#federal taxes

Explore tagged Tumblr posts

Text

No (Federal) Taxes on Tips

No Tax on Tips by the Daily Show ft Desi Lydic

youtube

youtube

Desi Lydic: It's weird he's even talking about sending teachers to the gulag, because Trump has more popular policies, like his proposal to end taxes on tips, which is so popular that Kamala Harris now says that SHE supports it. And Trump is not happy about that … Look, to be fair, Kamala did copy Trump's no tax on tips idea,

which would make it the first time in history that a woman got credit for repeating a man's idea.

We did it, girls. And she didn't stop there. Kamala also completely ripped off his idea to lead in the polls by 3 points against a rapidly deteriorating candidate. That was his thing. That was his thing.

.

Harris v. Trump on Taxing Tips by Robert Reich

youtube

Kamala Harris, Saturday, in Las Vegas: Raise the minimum wage. And eliminate taxes on tips for service and hospitality workers Donald Trump, at Mar-A-Lago: We’re gonna have no tax on tips. Very simple

Ali Velshi from MSNBC: The Trump plan sounds like it's for regular people, but it could easily be a backdoor way to give big tax breaks to rich people who can reclassify their commission income as tips

Robert Reich: You betcha. In fact, we are going to see all kinds of things reclassified as tips. You can bet that private equity managers and hedge fund managers, who are now in the seven or eight digit classification, suddenly a lot of what they earn will become tips. At least under Donald Trump's proposal, because it's not — there are no guardrails. There's no limits to who can declare what as tips Ali Velshi from MSNBC: The key difference in Kamala Harris’ no taxes on tips proposal is that it's only for service and hospitality workers RR: I think it could be helpful if combined, as Kamala Harris wants to do, with a minimum wage hike. And also limit it so that Wall Street commission professionals can't sort of reclassify their income as tips. By the way, let me just say one further thing about this, and that is that the Labor Department under Donald Trump DID change the regulations to allow employers to take the tipped incomes of their employees and use it for their profits.. I mean, it's quite rich that Donald Trump has jumped on this one

.

Americans For Tax Fairness (@/4TaxFairness)

"No taxes on tips" isn't the win you think it is. Most tipped workers wouldn't get much of a tax cut at all. But you know who would? Corporations that employ tipped workers and the wealthy who can relabel their income as "tips" at will. Pass.

(Title of the above image is Table 1: The No Tax on Tips Act would provide no or paltry tax cuts to many tipped employees – far less than restoring American Rescue Plan tax credits)

.

Robert Reich (@/RBReich) quote-retweeted with:

Trump keeps touting plans to not tax tips. But estimates show that a majority of tipped workers wouldn't benefit. Who would benefit? Big earners like hedge fund managers who could convert their fees into "tips" and get big tax breaks. It's another Trump tax scam.

.

Why Trump's and Harris' proposals to end federal taxes on tips would be difficult to enact

By Dee-Ann Durbin | The Associated Press

Quotes:

Former President Donald Trump and Vice President Kamala Harris agree on one thing, at least: Both say they want to eliminate federal taxes on workers’ tips.

But experts say there’s a reason Congress hasn’t made such a change already. It would be complicated, not to mention enormously costly to the federal government, to enact. It would encourage many higher-paid workers to restructure their compensation to classify some of it as “tips” and thereby avoid taxes. And, in the end, it likely wouldn’t help millions of low-income workers.

“There’s no way that it wouldn’t be a mess,” said James Hines Jr., a professor of law and economics and the research director of the Office of Tax Policy Research at the University of Michigan’s Ross School of Business.

Both candidates unveiled their plans in Nevada, a state with one of the highest concentrations of tipped service workers in the country. Trump announced a proposal to exclude tips from federal taxes on June 9. Harris announced a similar proposal on Aug. 10.

.

Harris’ campaign has said she would work with Congress to draft a proposal that would include an income limit and other provisions to prevent abuses by wealthy individuals who might seek to structure their compensation to classify certain fees as tips.

