#loan eligibility

Explore tagged Tumblr posts

Text

How to Improve Your Debt-to-Income Ratio for a Higher Loan Amount?

When applying for a personal loan, lenders consider various factors to determine your eligibility. One of the most critical factors is your Debt-to-Income (DTI) ratio. A high DTI ratio can lower your chances of securing a loan or result in a lower loan amount.

So, how can you improve your DTI ratio and qualify for a higher personal loan amount? This guide will walk you through everything you need to know about the DTI ratio and the best strategies to improve it.

What Is Debt-to-Income (DTI) Ratio?

The Debt-to-Income (DTI) ratio is a financial metric that compares your monthly debt payments to your gross monthly income. It helps lenders assess your ability to manage additional debt.

Formula to Calculate DTI Ratio:

DTI Ratio=(Total Monthly Debt PaymentsGross Monthly Income)×100\text{DTI Ratio} = \left( \frac{\text{Total Monthly Debt Payments}}{\text{Gross Monthly Income}} \right) \times 100DTI Ratio=(Gross Monthly IncomeTotal Monthly Debt Payments)×100

For example, if you earn ₹50,000 per month and have ₹20,000 in debt obligations, your DTI ratio is: (20,00050,000)×100=40%\left( \frac{20,000}{50,000} \right) \times 100 = 40\%(50,00020,000)×100=40%

Why Does DTI Ratio Matter for a Personal Loan?

Lenders use the DTI ratio to determine how much additional debt you can handle. A low DTI ratio shows that you have sufficient income to repay the loan, increasing your chances of approval for a higher loan amount.

Ideal DTI Ratio for Personal Loans

✔ Below 30% – Excellent, high chances of approval for a large loan amount ✔ 30% - 40% – Good, but lenders may impose some restrictions ✔ 40% - 50% – Moderate risk, may get approved but with higher interest rates ✔ Above 50% – High risk, difficult to get approval for a personal loan

If your DTI ratio is high, you must work on reducing it before applying for a personal loan.

How to Improve Your DTI Ratio for a Higher Personal Loan Amount?

To enhance your loan eligibility, you need to either increase your income or reduce your existing debts. Let’s explore some of the best ways to improve your DTI ratio.

1. Pay Off Existing Debts

Reducing your outstanding debts is the most effective way to lower your DTI ratio. Start by:

✔ Paying off high-interest debts such as credit cards ✔ Clearing small loans to free up monthly income ✔ Making extra payments to close loans faster

📌 Example: If you have a ₹5,000 monthly credit card bill and you clear it, your DTI ratio will improve, increasing your eligibility for a higher personal loan amount.

2. Increase Your Monthly Income

If reducing debt isn't an immediate option, increasing your income can help improve your DTI ratio. Consider:

✔ Taking up freelance work – Writing, designing, consulting, etc. ✔ Starting a side business – Selling products online, offering services ✔ Negotiating a salary hike – Request a raise from your employer ✔ Renting out property – Earn passive income from real estate investments

📌 Example: If your current salary is ₹50,000 and you earn an extra ₹10,000 through freelancing, your income increases to ₹60,000. This lowers your DTI ratio, making you eligible for a bigger personal loan.

3. Consolidate Your Debt with a Personal Loan

If you have multiple high-interest debts, debt consolidation can be a smart move. You can take a personal loan at a lower interest rate and repay all high-cost debts.

✔ Reduces your monthly EMI burden ✔ Lowers your overall interest rate ✔ Helps manage finances with a single EMI

📌 Example: If you are paying ₹10,000 for a credit card and ₹8,000 for another loan, a personal loan with a lower EMI of ₹12,000 can reduce your DTI ratio.

4. Extend Your Loan Tenure

If you are struggling with high EMIs, extending your loan tenure can reduce your monthly debt payments and lower your DTI ratio.

✔ Lower EMIs make it easier to manage finances ✔ Lenders consider you a low-risk borrower

📌 Example: If your current EMI is ₹15,000 on a 5-year loan, extending it to 7 years can reduce your EMI to ₹12,000, improving your DTI ratio.

