#FINANCE GOALS

Explore tagged Tumblr posts

Text

All that I desire I possess.

Your attention is mine.

Your love is mine.

Your time is mine.

Your adoration is mine.

Your support is mine.

Your respect is mine.

Your resource is mine.

Your heart is mine.

Your mind is mine.

You are mine.

And I...

Am yours!

I chant it.

I believe it.

I receive it.

You're compelled.

If you'd like to donate, you can always do so through my cash app: $BlancaBitchcraft

#bitchcraft#witches#witchblr#witchcraft#witch#witchy#love spell#cast a spell#reblog to cast#love spells#witch resources#respect#compelling#compassion#mind control#female dominance#finance goals#dominance and submission#financial dominance#witching hour#wicked witch#witchcore#Blanca#rebirth#resources#mine#possession#renew good omens#renew#November

134 notes

·

View notes

Text

Discover how portfolio management firms and wealth management firms work together to optimize investments, minimize risks, and create a holistic financial strategy for long-term success.

#portfolio firms#wealth firms#investment#asset growth#risk strategy#tax planning#estate plan#retirement#finance goals#market trends#wealth growth#asset manage#smart invest#capital plan#fund manage#risk assess#money growth#ROI strategy#financial plan#advisory

0 notes

Text

🌟 Invest in Your Growth Today! 🌟 Hey future finance leaders! Did you know the best investments aren’t just in stocks but also in your mind? 🌱 Whether you’re chasing the CFA charter, aiming to conquer the FRM exams, or mastering US CMA, your efforts now will pay dividends FOREVER! 💸

🚀 Finaim is here to make your journey seamless! From cracking CFA Level 1 to decoding the FRM course duration and fees, we’ve got the best guidance for every step. Want to ace your dream investment banking job or understand the CMA course details? Let’s make it happen!

✨ Why wait? Transform your career with our expert-led courses and build a future where your returns compound like never before. Explore bank nifty investing, join top investment banking companies, and dominate the finance world like a pro. For more details VISIT: https://finaim.in/ FINAIM ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005 PHONE NO: 087009 24049

#cfa#frm#us cma#investment banking#investing#finance goals#investors#online and offline classes#CFA level1#CFA level2#CFA level3#FRM part 1 and part 2#best coaching center in delhi

0 notes

Text

Common Misconceptions About Personal Finance

There's much to discuss regarding how to manage personal finances and the obstacles and mistakes encountered along the way. However, let's begin with a few key questions that are crucial in the realm of personal finance.

What is personal finance? Personal finance means managing your money and investing money in order to achieve your financial goals.

What are your financial goals? It helps a lot to set your financial goals before you start managing your money. The financial goals may differ depending on your priorities. There are no hard and fast rules to setting goals for financial management. Your financial goals can look like a house, car, education, investments, etc. Therefore, it’s important to get clear about your financial goals, beforehand.

Things people get wrong about personal finance:

It’s Daunting & Intimidating: Personal finance is only scary as long as you avoid it. Also, lack of understanding or rather dare I say, financial illiteracy makes personal finance look like a monster from afar.

Poor Financial Discipline: The best way to manage your finances is to have good discipline when it comes to your expenses. Overspending or unnecessary expenditures are your worst money when it comes to personal finance.

No Investments: You should invest as much as you can in your younger years to lessen the risk as you near your retirement age. Investments help you secure your financial future.

No Retirement Plans: When you think of retirement, you may or may not think that it’s something that you will have to face later, down the years. Also, retirement is not just about saving for later. It’s also about carrying your experiences into the old age. One should start thinking about their retirement plans quite young.

Accumulating Debt: All debt is not bad but too much debt is also not good for your financial health. There is no point in accumulating debt if it’s leading to a dent in your pocket.

Too Many Credit Cards: Credit cards are good for you if you practice good financial discipline. Otherwise, they can be costly in the long run. Having too many credit cards may lead to the failure of repayment and accumulation of debt which should not have a place in your financial goals.

To avoid all the financial mistakes, you could get wrong in terms of your goals of financial management, you can use the same points as personal finance tips.

0 notes

Text

Study Trick That No One Told Me.

Division of subjects:

Every subject is learnt and graded in a different way. You can't use the same study techniques for every subject you have. You have mostly 3 types of subjects:

Memorization based

Practical/Question based

Theory/Essay based

Memorization based:

Mostly Biology, Sciences, Geography etc are fully based on memorization and so you'll use memory study techniques like flash cards and active recall.

