#FIRE movement

Explore tagged Tumblr posts

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

If you found this helpful, consider joining our Patreon.

#personal finance#saving money#retirement#saving for retirement#retirement account#retirement fund#401k#FIRE movement#early retirement#financial independence#investing#stock market#investors

77 notes

·

View notes

Note

I want to FIRE! Do you have any tips for that ;)

Hi love! While I'm not committed to their FIRE movement per se, here are some of my best tips to set yourself up for financial success:

Diligently keep track of your income and expenses. Audit every week or month to give yourself an honest look at your financial activity

Create financial goals and a realistic budget to help you achieve them

Prioritize saving up a 6-month emergency fund, maxing out your Roth IRA (or backdoor Roth IRA) and HSA account (if in the U.S.)

Purchase high-quality, timeless items that are built to last; It's cheaper in the long run to maintain items vs. constantly repurchasing items if you have the option

Create multiple sources of income: A 9-5 job, investments, side hustle, digital products, etc. Find ways to monetize activities you would enjoy doing without earning a dime

Focus on building a strong network and high-value, transferable skills: Even if you plan on working as an employee forever (no shame in that – it's a great way to get a steady paycheck), always strategize your career in a way that would leave you equipped to make it on your own. You need to be in the driver's seat of your career and financial life at all times

Make food at home, take care of your health, and take advantage of preventative medical testing, screenings, and procedures. Losing your health (physical and mental) is the easiest way to ruin your life satisfaction and your finances

Hope this helps xx

#finance#moneymindset#financial planning#savings tips#personal investments#female entrepreneurs#femme fatale#dark femininity#dark feminine energy#successhabits#success mindset#goal setting#it girl#queen energy#dream girl#female excellence#female power#femmefatalevibe#fire movement

77 notes

·

View notes

Text

When the pigs are not breeding the pigs are not worried, but the farmer and butcher are.

youtube

Just some wisdom I found in the comments section and the synopsis of the video.

#birth rate#pronatalism#fuck capitalism#Therese Lee#pigs#Youtube#farmcore#skeptic aesthetic#thoughts and tariffs#concepts of condolences#fafo#wealth building#money matters#financial freedom#debt free journey#FIRE movement#money mindset

3 notes

·

View notes

Text

The FIRE Movement: A Comprehensive Guide to Financial Independence and Early Retirement

Introduction In recent years, a revolutionary concept has emerged in the realm of personal finance, captivating the imagination of young adults worldwide. Known as the FIRE movement, which stands for Financial Independence, Retire Early, this philosophy offers more than just financial advice—it proposes a radical shift in lifestyle. This in-depth guide explores the intricacies of the FIRE…

View On WordPress

#asset allocation#budgeting tips#Compound interest#early retirement#financial autonomy#financial freedom#financial independence#Financial planning#FIRE movement#frugality#lifestyle choices#lifestyle inflation#living below means#passive income#personal finance#retire early#retirement planning#Risk management#savings strategies#side hustles#smart investing#Wealth Management

6 notes

·

View notes

Text

3 Books Every Twenty-Something Should Read (By a Twenty-Something)

(In no particular order)

The Defining Decade by Dr. Meg Jay

This book has been my go-to for various points of my college (and now post-grad) career. Whenever I felt that I was "lost" or had a "mid-life crisis", this book always came to the rescue.

In this book, Meg Jay goes through how to best use your 20s. Whether that be through relationships, hobbies, education and career choices. She also expands on the concept of developing identity capital which is a collection of things that make you, you. One of my favourite quotes by Meg is, "“Twentysomething is like airplanes, planes just leaving New York City-bound somewhere west. Right after takeoff, a slight course change is a difference between landing in either Seattle or San Diego. But once a plane is nearly in San Diego, only a big detour will redirect it to the northwest.”

2. Quit Like a Millionaire by Bryce Leung and Kristy Shen

This is a personal finance book that details how a Canadian couple, Bryce and Kristy, retired in their thirties. Both working as software engineers, they sought to buy a home in Toronto but found that getting into the housing market was out of reach. Instead, they opted to use the money that could have gone towards a house into the stock market where they were both able to retire and travel the world.

Reading this opened my eyes to the various possibilities and routes to financial independence. One that isn't defeatist about the current housing market, but rather optimistic about other possibilities!

