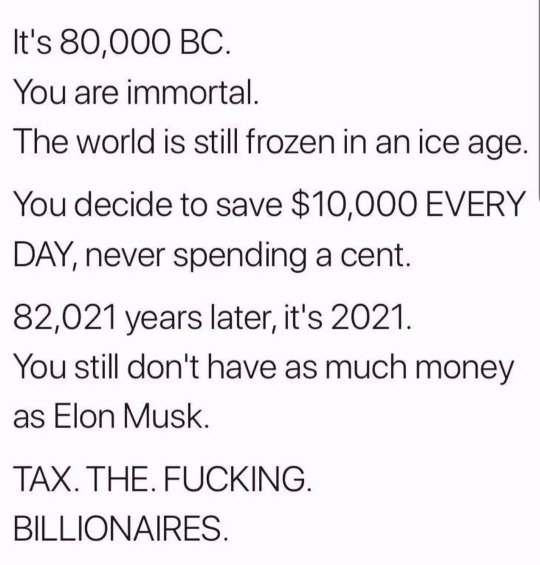

#TAX the RICH

Explore tagged Tumblr posts

Text

Source

Source

#climate news#climate crisis#climate action#climate change#eat the rich#tax the rich#the left#environmentalism#environment#progressive#twitter post#current events#news

311 notes

·

View notes

Text

here's a fun little definition to help people understand what inflation is, please follow and reblog for more

/credit: Lily Orchard

#lily orchard#tarrifs#economy#democracy#republicans#politics#trump#eat the rich#tax the rich#us politics#progressive#corporate greed#leftism#the left#communism#culture#eat the fucking rich#fuck capitalism#fuck trump#financial#retail#fuck republicans#fuck republikkkans#definition#infographic#information post#information#informative#economic theory#markets

59 notes

·

View notes

Text

#republican assholes#maga morons#tax the rich#Republicans will cut Medicaid and Medicare#crooked donald#traitor trump#republican hypocrisy

54 notes

·

View notes

Text

It‘s scary to see how very important european petitions get no visibility whatsoever. We had a basic income petition last year which failed because not enough people knew about it. Now we have a „tax the rich“ one that only lasts until october this year and only has around 250k out of 1 mio. signings.

Most EU people go through their every day life w/o knowing about them. There are no ads, no marketing…nothing. I know that costs money though one might think important petitions that lead to a better and progressive life would be supported by the government or ministries in some way, but nooooo

And why should they? It’s petitions that would help out the poor and middle class, but endanger capitalism and their exploitation, sooo: government and business leads for example.

So here the link for those who are interested:

40K notes

·

View notes

Text

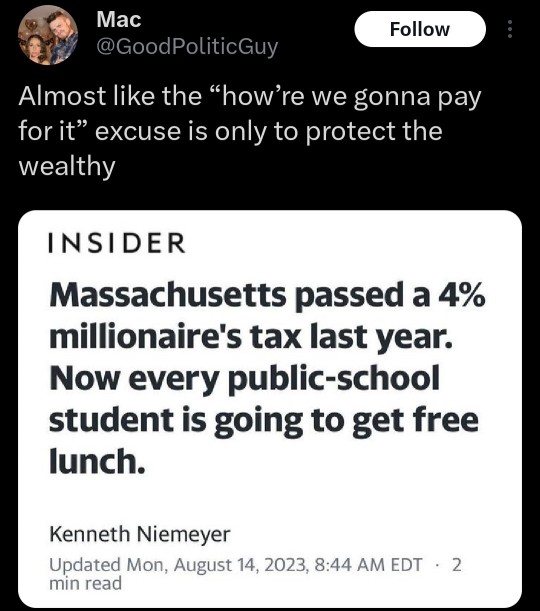

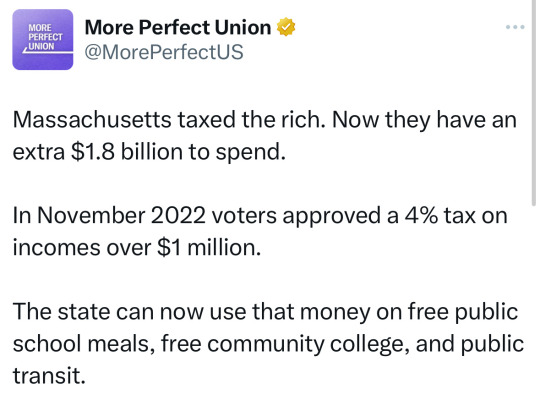

In 2022, Massachusetts residents voted in favor of a Fair Tax ballot measure to extra-super-duper-tax those earning more than one million dollars a year and to spend the revenue from that on education and transportation initiatives.

