#no tax on social security

Explore tagged Tumblr posts

Text

#politics#elon musk#inequality#tax the rich#social security#republicans#apartheid clyde#libertarians

877 notes

·

View notes

Video

"It is the Trump University of tax plans."

--Brendan Duke on Trump's "no tax on tips" proposal

TRUMP'S "NO TAX ON TIPS" PLEDGE: Ali Velshi, Brendan Duke, and the Center for American Progress do a good job of explaining how hedge fund managers could benefit from no tips on taxes, but service industry workers making less than $28,000 a year (roughly $14.00 an hour) would basically not benefit from this policy, because their income is too low to pay much if any tax anyway.

TRUMP'S "NO TAX ON SOCIAL SECURITY" PLEDGE: Similarly, as Ali Velshi explains, low income seniors who pay little or no taxes anyway, would not benefit from "no tax on Social Security." It is wealthy seniors who would benefit. This plan would also further shrink the Social Security Trust Fund if wealthy seniors don't pay taxes on their benefits.

BRENDAN DUKE: This is a $1.5 trillion cut to Social Security, and Medicare. Medicare also gets the revenue, so it also meets cuts to revenue benefits. It pushes forward the dates of these automatic cuts happen, and increases the severity of the projected cuts to Social Security and Medicare. This is not a tax cut. This is a cut of Social Security and Medicare benefits. [color emphasis added]

TRUMP'S 10% TAX ON IMPORTED GOODS: Brendan Duke points out how Trump plans on extending tax cuts for the rich and paying for them by a tax on imports:

BRENDAN DUKE: Or, I think what is actually crazy, and has not got enough attention is Donald Trump is talking about extending his tax cuts for the wealthy, but this time he's going to pay for it with a 10% tax on every imported good coming into the country. Groceries, clothing, basically everything you buy at Walmart and Amazon cost a typical family $2600, wipes up every tax-cut they get that he is promising. It is a scam. It is Trump university all over again. [color emphasis added]

We need to explain to our Trump-loving relatives and friends what Trump's tax cuts really mean.

youtube

‘It’s just a scam’: The real truth about Trump’s no tax on tips or social security pledge

Brendan Duke, Senior Director of Economic Policy at the Center for American Progress Action Fund, joins MSNBC’s Ali Velshi to explain why Donald Trump’s proposed tax cuts on tips and Social Security are the “Trump University of tax plans” that would provide “tax cuts for the wealthy, pennies for low- and middle-income families.”

#trump#no tax on tips#no tax on social security#10% tariffs#trump tax policy scams#ali velshi#brendan duke#msnbc#youtube

60 notes

·

View notes

Text

194 notes

·

View notes

Text

Broligarchs – sounds like the name of a TV series that should be in development at HBO (if they're smart). Imagine a cross between Silicon Valley and The Regime. 🤨

As awful as a second Trump term may be, there will be the occasional odd bits of unintentional entertainment as well. Imagine the Department Of Greedy Egotists announcing cuts to Medicare, Medicaid, Veterans' Benefits, and Social Security around the same time the GOP Congress is voting to extend the earlier Trump tax breaks for the filthy rich. Hilarity (and chaos) will ensue.

#broligarchs#donald trump#maga#republcans#vivek ramaswamy#elon musk#doge#greed#tax breaks for the filthy rich#oligarchs#social security#medicare#medicaid#veterans' benefits#ed wexler

180 notes

·

View notes

Text

youtube

6 minute YouTube video explaining how Ramaswamy and Musk’s DOGE budget cuts are completely unrealistic. The only way they can save the $2 trillion they proposed is by cutting Social Security, Medicare, and Veterans benefits. They are also planning on cutting the National Institute of Health, and all funding for the arts and sciences among other things. Best of all they are going to further cut taxes for the top 1% while cutting all those services to the bottom 98% of the country.

👆

#elongated muskrat#vivek ramaswamy#social security#Medicare#Veterans Administration#republican assholes#maga morons#tax cuts for the rich#Youtube

87 notes

·

View notes

Text

Tax the rich!

