#stephanie kelton

Explore tagged Tumblr posts

Text

youtube

An International Take on the US Election with Jon Stewart & Mayor of London Sadiq Khan (Preview)

This week Jon is joined by the mayor of London, Sadiq Khan to discuss the polar differences between elections in the United States and the United Kingdom, the impact fundraising has on political campaigns, and the influence this year’s presidential election will have on the rest of the world.

youtube

2024 Election, Media Misinformation, & Geopolitics with Jon Stewart and London Mayor Sadiq Khan

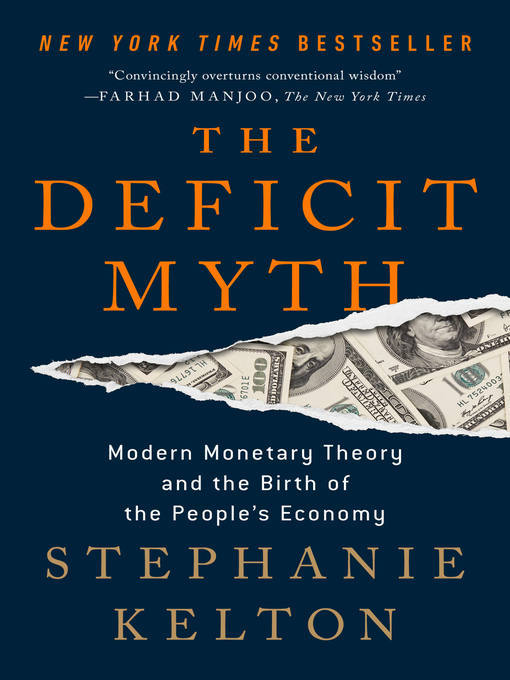

In this episode, Jon sits down with the Mayor of London, Sadiq Khan, to explore the challenges the US and UK face during their differing election cycles. From immigration to populism to social media, they explore how crucial it is for our representatives to keep us informed without the interference of misinformation. In response to last week’s episode on the economy, Jon is joined by economics professor and author of The Deficit Myth, Stephanie Kelton, to tackle government spending and deficits.

#jon stewart#bearded jon#the jon stewart show#the daily show with jon stewart#the colbert report#the late show with stephen colbert#the problem with jon stewart#the weekly show with jon stewart#stephanie kelton#sadiq khan#indecision 2024#media criticism#elections#immigration#populism#capitalism#government spending#corruption#campaign finance#our long ass campaign season#election interference#social media#discussion#interview#videos

3 notes

·

View notes

Note

I know the other people you mentioned, but who is Kelton?

Stephanie Kelton is a professor, economist, and one of the chief proponents of Modern Monetary Theory. In her book The Deficit Myth, she argues that the primary method of thinking about deficits at the macro-level is wrong. This theory has become very popular among progressive policy makers and forms a significant underpinning of their economic policy proposals, such as the Federal Job Guarantee, while the theory is considered to be fringe nonsense by economists, more of an article of faith that proscribes its adherents to positions of privileged policy advisors rather than a concrete theory that can be modeled. Per the Banque of France: "Overall, it appears that MMT is based on an outdated approach to economics and that the meaning of MMT is a more that of a political manifesto than of a genuine economic theory."

MMT has been rather notorious for its refusal to create testable models, a neglect in monetary policy over fiscal policy, and an insistence on always being right, which is intellectually exhilarating among its proponents for its conspiracy-minded claims, but frustrating for the scientifically-minded who prefer data and hard evidence. One of the chief shortcomings among the MMT crowd is that fiscal policy crowds out monetary policy, largely due to the relatively constant inflationary rates for decades previous to the point where those not knowledgeable in economic history forget about it.

