no longer there.

THE TAKEAWAYS

1. Cliff Weitzman (aka Ofek Weitzman) is a scumbag with no qualms about taking fanwork without permission, feeding it to AI and monetizing it for his own financial gain;

2. Fandom can really get things done when it wants to, and

3. Our fanworks appear to be hidden, but they’re NOT DELETED from Weitzman’s servers, and independently published, original works are still listed without the authors' permission. We need to hold this man responsible for his theft, keep an eye on both his current and future endeavors, and take action immediately when he crosses the line again.

THE TIMELINE, THE DETAILS, THE SCREENSHOTS (behind the cut)

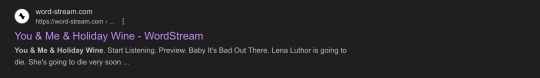

Sunday night, December 22nd 2024, I noticed an influx in visitors to my fic You & Me & Holiday Wine. When I searched the title online, hoping to find out where they came from, a new listing popped up (third one down, no less):

This listing is still up today, by the way, though now when you follow the link to word-stream, it just brings you to the main site. (Also, to be clear, this was not the cause for the influx of traffic to my fic; word-stream did not link back to the original work anywhere.)

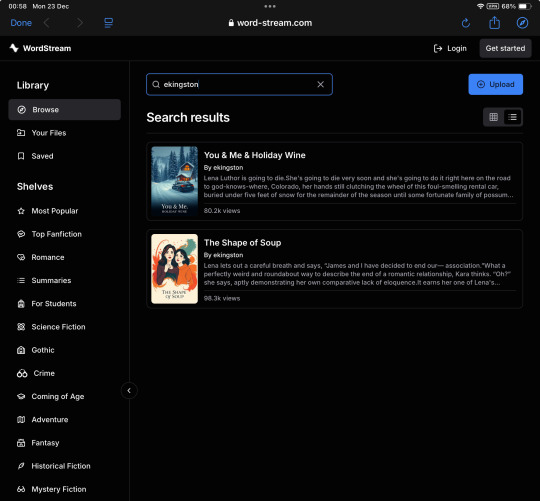

I followed the link to word-stream, where to my horror Y&M&HW was listed in its entirety—though, beyond the first half of the first chapter, behind a paywall—along with a link promising to take me—through an app downloadable on the Apple Store—to an AI-narrated audiobook version. When I searched word-stream itself for my ao3 handle I found both of my multi-chapter fics were listed this way:

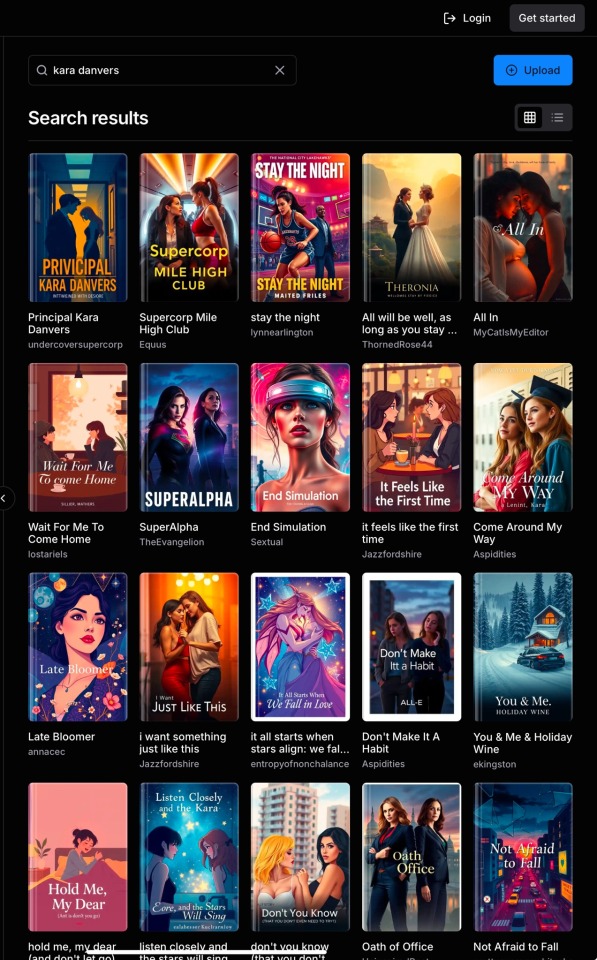

Because the tags on my fics (which included genres* and characters, but never the original IPs**) weren’t working, I put ‘Kara Danvers’ into the search bar and discovered that many more supercorp fics (Supergirl TV fandom, Kara Danvers/Lena Luthor pairing) were listed.

