#black page journal

Explore tagged Tumblr posts

Text

I'm straight up obsessed with this black page dot journal, y'all.

Gonna be using it for junky inspiration for my WIPs and OCs. This shit's kick-starting my brain and my FUCK have I needed a kickstart.

#ruinrant#writing#writeblr#journaling#scrapbooking my WIPs#brb im hyperfixating#junk journal#black page journal#this pleases my dark lil soul#also made me notice all my fave ideas have a supernatural/creatures element#gotta love monsters

80 notes

·

View notes

Text

@shallowseeker @angelsdean

Sam inherited John's drawing skills

– Sam in 3x05 – John Winchester's Journal

– a black dog in John Winchester's Journal

Meanwhile, Dean in the Men of Letters Bestiary

#(the bestiary's pages above are about reapers skinwalkers and death omens)#eye find john's black dog funny#the men of letters bestiary#john winchester's journal#drawing skills in spn#my post

141 notes

·

View notes

Text

moonwatcher (remake) - art by gumywrm

🌑 🦋 📚 / 💫 x 💫 / 📚 🦋 🌑

#stimboard#stim#stimblr#starting off the year strong with a stimboard remake bay bee#the first one i made on this acc too#moonwatcher#moonwatcher wof#moon wof#nightwing#moth#bug#bug cw#lunar moth#book#journal#scrap journal#black#white#green#gold#pen#page flipping#hands#nature#sky#moon#wings of fire#wof

36 notes

·

View notes

Text

Certain people in my life might not change, but I can. By change, I mean shifting the habit of not liking myself, of hating my body, of suppressing my deepest desires and the truths of who I am.

#journal#journal thoughts#self reflection#self respect#self awareness#self care#self promo#the artists way#abrahamhicks#yogaeveryday#inspiring quotes#writerscorner#yogainspiration#unicornthoughts#black writblr#oprah daily#dali lama#morning pages#marianne williamson#a journey to love#self positivity#low self confidence#black women#low self image#spilled ink#feeling insecure#mindfulmoments#motivation

30 notes

·

View notes

Text

This journal feels like it’s going by much faster than usual, even though I feel like I’ve been writing less than last year. I wonder if it’s because I haven’t been interacting with it much outside of writing (I only properly decorated it about two days ago), or because last year I had more order and structure and now I’m so much more messy, or I really am writing more than last year. Cause I can’t say my writing’s gotten bigger

#journaling#I’m two thirds of the way through in a week already and they used to last me like a month#also someone needs to stop me from buying moleskine again this is terrible#I’m confined to one black gel pen or having to stick a paper on the back of the page and write on that#because my regular pen bleeds terribly on this paper#but I got charmed by the pretty boxed set and I bought it#so now I have two other moleskines to use up -_-

7 notes

·

View notes

Text

#digital camera#digi cam#indie craft#hipness purgatory#black out poetry#stipiling#collage#journal#journal pages#scrapbook journal#journal addicted#journal spread#grunge journal#journaling#my journal#art journal#journal page#junk journal#physical journal#diary#diary entry#personal diary#diary pages#diarist

37 notes

·

View notes

Text

FARLEIGH No... No, you don't. You used it seven times. Oliver reddens. OLIVER No I didn't. FARLEIGH Yes you did. I counted.

#saltburn#this is a wip!!#but im deathly afraid of fucking it up once i start color#and im not sure yet if i want to make it just black and red and gold (my usual) or go all out with paint#paint would make a lot more sense because the page next to this one will be a collage#this is my journal. so. i'll be collaging#and it'll have different colors. ya know.#so iDK but im scared of losing this forever now that i like it so. be it here. posted discreetly at night dont look#mine#my art

21 notes

·

View notes

Text

did some completely unplanned decorating of my hobonichi avec today

#citrus black did not in fact blacken 😂#fountain pen inks#hobonichi#journaling#paper is a william morris design from a wrapping paper book(?) i bought eons ago#i’ll be using it for creative journaling#(my avec)#only rules are a page a day of any kind of creative output#except writing#cause that goes in my journal journal

2 notes

·

View notes

Text

I've decided that Ava Silva

despises Spongebob.

Why?

For the plot of her villain annoys heroine until she falls in love with him, of course.

