#no tax on tips

Explore tagged Tumblr posts

Text

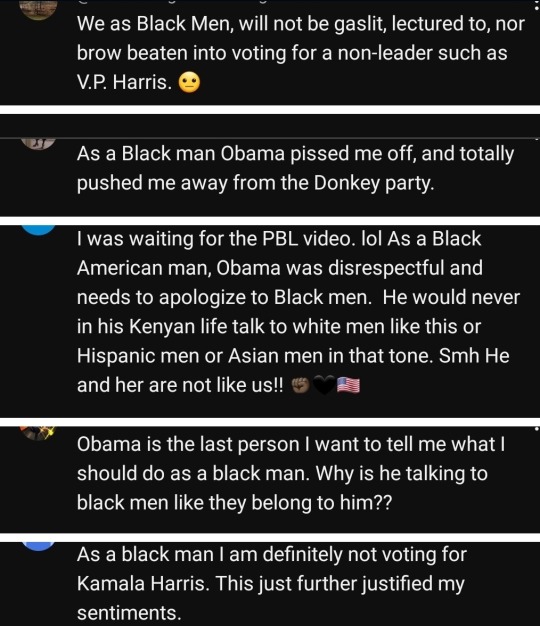

Black MEN tell Barack Obama to go home to Martha's Vineyard & kick rocks!!

youtube

"No more simping! It's Trump 2024"

youtube

Anton's follow up commentary: https://youtu.be/72b5EywbWqg?si=jtjO9cTFB4eIN7AS

Nina Turner calls out Obama's DISRESPECTFUL tone towards BLACK Men

youtube

"...finger wagging & shaming..." from Obama to BLACK Men

youtube

youtube

Obama's "plantation speech" is rejected

youtube

Eloquent Pastor reminds BLACK men it's none of Obama's business which box you check in the PRIVATE voting booth.

youtube

"Barry leave us alone!"

youtube

Polling Black men in Chicago

youtube

Ace Smart

youtube

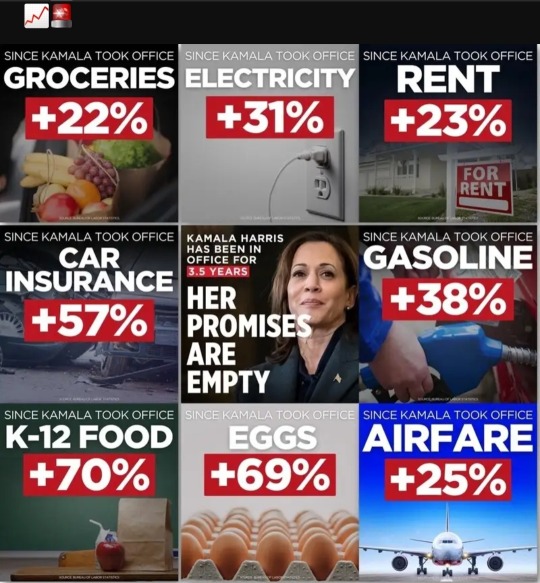

Under Trump: No new wars, better economy & low crime.

Under Kamala Harris:

#Kamala Harris is a Cop#nina turner#barack obama#black men#kamala harris is a dirty cop#no tax on tips#1994 crime bill#obama shames black men#close the border#Youtube

64 notes

·

View notes

Text

No (Federal) Taxes on Tips

No Tax on Tips by the Daily Show ft Desi Lydic

youtube

youtube

Desi Lydic: It's weird he's even talking about sending teachers to the gulag, because Trump has more popular policies, like his proposal to end taxes on tips, which is so popular that Kamala Harris now says that SHE supports it. And Trump is not happy about that … Look, to be fair, Kamala did copy Trump's no tax on tips idea,

which would make it the first time in history that a woman got credit for repeating a man's idea.

We did it, girls. And she didn't stop there. Kamala also completely ripped off his idea to lead in the polls by 3 points against a rapidly deteriorating candidate. That was his thing. That was his thing.

.

