#finance blogger

Explore tagged Tumblr posts

Text

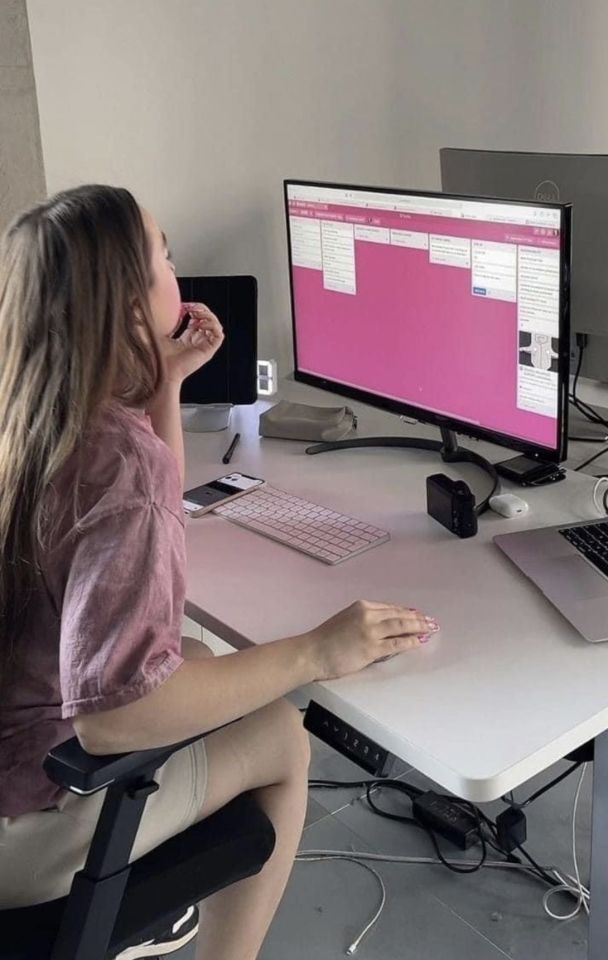

corporate barbie 👩💼💄💗📈

gonna be starting my full-time job soon, i'm looking forward to being the newbie who's on top of things & surprise everyone with how much i know 💅

#it girl#becoming that girl#pink pilates princess#glow up#self care#that girl#wonyoungism#girl blogger#pink pilates girl#motivation#corporate barbie#working#business woman#business#entrepreneur#finance#accounting#girlblogging#girlblog#pink moodboard#pink aesthetic#pink blog

617 notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

77 notes

·

View notes

Text

i've been making my own coffees for a while now, so don't be surprised if you see me on the forbes thirty under thirty list 🤭

#im an entrepreneur. a finance bro. but better.#girlblogging#girlblogger#this is a girlblog#female hysteria#gaslight gatekeep girlboss#i’m just a girl#female experience#pinterest girl#shitpost#dream girl#digital girl#hell is a teenage girl#manic pixie dream girl#girlhood#this is what makes us girls#girl blogger#girl things#thought daughter#last girl on earth#just girly thoughts#just girly things#just girly posts#girl boss gaslight gatekeep#just girls being girls#just girlboss things#hyper feminine#femcel#the feminine urge#female gaze

22 notes

·

View notes

Text

Work & Money Update

Hi everyone!

Well the auditors came two weeks ago and they showed up at 4pm on a Friday. Yikes lol Long story short we passed with a minor deficiency so we will remain open it seems. My office is awaiting their final letter to officially be in the clear but it seems we passed.

I like it because well I didn't want to find another job. I hate change. What I did learn in the midst of all this, is that other jobs pay more. So I will definitely keep that in mind. I get paid well but its nice to know the market value of your position out there.

I started tracking my expenses last month because I want to get my financial shit together. Im good with money but I was on maternity leave for 5 months and the new expenses with a baby aren't cheap as you all know. Now that i have been back to work for a month and was able to track my spending for the month of August its time to double down and bring certain expenses down so I can build my savings up again.

