#wealth security

Explore tagged Tumblr posts

Text

The Complete Guide to Comprehensive Wealth Management Service

Money control can feel overwhelming, particularly whilst juggling a couple of investment debts, retirement plans, and financial dreams. This complexity explains why more people and households are turning to wealth management services for complete monetary guidance.

The Role of Wealth Management Services

Think of wealth control services as having a grasp conductor orchestrating every component of your monetary symphony. While every person can discover ways to play man or woman units—like shares, bonds, or actual estate investments—a professional wealth manager guarantees these kinds of elements paintings in best harmony.

The maximum professional portfolio management firms offer a way greater than basic funding advice. These specialists take a holistic approach, thinking about the whole thing, from tax performance and property planning to risk management and philanthropic giving. This comprehensive strategy facilitates protecting and developing wealth throughout more than one generation.

A Holistic Approach to Financial Planning

Consider how the best portfolio management services combine diverse economic components. When making funding choices, they factor in tax implications, destiny education charges, retirement goals, and even healthcare making plans. This interconnected approach prevents the commonplace pitfall of getting different monetary strategies working in opposition to each other.

The real fee of wealth control offerings becomes apparent during essential life transitions. Whether navigating an inheritance, selling a business, or planning for retirement, those specialists provide strategic guidance, which can save you expensive errors. They expect potential challenges and opportunities, allowing clients to make informed decisions in place of reactive ones.

Customized Investment Strategies

Portfolio control firms excel at growing custom-designed funding strategies. Rather than applying a one-length-fits-all method, they increase tailored portfolios that align with precise goals, danger tolerance, and time horizons. This personalization extends beyond simply funding choice—it encompasses tax optimization, estate-making plans, and threat management strategies.

Another widespread benefit of running with wealth control services is their capability to offer objective, emotionally indifferent recommendations. When markets end up unstable or financial decisions grow to be complicated by way of non-public factors, having an experienced expert guide can prevent impulsive choices that would damage long-term financial fitness.

Access to Advanced Financial Tools and Resources

The high-quality portfolio management offerings additionally convey state-of-the-art tools and assets that person traders commonly can't access. From superior portfolio analytics to unique investment opportunities, these firms leverage their institutional skills to advantage their clients. They can discover possibilities and dangers that won't be apparent to individual traders.

Long-Term Financial Security and Wealth Transfer

The dating with a wealth management provider frequently extends past the number one customer. These firms can assist in training their own family members approximately financial responsibility, facilitate circle of relatives meetings about wealth transfer, and ensure that economic values and know-how are passed easily among generations. This circle of relatives-oriented method allows for the maintenance of wealth and monetary knowledge across more than one generation.

Reducing Stress and Saving Time

One frequently disregarded gain is the time and pressure reduction that comes with expert wealth management. Instead of spending infinite hours studying investments, tracking marketplace changes, and handling numerous monetary bills, clients can focus on their careers, families, and private interests while understanding their economic future is in capable hands.

Looking Ahead: The Growing Importance of Wealth Management Services

Looking in advance, wealth control offerings turn into increasingly more critical as economic markets grow more complicated and interconnected. Those who partner with experienced wealth control experts position themselves to navigate destiny-demanding situations even as taking advantage of emerging opportunities inside the international economic landscape.

Final Thoughts

The selection to paint with a wealth management service represents an investment in economic fulfillment and peace of mind. By offering comprehensive, coordinated economic steerage, those specialists assist clients in acquiring their economic dreams at the same time as averting costly errors and missed possibilities.

#wealth management#portfolio firms#investment plans#asset growth#risk control#tax saving#retirement fund#estate planning#money growth#smart investing#wealth security#finance guide#financial tips#market trends#fund management#wealth success#profit strategy#capital gains#money control#financial plan

0 notes

Text

Estate planning is an essential process, especially for NRIs who are looking to secure their wealth and ensure it is managed properly for future generations. In this video, we dive deep into the key aspects of estate planning, focusing on the unique challenges and opportunities that NRIs face. Let's talk about estate planning today and how it can impact your NRI wealth, whether you are considering the distribution of assets, tax planning, or ensuring that your investments are safe.