3. The Almanack of Naval Ravikant

The writer, Naval Ravikant, is the founder of various companies in Silicon Valley and wrote a guide to building wealth and emotional well-being unlike anything else I've seen. Most books I read surrounding generating wealth are pretty redundant, but what I found by reading this book was that everything written was unique yet so simple.

#personal development#books#book reviews#naval#naval ravikant#the almanack of naval ravikant#kristy shen#bryce leung#fire#personal finance#fire movement#financial independence#the defining decade#meg jay#defining decade#book#roncy89

3 notes

·

View notes

Text

Escape the Rat Race: Achieving Financial Independence Through the FIRE Movement

Imagine a life unshackled from the daily grind, where work becomes a choice, not a necessity. This is the alluring promise of the Financial Independence, Retire Early (FIRE) movement, a growing community of individuals dedicated to achieving financial freedom at a younger age. While the idea of early retirement might seem like a pipe dream, the FIRE movement offers a roadmap – albeit a…

0 notes

Text

The retire early (FIRE) movement

The retire early or Financial Independence Retire Early (FIRE) movement is led by a large group of people dedicated to extreme saving and investing to allow them an earlier than normal retirement. These people, collectively, implement ways to cut down on expenses to allot a large portion of their income to investing. This in turn allows them to retire in their 40's, 30's, and sometimes 20's! To give some examples of their methods, living in shared housing (roomates, duplexes, etc), cooking from scratch and sticking to a strict budget, paying cash to purchase cheap/used vehicles, and living far below their means.

This level of saving and investing is very out the norm and takes alot of discipline. If your interested you should check out more FiRE movement articles.

References:

Kerr. A. (2024, August 16) "Financial Independence, Retire Early (FIRE): How It Works". https://www.investopedia.com/terms/f/financial-independence-retire-early-fire.asp

0 notes

Text

南の島でサイドFIRE

サイドFIREへの道のりやお金にまつわる話しなど、皆さまにきっと役立つ有益情報をエンタメ(円貯め)風に発信しています!