Having my savings while i was off on maternity leave allowed me to live comfortably while i stayed home. So i am more than determined to grow it even more. I know having savings helps but when you think you don't need it maybe you don't save as much. And this just showed me why I should always save. But now i want to save more!!

I started making my iced coffees at home since last week. I brew my own coffee but when out I'd pay for iced coffee so I stopped myself lol I learned on tiktok how to make my own pumpkin cream foam for my iced coffee so i don't have to pay $10 at Starbucks for that seasonal drink haha

I'm doing two no spend days during the week as well and Eating out twice a week only. This is just to start. I need to just cut back a bit so i can rebuild my savings.

Anyways, hope you all are doing great!!!

:0)

17 notes

·

View notes

Text

Changing My Mindset

Hey, young stars and hearts! Mimi here, and I am starting my big girl finance journey as someone who works 40 hours a week, gets paid biweekly, and is currently financially destitute.

Growing up, I was taught to work hard and you can get everything you want, so I did. I was programmed, of course, being raised in a two-parent black household seeing my dad work 16 hours a day and my mom be a full-time mom and college student.

That's all I knew, as soon as I started working my first job at Whataburger, literally a week after I turned 16. For a while, I was really happy. I felt like an adult, making my own money and decisions. Excuse my french but you couldn't tell me shit! I was that girl.

But as I got older, when I was only 19, that spark faded and I wanted more, not in a greedy way but I felt complacent. I noticed I was working endlessly, sometimes 7 days a week, 12-16 hours shifts because I was a "hard worker" for 8.50. I felt that it was expected, in my mind, I had no choice because I had to work. In actuality, I was overworking myself and I was starting to feel it was for no reason.

In 2022, I went through my first spiritual awakening and I questioned everything I knew. I was broken down so badly that I literally quit my job because I truly felt I was no longer serving me. 9 months. I went 9 months without a job because I needed to reprogram my mind by affirming and meditating. I started over, and I was better from then, I still had the worker bee mindset.

2 years to date, on July 14, 2024, I am going through the same thing but on another level, I am realizing that this is much deeper than I thought. It is subconscious. I know I am very long-winded, lol, but with that being said I have recently started listening to affirmations again.

I feel a difference in myself, I see a difference. my goal is to reprogram my mind to believe that I work smart and play hard, anything that I want I can get with ease, I am truly divine, and that money flows to me effortlessly and that I don’t chase. I attract anything positive that I want to be associated with. I have found my to people for that.

I want to share my favorite spiritual creators and videos that I enjoy. Of course, I listen to affirmations from YouTube, but I feel listening it all depends on the creator. All of my favorite creators will be linked below! I hope you all enjoy them as much as I do!

Evolving into More

Free Tea

maleeka, is my gurdian angel

Ayesha Noella | Affirmations

Whimsical Tarot

White Feather Tarot

TheWizardLiz

Shonnetta's Divine Tarot

SheraSeven

#aesthetic#inspiration#beauty and wellness#black beauty#beauty#self care#self love#beautiful women#black women#black luxury#manifesation#manifesting#luxury#luxurious#affirmyourlife#affirm and persist#affirmdaily#afffirmations#wellnessjourney#wellness girl#wellness tips#money#money tips#finance tips#abundance#abundant#growth mindset#becoming that girl#becoming her#girl blogger

11 notes

·

View notes

Text

#books#bitcoin#crypto#cryptocurrency#bitcoins#blog#girl blogger#ask blog#tumblog#blog post#tumblelog#blogging#@na blog#bd/sm blog#microblog#investors#investment#ace attorney investigations#studio investigrave#finances#opportunities#wealth#money