#Estate Planning#NRI Wealth Management#Secure Your Wealth#Estate Planning for NRIs#Asset Protection#Wealth Security#Financial Planning#NRI Legal Advice#Family Wealth Planning#Protect NRI Wealth

0 notes

Text

We live in an era where the traditional financial landscape is undergoing a dramatic shift, with wealth rapidly transitioning from traditional assets to digital ones.

Smart digital assets, shielded from the effects of inflation and possessing superior intrinsic value, are continuously driving this wealth transfer at an exponential rate.

Unless you diversify your investment portfolio to include smart digital assets, you risk having your wealth relegated to insignificance by 2030.

Digital Shopping Mall (DSM) presents a unique opportunity to diversify your wealth by acquiring its inflation-proof and theft-proof digital shopping points (DSPs) at an early stage.

These DSPs, designed to possess the highest intrinsic value, are underpinned by an innovative tokenomics model that creates an unprecedented win-win-win-win scenario for suppliers, consumers, passive income earners, and DSM itself.

DSM's revolutionary business model empowers suppliers to expand their customer base like never before, enables consumers to purchase goods and services at up to 100 times below retail prices, and allows passive income earners to generate substantial returns without the need for direct recruitment, through earning commissions for recommending new products and services.

It is no wonder that even a purchase of just 1,000 DSPs for only $100 in our pre-launch deal presents an unparalleled opportunity to acquire a billion-dollar purchasing power within one to three years.

For more information about DSM' groundbreaking business model, visit my blog here https://smartpreordering.blogspot.com

#Digital Shopping Mall#Digital Shopping Points#Digital Shopping Coin#Wealth#wealth hacks#Wealth security#Asset digitization#Newa world order#new financial system#Cryptocurrency

0 notes

Text

Big thing I’ve got from my study of disability in the early modern period in Britain, including dissertation research?

Poor relief that gives money out to the poorest people is probably the most benefit per amount of money, but it’s *massively*, *massively* resented by wealthier people. Not only because it’s redistribution of wealth, given it was usually raised by local taxation, but because it takes both control and opportunities to benefit from them.

The big thing money gives is options, choice, and freedom. Wealthier people value having that and massively resent poorer people having it. They much prefer giving charity to paying their taxes because a) giving charity lets them keep control of the money, even at a remove, and b) they usually find a way to benefit more directly from it.

This is basically why we have the current social security systems we have, where so much more is spent on control and policing of the behaviour of poor and disabled people than actually helping. Universal benefits were popular when the systems were set up for a variety of reasons, including reducing resentment by wealthier people, but largely because means-testing is *more expensive* and *less efficient*than universal benefits.

Wealthier people screaming for more means-testing are doing so because they prefer to have more money spent on tormenting people who are struggling with the conditions that those wealthier people create and maintain because it benefits them than that money actually reaching them.

That’s not how they parse it in their heads, I’m sure, but it *is* the reality of the situation.

#disabled#disability#disableism#ableism#social security#social safety net#wealth redistribution#social control#charity#universal benefits#universal basic income

188 notes

·

View notes

Text

#politics#us politics#political#donald trump#news#president trump#elon musk#american politics#jd vance#law#social security#senior benefits#oligarch#oligarchy#wealth disparity#wealth inequity#wealth redistribution#middle class wealth#wealth inequality#wealth#money#economics#economy#poor#middle class#senior citizens#us citizens#social security office#trump admin#maga

52 notes

·

View notes

Text

the key difference between kaiser and isagi as guys who boost their self-esteem by beating others is that isagi isn't satisfied by overcoming opponents who aren't a match for his skill while kaiser exclusively picks fights he thinks he can win

#bolo liveblogs#blue lock#bllk#isagi yoichi#michael kaiser#had this epiphany at approximately four am last night#don't think I'm saying isagi does this out of the kindness of his heart or anything either he's just challenge-motivated#this has been part of his character since the tag game when he targeted the strongest guy in the room instead of taking an easy win#looking for evenly-matched opponents to analyze and ''devour'' is a pattern for him!#kaiser meanwhile is afraid that he has nothing outside of football#(I mean this both psychologically and in terms of material wealth and security. ray dark recruited a kid with no other options on purpose)#so he never takes any chances#he goes out of his way to avoid having relationships with equals and doesn't want an opponent he can't crush#isagi's refusal to do exactly that INFURIATES him

76 notes

·

View notes

Text

Fear focused feminist always get mad when I say,

“You should be able to depend on the man you’re dating financially.”

