#daniel kaufman

Explore tagged Tumblr posts

Text

📊 Economists Warn of New Inflation Hazards Post-Election

As we approach the presidential election, economists are raising concerns about potential inflation hazards. While inflation has cooled due to higher interest rates, supply chain improvements, and an increased workforce, the policies of the next administration could significantly impact its trajectory.

Key Insights:

- Trump's Policies: Broad tariffs, worker deportations, and pressure on the Federal Reserve could reignite inflation. Potential tax cuts and deficit increases may further drive inflation.

- Harris's Policies: Focus on home construction and anti-price gouging measures. Aims to offset spending with revenue increases to manage inflation.

Economists caution that Trump's approach may destabilize the economy if unchecked. As real estate developers and investors, staying informed about these potential changes is crucial for strategic planning and investment decisions.

#Economy #Inflation #RealEstate #InvestmentOpportunities #Election2024

What are your thoughts on the potential inflation hazards post-election? Let’s discuss!

Stay informed with the latest economic insights and trends! 📈✨

#politics#election 2024#us elections#presidential election#donald trump#kamala harris#real estate#investment#danielkaufmanrealestate#economy#real estate investing#daniel kaufman#housing#construction#homes#housing forecast

10 notes

·

View notes

Photo

Zion National Park :: Daniel Kaufman

* * * *

"Never once in my life did I ask God for success or wisdom or power or fame. I asked for wonder, and he gave it to me."

- Abraham Joshua Heschel

135 notes

·

View notes

Text

Why I Think CRE Will Be a Safe Harbor Amid Tariff Turmoil

But I’m watching two caveats that could shake that thesis. When the Trump administration announced sweeping tariffs on April 2, the immediate reaction across markets was predictable: volatility surged, equity indices swung wildly, and conversations in capital circles turned toward downside protection. As someone who spends every day in the world of commercial real estate, I believe CRE may…

View On WordPress

#banking#construction#Daniel kaufman#Daniel Kaufman Real Estate#Donald Trump#economics#Economy#Housing Market#investing#Real Estate#real estate investing

0 notes

Text

Viviendas eficientes: la apuesta bioclimática de Jujuy y su cooperación internacional

Viviendas eficientes: la apuesta bioclimática de Jujuy y su cooperación internacional Viviendas eficientes en Jujuy: cooperación internacional impulsa construcción sostenible con diseños bioclimáticos para reducir consumo y emisiones.

Jujuy se ha destacado en los últimos años por su compromiso con el desarrollo sostenible, y uno de los ejemplos más recientes y significativos es el de las viviendas eficientes impulsadas a través de un proyecto de cooperación internacional. Este esfuerzo está coordinado por la Secretaría de Ordenamiento Territorial y Hábitat (SECOTyH) del Ministerio de Infraestructura de Jujuy y cuenta con la…

#adobe#Alto Comedero#arquitectura bioclimática#arquitectura sostenible#bioarquitectura#cambio climático#captores de temperatura#confort térmico#cooperación internacional#Daniel Kaufman#diseño bioclimático#ecología urbana#Eduardo Cazón#Eficiencia Energética#energías renovable#Jujuy Verde#materiales ecológicos#muro Trombe#Plan Piloto de Eficiencia Energética#pozo canadiense#Premios Latinoamérica Verde#SECOTyH#termotanque solar#termotanques solares#ventilación geotérmica#viviendas bioclimáticas#viviendas eficientes#Viviendas Sociales#Yvelines

0 notes

Text

The Unbearable Lightness of Being (1988)

#the unbearable lightness of being#daniel day lewis#juliette binoche#philip kaufman#film#movies#cinematography#drama#romance

344 notes

·

View notes

Text

Juliette Binoche and Daniel Day-Lewis on the set of 'The Unbearable Lightness of Being', 1988.

Directed by Philip Kaufman

#juliette binoche#daniel day lewis#the unbearable lightness of being#90s films#aesthetic#vintage#old school cool#style#beauty#family#doggo#must love dogs#puppy#90s aesthetic#philip kaufman

68 notes

·

View notes

Text

“La insoportable levedad del ser” del director Philip Kaufman, basada en un libro de Milán Kundera

#milan kundera#la insoportable levedad del ser#philip kaufman#juliette binoche#daniel day lewis#lena olin#cinemetography#cinephile#movies#art#great story

214 notes

·

View notes

Text

The Unbearable Lightness of Being (1988) Philip Kaufman

19 notes

·

View notes

Text

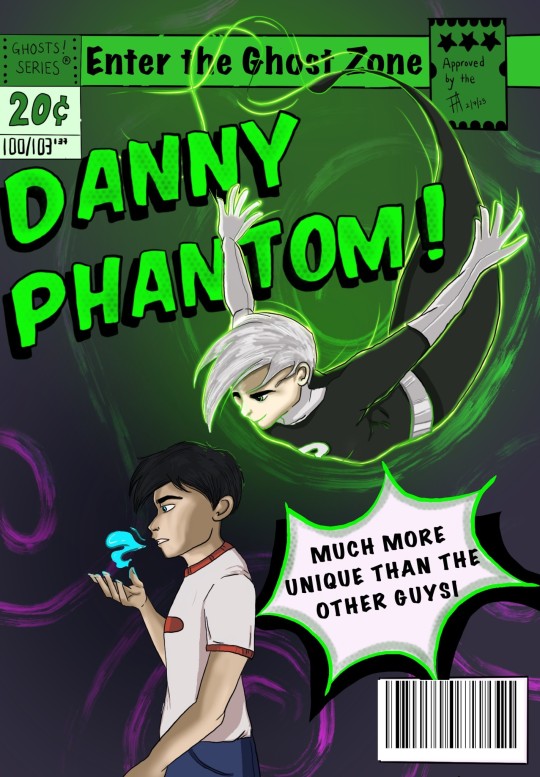

How successful would Danny Phantom…

Would you like to submit a character? Click this link if you do!