2 notes

·

View notes

Text

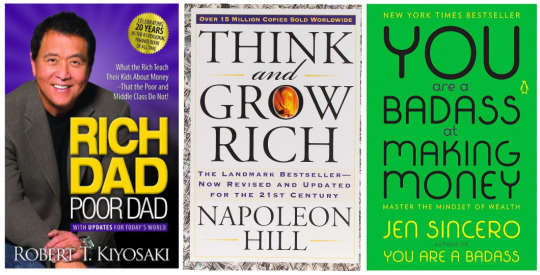

The Self-Improvement Project: Books To Become A Money Magnet

Rich Dad, Poor Dad by Robert T. Kiyosaki

Think and Grow Rich by Napoleon Hill

The Psychology of Money by Morgan Housel

You Are a Badass At Making Money: Master the Mindset of Wealth by Jen Sincero

Money: A User's Guide by Laura Whateley

Girls That Invest by Simran Kaur

How To Make It Happen by Maria Hatzistefakis

Secrets Of Six-Figure Women by Barbara Stanny

MONEY Master The Game: 7 Simple Steps To Financial Freedom by Tony Robbins

We Should All Be Millionaires: A Women's Guide To Earning More, Building Wealth and Gaining Economic Power by Rachel Rodgers

Lean In: Women, Work and The Will To Lead by Sheryl Sandberg

The Millionaire Mind by Thomas J Stanley

How To Be An Overnight Success by Maria Hatzistefakis

#books#book blog#booklr#readblr#book reccs#book recommendations#bookaddict#bookworm#book list#finance#books about money#books about finance#financial independence#think and grow rich#rich dad poor dad#you are a badass at making money#the psychology of money#bookblr#book blogger#book community#book lover#self improvement#money magnet#money

15 notes

·

View notes

Text

I was browsing one of my friends' blog and the two ads I kept getting were for "finance" and "divorce"

3 notes

·

View notes

Text

best financially free summer vacay !

I have the money i have when i need it

i have the money i want when its time for vacation

I'm financially free and travel where and when i want

My income is exploding

My financial success is here

I always attract good travel/vacation opportunities

I can travel

I can travel the world when i want

This summer is endless fun

This summer is endless travel

I can make time for travel when i need it/want it

I'm financially able to spend my money on travel

Travel is all around me

Travel is waiting for me

I invest in myself daily

I live intentionally

I deserve joy and happiness

I'm healing and growing this summer

I deserve to spend time relaxing on vacation

I shine like the light from the sun

I'm blooming this summer

This is my season and I'm going to enjoy it

I'm letting go of all toxicity this summer

I deserve the most enjoyable summer

#affirmyourlife#manifestation#law of assumption#law of attraction#night luxe#manifesting#manifest#luxury#luxurious#luxe#girl blogging#girl blogger#girlblogging#wealth#wealthy#millionaire#billionaire#money#valuation#finance#self concept#loa#law of expectancy#law of manifestation#law of abundance#master manifestor#affirm and persist#loassumption

9 notes

·

View notes

Text

Demystifying the Bull and Bear: Understanding Market Trends

In the world of finance and investing, terms like “bull market” and “bear market” are frequently thrown around. But what do these terms really mean? Today, we’ll dive into the fascinating world of market trends and gain a clear understanding of these commonly used phrases. Bull Market: Riding the Wave of Optimism When we hear the term “bull market,” it signifies a period of rising stock prices…

View On WordPress

#Bear Market#Blogger#Blogging#Bull Market#dailyprompt#Demystifying the Bull and Bear: Understanding Market Trends#Financial#Financial advice for beginners#Financial Freedom#Financial Literacy#Generational Wealth#knowledge#money#Money Fun Facts#Moneymaking#Passive Income#Personal Finance#Riding the Wave#Wealth

7 notes

·

View notes

Text

Withholding tax on online sellers could address revenue leakages

With the 1% withholding tax on online sellers already in effect, there is potential that the said tax could address revenue leakages, according to a BusinessWorld news article. To put things in perspective, posted below is an excerpt from the BusinessWorld news article. Some parts in boldface… THE GOVERNMENT should ensure that it will be able to properly implement and monitor the collection of…

View On WordPress

#Asia#Blog#blogger#blogging#Bureau of Internal Revenue (BIR)#business#business news#BusinessWorld#capitalism#Carlo Carrasco#commerce#economics#economy#Economy of the Philippines#finance#geek#governance#government#Inspiration#jobs#journalism#money#news#online sellers#online selling#Philippine economy#Philippines#Philippines blog#public service#Southeast Asia