Fortunately, Kelton has exposed her lack of knowledge on macroeconomics and monetary policy when it comes to the 2020's inflation spiral. Kelton famously predicted back in 8 April 2021 (so before the Russian war in Ukraine placed inflationary pressures on food and fuel), stated that "Have you considered the possibility that raising rates might move inflation higher?" This was useful, because it was something that was empirical, something that could be tested and measured. Again in a stroke of good fortune, we did receive data - Erdogan had pursued Fisherist policies that were in line with what Kelton was predicting. If she was right, then we would have seen inflation in Turkey drop in response to Erdogan's policies. The opposite happened - inflation skyrocketed in comparison to other regional markets; Turkey's inflation rate was well in excess of other economies, peaking over 80% in 2022. So Kelton was completely wrong in this regard. While one bad prediction shouldn't invalidate everything, the consistently poor performance of MMT in an ideal world would leave this theory relegated to the dustbin.

It didn't happen, of course, but I never expected it to. The scientific method is anathema to public policy discourse.

Thanks for the question, Anon.

SomethingLikeALawyer, Hand of the King

8 notes

·

View notes

Text

📣 Featuring Stephanie Kelton, FINDING THE MONEY screens in competition at the Bend Film Festival on Oct 13, 14 & 15. Director Maren Poitras will be in attendance with subjects and experts L. Randall Wray and Rohan Grey.

Tickets: 👉 https://bit.ly/FTMatBENDFF2023

Stay close, we're coming to a city near you!

#MMT#Modern Monetary Theory#maren poitras#documentary#film#marc smolowitz#finding the money#stephanie kelton

2 notes

·

View notes

Text

youtube

8 notes

·

View notes

Text

youtube

0 notes

Text

#code 8 2024#code 8 part ii#code 8#jeff chan#Robbie Amell#Connor Reed#Stephen Amell#Garrett Kelton#Sarena Parmar#Stephanie Kingston

11 notes

·

View notes

Text

Legs woke up killing me throughout my commute for some reason; wondering if my 5.5 hours last night might be why... But seeing how much the coffee helps me through today 🥱☕

(Also, new shirt!)

#ore no kao#[hoping my trainer doesnt put me through another circuit later 😩]#listening to a Briahna Joy Gray interview with economist Stephanie Kelton should also help; she's great

8 notes

·

View notes

Text

The Tale of Two Countries: When MMT Becomes a Comedy of Errors

Ah, Modern Monetary Theory (MMT), the economic doctrine that’s as divisive as pineapple on pizza. It’s the theory that promises to turn governments into economic superheroes, capable of ending poverty, creating jobs, and maybe even solving world hunger. All you need is a printing press and a dream, right? Well, let’s take a journey down under to Australia and then hop over to Argentina to see how…

View On WordPress

0 notes

Text

Even if you think AI search could be good, it won’t be good

TONIGHT (May 15), I'm in NORTH HOLLYWOOD for a screening of STEPHANIE KELTON'S FINDING THE MONEY; FRIDAY (May 17), I'm at the INTERNET ARCHIVE in SAN FRANCISCO to keynote the 10th anniversary of the AUTHORS ALLIANCE.

The big news in search this week is that Google is continuing its transition to "AI search" – instead of typing in search terms and getting links to websites, you'll ask Google a question and an AI will compose an answer based on things it finds on the web:

https://blog.google/products/search/generative-ai-google-search-may-2024/

Google bills this as "let Google do the googling for you." Rather than searching the web yourself, you'll delegate this task to Google. Hidden in this pitch is a tacit admission that Google is no longer a convenient or reliable way to retrieve information, drowning as it is in AI-generated spam, poorly labeled ads, and SEO garbage:

https://pluralistic.net/2024/05/03/keyword-swarming/#site-reputation-abuse

Googling used to be easy: type in a query, get back a screen of highly relevant results. Today, clicking the top links will take you to sites that paid for placement at the top of the screen (rather than the sites that best match your query). Clicking further down will get you scams, AI slop, or bulk-produced SEO nonsense.

AI-powered search promises to fix this, not by making Google search results better, but by having a bot sort through the search results and discard the nonsense that Google will continue to serve up, and summarize the high quality results.