Her campaign said these requirements, which it did not specify, would be intended “to prevent hedge fund managers and lawyers from structuring their compensation in ways to try to take advantage of the policy.” Trump's campaign has not said whether its proposal would include any such requirements.

Even so, Hines suggested that millions of workers — not just wealthy ones — would seek to change their compensation to include tips, and could even do so legally. For example, he said, a company might set up a separate entity that would reward its employees with tips instead of year-end bonuses.

“You will have taxpayers pushing their attorneys to try to characterize their wage and salary income as tips,” Hines said. “And some would be successful, inevitably, because it’s impossible to write foolproof rules that will cover every situation."

.

Though supporters say the measures are designed to help low-wage workers, many experts say that making tips tax-free would provide only limited help to those workers.

The Budget Lab at Yale, a non-partisan policy research center, estimates that there were 4 million U.S. workers in tipped occupations in 2023. That amounted to about 2.5% of all employees, including restaurant servers and beauticians. Tipped workers tend to be younger, with an average age of 31, and of lower income. The Budget Lab said the median weekly pay for tipped workers in 2023 was $538, compared with roughly $1,000 for non-tipped workers.

As a result, many tipped workers already bear a lower income-tax burden. In 2022, 37% of tipped workers had incomes low enough that they paid no federal income tax at all, The Budget Lab said.

“If the issue is you’re concerned about low-income taxpayers, there are a lot better ways to address that problem, like expanding the Earned Income Tax Credit or changing tax rates or changing deductions,” Hines said.

In her speech in Nevada, Harris also called for raising the federal minimum wage. (The platform on Trump’s campaign site doesn’t mention the minimum wage.)

Changing federal tax policy on tips would also be costly. The Committee for a Responsible Federal Budget, a non-partisan group, estimates that exempting all tip income from federal income and payroll taxes would reduce revenue by $150 billion to $250 billion between 2026 and 2035. And it said that amount could rise significantly if the policy changed behavior and more people declared tip income.

Whether Trump or Harris wins the presidential election, tax policy will be high on Congress’ agenda in 2025. That’s because Trump-era tax cuts, passed in 2017, are set to expire. But Hines said he thinks Congress will be in no hurry to add “vast amounts of complexity” to the tax code.

“A presidential candidate can say whatever they want, but it's the House and Senate that have to do it,” he said.

#long#i post#i link#link to article#i quote#no tax on tips#no taxes on tips#tips#us politics#youtube#gratuity#minimum wage#low income#taxpayer#taxes#tax#federal taxes#daily show#desi lydic#hepeating#robert reich#msnbc#ali velshi#the last word with lawrence o'donnell#wheres o'donnel tho#i dont watch msnbc#so im confused#whatever#commission#hedge fund managers

