#robert t kiyosaki

Explore tagged Tumblr posts

Text

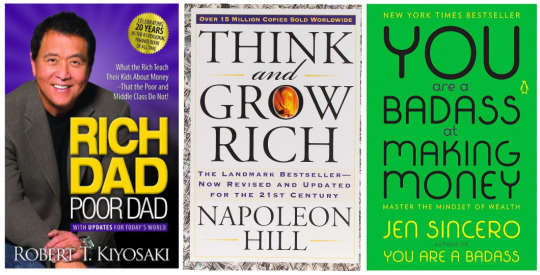

10 Books to Read

Good Vibes Good Life - Vex King

The Secret - Rhonda Byrne

The Intelligent Investor - Benjamin Graham

Atomic Habits - James Clear

The Psychology of Money - Morgan Housel

Make Your Bed - Admiral William H. McRaven

Rich Dad Poor Dad - Robert T. Kiyosaki

The 48 Laws of Power - Robert Greene

Think and Grow Rich - Napoleon Hill

The Power of Discipline - Daniel Walter

#junipers wonderful life#productivity#books#good vibes good life#the secret#the intelligent investor#atomic habits#the psychology of money#make your bed#rich dad poor dad#the 48 laws of power#think and grow rich#the power of discipline#vex king#rhonda byrne#benjamin graham#james clear#morgan housel#admiral william h mcraven#robert t kiyosaki#robert greene#napoleon hill#daniel walter

2 notes

·

View notes

Text

Buy Rich Dad Poor Dad (Hindi) Book Online in India

Get Rich Dad Poor Dad (Hindi) Book at Best price in India. Upto 40% Off

0 notes

Text

youtube

TODAY'S TOPIC: In our exploration of Robert T. Kiyosaki's "Rich Dad Poor Dad," we've uncovered 33 pivotal lessons for wealth-building. These lessons encompass a spectrum of principles, from embracing financial education and mastering assets and liabilities to making money work for you through strategic investments. The importance of entrepreneurship, learning from mistakes, and developing financial discipline were highlighted, alongside the need to embrace change and leverage time wisely.

Strategic networking, continuous self-improvement, and prudent risk management emerged as crucial elements in the journey to financial success. Diversifying investments, understanding market trends, and fostering continuous innovation were emphasized, while tax efficiency and a strong credit profile were deemed essential. Lessons on asset protection, legal awareness, and patience in investments rounded out the practical aspects of wealth-building.

Effective communication, a long-term perspective, and social responsibility were highlighted as key traits, along with the pursuit of financial independence and adaptability in career choices. The art of selling, creating multiple income streams, and the prudent use of debt were identified as valuable skills. Mastering emotions, legacy building, and a commitment to lifelong learning concluded our wealth-building insights.

These lessons collectively provide a comprehensive guide, offering actionable strategies and insights to navigate the intricate path to financial prosperity. Join us for more wisdom on "The Wealthy Status" as we continue to unravel the secrets of enduring wealth.

#robert t kiyosaki#robert kiyosaki#rich dad poor dad#how to make money#rich dad#how to get rich#poor dad#rich dad poor dad summary#book#books#33#life lessons#life advice#money#wealthy#wealth#robert kiyosaky#invest#fine living#money mindset#5 club#dicipline#kiyosaki#robert kiyosaki interview#robert#kiyosaki books#investing#create wealth#millionare#rich

0 notes

Photo

Failure defeats losers ~ @theRealKiyosaki

Failure defeats losers, failure inspires

inspiration, failure, business, business quotes, failure quotes, inspiration quotes, loser, loser quotes, winner, winner quotes, Robert T. Kiyosaki, Robert T. Kiyosaki quotes #PICTUREQUOTES, #QUOTES

#inspiration#failure#business#business quotes#failure quotes#inspiration quotes#loser#loser quotes#winner#winner quotes#Robert T. Kiyosaki#Robert T. Kiyosaki quotes#PICTURE QUOTES#QUOTES

6 notes

·

View notes

Text

6 libros para leer, si quieres emprender o aprender sobre el funcionamiento del dinero