Harris v. Trump on Taxing Tips by Robert Reich

youtube

Kamala Harris, Saturday, in Las Vegas: Raise the minimum wage. And eliminate taxes on tips for service and hospitality workers Donald Trump, at Mar-A-Lago: We’re gonna have no tax on tips. Very simple

Ali Velshi from MSNBC: The Trump plan sounds like it's for regular people, but it could easily be a backdoor way to give big tax breaks to rich people who can reclassify their commission income as tips

Robert Reich: You betcha. In fact, we are going to see all kinds of things reclassified as tips. You can bet that private equity managers and hedge fund managers, who are now in the seven or eight digit classification, suddenly a lot of what they earn will become tips. At least under Donald Trump's proposal, because it's not — there are no guardrails. There's no limits to who can declare what as tips Ali Velshi from MSNBC: The key difference in Kamala Harris’ no taxes on tips proposal is that it's only for service and hospitality workers RR: I think it could be helpful if combined, as Kamala Harris wants to do, with a minimum wage hike. And also limit it so that Wall Street commission professionals can't sort of reclassify their income as tips. By the way, let me just say one further thing about this, and that is that the Labor Department under Donald Trump DID change the regulations to allow employers to take the tipped incomes of their employees and use it for their profits.. I mean, it's quite rich that Donald Trump has jumped on this one

.

Americans For Tax Fairness (@/4TaxFairness)

"No taxes on tips" isn't the win you think it is. Most tipped workers wouldn't get much of a tax cut at all. But you know who would? Corporations that employ tipped workers and the wealthy who can relabel their income as "tips" at will. Pass.

(Title of the above image is Table 1: The No Tax on Tips Act would provide no or paltry tax cuts to many tipped employees – far less than restoring American Rescue Plan tax credits)

.

Robert Reich (@/RBReich) quote-retweeted with:

Trump keeps touting plans to not tax tips. But estimates show that a majority of tipped workers wouldn't benefit. Who would benefit? Big earners like hedge fund managers who could convert their fees into "tips" and get big tax breaks. It's another Trump tax scam.

.

Why Trump's and Harris' proposals to end federal taxes on tips would be difficult to enact

By Dee-Ann Durbin | The Associated Press

Quotes:

Former President Donald Trump and Vice President Kamala Harris agree on one thing, at least: Both say they want to eliminate federal taxes on workers’ tips.

But experts say there’s a reason Congress hasn’t made such a change already. It would be complicated, not to mention enormously costly to the federal government, to enact. It would encourage many higher-paid workers to restructure their compensation to classify some of it as “tips” and thereby avoid taxes. And, in the end, it likely wouldn’t help millions of low-income workers.

“There’s no way that it wouldn’t be a mess,” said James Hines Jr., a professor of law and economics and the research director of the Office of Tax Policy Research at the University of Michigan’s Ross School of Business.

Both candidates unveiled their plans in Nevada, a state with one of the highest concentrations of tipped service workers in the country. Trump announced a proposal to exclude tips from federal taxes on June 9. Harris announced a similar proposal on Aug. 10.

.

Harris’ campaign has said she would work with Congress to draft a proposal that would include an income limit and other provisions to prevent abuses by wealthy individuals who might seek to structure their compensation to classify certain fees as tips.

Her campaign said these requirements, which it did not specify, would be intended “to prevent hedge fund managers and lawyers from structuring their compensation in ways to try to take advantage of the policy.” Trump's campaign has not said whether its proposal would include any such requirements.

Even so, Hines suggested that millions of workers — not just wealthy ones — would seek to change their compensation to include tips, and could even do so legally. For example, he said, a company might set up a separate entity that would reward its employees with tips instead of year-end bonuses.

“You will have taxpayers pushing their attorneys to try to characterize their wage and salary income as tips,” Hines said. “And some would be successful, inevitably, because it’s impossible to write foolproof rules that will cover every situation."

.

Though supporters say the measures are designed to help low-wage workers, many experts say that making tips tax-free would provide only limited help to those workers.

The Budget Lab at Yale, a non-partisan policy research center, estimates that there were 4 million U.S. workers in tipped occupations in 2023. That amounted to about 2.5% of all employees, including restaurant servers and beauticians. Tipped workers tend to be younger, with an average age of 31, and of lower income. The Budget Lab said the median weekly pay for tipped workers in 2023 was $538, compared with roughly $1,000 for non-tipped workers.