Now, there are plenty of obvious objections to this plan. For starters, why wouldn't Google just make its search results better? Rather than building a LLM for the sole purpose of sorting through the garbage Google is either paid or tricked into serving up, why not just stop serving up garbage? We know that's possible, because other search engines serve really good results by paying for access to Google's back-end and then filtering the results:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

Another obvious objection: why would anyone write the web if the only purpose for doing so is to feed a bot that will summarize what you've written without sending anyone to your webpage? Whether you're a commercial publisher hoping to make money from advertising or subscriptions, or – like me – an open access publisher hoping to change people's minds, why would you invite Google to summarize your work without ever showing it to internet users? Nevermind how unfair that is, think about how implausible it is: if this is the way Google will work in the future, why wouldn't every publisher just block Google's crawler?

A third obvious objection: AI is bad. Not morally bad (though maybe morally bad, too!), but technically bad. It "hallucinates" nonsense answers, including dangerous nonsense. It's a supremely confident liar that can get you killed:

https://www.theguardian.com/technology/2023/sep/01/mushroom-pickers-urged-to-avoid-foraging-books-on-amazon-that-appear-to-be-written-by-ai

The promises of AI are grossly oversold, including the promises Google makes, like its claim that its AI had discovered millions of useful new materials. In reality, the number of useful new materials Deepmind had discovered was zero:

https://pluralistic.net/2024/04/23/maximal-plausibility/#reverse-centaurs

This is true of all of AI's most impressive demos. Often, "AI" turns out to be low-waged human workers in a distant call-center pretending to be robots:

https://pluralistic.net/2024/01/31/neural-interface-beta-tester/#tailfins

Sometimes, the AI robot dancing on stage turns out to literally be just a person in a robot suit pretending to be a robot:

https://pluralistic.net/2024/01/29/pay-no-attention/#to-the-little-man-behind-the-curtain

The AI video demos that represent "an existential threat to Hollywood filmmaking" turn out to be so cumbersome as to be practically useless (and vastly inferior to existing production techniques):

https://www.wheresyoured.at/expectations-versus-reality/

But let's take Google at its word. Let's stipulate that:

a) It can't fix search, only add a slop-filtering AI layer on top of it; and

b) The rest of the world will continue to let Google index its pages even if they derive no benefit from doing so; and

c) Google will shortly fix its AI, and all the lies about AI capabilities will be revealed to be premature truths that are finally realized.

AI search is still a bad idea. Because beyond all the obvious reasons that AI search is a terrible idea, there's a subtle – and incurable – defect in this plan: AI search – even excellent AI search – makes it far too easy for Google to cheat us, and Google can't stop cheating us.

Remember: enshittification isn't the result of worse people running tech companies today than in the years when tech services were good and useful. Rather, enshittification is rooted in the collapse of constraints that used to prevent those same people from making their services worse in service to increasing their profit margins:

https://pluralistic.net/2024/03/26/glitchbread/#electronic-shelf-tags

These companies always had the capacity to siphon value away from business customers (like publishers) and end-users (like searchers). That comes with the territory: digital businesses can alter their "business logic" from instant to instant, and for each user, allowing them to change payouts, prices and ranking. I call this "twiddling": turning the knobs on the system's back-end to make sure the house always wins:

https://pluralistic.net/2023/02/19/twiddler/

What changed wasn't the character of the leaders of these businesses, nor their capacity to cheat us. What changed was the consequences for cheating. When the tech companies merged to monopoly, they ceased to fear losing your business to a competitor.

Google's 90% search market share was attained by bribing everyone who operates a service or platform where you might encounter a search box to connect that box to Google. Spending tens of billions of dollars every year to make sure no one ever encounters a non-Google search is a cheaper way to retain your business than making sure Google is the very best search engine:

https://pluralistic.net/2024/02/21/im-feeling-unlucky/#not-up-to-the-task

Competition was once a threat to Google; for years, its mantra was "competition is a click away." Today, competition is all but nonexistent.

