#modern monetary theory

Explore tagged Tumblr posts

Text

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

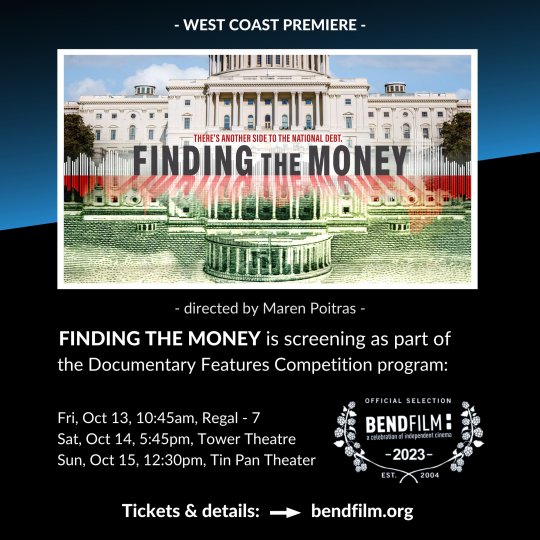

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Text

Is money real?

62 notes

·

View notes

Text

For most of the time, politicians have ostensibly retreated into the pre-Keynesian view that governments should run like households and seek to ‘balance their books.’ And most of the media has tended to endorse this fallacy. But when it was obviously necessary to act to save the economy, for example after the Global Financial Crisis or during the height of the pandemic when much of the economy had to be shut down, governments suddenly remembered that they have the extraordinary power to create money. After the Global Financial Crisis, the government – via the Bank of England’s Quantitative Easing programme – created around £445 billion of new money to prevent a collapse in the banking system. During COVID, the government created around £450 billion more to prevent a collapse in household finances when people would otherwise have had no income. In total, during the 21st century, the government has created £895 billion of new money – when it had the will to do so. And the view from economists is supportive. The argument for government spending to pay for healthcare, save businesses from bankruptcy, create new jobs and prevent a climate apocalypse has been made by the proponents of Modern Monetary Theory, for example Stephanie Kelton in her book The Deficit Myth. This book explains in detail how money is created and shows that the idea that governments should – or even responsibly could – budget in the same way as a normal household is no more than (admittedly compelling) rhetoric. But politicians and the media have – by and large – reverted to the notion that the government finances constitute a brake on what can be done for the public good. And our government continues to rein-in public spending even though it is clear that most public services are struggling badly.

109 notes

·

View notes

Text

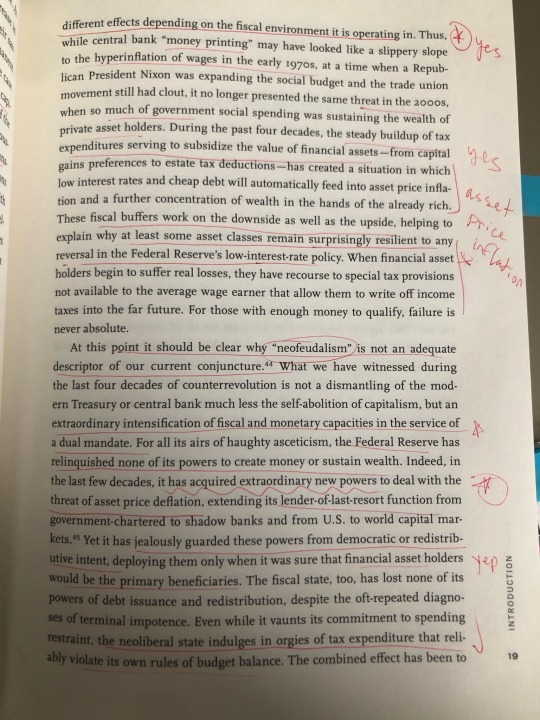

If you’ve been in one of my seminars you’d know that Melinda Cooper is one of my favorite thinkers… and the most underrated scholar working in Capitalism Studies and political economy today. Her new book, Counterrevolution: Extravagance and Austerity in Public Finance, is a deep intellectual history of the modern fiscal state that looks at the influence of the Virginia School of economics on shaping monetary and fiscal policy in the US from the 1970s onward. It’s super technical and wonky but admittedly, I love reading technical and wonky works of political economy (it bothers me when Marxists don’t know how the economy actually works). Someone had to write this book… I believe Melinda Cooper was the right woman for the job. Who else can explain how tax policy is class war, or toggle between levels of abstraction as seamlessly as Cooper does? My former New School student (now doing a PhD at Yale) is disappointed it’s not sexy Marxist theory but I think it’s great that Melinda Cooper is in the ring with the political economy bros. I don’t agree with some of the politics of this book (it’s somewhat MMT in flavor) but find it impressive nonetheless.

10 notes

·

View notes

Text

📣 Featuring Stephanie Kelton, FINDING THE MONEY screens in competition at the Bend Film Festival on Oct 13, 14 & 15. Director Maren Poitras will be in attendance with subjects and experts L. Randall Wray and Rohan Grey.