#ch2 of atsbb is going slowly but i'm picking at it i even finally wrote skeleton dialogue for the black mass#at some point she should show adriel an ep of spongebob it'd be the only time she had a good time because he nearly has a meltdown#warrior nun#warrior nun fandom#warrior nun fanfiction#ava silva#warrior nun headcanons#adriel#ava x adriel#avadriel#otp#heroine x villain#diary pages#writing journal#everyone remember ava's bi and so am i#it's the fate of the heroine to fall in love with the villain#and the sea became blood#warrior nun biblical au#tbh the black mass isn't dialogue just adriel leading the mass and the satanists answering him#i still have to translate it to latin#ava has good sense that's why hates spongebob#i hate spongebob everyone should hate spongebob

5 notes

·

View notes

Text

Recent game related things .. hrmm...

#I do like the inconsistency of the first map. that is actually something older but that I re-found and added to my Game Reference stuff#so that when characters reference where they're from I can be accurate. I like that the whole map is kind of shifted up that way. Where the#actual south part doesnt even count as the south since its Too Far and Scary lol. and if you say you're from 'the north' thats basically#like.. one single continent. Though some people do make distinctions like 'north midlands' or etc. still. I like the ways that common#language isn't always precisely accurate like that. and thinking about why a culture would classify things a certain way or etc. etc.#The inventory page is so funny to me because it's literally just the BASe like.. sample layout just to make sure it works properly with 0#actual design into it. just colored rectangles thrown together in MS paint. but what if I like... left it like that.. what if all the other#art in the game and UI is like stylized and fully matching BUT the inventory/journal/etc. screens I just left as plain colored blocks#with random misalignments and black spots and etc gjhbhjj... It looks unfinished in a Funny Contrast way to me.#the wordcounts are just like... my past few days of writing.. I am still not getting 2200 words a day done or whatever I needed. I'm lucky#if it's even half of that .... tee hee.. :3c I do also keep having appointments and other things going on but..grrr...#The full map of the area is probably not necessary but I thought it would be more realisitc if people were able to reference things. Like i#you have people all living in a city area probably at some point someone might mention a neighboring city or some landmark nearby#or etc. so I thought having at least the basic names of what's around for reference would be sensible. A side character mentioning#'oh yeah I don't live here full time I just travel from Marisene sometimes' or whatever makes it seem more like a Real#Fleshed Out Place than people just making vague references like 'the river' or 'i come from a city nearby' or 'i went to a place somewhere#around here' or 'the other city' or etc. lol.. Especially since global cities/global areas are weird as they operate almost like an#independent country within their walls. so it's like a micro country inside of another country usually. just plopped down in some agreed#upon plot of land that won't be too disruptive to the main country around it. That could get very complex depending on the cultural and#political backdrop of where they're placed (though obviously they try to choose the 'easiest' areas possible for it). Asen is a very mild#country without much history of conflict or anything so it's fine. But still interesting that Sifeh and the entire branched out global area#border three other districts of Asen. Which means like 3 times the local representitives you'l have to negotiate with for some major change#or anything. I think one of the 'random characters you can find around the world and have short discussions with just to make the area#feel more populated and real even though theyre not actual important npcs' is going to be a guy who actually serves on the council that#handles running the global areas and he's like.. some perpetually exhausted middle aged elf running around with a clipboard or whatever#ANYWAY...... hrgh... still trying to write when I can....#I WISH so badly that I had the scope for a simple character creation menu and all character interactions would allot for the background#of your player character. And also to have a simple day night cycle where places in the world you explore/people you talk to during the day#have new options or dialogue at night.. BUT alas... I already am so behind on everything as is lol.. aughhh... T o T#As the worlds number one Needless Detail And Complexity Enjoyer i must dilligently prevent myself from adding additional complexity

4 notes

·

View notes

Text

kinda crappy lighting BUT… I have completed it… the Book of Vanitas…

#you wouldn’t believe how hard it was to get the journal base for this#we had to go to TWO separate michaels just to find one#and it was the LAST ONE in stock#apparently these specific black-paged hardcover journals are in high demand??#anyways shout out to the nice michales person who told us that the michaels a few towns over was much nicer and probably had what we needed#vanitas#vanitas no carte#case study of vanitas#vanitas cosplay#book of vanitas#the book of vanitas#cosplay#cosplay props#moxie cosplays#moxie crafts

54 notes

·

View notes

Text

I release my need to be in control.✨

#journal#journal thoughts#affirmations#art blogs on tumblr#morning pages#the artists way#trust the process#manifesation#manifesting#a journey to love#mindfulmoments#self positivity#inspiring quotes#unicornthoughts#writerscorner#motivation#black women#yogainspiration#heart centered