Depending on him doesn’t mean you’re broke. It means you depend on him to provide the basic necessities of life. Like the bills, groceries, transportation.

A woman’s money is HER money. She can Save it, Invest it, Start a business. Or save his.

Even without working a woman should be able to depend on a man to fund her savings & investments for her. (Like after a woman has just given birth and stays home for awhile) A smart woman knows to build real wealth in this dynamic.

Depending on a man doesn’t mean to be uninvolved with the marital finances for 20 years and end up broke after a divorce. Be smart. Build wealth.

And income ≠ wealth. (Which is why so many high earning 'independent' women are still broke)

#date smart#feminine dating#hypergamy#date up#marry up#marry well#provider men#providers#provided for#smart woman#secured wife#wealthy wife#wealthy woman#feminine masculine polarity#polarity#build wealth#fearful feminist#hypergamous#hypergamyblr#hypergamy tips#black femininity#housewife#houswives#sahm#stay at home mom#level up

35 notes

·

View notes

Text

Fisherman Minedai (wip)

#my art#digital art#fanart#yakuza#rgg fanart#rgg#yakuza mine yoshitaka#minedai#minedai fanart#yakuza like a dragon#infinite wealth#infinite wealth deleted scene#the real reason daigo didn’t want to leave the fish shack#mr ceo wouldve never let that security company fail#just sayin!!!!

73 notes

·

View notes

Note

Heard Bethany got robbed at gunpoint????? What are you gonna do to make the business more safe?!

What if you and her get murdered to death and they get their hands on your kratum and then your bitcoin?

My Response.

Bethany was greatly rewarded for her heroic efforts!

She earned 100% of the trap house's earnings today!

New arrangements have been made. I will be guarding the entrance with my sawed-off from now on. My brother Jean will also serve as muscle.

8 notes

·

View notes

Text

okay so. don’t crucify me. but su she and jin guangyao do actually make some pretty compelling points.

#critical class analysis of mdzs when???? when will i write it when????#but like.#like#fuck okay i love how it ends#because i love a happy ending#but i just keep thinking about how su she and ESP jin guangyao are right that… they kinda… had to do what they did#like su she has a few more blunders and he’s clearly jealous/resentful but… he’s not necessarily wrong about being looked down on in the la#for reasons he can’t really control#and jgy… where to even begin like okay he shouldn’t have done all those horrible things#but they ALL did horrible things#the difference is that jgy did not have anyone backing him if he fucked up if he wanted to live in dignity#he had to make sure his spot was secure#lxc lwj and whoever else was in the guanyin temple can judge him all they want#but except for wwx they’re all clan leaders or uncontested heirs#they have a level of wealth & security that allows them to make judgements on the actions of others#knowing that they can act basically free from lasting consequence#the only person who isn’t immune is wei wuxian but even then… he had the jiang clan in the past#which. it’s complicated. i know it’s complicated.#but he did attain a lot of privilege thru his connection with them and they did protect him as much as they reasonably could have#in the circumstances they were given#for the most part#and then in the future he has lan wangji who will literally kill anyone that comes at him#makes sure he’s warm and fed and kept entertained and away from pesky things like#responsibilities#and difficult conversations#so even tho he once knew a life like jgy’s he’s so far removed from it now#and just#sorry there’s a reason why all of this is in the tags#it’s not super clear in my head yet#but this is the start i promise i will come back to it

25 notes

·

View notes

Text

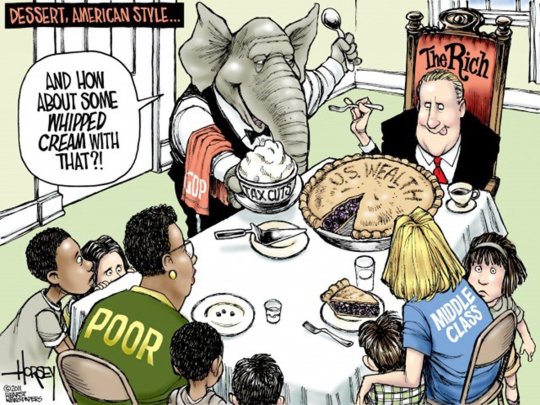

Horsey

* * * *

LETTERS FROM AN AMERICAN

December 4, 2024

Heather Cox Richardson

Dec 05, 2024

In 1883, as the Republican Party moved into full-throated support for the industrialists who were concentrating the nation’s wealth into their own hands while factory workers stayed above the poverty line only by working 12 hours a day, seven days a week, Yale sociologist William Graham Sumner responded to those worried about the extremes of wealth and poverty in the country with his book What Social Classes Owe to Each Other.