Tickets: 👉 https://bit.ly/FTMatBENDFF2023

Stay close, we're coming to a city near you!

#MMT#Modern Monetary Theory#maren poitras#documentary#film#marc smolowitz#finding the money#stephanie kelton

2 notes

·

View notes

Text

What started as a class project turned into a 24-page vision for a Degrowth Deal. If you’re interested, you can download the pdf from my Substack. Link.

1 note

·

View note

Text

Deficits are not a problem. They knew that shit 2000 BC at least.

"Render onto cesar which it is cesars" Money comes from the state, then the state collects taxes, so multiple people will have to do the work the state wants to get the state money to pay its taxes.

Money is an incentive structure. To make people do what you want them to do.

I will not criticize Trump for destroying the United States. I would do the same, just maybe not out of ignorance.

Beautifully explained, though the left will never acknowledge the truth. 🤔

1K notes

·

View notes

Text

Andrea B. Nardi: tra narrativa, saggistica e passione per la verità. Intervista di Alessandria today

Andrea B. Nardi è un autore poliedrico, con un percorso di vita che attraversa sport, letteratura, sceneggiatura e traduzione. Ha vissuto in diversi paesi e si è dedicato a molteplici discipline, dalla vela professionistica alla scrittura di saggi e romanzi. In questa intervista racconta il filo conduttore che unisce le sue esperienze, il suo amore per la prateria americana e le sue battaglie…

#Alessandria today#Andrea B. Nardi#autori emergenti#autori italiani#cinema d’autore.#cinema indipendente#Conan Doyle#cortometraggi premiati#critica sociale#cultura del Midwest#cultura e società#Debito pubblico#denuncia politica#economia e politica#finanza globale#futuro dell’editoria#Google News#indipendenza economica#italianewsmedia.com#Jack London#la vita dei cowboy#Lava#letteratura americana#libertà e indipendenza#lotta contro il sistema bancario#menzogne storiche#Modern Monetary Theory#Narrativa storica#pensiero critico#Pier Carlo

0 notes

Text

Economists Invented Austerity And Paved the Way to Fascism. WE MUST FIGH...

youtube

#spd#arbeitsplätze#arbeitsbedingungen#sparmaßnamen#fpö#fck afd#afd#cdu#austerity#deficit myth#modern monetary theory#scam#lies#eat the rich#no war but class war#general strike#class consciousness#Youtube

1 note

·

View note

Text

#game changer #dropout #dropout tv #secret sober #he tricked them into making more money for themselves #by adjusting the incentives and relying on their chaotic instincts #when you run the table and rig the game to benefit the players #when you know they are chaos monkeys but you're the biggest chaos monkey of them all #when you use their own base instincts against them in order to maximize abundance #I'm pretty sure that's what modern money theory is #i thought they really might kill him this time (tags courtesy of OP)

I'm going to tell my kids that Sam Reich manipulating drunk girl energy competitive spirit was Modern Money Theory

#i copy notes#dropout#dropout tv#game changer#game changer 7x05#the drinking game#sam reich#modern monetary theory#modern money theory

137 notes

·

View notes

Text

🟡🧠🔨Ray Dalio Reveals the Hard Truth About America's Path Forward (Tone: 270)

Ray Dalio warns of America's shift towards industrial self-sufficiency & rising BRICS influence. Expect geopolitical & economic transformation. #Economy #Geopolitics

Posted on November 19th, 2024 by @TomBilyeu ABOUT THIS VIDEO: In this video, Ray Dalio discusses America’s economic, political, and geopolitical future. He outlines five key forces driving global changes, including debt cycles, internal political order, international relations, technological advancement, and acts of nature such as climate change. Dalio highlights a shift towards a more…

View On WordPress

#America First#BRICS nations#chip manufacturing#deregulation#Economic Growth#Economic Predictions#economic restructuring#education reform#geopolitical tension#global order#global power shift#government efficiency#industrial policy#international trade#Leadership Transition#manufacturing independence#modern monetary theory#national resilience#political reform#productivity reforms#protectionism#Ray Dalio#societal division#tariffs#technological self-sufficiency#U.S. dominance#U.S. economy#U.S.-China relations

0 notes

Text

July 2023

0 notes

Text

Bitches on tumblr stop accidentally reinventing Modern Monetary Theory challenge (impossible)

1 note

·

View note

Text

i had an idea a while back for something called infinity coin which is an infinite currency. its basically just a jpeg and you can copy it as many times as you want to make more money. the infinity economy is founded on the principle that money has no meaningful relationship to the underlying material conditions anyways so we might as well just make infinite money and give it out to everyone on earth so they can solve real problems by spending infinite money on them. one infinity coin = infinite USD. pretty good exchange rate if you ask me

#economics#economy#society#money#free money#money printing#modern monetary theory#philosophy#ecommerce#life#thoughts#my thoughts#bookworm thoughts#research#mathematics#algorithm#science

0 notes

Text

It's not your tax money going to fund Israel. It's just not. I'm pissed about all the money being sent to fund genocide, but that is simply not how taxes or fiat currency work. Leftist need to do a better job of understanding this.

0 notes