14 notes

·

View notes

Text

playing Revenants hunt almost immediately after finishing black veil is so weird because like black veil felt like it took forever to finish (in a good way, it gave me so many thoughts) but Revenants hunt felt like it went by in a blink of an eye (also not in a bad way, it's like a 500 word fanfic)

#all in all i liked both#black veil much more than revenant#but that's bcus i cant stop thinking of the implications of it#and the last journal page and the potential misery it invokes#mystery case files#mcf#the black veil#the revenants hunt

2 notes

·

View notes

Text

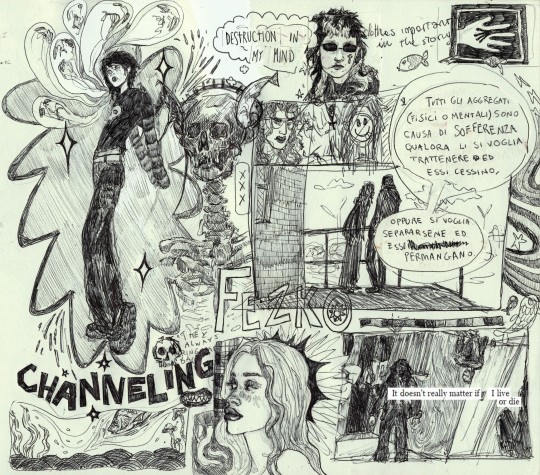

Tutti gli aggregati fisici o mentali sono causa di sofferenza qualora li si voglia trattenere ed essi cessino, oppure si voglia separarsene ed essi permangano.

#original character#oc#junk journal#drawing journal#sketchbook#sketchbook page#black pen#black pen drawing#euphoria#euphoria drawing#buddhismo#buddismo

14 notes

·

View notes

Text

Ok this post started as a reply to another post about how numbers were fake and got away from me a bit, strap in.

EDIT: Public Service loan forgiveness is a federal program in the US where if you work in government for 10 years the government will pay off the remainder of your student loans. This is way more important than the rest of this godforsaken screed and I'd appreciate a reblog to get out information on that.

This is a facebook group run by my dad(!) among others with a ton of useful information in case student loans are something you are struggling with and have a public service job or are looking to change careers.

Ok, Autism time.

TLDR: Companies are incentivized to borrow money because they can reliably only pay back a fraction of it while using it to inflate their stock price. You are disincentivized from borrowing money because you will pay back 120-130% of what you borrowed unless (and sometimes even if) you file for bankruptcy. We actually do need a financial sector but it's badly under regulated, and also international finance has no rules and is an imperial power-fest. Also anti-finance is an antisemitic dogwhistle.

Debt is one of the fuckiest things on the planet and I wrote this for my own edification but in case it helps someone make sense of a new concept that'd be pretty cool.

Proof the numbers in the economy are fake:

No debt is repaid in exact numbers. You borrow 10k, and probably you pay back 11-13k over a number of years. The government borrows 1 trillion dollars and pays back 1.1 trillion dollars over a number of years. A company borrows 1 million dollars, they pay back 1.1 million dollars over a number of years. The numbers almost always go up, this is one reason we have inflation. You can pay less than you borrowed, but only under certain conditions. Inflation is one, such that you pay relatively less though absolutely more. Typically the numbers only go down if someone defaults, but that's usually the worst case scenario because it breaks the kind of promise that the whole economy is based on.

If you default, your debt is sold by the bank to someone else. Not for 10k, or whatever is left on the balance, but for probably 1-2k, a fraction of what it's "worth" and then the person who bought it tries to get you to pay the rest of the balance while the bank reports the loss as part of their tax deductible operating expenses.

Then, you're still on the hook for the 11-13k plus whatever fees the debt collector wants to charge. And if you don't pay those, they do it again, selling what they bought for 1-2k for 4-5 hundred, and so on, until you file for chapter 11 bankruptcy and are no longer legally obliged to pay all of the debt. In practice, this means the government negates the lender's right to collect the full balance in exchange for you going on a payment plan based on a new agreement the government brokers between you and the lender.

After this, because you failed to pay back the full balance, you will find it almost impossible to find banks to loan you money, even if in the end you paid way more than the 11-13k you would have paid back if you had made your payments on time.

In general, if you file for bankruptcy, you lose.