5. Avoid Taking New Loans Before Applying for a Personal Loan

Applying for multiple loans at once can increase your DTI ratio, reducing your chances of approval for a high loan amount.

✔ Limit new loan applications until your current debts are under control ✔ Avoid unnecessary credit card purchases that increase your outstanding dues

📌 Example: If you plan to take a personal loan next month, avoid applying for a car loan today, as it will increase your debt burden.

6. Make Lump-Sum Payments Towards Your Debt

If you receive a bonus, tax refund, or unexpected income, consider making a lump-sum payment towards your outstanding debt.

✔ Reduces overall debt amount ✔ Improves credit score ✔ Lowers DTI ratio for a higher loan amount

📌 Example: If you owe ₹1,00,000 on a personal loan, using a ₹50,000 bonus to prepay will reduce your EMIs and improve your loan eligibility.

7. Improve Your Credit Score

A high credit score (750+) improves your credibility and increases your loan approval chances.

✔ Pay EMIs and credit card bills on time ✔ Keep credit card utilization below 30% ✔ Avoid multiple loan applications within a short period

📌 Example: A credit score of 800 with a DTI ratio below 40% can help you qualify for the highest loan amount at the lowest interest rate.

How Soon Can You Improve Your DTI Ratio?

Improving your DTI ratio depends on how quickly you can reduce debts and increase income.

✔ Short-Term Fixes (1-3 Months): Pay off small debts, make lump-sum payments, negotiate lower EMIs ✔ Mid-Term Strategies (3-6 Months): Increase income, consolidate debt, improve credit score ✔ Long-Term Plans (6-12 Months): Reduce major loans, avoid new credit, increase savings

📌 Tip: Start improving your DTI ratio at least 3-6 months before applying for a personal loan.

Final Thoughts

Your Debt-to-Income (DTI) ratio is a crucial factor in determining your personal loan eligibility. A lower DTI ratio increases your chances of securing a higher loan amount at better terms.

To improve your DTI ratio, focus on:

✔ Paying off existing debts ✔ Increasing your income through side jobs or freelancing ✔ Consolidating high-interest debts with a lower-cost loan ✔ Reducing EMIs by extending loan tenure ✔ Avoiding new loans before applying for a personal loan

By implementing these strategies, you can significantly boost your DTI ratio, making it easier to secure a higher personal loan amount with favorable interest rates.

#fincrif#personal loan online#loan apps#nbfc personal loan#finance#bank#personal loans#personal loan#loan services#personal laon#Personal loan#Debt-to-income ratio#DTI ratio improvement#Loan eligibility#Higher loan amount#Reduce debt burden#Increase income for loan#Personal loan approval#Credit score improvement#Loan EMI reduction#Debt consolidation loan#Loan repayment strategy#Monthly debt payments#Personal loan interest rate#Extend loan tenure#Lower EMI payments#Credit card debt reduction#Financial planning for loans#Improve loan eligibility#Personal loan refinancing

1 note

·

View note

Text

🚫 Debunking the 5 Myths Around Loan Approvals: What You Need to Know! 🚫

💡 Think you know everything about loan approvals? Think again! In this quick video, we’ll bust the 5 most common myths that could be holding you back from securing a loan.

🔍 Myth #1: You need perfect credit to get a loan. ⏳ Myth #2: Loan approvals take forever. 💰 Myth #3: All loans come with hidden fees. 🔒 Myth #4: A rejection means you're done. 💳 Myth #5: More loans equal more debt.

At BHS Instant Loan Solutions, we’re committed to making the loan process transparent and hassle-free. 👉 Ready to get the loan you need? Reach out to us today and experience a fast, simple, and stress-free loan process.