Then the surveillance business consolidated into a small number of firms. Two companies dominate the commercial surveillance industry: Google and Meta, and they collude to rig the market:

https://en.wikipedia.org/wiki/Jedi_Blue

That consolidation inevitably leads to regulatory capture: shorn of competitive pressure, the companies that dominate the sector can converge on a single message to policymakers and use their monopoly profits to turn that message into policy:

https://pluralistic.net/2022/06/05/regulatory-capture/

This is why Google doesn't have to worry about privacy laws. They've successfully prevented the passage of a US federal consumer privacy law. The last time the US passed a federal consumer privacy law was in 1988. It's a law that bans video store clerks from telling the newspapers which VHS cassettes you rented:

https://en.wikipedia.org/wiki/Video_Privacy_Protection_Act

In Europe, Google's vast profits lets it fly an Irish flag of convenience, thus taking advantage of Ireland's tolerance for tax evasion and violations of European privacy law:

https://pluralistic.net/2023/05/15/finnegans-snooze/#dirty-old-town

Google doesn't fear competition, it doesn't fear regulation, and it also doesn't fear rival technologies. Google and its fellow Big Tech cartel members have expanded IP law to allow it to prevent third parties from reverse-engineer, hacking, or scraping its services. Google doesn't have to worry about ad-blocking, tracker blocking, or scrapers that filter out Google's lucrative, low-quality results:

https://locusmag.com/2020/09/cory-doctorow-ip/

Google doesn't fear competition, it doesn't fear regulation, it doesn't fear rival technology and it doesn't fear its workers. Google's workforce once enjoyed enormous sway over the company's direction, thanks to their scarcity and market power. But Google has outgrown its dependence on its workers, and lays them off in vast numbers, even as it increases its profits and pisses away tens of billions on stock buybacks:

https://pluralistic.net/2023/11/25/moral-injury/#enshittification

Google is fearless. It doesn't fear losing your business, or being punished by regulators, or being mired in guerrilla warfare with rival engineers. It certainly doesn't fear its workers.

Making search worse is good for Google. Reducing search quality increases the number of queries, and thus ads, that each user must make to find their answers:

https://pluralistic.net/2024/04/24/naming-names/#prabhakar-raghavan

If Google can make things worse for searchers without losing their business, it can make more money for itself. Without the discipline of markets, regulators, tech or workers, it has no impediment to transferring value from searchers and publishers to itself.

Which brings me back to AI search. When Google substitutes its own summaries for links to pages, it creates innumerable opportunities to charge publishers for preferential placement in those summaries.

This is true of any algorithmic feed: while such feeds are important – even vital – for making sense of huge amounts of information, they can also be used to play a high-speed shell-game that makes suckers out of the rest of us:

https://pluralistic.net/2024/05/11/for-you/#the-algorithm-tm

When you trust someone to summarize the truth for you, you become terribly vulnerable to their self-serving lies. In an ideal world, these intermediaries would be "fiduciaries," with a solemn (and legally binding) duty to put your interests ahead of their own:

https://pluralistic.net/2024/05/07/treacherous-computing/#rewilding-the-internet

But Google is clear that its first duty is to its shareholders: not to publishers, not to searchers, not to "partners" or employees.

AI search makes cheating so easy, and Google cheats so much. Indeed, the defects in AI give Google a readymade excuse for any apparent self-dealing: "we didn't tell you a lie because someone paid us to (for example, to recommend a product, or a hotel room, or a political point of view). Sure, they did pay us, but that was just an AI 'hallucination.'"

The existence of well-known AI hallucinations creates a zone of plausible deniability for even more enshittification of Google search. As Madeleine Clare Elish writes, AI serves as a "moral crumple zone":

https://estsjournal.org/index.php/ests/article/view/260

That's why, even if you're willing to believe that Google could make a great AI-based search, we can nevertheless be certain that they won't.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/15/they-trust-me-dumb-fucks/#ai-search

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

djhughman https://commons.wikimedia.org/wiki/File:Modular_synthesizer_-_%22Control_Voltage%22_electronic_music_shop_in_Portland_OR_-_School_Photos_PCC_%282015-05-23_12.43.01_by_djhughman%29.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#twiddling#ai#ai search#enshittification#discipline#google#search#monopolies#moral crumple zones#plausible deniability#algorithmic feeds

1K notes

·

View notes

Note

Are there any economics books you'd recommend, or finance books that aren't personal finance? Thanks!

