#rich dad poor dad

Explore tagged Tumblr posts

Text

#books#reading#thereadmind#thereadmind.com#book blog#love books#best books#book review#bookish#i love books#top books#self help books#bookstagram#booklover#book#booklr#bookblr#bookworm#finance#investing#money#wealth#rich dad poor dad#money saving#finance books

11 notes

·

View notes

Text

"Rich Dad Poor Dad" by Robert Kiyosaki is a personal finance and self-help book that focuses on the importance of financial education and how it can lead to financial success.

The book is based on the author's experiences and lessons learned from two different father figures in his life. One was his own father, who he refers to as his "poor dad," and the other was his best friend's father, who he refers to as his "rich dad."

The author uses anecdotes and stories from his own life to illustrate key financial concepts, such as the difference between assets and liabilities, the importance of cash flow, and the power of passive income.

The book is divided into ten chapters and covers a range of topics, including:

Rich Dad, Poor Dad

The Rich Don't Work for Money

Why Teach Financial Literacy?

Accounting and the Cash Flow Pattern

The History of Taxes and the Power of Corporations

The Rich Invent Money

Work to Learn—Don't Work for Money

Overcoming Obstacles

Getting Started

Still Want More? Here Are Some To Do's

This book has inspired many people to take control of their finances and start building wealth. It encourages readers to think differently about money and to focus on creating passive income streams rather than relying on a traditional job.

#rich dad poor dad#robert kiyosaki#moneytips#successmindset#successsecrets#finance#new books#non fiction#entreprenuership#entreprenuerlife#booksbooksbooks#books and reading#book review#books#best seller books#bookclub#bookshelf#bookstagram#books & libraries#booktok#book recommendations

161 notes

·

View notes

Text

The poor and the middle class work for money. The rich have money work for them.

From RICH DAD POOR DAD By Robert T. Kiyosaki

#dark academia#spilled thoughts#bookish#book review#book quotes#booklover#self help#self help books#motivatedmindset#chaotic academia#quoteoftheday#phycology#aesthetic#rich dad poor dad#money#how to heal#how to get rich

35 notes

·

View notes

Text

Hey babes! If you haven't picked this book up, I HIGHLY RECOMMEND IT. It's alot more insightful thank you think! So much depth about the rich and poor and how to get out of the rat race! You can buy it here:

https://amzn.to/3Qz7F9b

#ispoiledlady#mine#make money#rich dad poor dad#get out of the rat race#reprogram your brain#rich lifestyle#luxury#spoiledxo#affirmations

31 notes

·

View notes

Text

10 Books to Read

Good Vibes Good Life - Vex King

The Secret - Rhonda Byrne

The Intelligent Investor - Benjamin Graham

Atomic Habits - James Clear

The Psychology of Money - Morgan Housel

Make Your Bed - Admiral William H. McRaven

Rich Dad Poor Dad - Robert T. Kiyosaki

The 48 Laws of Power - Robert Greene

Think and Grow Rich - Napoleon Hill

The Power of Discipline - Daniel Walter

#junipers wonderful life#productivity#books#good vibes good life#the secret#the intelligent investor#atomic habits#the psychology of money#make your bed#rich dad poor dad#the 48 laws of power#think and grow rich#the power of discipline#vex king#rhonda byrne#benjamin graham#james clear#morgan housel#admiral william h mcraven#robert t kiyosaki#robert greene#napoleon hill#daniel walter

2 notes

·

View notes

Text

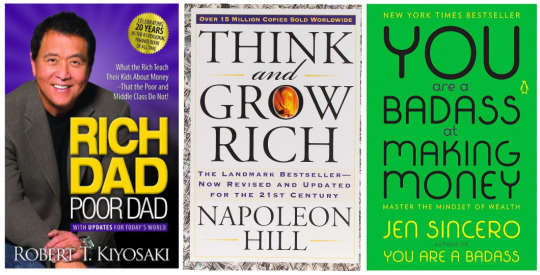

The Self-Improvement Project: Books To Become A Money Magnet

Rich Dad, Poor Dad by Robert T. Kiyosaki

Think and Grow Rich by Napoleon Hill

The Psychology of Money by Morgan Housel

You Are a Badass At Making Money: Master the Mindset of Wealth by Jen Sincero

Money: A User's Guide by Laura Whateley

Girls That Invest by Simran Kaur

How To Make It Happen by Maria Hatzistefakis

Secrets Of Six-Figure Women by Barbara Stanny

MONEY Master The Game: 7 Simple Steps To Financial Freedom by Tony Robbins

We Should All Be Millionaires: A Women's Guide To Earning More, Building Wealth and Gaining Economic Power by Rachel Rodgers

