#House Flipping

Explore tagged Tumblr posts

Text

That is the case with this Craftsman remodel.

Cute craftsman needs to be rehabbed.

And, this is what it got. Unrecognizable.

571 notes

·

View notes

Text

'We buy ugly houses' is code for 'we steal vulnerable peoples' homes'

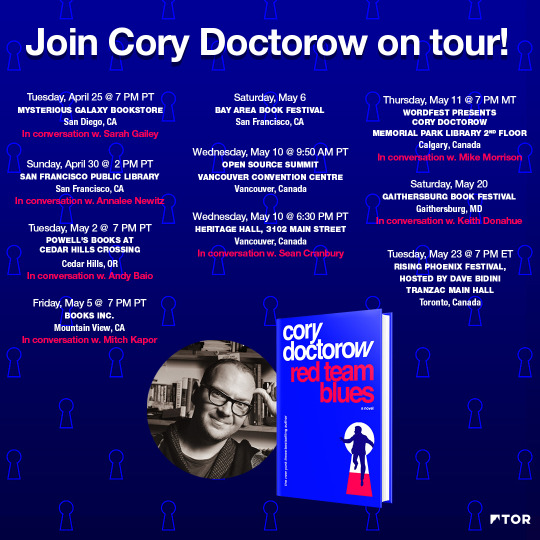

Tonight (May 11) at 7PM, I’m in CALGARY for Wordfest, with my novel Red Team Blues; I’ll be hosted by Peter Hemminger at the Memorial Park Library, 2nd Floor.

Home ownership is the American dream: not only do you get a place to live, free from the high-handed dictates of a landlord, but you also get an asset that appreciates, building intergenerational wealth while you sleep — literally.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

Of course, you can’t have it both ways. If your house is an asset you use to cover falling wages, rising health care costs, spiraling college tuition and paper-thin support for eldercare, then it can’t be a place you live. It’s gonna be an asset you sell — or at the very least, borrow so heavily against that you are in constant risk of losing it.

This is the contradiction at the heart of the American dream: when America turned its back on organized labor as an engine for creating prosperity and embraced property speculation, it set itself on the road to serfdom — a world where the roof over your head is also your piggy bank, destined to be smashed open to cover the rising costs that an organized labor movement would have fought:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Today, we’re hit the end of the road for the post-war (unevenly, racially segregated) shared prosperity that made it seem, briefly, that everyone could get rich by owning a house, living in it, then selling it to everybody else. Now that the game is ending, the winners are cashing in their chips:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

The big con of home ownership is proceeding smartly on schedulee. First, you let the mark win a little, so they go all in on the scam. Then you take it all back. Obama’s tolerance of bank sleze after the Great Financial Crisis kicked off the modern era of corporations and grifters stealing Americans’ out from under them, forging deeds in robosigning mills:

https://www.marketwatch.com/story/us-breaks-down-93-bln-robo-signing-settlement-2013-02-28

The thefts never stopped. Today on Propublica, by Anjeanette Damon, Byard Duncan and Mollie Simon bring a horrifying, brilliantly reported account of the rampant, bottomless scams of Homevestors, AKA We Buy Ugly Houses, AKA “the #1 homebuyer in the USA”:

https://www.propublica.org/article/ugly-truth-behind-we-buy-ugly-houses

Homevestors — an army of the hedge fund Bayview Asset Management — claims a public mission: to bail out homeowners sitting on unsellable houses with all-cash deals. The company’s franchisees — 1,150 of them in 48 states — then sprinkle pixie dust and secret sauce on these “ugly houses” and sell them at a profit.

But Propublica’s investigation — which relied on whistleblowers, company veterans, court records and interviews with victims — tells a very different story. The Homevestor they discovered is a predator that steals houses out from under elderly people, disabled people, people struggling with mental illness and other vulnerable people. It’s a company whose agents have a powerful, well-polished playbook that stops family members from halting the transfers the company’s high-pressure salespeople set in motion.