Be sure to follow us on all platforms!

Add Civic Cipher to your podcast favorites!

#civic cipher#fox news#cnn#global warming#climate activism#climate change#black lives matter#blm#defund the police#police brutality#police shooting#police chase#social security#congress#tax the rich#donald trump#trump#joe biden#Biden#ron desantis#conservative#conservatives#conservatism#liberals#liberal#liberalism#republican#republicans#republicanism#democrat

385 notes

·

View notes

Text

Social Security is class war, not intergenerational conflict

Today, Tor.com published my latest short story, "The Canadian Miracle," set in the world of my forthcoming (Nov 14) novel, The Lost Cause. I am serializing this one on my podcast! Here's part one.

The very instant the Social Security Act was passed in 1935, American conservatives (in both parties) began lobbying to destroy it. After all, a reserve army of forelock-tugging plebs and family retainers won't voluntarily assemble themselves – they need to be goaded into it by the threat of slowly starving to death in their dotage.

They're at it again (again). The oligarch-thinktank industrial complex has unleashed a torrent of scare stories about Social Security's imminent insolvency, rehearsing the same shopworn doom predictions that they've been repeating since the Nixonite billionaire cabinet member Peter G Peterson created a "foundation" to peddle his disinformation in 2008:

https://en.wikipedia.org/wiki/I.O.U.S.A.

Peterson's go-to tactic is convincing young people that all the Social Security money they're paying into the system will be gobbled up by already-wealthy old people, leaving nothing behind for them. Conservatives have been peddling this ditty since the 1930s, and they're still at it – in the pages of the New York Times, no less:

https://www.nytimes.com/2023/10/26/opinion/social-security-medicare-aging.html

The Times has become a veritable mouthpiece for this nonsense, publishing misleading and nonsensical charts and data to support the idea that millennials are losing a generational war to boomers, who will leave the cupboard bare:

https://www.nytimes.com/2023/10/27/opinion/aging-medicare-social-security.html

As Robert Kuttner writes for The American Prospect, this latest rhetorical assault on Social Security is timed to coincide with the ascension of the GOP House's new Speaker, Mike Johnson, who makes no secret of his intention to destroy Social Security:

https://prospect.org/economy/2023-10-31-debunking-latest-attack-social-security/

The GOP says it wants to destroy Social Security for two reasons: first, to promote "choice" by letting us provide for our own retirement by flushing even more of our savings into the rigged casino that is the stock market; and second, because America doesn't have enough dollars to feed and house the elderly.

But for the New York Times' audience, they've figured out how to launder this far-right nonsense through the language of social justice. Rather than condemning the impecunious olds for their moral failing to lay the correct bets in the stock market, Social Security's opponents paint the elderly as a gerontocratic elite, flush with cash that rightfully belongs to the young.

To support this conclusion, they throw around statistics about how house-rich the Boomers are, and how much consumption they can afford. But as Kuttner points out, the Boomers' real-estate wealth comes not from aggressive house-flipping, but from merely owning a place to live. America's housing bubble means that younger people can't afford this basic human necessity, but the answer to that isn't making old people homeless – it's providing a lot more housing, and banning housing speculation:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

It's true that older people are doing a lot of consumption spending – but the bulk of that spending isn't on cruises to Alaska to see the melting glaciers, it's on health care. Old people aren't luxuriating in their joint replacements and coronary bypasses. Calling this "consumption" is deliberately misleading.

But as Kuttner points out, there's another, more important point to be made about inequality in America – the most significant wealth gap in America is between workers and owners, not young people and old people. The "average" Boomer's net worth factors in the wealth of Warren Buffett and Donald Trump. Older renters are more rent-burdened and precarious than younger renters, and most older Americans have little to no retirement savings:

https://www.forbes.com/sites/teresaghilarducci/2023/10/28/the-new-york-times-greedy-geezer-myth/

Less than one percent of Social Security benefits go to millionaires – that's because the one percent constitute one percent of the population. It's right there in the name. The one percent are politically and economically important, but that's because they are low in numbers. Giving Social Security benefits to everyone over 65 will not result in a significant outlay to the ultra-wealthy, because there aren't many ultra-wealthy people in America. The problem of inequality isn't the expanding pool of rich people, it's the explosion of wealth for a contracting pool of rich people.

