#Silicon Valley Bank

Explore tagged Tumblr posts

Text

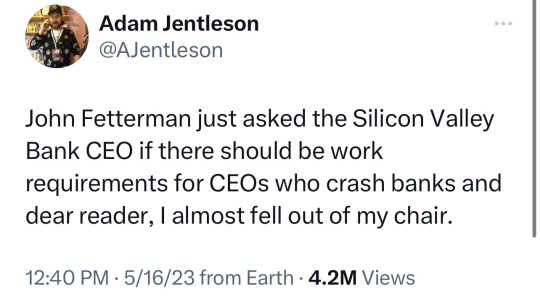

"Republicans want to give a work requirement for SNAP. A hungry family has to have these kinds of penalties," said Fetterman.

SNAP is the Supplemental Nutrition Assistance Program. Republicans want to make it even harder than it already is to access life-saving programs like SNAP and Medicaid, as a part of their “debt ceiling” “negotiations,” and their never ending attempts to to gut the social safety net, and their never ending assault on poor people.

"Shouldn't you have a working requirement after we bail out your bank with billions?" Fetterman asked Gregory Becker (a registered Republican), the former Silicon Valley Bank executive.

Other than blaming the media, customers and anyone except SVB Bank, Becker did not have a good answer.

It’s worth noting that

A) Becker dumped nearly 12,500 shares for more than $3.5 million on Feb. 27, the same day that Chief Financial Officer Daniel Beck unloaded $575,180 worth of company stock, and many SVB executives received exorbitant bonuses just hours before the bank run.

And B) Greg Becker lobbied the federal government to relax Dodd-Frank provisions on regional banks, and then Trump did precisely that.

245 notes

·

View notes

Text

6 Lessons YOU Can Learn from the Silicon Valley Bank Crash

When news of the Silicon Valley Bank crash broke, I sighed deeply. Because sighing deeply is the age-appropriate version of a toddler pounding their fists on the floor screaming “I don’ wanna, I don’ wanna, I DON’ WANNA!” That’s always how I feel when I have to understand some complicated new brouhaha caused by oligarchs’ greed, when all I truly need in this life is more naptime.

Guys, don’t worry. Because I am a grown-up woman with finely tuned coping mechanisms, I worked through my tantrum and I did it! I understand what the hell happened to Silicon Valley Bank.

Paragon of intellectual generosity that I am, I’m going to explain it back to you.

If you want an in-depth, technical breakdown, this ain’t gonna be it. I’m going to focus on what this means for us plebs. That means skipping all the boring parts, creatively employing childish metaphors, recklessly speculating about its impact on the future of the economy, and oversimplifying absolutely everything.

Complex, dense financial topics explained by babies, for babies. That’s the Bitches Get Riches brand promise!

Keep reading.

If you liked this article, join our Patreon!

75 notes

·

View notes

Text

SVB bailouts for everyone - except affordable housing projects

For the apologists, the SVB bailout was merely prudent: a bunch of innocent bystanders stood in harm’s way — from the rank-and-file employees at startups to the scholarship kids at elite private schools that trusted their endowment to Silicon Valley Bank — and so the government made an exception, improvising measures that made everyone whole without costing the public a dime. What’s not to like?

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/15/socialism-for-the-rich/#rugged-individualism-for-the-poor

But that account doesn’t hold up to even the most cursory scrutiny. Everything about it is untrue. Take the idea that this wasn’t a “bailout” because it was the depositors who got rescued, not the shareholders. That’s just factually untrue: guess where the shareholders kept their money? That’s right, SVB. The shareholders of SVB will get billions in public money thanks to the bailout. Billions:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

But is it really public money? After all, the FDIC payouts come from a pool of funds raised from all of America’s banks. The billions the public put into SVB will be recouped through hikes on the premiums paid by every bank. Well, sure — but who do you think the banks are going to gouge to cover those additional expenses? Hint: it’s not going to be the millionaires who get white-glove treatment and below-cost loans. It’ll be the working people whom the banks steal billions from every year in overdraft fees — 78% of these are paid by 9.2% of customers, the very poorest, and they amortize to a 3,500% loan:

https://pluralistic.net/2021/04/22/ihor-kolomoisky/#usurers

As Adam Levitin put it on Credit Slips:

They will pass those premiums through to customers because the market for banking services is less competitive than the market for capital. In particular, the higher costs for increased insurance premiums are likely to flow to the least price-sensitive and most “sticky” customers: less wealthy individuals. So average Joes are going to be facing things like higher account fees or lower APYs, without gaining any benefit. Instead, the benefit of removing the cap would flow entirely to wealthy individuals and businesses. This is one massive, regressive cross-subsidy. It’s not determinative of whether raising the cap is the right policy move in the end, but this is something that should be considered.

https://www.creditslips.org/creditslips/2023/03/the-regressive-cross-subsidy-of-uncapping-deposit-insurance.html

The SVB apologists display the most curious and bizarre imaginative leaps…and imaginative failings. For them, imagining that regulators will just wing it to the tune of hundreds of billions in public money is simplicity itself. Meanwhile, imagining that those same regulators would say, “Not one penny unless every shareholder agrees to sign away their deposits” is literally impossible.

This bizarrely inconstant imagination carries over into all of the claims used to justify the SVB bailout — like, say, the claim that if SVB wasn’t bailed out, everyone would pile into too big to fail banks like Jpmorgan. This is undoubtably true — unless (and hear me out here!), regulators were to use this failure as a launchpad for public banks, and breakups of Jpmorgan, Wells Fargo, Citi, et al.

This is a very weird imaginative failure. America operated public banks. It had broken up too big to fail banks. These weren’t the deeds of a fallen civilization whose techniques were lost to the mists of time. There are literally people alive today who were around when America operated nationwide public banks — a practice that only ended in 1966! We’re not talking about recovering the lost praxis of the druids who built Stonehenge without power-tools, here.

The most telling imaginative failure of SVB apologists, though, is this: they think that people are angry that the government saved the janitors at startups and the scholarship kids at private schools, and can’t imagine that people are angry that America didn’t save anyone else. If you’re a low-income student at an elite private school, there’s billions on hand to save you — but not because the government gives a damn about you — saving you is a side effect of saving all the rich kids you go to school with.

Likewise, the startup janitors aren’t the target of the bailout — they’re overspill from the billions mobilized to rescue the personal fortunes of tech billionaires who supply VCs’ investment capital. If there was a way to bail out the startups without bailing out the janitors, that’s exactly what would happen.

How do I know this? Well, first of all, the “investors” who demanded — and received — a bailout are on record as hating workers and wanting to fire as many of them as possible. As one of the loudest voices for the bailout said of Twitter employees, in a private message to Elon Musk following the takeover: “Day zero: Sharpen your blades boys 🔪”:

https://pluralistic.net/2023/03/21/tech-workers/#sharpen-your-blades-boys

But there’s even better evidence that the bailout’s intended target was wealthy, powerful people, and every chance to carve out working people was seized upon. When regulators engineered the sale of SVB to First Citizens Bank, they did not require First Citizens to honor SVB’s community development obligations, killing thousands of affordable housing units that had been previously greenlit:

https://calreinvest.org/wp-content/uploads/2021/05/Community-Benefits-Plan-SVB-CRC-GLI.pdf

Tens of thousands of people wrote to regulators, urging them to transfer SVB’s Community Benefits Plan obligation to First Citizens:

https://www.dailykos.com/campaigns/petitions/sign-the-petition-save-affordable-housing-keep-the-promises-silicon-valley-bank-made

As did Rep Maxine Waters, the ranking member of the House Financial Services Committee:

https://democrats-financialservices.house.gov/uploadedfiles/318_cwm_ltr_fdic.pdf

But First Citizens — a bank whose slot in America’s top-20 banks was secured through a string of exceptions, exemptions and waivers — was not required to take on SVB’s obligations to carry out loans to build thousands of affordable housing units in the Bay Area and Boston, including a 112-unit building for people with disabilities planned for a plum spot across from San Francisco City Hall:

https://www.levernews.com/regulators-stiffed-low-income-communities-in-silicon-valley-bank-bailout/

All those people who wanted SVB’s community development obligations to carry forward vastly outnumbered the people calling for billionaires portfolio companies to be saved — but they merely spoke on behalf of people who sought the most basic of human rights — shelter. No one listened to them. Instead, it was the hyperventilating all-caps “investors” who spent SVB’s no-good weekend shouting on Twitter about the fall of civilization who got what they wanted, with a bow on top, and a glass of publicly funded warm milk before bed.