Hell yes. A book recommendation request is like my personal Bat Signal! Here are some of my favorite books by contemporary economists, memoirists, journalists, and sociologists with a focus on finance:

Poverty, by America by Matthew Desmond

Evicted: Poverty and Profit in the American City by Desmond, Matthew

Plunder: Private Equity's Plan to Pillage America by Brendan Ballou

These Are the Plunderers: How Private Equity Runs—and Wrecks—America by Gretchen Morgenson

Pound Foolish: Exposing the Dark Side of the Personal Finance Industry by Olen, Helaine

Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty by Banerjee, Abhijit V.

Profit and Punishment: How America Criminalizes the Poor in the Name of Justice by Messenger, Tony

The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy by Kelton, Stephanie

The System: Who Rigged It, How We Fix It by Reich, Robert B.

Winners Take All: The Elite Charade of Changing the World by Giridharadas, Anand *

Squeezed: Why Our Families Can't Afford America by Quart, Alissa

Hand to Mouth: Living in Bootstrap America by Tirado, Linda *

Dark Money: The Hidden History of the Billionaires Behind the Rise of the Radical Right by Mayer, Jane

I expect a book report on each and every one!

Now reblog with your own recommendations, my darlings. I read about a book a week, so I'm always adding to my to-read list.

Did we just help you out? Tip us!

178 notes

·

View notes

Text

For most of the time, politicians have ostensibly retreated into the pre-Keynesian view that governments should run like households and seek to ‘balance their books.’ And most of the media has tended to endorse this fallacy. But when it was obviously necessary to act to save the economy, for example after the Global Financial Crisis or during the height of the pandemic when much of the economy had to be shut down, governments suddenly remembered that they have the extraordinary power to create money. After the Global Financial Crisis, the government – via the Bank of England’s Quantitative Easing programme – created around £445 billion of new money to prevent a collapse in the banking system. During COVID, the government created around £450 billion more to prevent a collapse in household finances when people would otherwise have had no income. In total, during the 21st century, the government has created £895 billion of new money – when it had the will to do so. And the view from economists is supportive. The argument for government spending to pay for healthcare, save businesses from bankruptcy, create new jobs and prevent a climate apocalypse has been made by the proponents of Modern Monetary Theory, for example Stephanie Kelton in her book The Deficit Myth. This book explains in detail how money is created and shows that the idea that governments should – or even responsibly could – budget in the same way as a normal household is no more than (admittedly compelling) rhetoric. But politicians and the media have – by and large – reverted to the notion that the government finances constitute a brake on what can be done for the public good. And our government continues to rein-in public spending even though it is clear that most public services are struggling badly.

109 notes

·

View notes

Text

Taking a deep dive into a revolutionary new theory called Modern Monetary Theory or #MMT, our documentary FINDING THE MONEY has found much success this fall, including packed houses and memorable Q&As at our World Premiere at the Woodstock Film Festival, Boston GlobeDocs, and the Bend Film Festival in Oregon.

We also won the audience award at the San Francisco Green Film Festival, where the film was the festival's closing night selection and even made it onto the front page of the San Francisco Chronicle Datebook!

Huge congratulations to Maren Poitras, our amazing director, and our entire filmmaking team.

Next up: We’re participating in the IDFA Docs For Sale market this week, and we are actively confirming the film for many more festivals as we gear up for the film's wide release in May 2024.

Follow the film's adventures at findingmoneyfilm.com and for more of 13th Gen's fall news, check out our latest newsletter: 👉 https://bit.ly/4779wYE

#documentary#filmmaker#Finding The Money#Modern Monetary Theory#Marc Smolowitz#Stephanie Kelton#economics#film#Maren Poitras#Woodstock Film Festival#green film festival#climate#San Francisco

0 notes

Video

youtube

Stephanie Kelton: The big myth of government deficits | TED

6 notes

·

View notes

Note

if i have monopoly money that my roommate tells me i can give them in exchange for various favors, for no other reason than they find it to be an amusing game, but then they have the idea to start giving it to me for various favors from me, does that monopoly money become real money?

this is a chapter in that stephanie kelton book

10 notes

·

View notes

Note

You said before that price controls don't work. What do you make of the New Yorker article on Isabella Weber?