I went looking online for any mention of word-stream and AI plagiarism (the covers—as well as the ridiculously inflated number of reviews and ratings—made it immediately obvious that AI fuckery was involved), but found almost nothing: only one single Reddit post had been made, and it received (at that time) only a handful of upvotes and no advice.

I decided to make a tumblr post to bring the supercorp fandom up to speed about the theft. I draw as well as write for fandom and I’ve only ever had to deal with art theft—which has a clear set of steps to take depending on where said art was reposted—and I was at a loss regarding where to start in this situation.

After my post went up I remembered Project Copy Knight, which is worth commending for the work they’ve done to get fic stolen from AO3 taken down from monetized AI 'audiobook’ YouTube accounts. I reached out to @echoekhi, asking if they’d heard of this site and whether they could advise me on how to get our works taken down.

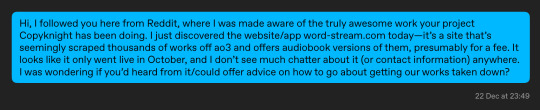

While waiting for a reply I looked into Copy Knight’s methods and decided to contact OTW’s legal department:

And then I went to bed.

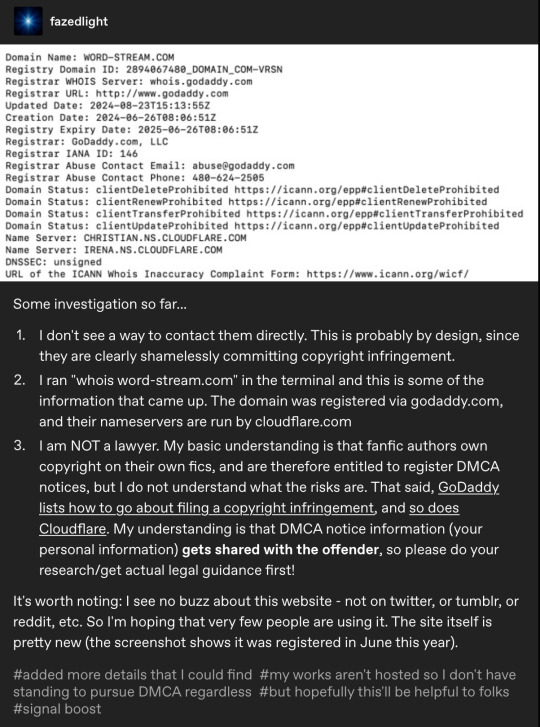

By morning, tumblr friends @makicarn and @fazedlight as well as a very helpful tumblr anon had seen my post and done some very productive sleuthing:

@echoekhi had also gotten back to me, advising me, as expected, to contact the OTW. So I decided to sit tight until I got a response from them.

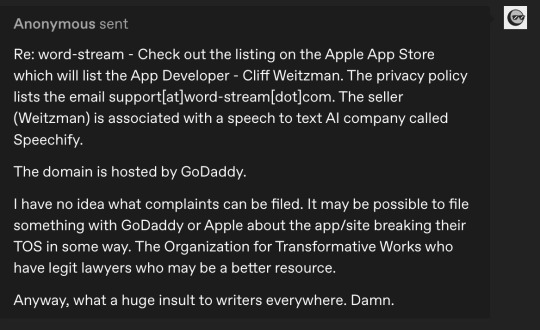

That response came only an hour or so later:

Which was 100% understandable, but still disappointing—I doubted a handful of individual takedown requests would accomplish much, and I wasn’t eager to share my given name and personal information with Cliff Weitzman himself, which is unavoidable if you want to file a DMCA.

I decided to take it to Reddit, hoping it would gain traction in the wider fanfic community, considering so many fandoms were affected. My Reddit posts (with the updates at the bottom as they were emerging) can be found here and here.

