#Asset digitization

Explore tagged Tumblr posts

Text

man I love @havanillas 's merventurine au

process gif under cut:

#hope the first thing everyone notices is ratio's assets#ratiorine#aventurine#dr ratio#hsr#veritas ratio#merventurine au#merventurine#merman#aventio#honkai star rail#artists on tumblr#illustration#digital art#my art#honkai fanart

10K notes

·

View notes

Text

[insert poetic title here]

fun fact: this did not start out as isat fanart

(rambling in tags)

#I was actually doing some personal writing and when I read it over a few days later I could only hear it in loops voice#speaking of which#i totally recommend watching ShortOneGaming's playthrough of the game#their voices for the characters match so well in my mind i can't separate them XD#also i have no clue why but this took FOREVER#I had the thumbnailing and paneling done so quickly but my motivation to finish it just left me midway through the third page T-T#Even though this is one of the shorter comics I've made (AND NO COLOUR) it somehow took my like twice as long -3-#loop is so fun to draw!#well actually fun to colour would be more accurate lol#also did you know that a keyknife was an actual thing??#I wanted to check if their was an a visual asset of it in the game only to find out they're just everyday objects you can own???#maybe im just seriously out of the loop lol#and i know the buttons are wrong but i was already mostly finished inking by the time i realized so lets just say its a stylistic choice#isat fanart#isat spoilers#sasasaap spoilers#two hats spoilers#cw body horror#??? i think#comic#artists on tumblr#fanart#digital illustration#digital art#isat#isat siffrin#isat loop#in stars and time spoilers#my art#my comic

3K notes

·

View notes

Text

We live in an era where the traditional financial landscape is undergoing a dramatic shift, with wealth rapidly transitioning from traditional assets to digital ones.

Smart digital assets, shielded from the effects of inflation and possessing superior intrinsic value, are continuously driving this wealth transfer at an exponential rate.

Unless you diversify your investment portfolio to include smart digital assets, you risk having your wealth relegated to insignificance by 2030.

Digital Shopping Mall (DSM) presents a unique opportunity to diversify your wealth by acquiring its inflation-proof and theft-proof digital shopping points (DSPs) at an early stage.

These DSPs, designed to possess the highest intrinsic value, are underpinned by an innovative tokenomics model that creates an unprecedented win-win-win-win scenario for suppliers, consumers, passive income earners, and DSM itself.

DSM's revolutionary business model empowers suppliers to expand their customer base like never before, enables consumers to purchase goods and services at up to 100 times below retail prices, and allows passive income earners to generate substantial returns without the need for direct recruitment, through earning commissions for recommending new products and services.

It is no wonder that even a purchase of just 1,000 DSPs for only $100 in our pre-launch deal presents an unparalleled opportunity to acquire a billion-dollar purchasing power within one to three years.

For more information about DSM' groundbreaking business model, visit my blog here https://smartpreordering.blogspot.com

#Digital Shopping Mall#Digital Shopping Points#Digital Shopping Coin#Wealth#wealth hacks#Wealth security#Asset digitization#Newa world order#new financial system#Cryptocurrency

0 notes

Text

paper agnes and the thousand doors

#no energy to draw much rn so take me playing around with older assets#oops i forgor to fix audience loop#digital art#art#oc#oc art#gif