It's bad journalism, start to finish. It doesn't just misreport the truth, it actively perverts the truth in an attempt to tell a compelling story and promote a false interpretation of economics and policy making.

First off, there's a ton of factual errors. The article makes the claim that the inflation that the world has been experiencing has been concentrated in the energy sector, but a cursory glance at the data shows that to be false - inflation is broad-based to the point where even fuel prices influencing cost-push inflation wouldn't have impacted the CPI as much, and certainly not in the way that service prices have been increasing faster than goods prices last quarter. Second, the article argues that the German government issued a price control on natural gas...but they didn't. They instead cut a subsidy check based on past consumption rates, in essence, subsidizing a certain amount of gas with the onus on the consumer to pay more past a certain quantity. The other members of the commission have attacked the article as being incorrect, which should be enough to tell you the poor level of quality of research done in the article.

Secondly, Weber's actual proposed policy isn't what is being talked about in the German gas commission. Weber proposed a broad screen of price controls, citing the Second World War as a successful example at how non-inflationary they were. The big problems with this, like with most non-expert use of simple policy analogy, is that none of the circumstances are similar. Rationing caused a large decrease in private consumption as valuable materiel was redirect to war production, and monetary policy expectations were different; and Weber is hardly suggesting that we break out the ration cards. Better examples would be the Nixon price controls of 1971, which only kicked the inflationary can down the road a few years and it hit much harder, or the disastrous Venezuelan price control which caused hyperinflation and whose only real utility was to force non-Maduro loyalists to have their businesses confiscated and given to cronies to maintain his unstable grip on power.

Thirdly, the author makes omits the actual interesting economic discussion being done, such as how much of inflation should be attributed to cost-push versus demand-pull, or the utility of the G7 price cap on Russian oil (not to mention the massive extenuating circumstance of Russia's invasion of Ukraine which was the cause for the policy, not inflation). These are actual insights that can be used by policymakers. Instead, the story is crafted of a simplistic fairy tale about an outsider possessing secret wisdom that the establishment scoffs at. It's a psychologically comforting fiction, but it does a great disservice to actual economics work and further discredit actual economics work in favor of simple, psychologically-comforting fictions. It is appealing because it's a reduction of a complicated affair to a very simple morality play - problems are simple and it's just those evil bad people that want to stop us. Misinformation like this actively hurts public engagement with experts, it's psychologically tailored to maximize engagement. Much like the puff piece a few years back on Stephanie Kelton and MMT or the more-recent "greedflation" thesis, it's just more garbage designed to promote ignorance over knowledge.

Thanks for the question, Anon.

SomethingLikeALawyer, Hand of the King

10 notes

·

View notes

Photo

The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy

by Stephanie Kelton (2020)

Stephanie Kelton's brilliant exploration of modern monetary theory (MMT) dramatically changes our understanding of how we can best deal with crucial issues ranging from poverty and inequality to creating jobs, expanding health care coverage, climate change, and building resilient infrastructure. Any ambitious proposal, however, inevitably runs into the buzz saw of how to find the money to pay for it, rooted in myths about deficits that are hobbling us as a country. Kelton busts through the myths that prevent us from taking action: that the federal government should budget like a household, that deficits will harm the next generation, crowd out private investment, and undermine long-term growth, and that entitlements are propelling us toward a grave fiscal crisis. MMT, as Kelton shows, shifts the terrain from narrow budgetary questions to one of broader economic and social benefits. With its important new ways of understanding money, taxes, and the critical role of deficit spending, MMT redefines how to responsibly use our resources so that we can maximize our potential as a society. MMT gives us the power to imagine a new politics and a new economy and move from a narrative of scarcity to one of opportunity.

4 notes

·

View notes