📞 Contact us: 9743739944 🌐 Visit us: bhsinstantloans.in

#credit score myths#mortgage myths#loan myths#financial education#va loan explained#real estate#va loan#va loan process#financing misconceptions#first time home buyer#mortgage#first-time homebuyer#approval process#mortgage approval tips#financial literacy#home financing#loan approval#loan eligibility#home buying tips

0 notes

Text

Unveiling Credit Cards and Their Impact on Your Credit Score and Loan Approval Success in 2024

Credit cards are a cornerstone of modern personal finance. While they offer rewards, convenience, and the ability to manage cash flow, their usage can directly impact your credit score and determine your loan eligibility. Understanding this dynamic is essential for anyone aiming to build a robust financial profile. In this article, we provide a comprehensive guide on how credit card management…

#payment history#credit card impact#building credit history#credit report#credit card management#loan approvals#credit mix#credit card mistakes#personal finance tips#credit card usage#responsible credit management#credit profile#interest rates#Credit Cards#Credit Utilization#Credit Card Rewards#loan amounts#Loan Eligibility#financial responsibility#credit score#loan terms

0 notes

Text

Securing a Loan Against Property: Essential Information on Interest Rates, Eligibility Criteria, and Required Documents

Unlocking the potential of your property through a loan can offer financial flexibility and stability. This guide provides crucial insights into interest rates, eligibility criteria, and the documents required for obtaining a loan against property, empowering you to navigate the borrowing process with confidence.

Understanding Loan Against Property Interest Rates:

Competitive Rates: Interest rates vary among lenders, influenced by market conditions, loan tenure, and borrower profile. Researching and comparing rates from multiple lenders is essential to secure competitive offers.

Fixed vs. Floating Rates: Borrowers must decide between fixed or floating interest rates. Fixed rates offer stability with consistent payments, while floating rates may fluctuate based on market changes.

Rate Factors: Interest rates are determined by factors such as loan tenure, loan-to-value ratio, borrower's credit history, and prevailing economic conditions.

Loan Against Property Eligibility Criteria:

Property Ownership: Applicants must be legal owners of the property offered as collateral, with clear title deeds.

Minimum Age: Borrowers typically need to be at least 21 years old at the time of application.

Income Stability: Demonstrating a stable income source is crucial, whether through salaried employment or self-employment. Income proofs such as salary slips or tax returns may be required.

Property Valuation: Lenders assess the market value of the property to determine loan eligibility. Clear property titles and proper documentation are essential.

Credit History: A good credit score enhances eligibility and may qualify borrowers for lower interest rates. Lenders evaluate creditworthiness based on repayment history and existing liabilities.

Required Documents for Loan Against Property:

Property Documents: Clear title deeds, sale deed, and other property ownership documents.

Identity Proof: Passport, Aadhar card, driver's license, or any government-issued identification.

Address Proof: Utility bills, rental agreement, or any document verifying current residential address.

Income Proof: Salary slips, income tax returns, bank statements, or audited financial statements for self-employed individuals.

Passport Size Photographs: Recent passport-sized photographs of the applicant.

Loan Application Form: Complete loan application form provided by the lender, filled with accurate details.

0 notes

Text

In Cambodia, the world of small and medium-sized businesses is a big deal. These businesses are like the engines that power the country’s progress. They generate employment, stimulate economic growth, and enhance the quality of life for many.

0 notes

Text

#tcg#flats in hinjewadi#the cliff garden#hinjewadi#pune#loan eligibility#housing loan#buy property#propertyforsale

0 notes

Text

Salaried Personal Loans vs. Gold Loans: Choosing the Right Option

When it comes to financing your needs or addressing financial emergencies, two common options that often come into consideration for salaried employees are personal loans and gold loans. Both offer their unique set of advantages and considerations. In this article, we'll compare the features of these two loan types to help salaried individuals make an informed decision regarding which option suits their needs best.

Personal Loans

Advantages:

Unsecured: Personal loans are unsecured, meaning you don't need to provide collateral such as gold or property to secure the loan. This is particularly appealing if you don't want to risk losing assets.

Flexible Use: Personal loans can be used for a wide range of purposes, from medical expenses and education fees to debt consolidation and travel. You have the flexibility to decide how to use the funds.

Quick Approval: Many financial institutions offer instant personal loans online for salaried individuals, ensuring speedy access to funds when needed.

Fixed Interest Rates: Personal loans often come with fixed interest rates, providing stability in your monthly repayments.

