#Finance and Investment

Explore tagged Tumblr posts

Text

Step-by-Step Guide for Binary Trading: Master the Basics and Start Trading with Confidence

Introduction

In today’s fast-paced financial markets, binary trading has emerged as a popular and accessible option for investors looking to engage in short-term speculation. Unlike traditional forms of trading that require complex strategies and technical analysis, binary options trading simplifies the process by offering a fixed payout for a correct prediction on whether the price of an asset will rise or fall. If you’re considering entering this exciting field, a comprehensive understanding is essential. In this article, we’ll provide a detailed step-by-step guide for binary trading that will help you grasp the fundamentals, understand key strategies, and manage your risks effectively.

What Is Binary Trading?

Before we dive into the step-by-step guide, let’s first define what binary trading is. Binary options are financial instruments that allow traders to predict the price movement of an asset, such as a stock, currency pair, or commodity. The term "binary" refers to the two possible outcomes of a trade: either the price will go up or it will go down.

A binary option trade involves choosing a specific asset and predicting whether its price will rise or fall by the expiry time of the contract. If the prediction is correct, the trader receives a fixed payout; if wrong, the trader loses the invested amount. It’s a simple concept, but the key to successful binary trading lies in understanding how to make accurate predictions and manage risk.

Step-by-Step Guide for Binary Trading

Step 1: Understand the Basics of Binary Options

To start, it’s crucial to have a clear understanding of the binary options market. Binary options are typically available on various assets, including:

Stocks: Prices of shares from major companies.

Forex (Foreign Exchange): Currency pairs like EUR/USD or GBP/JPY.

Commodities: Gold, silver, oil, and other natural resources.

Indices: Stock market indices like the S&P 500 or FTSE 100.

In binary options trading, you’ll be asked to predict whether the price of an asset will go "up" (Call option) or "down" (Put option) within a certain time frame. The potential return is usually predefined (e.g., 70-90% of your investment), making it easier to calculate potential profits or losses.

Step 2: Choose a Reputable Binary Options Broker

Selecting a trustworthy binary options broker is the foundation of successful trading. In order to find the best one, consider factors such as:

Regulation: Ensure the broker is regulated by a recognized financial authority. This adds a layer of security and protects your funds.

Platform features: Look for user-friendly platforms with powerful tools for analysis and real-time data.

Assets available: Check the range of assets you can trade. Some brokers specialize in specific markets, while others offer a wide variety.

Payout structure: Compare the payouts offered by different brokers. A high payout percentage can significantly boost your earnings.

Customer support: A good broker should offer responsive customer support to address any issues you might encounter.

Step 3: Choose Your Asset and Time Frame

Once you’ve registered with a binary options broker and logged into your trading platform, the next step is to choose your asset. The asset you pick will determine the volatility, market conditions, and potential profits. You can trade stocks, commodities, forex pairs, or indices.

After selecting an asset, you’ll need to choose a time frame, known as the expiry time. This is the duration in which the price of the asset is expected to move in a particular direction. Expiry times can range from as short as 30 seconds to as long as several hours or even days.

Step 4: Analyze the Market

To increase the likelihood of making successful predictions, you need to analyze the market. There are two primary ways to do this:

Technical Analysis: This method involves studying past market data, particularly price charts, to identify patterns and trends. Tools like moving averages, RSI (Relative Strength Index), and Bollinger Bands are commonly used in binary options trading.

Fundamental Analysis: This approach involves understanding the factors that influence the price of an asset, such as economic data, company earnings reports, or geopolitical events. While this type of analysis is more relevant for long-term trading, it can also be helpful for predicting short-term movements.

Step 5: Place a Trade

After completing your market analysis, it’s time to place a trade. You will need to choose the direction of the asset’s price movement (Up or Down), decide on the investment amount, and set the expiry time. Once you’ve confirmed these details, place your trade and wait for the result.

When you place a binary options trade, it’s essential to understand the risks involved. Binary options are all-or-nothing instruments, meaning you either win a fixed payout or lose your investment. This makes it vital to trade responsibly and avoid placing large bets without sufficient analysis.

Step 6: Manage Your Risk with Money Management Strategies

In binary trading, managing your risk is just as important as making correct predictions. Effective money management strategies help protect your capital and maximize long-term profitability. Here are a few strategies you can employ:

Fixed Investment Strategy: This involves risking the same amount of money on every trade. It’s a safe approach that helps minimize large losses but may limit your potential profits.