Sumner concluded it was unfair that “worthy, industrious, independent, and self-supporting” men should be taxed to support those he claimed were lazy. Worse, he said, such a redistribution of wealth would destroy America by destroying individual enterprise. Sumner called for a “laissez-faire” world in which those who failed should be permitted to sink into poverty, and even to die, to keep America from becoming a land where lazy folks waited for a handout. Such people should be weeded out of society for the good of the nation.

Republicans echoed Sumner’s What Social Classes Owe to Each Other, concluding, as he did, that the wealthy owed the lower classes nothing. Even though “his views are singularly hard and uncompromising,” wrote the New York Times, “it is difficult to quarrel with their deductions, however one may feel one’s finer instincts hurt by their apparent cruelty.”

In contrast to those who believed government should stay out of economic affairs so individuals can amass as much wealth as they can, others looked at the growing extremes of wealth, with so-called robber barons like Cornelius Vanderbilt II building a 70-room summer “cottage” while children went to work in mines and factories, and concluded that the government must try to hold the economic playing field level to give everyone equal chance to rise to prosperity.

Prevailing opinion in the U.S. has seesawed between these two ideologies ever since.

In the Progressive Era, members of both major parties and other upstart parties turned against Sumner’s argument, working to clean up cities, establish better working conditions, provide education, and regulate food and drugs to protect consumers. After World War I, Republicans led a backlash against those regulations and the taxes necessary to pay for their enforcement. In October 1929 the unregulated stock market crashed, ushering in the Great Depression.

From 1933 to 1981, Americans of both parties came to agree that the government must regulate the economy and provide a basic social safety net, promote infrastructure, and protect civil rights. They believed such intervention would stabilize society and prevent future economic disasters by protecting the rights of all individuals to have equal access to economic prosperity.

Then in 1981, the country began to back away from that idea. Incoming president Ronald Reagan echoed William Graham Sumner when he insisted that this system took tax dollars from hardworking white men and redistributed them to the undeserving. In a time of sluggish economic growth, he assured Americans that “government is not the solution to our problem; government is the problem,” and that tax cuts and deregulation were the way to make the economy boom.

For the next forty years, lawmakers pushed deregulation and tax cuts, privatization of infrastructure, and cuts to the bureaucracy that protected civil rights. Those forty years, from 1981 to 2021, hollowed out the middle class as about $50 trillion moved from the bottom 90% of Americans to the top 1%.

When he took office in January 2021, President Joe Biden set out to reverse that trend and once again use the government to level the economic playing field, returning the nation to the proven system of the years before 1981, under which the middle class had thrived. His director of the Federal Trade Commission, Lina Khan, began to break up the monopolies that had come to control the economy, while new rules at the Department of Labor expanded workers’ rights to overtime pay, and the government worked to expand access to healthcare.

Under Biden and the Democrats, Congress passed a series of laws to bring manufacturing jobs back to the United States. Those laws used federal money to start industries that then attracted private capital—more than $1 trillion of it. According to policy researcher Jack Conness, the CHIPS and Science Act and the Inflation Reduction Act are already responsible for more than 135,000 of the 1.6 million construction and manufacturing jobs created during the Biden administration.

As Jennifer Rubin noted in the Washington Post today, “It is stunning, frankly, that the most successful and far-flung private-public collaboration in history—one that is transforming cities, states and regions—has gotten so little coverage from legacy media. It may be the most critical government-driven initiative since the GI Bill following World War II.”