Considerations:

Interest Rates: Personal loans may have slightly higher interest rates compared to some other loan types, such as gold loans.

Eligibility Criteria: Lenders may have specific eligibility requirements, including minimum income and credit score criteria.

Apply for Instant personal loan online for salaried

Gold Loans

Advantages:

Secured: Gold loans are secured by the gold jewelry or assets you provide as collateral. This often leads to lower interest rates compared to unsecured loans.

Quick Processing: Gold loans can be processed relatively quickly since the evaluation of the gold's value is a straightforward process.

Lower Credit Score Requirement: Since gold loans are secured, lenders may be more lenient with credit score requirements.

Considerations:

Risk of Asset Loss: If you're unable to repay the loan, you risk losing the gold assets you've pledged as collateral.

Limited Use: Gold loans are typically intended for specific purposes, such as business investment or working capital needs. They may not be as versatile as personal loans.

Interest Compounding: Gold loan interest rates may compound over time, potentially increasing the overall cost of borrowing.

Choosing the Right Option

The choice between a personal loan and a gold loan depends on your specific needs, financial situation, and risk tolerance. Here are some factors to consider:

If you require funds for a diverse range of purposes and want flexibility in their use, a personal loan may be more suitable.

If you have gold assets that you're willing to pledge as collateral, and you're looking for lower interest rates, a gold loan could be a viable option.

Consider your ability to repay the loan and the consequences of default. With a gold loan, the risk involves losing the pledged assets, while with a personal loan, it's primarily financial.

Ultimately, it's essential to assess your financial goals and preferences carefully. If you decide that a personal loan aligns with your needs, explore personalized loan solutions designed for salaried employees at Privo- Instant easy loan app. Making an informed decision between these two loan options can help you achieve your financial objectives while managing risk effectively.

#Salaried Personal Loans#Gold Loans#Loan Comparison#Borrowing Options#Financial Decision#Loan Types#Credit Choices#Personal Finance#Loan Eligibility#Interest Rates#Collateral Loans

0 notes

Text

Looking to invest in the booming cannabis industry? Our Ultimate Guide to Cannabis Real Estate Loans will help you navigate the complex world of cannabis real estate financing. Discover eligibility requirements, application tips, and more on the Alta Fund blog.

#Cannabis Real Estate#Real Estate Loans#Cannabis Industry#Investing#Alternative Investments#Financing#Commercial Real Estate#Loan Application#Loan Eligibility#Cannabis Business#Business Finance#Alta Real Estate Fund

0 notes

Text

I wish the concept of student loans had a tangible and sapient form so that I could attack it like a chimp

#the fuck do you mean I can't change my loans status because you won't let me log in because YOU haven't verified my identity#I SENT YOU ALL THE SHIT YOU NEED WEEEEKS AGO. ALL THE DOCUMENTS YOU ASKED FOR. VERIFY ME NOW#UNIVERSITY STARTS AGAIN IN TWOOOOO WEEKS. I NEED THIS SORTED NEEOOOWWW#also thank you nz government. for telling me I am eligible for fees free study. SEVERAL WEEKS AFTER THE DEADLINE FOR APPLYING FOR LOANS#GODDDDDDDDD#feel free to reblog. fellow student loans and student loans admin haters

22 notes

·

View notes

Text

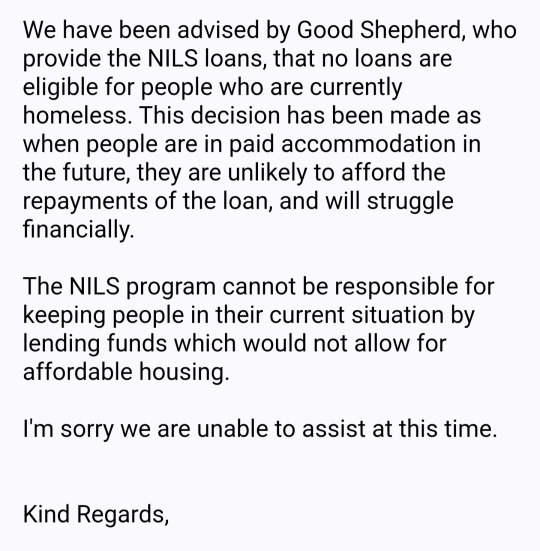

I just had to share this email I got so all y'all can appreciate the absolute state of welfare services in Australia with me:

The NILs Loan Scheme is a government funded, no interest loan scheme for people on low incomes, but this leaves me wondering exactly who tf can qualify for their loans. Because it seems like if you have any symptoms of poverty it's a no.

