#lending regulations

Explore tagged Tumblr posts

Text

The Revealed Roadmap to Safe Borrowing in the Digital Age

Are you in need of quick funds but overwhelmed by the plethora of digital loan options out there? Fret not! In this blog, I will take you on a joyride through the ins and outs of secure digital borrowing.

Understanding the Digital Loan Landscape in India

India's digital lending space has been experiencing a meteoric rise in recent years. With the advent of innovative fintech platforms, getting access to loans has become faster and easier than ever before. However, this convenience comes with its share of challenges and risks, making it essential for borrowers to tread cautiously.

Digital Loan Guru's Safe Borrowing Roadmap

1. Know Your Financial Terrain

Before embarking on the borrowing journey, it is vital to assess your financial terrain. Evaluate your income, expenses, and existing debts to determine the amount you can afford to borrow comfortably. The Digital Loan Guru advises borrowers to avoid overburdening themselves with loans that could lead to a debt trap.

Also Read: Why Opt for Professional Loans Instead of Regular Personal Loans

2. Master the Art of Comparison

In a market flooded with digital lending options, the key to safe borrowing lies in comparing the various loan products available. Pay attention to interest rates, processing fees, tenure, and hidden charges. The Digital Loan Guru's tip: Always opt for the loan that suits your needs and financial capabilities the best.

3. Watch Out for Digital Loan Scams

The dark side of the digital world includes scams and fraudulent loan providers. Abhay Bhutada, Poonawalla Fincorp's MD, advises that when starting financial transactions and communicating with financial institutions across various digital financial platforms, it is crucial to use caution and implement responsible practices.

4. Embrace the Power of Reviews

Don't navigate the digital loan universe blindly! The experiences of other borrowers can offer invaluable insights. Check online reviews and testimonials to gauge the reputation and reliability of the lending platforms you're considering. The Digital Loan Guru believes in the wisdom of the crowd.

5. Digital Lending Regulations

The world of digital lending in India is under the vigilant eye of regulatory bodies, ensuring borrowers' safety and interests. The Reserve Bank of India (RBI) and other financial authorities have laid down guidelines for digital lenders to follow.

Harshvardhan Lunia, CEO & Founder of Lendingkart, stresses that these regulations enhance customer experiences and safeguard their data in the hands of ethical digital lending entities.

Also Read: The Rise of Decentralized Finance (DeFi): Exploring the Opportunities and Risks of a Borderless Financial Ecosystem

Conclusion

Remember to know your financial limits, compare wisely, and be cautious of scams. By staying informed about digital lending regulations, you can confidently make borrowing decisions that pave the way to financial success.

0 notes

Text

#2008#bankruptcy#credit default swaps#crisis#derivatives#financial collapse#fraud#government bailout#investigation#lending practices#mortgage-backed securities#regulation#regulatory failure#risky loans#Silicon Valley Bank#subprime mortgages#systemic risk#United States

11 notes

·

View notes

Text

any time I see people tying minor world events to economics I’m like. that’s not how economics works. I know you want it to be how it works so you can blame someone. but that’s not how it works in any country or global economy.

