#Invest real estate

Explore tagged Tumblr posts

Text

#Porsche#Mansion#Luxury#Rich#Wealthy#Cars#German#Germany#Automotive#Auto#Real Estate#House#Wealth#Men#Masculinity#Lifestyle#Bossed Up#Boss Life#Foreign#Foreign Car#Foreign Cars#Net Worth#Portfolio#Generational Wealth#Investments#Business Man#Rich Man#Prosperity#Opulence#GLRYB2GD

2K notes

·

View notes

Text

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

1K notes

·

View notes

Text

Invest in real estate for as little as $5 Buy shares of rental properties, earn monthly income, and watch your money grow

#Invest in real estate#Real-estate Investing#Real estate investing app#Real estate investments#Invest in rental properties#Real estate app#App to invest in real estate#Invest real estate#investing offers#invest

1 note

·

View note

Text

How to Invest In Real Estate (2021) - dir. John Wilson

1K notes

·

View notes

Text

As a African domestic worker in 1850s California, Mary Ellen Pleasant eavesdropped on her wealthy clients so that she could learn how to invest her money wisely. She later used this knowledge to build a real estate empire — which was worth over $30 million.

Pleasant put her investment profits to good use by purchasing businesses like laundries and boarding houses before building a real-estate portfolio. Before long, she owned shares in other businesses like restaurants, dairies, and a bank. It's believed that her white male business partner helped her acquire numerous investments under his name so that she wouldn't have to encounter as many issues as other aspiring. African businesswomen of the era. Pleasant soon became one of the wealthiest women in America, and she always tried to use her money for good, first by supporting antislavery causes and then later by fighting against racial discrimination. When it came to standing up for what she believed in, she once famously said, "I'd rather be a corpse than a coward."

#african#afrakan#kemetic dreams#africans#brownskin#brown skin#afrakans#african ellen pleasant#antislavery#investing#real estate#portfolio#america#business partner#california

187 notes

·

View notes

Text

"Fuel your financial journey with the power of US stocks! 🚀 Don't just watch, be a part of the wealth revolution! 📈 Join my dynamic stock investment group, where opportunities ignite, insights flourish, and success awaits. Seize the moment, let's rewrite the story of your financial triumph together! 💪💼

#financial literacy#financialfreedom#finance#financial#economy#ecommerce#investors#investing#invest#stock market#stocks#stock#real estate#investor#self love#encouragement#encourage#selfworth#manifest#growth#grow#improvement#motivation#motivatedmindset#mindset#growthmindset#improve#quote#quotes#inspirational quotes

55 notes

·

View notes

Text

📊 Economists Warn of New Inflation Hazards Post-Election

As we approach the presidential election, economists are raising concerns about potential inflation hazards. While inflation has cooled due to higher interest rates, supply chain improvements, and an increased workforce, the policies of the next administration could significantly impact its trajectory.

Key Insights:

- Trump's Policies: Broad tariffs, worker deportations, and pressure on the Federal Reserve could reignite inflation. Potential tax cuts and deficit increases may further drive inflation.

- Harris's Policies: Focus on home construction and anti-price gouging measures. Aims to offset spending with revenue increases to manage inflation.

Economists caution that Trump's approach may destabilize the economy if unchecked. As real estate developers and investors, staying informed about these potential changes is crucial for strategic planning and investment decisions.

#Economy #Inflation #RealEstate #InvestmentOpportunities #Election2024

What are your thoughts on the potential inflation hazards post-election? Let’s discuss!

Stay informed with the latest economic insights and trends! 📈✨

#politics#election 2024#us elections#presidential election#donald trump#kamala harris#real estate#investment#danielkaufmanrealestate#economy#real estate investing#daniel kaufman#housing#construction#homes#housing forecast

10 notes

·

View notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

93 notes

·

View notes

Text

Says “I’ve read about this before” as though my extensive hyperspecific knowledge on a random topic was achieved through respected academic readings and not cobbled together through the special interests of novel characters I paid too much attention to