A helpful Reddit user posted a guide on how users could go about filing a DMCA against word-stream here (to wobbly-at-best results)

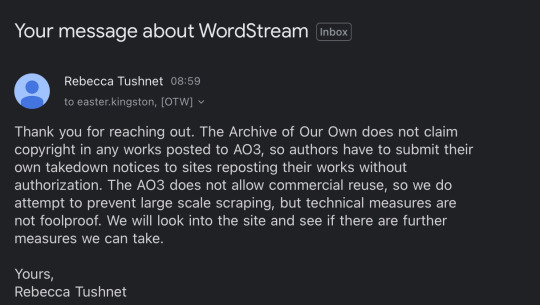

A different helpful Reddit user signed up to access insight into word-streams pricing. Comment is here.

Smells unbelievably scammy, right? In addition to those audacious prices—though in all fairness any amount of money would be audacious considering every work listed is accessible elsewhere for free—my dyscalculia is screaming silently at the sight of that completely unnecessary amount of intentionally obscured numbers.

Speaking of which! As soon as the post on r/AO3—and, as a result, my original tumblr post—began taking off properly, sometime around 1 pm, jumpscare! A notification that a tumblr account named @cliffweitzman had commented on my post, and I got a bit mad about the gist of his message :

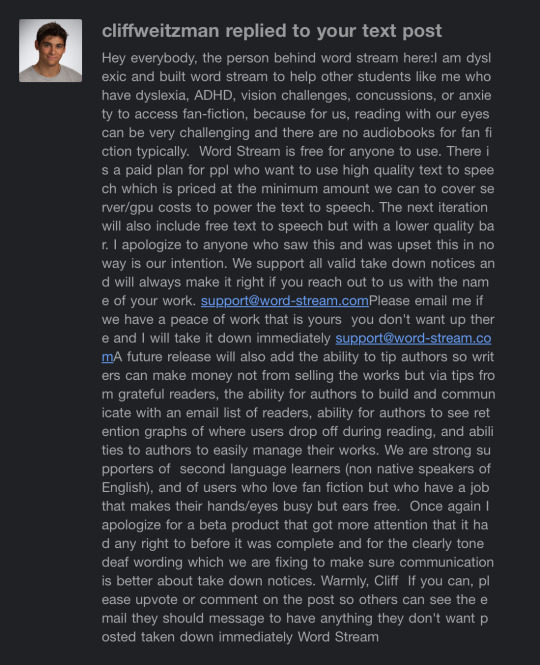

Fortunately he caught plenty of flack in the comments from other users (truly you should check out the comment section, it is extremely gratifying and people are making tremendously good points), in response to which, of course, he first tried to both reiterate and renegotiate his point in a second, longer comment (which I didn’t screenshot in time so I’m sorry for the crappy notification email formatting):

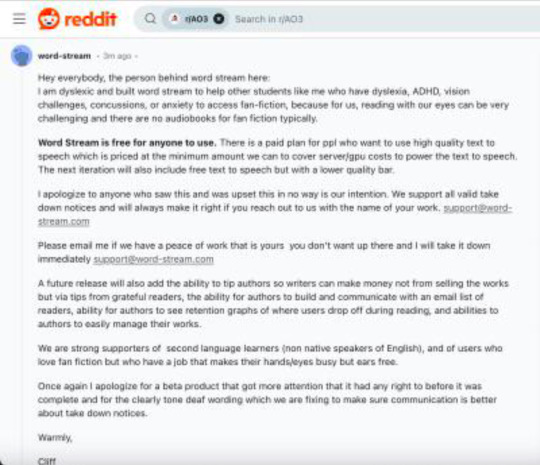

which he then proceeded to also post to Reddit (this is another Reddit user’s screenshot, I didn’t see it at all, the notifications were moving too fast for me to follow by then)

... where he got a roughly equal amount of righteously furious replies. (Check downthread, they're still there, all the way at the bottom.)

After which Cliff went ahead & deleted his messages altogether.