As a result, many tipped workers already bear a lower income-tax burden. In 2022, 37% of tipped workers had incomes low enough that they paid no federal income tax at all, The Budget Lab said.

“If the issue is you’re concerned about low-income taxpayers, there are a lot better ways to address that problem, like expanding the Earned Income Tax Credit or changing tax rates or changing deductions,” Hines said.

In her speech in Nevada, Harris also called for raising the federal minimum wage. (The platform on Trump’s campaign site doesn’t mention the minimum wage.)

Changing federal tax policy on tips would also be costly. The Committee for a Responsible Federal Budget, a non-partisan group, estimates that exempting all tip income from federal income and payroll taxes would reduce revenue by $150 billion to $250 billion between 2026 and 2035. And it said that amount could rise significantly if the policy changed behavior and more people declared tip income.

Whether Trump or Harris wins the presidential election, tax policy will be high on Congress’ agenda in 2025. That’s because Trump-era tax cuts, passed in 2017, are set to expire. But Hines said he thinks Congress will be in no hurry to add “vast amounts of complexity” to the tax code.

“A presidential candidate can say whatever they want, but it's the House and Senate that have to do it,” he said.

#long#i post#i link#link to article#i quote#no tax on tips#no taxes on tips#tips#us politics#youtube#gratuity#minimum wage#low income#taxpayer#taxes#tax#federal taxes#daily show#desi lydic#hepeating#robert reich#msnbc#ali velshi#the last word with lawrence o'donnell#wheres o'donnel tho#i dont watch msnbc#so im confused#whatever#commission#hedge fund managers

5 notes

·

View notes

Text

Wait.. Kamala to end tax on tips, or Trump?

Either way.. servers will take it .. ;)

5 notes

·

View notes

Text

2 notes

·

View notes

Text

No Tax On Tips

Aloha kākou. Follow me back through the Wayback machine with Mr. Peabody and Sherman. It’s the year 2020 just a few months before the reelection of President Trump. When Pedo-Hitler Biden and the Marxist democrats rigged the election. Queue Intro: Back in 2020, when the Covid Scamdemic first broke out, the painful decision to shut down the country, indeed the world, for two weeks to flatten the…

View On WordPress

#Capitol Gains#Economic Opportunity#Economy#Election 2020#Election 2024#Hospitality#income#IRS#Jobs#Marxist Democrats#No Tax On Tips#Republicans#Student Debt#taxes#tips#Trump Economy#Unions

2 notes

·

View notes

Text

Breaking Down Trump’s ‘No Tax on Overtime’ Proposal for Workers

It’s Friday evening, and after a long week of extended shifts, Alex is finally heading home. As he glances at his paycheck, he feels the familiar sting—those extra hours he worked overtime are heavily reduced by taxes. While the additional income is always welcome, the amount taken out in taxes leaves him questioning if the extra effort is worth it. Now, imagine a world where that overtime pay was untouched by taxes. This is the essence of Trump’s latest proposal—no taxes on overtime wages—and for workers like Alex, it seems almost too good to be true.

This proposal has sparked significant conversation about how such a policy could impact the take-home pay of millions of Americans, the broader economy, and the labor market. Let’s break down how it might work, who stands to benefit the most, and what the ripple effects could be.

How Overtime Pay Works and What Could Change

Under current U.S. law, most employees who work more than 40 hours per week are entitled to receive overtime pay at 1.5 times their regular hourly wage. For example, if Alex typically earns $20 per hour, he would make $30 per hour for any time worked beyond 40 hours in a week. However, those additional earnings don’t all go straight into his pocket. Federal, state, and payroll taxes take a significant bite out of the extra pay.

Consider a typical scenario: Alex works 10 extra hours at his overtime rate of $30 per hour, giving him an additional $300 in gross income. But once taxes are applied, he could see up to 25% of that overtime pay disappear, leaving him with $225 or less. Trump’s proposal seeks to change this by eliminating the tax burden on overtime earnings, allowing workers to keep 100% of the money they earn during those extra hours.

Potential Financial Impact on Workers

So, how much could this change actually put back into workers' pockets? Let’s look at some numbers.