“[T]he widespread benefits derived from this massive undertaking—for individuals, communities, national security and government itself (through increased tax revenue)—demonstrate how far superior this approach is to trickle-down economics, which slashes taxes for the rich and big corporations,” Rubin continued. “With the latter, the tax savings for corporations go to everything from stock buybacks to increased compensation for CEOs to foreign investment,” while “the cost of the tax cuts runs up the national debt at a much greater rate than a public-private approach…. Republicans deliver temporary stimulus and wind up with more debt and more income inequality.”

But in 2024, voters elected Donald Trump, who promised to reject Biden’s economic vision and resurrect the system of the years before 2021 in which a few individuals could amass as much wealth as possible. Just ten days after the election, a Texas judge overturned the Biden administration’s overtime pay rule, permitting employers to cancel the raises they gave their employees to comply with that rule.

The change in ideology is clear from Trump’s cabinet picks. While the total net worth of the officials in Biden’s Cabinet was about $118 million, Laura Mannweiler of U.S. News and World Report noted, a week ago she estimated the worth of Trump’s roster of appointees to be at least $344.4 billion, more than the gross domestic product of 169 countries. That number did not include his pick for treasury secretary, Scott Bessent, whose net worth is hard to find.

Today, Trump added another billionaire to his roster, picking entrepreneur and private astronaut Jared Isaacman as the next administrator of the National Aeronautics and Space Administration (NASA). Isaacman is a close ally of billionaire Elon Musk, who aspires to colonize Mars. In a post on X after the announcement, Isaacman vowed to “usher in an era where humanity becomes a true spacefaring civilization.”

To free up capital for such ventures, Trump’s team has promised more business deregulation and tax cuts for the wealthy and corporations. Today, Trump tapped Paul Atkins, who has called for looser regulation of cryptocurrency, to chair the Securities and Exchange Commission. Atkins is expected to roll back the financial regulations initiated by his predecessor.

Trump has also vowed to cut the post–World War II government far more than anyone before him has done. He has put Musk and billionaire Vivek Ramaswamy in charge of a “Department of Government Efficiency” (DOGE); Musk proposes to cut $2 trillion out of the $6.75 trillion U.S. budget. How he would accomplish this is hard to imagine, since most of the budget is “mandatory” spending already baked into the budget, and much of that is Medicare, Medicaid, and Social Security. During the campaign, Trump promised he would not cut these very popular programs.

One of the things that constitute “discretionary” spending—which must be renewed every year—is veterans’ benefits, and yesterday Jeff Schogol of Task and Purpose noted “a growing chorus” calling for cuts to Veterans Affairs disability benefits after The Economist on November 28 called disability benefits “absurdly generous.” Disabled American Veterans spokesperson Dan Clare pointed out that the U.S. was at war for twenty years—in Afghanistan for twenty and in Iraq for eight—increasing the VA budget. Since Congress passed the PACT Act, formally known as the Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics Act, in 2022, more than 1.2 million veterans exposed to burn pits and other toxics have been treated for resulting health conditions.

Today, Phil Galewitz of KFF Health News noted that nine states—Arizona, Arkansas, Illinois, Indiana, Montana, New Hampshire, North Carolina, Utah, and Virginia—have trigger laws to end their expansion of Medicaid if federal funding is reduced. As many as 3.7 million people in these states would lose healthcare coverage if these laws go into effect. Other states might then follow suit as lost federal money would have to be made up by the states.

On X this week, Musk commented that a thread by Senator Mike Lee (R-UT) attacking Social Security was “interesting.” Yesterday on the Fox News Channel, Representative Richard McCormick (R-GA) suggested: "We're gonna have to have some hard decisions. We're gonna have to bring in the Democrats to talk about Social Security, Medicaid, Medicare. There's hundreds of billions of dollars to be saved, and we know how to do it; we just have to have the stomach to take those challenges on."

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Horsey#Letters From An American#Heather Cox Richardson#Musk#Mike Lee#Social Security#Social Safety Net#Medicare#Medicade#Veterans#wealth inequality#American History

8 notes

·

View notes

Text

Finding Your Investment Path: A Simple Guide

In the vast ocean of financial opportunities, finding the right investment scheme can feel like searching for a needle in a haystack. Every individual's financial goal, risk tolerance, and investment horizon are unique, making it crucial to navigate through the diffrent of options available in the market. From fixed income to equity and everything in between, understanding the various investment schemes is key to building a robust and diversified portfolio tailored to your needs.