Propublica reveals homeowners with advanced dementia who signed their shaky signatures to transfers that same their homes sold out from under them for a fraction of their market value. They show how Homevestor targets neighborhoods struck by hurricanes, or whose owners are recently divorced, or sick. One whistleblower tells of how the company uses the surveillance advertising industry to locate elderly people who’ve broken a hip: “a 60-day countdown to death — and, possibly, a deal.” The company’s mobile ads are geofenced to target people near hospitals and rehab hospitals, in hopes of finding desperate sellers who need to liquidate homes so that Medicaid will cover their medical expenses.

The sales pitches are relentless. One of Homevestor’s targets was a Texas woman whose father had recently been murdered. As she grieved, they blanketed her in pitches to sell her father’s house until “checking her mail became a traumatic experience.”

Real-estate brokers are bound by strict regulations, but not house flippers like Homevestors. Likewise, salespeople who pitch other high-ticket items, from securities to plane tickets — are required to offer buyers a cooling-off period during which they can reconsider their purchases. By contrast, Homevestors’ franchisees are well-versed in “muddying the title” to houses after the contract is signed, filing paperwork that makes it all but impossible for sellers to withdraw from the sale.

This produces a litany of ghastly horror-stories: homeowners who end up living in their trucks after they were pressured into a lowball sales; sellers who end up dying in hospital beds haunted by the trick that cost them their homes. One woman who struggled with hoarding was tricked into selling her house by false claims that the city would evict her because of her hoarding. A widow was tricked into signing away the deed to her late husband’s house by the lie that she could do so despite not being on the deed. One seller was tricked into signing a document he believed to be a home equity loan application, only to discover he had sold his house at a huge discount on its market value. An Arizona woman was tricked into selling her dead mother’s house through the lie that the house would have to be torn down and the lot redeveloped; the Homevestor franchisee then flipped the house for 5,500% of the sale-price.

The company vigorously denies these claims. They say that most people who do business with Homevestors are happy with the outcome; in support of this claim, they cite internal surveys of their own customers that produce a 96% approval rating.

When confronted with the specifics, the company blamed rogue franchisees. But Propublica obtained training materials and other internal documents that show that the problem is widespread and endemic to Homevestors’ business. Propublica discovered that at least eight franchisees who engaged in conduct the company said it “didn’t tolerate” had been awarded prizes by the company for their business acumen.

Franchisees are on the hook for massive recurring fees and face constant pressure from corporate auditors to close sales. To make those sales, franchisees turn to Homevana’s training materials, which are rife with predatory tactics. One document counsels franchisees that “pain is always a form of motivation.” What kind of pain? Lost jobs, looming foreclosure or a child in need of surgery.

A former franchisee explained how this is put into practice in the field: he encountered a seller who needed to sell quickly so he could join his dying mother who had just entered a hospice 1,400 miles away. The seller didn’t want to sell the house; they wanted to “get to Colorado to see their dying mother.”

These same training materials warn franchisees that they must not deal with sellers who are “subject to a guardianship or has a mental capacity that is diminished to the point that the person does not understand the value of the property,” but Propublica’s investigation discovered “a pattern of disregard” for this rule. For example, there was the 2020 incident in which a 78-year-old Atlanta man sold his house to a Homevestors franchisee for half its sale price. The seller was later shown to be “unable to write a sentence or name the year, season, date or month.”

The company tried to pin the blame for all this on bad eggs among its franchisees. But Propublica found that some of the company’s most egregious offenders were celebrated and tolerated before and after they were convicted of felonies related to their conduct on behalf of the company. For example, Hi-Land Properties is a five-time winner of Homevestors’ National Franchise of the Year prize. The owner was praised by the CEO as “loyal, hardworking franchisee who has well represented our national brand, best practices and values.”

This same franchisee had “filed two dozen breach of contract lawsuits since 2016 and clouded titles on more than 300 properties by recording notices of a sales contract.” Hi-Land “sued an elderly man so incapacitated by illness he couldn’t leave his house.”