The average U.S. employee works about 42-43 hours per week, meaning they clock in roughly 2-3 hours of overtime on a regular basis. According to labor statistics, the average hourly wage in the U.S. is around $28.52. At an overtime rate of 1.5 times that amount, the average overtime pay is roughly $42.78 per hour.

If a worker puts in three hours of overtime each week, that equates to about $128 in overtime pay per week. Multiply that by 52 weeks, and it adds up to $6,656 in overtime earnings annually. Under current tax laws, a worker could lose about 25% of that in taxes, leaving them with around $4,992. Trump’s proposed “no tax on overtime” plan could allow that same worker to keep the entire $6,656, resulting in a nearly $1,700 increase in take-home pay each year.

For workers in industries where overtime is common, like healthcare, manufacturing, and construction, the financial benefits could be even greater. In healthcare, where nurses and medical professionals often work extensive overtime, the extra income could provide significant relief, especially in a sector already dealing with wage concerns and burnout.

Which Workers Stand to Gain the Most?

Not all workers are equally impacted by overtime, and therefore, not all will see the same level of benefit from this proposal. Certain sectors of the economy rely more heavily on overtime hours, and employees in those fields could see the biggest financial boost.

Take the manufacturing industry as an example. In 2023, manufacturing workers averaged 3.5 hours of overtime per week. With the average hourly wage in manufacturing sitting around $25, overtime earnings would be roughly $37.50 per hour. Over the course of a year, that translates into about $6,825 in overtime pay. If current tax laws take away 25% of that income, the worker is left with $5,119. Trump’s proposal would allow them to keep the entire amount, potentially boosting their income by over $1,700 annually.

Similarly, in the healthcare industry, nurses working overtime can easily rack up 10 to 15 hours of extra work each week. With average hourly wages in healthcare ranging from $30 to $50 per hour, these employees could see significant increases in their take-home pay under a tax-free overtime policy.

Potential Economic Impacts

While workers may be excited about the prospect of keeping more of their overtime earnings, there are broader economic implications to consider. Removing taxes on overtime pay would result in a significant reduction in government revenue. Payroll taxes contribute to Social Security and Medicare funding, and any loss of revenue in these areas could necessitate changes in tax rates elsewhere or cuts to government programs.

Additionally, there’s the question of how businesses might respond. If companies know their employees will take home more money from overtime, they may decide to limit overtime opportunities to keep labor costs in check. This could be particularly true in industries that already face tight profit margins. On the flip side, if workers are more willing to take on overtime due to the increased financial incentive, overall productivity might see a boost, leading to positive outcomes for both workers and employers.

Feasibility and Legislative Hurdles

The path to implementing this “no tax on overtime” proposal is anything but certain. Tax policies are always a hot-button issue in Washington, and eliminating taxes on overtime pay would likely face resistance from lawmakers concerned about its impact on the federal budget. Additionally, some opponents might argue that such a policy disproportionately benefits certain segments of the workforce while leaving others unaffected.

That being said, this proposal taps into a broader discussion about wage stagnation and the rising cost of living. For many workers, particularly those in blue-collar jobs, overtime pay is a critical part of their income, and any effort to increase that income without the burden of taxes is bound to gain attention.

Conclusion

Trump’s “no tax on overtime” proposal offers the potential for substantial financial benefits to American workers, particularly those in industries that rely on overtime hours. If implemented, this policy could put hundreds or even thousands of extra dollars into the pockets of hard-working employees each year. However, the broader economic implications and the legislative challenges surrounding this proposal mean that its future remains uncertain.

While workers weigh the potential benefits, businesses will need to explore business tax solutions to navigate the evolving landscape and ensure they are prepared for any shifts in tax policy.

1 note

·

View note

Text

Yes Virginia, when you can't beat them, join them. Harris proposes no tax on tips.

Yes Virginia, when you can’t beat them, join them. Harris proposes no tax on tips. Much of the MSM is reporting on how Harris is proposing no tax on tips. Sounds original doesn’t it? Let’s see what other original idea she comes up with. U.S. Vice President Kamala Harris told supporters in Nevada on Saturday she supported eliminating taxes on tips, taking a similar position to her rival Donald…

0 notes

Text

Another GOP tax scam.