If conservatives were serious about limiting the grip of these "undeserving" Social Security recipients on our economy and its politics, they'd advocate for interitance taxes (which effectively don't exist in America), not the abolition of Social Security. The problem of wealth in America is that it is establishing permanent dynasties which are incompatible with social mobility. In other words, we have created a new hereditary aristocracy – and its corollary, a new hereditary peasantry:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Hereditary aristocracies are poisonous for lots of reasons, but one of the most pressing problems they present is political destabilization. American belief in democracy, the rule of law, and a national identity is q function of Americans' perception of fairness. If you think that your kids can't ever have a better life than you, if you think that the cops will lock you up for a crime for which a rich person would escape justice, then why obey the law? Why vote? Why not cheat and steal? Why not burn it all down?

The wealthy put a lot of energy into distracting us from this question. Just lately, they've cooked up a gigantic panic over a nonexistent wave of retail theft:

https://www.techdirt.com/2023/10/31/the-retail-theft-surge-that-isnt-report-says-crime-is-being-exaggerated-to-cover-up-other-retail-issues/

Meanwhile, the very real, non-imaginary, accelerating, multi-billion-dollar plague of wage theft is conspicuously missing from the public discourse, despite a total that dwarfs all retail theft in America by an order of magnitude:

https://fair.org/home/wage-theft-is-built-into-the-business-models-of-many-industries/

America does have a property crime crisis, but it's a crisis of wage-theft, not shoplifting. Likewise, America does have a retirement crisis: it's a crisis of inequality, not intergenerational conflict.

Social Security has been under sustained assault since its inception, and that's in large part due to a massive blunder on the part of FDR. Roosevelt believed that people would be more protective of Social Security if they thought it was funded by their taxes: "we bought it, it's ours." But – as FDR well knew – that's not how government spending works.

The US government can't run out of US dollars. The US government doesn't get its dollars for spending from your taxes. The US government spends money into existence and taxes it out of existence:

https://pluralistic.net/2020/12/14/situation-normal/#mmt

A moment's thought will reveal that it has to be this way. The US government (and its fiscal agents, chartered banks) are the only source of dollars. How can the US tax dollars away from earners unless it has first spent those dollars into the economy?

The point of taxation isn't to fund programs, it's to reduce the private sector's spending power so that there are things for sale to the public sector. If we only spent money into the economy but didn't take any out of the economy, the private sector would have so many dollars to spend that any time the government tried to buy something, there'd be a bidding war that would result in massive price spikes.

When a government runs a "balanced budget," that means that it has taxed as much out of the economy as it put into the economy at the start of the year. When a government runs a "surplus," that means it's left less money in the economy at the end of the year than there was at the beginning of the year. This is fine if the economy has contracted overall, but if the economy stayed constant or grew, that means there are fewer dollars chasing more goods and services, which leads to deflation and all kinds of toxic outcomes, like borrowing more bank-created money, which makes the finance sector richer and the real economy poorer.

Of course, most governments run "deficits" – which is another way of saying that they leave more dollars in the economy at the end of the year than there was at the start of the year, or, put another way, a deficit probably means that your economy got bigger, so it needed more dollars.

None of this means that governments can spend without limit. But it does mean that governments can buy anything that's for sale in their own currency. There are a lot of goods for sale in US dollars, both goods that are produced domestically and goods from abroad (this is why it's such a big deal that most of the world's oil is priced in dollars).