#it’s like saying gravity only exists on Tuesdays#this is directly looking at two things:#one: saying the FFR (federal funds rate) is why ‘start up’s’ in the gig economy are failing#and two: someone saying we should cause a bank run (multiple bank runs) when we’re still in pre-recession waters#per point one: the FFR is for banks and credit unions and determines what rate at which lending happens#it effects things like housing; car loans; savings accounts; etc because it sets a floor at which interest rates have to be#it does not affect how much money VCs pour into companies they think are going to be worth billions#which VCs pour money into them so they get a % of the company as stock#so they’re incentivized for the company to do well and make them a profit when they go public#not to say these companies might not have traditional bank loans but it’s very unlikely for the amount they’re spending#additionally as we all should have learned from the Glass-Stegel act and the 08 crash#banks need to keep their commercial investments and consumer investments separate#so yes these companies are failing…. but for other reasons like increased regulation; changing preferences in the consumer and economy;#but MOSTLY they were unsustainable businesses at the onset; they didn’t need to be profitable; just go public and make billions on stock#now for point two this one is simple: IF YOU CAUSE MULTIPLE BANK RUNS#THEY BECOME A SELF FULFILLING PROPHECY#AND THEN MORE BANKS FAIL AND WE GET A RECESSION#all caps were necessary here#if you look at the Great Depression (a great example of a banking panic)#not all of the banks were initially failing#but by people panicking about their money (and a lack of the FDIC at the time)#but because people panicked and pulled their money out the banks failed anyway and caused the worst recession in US history#so yes feel free to cause a banking run and tank the economy#it’s likely Europe will enter a recession in the next 6 months so please exacerbate the situation#(which because global economy will push us further into possible recession)#I’m sure people will have plenty of time to feel smug and superior while sitting on a mattress of cash and looking for jobs#ugh anyway bad economics bothers me#just cause you watched a dude rant about it on YouTube (when he doesn’t know what a Phillips curve is) doesn’t mean you know economics#thoughts? thoughts#or: wHy DoNt YoU jUsT bAlAnCe ThE eCoNoMy LiKe My ChEcKbOoK

1 note

·

View note

Text

my dad got us all the beatsaber DLCs let's gooooooo

I was looking at them last night and debating whether or not I actually wanted to spend all the money it would take to get the Metallica, Fall Out Boy, Linkin Park, Rock Mixtape, Panic! 2, and The Weekend DLCs

But my dad just got all of them for us

#I love beatsaber#I'm the best player in my house#My best song is probably Pop/Stars#I also have a TON of custom songs though#My favorite is probably Cherry Pie#I'm adding Wherever I May Roam and Riding The Storm Out to my classic rock collection tonight#I might also add The Regulator and You Are The Wilderness so that I have a couple twd related songs#Serpents (basement) and Heavy Games could work too#but there's not many songs on the soundtrack that lend themselves well to beatsaber#I can't make up my mind on Easy Street. It will work. It could even be good. But do I want to drive myself crazy?#Maybe I should do some Hozier. Idk how good it'll be. All his songs (at least the ones I like) are kinda slow#idle speaks#queenie rambles

1 note

·

View note

Text

Lawsuit Challenges CFPB’s ‘Buy Now, Pay Later’ Rule

On Oct. 18, 2024, fintech trade group Financial Technology Association (FTA) filed a lawsuit challenging the Consumer Financial Protection Bureau’s (CFPB) final interpretative rule on “Buy Now, Pay Later” (BNPL) products. Released in May 2024, the CFPB’s interpretative rule classifies BNPL products as “credit cards” and their providers as “card issuers” and “creditors” for purposes of the Truth…

#administrative procedure act#APA#BNPL#buy now pay later#card issuers#CFPB#Consumer Financial Protection Bureau#credit cards#creditors#District Court for the District of Columbia#Financial Technology Association#fintech#FTA#interpretive rule#lawsuit#Regulation Z#TILA#Truth in Lending Act

0 notes

Text

An open letter to the U.S. Congress

Pass the Stop Wall Street Landlords Act

15 so far! Help us get to 25 signers!

The housing crisis in our nation is reaching unprecedented levels, making homeownership increasingly out of reach for many hardworking individuals and families. A major contributor to this crisis is the unchecked activity of Wall Street firms and institutional investors who are treating homes as mere speculative assets, driving up prices and pricing out potential homebuyers. We cannot stand idly by as private equity giants and corporate landlords continue to exploit the housing market for their own profit, at the expense of our communities. The Stop Wall Street Landlords Act seeks to put an end to this predatory behavior by implementing sensible regulations and disincentives for large investors to hoard single-family homes. This legislation represents a critical step towards restoring balance and fairness to the housing market, ensuring that homes are available and affordable for those who need them most. I strongly urge you to support this bill and prioritize the needs of everyday Americans over the greed of wealthy investors. Our constituents deserve the opportunity to build equity and achieve the dream of homeownership without being priced out by exploitative corporate tactics. Together, we can take meaningful action to address this crisis and make housing more accessible for all.