Practical/Question based:

Maths, Physics, Chemistry, Accountancy etc are practice subjects. The more you do your questions and understand how a sum is done, the better you can score.

Theory/Essay based:

English, history, business studies etc are theory based. The more you write, the way you write and the keywords you use are the only things that will get you your grades. So learn the formats and the structure on how to write your answers

Note: Some subjects are a combination of the three. Like Economics etc

The reason we divide the subjects is because you can adopt the right study methods for the right subject. Like ex: business studies is mostly based on how you write your answer and the keywords, if you're gonna spend your time memorizing in this, it's a waste of time and energy.

Hope this helps :)

#studyblr introduction#studyblr#study motivation#school#study blog#student#studyspo#studying#study aesthetic#high school#study tips#study buddy#studybrl#study break#study goals#goals#academic goals#academic girly#it girl#senior year#self improvement#student life#studyblr community#high school studyblr#high school tips#study hard#study#accounting#finances#economics

452 notes

·

View notes

Text

there's somethin about maid eito and bookworm yakumo

After i drew ⤴

i woke up the next day and said, NO. I NEED BALANCE!!!!

theeeere we go

#theyre sio exstupido#maid eiden walks into the room and i fall to my knees in supplication#anything u want kittymaideito. i'll sayt the stupid chants over my omuyrice. i'll do a little dance for u#yeah. so i get the . yakumo losing his life savings to his fave charming maid#it's a horrible addiction. this maid cafe habit of yakumo's#in a universe where they don't yet know each other#and yakumo falls into a spiral of throwing all his cash at eidream#once eiden finds out that yaku's entered Maladaptive Territory with the visits#you know. like. the man's actually struggling to keep his finances afloat bc he's too busy buying out eiden's entire stock of photos#then eiden will do that 😬 my guy i'm worried about u . like. i'm not worth spending your tuition money. pls.#cocoa is all: yeah... as much as i want the cafe to be successful idk how i feel about customers getting evicted bc of us#aster is all: YOU FOOLS!!!!! WHY WOULD YOU TELL A LOYAL CUSTOMER TO *STOP* SPENDING?!?!?!?#cocoa and aster debating in the back room about the ultimate goal of customer Happiness vs squeezing these simps for all they're worth#yakuei#nu carnival eiden#nu carnival yakumo

150 notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

78 notes

·

View notes

Text

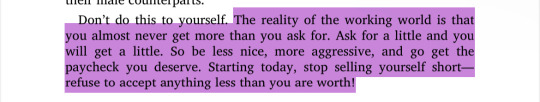

Excerpt from Smart Women Finish Rich by David Bach

#high value woman#leveling up#elegance#hypergamy#affluence#luxury#goals#level up#divine feminine#financialeducation#financial literacy#finance#bookblr#bookworm#books#hot and educated#hot girls read#dream girl journey#Dream girl#glow up diaries#glow up journey#glow up guide#glow up#powerful woman#self development#self improvement#becoming that girl#becoming her#beneficiaryblr#spoiledblr

55 notes

·

View notes

Text

70 notes

·

View notes

Text

The obvious question—why do women organize against their own freedom—is thorny.4 In her 1983 book Right-Wing Women, radical feminist author Andrea Dworkin tried to answer it. She described three types of antifeminism. “Man dominant” was the crudest form, resting on the principle that men should subjugate women because male dominance is natural, necessary, and rooted in love. “Woman superior” held that female power resided in women’s lofty moral sensibility and sexual desirability—not to be confused with their sexual desire. Women’s authority was innate yet limited, physical yet passive. (“She’s ethereal,” Dworkin wrote, “she floats.”) The last type, “separate but equal,” emphasized that the sexes were destined for different spheres of existence, neither of which was better than the other. Women bearing and nurturing children was just as important as men providing for them financially or fighting wars to protect them. Dworkin theorized that some women embraced antifeminism, in one form or a combination, as a means of self-preservation in the face of male oppression. “Feminists, from a base of powerlessness, want to destroy that power,” she said. “Right-wing women, from a base of powerlessness, the same base, accommodate to that power because quite simply they see no way out from under.” Dworkin also argued that any disdain antifeminist women felt toward an “other” on the basis of race or another identity marker was really displaced rage they felt toward men. “They are easily controlled and manipulated haters,” she said of these women. “Having good reason to hate, but not the courage to rebel, women require symbols of danger that justify their fear.”5 Dworkin’s interpretation was compelling, but it contained two monolithic assumptions: that the patriarchy is an absolute negative for all women, and that women act largely on the basis of their womanhood. In fact, the overlapping lines of race, class, and culture complicate both ideas. What about women who benefit—or want to benefit—from existing structures of dominance? We risk stripping them of responsibility when we suggest that the harm they do is merely a way of coping with their own oppression, whether real or presumed. As Adrienne Rich wrote in Of Woman Born, “Theories of female power and female ascendancy must reckon fully with the ambiguities of our being, with the continuum of our consciousness, the potentialities for both creative and destructive energy in each of us.”6