#FIRE

0 notes

Text

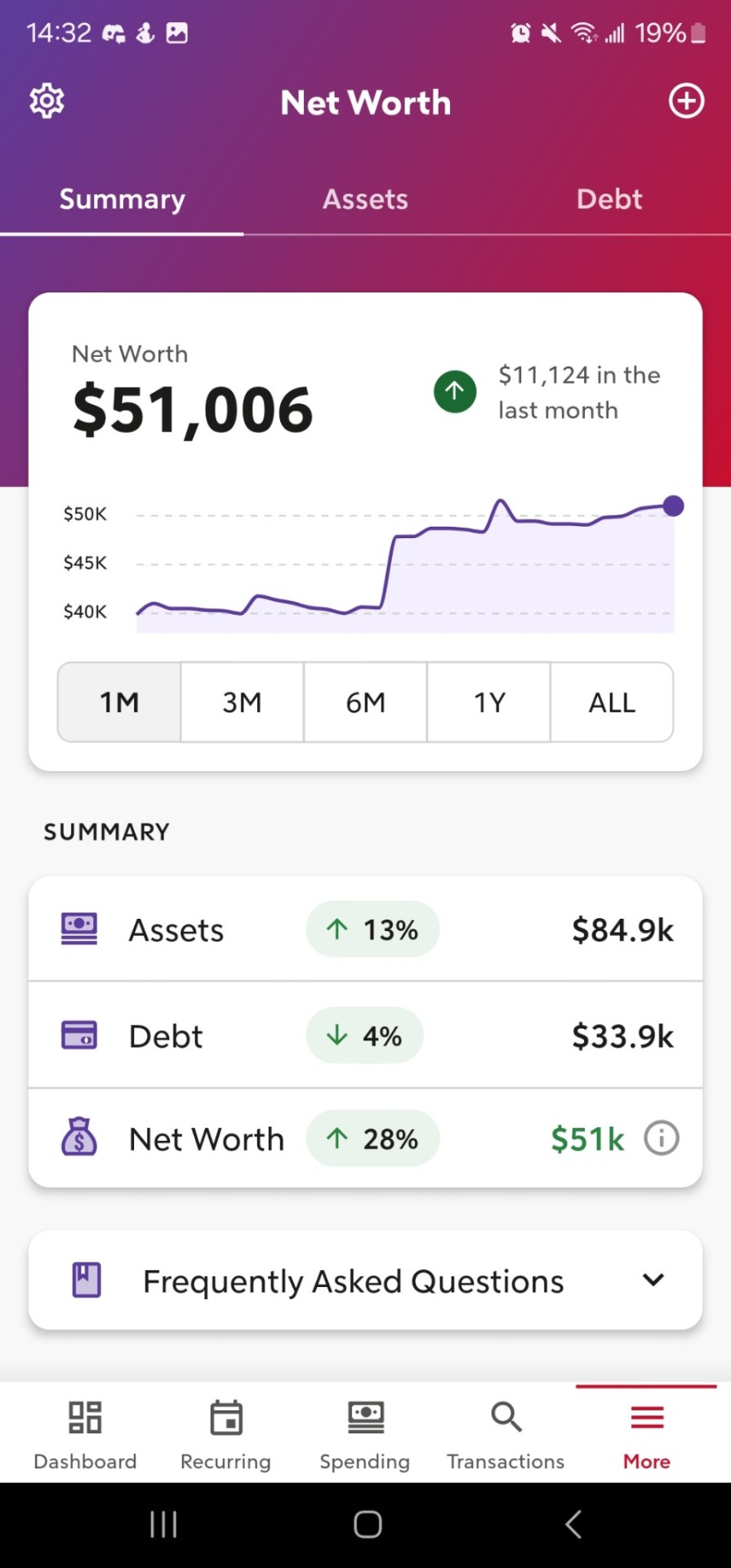

Since October 2023,

I've been focusing on improving my financial wellness and we're now 8 months from being consumer debt free.

0 notes

Text

FIRE Basics

What is FIRE? FIRE stands for Financial Independence, Retire Early. The fire movement has a lot of different types of philosophies and strategies that people embrace, but the commonality that ties them together is the idea of achieving financial independence so that your life isn’t dictated by earning an income. Financial independence is typically defined in FIRE as having enough passive…

View On WordPress

#budgeting#educational#FI#finance#finances#financial independence#fire#fire movement#investing#money#personal-finance#real hourly wage#resources#retire early#saving

0 notes

Text

Cryptocurrency: A Beginner's Guide

In a world dominated by digital innovations, cryptocurrency has emerged as a buzzword that many have heard but few truly understand. If you’ve found yourself intrigued but perplexed by this digital currency phenomenon, fear not – you’re not alone. Let’s embark on a journey to demystify cryptocurrency and shed light on what it really is. At its core, cryptocurrency is a form of digital or virtual…

View On WordPress

0 notes

Text

The FIRE Movement, Explained

Am I really writing about the FIRE movement? Seven years into running what is, ostensibly, a FIRE movement blog? Why yes, I am!

Today, I’m explaining a concept so important to us—so central and foundational to every aspect of our lives—that we forgot to write about it. For years.

Keep reading.

If you found this helpful, consider joining our Patreon.

#FIRE movement#early retirement#financial independence#personal finance#money management#financial freedom

53 notes

·

View notes

Text

Stocks Update: Long road to F.I.R.E

So. My last post was February last year, and I’m picking up where I left off to give an update on this self-imposed challenge. First up, I transferred to a higher paying job (compared to my previous employer that is). Which means that I get to add more to my investments. Yay! So let’s see the figures in terms of annual dividends. 2020202120222023$238$322$716$1190 So we all know what went on…

View On WordPress

0 notes

Text

Capitalism is the root of all economic evil.

If you've ever wondered why you can spend $1,000 in an hour but go weeks without spending a dime, it might be a sign of an unhealthy relationship with money. Before we can start healing this relationship, it's important to understand who's to blame. Let Chelsea Fagan from The Financial Diet break down the 6 people responsible.

youtube

#anti capitalism#antifascist#Suze Roman#ronald reagan#tfd#The financial diet#personal finance#Youtube#skeptic aesthetic#fafo#thoughts and tariffs#concepts of condolences#FIRE movement#financial indepence retire early#money mindset#money matters#wealth building#financial freedom

1 note

·

View note

Text

1 note

·

View note

Text

4 Ways to FIRE: The FIRE Movement

Exploring the FIRE movement and different types. Learn the pillars of FIRE and decide if it is right for you.

Igniting Your Path to Financial Independence In the realm of personal finance, few concepts have sparked as much interest and debate in recent years as the FIRE movement. An acronym for “Financial Independence, Retire Early,” FIRE embodies a lifestyle and financial strategy that’s gaining momentum among millennials and older generations alike. Let’s dive into the essence of FIRE and explore its…

View On WordPress

1 note

·

View note