Percentage-based Strategy: Here, you risk a set percentage of your account balance on each trade. This method adjusts your trade size based on the size of your account, reducing the risk of heavy losses during a losing streak.

Martingale Strategy: This strategy involves doubling your investment after a loss, with the goal of recovering previous losses once you win. While it can be effective, it’s a high-risk strategy and should only be used with caution.

Step 7: Monitor Your Trades and Evaluate Results

After placing your trade, it’s important to monitor its progress, especially if you’re using short expiry times. However, avoid excessive watching as this can lead to emotional decisions that may affect your judgment.

Once the trade expires, evaluate the results. If your prediction was correct, you will receive the fixed payout. If you were wrong, you will lose your invested amount. Regardless of the outcome, always take the time to review each trade to learn from your mistakes and successes.

Step 8: Keep Learning and Improving

Binary options trading is a continuous learning process. It’s important to regularly assess your trading strategy and adapt to market changes. Keep an eye on news that could affect your chosen assets and always strive to improve your skills and knowledge. Many brokers offer demo accounts where you can practice trading without risking real money—this is an excellent way to build confidence before moving to a live trading account.

Conclusion

In summary, binary options trading can be an exciting and profitable venture when approached with the right knowledge and strategy. By following this step-by-step guide for binary trading, you’ll have a solid foundation to start trading responsibly and effectively. Remember, it’s crucial to always practice good risk management, continue learning, and trade with a clear strategy in mind.

Binary trading might seem simple at first glance, but it requires discipline, patience, and a willingness to learn. By applying the steps outlined in this guide, you’ll increase your chances of success and move closer to becoming a proficient binary options trader.

0 notes

Text

Basic Financial Rules To Live By 💰✨

Create a plan that shows how much money you get and how much you spend. This helps you see where your money goes.

Set aside a part of your money as savings. Try to save at least 10-20% of what you earn.

Be careful with borrowing money, especially if you have to pay back a lot of extra money (interest).

Save some money for unexpected things like medical bills or losing your job. Aim to have enough to cover your living costs for a few months.

Put your saved money into different things that can make it grow, like stocks or real estate. Be patient, as it takes time.

Don't spend more money than you make. Stick to buying what you really need, not just what you want.

Decide what you want to do with your money, both in the short term (like a vacation) and long term (like retirement).

Set up automatic transfers to your savings and bills so you don't forget to save or pay your bills on time.

Make saving money a top priority before spending on other things.

Regularly look at your money situation, adjust your plan as needed, and see how your investments are doing.

Pay your bills on time and use credit wisely (like credit cards) to keep a good credit score, which can help you get better deals on loans.

Save money for when you're older and don't work anymore. Use retirement accounts to help with this.

Think before you buy things. Don't buy something just because you want it; think if it's necessary.

Keep learning about how money works and how to make smart money choices.

Only use your emergency fund for real unexpected problems, not for things you just want to buy.

#financial planning#finance#investing#money#girl math#wealth#level up journey#it girl#dream girl#dream girl guide#dream girl tips#dream girl journey#that girl#becoming that girl#educate yourself#wealth mindset#growth mindset#success mindset

3K notes

·

View notes

Text

BUDGETING + SAVING MONEY FOR TEENS 𐙚

For many of us, we are entering an age when we can work casual jobs such as retail or fast food. It’s not a lot of money that we receive, depending on how often you get paid, but it can go a long way in the long term.

In this post, I’ll be discussing how to budget for your needs/wants and save money for future goals.

CREATING GOALS, you may want to save a certain amount of money in a time frame, want to make a big purchase (like a car) or buy everything off your wishlist. It is entirely up to you what your goals are, so I can’t say too much. However, the more specific it is, the better.

HOW MUCH? Determine how much money you need to save to achieve your goal. In total, and monthly.

There are three types of saving goals that may apply to you;

Short-term goals >1 year (outings, latest gadget, buying your cart)

Medium-term goals 1-2 years (road trips, shopping spree)

Long-term goals 2-4 years (higher education, car)

It’s very important to set a realistic time frame, as teens we don’t get paid much and we also don’t work as much. You don’t want to overwhelm yourself as well, as it takes patience and self-control to achieve these goals.

NO LOOONG-TERM GOALS! This may sound aggressive, but any money that just sits in your account for years on end is dead money. Even though the amount of money is increasing, its value is slowly decreasing. Keep your goals achievable within a time frame of less than four years. It's much more useful if this money is put into some type of investment instead.