#Sisters in hate#Seyward Darby#Interesting book I'm chewing on as I spin up my coding today#This is admittedly an aside in the section on Ayla Stewart#just after her biography which I freely admit makes me want to weep in frustration because it's all so incredibly stupid#And predictable#Anyway have an aside from Dworkin that neatly lays out the blind spots in radfem ideology#Which is: marginalization is complicated abs multifaceted#And marginalized people are often happy and quite competent at using intersectional struggles as a way of accruing power and resources#You will never ever ever make a better and more equal world if you don't account for the agency and diverse goals people in any group have#You have to understand why women participate in and often disproportionately enforce patriarchy first#And the key to that is personal power/social status/finances/resources/respect#Which can be accrued easily simply by assuring everyone that you are One Of The Good Ones#You'll see this over and over again if you make a study of marginalized people in history: people use the strictures of caste like weapons#just to get where they're going#another fine lesson from Mulan (1998) really

10 notes

·

View notes

Text

The Synergy Between Portfolio Management Firms and Wealth Management Firms

Introduction

Portfolio management firms are in the vanguard of modern financial services, but their real value is unleashed only when they function in conjunction with wealth management firms. This synergistic combination will create a complete approach to achieving financial success by transcending boundaries that are imposed by traditional investment.

Understanding the Roles

Understanding the different roles of these financial giants helps shed light on their combined impact. With an emphasis on market analysis, risk assessment, and performance optimization, investment portfolio management businesses excel in the strategic selection and administration of investment assets. These experts create and manage investment portfolios for both individual and institutional clients that are suited to particular financial goals.

Meanwhile, wealth management firms look at financial well-being from a bigger perspective. Other than investments, they look at estate planning, tax efficiency, retirement strategies, and generational wealth transfer. This comprehensive view ensures that all investment decisions would be aligned with long-term financial goals and circumstances in life.

Complementary Expertise

The wealth management firms complement the expertise of portfolio management firms, thereby bringing a level of financial expertise to clients. Such a collaboration provides an investment strategy and a complete financial plan with seamless integration. For example, a portfolio manager can change investment allocations while fully aware of the client's tax situation, estate planning goals, and upcoming financial needs through insights from the wealth management team.

Synergy in Life Transitions

The synergy becomes particularly valuable during major life transitions. Consider a business owner preparing for retirement. The wealth management firm develops a succession plan and tax-efficient exit strategy, while the portfolio management firm adjusts investment allocations to generate reliable retirement income. This coordinated effort maximizes financial outcomes while minimizing potential disruptions.

Goal-Oriented Investment Strategies

When wealth management services are added to investment portfolio management, then it assumes altogether new dimensions. Instead of focusing only on market performance, portfolio strategies could be created with specific life goals in mind, including funding a child's education, establishing a charity foundation, or ensuring a comfortable retirement. Goal-oriented investment decisions are more important and durable.Institutional and Family Office Benefits

The Role of Technology

Technology is playing an important role in strengthening this partnership. Advanced portfolio management platforms are now integrating smoothly with wealth management systems to give clients a holistic view of their financial universe. This integration with technology helps clients make more informed decisions and respond faster to changes in the market or their personal circumstances.

Accessibility for Small and Mid-Size Investors

This jointly offers benefits to small and midsize investors. Though they cannot individually access the highest-tier portfolio management firms, wealth management firms can pool client assets to allow access to investment opportunities otherwise made institutional only. Thus, sophisticated investment strategies are democratized, with personalized service still available.

Strengthened Risk Management

Risk management becomes more robust when portfolio and wealth management firms work together. Investment risks can be evaluated not just in terms of market volatility, but also in the context of personal risk factors, insurance coverage, and estate planning needs. This comprehensive risk assessment leads to more resilient financial strategies.