2 notes

·

View notes

Text

fall lookbook: business casual🍂💼🎀👩💻

if you can't tell, my business casual style icons include lorelai gilmore, rachel zane, elle greenaway, rachel green, etc. 💌

#it girl#becoming that girl#pink pilates princess#glow up#self care#that girl#wonyoungism#girl blogger#pink pilates girl#motivation#corporate barbie#working#business woman#business#entrepreneur#finance#accounting#girlblogging#girlblog#pink moodboard#pink aesthetic#pink blog#business casual#work outfits#office attire#office aesthetic#work aesthetic#lawyer#law student#law studyblr

298 notes

·

View notes

Text

At Sense of Stocks Academy, we believe that everyone should have access to quality educational resources

about stocks. Our mission is to simplify complex concepts and provide practical insights, empowering

individuals to make informed investment decisions. Join us on this exciting journey through the world of stocks!

Overview of Stock Sectors

1 Technology Sector

Discover the driving force behind technological advancements and the potential for growth in this ever evolving sector.

2 Healthcare Sector

Explore the impact of medical breakthroughs and the opportunities available in the healthcare industry.

3 Financial Sector

Dive into the world of banking, insurance, and investments, where profitability and risk management intersect.

Blue Chip Stocks and Their Characteristics

Definition – Learn what blue chip stocks are and discover why they are considered reliable, stable, and well-established.

Examples -Explore renowned blue chip companies like Apple, Microsoft, and Coca-Cola, known for their long history of success.

Benefits -Discover the advantages of investing in blue chip stocks, such as consistent dividends and reduced volatility.

Penny Stocks and Their Characteristics

Low Price

Unlock the potential of penny stocks, which are typically priced under $5, attracting investors seeking high returns.

Volatility

Explore the risks and rewards associated with penny stocks, known for their price fluctuations and speculative nature.

Trading Volume

Understand the impact of low trading volume on penny stocks, requiring careful analysis and swift decision making.

Growth Stocks and Their Characteristics

High Potential

Uncover companies with strong growth prospects, promising exponential returns for investors with a long-term vision.

Innovation

Explore the exciting world of growth stocks, where groundbreaking technologies and disruptive ideas propel companies forward.

Risk & Reward

Understand the trade-off between risk and potential reward when investing in growth stocks, a journey filled with excitement and uncertainty.

Value Stocks and Their Characteristics

Value stocks are hidden gems waiting to be discovered. They represent companies that are undervalued by

the market, providing an opportunity for investors to capitalize on their growth potential. With a keen eye for

value, smart investors can often unearth treasures amidst the noise of the stock market.

Vision

Our vision is to empower individuals with the knowledge and tools to thrive in the stock market, enabling them

to achieve their financial goals and secure a prosperous future.

MISSION

Our mission is to provide high-quality education and training to individuals seeking to excel in their chosen

field. Through our comprehensive curriculum, experienced instructors, and state-of-the-art facilities, we aim to

equip our students with the skills, knowledge, and confidence needed to succeed in today’s competitive

professional landscape. We are committed to fostering a supportive and inclusive learning environment that

encourages personal growth, critical thinking, and collaboration. By empowering our students to reach their

full potential, we strive to make a positive impact on their lives and contribute to the advancement of their respective industries.

2 notes

·

View notes

Text

How you should invest in your 20s – housesofinvestors

Introduction

Investing is one of the most important things you can do for your future. It helps build wealth and gives you a chance to really see how much money you’re making over time. But it’s not always easy—especially when you’re young! Here are some tips so that you can invest in your 20s:

Get rid of any high-interest debt

High-interest debt is the worst kind of debt, and it’s one of the biggest threats to your financial future. If you have high-interest debt, it’s time to get rid of it (or at least pay off as much as possible).