Naturally, there were the naysayers. Those who warned that all of the state’s rich people would move away to their very own Galt’s Gulch or whatever, if they were forced to pay a four percent tax on anything they make over a million dollars. The implication there, of course, is that raising this tax would, ironically, lead to the state collecting less revenue overall.

That didn’t happen! In fact, the state has already raised $1.8 billion in revenue so far for this fiscal year — which is $800 million more than they expected, and they still have a few months to go. The vast majority of the surplus will go to a fund that legislators can use for one-time investments in various projects.

The revenue has already been invested in universal school lunches, in more scholarships to public colleges, in improvements to the MBTA, and to repair roads and bridges. These are all things that will improve the quality of life for everyone, including the “ultra-rich” who happen to live there. The fact is, it’s just nice to live in a society that is more civil, that takes care of its people and its children and that fixes things when they are broken.

[ ]

Elizabeth Warren, Pramila Jayapal, and others have introduced bills in the House and Senate for a nationwide millionaire’s tax of two percent — two cents on the dollar for all wealth exceeding $50 million and six percent on all wealth over a billion dollars. This would bring in an estimated $3.75 trillion over 10 years, which we could use to improve the lives of all US citizens. We could have so many nice things!

It’s time to stop living in fear of what millionaires and billionaires — who have made their fortunes off of roads we’ve paid for and employees we’ve paid to educate — will do or where they will move if forced to pay their fair share. That’s no way to live. If they have some place better to go that won’t force them to contribute to improving their community? Let them. Other people will come along and be more than happy to pick up where they left off. But more than likely, they won’t do jack shit because they’re rich, and if they wanted to live someplace else, they’d be there by now.

#us politics#us taxes#wealth disparity#tax the rich#Massachusetts#public services#economic justice is social justice#Wonkette#Robyn Pennacchia

11K notes

·

View notes

Text

Tax billionaires. Regulate campaign financing.

2K notes

·

View notes

Text

Things Biden and the Democrats did, this week #26

July 5-12 2024

The IRS announced it had managed to collect $1 billion in back taxes from high-wealth tax cheats. The program focused on persons with more than $1 million in yearly income who owned more than $250,000 in unpaid taxes. Thanks to money in Biden's 2022 Inflation Reduction Act the IRS is able to undertake more enforcement against rich tax cheats after years of Republicans cutting the agency's budget, which they hope to do again if they win power again.

The Biden administration announced a $244 million dollar investment in the federal government’s registered apprenticeship program. This marks the largest investment in the program's history with grants going out to 52 programs in 32 states. The President is focused on getting well paying blue collar opportunities to people and more people are taking part in the apprenticeship program than ever before. Republican pledge to cut it, even as employers struggle to find qualified workers.

The Department of Transportation announced the largest single project in the department's history, $11 billion dollars in grants for the The Hudson River Tunnel. Part of the $66 billion the Biden Administration has invested in our rail system the tunnel, the most complex Infrastructure project in the nation would link New York and New Jersey by rail under the Hudson. Once finished it's believed it'll impact 20% of the American economy by improving and speeding connection throughout the Northeast.

The Department of Energy announced $1.7 billion to save auto worker's jobs and convert factories to electronic vehicles. The Biden administration will used the money to save or reopen factories in Michigan, Ohio, Pennsylvania, Georgia, Illinois, Indiana, Maryland, and Virginia and retool them to make electric cars. The project will save 15,000 skilled union worker jobs, and created 2,900 new high-quality jobs.

The Department of Housing and Urban Development reached a settlement with The Appraisal Foundation over racial discrimination. TAF is the organization responsible for setting standards and qualifications for real estate appraisers. The Bureau of Labor Statistics last year found that TAF was 94.7% White and 0.6% Black, making it the least racially diverse of the 800 occupations surveyed. Black and Latino home owners are far more likely to have their houses under valued than whites. Under the settlement with HUD TAF will have to take serious steps to increase diversity and remove structural barriers to diversity.

The Department of Justice disrupted an effort by the Russian government to influence public opinion through AI bots. The DoJ shut down nearly 1,000 twitter accounts that were linked to a Russian Bot farm. The bots used AI technology to not only generate tweets but also AI image faces for profile pictures. The effort seemed focused on boosting support for Russia's war against Ukraine and spread negative stories/impressions about Ukraine.