2K notes

·

View notes

Text

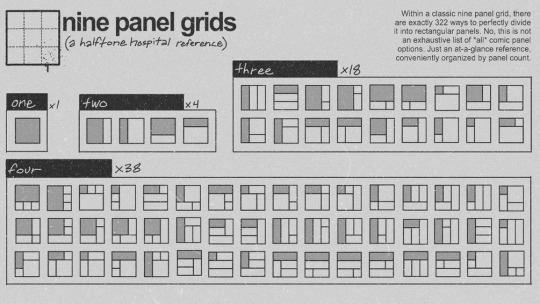

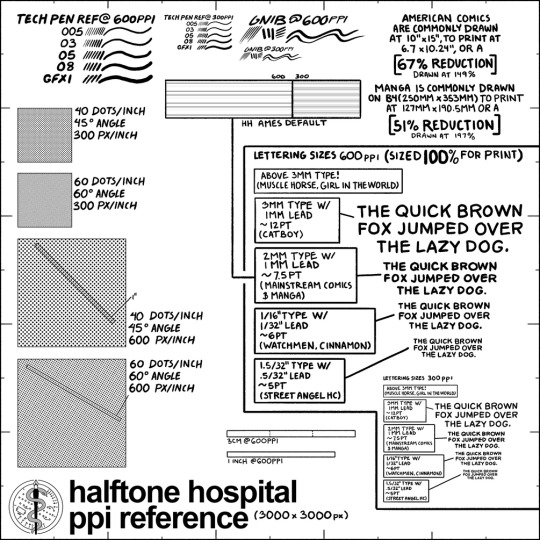

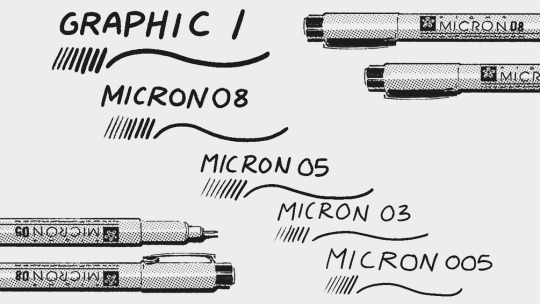

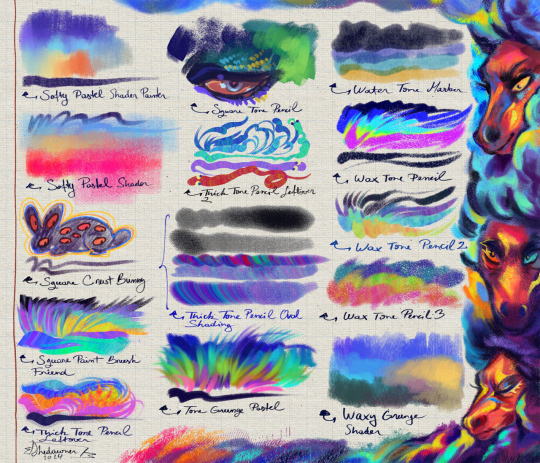

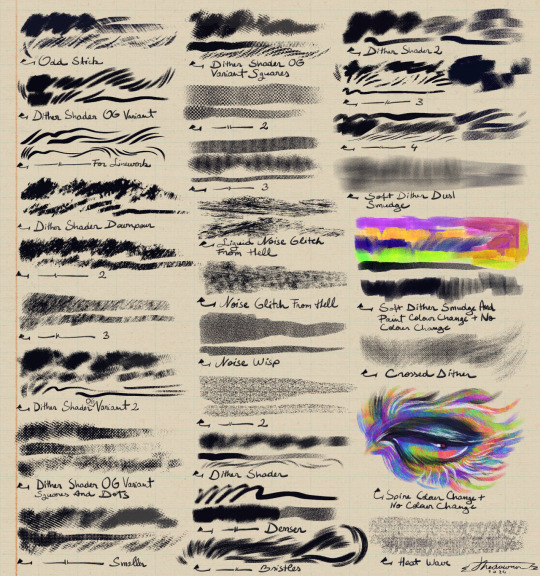

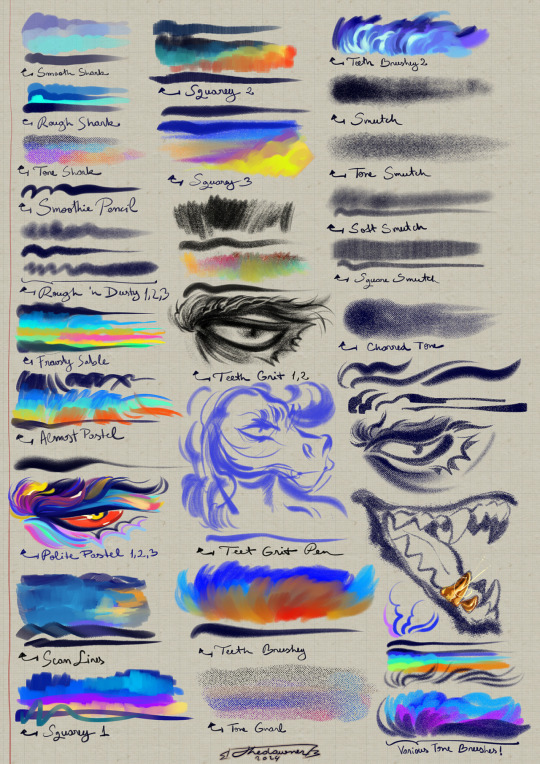

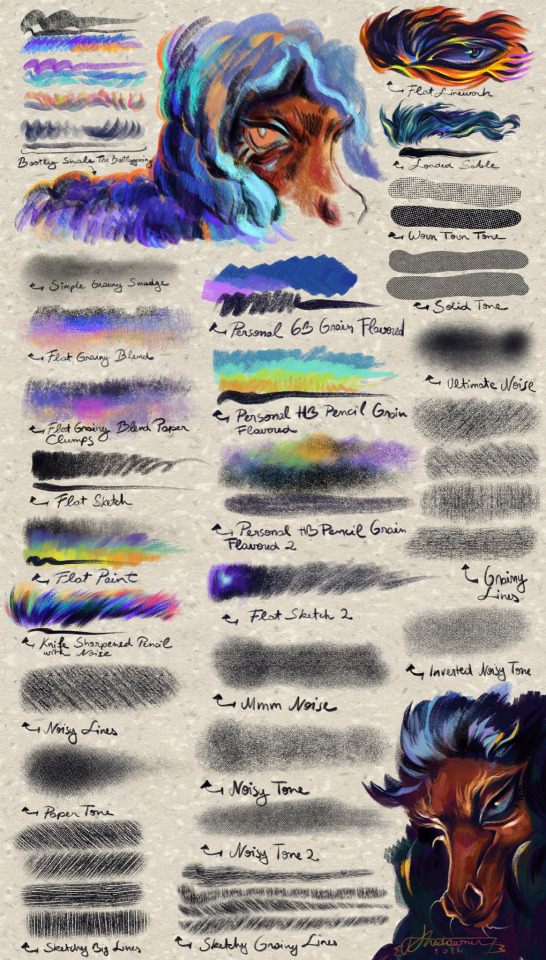

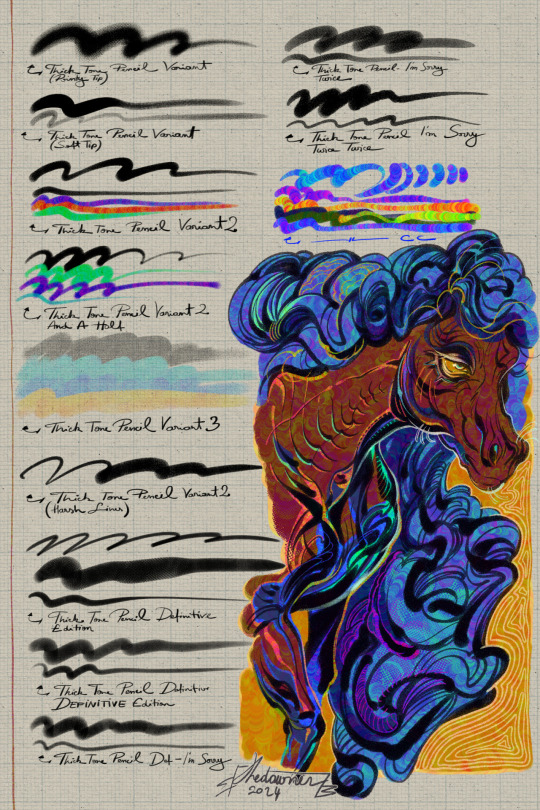

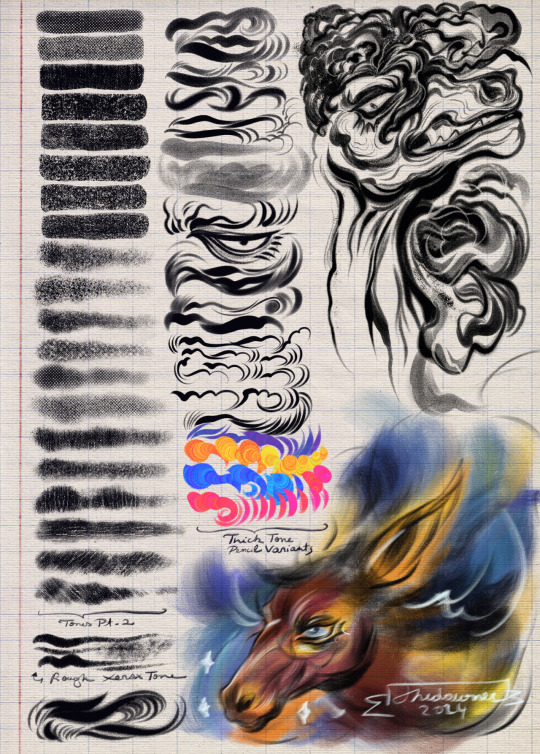

Evergreen PSA: Victoria Douglas is doing magnificent work creating digital assets and resources for cartoonists at HALFTONE HOSPITAL. These