#also the fun fact lists i read through like a decade ago#greatest real estate agent really did get building construction stuff right#the apothecary diaries cementing that flour is a combustible...... save me. save me maomao#characters that read classics and then talked/thought about the classics with citations included... thank you#I’ve got many whale informations that you wouldn’t be expected to know off the top of your head#and also snake informations I have those too#characters very invested in their field of work thank you thank you

28 notes

·

View notes

Text

The apartment block. 🏙🌃 🟧🟪(mixed media collage)🏢

#apartment#apartment complex#apartment buildings#condo#real#real estate#real estate investing#real estate industry#real estate agent#bronx#staten island#city life#cityscape#skyscraper#pop art#contemporary art#fine art#folk art#childrens book illustration#modern art#basquiat#naive art#fort greene#williamsburg#collage art#town house#affordable house#affordable housing#public housing#andy warhol

34 notes

·

View notes

Text

#invest in student housing#passive income#real estate investing#long term financial success#long term financial growth

6 notes

·

View notes

Text

Feel like I shouldn't have to say this and I'm mostly just preaching to the choir but housing should not be an investment opportunity. Living, breathing humans reside in that house. You're disgusting if you're a landlord, even more so if you have your tenants live in dangerous conditions. If you're gonna own the property, it's your responsibility for maintenance. Point-blank and I don't wanna hear anyone tell me otherwise.

#capitalism#anti capitalism#anti capitalists be like#capitalist hell#late stage capitalism#capitalist dystopia#investment#real estate investing#investors

44 notes

·

View notes

Text

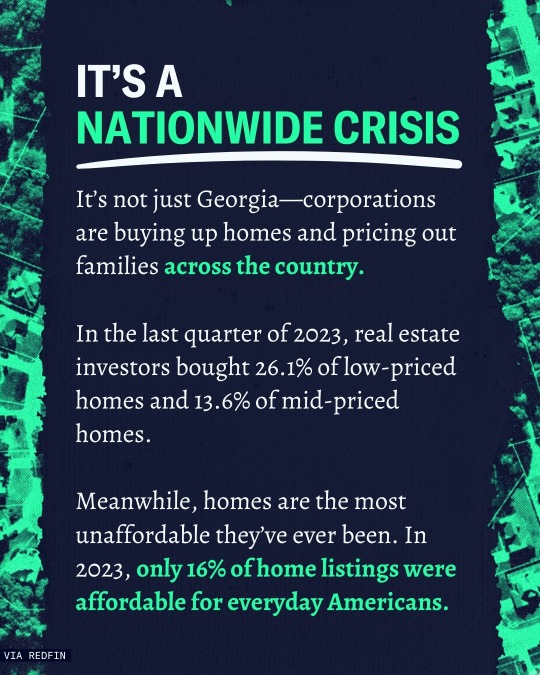

Everybody gets firsts before anybody gets seconds, but for housing. It should be illegal to stock up on a basic human necessity until people can't afford it. There is not a housing shortage in the USA, there is a hoarding problem.

I judge people who own more than they need. I'm sorry, but I do. That's true if you have a vacation home or if it's a rental property. It's true if it's one property or if it's ten. Your "investment" could be someone else's first and only home.

#leftist#liberal#democrat#housing#housing crisis#investment#real estate investing#real estate#real property#investing#socialist#socialism#kind of#responsibility#greed#hoarding#rich get richer#poor get poorer

46 notes

·

View notes

Note

has dream ever mentioned owning land/property? he definitely has, right? like the land the dransion is on is most likely his, and so are his warehouses

yeah he owns two warehouses and lives on a decent amount of land from what we've seen on streams and how he explains it so yeah I'd assume he at least owns all of that

#coming from someone whos parent is in real estate the best thing for you to do as a wealthy person is to invest in property#so it would make sense lmao#ask#anon

11 notes

·

View notes

Text

Report has come out showing that nearly half of the speculative real estate investors largely responsible for making Canada's largest city also one of the most expensive to rent in are losing money and I am here for it.

89 notes

·

View notes

Text

Always be investing.

You will normally pay less taxes on it as well.

#wealth#cash#money#rich#earn money online#goals#millionaire#money goals#motivation#investing stocks#investors#real estate investing#investing#investment

4 notes

·

View notes