August 5, 2024

At a rally in Nevada this past June, convicted felon and rapist Donald Trump — in addition to pushing his usual litany of lies, bloviated self-praise and whiny grievances — floated a proposal to exempt tips from federal income taxes, something he promised to do "right away, first thing in office." Republicans, of course, were quick to embrace their god-emperor's whim, regardless of whether it made sense. Or was even feasible.

Part-time Texas senator and full-time Trump toady Ted Cruz immediately offered up the "No Tax On Tips Act." Which would affect 2.24 million wait staff across the country whose tips make up a large percentage of their income, according to US Bureau of Labor Statistics estimates.

But like so many GOP schemes, this one is merely another con aimed at enriching the rich while not doing much, if anything, to help working people. For a start, it would provide precisely zero tax relief for the more than 95% of low- and moderate-wage workers who are not in tipped occupations. And the fine print of Cruz's bill reveals just how scammy it is, even for the ones it supposedly covers.

For example, under the proposed No Tax On Tips legislation, a single parent with one child, who earns $5,000 in wages and $19,000 in tips per year, would receive no tax cut at all. Nor would a married couple making $28,000, even if the whole amount was tips.

In fact, the bill does nothing at all for a lot of tipped workers. Economist Ernie Tedeschi of the Yale Budget Lab estimates that more than one-third of tipped employees actually don't pay any income taxes because their earnings are so low they're already exempt. These peons wouldn't benefit the tiniest iota from Trump's tip flim-flam.

On the other hand, nothing in Cruz's bill prevents high-income professionals, such as hedge fund managers and lawyers, from declaring their compensation as tips and obtaining a far heftier tax break than low-income workers. For instance, a married couple making $1 million in wages could get a tax cut of $180,000 by shifting half of those wages to tax-free tips.

Clearly, the Trump-inspired No Tax on Tips Act would provide no — or, at best, paltry — benefits to many tipped employees. Moreover, such a law would give these laborers tax cuts that are far less than they would receive if we simply restored the tax credits in President Biden's American Rescue Plan. But Republicans would never allow that. Not when their objective is to fleece the working class.

0 notes

Text

Move To A Darker Place

This is a story of Man Vs. Machine.

---

Last March, my father attempted to file his Taxes.

My beloved father is a Boomer. Unlike most Boomers, my father is rather handy with technology because he was one of the people that had a not-insignificant hand in Developing a hell of a lot of it. He was studying Computer Science at Cal Poly before the computer science degree existed. I have many fond childhood memories of skipping through the aisles of various electronic and computer part warehouses while Dad described something that either terrified the staff or made them worship him as a God. He taught himself how to use his smartphone. Internationally.

So when he saw the option to file digitally with the IRS through the “ID.me” program, he leapt at the chance to celebrate the Federal Government finally entering the Digital Age.

It was all going swimmingly for about six hours, until he was ready to file and the system told him that it needed to verify his identity.

��Very Well.” said my father, a man unafraid of talking to himself and getting something out of the conversation. “It wouldn’t do for me to get someone else’s return.”

The System told him that it needed him to take a “Digital Image ID”.

a.k.a: A Selfie.

“A-ha!” Dad beams. Dad is very good at taking selfies. He immediately pulled out his phone, snapped one, and tried to upload it.

Please log into your Id.me Account and use the provided app to submit your Digital Image ID. The System clarified.

“Oh. You should have said so.” Dad pouted, but used his phone to log onto the ID.me account, do the six security verification steps and double-checked that the filing looked the same as it did on the desktop, gave the IRS like nine permissions on his phone, and held up the camera to take his Federal Privacy Invasion Selfie.

Please align your face to the indicated grid. Said The System, pulling up a futuristic green-web-of-polygons approximation.

“Ooh, very Star Trek. Gene Roddenberry would HATE this!” Dad said cheerfully, aligning his face to the grid. My father is a bit… cavalier, when it comes to matters of personal information and federal government, because he’s been on FBI watchlists since the late 60’s when he was protesting The Vietnam War and Ronald Regan before he’d broken containment. Alas.