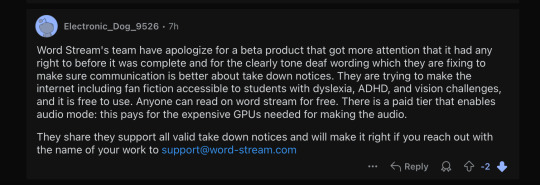

It’s not entirely clear whether his account was suspended by Reddit soon after or whether he deleted it himself, but considering his tumblr account is still intact, I assume it’s the former. He made a handful of sock puppet accounts to play around with for a while, both on Reddit and Tumblr, only one of which I have a screenshot of, but since they all say roughly the same thing, you’re not missing much:

And then word-stream started throwing a DNS error.

That lasted for a good number of hours, which was unfortunately right around the time that a lot of authors first heard about the situation and started asking me individually how to find out whether their work was stolen too. I do not have that information and I am unclear on the perimeters Weitzman set for his AI scraper, so this is all conjecture: it LOOKS like the fics that were lifted had three things in common:

They were completed works;

They had over several thousand kudos on AO3; and

They were written by authors who had actively posted or updated work over the past year.

If anyone knows more about these perimeters or has info that counters my observation, please let me know!

I finally thought to check/alert evil Twitter during this time, and found out that the news was doing the rounds there already. I made a quick thread summarizing everything that had happened just in case. You can find it here.

I went to Bluesky too, where fandom was doing all the heavy lifting for me already, so I just reskeeted, as you do, and carried on.

Sometime in the very early evening, word-stream went back up—but the fan fiction category was nowhere to be seen. Tentative joy and celebration!***

That’s when several users—the ones who had signed up for accounts to gain intel and had accessed their own fics that way—reported that their work could still be accessed through their history. Relevant Reddit post here.

Sooo—

We’re obviously not done. The fanwork that was stolen by Weitzman may be inaccessible through his website right now, but they aren’t actually gone. And the fact that Weitzman wasn’t willing to get rid of them altogether means he still has plans for them.

This was my final edit on my Reddit post before turning off notifications, and it's pretty much where my head will be at for at least the foreseeable future:

Please feel free to add info in the comments, make your own posts, take whatever action you want to take to protect your work. I only beg you—seriously, I’m on my knees here—to not give up like I saw a handful of people express the urge to do. Keep sharing your creative work and remain vigilant and stay active to make sure we can continue to do so freely. Visit your favorite fics, and the ones you’ve kept in your ‘marked for later’ lists but never made time to read, and leave kudos, leave comments, support your fandom creatives, celebrate podficcers and support AO3. We created this place and it’s our responsibility to keep it alive and thriving for as long as we possibly can.

Also FUCK generative AI. It has NO place in fandom spaces.

THE 'SMALL' PRINT (some of it in all caps):

*Weitzman knew what he was doing and can NOT claim ignorance. One, it’s pretty basic kindergarten stuff that you don’t steal some other kid’s art project and present it as your own only to act surprised when they protest and then tell the victim that they should have told you sooner that they didn’t want their project stolen. And two, he was very careful never to list the IPs these fanworks were based on, so it’s clear he was at least familiar enough with the legalities to not get himself in hot water with corporate lawyers. Fucking over fans, though, he figured he could get away with that.

**A note about the AI that Weitzman used to steal our work: it’s even greasier than it looks at first glance. It’s not just the method he used to lift works off AO3 and then regurgitate onto his own website and app. Looking beyond the untold horrors of his AI-generated cover ‘art’, in many cases these covers attempt to depict something from the fics in question that can’t be gleaned from their summaries alone. In addition, my fics (and I assume the others, as well) were listed with generated genres; tags that did not appear anywhere in or on my fic on AO3 and were sometimes scarily accurate and sometimes way off the mark. I remember You & Me & Holiday Wine had ‘found family’ (100% correct, but not tagged by me as such) and I believe The Shape of Soup was listed as, among others, ‘enemies to friends to lovers’ and ‘love triangle’ (both wildly inaccurate). Even worse, not all the fic listed (as authors on Reddit pointed out) came with their original summaries at all. Often the entire summary was AI-generated. All of these things make it very clear that it was an all-encompassing scrape—not only were our fics stolen, they were also fed word-for-word into the AI Weitzman used and then analyzed to suit Weitzman’s needs. This means our work was literally fed to this AI to basically do with whatever its other users want, including (one assumes) text generation.