I applied because I need the clutch replaced in my van, which I live in. It's lucky that I actually CAN afford the cost myself (due to living in a van & not participating in Australia's increasingly ridiculous housing market). I thankfully can afford such an expense these days & was just looking for a responsible financial buffer, just in case. But if this had happened to me a few years ago when I first became homeless and was far less financially stable, then my next living situation wouldn't be "affordable housing" it would be a fucking tent.

Anyway, the backwards ass state of a GOVERNMENT FUNDED welfare scheme refusing to assist those who need welfare the most because they don't want to encourage homelessness or whatever the dumb fuck? Just really rustled my jimmies tbh. Just screams "yet another govt welfare scheme that's actually just about handing out money to fake charities & not helping the poor". Good Shephard just got on the "do not donate to these grifters" list along with the Salvos😒

#I got a root canal & a heap of skin cancer to pay for on top of this clutch replacement right#& I got it#but there's going to be $100 left in my bank account with this all said & done#& I could use ZIP or AfterPay or whatever if need be#but I figured a no-interest no-fee no-nothing loan would be the gold standard of responsible financial decision-making#& lol turns out the eligibility requirements for a NILs loan are HIGHER than a Buy Now Pay Later (w exorbitant fees) type of loan#how tf can you call that a loan scheme for people on low incomes?#when you gotta be at least middle class to qualify?#the fucking state of Australian welfare agencies istg#& I ain't even shocked atp because this is the response I've always gotten from welfare agencies#they always have some (often very stupid) excuse as to why they can't do what they say they do#I hear so often “oh there's plenty of support for the poor & homeless they just choose to be that way”#but this is the support just fyi#this is why poverty & homelessness still exist in Australia#bc all the agencies & organisations & departments & corporations that are “on the job” are only on the job of securing their own pay checks#with as little expenditure on the poor as they can get away with#auspol#poverty

9 notes

·

View notes

Text

way easier to be poor/unemployed in massachusetts i GOTTA say

#not eligible for healthcare tax credits bc i made under $30k from unemployment and family loans this year. the cheapest least bad plan#is $350 a month. and i have Not been going to the doctor bc i can’t even afford copays rn#this is unappealable btw. so much fun!!!

8 notes

·

View notes

Text

How Do Loan Brokers Help in Getting a Personal Loan?

A personal loan is one of the most popular financial solutions for individuals seeking quick funds for emergencies, home renovations, weddings, or medical expenses. However, navigating the loan application process can be overwhelming, especially with multiple lenders offering different terms. This is where loan brokers come into play.

A loan broker acts as an intermediary between borrowers and lenders, helping individuals find the best personal loan that matches their financial profile. But how exactly do loan brokers help in getting a personal loan? Let’s dive into their role, benefits, and potential drawbacks.

Who Is a Loan Broker?

A loan broker is a financial professional who connects borrowers with banks, NBFCs (Non-Banking Financial Companies), and other lenders. Unlike direct lenders, brokers do not lend money themselves; instead, they analyze a borrower’s financial situation, credit score, and loan requirements to find the most suitable personal loan options.

They typically work with multiple lenders and negotiate terms on behalf of the borrower, ensuring they secure the best interest rates, loan tenure, and repayment terms.

How Do Loan Brokers Help in Getting a Personal Loan?

Loan brokers simplify the loan application process in several ways:

1. Assessing Your Loan Eligibility

Before applying for a personal loan, it’s essential to understand your eligibility. Loan brokers assess:

Credit score

Income level

Employment status

Existing debts

Based on these factors, they recommend suitable lenders and loan options, ensuring you meet the eligibility criteria before applying.