Anyway, there is very little information the federal government does not have on him already, but he’s as good at stalking the FBI as they are at stalking him, and had worked out a solution: He has something approaching a friendship with the local Federal Agent (Some guy named “Larry”. Allegedly), and got Larry hooked on Alternative Histories and Dad’s collection of carefully-researched “there is very likely buried treasure here” stories, and Larry is loath to bother his favorite Historical Fanfiction author too much.

But I digress.

After thinking for a minute, The System came back with an Error Message. Please remove glasses or other facial obstructions.

And here is where the real trouble began.

See, my father wears glasses that do substantially warp the appearance of his face, because he is so nearsighted that he is legally blind without them. His natural focal point is about 4 inches in front of his nose. While Dad can still take a selfie because he (approximately) knows where his phone is if it’s in his hand, he cannot see the alignment grid.

He should ask someone to take it for him! I hear the audience say. Yes, that would be the sane and reasonable thing to do, but Dad was attempting to do taxes at his residence in Fort Collins, while his immediate family was respectively in Denver, Texas and Canada. He tried calling our neighbors, who turned out to be in Uganda.

He looked down at the dog, Arwen, and her little criminal paws that can open doorknobs, but not operate cell phones.

She looked back at him, and farted.

“Well, I’ll give it a try, but if it gives me too much trouble, I’ll call Larry, and Larry can call the IRS about it.” Dad told her.

She continued to watch him. Arwen is an Australian Kelpie (a type of cattle-herding dog), going on 14 years old, deaf as a post and suffering from canine dementia now, but she still retains her natural instinct to Micromanage. She was also trained as a therapy dog, and even if she can’t hear my dad, still recognizes the body language of a man setting himself up for catastrophe.

So, squinting in the late afternoon light next to the back door, Dad attempted to line his face up with a grid he could only sort-of see, and took A Federal Selfie.

The System thought about it for a few moments.

Image Capture Failed: Insufficient Contrast. The System replied. Please move to a darker place.

“...Huh.” Dad frowned. “Alright.”

He moved to the middle of his office, away from the back door, lit only by the house lighting and indirect sunlight, and tried again.

Image Capture Failed. Please move to a darker place.

“What?” Dad asked the universe in general.

“Whuff.” Arwen warned him against sunk costs.

Dad ignored her and went into the bathroom, the natural habitat of the selfie. Surely, only being lit by a light fixture that hadn’t been changed since Dad was attempting to warn everyone about Regan would be suitably insufficient lighting for The System. It took some negotiating, because that bathroom is “Standing Room Only” not “Standing And Holding Your Arms Out In Front Of You Room”. He ended up taking the selfie in the shower stall.

As The System mulled over the latest attempt, Arwen shuffled over and kicked open the door to watch.

Image Capture Failed. Please Move to a Darker Place.

“Do you mean Spiritually?” Dad demanded.

“Whuff.” Arwen cautioned him again.

Determined to succeed, or at least get a different error message that may give him more information, Dad entered The Downstairs Guest Room. It is the darkest room in the house, as it is in the basement, and only has one legally-mandated-fire-escape window, which has blinds. Dad drew those blinds, turned off the lights and tried AGAIN.

Image Capture Failed. Please Move To A Darker Place.

“DO YOU WANT ME TO PHOTOGRAPH MYSELF INSIDE OF A CAVE??” Dad howled.

“WHUFF!” Arwen reprimanded him from under the pull-out bed in the room. It’s where she attempts to herd everyone when it’s thundering outside, so the space is called her ‘Safety Cave’.

Dad frowned at the large blurry shape that was The Safety Cave.

“Why not?” he asked, the prelude to many a Terrible Plan. With no small amount of spiteful and manic glee, Dad got down onto the floor, and army-crawled under the bed with Arwen to try One Last Time. Now in near-total darkness, he rolled on his side to be able to stretch his arms out, Arwen slobber-panting in his ear, and waited for the vague green blob of the Facial grid to appear.

This time, when he tapped the button, the flash cctivated.

“GOD DAMN IT!” Dad shouted, dropping the phone and rubbing his eyes and cursing to alleviate the pain of accidentally flash-banging himself. Arwen shuffled away from him under the bed, huffing sarcastically at him.