▶ Created on October 23 by Jason

📱 Text SIGN PNJEQK to 50409

#jason#PNJEQK#Housing#Economy#Community#Affordability#Equity#Regulation#Real estate#Family support#Property ownership#Market fairness#Economic justice#Tenant rights#Investment reform#Financial stability#Wealth distribution#Corporate power#Responsible lending#Investor accountability#Corporate landlords#Single-family homes#Home affordability#Housing crisis solutions#Wall Street intervention#Real estate reform#Financial exploitation#Private equity regulation#Congressional action#Stop Wall Street Landlords Act

0 notes

Text

RBI to Launch Public Repository for Digital Lending Apps

In a significant move to enhance consumer protection and transparency in digital lending, the Reserve Bank of India (RBI) has announced the creation of a public repository for digital lending apps (DLAs). This initiative aims to help customers verify whether a lending app is associated with regulated entities, such as banks, and avoid potentially illegal apps.

Background and Need

On September 2, 2022, the RBI issued comprehensive guidelines for digital lending, addressing critical issues like customer protection, data privacy, interest rates, recovery practices, and mis-selling. Despite these guidelines, reports have surfaced about unscrupulous digital lenders falsely claiming affiliations with RBI-regulated entities.

A recent RBI Working Group found that about 600 of the 1,100 digital lending apps available on Indian Android devices are illegal. With the proliferation of new lending apps, it’s increasingly challenging for users to determine the legitimacy of these apps.

The Repository’s Role

The RBI’s new repository will be a valuable tool for consumers. It will list digital lending apps deployed by regulated entities, allowing users to check if an app is legitimate or illegal. The data will be submitted directly by regulated entities to the repository and updated regularly. This will ensure that borrowers can easily identify whether a lending app is associated with a recognized, regulated entity.

Guidelines and Compliance

The RBI’s guidelines mandate that regulated entities disclose loan rates upfront and ensure borrowers are well-informed about loan products during the onboarding process. Additionally, these entities are required to assess borrowers' economic profiles before extending loans.

Protecting Consumers

This initiative follows alarming trends where predatory lending practices have led to severe consequences for many individuals, including harassment and extortion. By providing a centralized, publicly accessible list of verified lending apps, the RBI aims to curb these unethical practices and safeguard consumers against fraudulent activities.

For more information, the repository will be accessible on the RBI’s official website, offering a crucial resource for both current and prospective borrowers.

1 note

·

View note

Text

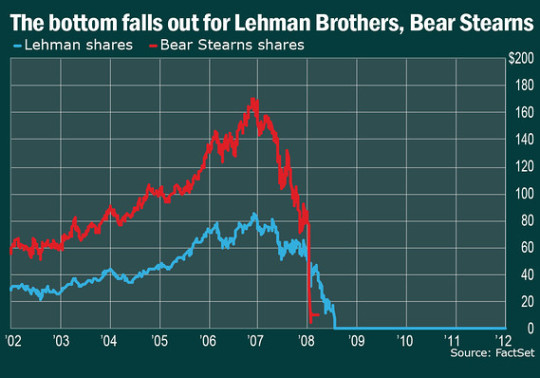

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges. ll. Background of the 2008 Market Crash A. Economic conditions leading up to the crash Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

Australia-Based Crypto Lender Sentenced for False Credit License Claims

Helio Said to Be in Breach of Australian Consumer Protection Law

The Australian Securities and Investments Commission (ASIC) announced on Aug. 17 that the Melbourne-based cryptocurrency lender Helio Lending has been sentenced for falsely claiming it held a credit license. According to the regulator, such a claim is in breach of section 30 of Australia’s National Consumer Credit Protection Act 2009. In a statement, the Aussie securities regulator revealed that the license claim was made in an article that appeared on Helio’s website in Aug. 2019. The regulator argued that Helio portrayed itself as a licensed entity when it knew full well that it was not a holder of the Australian Credit License (ACL). Commenting on her organization’s punishment of Helio, ASIC Deputy Chair Sarah Court said: We expect entities and individuals to provide accurate information to their customers and potential customers. Helio falsely claimed that it held an Australian Credit Licence (ACL), misleading their customers to believe that they had the protections afforded by such a licence. For admitting to committing the offense, Helio is said to have entered a “recognisance” of $9,560 (AUD15,000) for 12 months which is contingent on the crypto lender’s good behavior. However, the regulator said the second charge relating to the content seen on Helio’s website has since been withdrawn. What are your thoughts on this story? Let us know what you think in the comments section below. Read the full article