things are all pay-what-you-will, which is an incredible gift to the community.

What sorts of things, you ask?

A printable 11x17 poster of all possible formal divisions of a nine panel grid. That's 322 layouts!

A digital sizing reference guide to make sure your pages are being drawn at the right resolution before you find out they're too small the week of the deadline!

Loads of great brushes for Photoshop, ClipStudio, and Procreate, including these Micron pens!

We could go on, but will stop for now because you should just go download some stuff. (And, of course, chuck in some $$ if you can afford to!)

#making comics#victoria douglas#halftone hospital#resources#brushes#assets#digital art#clip studio#comics#photoshop#artists on tumblr#free resources

911 notes

·

View notes

Text

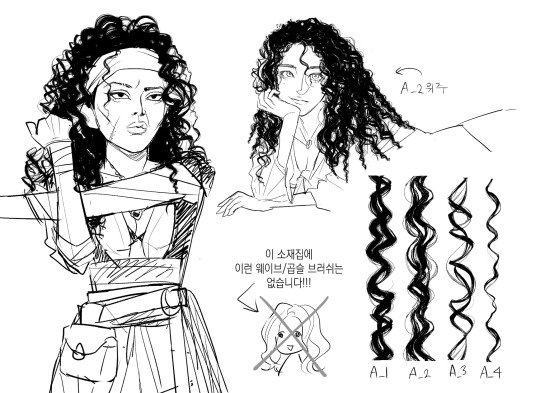

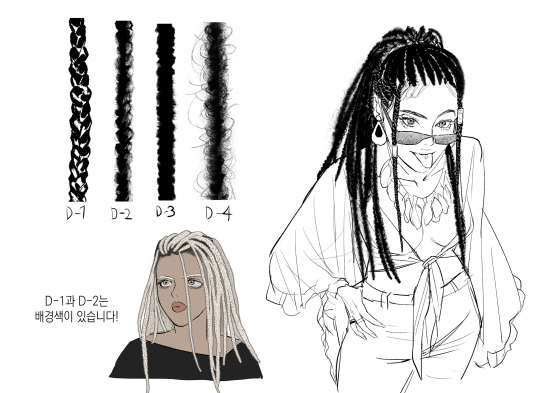

This isn’t like my normal brush rec posts but I wanted to get something out quickly bc there’s an excellent curly hair brush pack on the CSP asset store for free rn! The sale’s going until July 1!!