2. Finding the Best Loan Offers

Different banks and financial institutions offer varying interest rates and terms. A loan broker compares multiple lenders and finds a personal loan with:

Competitive interest rates

Flexible repayment terms

Minimal processing fees

This saves borrowers from the hassle of researching and negotiating with multiple lenders.

3. Reducing Loan Rejection Risks

Applying for a personal loan with multiple lenders can negatively impact your credit score if applications get rejected. Loan brokers reduce this risk by applying only to lenders where you have a higher approval chance.

They match your profile with suitable lenders, ensuring a higher probability of approval.

4. Negotiating Better Loan Terms

Loan brokers have established relationships with lenders, which allows them to negotiate:

Lower interest rates

Reduced processing fees

Flexible repayment tenures

This can lead to substantial cost savings over the loan tenure.

5. Handling Loan Documentation

A major hurdle in securing a personal loan is dealing with complex paperwork. Loan brokers assist with:

Filling out the application form correctly

Submitting required KYC (Know Your Customer) documents

Providing income proof and credit reports

This reduces errors that can cause application delays or rejections.

6. Speeding Up Loan Processing

Since loan brokers work directly with lenders, they help expedite the approval and disbursement process. Some brokers have tie-ups with financial institutions that enable instant loan approvals for eligible borrowers.

7. Providing Personalized Loan Advice

Every borrower’s financial situation is unique. A loan broker offers customized advice on:

Choosing fixed vs. floating interest rates

Deciding on loan tenure

Managing repayment schedules

They also guide borrowers on prepayment options and foreclosure charges to optimize loan repayment.

Benefits of Using a Loan Broker for Personal Loans

1. Saves Time & Effort

Instead of visiting multiple banks, a loan broker provides all loan options in one place, saving time and effort.

2. Access to Multiple Lenders

Brokers have direct connections with banks, NBFCs, and digital lenders, offering more loan options than borrowers can find on their own.

3. Increases Loan Approval Chances

By matching borrowers with the right lender, brokers improve approval chances, reducing the risk of loan rejection.

4. Helps Borrowers with Low Credit Scores

Individuals with a low credit score may struggle to get a personal loan. Brokers help find lenders willing to approve loans for bad credit borrowers at reasonable terms.

5. Expert Financial Guidance

Loan brokers educate borrowers on loan terms, hidden charges, and repayment strategies, ensuring they make informed decisions.

Potential Drawbacks of Using a Loan Broker

While loan brokers offer several advantages, there are some downsides:

1. Broker Fees or Commission

Some brokers charge processing fees or commissions for their services. Borrowers should clarify fee structures before proceeding.

2. Potential for Bias

Certain brokers may prioritize lenders offering them higher commissions, which may not always be the best loan option for the borrower.

3. Scams & Fraudulent Brokers

Not all brokers are legitimate. Some may misrepresent loan terms or charge hidden fees. Always verify a broker’s credentials before engaging in their services.

How to Choose the Right Loan Broker?

To ensure a safe and reliable experience, consider these factors when choosing a loan broker:

1. Check Broker’s Reputation

Look for reviews, testimonials, and ratings on financial platforms before selecting a broker.

2. Verify Licensing & Accreditation

Ensure the broker is registered with relevant financial regulatory authorities to avoid scams.

3. Compare Fees & Commission

Ask about upfront charges and compare them with other brokers to avoid unreasonable fees.

4. Understand Their Lender Network

A good broker should have tie-ups with multiple banks, NBFCs, and digital lenders for diverse loan options.

5. Clarify Loan Terms

Ensure the broker clearly explains interest rates, repayment terms, and other charges before proceeding.

Can You Get a Personal Loan Without a Broker?

Yes, you can directly apply for a personal loan through:

Bank websites

NBFCs & digital lending platforms

Loan aggregators

However, using a loan broker simplifies the process, especially if you are unfamiliar with loan comparisons, eligibility requirements, and documentation.