#ACL#allegation#ASIC#Australia#credit#Crypto#exchange#false#guilty#lending#License#Melbourne#platform#regulator#revealed#sentenced

0 notes

Video

youtube

South Korea To Ease Lending Rules On Foreign Bank Branches #southkorea ...

#youtube#South Korea To Ease Lending Rules On Foreign Bank Branches. southkorea seoul bnks finance news asia South Korea's financial regulator said

0 notes

Text

அந்நிய செலாவணி வழக்கறிஞர்களின் விரிவான சட்ட சேவை

சென்னையில் உள்ள ராஜேந்திர சட்ட அலுவலகம் அந்நிய செலாவணி வழக்கறிஞர்களின் விரிவான சட்ட சேவைகளுக்காக புகழ்பெற்றது. அனுபவம் வாய்ந்த மூத்த வழக்கறிஞர்கள் மற்றும் கார்ப்பரேட் வழக்கறிஞர்கள் பல்வேறு சட்ட விஷயங்களில் அனுபவம் வாய்ந்த வழிகாட்டுதல் மற்றும் ஆலோசனைகளை வழங்க உள்ளனர். சட்ட அலுவலகத்தால் வழங்கப்படும் சேவைகள் தனிநபர் மற்றும் பெருநிறுவன வாடிக்கையாளர்களுக்கு நிதி, வங்கி மற்றும் அந்நிய செலாவணி…

View On WordPress

#a study on foreign exchange management#ADVOCATES#ADVOCATES in Adyar#Appellate lawyers Foreign Exchange Law.#ATTORNEYS#e foreign exchange management act 1999#Foreign Exchange Agents#Foreign Exchange disputes#foreign exchange exposure management#foreign exchange exposure management in india#foreign exchange exposure management pdf#foreign exchange exposure management policy#foreign exchange exposure management ppt#Foreign exchange issues.#Foreign Exchange Law#Foreign Exchange Laws#Foreign Exchange Lawyers#Foreign Exchange Management#foreign exchange management (borrowing and lending in rupees) (amendment) regulations 213#foreign exchange management (borrowing and lending in rupees) regulations#foreign exchange management (borrowing and lending in rupees) regulations 2#foreign exchange management (current account transactions) rules#foreign exchange management (deposit) regulations 216#foreign exchange management (deposit) regulations 217#foreign exchange management (export of goods & services) regulations 215#foreign exchange management (guarantees)#foreign exchange management (guarantees) regulations 2#foreign exchange management (guarantees) regulations 2 amendment#foreign exchange management (guarantees) regulations 216#foreign exchange management (insurance) regulations

0 notes

Text

#2008 recession#bailout#central banks#consumer confidence#economic downturn#financial institutions#foreclosure#global financial crisis#government debt#government regulation#housing market crash#quantitative easing#risky lending practices#stimulus package#stock market#subprime mortgages#TARP#unemployment

0 notes

Text

The UK government is looking for ways to protect the country's tech and life sciences sectors from losses caused by the collapse of Silicon Valley Bank (SVB). It is exploring options such as an emergency fund to provide a cash lifeline to support startups, and a private bailout. Several bidders have expressed interest in taking over SVB's UK subsidiary, including the Bank of London, OakNorth, Royal, HSBC, and JP Morgan. US customers of SVB will have access to all their cash on Monday, with the $250,000 deposit protection cap being scrapped. Regulators are offering a $25bn emergency lending facility for other American banks. The collapse of SVB, the biggest bank failure since 2008, has put hundreds of startups at risk of insolvency. The government is asking affected startups to disclose how much cash they had on deposit at SVB UK, how much they tend to spend each month, and whether they had access to any other bank accounts other than the collapsed lender.