Lean In: Women, Work and The Will To Lead by Sheryl Sandberg

The Millionaire Mind by Thomas J Stanley

How To Be An Overnight Success by Maria Hatzistefakis

#books#book blog#booklr#readblr#book reccs#book recommendations#bookaddict#bookworm#book list#finance#books about money#books about finance#financial independence#think and grow rich#rich dad poor dad#you are a badass at making money#the psychology of money#bookblr#book blogger#book community#book lover#self improvement#money magnet#money

16 notes

·

View notes

Text

Wait, so does that mean...

#bakuage sentai boonboomger#boonboomger ep 26#taiya handle#boon red#raita naito#rich dad poor dad#my uncle had this in his house#i read it when i was like 11#i did not get it

4 notes

·

View notes

Text

3 notes

·

View notes

Text

Do you think Megumi got an allowance from rich Daddy Gojo? There's no way he didn't. There's no way Gojo would have his boy out here beggin for change.

"We don't do that in this household, thank you."

46 notes

·

View notes

Text

How Young Adults Can Balance Purpose in Life and Financial Security: A brief critical interview into messages from the book “Rich Dad Poor Dad”

In 2024, young adults face unique challenges as they navigate their careers and personal lives in a world that's more interconnected and unpredictable than ever. The rise of the gig economy, remote work, and AI advancements has opened up new opportunities, but it also means increased competition and uncertainty in the job market. With skyrocketing living costs, economic volatility, and social pressure to "succeed" early, many are caught in the tension between pursuing personal fulfillment and achieving financial security. In this landscape, Rich Dad Poor Dad by Robert Kiyosaki remains a popular guide for financial independence, but it raises the question: Is wealth creation the ultimate goal, or can we redefine success?

I had an interview with ChatGpt (4o) where we explored how young people can juggle both personal fulfillment and financial security—and how the lessons from Rich Dad Poor Dad fit into the complex realities of today. This conversation offers practical tips for both fans and critics of Kiyosaki's financial philosophies.

Q: Hi ChatGPT, I will have a small interview with you today. Can you briefly share the key notes of Rich Dad Poor Dad and discuss if its lessons still fit in today’s world of 2024?

ChatGPT: Absolutely. The key ideas from Rich Dad Poor Dad revolve around financial education, the difference between assets and liabilities, and the importance of building passive income streams. Kiyosaki emphasizes that many people are stuck in a "rat race" because they work for money rather than letting money work for them. He advocates for investing in assets like real estate or businesses to achieve financial independence.

As for 2024, these principles still resonate, but they need to be adapted. With rising living costs and new technologies changing the job market, many people find traditional investments like real estate less accessible. However, the core message about financial literacy, avoiding unnecessary debt, and creating diversified income streams is more relevant than ever, especially in a world with more uncertainty and more opportunities for digital and non-traditional investments.

Q: What about people with other aims and priorities in life such as young artists, charity workers, craftsman or researchers? Is the creation of wealth the ultimate goal?

ChatGPT: That’s an important question. The focus of Rich Dad Poor Dad—and a lot of financial advice today—centers around tech, finance, and real estate, often assuming that wealth creation is the primary objective. But what about people whose main focus isn’t on accumulating wealth? For artists, researchers, healthcare workers, or people in charity, their goal is often about making the world a better place.

For them, wealth might not be measured in financial terms but in the internal wealth that comes from living a meaningful, impactful life. Financial independence isn’t irrelevant—everyone needs a degree of financial security—but it’s not the only form of wealth. People can create value and fulfillment through their actions and contributions to society, even if their focus isn’t on building a financial empire. It’s about balancing personal purpose with practical financial needs.