The Department of Transportation announces $1.5 billion to help local authorities buy made in America buses. 80% of the funding will go toward zero or low-emission technology, a part of the President's goal of reaching zero emissions by 2050. This is part of the $5 billion the DOT has spent over the last 3 years replacing aging buses with new cleaner technology.

President Biden with Canadian Prime Minster Justin Trudeau and Finnish President Alexander Stubb signed a new agreement on the arctic. The new trilateral agreement between the 3 NATO partners, known as the ICE Pact, will boost production of ice breaking ships, the 3 plan to build as many as 90 between them in the coming years. The alliance hopes to be a counter weight to China's current dominance in the ice breaker market and help western allies respond to Russia's aggressive push into the arctic waters.

The Department of Transportation announced $1.1 billion for greater rail safety. The program seeks to, where ever possible, eliminate rail crossings, thus removing the dangers and inconvenience to communities divided by rail lines. It will also help update and improve safety measures at rail crossings.

The Department of the Interior announced $120 million to help tribal communities prepare for climate disasters. This funding is part of half a billion dollars the Biden administration has spent to help tribes build climate resilience, which itself is part of a $50 billion dollar effort to build climate resilience across the nation. This funding will help support drought measures, wildland fire mitigation, community-driven relocation, managed retreat, protect-in-place efforts, and ocean and coastal management.

The USDA announced $100 million in additional funds to help feed low income kids over the summer. Known as "SUN Bucks" or "Summer EBT" the new Biden program grants the families of kids who qualify for free meals at school $120 dollars pre-child for groceries. This comes on top of the traditional SUN Meals program which offers school meals to qualifying children over the summer, as well as the new under President Biden SUN Meals To-Go program which is now offering delivery of meals to low-income children in rural areas. This grant is meant to help local governments build up the Infrastructure to support and distribute SUN Bucks. If fully implemented SUN Bucks could help 30 million kids, but many Republican governors have refused the funding.

USAID announced its giving $100 million to the UN World Food Program to deliver urgently needed food assistance in Gaza. This will bring the total humanitarian aid given by the US to the Palestinian people since the war started in October 2023 to $774 million, the single largest donor nation. President Biden at his press conference last night said that Israel and Hamas have agreed in principle to a ceasefire deal that will end the war and release the hostages. US negotiators are working to close the final gaps between the two sides and end the war.

The Senate confirmed Nancy Maldonado to serve as a Judge on the Seventh Circuit Court of Appeals. Judge Maldonado is the 202nd federal Judge appointed by President Biden to be confirmed. She will the first Latino judge to ever serve on the 7th Circuit which covers Illinois, Indiana, and Wisconsin.

Bonus: At the NATO summit in Washington DC President Biden joined 32 allies in the Ukraine compact. Allies from Japan to Iceland confirmed their support for Ukraine and deepening their commitments to building Ukraine's forces and keeping a free and Democratic Ukraine in the face of Russian aggression. World leaders such as British Prime Minster Keir Starmer, German Chancellor Olaf Scholz, French President Emmanuel Macron, and Ukrainian President Volodymyr Zelenskyy, praised President Biden's experience and leadership during the NATO summit

#Joe Biden#Thanks Biden#politics#us politics#american politics#election 2024#tax the rich#climate change#climate action#food insecurity#poverty#NATO#Ukraine#Gaza#Russia#Russian interference

3K notes

·

View notes

Text

Paywall-Free Version

"Massachusetts’ so-called “millionaires tax” appears primed to actually deliver billions.

State officials said Monday that the voter-approved surtax on high earners has generated more than $1.8 billion in revenue this fiscal year... meaning state officials could have hundreds of millions of surplus dollars to spend on transportation and education initiatives.

The estimated haul is already $800 million more than what Governor Maura Healey and state lawmakers planned to spend from its revenue in fiscal year 2024, the first full year of its implementation. Most of the additional money raised beyond the $1 billion already budgeted would flow to a reserve account, from which state policymakers can pluck money for one-time investments into projects or programs.

The Department of Revenue won’t certify the official amount raised until later this year. But the estimates immediately buoyed supporters’ claims that the surtax would deliver much-needed revenue for the state despite fears it could drive out some of the state’s wealthiest residents.

“Opponents of the Fair Share Amendment claimed that multi-millionaires would flee Massachusetts rather than pay the new tax, and they are being proven wrong every day,” said Andrew Farnitano, a spokesperson for Raise Up Massachusetts, the union-backed group which pushed the 2022 ballot initiative.