CREATING A BUDGET

Calculate how much money you receive every month, and how much money you spend every month.

You have two types of expenses. Fixed and variable. Fixed are any expenses required in your day-to-day life or it’s an amount of money that doesn’t change e.g. subscriptions or transportation costs. Variable costs are expenses that may fluctuate, like food, or any other recreational activities.

Record the average you’re spending monthly with these two categories.

There are many ways people choose to budget, but you have to choose a system that works for you.

Work out how much money you need to save each month to achieve your goal.

However, for anyone who’s starting in budgeting, I would say to allocate your costs using a percentage system. Your percentages for each category are going to differ from mine; e.g. 60% = savings, 20% = wants, 20% needs. Make sure it reflects the end goal.

Track your progress. This is the major part of budgeting, you want to be recording and regularly reviewing how much money you’re spending and comparing it to how much you’re earning. It allows for space to reflect on the flow of your money like if some purchases are worth it, if you’re impulsively spending, or if you’re frequently withdrawing money from your savings.

Adjust if needed. Maybe you want to put more money in savings and less into wants, or you want to put more into wants and less into needs.

SAVING TIPS

SAY NO! This is probably my biggest struggle at the moment, but say no to things that will cause you to go off track. Whether its outings, getting fast-food or anything similar, say no. You have to be firm with your financial boundaries, as these opportunities will always arise again.

RESTRICT IMPULSIVE SPENDING. We all have our moments when we see a product and we instantly think ‘I’ve got to have this’. Giving in once or twice is okay, but it shouldn’t become a habit at all. Its unnecessary spending (most of the time!) and leads to buyers remorse.

IS IT WORTH IT? Always remember to work out which products you’re getting the most value out of.

PAYING FOR THE NAME, a lot of brands will cut down on quality to save a few dollars, so essentially the customer is only paying for the name of that brand. Just because a store is more expensive, doesn’t mean its better.

#prettieinpink#becoming that girl#that girl#clean girl#green juice girl#dream girl#dream girl tips#it girl#vanilla girl#glow up#pink pilates princess#dream girl journey#dream girl life#dream girl vibes#dream life#wealth#old money#money#finances#invest#wonyoungism#it girl tips#it girl energy#winter arc#abundance#becoming her#that girl lifestyle#that girl routine#glow up era#feminine journey

748 notes

·

View notes

Text

financial literacy⋆.ೃ࿔*:・✍🏽🎀

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

WHAT IS FINANCIAL LITERACY ;

financial literacy is handling ur money wisely. the google definition of financial literacy is the ability to understand and apply different financial skills effectively, including personal financial management, budgeting, and saving.

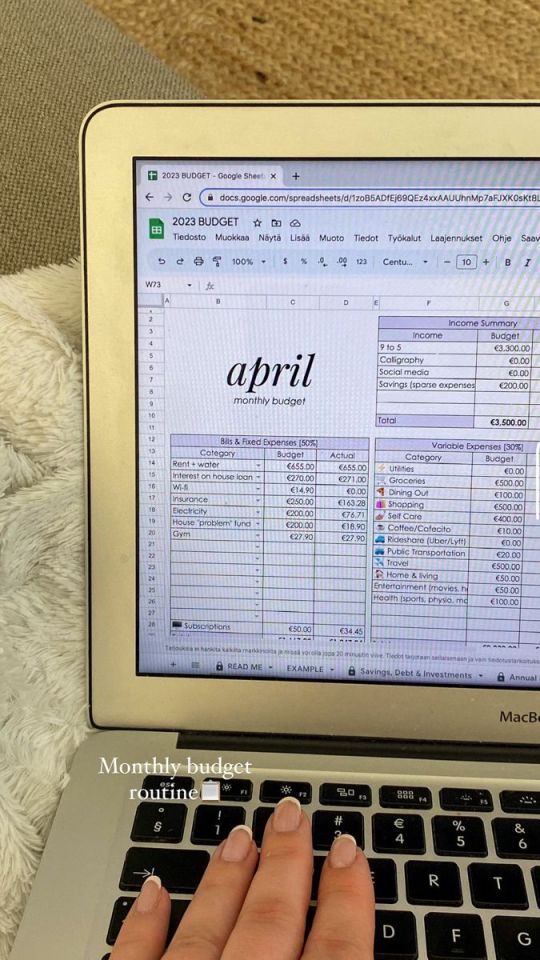

ALL ABOUT BUDGETING ;

when u hear the word "budget" its rly easy to think "omg limiting belief" or think of it in a negative light but a budget is just a plan on how u manage ur money. its not always constrictive and negative like u may or may not think of it to be.