Q: So how do young people balance these personal paths with the need for financial security? Can they pursue their passions and still avoid financial instability?

ChatGPT: It’s all about finding a balance between passion and practicality. First, young adults need to get clear about their values and goals—what really drives them beyond the paycheck. From there, they can explore ways to align those passions with financially viable career paths. For example, an artist might explore digital content creation or design, where creativity is highly valued, or a social worker might work within nonprofits while building financial literacy on the side.

I also encourage young people to think about monetizing skills in ways that don’t compromise their passions. Freelancing, creating digital products, or even using platforms like Patreon can help them earn money while still doing work they love. It’s about being strategic: not every passion needs to pay the bills right away, but finding ways to build financial stability alongside it is crucial.

Q: Rich Dad Poor Dad puts a big focus on assets and liabilities. How can young people build financial security if they don’t have the startup capital to invest in things like real estate?

ChatGPT: That's a great point, especially since in 2024, real estate and traditional investments are out of reach for many young people due to high costs and economic uncertainty. But the principles of building assets and avoiding liabilities are still relevant—just applied differently.

In today’s world, young people can look into low-cost, accessible investments like index funds, micro-investing apps, or even digital assets like cryptocurrency (with caution, of course). It's about starting small and building over time. They can also focus on creating intangible assets, like skills, networks, and personal brands, that increase their value in the job market.

The idea isn’t just about accumulating property or stocks but about finding ways to diversify income streams. Whether it's freelance work, passive income from side projects, or investing in education that will pay off later, young people can adopt Kiyosaki’s asset-building mindset without needing to own real estate from day one.

Q: For those who are more critical of Rich Dad Poor Dad, especially those who focus on humanitarian or creative fields, is financial independence even relevant?

ChatGPT: Financial independence isn’t the only goal, and it’s not more important than finding fulfillment in your work. For people in fields like healthcare, education, the arts, or charity, success is often measured by the impact they have, not their financial portfolio. But financial security is still relevant—it’s what gives them the freedom to continue doing meaningful work without worrying about survival.

It’s also about recognizing that internal wealth—like creativity, human connection, and purpose—can coexist with financial independence. In fact, by managing money wisely, even people in low-paying or creative fields can avoid financial stress and maintain their focus on the work they love. It's about making conscious choices that support both your purpose and your financial well-being.

Q: What practical tips do you have for young adults who want to follow their passion but still ensure they’re financially secure?

ChatGPT: There are several ways to approach this:

Learn basic financial literacy: It sounds boring, but understanding budgeting, saving, and investing early on will set you up for success. Even if your passion is art or social work, knowing how to manage money will reduce stress in the long run.

Work to learn, not just to earn: Early in your career, prioritize jobs that teach you valuable skills, not just ones that pay the most. These skills will give you more opportunities down the road, and you’ll be better positioned to turn your passion into a sustainable career.

Diversify your income streams: Don’t rely solely on one source of income, especially if it’s in a field that doesn’t pay well initially. Side gigs, freelancing, and passive income projects can provide financial stability while you focus on what you love.

Keep a growth mindset: Be open to learning and adapting. You might not make money doing what you love immediately, but if you’re flexible and constantly improving, opportunities will come.

Build a personal brand and network: Especially in creative fields, a strong personal brand can lead to more opportunities. Networking with like-minded people can open doors to projects or jobs that align with your values and financial goals.

Q: Do you think the messages of Rich Dad Poor Dad are too focused on financial success? How can people who prioritize personal fulfillment use the book’s advice without losing sight of their values?

ChatGPT: It’s true that Rich Dad Poor Dad is very focused on financial success, but its core lessons—like building assets, understanding money, and taking control of your financial future—can be adapted for any career or passion. The key is to use the book’s ideas as tools, not a blueprint for your entire life.

If your priority is personal fulfillment, you can still use Kiyosaki’s principles to build the financial security that allows you to pursue your passion without distraction. The goal isn’t to become wealthy at all costs but to create a solid financial foundation so you can live a life aligned with your values. You just have to tailor the advice to fit your unique path.