Fixed Income: Let's begin with the fundamentals. Your investment portfolio's fixed income investments are similar to the consistent beat of a drum. The traditional examples are bonds and certificates of deposit (CDs). They are the best option for people looking for stability because they provide predictable returns at a lower risk. And you can earn average 8-10% return. Managed Portfolios: Do you like someone else to do the grunt work? You may want to consider managed portfolios. These expertly managed funds provide a hands-off approach to investing, catered to your financial objectives and risk tolerance.

Insurance: Although the main goal of insurance is to provide protection, several plans also include investment options. For example, life insurance policies give you coverage and the opportunity to gradually build up cash value; for the astute investor, this is a two-for-one offer. Derivatives: At this point, things become a little more intricate. The value of derivatives is derived from underlying securities or indexes. This group includes swaps, futures, and options. They can be employed speculatively or for hedging, but they're not for the timid. but do not invest in derivatives until and unless you are expert in this field.

Credit Instruments: Now let's talk about credit instruments, which include peer-to-peer lending websites and corporate bonds. With the range of risk and return potential offered by these products, you can tailor your portfolio to your degree of risk tolerance. Equities: Ah, the stock market, the global investor community's playground. Purchasing stock entails obtaining ownership of shares in publicly traded corporations. It's all about dividends and growth potential, but be prepared for market turbulence. Keep it straightforward: align your investments with your time horizon, risk appetite, and goals. To distribute the risk, diversify between several programs. And keep up with market developments at all times. Recall that there isn't a single, universal strategy for investing. Discover what works for you and get to work accumulating wealth!

#invetment#wealth#fixed income#security#risk#return#instrument#financial planning#financial services#low risk high reward

15 notes

·

View notes

Text

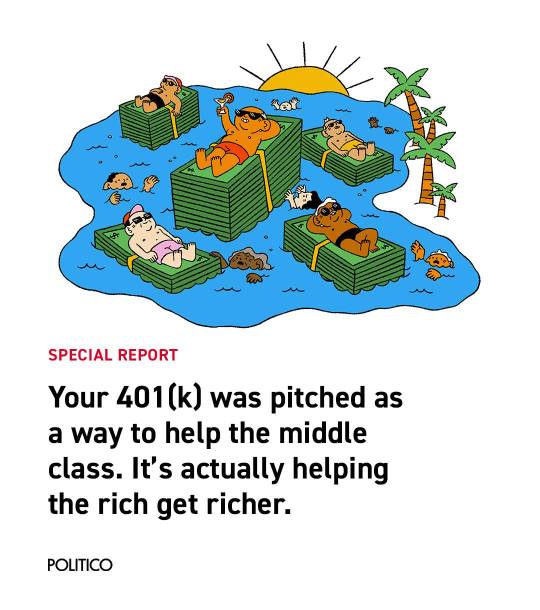

x

#401(k)#savings#tax-advantaged retirement#bipartisan legislation#wealth gap#federal budget#financial industry#lobbying#retirement security#tax law#retirement savings#bipartisan#wealth disparities#federal deficit#financial services industry#tax-advantaged accounts#tax breaks#Congress#lobbyists#Social Security#Medicare

18 notes

·

View notes

Text

I think a large reason we have so much discourse is that a lot of people don’t consider weakness and softness as if relates to class.

Like they’ll talk about how Izzy calls Ed and Stede soft or weak for certain things—and then just leave it that. With no consideration for why a pirate wouldn’t value those traits.

Like…a great deal of Stede’s ability to be soft is tied up into his lack of financial consideration. Like yes I think talking it through, being nice, enjoying fine things etc is a good thing, it’s also something that comes from privilege.

Like even speaking as a matter of time, if your not struggling to feed yourself (and in Izzy and Ed’s case, uhhh 50+ others) you are given more opportunity to work through things, and make changes.

Like…it’s either about masculinity or class, but class plays heavily into what sort of exploration is available to you. And growing up poor is going to give you a different sort of value for the tough it out, take care of yourself mindset, because you have to focus all your energy on surviving.

And then people just treat it like typical masculinity based toxicity, but it’s a lot more than that, and like…background matters. Sometimes people deserve a little more grace due to circumstances.