5 notes

·

View notes

Text

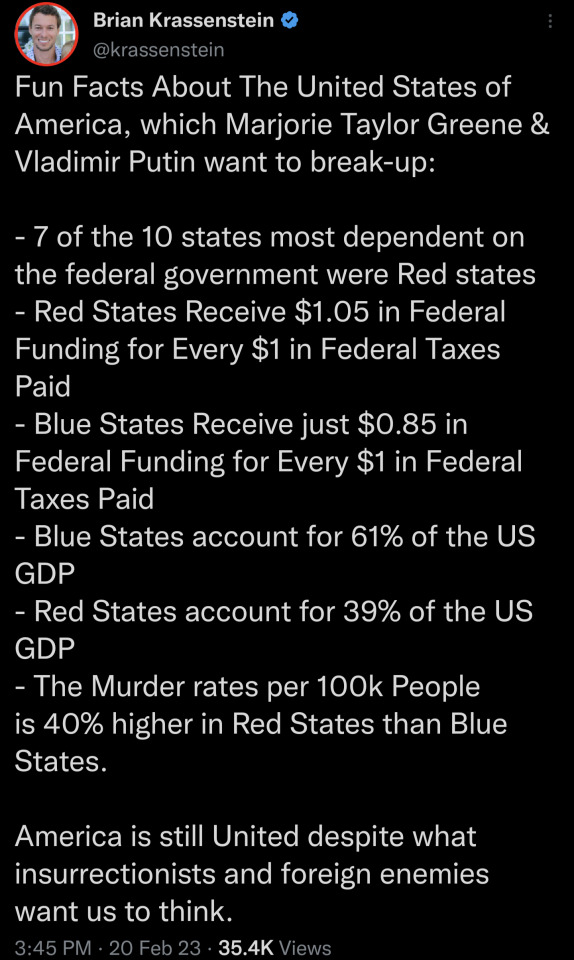

#us politics#twitter#tweet#2023#brian krassenstein#red states#blue states#blue states pay for red states#rep. marjorie taylor greene#vladimir putin#federal funding#federal taxes#gross domestic product#murder rates#domestic terrorism#russia#imperial russia#foreign adversaries

92 notes

·

View notes

Text

Trump tells a crowd in Las Vegas he is working with Congress on a bill to exclude tips from federal taxes

https://urlhub.pro/01bf53

3 notes

·

View notes

Text

Federal tax brackets in 1955 during the Golden age of our economy.

#Federal tax brackets in 1955 during the Golden age of our economy.#federal taxes#federal#us taxes#property taxes#death and taxes game#filing taxes#taxes#tax#1955#economics#economy#capitalism#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#poverty#homeless#eat the rich#eat the fucking rich#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese

7 notes

·

View notes

Text

An open letter to the U.S. Congress

Co-sponsor the American Stability Act to end income inequality!

624 so far! Help us get to 1,000 signers!

As your constituent, I am urging you to co-sponsor the American Stability Act (ASA). The American Stability Act is a bold, elegant solution to the threat posed by destabilizing levels of inequality.

The American Stability Act does the following:

-ELIMINATES FEDERAL TAXES for any taxpayer making less than the median cost of living for a single adult with no children (slightly above $40,000 a year);

-SHIFTS the responsibility for these revenues onto taxpayers making more than $1 million a year;

-REPLACES the ‘minimum’ wage with a new “Stability Wage,” which is set to the median cost of living in the US for a single adult with no children, and then indexes it to make that principle permanent.

We need bold, innovative reform. Lawmakers like you must structure a more stable, prosperous economy that will deliver the results we need for a strong nation.

▶ Created on October 28 by Jess Craven · 623 signers in the past 7 days

📱 Text SIGN PVBLPU to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PVBLPU#tax the rich#income inequality#American Stability Act#economic reform#fair taxation#progressive tax policy#Congress#social justice#eliminate poverty#median cost of living#tax reform#federal taxes#stability wage#minimum wage#living wage#wealth inequality#end income inequality#economic stability#prosperity#economic justice#wealth redistribution#economic fairness#bold reform#innovative policies#working-class rights#fiscal policy#sign the petition#constituent action

2 notes

·

View notes

Text

#free palestine#signal boost#save palestine#palestine#don’t use my taxes to aid a genocide#genocide#ethnic cleansing#federal taxes#khaled beydoun#international law#war crimes#blaze🔥

5 notes

·

View notes

Photo

It’s real, I use this site myself every year since it’s been out.

150K notes

·

View notes

Text

Hunter Biden pleaded guilty in federal tax case

US President Joe Biden’s son, Hunter Biden, pleaded guilty to federal tax charges, avoiding a potentially embarrassing trial ahead of the US presidential election.

Biden was due in Los Angeles federal court on charges of failing to pay $1.4 million in taxes. According to the charges, he spent the money on drugs, escorts, and luxury items.

He pleaded guilty to all nine charges. Judge Mark Scarsi told Biden he could face up to 17 years in prison and a fine of as much as $450,000. Sentencing is scheduled for 16 December. Earlier in the day, Biden offered to plead guilty to the charges but not admit wrongdoing. It was an unusual legal manoeuvre dubbed the Alford plea.

The guilty plea breaks a week-long trial that was supposed to take place in the midst of the election campaign. On 5 November, voters will choose between Vice President Kamala Harris, a Democrat, and former Republican President Donald Trump. Joe Biden abandoned his bid for re-election in July under pressure from Democrats.