#The UK government is looking for ways to protect the country's tech and life sciences sectors from losses caused by the collapse of Silicon#and a private bailout. Several bidders have expressed interest in taking over SVB's UK subsidiary#including the Bank of London#OakNorth#HSBC#and JP Morgan. US customers of SVB will have access to all their cash on Monday#000 deposit protection cap being scrapped. Regulators are offering a $25bn emergency lending facility for other American banks. The collaps#the biggest bank failure since 2008#has put hundreds of startups at risk of insolvency. The government is asking affected startups to disclose how much cash they had on deposi#and whether they had access to any other bank accounts other than the collapsed lender.#thepostman24

0 notes

Text

Karlach: I found the love of my life. I'd say I'm pretty happy. Gale: And I couldn't be happier for you. A fitting reward for the sacrifices you made in getting here. Gale: I've told my students plenty of tales about our escapades. You're something of a hero to them, you know. Gale: I'd be delighted to introduce you to my current cohort - as a guest lecturer, perhaps? I'm sure they'd have plenty of questions for you. Karlach: Sorry, wiz, I'm going back to Avernus after the party. Gale: I suppose, if I were to open a contained portal in a particularly safe region of Avernus... devnote: Mulling the problem over, considering this solution Gale: No. The Blackstaff would never allow it. Health and safety, you see - it's all the rage in wizardry these days. devnote: Dismissing his previous thought - it will never work, Hint of an eye roll about the new health and safety regulations Gale: Perhaps I might come to you, then? I recently met the most excellent diabolist who should be able to lend a hand with the travel arrangements... Karlach: Sounds like you're coming to the Hells then, Gale. I can't wait. Gale: You just let me know which hill of burning sulphur to aim for, and I'll have popped through a portal before you can say 'Zariel'.

not only do i have a soft spot for karlach and gale's friendship, but gale rolling his eyes at the new health and safety regulations at blackstaff academy will never not be funny to me.

very in line with him trying to cast a spell with the blackstaff as a first year student himself, accidentally opening a portal to a different dimension, only to be greeted by a death slaad.

#gale dekarios#karlach cliffgate#gale of waterdeep#baldur's gate 3#bg3#baldurs gate 3#ch: gale dekarios#ch: karlach#vg: baldur's gate 3#series: baldur's gate#meta: mybg3#smh wizard aren't allowed to do things anymore these days

1K notes

·

View notes

Text

Dowager Queen Alicent

Season 1 comes to an end with the death of King Viserys and the coronations of Queen Rhaenyra and King Aegon... the civil war between Team Black and Team Green is set to wreck havoc on Westeros. Here we have the recently widowed Dowager Queen Alicent in her mourning greens. Can't be too bright about it just yet of course. Hopefully now you can see the ways that her design has grown more and more in the direction of fantasy-tudor. I love all the detailing in fanart for the series that utilize Tudor fashion and hoped I could pull from some of the shape language and the feeling of the "height of power" that Tudor style lends so well to costuming. I kept her buttons on the sleeves though because I thought that was a really fun nod to medieval fashion trends that the show included in her later dresses. See if you can spot all the details that imply strict religious dress regulations and direct visual opposition to Team Black!

I am the artist! Do not post without permission & credit! Thank you! Come visit me over on: instagram, tiktok or check out my coloring book available now \ („• ֊ •„) /

https://linktr.ee/ellen.artistic

#alicent hightower#team green#fire and blood#house of the dragon#redesigning hotd#ellenart#ellen artistic#character design#digital illustration#costume design#historically inspired#house hightower#medieval hightowers

666 notes

·

View notes

Text

GUC OFFİCİAL

Welcome to the world of GUC Official, where style meets sustainability. At GUC, we believe that fashion should not only enhance your wardrobe but also respect the planet. Our commitment to slow fashion ensures that every piece is crafted with care, prioritizing quality over quantity. Discover our exquisite collection, featuring breathable blazer linen that effortlessly elevates your look, luxurious silk clothing that drapes beautifully, and versatile basic cotton tees that form the foundation of a stylish ensemble. Embrace a more thoughtful approach to fashion with GUC Official, where every garment tells a story of elegance, comfort, and conscious living.