budgeting : keeping track of how much $ ur bringing in and how much ur spending…💬🎀

planning a budget is ez pz. you can use some paper and sparkly pink gel pens to create an adorable budget, or u can download different sheets online and just have your budget digitally. theres a plethora of resources out there so just choose whichever is easier for u.

something else that i learned about during this course was the 50:30:20 rule. its called the 50:30:20 rule because 50% of ur money goes towards ur needs, 30% goes towards wants and 20% goes towards ur savings. and this isnt concrete, its just a good framework and u can adjust to ur own specific needs and goals.

for example if u manifested $4000. ur 50% would be $2000, ur 30% would be $1200 and ur 20% would be $800…💬🎀

HOW DO U KNOW WHAT UR NEEDS/WANTS ARE ;

things like ur rent and groceries are ur needs and things like vacations and going out with ur girls are wants. and to apply the 50:30:20 rule you first have to...

♡ calculate ur needs, wants and savings budget

♡ compare ur expenses to ur budget

the way u do this is to subtract your expenses from your budget. this is your budget balance. if your budget balance is zero or positive, that means you are living within your means and have some extra money. if your budget balance is negative, that means you are spending more than you should and may have a budgeting problem.

let me know if u guys want more content about this cuz i had a lot of fun writing this…💬🎀

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

647 notes

·

View notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about money#submitted june 26#crypto#cryptocurrency#money#personal finance#investments

246 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

493 notes

·

View notes

Text

🐙⚔️

#new method of dining & dashing: dine and doze. sleep until they give up on u and u get out of the bill. its genius#he didnt even order a drink like silver ur bill wouldnt be too high. surely. glances at azul#im actually v curious abt the finances of briar valley students beyond malleus. like im sure lilia is taken care of from military days#but like? the guy is retired. so when did he officially retire in a 'no longer getting income' way. or do they do pensions#or did he invest. or save. does twst have 401ks. what abt roth iras. what abt etfs. money market accts? high int savings?? i need to know#did he get a bond for silver as a baby that he can take out at 18. does silver get allowance. or part time job? i NEED TO KNOW#sebek seems middle class so do lilia and silver BUT I NEED DETAILS#also in the bg pretend trey is talking to jade offscreen. and the canonicity of this drawing is after book 5#so no ortho OR sebek in freshmen squad. not yet#twst#twisted wonderland#twst silver#azul ashengrotto#ace trappola#deuce spade#jack howl#epel felmier#trey clover#suntails#i would say mostro lounge was fun to draw but i dont make a habit of lying#well i mean. it wasnt NOT fun. it was satisfying? i felt accomplished? but the process was a bit rough

279 notes

·

View notes

Text

Exciting news from Arizona! The opening of the Eleven Mile Solar Center marks a $1 billion investment in clean energy by ACPMember OrstedUS The solar & energy storage project is set to power 65,000 homes. Take a look at the project celebration.

#clean energy#solar energy#sustainable development#investing#capitalism#finance#baking#city#commercial#clouds