In today’s complex world, financial independence and personal fulfillment don’t have to be mutually exclusive. Whether you’re an artist, healthcare worker, or someone dedicated to social change, learning to manage your money can support your deeper goals. Kiyosaki’s Rich Dad Poor Dad offers valuable lessons, but in 2024, it’s up to each individual to define what success—and wealth—truly mean for them.

Q: Thank you very much for your time. Even though you are an AI, the conversations are always enlightening.

ChatGPT: You're very welcome! I'm glad you find our conversations valuable. My goal is to offer helpful insights, regardless of the format. It's always a pleasure to assist, and I hope the ideas we discuss continue to spark useful thoughts and directions for you.

Thanks for reading!

____________________________

Interview created in OpenAI’s GPT-4.0 LLM and AI-generated image made in Microsoft designer

#openai#chatgpt#personal finance#finance#robert kiyosaki#rich dad poor dad#fullfillment#interview#life work balance#career

1 note

·

View note

Text

The Best Personal Finance Books You Need to Read

The Best Personal Finance Books You Need to Read Personal finance books serve as valuable educational resources, providing insight into fundamental financial principles.Understanding key concepts like budgeting, investing, and debt management empowers individuals to make informed decisions about their money.Informed individuals are better equipped to navigate complex financial scenarios,…

View On WordPress

#best personal finance books#books#books to read#broke millennial#esha beauty blogs#i will teach you to be rich#personal finance#personal finance books#rich dad poor dad#robert keyosaki#the best personal finance books you need to try#the millionaire next door#the richest man in babylon#the total money makeover#top personal finance books to read#your money or your life

4 notes

·

View notes

Text

Delve into the enduring principles of financial success with Robert Kiyosaki's Rich Dad Poor Dad. For 25 years, this bestseller has empowered readers worldwide with invaluable insights into money, investing, and wealth-building. Through the contrasting perspectives of his real father and his best friend's wealthy dad, Kiyosaki unveils the secrets to financial independence. Discover why earning a high income isn't synonymous with wealth, why your house may not be an asset, and why financial education is essential for securing your future. With over 40 million copies sold globally, Rich Dad Poor Dad continues to inspire generations, offering timeless guidance in an ever-changing world.

#essentials#improvement#luxury#men#accessories#essential#cool gadgets#shopping#amazon#man#men must have#must have#gadgets#gentleman#elegance#elegant#classy#men style#for men#rich dad poor dad#book#books#self help#self help book#wealth#wealth management#successmindset#financial#money#millionaire

2 notes

·

View notes

Text

CALLED IT

knew there was something fishy about him when his tone-deaf book that was like chewing sandpaper and then shitting it whole didn’t even make sense

#rot in debt asshole#robert kiyosaki#rich dad poor dad#*insert captain holt VINDICATION gif*#books#finance#dnf

5 notes

·

View notes

Photo

#Iconoclast - Robert Kiyosaki

Robert grew up in the small town of Hilo, Hawaii. He went to college at Kings Point Merchant Marine Academy in New York state. Upon graduation, Robert turned down a well-paying job with Standard Oil and chose to enlist in the Marine Corps as a helicopter pilot at the time of the Vietnam War.

#Gentlemans Code#iconoclast#icon#financial education#finance#rich dad poor dad#rich dad education#hawaii#USA#investing#real estate#robert kiyosaki#entrepreneur#entrepreneurship#money#teacher

8 notes

·

View notes

Text

youtube

Rich Dad Poor Dad | Full Video | @surajkumar14648

In this video, I provide an in-depth review of the highly acclaimed book 'Rich Dad Poor Dad' by Robert Kiyosaki. I discuss the key concepts and lessons from the book, including the importance of financial education, the difference between assets and liabilities, and the power of investing in real estate. Whether you're a beginner or an experienced investor, this video will give you valuable insights on how to elevate your financial mindset and achieve financial independence.

#growth#mindset#personal#personal growth#rich dad poor dad#succession#audiobook#audiobooks#rich#book summary#Youtube

2 notes

·

View notes