Image Capture Failed. Please move to a darker place.

“MOTHERFU- hang on.” Dad squinted. The System sounded strange. Distant and slightly muffled.

Dad squinted really hard, and saw the movement of Arwen crawling out from under the bed along the phone’s last known trajectory.

“ARWEN!” Dad shouted, awkwardly reverse-army crawling out from under the bed, using it to get to his feet and searching for his glasses, which had fallen out of his pocket under the bed, so by the time he was sighted again, Arwen had had ample time to remove The Offending Device.

He found her out in the middle of the back yard, the satisfied look of a Job Well Done on her face. She did not have the phone.

“Arwen.” Dad glared. It’s a very good glare. Dad was a teacher for many years and used it to keep his class in order with sheer telepathically induced embarrassment, and his father once glared a peach tree into fecundity.

Arwen regarded him with the casual interest a hurricane might regard a sailboat tumbling out of its wake. She is a force of nature unto herself and not about to be intimidated by a half-blind house ape. She also has cataracts and might not be able to make out the glare.

“I GIVE UP!” Dad shouted, throwing his hands in the air and returning to the office to write to the IRS that their selfie software sucks ass. Pleased that she had gotten her desired result, Arwen followed him in.

To Dad’s immense surprise, the computer cheerfully informed him that his Federally Secure Selfie had been accepted, and that they had received and were now processing his return!

“What the FUCK?” Dad glared. “Oh well. If I’ve screwed it up, Larry can call me.”

---

I bring this up because recently, Dad received an interesting piece of mail.

It was a letter from the IRS, addressed to him, a nerve-wracking thing to recessive at the best of times. Instead of a complaint about Dad’s Selfie Skills, it was a letter congratulating him on using the new ID.me System. It thanked him for his help and expressed hopes he would use it again next year, and included the selfie that The System had finally decided to accept.

“You know, my dad used to complain about automation.” Dad sighed, staring at the image. “Incidentals my boy! My secretary saves the state of California millions of dollars a year catching small errors before they become massive ones! He’d say. Fought the human resources board about her pay every year. I used to think he was overestimating how bad machines were and underestimating human error, but you know? He was right.”

He handed me the image.

My father was, technically, in the image. A significant amount of the bottom right corner is taken up by the top of his forehead and silver hair. Most of the image, the part with the facial-recognition markers on it, was composed of Arwen’s Alarmed and Disgusted Doggy face.

“Oh no!” I cackled. “Crap, does this mean you have to call the IRS and tell them you’re not a dog?”

“Probably.” Dad sighed. “I know who I’m gonna bother first though.” he said, taking out his phone (Dad did find his phone a few hours after Arwen absconded with it when mom called and the early spinach started ringing).

“Hey Larry!” Dad announced to the local federal agent. “You’re never gonna believe this. My dog filed my taxes!”

Larry considered this for a moment. “Is this the dog that stole my sandwich? Out of my locked car?” he asked suspiciously.

“The very same.” Dad grinned.

“Hm. Clever Girl.” Federal Agent Larry sighed. “I figured it was only a matter of time before she got into tax fraud.”

---

I'm a disabled artist making my living writing these stories. If you enjoy my stories, please consider supporting me on Ko-fi or Pre-ordering my Family Lore Book on Patreon. Thank you!

#Family Lore#Dogs#arwen#Arwen the Crime Dog#Taxes#Ronald Regan mention (derogatory)#long post under the cut#this one is funny this time#I could really use some extra tip money this month

10K notes

·

View notes

Video

"It is the Trump University of tax plans."

--Brendan Duke on Trump's "no tax on tips" proposal

TRUMP'S "NO TAX ON TIPS" PLEDGE: Ali Velshi, Brendan Duke, and the Center for American Progress do a good job of explaining how hedge fund managers could benefit from no tips on taxes, but service industry workers making less than $28,000 a year (roughly $14.00 an hour) would basically not benefit from this policy, because their income is too low to pay much if any tax anyway.