64 notes

·

View notes

Text

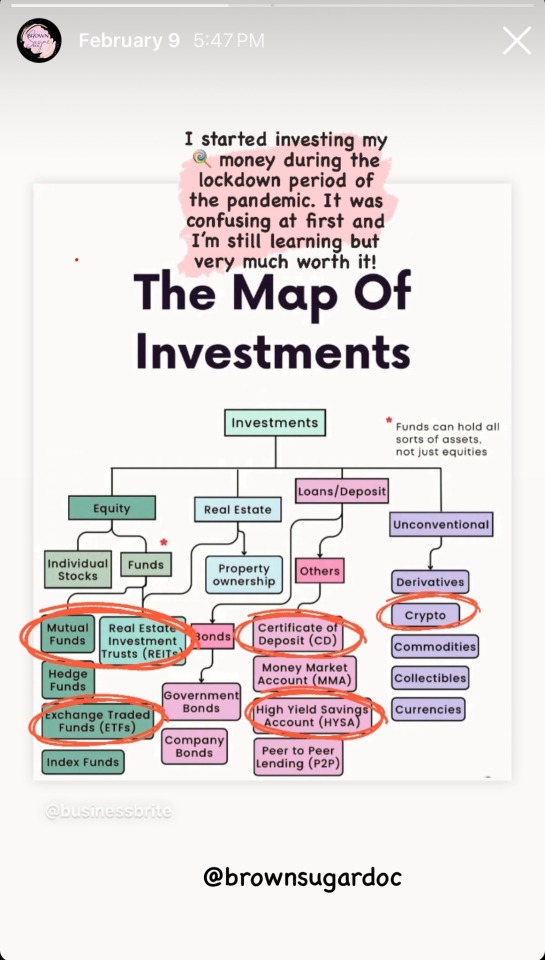

How are you investing 🍬 or extra money? I started trying to learn about stock investments during the panorama. I lost just under $5k playing around with crypto 😭 but I learned (and still learning) a lot about financial management. I recently moved $10k from my HY savings account to a CD. I was dating a finance guy and he told me to open up a CD because it’s a higher interest rate and he matched my initial deposit 🥰 There’s so much to learn but it’s much better than letting money sit & collect dust! I’ve been wanting to hop on live & share my experiences with sugar investments 🤔

#sugar lifestyle#sugar blog#levelup#money mindset#finance#extra money#sugar bowl#sugar baby tips#sugar dating#heaux tips#hypergamy#black women in luxury#dating#levelingup#sugar life#investing

146 notes

·

View notes

Text

like you used to hate watch myung gi’s channel because you’re a bitter pervert (who privately posts about how stupid he is while simultaneously gooning) and now you’re in the games with him and his baby mama, trying to ignore that you’re jealous even if you think he’s a loser

#SORRY!#me and io in this bitch alone like oh okay#you leave hate comments while you’re *GUNSHOTS* on your phone screen#it’s funnier if you didn’t even invest in his bitcoin bc you know better#people say they want more toxic readers well i’m just embracing it#myung gi lowk dragging me out of in ho hell into finance bro city#but like i still want to rim in ho and suck on his toes#📜.scrolls#squid game#squid game x reader#myung gi x reader#myung gi#squid game season 2

24 notes

·

View notes

Text

If we’re made in “god’s image” then does god also have a crippling piss kink?

327 notes

·

View notes

Text

WHY INVESTING IN YOURSELF WILL CHANGE YOUR LIFE

"The best thing you can do is to be exceptionally good at something," said Buffett. He added, "Whatever abilities you have can't be taken away from you. They can't actually be inflated away from you. ... So the best investment by far is anything that develops yourself, and it's not taxed at all."

- Warren Buffet

There is a reason people call Mr. Buffet the "Oracle/Sage Of Omaha".

Not only he is great at asset management and making the right predictions when it comes to the financial markets, but he is also very wise and offers great advice.

Investing in your own self is the only type of investment you can make that is absolutely safe and guaranteed to give you a return on investment that would satisfy you.

Knowledge is fuel. You are the vehicle.

We are living in times of abundance. Knowledge and data curation is the hottest skill someone can learn right now. That's what AI models like ChatGPT do. They curate useful data from trash. That's what you should also do with your mind. Throw out what's hindering your growth and feed your brain with nutritious food for thought.

We are nearing the "Age Of Abundance", the Golden Saturnian Age of our times. Don't fall into oblivion.

The resources are within a finger's reach. You are actually holding the most precious asset in your hands right now, that's how I reached you.

Whoever takes advantage of this situation will succeed.

Read books, articles, essays. Watch videos and documentaries. Educate yourself for free. If you have the ability to get a university degree for free, do it ! Don't fall in the trap of "degrees are useless". Instead choose to educate yourself in subjects that interest you and make you even more savvy. Invest in evergreen skills. Learn content creation, marketing and money management. Study philosophy to learn the art of critical thinking.

In the next 10 years we will all transform from 9 to 5 slaves to freelancers and one-person businesses. This is where we are headed. Notice all the lay-offs and how artificial intelligence has taken the world by storm.

Be proactive.

#finance#level up journey#leveling up#leverage#level up#investment#essay#source:thesirencult#hypergamyblr#seduction#tarot reading#ai#business#entreprenuership

378 notes

·

View notes

Text

Wealth Building: Money Topics You Should Learn About If You Want To Make More Money

Budgeting: This means keeping track of how much money you have and how you spend it. It helps you save money and plan for your needs.

Investing: This is like putting your money to work so it can grow over time. It's like planting seeds to grow a money tree.

Saving: Saving is when you put some money aside for later. It's like keeping some of your treats for another day.

Debt Management: This is about handling money you owe to others, like loans or credit cards. You want to pay it back without owing too much.