Lectura inteligente sobre el dinero, las deudas, finanzas, el ahorro y el emprendimiento Hola, Curly hace unos meses me propuse sanar mi economía y mejorarla. No solo para este momento, sino para el futuro. Luego se me ocurrió, que de paso podía aprender a montar un negocio. Para conseguir estos dos objetivos tenía que saber los pasos básicos para llevarlo a cabo. Y eso significaba: uno ir a la…

View On WordPress

#deudas#dinero#El hombre más rico de Babilonia#emprender#finanzas#Georges s. Clason#gestión de ahorro#lectura#leer#Napoleon Hill#paciencia#Padre rico Padre pobre#Piense y hagase rico#problemas#Robert T. Kiyosaki

1 note

·

View note

Text

Descobri que muita gente usa arrogância para tentar esconder a própria ignorância.

1 note

·

View note

Text

True learning takes energy, passion and a burning desire.

-Robert T. Kiyosaki

#quotes#inspiring quotes#quoteoftheday#inspiration#words#motivation#writing#original poem#life learning#learning

21 notes

·

View notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

93 notes

·

View notes

Text

The poor and the middle class work for money. The rich have money work for them.

From RICH DAD POOR DAD By Robert T. Kiyosaki

#dark academia#spilled thoughts#bookish#book review#book quotes#booklover#self help#self help books#motivatedmindset#chaotic academia#quoteoftheday#phycology#aesthetic#rich dad poor dad#money#how to heal#how to get rich

36 notes

·

View notes

Text

The Self-Improvement Project: Books To Become A Money Magnet

Rich Dad, Poor Dad by Robert T. Kiyosaki

Think and Grow Rich by Napoleon Hill

The Psychology of Money by Morgan Housel

You Are a Badass At Making Money: Master the Mindset of Wealth by Jen Sincero

Money: A User's Guide by Laura Whateley

Girls That Invest by Simran Kaur

How To Make It Happen by Maria Hatzistefakis

Secrets Of Six-Figure Women by Barbara Stanny

MONEY Master The Game: 7 Simple Steps To Financial Freedom by Tony Robbins

We Should All Be Millionaires: A Women's Guide To Earning More, Building Wealth and Gaining Economic Power by Rachel Rodgers

Lean In: Women, Work and The Will To Lead by Sheryl Sandberg

The Millionaire Mind by Thomas J Stanley

How To Be An Overnight Success by Maria Hatzistefakis

#books#book blog#booklr#readblr#book reccs#book recommendations#bookaddict#bookworm#book list#finance#books about money#books about finance#financial independence#think and grow rich#rich dad poor dad#you are a badass at making money#the psychology of money#bookblr#book blogger#book community#book lover#self improvement#money magnet#money

16 notes

·

View notes

Text

I recently picked up my Dewey Decimal Challenge again.

(Long story: libraries were closed for COVID, then our local library closed for renovations, then when it reopened in a temp space, it had a tiny Dewey reference shelf, etc.)

I don't have time anymore to write reviews - maybe I will for the ones I read over the summer - but I'd like to hold myself accountable by at least posting the Dewey call number and title/author for the books I did read.

So here goes.

300s: Social sciences, sociology, anthropology 306.0974 - The Queens Nobody Knows: an urban walking guide by William B. Helmreich

310s: Statistics - apparently I accidentally skipped. Thought I read it before COVID.

320s: Political Science 328.7309 - Courage in the People's House by Rep. Joe Neguse

330s: Economics 332.024 - Rich Dad, Poor Dad by Robert T. Kiyosaki

340s: Law 346.7304 - Mine! by Michael Heller and James Salzman 347.7326 - Showdown by Wil Haygood

350s is on my night table waiting for me!

2 notes

·

View notes

Text

Buy Rich Dad Poor Dad Gujarati Book Online in India

Get Rich Dad Poor Dad Gujarati Book at Best price in India. Upto 40% Off

0 notes

Text

youtube

#robert t kiyosaki#robert kiyosaki#rich dad poor dad#how to make money#rich dad#how to get rich#poor dad#rich dad poor dad summary#book#books#33#life lessons#life advice#money#wealthy#wealth#robert kiyosaky#invest#fine living#money mindset#5 club#dicipline#kiyosaki#robert kiyosaki interview#robert#kiyosaki books#investing#create wealth#millionare#rich