Another franchisee, Patriot Holdings, uses the courts aggressively to stop families of vulnerable people from canceling deals their relatives signed. Patriot Holdings’ co-owner, Cory Evans, eventually pleaded guilty to to two felonies, attempted grand theft of real property. He had to drop his lawsuits against buyers, and make restitution.

According to Homevestors’ internal policies, Patriot’s franchise should have been canceled. But Homevestors allowed Patriot to stay in business after Cory Evans took his name off the business, leaving his brothers and other partners to run it. Nominally, Cory Evans was out of the picture, but well after that date, internal Homevestors included Evans in an award it gave to Patriot, commemorating its sales (Homevestors claims this was an error).

Propublica’s reporters sought comment from Homevestors and its franchisees about this story. The company hired “a former FBI spokesperson who specializes in ‘crisis and special situations’ and ‘reputation management’ and funnelled future questions through him.”

Internally, company leadership scrambled to control the news. The company convened a webinar in April with all 1,150 franchisees to lay out its strategy. Company CEO David Hicks explained the company’s plan to “bury” the Propublica article with “‘strategic ad buys on social and web pages’ and ‘SEO content to minimize visibility.’”

https://www.propublica.org/article/homevestors-aims-to-bury-propublica-reporting

Franchisees were warned not to click links to the story because they “might improve its internet search ranking.”

Even as the company sought to “bury” the story and stonewalled Propublica, they cleaned house, instituting new procedures and taking action against franchisees identified in Propublica’s article. “Clouding titles” is now prohibited. Suing sellers for breach of contract is “discouraged.” Deals with seniors “should always involve family, attorneys or other guardians.”

During the webinar, franchisees “pushed back on the changes, claiming they could hurt business.”

If you’ve had experience with hard-sell house-flippers, Propublica wants to know: “If you’ve had experience with a company or buyer promising fast cash for homes, our reporting team wants to hear about it.”

Catch me on tour with Red Team Blues in Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A Depression-era photo of a dour widow standing in front of a dilapidated cabin. Next to her is Ug, the caveman mascot for Homevestors, smiling and pointing at her. Behind her is a 'We buy ugly houses' sign.

Image: Homevestors https://www.homevestors.com/

Fair use: https://www.eff.org/issues/intellectual-property

#pluralistic#the rents too damned high#house flipping#llc brain#scams#elder abuse#ripoffs#weaponized shelter#predators#homevestors#we buy ugly houses#ugly houses#real estate#propublica

2K notes

·

View notes

Text

🤯 No. fucking. way.

#politics#housing#housing speculation#capitalism#tiktok#manufactured scarcity#house flipping#flip or flop

743 notes

·

View notes

Text

B.C.’s new home-flipping tax will go into effect on Jan. 1, 2025. This means that anyone who sells a home within a year of purchasing it will have to pay a 20 per cent tax rate on the profit.

That percentage drops to 10 per cent after 18 months and then down to zero after the person has owned the property for more than two years.

The tax is meant to crack down on house-flipping but some experts argue that it will impact people who are not trying to flip properties.

Continue reading

Tagging: @newsfromstolenland

86 notes

·

View notes

Text

Deck the Walls (2024, Jake Van Wagoner)

12/22/24

#Deck the Walls#Hallmark#Countdown to Christmas#Wes Brown#Ashley Greene#Danny Pellegrino#Claybourne Elder#Carolyn Hennesy#TV movie#Christmas#holiday#romance#interior design#house flipping#renovation#gay#construction

4 notes

·

View notes

Text

House flipping, but instead of destroying a beautiful vintage house to turn it into the same soulless, modern, minimalist hellscape we've all seen before, they plant a beautiful garden full of resilient and helpful native species on the boring manicured lawn.