Slow Fashion

Embracing slow fashion means opting for quality over quantity. At GUC, we believe in creating timeless pieces that withstand seasonal trends. Our commitment to sustainable practices ensures that each garment, from luxurious silk clothing to versatile basic cotton tees, is crafted with care and consideration for the environment.

By focusing on slow fashion, we encourage mindful consumption. Each item in our collection is designed to be cherished and worn for years, reducing the need for fast-fashion cycles that contribute to waste. Choosing a chic blazer linen from GUC not only elevates your wardrobe but also aligns with a lifestyle that values sustainability.

Our focus on durable fabrics means that you enjoy longer-lasting pieces while making a positive impact on the planet. Each silk clothing item is meticulously crafted to offer both style and comfort, proving that ethical fashion can also be high-fashion.

Join the movement towards sustainable dressing by exploring our curated collection. Embrace slow fashion today and invest in garments that make a statement, both in style and responsibility. Discover the perfect additions to your wardrobe at GUC, where fashion meets conscience.

Blazer Linen

The blazer linen collection at GUC is the perfect embodiment of the slow fashion movement, marrying comfort with style in every piece. Crafted from high-quality, breathable linen, these blazers offer a lightweight alternative to traditional outerwear, making them ideal for warmer climates or any occasion where effortless elegance is desired.

Each blazer is thoughtfully designed, ensuring versatility whether you’re heading to the office or meeting friends for brunch. The natural fibers lend a relaxed yet refined look, showcasing the beauty of slow fashion by prioritizing sustainability and longevity in your wardrobe.

Pair your blazer with silk clothing for a truly sophisticated ensemble, or layer it over basic cotton tees for a more casual vibe. With shades ranging from muted pastels to rich, deep tones, our blazer linen collection caters to diverse style preferences, making it easy to curate a chic outfit.

Embrace sustainable fashion without compromising style. Invest in a GUC blazer linen, and experience the confidence that comes with wearing timeless pieces that are both stylish and environmentally conscious.

Explore our collection today and step into the world of slow fashion, where every piece tells a story of creativity, craftsmanship, and care for our planet.

Silk Clothing

Discover the luxurious appeal of silk clothing at GUC, Our silk garments exemplify the principles of slow fashion, combining elegance with sustainability. Whether you're dressing for a casual outing or a formal event, our silk collection offers versatility and sophistication.

The benefits of choosing silk clothing are immense. Silk is renowned for its softness and breathability, making it comfortable for year-round wear. It's naturally temperature-regulating, ensuring you stay cool in summer and warm in winter, while its hypoallergenic properties make it an excellent choice for sensitive skin.

Our silk pieces are not only about aesthetics; they are crafted with care to ensure durability. By investing in quality silk clothing, you're participating in the slow fashion movement, minimizing waste and encouraging a more sustainable wardrobe. Choose from flowing silk blouses, elegant dresses, and stylish silk scarves that elevate any outfit.

Join us in promoting sustainable fashion. Explore our collection of silk clothing today and experience the perfect blend of luxury, comfort, and eco-friendly style.

Call to Action: Visit GUC now and redefine your wardrobe with our exquisite silk clothing options that capture the essence of slow fashion.

Basic Cotton Tees

Basic cotton tees represent the essence of versatile and sustainable fashion. Crafted from high-quality cotton, these tees offer unmatched comfort and breathability, making them an essential addition to any wardrobe.

Designed with a focus on durability, our basic cotton tees are perfect for layering or wearing on their own. Whether you’re dressing up for a casual outing or lounging at home, these tees provide a chic and effortless look.

Available in various colors, they can easily be paired with your favorite jeans, skirts, or shorts. Embrace the concept of slow fashion; our tees not only last but also ensure that you’re making a conscious choice for the environment.

Experience the beautiful blend of style, comfort, and sustainability. Invest in basic cotton tees that elevate your wardrobe while supporting eco-friendly practices.

Don't miss out—explore our collection today and see how easy it is to embrace a mindful, stylish lifestyle with basic cotton tees!

753 notes

·

View notes