Hunter Biden is accused of failing to pay taxes from 2016 to 2019, spending huge sums “on drugs, escorts and girlfriends, luxury hotels and rental properties, exotic cars, clothing, and other items of a personal nature,” according to the indictment.

The trial could also shed light on his work with Ukrainian gas company Burisma and other business dealings when his father was a vice president. The indictment said Hunter Biden “earned handsomely” by serving on the boards of Burisma and a Chinese private investment fund.

He is also appealing a conviction in a separate case in Delaware for illegally buying guns while using drugs. The White House stated, President Biden had ruled out the possibility of a pardon.

Read more HERE

#world news#news#world politics#usa#usa news#usa politics#united states#politics#us politics#us news#hunter biden#hunter biden trial#hunter biden guilty#biden trial#burisma#federal taxes

0 notes

Text

Tax Planning for High-Growth Startups: What You Need to Know

As a founder of a high-growth startup, you're likely juggling numerous responsibilities—from securing funding to scaling your business. Amidst this whirlwind, tax planning might not seem like the most pressing issue, but it’s a crucial element that can significantly impact your company’s financial health and long-term success. Here’s a guide to help you navigate the complex world of tax planning for startups, ensuring you’re prepared for both opportunities and challenges.

1. Understand Your Tax Obligations

The first step in effective tax planning is understanding what you owe. This includes federal, state, and local taxes. In the U.S., startups typically need to consider:

Income Tax: Based on your company's net income.

Payroll Tax: If you have employees, you need to withhold and pay Social Security, Medicare, and unemployment taxes.

Sales Tax: If you’re selling products or services, you might be liable for sales tax in various states.

Excise Tax: For certain types of businesses, like those in manufacturing or transportation, additional taxes might apply.

2. Choose the Right Business Structure

The structure of your business has a significant impact on your tax obligations. Common structures include:

Sole Proprietorship: Simple but doesn’t provide liability protection.

Partnership: Involves shared responsibility but also shared liability.

LLC (Limited Liability Company): Offers liability protection and flexibility in taxation.

C Corporation: Taxed separately from its owners but offers benefits like attracting investors and stock options.

S Corporation: Allows profits (and losses) to pass through to shareholders, avoiding double taxation.

Each structure has different implications for tax planning and should align with your long-term business goals.

3. Leverage Tax Deductions and Credits

Startups can take advantage of various tax deductions and credits to reduce their taxable income. Common deductions include:

Business Expenses: Salaries, rent, utilities, and office supplies.

Depreciation: For significant assets like equipment and technology.

Research and Development (R&D) Credits: For businesses investing in innovation.

Ensure you keep thorough records of all expenses and consult with a tax advisor to identify all available deductions and credits.

4. Plan for Equity Compensation

If you're offering stock options or other equity-based compensation to attract and retain top talent, be aware of the tax implications. Equity compensation can be complex, with different tax treatments depending on the type of stock options and timing of exercises.

Work with a financial advisor to structure equity compensation in a way that aligns with your tax strategy and incentivizes employees effectively.

5. Consider International Tax Issues

If your startup is expanding globally, international tax planning becomes critical. Be aware of:

Transfer Pricing: Rules governing how transactions between related business entities are priced.

VAT/GST: Sales taxes in various countries.

Tax Treaties: Agreements between countries to avoid double taxation.

Engage with experts in international tax to navigate these complexities and ensure compliance.

6. Prepare for Future Growth

As your startup scales, tax planning needs will evolve. Proactive planning can help you manage:

Increased Complexity: With growth, your tax situation will likely become more complex, requiring more sophisticated strategies.

Funding Rounds: New investments can alter your tax position and planning needs.

Exit Strategies: If you’re considering an acquisition or IPO, tax implications will be significant.

Regularly review and adjust your tax strategy as your business grows to avoid pitfalls and capitalize on opportunities.