Choosing the Right Financial Partner

The right financial partner is chosen in the right company, with adequate consideration for portfolio management firms' collaboration with other wealth management firms. In reality, the most effective partnerships work well with communications, incentives in line, and a commitment to client success. Look for companies with established relationships, compatible technological systems, and proven track records of collaborative success.

Conclusion

The value of the partnership between portfolio management firms and wealth management firms becomes more important as financial markets become more complex and personal financial needs become more sophisticated. This relationship delivers not just investment performance, but comprehensive financial success aligned with personal goals and values.

#portfolio firms#wealth firms#investment#asset growth#risk strategy#tax planning#estate plan#retirement#finance goals#market trends#wealth growth#asset manage#smart invest#capital plan#fund manage#risk assess#money growth#ROI strategy#financial plan#advisory

0 notes

Text

Here we go again

#they always meet their goal as soon as they start begging but these same people be on here crying about people asking for help from#horrific situations being scammers#ao3’s been in beta for years now right?#like I go on to read my Gojo Rengoku shit but I wouldn’t care if the entire site imploded in one night because this is ridiculous#it just makes you sad when sm of that money could go towards other shit#like ppl can spend their money on whatever they want but it’s distressing to see it wasted like this#rambling#like every other month they are asking for money and whenever#ppl ask about their finances and this and that they’re met with angry nerds crying about literally nothing important

13 notes

·

View notes

Text

@imspent

7 notes

·

View notes

Text

My focus/theme for the year of 2025:

Less is More.

My desire is to focus on being grateful for what I have and trying to break my terrible habit of wanting more. No more window shopping online, no more visiting store sites for "fun", no more tossing something because it has a scratch on it. Unless it is unusable, it will be cherished and used until it can no longer serve its purpose.

This goes for most consumables and long-term purchases. I want to be more purposeful with my purchases - I want to buy things that are good quality and meant to last. I don't want to be persuaded to buy something because it is an "upgrade" to what I already own.

I also want to fix the items I have and learn to repair them instead of simply tossing them without attempting to find out why it isn't working first.

I want to learn to be grateful for the things I have. I want to be more aware of my spending habits and what I already own. I want to be less of a consumer, honestly. In a reasonable matter.

#2025#less is more#consumerism#consumer culture#consumer#grateful#mindful#mindfulness#mindful living#gratefulness#shopping#finances#financial awareness#awareness#self awareness#self improvement#self reflection#spending habits#financial habits#;; my 2025 goals#;; my 2025#my 2025#2025 goals#goals#life goals#human behaviour#txt

8 notes

·

View notes

Text

127 days left

Today wasn't bad, could have done better but I'm honestly really proud that i almost completed my to do list T-T

Today I:

Completed 6 lessons in Arabic

Completed 2 lesson (Part 1-3) in Business Studies

Tomorrow's to do list:

Wake up early and revise Arabic + learn 1 more lesson.

Study Business Studies 4 chapters for midterm

#studyblr introduction#studyblr#study motivation#school#study blog#student#studyspo#studying#study aesthetic#high school#study tips#study buddy#studybrl#study break#study goals#goals#academic goals#academic girly#it girl#senior year#self improvement#student life#studyblr community#high school studyblr#high school tips#study hard#study#accounting#finances#economics

60 notes

·

View notes

Text

25 things to do in 2025

2025

1. Do ten pull ups

2. Bench 100 lbs (2 50lb db)

3. Squat 150

4. Slrdl 150

5. Run half marathon (under 2 hours)

6. Complete scuba certification

7. Do .75m with Luna

8. Progress relationship forward (move in and or engaged) or end it

9. Read 25 books

10. Finish tree sweater

11. Reply to texts better

12. Post Japan part 3 to facebook

13. Make Porto, Lisbon, pony, and other insta posts

14. Post Porto to fb

15. Post Lisbon to facebook

16. Post pony portugal o facebook

17. Sew something

18. Put plate back together with gold

19. Read clicker training book

20. Volunteer ten hours

21. Read more long news

22. Be a better friend. Reach out and be warm

23. Bake cookies

24. Clean the bathroom, dishwasher and washing machine

25. Live in the moment

Did I make a to do list instead of goals? …. Maybe but this is what we’re going with so here’s hoping for the best. Starting of well by getting my dishwasher cleaned and wiping down my washing machine

#also yes clean the bathroom is a year goal for me#sue me#trying to make the finances work with getting a cleaner every month because damn I cannot be trusted to do it#but also don’t really have 200 a month extra in my budget and idk what to cut#new years resolutions#new years goals#I will actually do ten pull ups this year

9 notes

·

View notes