This sort of works in reverse with the stock market: You buy stock and the company pays you back with interest because you are loaning them your money. Companies sell stock at an initial price, auctioning it off in lots to find out what people think it's worth, and what it's worth is based on a) its capacity to increase in value and b) the monthly/yearly interest repayment which is based on the IPO price. Higher price means more money raised for the company but only at the IPO rate because once it's on the secondary market the company doesn't actually see any of the money except as good publicity.

The interest payouts are called dividends, although only a few companies actually care about paying them out anymore. Many companies ignore their dividends and instead just try to pump the price of their stock on the secondary market, aka the stock market. The ratio between stock price and dividends gives you an interesting picture of how the company sees its long term strategy: Car companies which don't really grow tend to have low ratios between stock price and dividend. Tech companies, which are looking to blow up and act like they don't know nobody, tend to have very high stock prices and very low dividends.

Crucially, companies tend to see the stock price as a reflection of the company's health, or "consumer confidence" or something, and a lot of executive pay is tied to it because most of them get paid in stock.

But the number doesn't mean anything concrete (to the company) after the IPO.

The upshot of all this is that while you are expected to borrow and pay your balance back with interest, companies are rewarded for borrowing and then artificially increasing the size of their own debt (stock price) because that's how the people making the decisions get paid.

Crucially, and this is also the assumption when an individual takes on debt, the debt is supposed to enable the debtor to make more money than they would have without it. However, unlike the kind of debt most individuals take out, the debt from issuing stock doesn't (usually) pay off the principle. This is why companies can (sometimes) get away with taking on debt without actually paying it off. You could in principle do this too if you registered as an LLC and issued stock for yourself, but this would be weird and paying strangers dividends might be a big financial burden. Or it might work out, go wild. I'd say the odds of this working are fairly comparable to minting yourself as an NFT and trying to sell it, albeit without needing to use the blockchain. Please ask a lawyer first though.

Also, companies can take on way more debt with way less risk because it is significantly less punishing for a company to file for bankruptcy than a person. The LLC in LLC is short for Limited Liability Corporation. If a company files for bankruptcy, it usually gets to keep most of its assets, because the government in general wants it to keep producing whatever it was producing and its debts are restructured accordingly. Sometimes, however, the assets are sold and the creditors just lose out on any debt over and above the selling price of the assets. Companies can try to shed debts by selling their assets for cheap to a new company, filing for bankruptcy, and then leaving creditors with the losses. This is fraud, but sometimes they get away with it and the "limited liability" part means that even if it is fraud it is legally difficult to go after the people responsible. LLCs are why if your company goes bust, you as an employee cannot be sued, which is generally a good thing. However, the structure of LLCs make it very easy for a company to take on more and riskier debt while you, as an individual are expected to pay off everything you borrow.

In general, if a company files for bankruptcy, the creditors lose.

The Government, apart from regulations, mostly cares about finance for two reasons: Economic stability and Retirement savings.

All this shit is made up. It's a game with very complicated rules, but there's no natural reason for it to work in the particular way that it does. In fact, there are countries like Turkey where it works completely differently, mostly because of religious laws about interest collection. Both Christianity and Islam have complicated histories with finance, but I digress. The point it that finance is almost entirely held up by agreements between extremely fickle parties. Like, there are contracts, agreements, balance sheets, and so on but none of this is pegged to any real asset. (This is a good thing, people who tell you that we should go back to the gold standard are morons) What that means is that the government can decide at any time to forgive people's debts. They can just void the contracts, who's going to stop them? (Be careful if you have a banking system powerful enough to go toe to toe with the government. JP Morgan and a bunch of other wall street people actually tried to overthrow the US Government in 1933.) They need to be careful about this because being able to borrow money when you need it is a net positive, and doing it too often disincentivizes people from lending money making borrowing more expensive. But overwhelmingly, rather than forgiving small dollar loans to people, the government forgives giant loans to companies.

This is partially because the stability of the system, ie creditors getting paid in order to keep a steady supply of creditors, matters more than the fate of any particular player within it, and partially because big fish can manipulate the system to insulate themselves from consequence.