Governments do have to worry about getting into bidding wars with the private sector. To do that, governments come up with ways of reducing the private sector's spending power. One way to do that is taxes – just taking money away from us at the end of the year and annihilating it. Another way is to ration goods – think of WWII, or the direct economic interventions during the covid lockdowns. A third way is to sell bonds, which is just a roundabout way of getting us to promise not to spend some of our dollars for a while, in return for a smaller number of dollars in interest payments:

https://pluralistic.net/2021/04/08/howard-dino/#payfors

FDR knew all of this, but he still told the American people that their taxes were funding Social Security, thinking that this would protect the program. This backfired terribly. Today, Democrats have embraced the myth that taxes fund spending and join with their Republican counterparts in insisting that all spending must be accompanied by either taxes or cuts (AKA "payfors").

These Democrats voluntarily put their own policymaking powers in chains, refusing to take any action on behalf of the American people unless they can sell a tax increase or a budget cut. They insist that we can't have nice things until we make billionaires poor – which is the same as saying that we can't have nice things, period.

There are damned good reasons to make billionaires poor. The legitimacy of the American system is incompatible with the perception that wealth and power are fixed by birth, and that the rich and powerful don't have to play by the rules.

The capture of America's institutions – legislatures, courts, regulators – by the rich and powerful is a ghastly situation, and to reverse it, we'll need all the help we can get. Every hour that Americans spend worrying about their how they'll pay their rent, their medical bills, or their student loans is an hour lost to the fight against oligarchy and corruption.

In other words, it's not true that we can't have nice things until we get rid of billionaires – rather, we can't get rid of billionaires until we have nice things.

This is the premise of my next novel, The Lost Cause, which comes out on November 14; it's set in a world where care and solidarity have unleashed millions of people on the project of maintaining the habitability of our planet amidst the polycrisis:

https://us.macmillan.com/books/9781250865939/the-lost-cause

It's a fundamentally hopeful book, and it's already won praise from Naomi Klein, Rebecca Solnit, Bill McKibben and Kim Stanley Robinson. I wrote it while thinking through and researching these issues. Conservatives want us to think that we can't do better than this, that – to quote Margaret Thatcher – "there is no alternative." Replacing that narrative is critical to the kinds of mass mobilizations that our very survival depends on.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/intergenerational-warfare/#five-pound-blocks-of-cheese

This Saturday (Nov 4), I'm keynoting the Hackaday Supercon in Pasadena, CA.

#pluralistic#class war#inheritance tax#death tax#mmt#modern monetary theory#intergenerational war#intergenerational wealth transfers#social security#ss

352 notes

·

View notes

Text

Forbes: The Rich Stop Paying Social Security Tax Around January 1

What the Social Security tax is now, why it's running out of money & how to fix it rapidly!!

Sadly, tRump & his Republikkkans are trying to ruin it to get their rich friends' more tax cuts...

End?

#social security#taxes#&#how to fix the system's insolvency#politics#economy#rump#bought out by rich#4 tax cuts

38 notes

·

View notes

Text

48 notes

·

View notes

Text

How is this real? We've been paying into social security with every paycheck and now orange blowhole thinks he's gonna cut our benefits? The fuck you say.

#restore 1950s tax brackets#tax the rich#tax the 1%#tax the billionaires#billionaires should not exist#vote democrat#vote blue#vote biden#democrats#democracy#social democracy#vote blue to save democracy#vote blue 2024#democratic socialism#democrats now socialism later#social security#biden/harris 2024