Some of the terminology used here is a bit iffy (but that could be google translate), but as A Black Person, I really like the effort put into these brushes to accurately get our hair texture down.

Link lol

#csp assets#digital art brushes#csp brushes#clip studio paint brushes#curly hair#curly hair brush#clip studio assets#weekly brush post#those haven’t been weekly for a bit though sorry 😔#I really like this pack bc usually nonblack people do not make the effort to get our hair right#honking

1K notes

·

View notes

Text

fem!moshang bc winners love winning

#I always see sqh enjoying mbj’s…uh…assets#And I thought mbj deserved the same treatment#Not really important to this piece but I saw someone post about he/him lesbian mbj#and I have not been able to think about anything else for MONTHS#my art#digital art#svsss#fanart#the scum villain's self saving system#moshang#fem mobei jun#fem shang qinghua#mobei jun#shang qinghua#genderswap

363 notes

·

View notes

Text

Working on a little thing...

@lilybug-02 :3

#digital art#digital fanart#sprite art#pixel art#rpgmaker#rpgmaker mv#this is mostly just default assets and im gonna keep it that way- but the bread sprites are all mine :3

559 notes

·

View notes

Text

Throws a brick at him

#fanart#digital art#outlast#digital drawing#artist#outlast fanart#the outlast trials#volker brandt#prime asset oc#oc#fan character#outlast trials#red barrels#outlast oc

282 notes

·

View notes

Text

I'm having a 20% discount on all my shop items until December 6 (midnight)! Use the code BUG at checkout.

#procreate brushes#clip studio brushes#csp brushes#photoshop brushes#sai brushes#brushes#digital art#digital assets#digital brushes#procreate#csp#clip studio paint#sai#photoshop

267 notes

·

View notes

Text

my little pony divider blinkie (f2u with or without credit AFTER reblogging this post!)

[BLINKIES MASTERPOST]

#art#digital art#blinkie#blinkies#divider#assets#resources#my little pony#mlp#my little pony friendship is magic#mlp fim#mlp g4#pixel art#profile customization#webcore#old internet#spike#twilight#twilight sparkle#pinkie pie#fluttershy#rarity#applejack#rainbow dash

203 notes

·

View notes

Text

XV – The Devil | print

#coyoteworks#artists on tumblr#illustration#tarot card art#character illustration#tarot card#digital painting#leyendecker study#original character#oc#altair#background is hieronymus bosch's garden of earthly delights#and a modified asset from bunabi's free frames set#it's uhhhh. altair tuesday time to fake your death#this thing took me forever and at this point im like i have to stop myself from trying to make any more tweaks#because if i dont restrain myself i will be at it until i die#im decently happy with it at least. even if i did get to the point where i just#could not be bothered to try to figure out an original composition for the background. so i just slapped in bosch and colorgraded it a bit.#anyway if youre reading this love you bye !!

185 notes

·

View notes

Text

Art dump 2, lotta stuff

#scuba diver guy is a prime asset oc#his name is simon pierce he a bitch#bf:art#outlast trials#outlast#sketch#traditional art#sketchdump#digital art#the outlast trials#trepang2#dont know if i should tag curly#mehhh

129 notes

·

View notes

Text

halftone blenders for clip studio paint! a set of two blending brushes! they both use the same halftone texture, the only difference between them is the shape (one is a round brush, the other is a rectangle brush.) this was a staple of my procreate brush library, but i couldn't find one on csp, so i decided to create one myself

my other stuff

#csp brushes#csp assets#csp#clip studio paint#clip studio paint assets#clip studio paint brushes#digital art

311 notes

·

View notes

Text

Almost done with the intro to @kmodoposts next banger ;]

This one is a doozy visually! A completely lineless style that KMODO is helping create assets for. Working on trimming complexity down so we can get it out in good time -

#everyone I owe art to - thank you for your patience!#tadc#Playground#the amazing digital circus#I made 40...40 ASSETS JUST FOR THE OPENING#and one more BG to be made#mostly little pieces but it takes the cake for me

109 notes

·

View notes