#call back to those posts like#Izzy hates Stede/Stede’s things because he sees it as soft#not because Stede’s rich#wealth is linked to how soft you can be#and how much you are able to work through#and what negative aspects of a culture you feel you can change#because you need both time and security to make improvements#especially as a pirate#in 1717#izzy hands#this is not saying poor people can’t be soft btw#just that sometimes as hard life necessities making yourself hard to survive it

136 notes

·

View notes

Text

Health and Wealth: The Twin Pillars of a Fulfilling Life

Health and wealth are often considered the two most important aspects of a well-rounded and fulfilling life. While they may seem like separate entities, they are intricately linked and influence each other in profound ways. A healthy individual is better equipped to pursue wealth, while financial security can provide access to resources that promote and maintain good health.

The Importance of Health

Health, as the saying goes, is wealth. It is the foundation upon which all other aspects of life are built. Good health encompasses physical, mental, and social well-being, enabling individuals to thrive and reach their full potential.

* Physical Health: A healthy body is essential for carrying out daily activities, pursuing goals, and enjoying life's experiences. It provides the energy and vitality needed to work, play, and engage with the world.

* Mental Health: Mental well-being is equally crucial. A healthy mind allows for clear thinking, emotional stability, and resilience in the face of challenges. It enables individuals to maintain healthy relationships, manage stress, and make sound decisions.

* Social Health: Social well-being refers to the ability to form and maintain meaningful connections with others. Strong social networks provide support, reduce feelings of isolation, and contribute to overall happiness and life satisfaction.

The Significance of Wealth

Wealth, in its broadest sense, refers to an abundance of resources, not just financial assets. It includes material possessions, intellectual capital, social connections, and the ability to access opportunities. Financial wealth, however, plays a significant role in modern society, providing individuals with choices and a sense of security.

* Meeting Basic Needs: Financial wealth enables individuals to meet their basic needs, such as food, shelter, clothing, and healthcare. It provides a foundation for stability and reduces the stress associated with financial insecurity.

* Access to Opportunities: Wealth can open doors to better education, career opportunities, and personal development. It allows individuals to invest in their future and pursue their passions.

* Security and Freedom: Financial security provides a safety net in times of unexpected events, such as job loss or illness. It also offers the freedom to make choices that align with one's values and goals.

Balancing Health and Wealth

While both health and wealth are important, it's crucial to maintain a balance between the two. Prioritizing one at the expense of the other can lead to detrimental consequences.

* Prioritize Health: Health should always be a top priority. Without good health, the pursuit of wealth becomes meaningless. Make healthy choices, such as eating a balanced diet, exercising regularly, and getting enough sleep.

* Use Wealth Wisely: Wealth should be used to enhance well-being, not just to accumulate more possessions. Invest in experiences, relationships, and personal growth, which can bring lasting happiness and fulfillment.

* Save for the Future: Saving and investing are essential for long-term financial security. Having a financial cushion can provide peace of mind and allow for greater flexibility in life choices.

Additional Tips for a Healthy and Wealthy Life

* Manage Stress: Stress can negatively impact both physical and mental health, as well as financial decision-making. Practice stress-reducing techniques, such as meditation, yoga, or spending time in nature.

* Cultivate Positive Relationships: Strong social connections contribute to happiness and well-being. Invest time in nurturing relationships with family and friends.

* Give Back to Others: Helping others can bring a sense of purpose and fulfillment, which can have a positive impact on both mental and physical health.

* Continuously Learn and Grow: Investing in personal development and lifelong learning can enhance both your health and wealth.

Conclusion

Health and wealth are not mutually exclusive; they are intertwined and contribute to a fulfilling life. By prioritizing health, using wealth wisely, and maintaining a balance between the two, individuals can create a foundation for happiness, success, and overall well-being.

2 notes

·

View notes

Text

youtube

If you’re going to be a trad wife/housewife, be a smart one.

#Youtube#Housewife#tradwife#homemaker#traditional femininity#trad wives#sahm#wealthy wife#secured wife#Rich wife#traditional dating#traditional relationships#traditional wife#feminine dating#feminine dating tips#marry well#marry up#Date up#Hypergamy#Vetting#Vet him#Date smart#build wealth

18 notes

·

View notes