For example, in 2008, tons of first time homeowners had gotten "subprime mortgages," meaning they had borrowed more money than they could afford to repay in order to buy a first home. Increased buying meant prices went up, borrowers were unable to afford the increased property taxes from their suddenly valuable homes, and then were forced to sell, producing even more subprime borrowers. These debts were defaulted on, sold, and then bundled into packages where debt buyers could not see the insolvency of the loans. Then, the bubble burst. People suddenly realized that they had taken out a million dollar mortgage, which they could not afford the monthly payments on, on a house that would only sell for 400k. And they were on the hook for the entire million plus interest.

At this point, the government had a choice: they had to do something about the fact that millions of people had borrowed more money than they could afford. They could have bought the debt, and helped the homeowners pay in a situation similar to a chapter 11 bankruptcy where some assets are protected in order to prevent massive foreclosures, or they could have done what they did which was buy out the debt buyers and help the creditors recoup their losses. Instead of virtually slashing housing prices by forgiving mortgage debt in order to help people stay housed, they assumed the debts of the people who had bought subprime mortgage bundles, mostly banks, while refusing to go after the architects of the scheme who had issued the bad mortgages and sold them under false pretenses.

The biggest reason why this stuff really matters is that at least how the US does things right now, almost all retirement securities are tied to stock price. That's your 401ks, your Roth IRAs, etc. With the exception of Social Security and Medicare, almost all the income seniors have is based on the performance of the stock market. This isn't the worst idea, as compared to previous systems like large savings banks or just having parents cared for by their kids this is A) somewhat resistant to inflation and B) does not shackle predominantly young women to permanent unpaid elder care as was the case under past more patriarchal systems. It's good that in general inflation can't wipe out the savings of someone who saved 100,000 1970 dollars only to have that barely cover a week of cancer treatment. Finance makes that happen.

Also, people want to do things that cost more money than they have, like buy houses, start businesses, and go to college. Businesses also want to do things that cost more money than they have, like build factories, conduct research and development, and offer benefits to employees. Finance makes that happen.

We would still need finance even if (like under communism) the government paid for these things, and whether finance should be entirely public (communism) entirely private (anarcho-capitalism) or semi-private (status quo) is a really complicated question. Finance is not this intrinsically evil thing.

Also because of the aforementioned history of Christians making collecting interest illegal most demonization of finance is directly connected to the Jews, who under medieval law were forced into being bankers in order to avoid forcing Christians from committing the sin of usury (interest collection). Much history of antisemitism in Europe is directly connected to these sorts of laws. The stereotype of the greedy jew, for example, comes from the fact that when medieval governments wanted to raise money, such as for a crusade, they would increase taxes but only on the jews. This forced the jews who were legally forbidden from doing any other job to increase interest rates in order to stay financially solvent, demanding higher rates on borrowing and lower interest on savings. This effectively raised taxes on everyone, but looked like the lord was being generous while the jew was being greedy. Anyone who talks about the intrinsic evils of global finance, whether they know it or not, is parroting Nazi talking points. Bear in mind that the Nazis did the same shit as the medieval lords: by raising taxes on Jews and only Jews, as well as seizing the assets of Jewish refugees, expropriating Jewish owned businesses, and using the Jews as slave labor they funded significant social welfare programs and their invasions of neighboring European countries without significantly increasing taxes on anyone but the Jews, at least until ~1940.

But there are still perverse incentives.

Whenever finance (making money by moving money around) overshadows production (making shit people actually need) bad things happen. Enron was a prime example of this: it was a "holding company" (they owned property that other people used for production without being directly involved in that production) that used an asset shell game to boost their stock price to hundreds of times their dividend, then sold out leaving investors with worthless stock they had bought for thousands of dollars.

Crashes can usually be predicted in advance: the problem is that the government is usually lax with enforcing financial crime. Journalists and economists saw 2008, Enron, the Dot Com bubble, the Asian Financial Crisis, and many other financial disasters coming. Karl Marx argued that Capitalism exists in a permanent cycle of boom and bust as a result of its systematic incentives. There is a history of financial crisis going back to the story of Joseph in Genesis. However, even when governments can see it coming, financial prophylaxis, such as regulation, is usually seen as too expensive even when it is cheaper to prevent a disaster than to clean up after one. Worse, the fact that the bankers almost never get prosecuted means that financial mismanagement and crime continue to exacerbate what might be a natural tendency of markets to rise and fall. This is direct consequence of the structure of LLCs. The higher the highs, the lower the lows, but if you're trying to jump out of the market at the top and then buy up everyone else's assets for pennies at the bottom, you want the cycles to be as extreme as possible. That's the position major companies find themselves in, and it's basically only good for them.