"With this money from the ultra-rich, we can do even more to improve our public schools and colleges, invest in roads, bridges, and public transit, and start building an economy that works for everyone,” Farnitano said.

Voters approved the measure in 2022 to levy an additional 4 percent tax on annual earnings over $1 million. At the time, the Massachusetts Budget and Policy Center, a left-leaning think tank, projected it could generate at least $2 billion a year.

State officials last year put their estimates slightly lower at up to $1.7 billion, and lawmakers embraced calls from economists to cap what it initially spends from the surtax, given it may be too volatile to rely upon in its first year.

So far, it’s vastly exceeded those expectations, generating nearly $1.4 billion alone last quarter [aka January to March, 2024 - just three months!], which coincided with a better-than-expected April for tax collections overall...

State Senator Michael Rodrigues, the state’s budget chief, said on the Senate floor Monday that excess revenue from the tax could ultimately come close to $1 billion for this fiscal year. Under language lawmakers passed last year, 85 percent of any “excess” revenue is transferred to an account reserved for one-time projects or spending, such as road maintenance, school building projects, or major public transportation work.

“We will not have any problems identifying those,” Rodrigues said. “As we all know, [transportation and education] are two areas of immense need.”"

-via Boston Globe, May 20, 2024

#boston#massachusetts#united states#us politics#ultrarich#taxes#tax the rich#millionaire#millionaires tax#public transportation#education#good news#hope

2K notes

·

View notes

Text

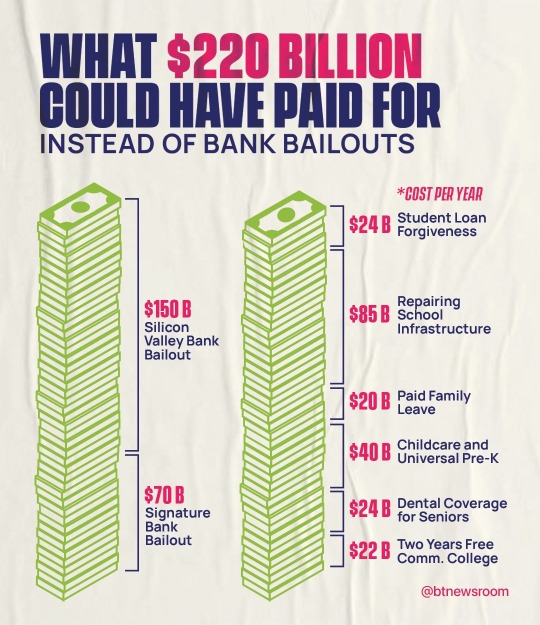

I hate it here

Let this be a lesson against believing politicians lies.

Keeping wealth concentrated in the 1% is the end goal of capitalism.

They will do whatever is necessary to keep the working class desperate and dependent on the system that impoverishes them.

#at what point to wh break out the guillotine#i’m so serious#capitalism#late stage capitalism#silicon valley bank#bank bailout#corruption#corporate corruption#corporate greed#eat the rich#tax the 1%#tax the rich#government bailout

8K notes

·

View notes

Text

Source

#tax the rich#eat the rich#politics#us politics#government#massachusetts#the left#progressive#current events#news#billionaires should not exist#good news

101K notes

·

View notes

Text

Don't let republicans fool you with their national populism cause they do not give a single care for veterans who died and suffered for America. They would hollow out the VA and fill it corporate and political stooges who would blindly follow the GOP's bidding. Our government doesn't care enough for veterans and here we have Republicans confirming it, remember it was Biden who passed the CARE act. So remember a future where our soldiers suffer more than they already do is what the Republicans want.

#politics#the left#leftism#us politics#culture#progressive#eat the rich#tax the rich#corporate greed#communism#veterans#political#project 2025#republican assholes#republican hypocrisy#republican party#gop#maga#democratic party#democracy#democrats#healthcare#elderly care#elderly wellness#elderly support#elderly assistance#elderly safety#age#issues#seniors

474 notes

·

View notes

Text

#eat the rich#fuck capitalism#wealth inequality#working class#anti capitalism#current events#tax the rich#lgbtqia#lgbtq community#income inequality#billionaires#the left#gay girls#queer#lgbtq

3K notes

·

View notes

Text

#restore 1950s tax brackets#vote blue#vote biden#democrats#tax the rich#tax the 1%#tax the billionaires#billionaires should not exist#vote democrat#democracy#social democracy#vote blue to save democracy#vote blue 2024#democratic socialism#democrats now socialism later#vote biden/harris#biden/harris 2024

697 notes

·

View notes