7. Consult with Professionals

Tax planning for startups can be intricate, and regulations frequently change. Consulting with a tax professional or advisor who specializes in startups can provide invaluable insights and help you navigate the complexities of the tax landscape.

Final Thoughts

Effective tax planning isn’t just about minimizing tax liabilities; it’s about aligning your tax strategy with your overall business goals. By understanding your tax obligations, leveraging deductions and credits, planning for equity compensation, and preparing for growth, you can position your startup for financial success and stability.

Remember, proactive tax planning can free up resources for innovation and expansion, ultimately supporting the long-term success of your high-growth startup. So, take the time to develop a robust tax strategy—your future self will thank you.

0 notes

Text

"Toil And Trouble," Winnipeg Tribune. July 1, 1943. Page 11. --- This citizen aged a few years and contributed a load of paper to salvage Wednesday when he hurried to beat the midnight income tax deadline. He is J. Bicknell, 842 Seventh st., Brandon. The picture was taken in the Income Tax office in the Federal building, Winnipeg.

#brandon manitoba#income tax#tax deadline#dominion of canada#federal taxes#canada during world war 2

0 notes

Text

hi!! dropping off some of the things i drew on my break so far. ^_^

#☆ my art .#baconnwaffles0#planetlord#mapicc#princezam#wato1876#wemmbu#pangi#eggchan#spokeishere#vitalasy#itzsubz#ashswag#thats all of em i think#spacewaffles#tax duo#ohhhh how i miss them#eclipse federation#ashzam#empire duo#devotion duo#lifesteal smp#unstable universe#lsshipping#this is a mess but i dont feel like organizing it#its just an art dump i guess#i'm feeling better so i just wanted to drop these here#might still be low on activity but i'm definitely doing better#mostly thanks to people from silly time gc hi creatures#a couple of those are uh reqs i remembered i had

477 notes

·

View notes

Text

Due to the fact this bill is written by an idiot most news sources aren't 100% clear on what it will affect. Although no matter how its taken, many goverment funded programs and loans are under attack. Stay vigilant and stay afloat as well as you can during this horrendous time.

I will update as more info is released.

#2024 presidential election#america has failed us#donald trump#american politics#politics#trumps america#trump#us election 2024#us politics#snap#food concerns#food help#poverty#poverty tax#federal programs#federal funding#yall traded your daughter's rights for nothing

40 notes

·

View notes

Text

Trump did say he was going to punish California for the crime of not voting for him, no one should be suprised either that's he spewing a stream of misinformation maliciously. We shouldn't take this lying down and keep steady, ironically enough the Republican's weakening of the federal government means that's it's easier to challenge him.

#culture#leftism#progressive#politics#the left#us politics#communism#eat the rich#tax the rich#corporate greed#anti trump#donald trump#trump#fuck trump#trump 2024#president trump#maga#trump administration#democrats#jd vance#california news#california fires#california wildfires#los angeles#sacramento county#sacramento california#san francisco#federal government#state#national

20 notes

·

View notes

Text

If you're wondering why I set up ko-fi membership stuff after I really resisted monetizing in any way for so long, btw... Honestly, it's because taxes and some big surprise vet bills this month kinda. decimated my savings. by a lot.

Normally I'm okay enough financially, but I'm in a really high cost of living area, and it's just been a really rough month in a lot of different ways.

So, if you're interested in supporting me or my work, whether it's with a membership or a one-time thing or whatever - and only if you can genuinely afford it - that would honestly be amazing and more helpful than I strictly like to admit

As an extra incentive, if this ko-fi thing goes well, I'll commit to actually answering asks and shit again lol

Either way <3 <3 to all of you

#me#admin#blog business#not news#ko fi#the federal tax system is fucking broken#literally appalling that I made below the poverty line last year and still owed $2k in taxes#that should be illegal to do to anyone#not that “the US tax system is broken” is news to anyone but yknow it bears repeating#vet bills are like medical bills also super broken in the us#I should not have to pay this much money just to say goodbye to my baby#..................yeah like I said rough month#maybe keep me and my baby Roo in your thoughts this week#that would be really kind <3

58 notes

·

View notes