#could they be a pro wrestler#danny phantom#danny phenton#danny fenton#danny fantom#nickelodeon#nicktoons#danny phantom au#danny phantom a glitch in time#danny phantom phandom#danny phantom fandom#danny phantom comic#going ghost#butch hartman#david kaufman#daniel fenton#cartoon#cartoon polls#tumblr polls#polls#character polls#fandom polls#wrestling#wrestling polls#poll time#hyper specific poll#poll game#wwe#professional wrestling#pro wrestling

13 notes

·

View notes

Text

Random Actors icons

‒ like or reblog if you save

#danny ramirez#danny ramirez icons#daniel kaluuya#daniel kaluuya icons#david iacono#david iacono icons#emilio sakraya#emilio sakraya icons#diego calva#diego calva icons#mark mckenna#mark mckenna icons#nicholas alexander chavez#nicholas alexander chavez icons#nico hiraga#nico hiraga icons#sean kaufman#sean kaufman icons#random actors#random actors icons#random icons#icons

19 notes

·

View notes

Text

Show some love over on my Instagram!

#danny phantom#danny phantom fanart#danny fenton#daniel fenton#vlad plasmius#nickelodeon#butch hartman#comic art#comic style#art on instagram#artwork#ghost#ghost boy#david kaufman#ectoplasm#ghost zone#phandom#phanart#fanart#rough draft korea

71 notes

·

View notes

Text

The End of an Unprecedented Campaign: Trump vs. Harris

Tonight marks the conclusion of one of the most unprecedented and invective-filled presidential campaigns in modern history. The 2024 race has seen dramatic twists, including the return of 78-year-old Donald Trump despite two impeachments, four indictments, and his new status as a convicted felon. This was followed by the sudden departure of President Joe Biden, who was run off by his own party after a botched debate and a firestorm of negative media coverage.

Facing a new rival in Vice President Kamala Harris, Trump has delivered months of disjointed, hours-long speeches filled with malapropisms and racial and ethnic insults. If elected to a second term, Trump has threatened to prosecute his political enemies and deploy the military in Democratic cities to target illegal immigrants. His allies have plans to dismantle many federal agencies and regulations, filling powerful posts with inexperienced loyalists. Trump also pledges to escalate the trade war with China and negotiate an end to the war in Ukraine, where Russia has killed tens of thousands of Ukrainians.

Harris, on the other hand, has focused her campaign on addressing alleged price gouging, reducing taxes, and helping with childcare costs. She and her fellow Democrats warn that beyond the radical policy shifts planned by Trump, the very essence of a 248-year-old democracy is at stake, and the whole world is watching.

Join the conversation and share your thoughts on this historic election. What do you think the future holds for the United States?

#presidential election#election 2024#us elections#trump 2024#donald trump#trump#harris walz 2024#kamala harris#real estate#investment#danielkaufmanrealestate#economy#real estate investing#daniel kaufman#housing#construction#homes#housing forecast#politics

7 notes

·

View notes

Text

The Unbearable Lightness of Being (1988). Central Europe, 1968: A Czech doctor with an active sex life meets a woman who wants monogamy, and then the Soviet invasion further disrupts their lives.

I couldn't help but feel multiple times while watching this that it was just so, so obvious that a man had both written and directed this. It has its sensual moments, for sure, in no small part because of the vulnerability and sexuality that Juliette Binoche and Lena Olin bring to their roles, but it feels so unbalanced and male gazey that it's hard to see it as anything other than objectification (to say nothing of Tomas' pretty eyeroll-worthy pick-up line). I don't know, this just didn't work for me at all, despite some stellar performances. 4/10.

#the unbearable lightness of being#1988#Oscars 61#Nom: Adapted Screenplay#Nom: Cinematography#Philip Kaufman#Milan Kundera#Jean-Claude Carrière#daniel day-lewis#juliette binoche#lena olin#Stellan Skarsgård#1960s#czechoslovakia#romance#politics#love triangle#photography#war#4/10

16 notes

·

View notes

Text

Boston Celtics’ $6.1B Private Equity Deal—What It Means for Investors

Listen, if you grew up in Boston, you know the Celtics aren’t just a team—they’re a legacy. And now, that legacy has a new price tag: $6.1 billion. A private equity investor-led group—fronted by Bill Chisholm, a Boston guy himself—just secured a majority stake in the franchise. This isn’t just another sports deal; this is the biggest private equity-backed sports acquisition in history, outpacing…

View On WordPress

#banking#Boston#Boston Celtics#Daniel kaufman#economics#Economy#investing#Private Equity#Sports#technology

0 notes

Text

Daniel Day-Lewis and Juliette Binoche in The Unbearable Lightness of Being, Philip Kaufman, 1988

19 notes

·

View notes

Text

The Unbearable Lightness of Being (1988)

#the unbearable lightness of being#daniel day lewis#juliette binoche#lena olin#philip kaufman#film#movies#cinematography#nature#drama#romance#dog#chess#photography#sunset

26 notes

·

View notes