Here are some tips for paying off high interest rates:

Only use credit cards when absolutely necessary. If there’s anything about credit cards that makes me want to vomit—and I mean vomit—it’s their exorbitant interest rates. The average APR on a 30 day introductory balance is around 19%. That means if you carry a $10,000 balance with an 18% APR, then every month alone adds up to almost $1,200 in interest charges! And who wants those kinds of monthly payments? No thanks! Instead make sure all purchases are made cash or debit card so that no one has access to any information about them except themselves (this goes double if they’re trying buy something expensive).

Avoid taking out new loans until after graduation day because even though borrowing money now doesn’t seem like much trouble now since everyone else seems so successful at doing this stuff without owing anyone anything back yet either end up paying huge amounts later down road when things go wrong due lack knowledge about how best manage finances during early twenties years where risk taking behavior may increase significantly due lack experience gained beforehand.”

Invest in what you know

Once you’ve completed your high school education, it’s time for the next step in your journey: investing. This may sound like a daunting task, but there are plenty of ways that you can invest in yourself and make sure that you’re doing things that are right for your interests and goals.

Investing in yourself means investing in what makes you happy—whether that’s dancing or playing tennis; volunteering at an animal shelter or helping out at an art gallery; collecting antiques or making music with friends. It also means putting down roots (literally) by moving out of home or getting married so that one day when those kids come along they don’t have to move away from their family again because their parents had big dreams but couldn’t follow through on them due to financial constraints.”

Buy term life insurance

Term life insurance is the best way to protect yourself and your family, since it protects you against the death of someone else.

Look into a Roth IRA

If you’re worried about paying taxes on your income when you invest, a Roth IRA is a great way to keep the money in your pocket—and out of the hands of Uncle Sam.

A Roth IRA can be opened by anyone who has earned income and reaches age 59½ (or 60 if they are disabled). The maximum contribution limit is $6,000 per year ($5,500 if married filing jointly). The IRS lets you contribute more than this amount if you have earned income above that threshold; however, there won’t be any tax deduction for doing so.

The advantage of opening an individual retirement account (IRA) is that once it’s open, contributions made into them don’t count toward taxable income until withdrawn or used for other purposes—so long as they aren’t withdrawn within five years after being deposited into an account

Don’t chase returns or hot stocks

When you start investing early, it’ll pay off later on in life

When you start investing early, it’ll pay off later on in life.

Investing early helps build a good foundation for your retirement. You can start with a small amount of money, and it will grow over time. This means that if the market goes up or down during the years that follow, you won’t lose everything because of bad timing or an ill-timed purchase (such as buying high and selling low).

Having more time to make up for mistakes is great! If something doesn’t work out as planned—like trying out an investment strategy that doesn’t pan out well—you’ll have more time before having to get rid of all those investments so they don’t take away from other things like rent/mortgage payments or student loans repayment plans..

My Opinion

When you start investing early, it’ll pay off later on in life. It’s important to remember that most of these ideas are things you can do today while still working a job and having fun! If nothing else, this article should give you an idea of what type of investments might be right for your specific situation.

#Tagsearly investing#invest money#invest money in your 20s#investment strategies#investment tips#writers on tumblr#finance#blogger

7 notes

·

View notes

Text

New Post!

The pandemic forced a new way of working – working from home. After the pandemic, hybrid work is in vogue. Businesses that offer hybrid work benefit in many ways. Here are some tips on how hybrid work can lead to business savings in the UK.

More on the blog. :)

Pin for later - https://in.pinterest.com/pin/212091463694304668/

#AhaNOW#WFH#workfromhome#business#work#workingfromhome#hybrid#hybridwork#businesssaving#saving#money#finance#blog#blogging#blogger#guestpost#guestposting#guestpostservices#workfromhomelife#workfromhomebusiness#hybridworkculture#hybridworkforce#guestblog#guestblogging#guestblogger

3 notes

·

View notes

Text

When it comes to long-term investments, two popular options that often come to mind are mutual funds and real estate. This post will compare mutual funds and real estate, highlighting their benefits and considerations for long-term investors.

#mutual funds#real estate#investment#finance and investments#right choice#blogging#blogger#blog post#blogspot#blogs

3 notes

·

View notes