5 notes

·

View notes

Text

I was just driving home, saw some newly renovated homes on the way, and something occurred to me(may be explicit idk I dont actl watch this stuff):

The HGTV aesthetic, Whites, Greys, and Blacks, those aren't just neutral colors: They're PRIMING Colors. They're colors you paint Other, BETTER Colors that you like MORE on top of.

Property Brothers, all these other assholes; they want you to live in a house painted to sell.

#HGTV#Priming#Painting#Aesthetics#Capitalism#Capitalist Aesthetics#Real Estate#House Flipping#Economic Bubbles#Economic Manias#zA Posts#zA Thinks

33 notes

·

View notes

Text

House remodelling progress. Tiles are in for the ensuit bathroom, new windows for my parents' room, dad's office, and my bathroom. The shower has been cut into the ensuite bathroom along with the recessed shelving. Overall, our builder is confident it'll all be finished by Christmas

#remodelling#house flipping#interior design#interior decorating#home interior#interiors#my place#bathroom remodeling#camera roll#personal#morgan takes photos#morgan designs things#iam

2 notes

·

View notes

Text

House remodelling progress. New windows came in, and they put the new window in for my bathroom today. Once the tiler comes back from vacation its all systems go for both the ensuit and the main family bathroom.

#camera roll#bathroom remodeling#bathrooms#my bathroom#interior decorating#home interior#interiors#interior design#renovation#house flipping#personal#morgan takes photos#iam

2 notes

·

View notes

Text

TV Realities

In the country where I live there are sadly many people who are homeless, hungry and unable to afford the basics of life thanks to the rising cost of living. Frighteningly this includes working people.

Yet 'cooking competition' shows and reality programs about people flipping houses for profit still keep getting made and shown here.

Is this callous and tone deaf or just harmless bubblegum TV?

Thoughts.......?

2 notes

·

View notes

Text

Fix And Flippers

Fix and Flippers are always looking for investors for trust deed investments.They work with individuals, corporations, pension plans, or IRAs. They are experts at matching private investor funds with low risk, high yield, secured by a hard asset and solid loan opportunities. They have solid systems in place that allow investors to earn between 8%-13% per annum, compared to the low-interest rates currently being offered by banks. Fix and Flippers has developed a relationship with many such brokers, mortgage companies, and lenders worthy of a referral.These lenders and mortgage companies have many years in the business and have vetted for their reputations as closers and being a preferred lender among the industries elite. Their referral sources are loyal and provide steady repeat business that affords them an overflow of business.

#Fix And Flip#Real Estate Investing#House Flipping#Property Renovation#Real Estate Flipping Houses#Flips#Flip This House#Property Investing#Renovate And Sell#Investment Properties#Home Renovation#Flippers Market#Rehabbing Homes#House Rehab#Profitable Flips#DIY Flipping#Flip Life#House Remodel#Real Estate Flipper#Fixer Upper#Fix And Flippers

2 notes

·

View notes

Text

Yesterday I posted the devastating renovation/restoration of this 1892 Victorian in Goshen, New York. Well, thanks to ephraelinhats who found the original photos of what it looked like before. They definitely could've salvaged some of the original elements. Look at this comparision:

They chose to lose the main entrance hall altogether, so it's not even shown on the listing. Definitely could've been restored, though. They made so many square angular rooms, now.

Some of the stair railing is gone, but the stairs could've been restored and the curving walls, too. Looks like the upper railings are still there.

Definitely a lot of it left. Looks like someone started to restore it, but they opened the 3rd floor up.

Okay, I see what they did here- a previous owner put the window in. But, did they have to square off the alcove?

The kitchen must've been around here, b/c those are the service stairs.

The kitchen now.

This must've been the dining room. That wainscoting could've been restored. Look at the crown molding and a niche above the fireplace, not a window, and if it was, it may have been stained glass.

Well, it's all gone and this is now the dining room.

They didn't need to get rid of the crown molding.

There was plenty of crown molding that could've been saved.

Don't know where this room is, but it had beautiful wood that could've been saved.

One of the bedrooms had a cute fireplace.