I'm not enough of an expert to have specific policy recommendations, except that in the 90s Bill Clinton overturned a law which separated savings banks from investment banks. Savings banks rely on high interest rates, both on loans they issue such as for mortgages, cars, and so on, and on the personal savings you receive from depositing money in them. Once upon a time (the 90s) you could put your money in a normal bank and get 5-6% interest in a savings account. This no longer happens. Investment banks make their money by taking your money, putting it on the stock market, and collecting the difference. Investment banks are more profitable (mostly for the bank) but more risky (mostly for you), like having someone start a casino with your money. House advantage is there, but they can still lose. Before the 90s, it was illegal for your bank to gamble with your savings on the stock market. Now it is not, and this law is something I think we should bring back.

When it comes to governments and the international system things are weirder.

It's really hard to make a government keep a promise, so they get to flaunt these rules. Also, as a rule, Governments only care about their citizens (sometimes defined very narrowly as non-immigrant, non-prisoner, white, etc) and not anybody else. Anything they do on behalf of any other group is only because it also benefits their citizens for some reason. The only real way to make a government keep a promise is by lawsuit, which they can ignore if they don't like, or war, which most people can't really do for fun. This is why The US Debt strategy for its entire history going back to Alexander Hamilton is to run up the credit card like it's Christmas. The plan as far as the USA is concerned is to borrow money and only pay off the interest rather than the principle. The only way someone is going to get the USA to pay off the principle is by beating them in a war. However, those interest payments are the most reliable debt interest payments in the world, unless the republicans in the house are real fucking numbskulls come June. I'm not exactly smart enough to understand the nuance of why all the other countries on earth let us do this but I think it has something to do with beating everyone on the planet in a war in the last century. However, the US always pays its debts in full, even if as a result of inflation what they're paying back is only part of what it was worth when they borrowed it. This is normal, though whether or not it's ethical depends on your views on american empire.

What's important about this is that things like the US debt clock are shameless right wing propaganda. Someone somewhere will tell you that the government has borrowed like three hundred thousand dollars on your behalf and that they expect you to pay it back. This is then used to argue against government spending. I won't get into fiscal policy but this is a lie, and it's better to keep borrowing and paying off debt than to try to achieve fiscal or financial independence internationally.

International finance is also directly used as an oppressive tool for reproducing capitalism in developing countries. The last thing I'll say on the subject is this: countries with less economic power than the G7 are subject to bullying by larger economies. Every country in the world borrows money, and this is generally a good thing. However, Unicef, the World Bank, and other international institutions set terms on the loans that they offer to countries that were robbed under colonialism and refuse to lend money to them unless they comply with various international standards. This sometimes includes things like requiring girls to be able to go to school, and sometimes requires forcing governments to pay license fees for US patents on things like insulin and oh boy if your prescription drug costs are high in the US just imagine how much money you have to pay for drugs with US patents on them after converting non-US money to dollars. Whether or not you agree with these sorts of policy requirements, they are neo-colonialism and do contribute to American domination over these countries. Just because we're loan sharking them for insulin money instead of invading their country for oil doesn't mean that isn't what it is. Intellectual property is one of the most contentious parts of these sorts of fights, where a country would be happy to void a US patent on behalf of its citizens but it can't without losing access to international loans.

There are lots of problems with finance and it's dialed into the entire modern political system so it's extra fucky to understand in greater detail than this, and while it is strictly speaking politically neutral, the more power you have the more you can manipulate it. There unfortunately aren't great tools the average person has to do about the state of the world financially, but I think it's helpful to know and I hope you enjoyed reading this. Maybe you smack a fascist with something from this if they start talking about how globalists run the banks.

#I was inspired by that BDG video about Healthcare#I swear I'm not an econ bro tho#Also this is what I did instead of writing grad school papers#God international relations is fucking depressing it's like a train wreck that started under the fucking mesopotamians and has not stopped#But actually don't worry about the debt though#unless it's your debt in which case vote democrat if you want to see more student loan forgiveness#How the fuck did I black out and write 3500 words about this#That's 10 fucking pages#This is half a journal article

8 notes

·

View notes

Text

My journal and bag

#polaroid iso48#digital camera#digi cam#journal#art journal#my journal#journaling#grunge journal#journal addicted#journal page#journal pages#journal spread#junk journal#physical journal#scrapbook journal#leather#boot black#ussr#military bag#paper republic

5 notes

·

View notes