***Fan fiction appears to have been made (largely) inaccessible on word-stream at this time, but I’m hearing from several authors that their original, independently published work, which is listed at places like Kindle Unlimited, DOES still appear in word-stream’s search engine. This obviously hurts writers, especially independent ones, who depend on these works for income and, as a rule, don’t have a huge budget or a legal team with oceans of time to fight these battles for them. If you consider yourself an author in the broader sense, beyond merely existing online as a fandom author, beyond concerns that your own work is immediately at risk, DO NOT STOP MAKING NOISE ABOUT THIS.

PLEASE check my later versions of this post via my main page to make sure you have the latest version of this post before you reblog. All the information I’ve been able to gather is in my reblogs below, and it's frustrating to see the old version getting passed around, sending people on wild goose chases.

Thank you all so much!

#fandom#plagiarism#AO3#speechify#word-stream#Cliff Weitzman#writers on tumblr#fan fic writing#AI plagiarism#independent authors#Ofek Weitzman#please share

44K notes

·

View notes

Text

The Surprising Benefits of Decluttering Toys for Kids

Less is More: The Power of Minimalism in Children’s Play As parents, we often find ourselves inundated with toys, each one promising to enrich our children’s lives in some specific way. From puzzles for spatial awareness to dolls that encourage empathy, it can feel like a never-ending quest to find the “perfect” toy. However, this abundance may not be as beneficial as we’ve been led to believe.…

#achieving goals#beauty hacks#body positivity#bodyweight exercises#breakup recovery#budgeting tips#building trust#cardio workouts#coaching business#color theory in fashion#communication skills#communication tips#conflict resolution#cooking for kids#coping with loneliness#dating advice#dating apps#decluttering#eco-friendly products#emergency fund#emotional intelligence#energy boosters#Entrepreneur Life#family activities#family dynamics#fashion hacks#fashion sustainability#fashion trends#financial independence#financial journey

0 notes

Text

Ways to Make Money Online and Offline

In today’s dynamic world, there are countless opportunities to generate income and achieve financial freedom. This comprehensive guide explores a wide range of strategies, both online and offline, that can help you make money and unlock new sources of wealth creation. Whether you’re looking to supplement your current earnings, start a side hustle, or embark on a new career path, this article…

#E-commerce Ventures#Entrepreneurship Tips#Financial Independence#Freelancing Jobs#Money-Making Apps#Offline Gigs#Online Income Opportunities#Passive Income Ideas#Side Hustles#Work From Home

0 notes

Text

Trucking Exodus: Why 35% of Owner-Operators Fail

Today, let’s talk about something that’s been weighing heavy on a lot of minds lately. Did you know that over a third of owner-operators—35.2% to be exact—are saying they’d leave the industry by the end of 2032 if things don’t get better? That’s not just a statistic; that’s a massive wake-up call for all of us. I know I don’t need to tell you how tough it’s been out here. Between skyrocketing…

View On WordPress

#business#cash flow management#Freight#freight broker issues#freight rates#Freight Revenue Consultants#independent truckers#logistics#owner-operator solutions#owner-operator struggles#owner-operators#save trucking industry#small carriers#Transportation#Trucking#trucking advocacy#trucking business tips#trucking costs#trucking crisis#trucking economy#trucking exodus#trucking financial strain#trucking future#trucking independence#trucking industry#trucking industry 2032#trucking industry challenges#Trucking industry news#trucking lifestyle#trucking market decline

0 notes

Text

Navigating Challenges: A Trad Wife’s Journey to Regaining Her Self-Sufficiency and Economic Stability

Life doesn’t come with a manual, and for many traditional wives (or “trad wives”), navigating life after stepping away from homemaking can feel like being thrown into uncharted waters. Whether due to divorce, separation, or simply a desire to step into a new chapter, regaining self-sufficiency and economic stability is a challenge—but one you are absolutely capable of conquering. The Turning…

View On WordPress

#Career Change For Moms#Career Skills For Moms#Career Tips For TradWives#Empower Women#Empowered Women#Financial Independence For Women#Financial Skills For Women#From Home To Career#Homemaker To Leader#Homemaker To Professional#Homemakers Can Lead#Rebuild Your Economy#Skills For The Workforce#Trad Wives Success#TradWife To Trailblazer#TradWives Reenter Workforce#TradWives Transformation#Women Career Transition#Women In Business#Women In Leadership#Workforce Reentry