The previous owner did some funky stuff to this bedroom. But, at least they kept the fireplace.

There are doors w/original ceramic knobs. Could've been salvaged.

If they did this much demo anyway, they could've done it differently.

I see what they did here w/the porches, but someone had painted the back part white. Looks like they sandblasted the brick. I wish they would've taken that much care to restore the interior.

#before & after comparison#victorian restoration#real estate#house flipping#houses#house tours#home tour

85 notes

·

View notes

Text

Financing Your Education Through House Flipping

Can you finance your college education by flipping houses?

Image via Pixabay Returning to school as an adult presents unique financial challenges, but house flipping offers a compelling solution. Investing in real estate can cover tuition costs while gaining hands-on experience in the property market. This approach provides a financial pathway to education. It also equips you with valuable skills in real estate investment. With careful planning and…

0 notes

Text

Overcoming Financial Beliefs That Hold You Back: Easy Steps to Build Confidence with Money

When it comes to managing money, mindset is everything. 💭 Thoughts like “I’m just not good with money” or “Money is always hard to come by” can sneak into your mind and hold you back from achieving financial freedom. These beliefs may seem small, but they can affect your decisions, actions, and ability to grow your wealth. Here’s the good news: 💡 You have the power to change them. In this post,…

#budgeting#Buying a Home#Due Diligence#finacial freedom#finance#Financial Planning#Financing Options#First-Time Home Buyers#Homeownership#House Flipping#investing#Investment Strategy#leverage#Location Analysis#money#Mortgage Loans#passive income#personal-finance#Property Investment#Real Estate Agent#Real Estate Investing#Real Estate Market#Rental Properties#wealth

0 notes

Text

Flipping for Christmas (2023, Katherine Barrell)

12/3/23

#Flipping for Christmas#Hallmark#Countdown to Christmas#Marcus Rosner#Ashley Newbrough#Natalie Lisinska#Eman Ayaz#Ray Galletti#Varun Saranga#Peter MacNeill#Scott Ryan Yamamura#TV movie#Christmas#romance#real estate#house flipping#renovation#inheritance#gentrification

4 notes

·

View notes

Text

youtube

A Day in the Life of a Real Estate Mogul

Hey Tumblr Fam! 🌟

Ever wonder what it’s like to swim with the big fishes in the real estate sea? Well, today, you’re getting a VIP pass to the show! 🎟️🏢

Setting the Scene

We’re looking at a unique property deal through the lens of a seasoned investor. This isn’t your cookie-cutter Airbnb setup; it’s a deep dive into the world of assumable VA loans and negotiation tactics that tailor to the seller's and buyer's needs alike.

The Heart of the Deal

What makes this deal fascinating is the strategy involved. The buyer is dealing with a property listed with conflicting details (a common real estate headache!), and they’re using their relationship with the seller to their advantage. They discuss everything from the property’s potential cash flow to the nuances of assumable loans.

Strategy Talk

Assumable VA loans are the star here. They allow a buyer to take over a loan with potentially lower interest rates than the market offers—a sneaky good benefit in today’s financial climate. 🌊💰

Real Talk

This negotiation isn’t just business; it’s about relationships. Knowing the seller from previous deals provides a smoother path to agreement. It’s like having a backstage pass to your favorite concert!

Dive In!

So, are you ready to dive into the real estate game? Whether you’re looking to invest or just curious about how the big deals are done, remember: It’s all about the approach, the terms, and understanding both the market and the people you’re dealing with.

Drop a like or reblog if you found this peek into a real estate mogul’s day intriguing! Got questions or want to share your own stories? Hit up the comments! 📬💬

#real estate negotiation#creative financing#VA loans#assumable loans#property investment#real estate deals#real estate strategy#property market#real estate financing#buying property#selling property#real estate tips#investment properties#real estate insights#real estate trends#property listings#mortgage strategies#real estate education#house flipping#rental property investment#Youtube

0 notes