TRUMP'S "NO TAX ON SOCIAL SECURITY" PLEDGE: Similarly, as Ali Velshi explains, low income seniors who pay little or no taxes anyway, would not benefit from "no tax on Social Security." It is wealthy seniors who would benefit. This plan would also further shrink the Social Security Trust Fund if wealthy seniors don't pay taxes on their benefits.

BRENDAN DUKE: This is a $1.5 trillion cut to Social Security, and Medicare. Medicare also gets the revenue, so it also meets cuts to revenue benefits. It pushes forward the dates of these automatic cuts happen, and increases the severity of the projected cuts to Social Security and Medicare. This is not a tax cut. This is a cut of Social Security and Medicare benefits. [color emphasis added]

TRUMP'S 10% TAX ON IMPORTED GOODS: Brendan Duke points out how Trump plans on extending tax cuts for the rich and paying for them by a tax on imports:

BRENDAN DUKE: Or, I think what is actually crazy, and has not got enough attention is Donald Trump is talking about extending his tax cuts for the wealthy, but this time he's going to pay for it with a 10% tax on every imported good coming into the country. Groceries, clothing, basically everything you buy at Walmart and Amazon cost a typical family $2600, wipes up every tax-cut they get that he is promising. It is a scam. It is Trump university all over again. [color emphasis added]

We need to explain to our Trump-loving relatives and friends what Trump's tax cuts really mean.

youtube

‘It’s just a scam’: The real truth about Trump’s no tax on tips or social security pledge

Brendan Duke, Senior Director of Economic Policy at the Center for American Progress Action Fund, joins MSNBC’s Ali Velshi to explain why Donald Trump’s proposed tax cuts on tips and Social Security are the “Trump University of tax plans” that would provide “tax cuts for the wealthy, pennies for low- and middle-income families.”

#trump#no tax on tips#no tax on social security#10% tariffs#trump tax policy scams#ali velshi#brendan duke#msnbc#youtube

60 notes

·

View notes

Text

Reurn of the Jedi 2024: President-Elect Donald J. Trump!!!

Cue the 1996 Meltdowns Part 2

youtube

youtube

youtube

#trump 2024#return of the jedi#no tax on tips#no tax on overtime#meltdowns 2016 B#mr president elect DJT#literally not 1 county

44 notes

·

View notes

Text

day 1522

#amphibian#frog#frogsona#tip: dont become self employed you have to do so much taxes related stuff all. the. time#(in my country. who knows about america based on what ive heard about your taxes its probably worse)#i dont neeed help btw im just complaning because i had to look at The Spreadsheets#didnt do my bookkeeping correctly for 2 months but i fixed it👍#its not even THAT bad i just needed to draw like. corporate vent art i guess

443 notes

·

View notes

Text

PREACH.

If you believe this, I have this AMAZING snake oil that I can sell you. It can cure ALL of your problems....

#fuck trump#vote biden#voting#vote blue#fuck republikkkans#vote democrats#tipping#tip tax#labor economy

92 notes

·

View notes

Text

64 notes

·

View notes

Text

not being able to animate is defeated by sasha rackett ( surprising no one )

#ok i KNOW the time is off lemme live.#but srsly if anyone has tips im down to hear!!#super sketchy but i am distracted easily..#rqg#rusty quill#rusty quill gaming#rqg fanart#rqgaming#rqg spoilers#sasha rackett#episode eeeeeeeeeeerm idk i forgot im so sorry#i love all of them they r so dear to me!!#super secret secret: if you pause on a frame its brock giving sasha the knife she's using so they're both sorta there in a way#fish art tax

56 notes

·

View notes

Text

currently banging my head against the wall trying to figure out the best way to do commission payment professional type way (creating an invoice that I can keep and show His Majesty's Revenue and Customs) while still allowing for tips..... also has anyone out there ever used Wise😭 cuz Paypal has some goofy fees for currency conversion but idk if it's worth like. confusing people

#shit like this confuses me so bad...... girl i should just get a normal job#not art#and this is not even the most difficult part. theres going to be Taxes#anyways for the tips thing its like. i can have a kofi etc but i dont want to like. ASK people for tips??#bc i would never ever require anyone to tip. but also there have been some incredibly generous people whose tipping really helped me#dont worry about me im just about to try and register as self employed

22 notes

·

View notes