Conclusion

A loan broker can be a valuable resource when applying for a personal loan, helping borrowers secure the best loan terms, reduce rejection risks, and streamline the application process. However, it’s crucial to choose a reputable broker and be aware of any associated costs.

Whether you decide to use a broker or apply directly, understanding the loan process is essential for making an informed financial decision.

#personal loan online#fincrif#nbfc personal loan#personal loans#bank#loan services#loan apps#personal loan#finance#personal laon#Personal loan#Loan broker#Personal loan broker#Loan approval#Loan eligibility#Personal loan interest rate#Best loan broker#Loan documentation#Loan comparison#Personal loan process#Instant personal loan#Loan application#NBFC personal loan#Bank loan approval#Online loan broker#Loan broker services#Personal loan for low credit score#Loan negotiation#Best personal loan rates#Loan rejection reasons

1 note

·

View note

Text

#Business Loan Interest Rates#Business Loans For Business#Interest Rate in Business Loan#Business Loan calculator#Personal and Business Loans#Small Business Loan Rates#Quick Business Funding#Best Small Business Loan#Low Interest Business Loans#Best bank For Business Loans#Business Loans UK#Loan For Small Business UK#Loan Business UK#Business lending UK#Company Loans UK#Best Business Loan Rates UK#Business Loans Interest Rates UK#Business Loans For New Business UK#Short term Business Loans UK#Low Rate Business Loans UK#aFFordable Business Loans#Business Borrowing#Business Loan Funding#Business Loans For Same Day Funding#Cash Flow Loans#Eligibility Criteria For Business Loan#Fast and Affordable Business Loan#Flexible and Affordable Business Loan#Flexible Business Loan Criteria#Hassle Free Business Loans

3 notes

·

View notes

Text

I decided to quit while I'm ahead and graduate early instead of finishing my Master's and I got a decent grade and can move on or whatever but. already it is hitting me how much more I am enjoying and interested in maths, now that I'm not studying it. I have literally been off my course for 2 days and already found the motivation and interest to look up multiple details and ideas for my own interest and how I'm so looking forward to some of the further (independant) study I'll be doing in the next year and just. It's crazy how poor teaching, an exclusively results-based focus, an awfully designed set of modules with poorly chosen content, a set of modules I hated and which I was ill-prepared for, a lack of almost any support from lecturers, no proper tutorials or any seminars for 3 years, and a deeply isolationist learning culture turned out to not be a very conducive learning environment to my AuDHD. who would have thought.

#note that I was doing an integrated Master's which is a UK thing#where you do a regular undergrad and a much smaller Master's in your 4th year without having graduated yet#so you're still eligible for undergrad grants & student loan#but because they're rushed the Master's are considered a bit. well useless#Also we only had max 16 contact hours but usually this was in fact 8 because they just put the other 8 as office hours#which you could only go to for specific queries for max 10 mins#in fairness some of this was due to chronic illness and working a lot (in a job I enjoyed far more than my degree) & Covid & my issues#but also. fuck that uni#mathblr#academia

4 notes

·

View notes

Text

I just got reprimanded because I wasn't able to sell any loans in April. It's the 4th of April today. We have no sales goals until the 3rd of each month. They either send me again to home office, or I'll stab someone in this place and cook them into delicious shepherd pies.

#most people calling the bank are 80 y/os and not really eligible for loans any more???#ok can you FIRST MONITOR THE KIND OF CALLS I HAVE before GIVING ME MORE STUPID REPRIMANDS?

2 notes

·

View notes

Text

Understanding Credit Card Eligibility for HDFC Bank

Credit cards have become an indispensable financial tool for many, offering convenience, rewards, and flexibility in managing expenses. Among the plethora of options available, HDFC Bank stands out as one of India's leading providers of credit cards, offering a wide range of options tailored to various lifestyles and needs. However, before applying for an HDFC credit card, it's crucial credit card eligibility for hdfc bank criteria to ensure a smooth application process

#credit card eligibility for hdfc bank#credit card eligibility#credit card services#insurance#personal loan#best credit cards compare

4 notes

·

View notes