121 notes

·

View notes

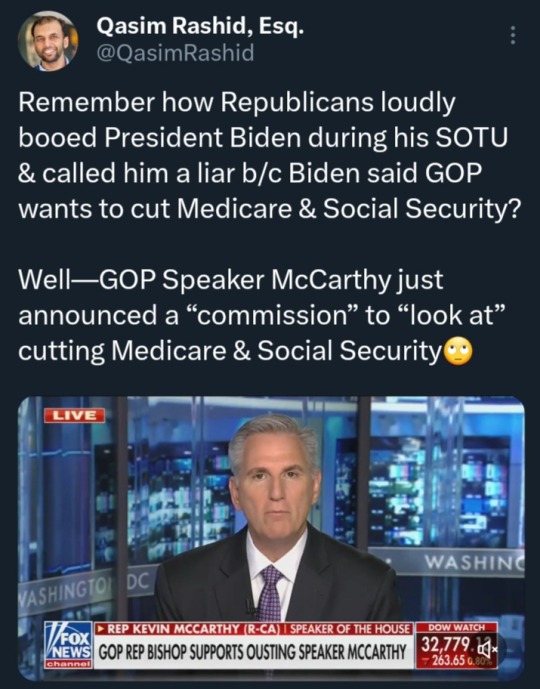

Photo

#Kevin McCarthy#Medicare#Social Security#Republican#Republicans#GOP#MAGA#tax#taxes#welfare#military#defense#budget#veteran#veterans#healthcare#Medicaid#SNAP#Meals on Wheels#school lunch

409 notes

·

View notes

Text

x

#401(k)#savings#tax-advantaged retirement#bipartisan legislation#wealth gap#federal budget#financial industry#lobbying#retirement security#tax law#retirement savings#bipartisan#wealth disparities#federal deficit#financial services industry#tax-advantaged accounts#tax breaks#Congress#lobbyists#Social Security#Medicare

18 notes

·

View notes

Text

Holy fuck y'all i should NOT be awake 😭

#p#i need to be up in six hours 😭😭#i had an awful exhausting evening#my hamster that i had before moving passed away#the car i bought not even two years ago is totaled and unfixable#i lost one of the gigs i thought i had secured for the school year#it is pms hell week for me and i keep swinging wildly between utter fully body rage and complete overwhelming despair and anxiety#i want to cry but ive done enough crying tonight thank you!!!!#please let tomorrow be kinder i desperately need it#please let the jobs ive emailed tonight email me back#and let the pay be good#i also have sooooo much to do before next tuesday oh my god#i need to prep for our session on saturday#finish lesson planning for the summer camp#finish character creation#grocery shop#quick clean of the house bcuz lord knows i wont be doing it while at the camp#i still havent received a v important piece of mail#figure out how to pay my taxes and insurance#prep for the meeting i have monday morning re new school year including some brain storming#reviewing the pacing calendar and handbook and looking at the google drive again#and im being social this entire weekend agh#plus look for jobs i guess??? bcuz money is needed#and theres family drama 🙃#ugh i should probably not be posting this on main#perhaps i will delete later ugh#life is just hard atm it will get better it always does#and i will not lose my rental nor will i be unable to pay my taxes and bills#it will be FINE#because i will make it fine

7 notes

·

View notes

Text

Funders have been acting like prioritizing community based cash distribution for people who often don't get access to these government payment systems is a total waste of resources for the entire past decade. No one piece of news from this week proves them more wrong than what appears to be attempts at the seizure of Treasury distribution systems that process payments for Social Security, Medicare, and tax returns.

We could have been so much more ready to step in and cover these holes if our access to resources weren't intentionally being throttled this whole time. Now I guess we might find out what happens if the people who won't be impacted by other benefits freezes don't get their tax returns this year 🤦🏻♀️

If we have to rebuild the whole thing, we'd better be doing universal basic income this time and SWs had better be at the helm of it.

#tax returns#treasury#mutual aid#universal basic income#social security#medicare#ruining the treasury like he ruined twitter#fascisim#institutional funding failures#support sex workers#give your money to sex workers

3 notes

·

View notes

Text

#lies and the lying liars who tell them#republicans#socialism#why do republicans hate socialism?#socialism is the answer#everything good we have is because of socialism#social security#medicare#medicaid#public schools#public libraries#public services#public beaches#public parks#sharing is caring#this is why we can't have nice things#we live in a society#live your truth#welfare states#red states#paying taxes#tax supported services#food programs#tax supported roads#toll roads#prioritizing businesses#public utilities#taking advantage#loving it while hating it#cognitive dissonance

12 notes

·

View notes

Video

youtube

Why You Need to Be Worried About Project 2025

#youtube#maga#trump#project 2025#republicans#us politics#us elections#america#civil rights#women's rights#ivf#taxes#us taxes#birth control#social security#medicare#retirement age#retirement

7 notes

·

View notes