0 notes

Text

RevenueWiz First Blogpost / Who are we? [EN]

Welcome to the RevenueWiz blog! 🚀✨

We're thrilled to have you here as we embark on our journey to empower individuals with the knowledge and tools necessary for achieving financial freedom. Founded in 2024, RevenueWiz has been dedicated to helping you navigate the complex world of affiliate marketing and trading, providing you with top-notch strategies and insights that can transform your financial future.

Who are we? 🤝

RevenueWiz is a small yet ambitious team, driven by curiosity and a passion for innovation. Though we may be few in number now, our sights are set on growth and expansion. We believe in the power of collaboration and are excited to grow together with you, our readers, and partners. 🌟

Our Expertise 📚

At RevenueWiz, we specialize in a diverse range of areas, ensuring that our affiliates can find the perfect niche for their interests and strengths:

Affiliate Marketing 📈: This is the cornerstone of our operations. We provide you with the best strategies to maximize your earnings through effective affiliate marketing techniques.

Trading 💹: From investment strategies to trading tips, we cover a wide array of topics designed to boost your earning potential and financial acumen.

Technology 💻: Stay ahead with the latest trends and innovations in the tech world, from gadgets to software.

Home and Decor 🏡: Explore stylish and practical solutions for your home, enhancing both functionality and aesthetic appeal.

Laptops and Gadgets 🖥️: We review and recommend the best tech products, ensuring you make informed decisions for your tech needs.

Outdoor Gear ⛺: From gardening tools to camping equipment, we have you covered for all your outdoor adventures.

Our Mission 🌐

To lead you on the path to financial freedom by providing reliable, actionable information and support. We believe that with the right knowledge, anyone can achieve their financial goals. We are committed to sharing valuable insights and the latest trends, all to help you stay informed and make the best decisions for your future.

Join Us on Our Journey 🚀

As a small, curious, and aspiring team, we're excited to grow and evolve with you. Our goal is to build a community where everyone can learn, share, and succeed together. Whether you're just starting out or are an experienced professional, RevenueWiz is here to support you every step of the way. 🤝

We believe in the power of collaboration and are looking forward to expanding our team and reaching new heights. Together, we can achieve great things and pave the way for a prosperous future.

Stay Tuned and Stay Empowered 🛤️

We’re excited to have you on this journey with us. Stay tuned for regular updates, insightful articles, and valuable resources that will help you stay ahead in the ever-evolving financial landscape. Connect with us, engage with our community, and let's journey together towards prosperity. 🌟

Thank you for joining us at the RevenueWiz blog. We’re excited to be part of your financial journey and can't wait to share more with you. 💬

#revenuewiz#affiliate marketing#trading tips#financial freedom#investment strategies#revenue growth#trading platforms#online income#market analysis#wealth management#passive income#financial independence#trading signals#stock market tips#forex trading#crypto trading#investment tools#money management#market trends#economic news#trading strategies#profit maximization#online trading#financial education#financial planning#personal finance#market insights#business growth#trading education#investment opportunities

0 notes

Text

Why Kenyans Can Earn Daily from Forex Instead of Seeking Jobs Overseas

Why search for overseas labor jobs when you can earn between KSh 1,000 to 5,000 daily trading Forex from your phone? Discover how Forex trading offers financial independence without leaving Kenya. Learn the steps to get started today.

Today, seeing thousands of Kenyans lined up at the Kenyatta International Convention Centre (KICC) for job interviews to work as laborers in Qatar was truly heartbreaking. The competition for these opportunities underscores a harsh reality: many Kenyans feel they must leave the country for stable income. However, this struggle for overseas jobs is unnecessary when there’s a reliable way to earn…

View On WordPress

#digital income#earn from Forex#earn from your phone#economic empowerment#financial freedom Forex#financial independence Kenya#Forex beginners Kenya#forex signals#Forex trading Kenya#jobs in Qatar#labor jobs#make money online Kenya#online income Kenya#trading for Kenyans#trading tips

0 notes