0 notes

Text

Rich Dad Poor Dad Book Review

Rich Dad Poor Dad book is written by Robert T. Kiyosaki, who is an American businessman and author. It’s a must have book for the beginners, who wants to gain knowledge about financial education. He had explained it with sharing his own experiences, based on the principles of financial literacy – investing, accounts, returns, liabilities, mutual funds etc. He had shared his own journey, as a…

View On WordPress

#blog#blogger#blogpost#book#book blogger#book club#book community#book lover#book marks#book nerd#book review#books#bookworm#classic novel#read#reader

3 notes

·

View notes

Text

A glimpse about Mutual funds

We all are fascinated about growing our passive income apart from the income that we acquire from various active sources i.e. from our jobs etc. But during the process when we desire for the time when “Money can work for us, instead of we working for it” as said by the great financial trainer Robert T Kiyosaki. We generally tend to have a fear or confusion whether we should invest in stocks or not?

This usually happens with most of us. The primary reason for this could be the lack of fundamental financial education. Having a desire to invest but unable to do so creates a dilemma which in turn opens a Pandora’s box for ourselves and we keep on working for money instead of creating a system where money can work for us.

What basically Mutual fund is?

A mutual fund as the name suggests is a fund in which several investors put in their share or contribution to generate a pool of money. This money is in turn invested by the company that basically offers the fund and since this is done by professionals who have proper knowledge about the financial market, you can get a better return out of it.

In simple terms, buying a mutual fund is like buying a pastry out of the entire cake. The mutual fund owner gets his share from the gains, profits, losses etc.

How Mutual funds are managed? Which body regulates it?

The company that manages the mutual fund is known as Asset Management Company. This company in turn hires a professional money manager, who trades in securities to accomplish the stated objective.

All the AMC’s are regulated by the Securities Exchange Board of India (SEBI). It provides regulations and guidelines which all AMC’s have to adhere.

Benefits of investing through Mutual funds.

All the mutual funds regulated by SEBI, are managed by highly professional money managers. These money managers always have a bulls-eye on the market and as it is their primary occupation they devote more time compared to any other investor who is investing in stocks individually. When you don’t have enough knowledge, mutual funds provide a way where you can avoid the stress of calculating difficult financial ratios and even analysing the company’s financial statement.

Basically, by using mutual funds, “You are using an instrument of money-making and using your money to earn more money for you, even if you don’t have an experience of doing it properly.

How to start the journey of investing in Mutual funds?

Investments in mutual funds can be done with a few clicks on the internet. Basically, through an online mode, it can be through the website offered by the Asset management company or through various apps.

1. Investing through an official website of Asset Management Company (AMC).

Every asset management company offers its website. Through that website, you can invest in various mutual funds schemes by just following the steps and completing your e-KYC verification. For this, your Aadhar and PAN card is required.

2. Through Apps

You can get the details of mutual funds and can easily invest in it by installing some apps in your smartphone. Various apps are available which allows you to get the details about the various mutual fund schemes, your account statement etc. Investors have a plethora of options for investing in various fund houses.

Precaution before investing in Mutual funds

As mutual funds are subject to market risks, you must choose your investing instrument carefully before investing. For any kind of financial investment activities, we recommend you to kindly learn about mutual funds and Systematic Investment Plan (SIP) in detail and if possible take the help of an expert professional regarding risks and returns. Because when it comes to investing, the only way to reduce the risk is to know the market in a better way from an expert.

3 notes

·

View notes

Text

How 'Rich Dad Poor Dad' Can Help You Transform Your Finances

Transform your financial future with Bookish Buzz's Rich Dad Poor Dad Challenge! Join us and learn how to make your money work for you with day 5 of the audiobook by Robert Kiyosaki. Check out our 7 helpful lessons from the book to apply to your own life. Don't miss out on this opportunity to gain financial freedom! #RichDadPoorDad

"Rich Dad Poor Dad" is an invaluable resource for anyone looking to take control of their finances and transform their financial future. Through its lessons on money, assets, and liabilities, financial literacy, and business ownership, readers can gain a better understanding of how to build wealth and achieve financial success. By taking action towards their financial goals and adopting a mindset of abundance, readers can begin to create a life of financial freedom and abundance.

youtube

2 notes

·

View notes