Credit Scores: Think of this like a report card for your money habits. It helps others decide if they can trust you with money.

Taxation: Taxes are like a fee you pay to the government. You need to understand how they work and how to pay them correctly.

Retirement Planning: This is making sure you have enough money to live comfortably when you're older and no longer working.

Estate Planning: This is like making a plan for your stuff and money after you're no longer here.

Insurance: It's like paying for protection. You give some money to an insurance company, and they help you if something bad happens.

Investment Options: These are different ways to make your money grow, like buying parts of companies or putting money in a savings account.

Financial Markets: These are places where people buy and sell things like stocks and bonds. It can affect your investments.

Risk Management: This is about being careful with your money and making smart choices to avoid losing it.

Passive Income: This is money you get without having to work for it, like rent from a property you own.

Entrepreneurship: It's like starting your own business. You create something and try to make money from it.

Behavioral Finance: This is about understanding how your feelings and thoughts can affect how you use money. You want to make good choices even when you feel worried or excited.

Financial Goals: These are like wishes for your money. You need a plan to make them come true.

Financial Tools and Apps: These are like helpers on your phone or computer that can make it easier to manage your money.

Real Estate: This is about buying and owning property, like a house or land, to make money.

Asset Protection: It's about keeping your money safe from problems or people who want to take it.

Philanthropy: This means giving money to help others, like donating to charities or causes you care about.

Compounding Interest: This is like a money snowball. When you save or invest your money, it can grow over time. As it grows, you earn even more money on the money you already earned.

Credit Cards: When you borrow money or use a credit card to buy things, you need to show you can pay it back on time. This helps you build a good reputation with money. The better your reputation, the easier it is to borrow more money when you need it.

Alternate Currencies: These are like different kinds of money that aren't like the coins and bills you're used to like Crypto. It's digital money that's not controlled by a government. Some people use it for online shopping, and others think of it as a way to invest, like buying special tokens for a game.

1K notes

·

View notes

Text

Real me

48 notes

·

View notes

Text

financial literacy continued⋆.ೃ࿔*:・👛💵

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

HOW TO SAVE MONEY ;

automatically deposit a certain percentage of ur income into ur savings account so that u dont even have to think about it

to do something more FUN tho, (at least in my opinion) is to make a challenge where u have to save every $10 dollar bill, or $20 dollar bill or whatever. just something to make saving money seem like a game if u wanna have some fun with it.

EMERGANCY FUND ;

most experts will tell u that ur emergency fund should be 3-6 months of ur needed expenses. so calculate ur needed expenses and multiply that by 6 to figure out how much you'd need to have in ur emergency fund.

PAYING YOURSELF FIRST ;

you should always put urself first in every single situation including financially. so to pay urself first simply means to put ur future and needs before anything else. FOR EXAMPLE... let's say u wanna buy an ipad by the end of the year, an ipad is $345.

lets also say that u get paid weekly, so you'd divide $345 by the number of weeks in a year (52) you'd get 6.6. so you'd have to save roughly $6-$6.50 a week which isnt a lot at all. and you'd be getting what u want.

INTEREST AND CREDIT ;

interest is like a reward that the bank gives you for trusting them to look after your money. the more money you have in your account, and the longer you keep it there, the more interest you can earn…💬🎀

so the bank calculates interest as a percentage of the total amount in a bank account. so if the bank pays a 1% interest you'll earn $1 for every $100 in ur bank account over the course of a year. so if u have $500 in ur account you'll get $5. its not a lot, but interest builds on itself.

credit is the ability of the consumer to acquire goods or services prior to payment with the faith that the payment will be made in the future…💬🎀

for example missing payment deadlines can negatively affect ur credit score. why is this important? if u wanna go to college and wanna use student loans, u might not be able to if ur credit history is bad. as ur credit history grows you'll get a credit score. the higher ur score, the better ur credit is.

BUILDING CREDIT ;

get a secured card. a secured credit card is a special type of credit card with a down payment. when you open the card, you will give the credit card company a deposit to hold. it can be as little as $100. the company holds the money for you and gives you a credit card with a line of credit equal to your deposit

sign up for victoria's secret direct paper mailers. you'll get a coupon each month for 1 free panty for every purchase. when u go to the mall, get urself a panty and a sweet treat 🧁 (DO NOT PUT ANYTHING ON THE CARD THAT U CANT IMMEDIATELY PAY OFF)

and then go home and pay ur credit card bill off, and then dont use it again until the next month.

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

832 notes

·

View notes