The US finance sector is reckless to the point of being criminally negligent. It constitutes an existential risk to the nation. And yet, every time it gets into trouble, regulators are able to imagine anything and everything to shift their risks to the public’s shoulders.

Meanwhile, everyday people are frozen out. School lunches? Unaffordable. Student debt cancellation? Inconceivable. Help for the hundreds of thousands of NYC schoolchildren whose schools are facing a $469m hack-and-slash attack? That’s clearly impossible:

https://council.nyc.gov/joseph-borelli/2022/09/06/nyc-council-calls-for-mayor-adams-doe-to-fully-restore-469m-in-school-funding/

When it comes to helping everyday people, American elites and their captured champions in the US government have minds that are so rigid and inflexible that it’s a wonder they can even dress themselves. But when the fortunes and wellbeing of the wealthy and powerful are on the line, their minds are so open that some of their brains actually leak out of their ears and nostrils:

https://pluralistic.net/2023/03/15/mon-dieu-les-guillotines/#ceci-nes-pas-une-bailout

Every bank merger is supposed to come with a “public interest analysis.” But these analyses are “perfunctory.” They needn’t be:

https://openyls.law.yale.edu/bitstream/handle/20.500.13051/8305/Kress_Article._Publication__1_.pdf

First Citizens got a hell of a bargain: it paid zero dollars for SVB’s assets, its deposits and its loans. Any losses it incurs from its commercial loans over the next five years will be paid by the FDIC, no questions asked. The inability of regulators to convince First Citizens to assume SVB’s community obligations along with those billions in public largesse speaks volumes.

Meanwhile, SVB’s shareholders continue to claim that their headquarters are a relatively unimportant office in Manhattan, and not their glittering, massive corporate offices in San Jose, as part of their bid to shift their bankruptcy proceeding to the Southern District of New York, where corporate criminals like the Sackler opioid family have found such a warm reception that they were able to escape “bankruptcy” with billions in the bank, while their victims were left in the cold:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

Contrary to what SVB’s apologists think, the case against them isn’t driven by spite — it’s driven by fury. America’s “socialism for the rich, rugged individualism for the poor” has been with us for generations, but rarely is it so plain as it is in this case.

There’s only two days left in the Kickstarter campaign for the audiobook of my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon’s Audible refuses to carry my audiobooks because they’re DRM free, but crowdfunding makes them possible.

[Image ID: A glass-and-steel, high-tech office building. Atop it is a cartoon figure of Humpty Dumpty, whose fall has been arrested by masses of top-hatted financiers, who hold fast to a rope that keeps him in place. At the foot of the office tower is heaped rubble. On top of the rubble is another Humpty Dumpty figure, this one shattered and dripping yolk. Protruding from the rubble are modest multi-family housing units.]

Image:

Lydia (modified) https://commons.wikimedia.org/wiki/File:Vicroft_Court_Starley_Housing_Co-operative_%282996695836%29.jpg

Oatsy40 (modified) https://www.flickr.com/photos/oatsy40/21647688003

Håkan Dahlström (modified) https://www.flickr.com/photos/93755244@N00/4140459965

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#housing crisis#svb#silicon valley bank#plutocracy#bailouts#affording housing#socialism for the rich#rugged individualism for the poor#regional banking#community development banks#housing

89 notes

·

View notes

Text

“Big banks including JPMorgan Chase & Co. and PNC Financial Services Group Inc. are vying to buy First Republic Bank in a deal that would follow a government seizure of the troubled lender, according to people familiar with the matter.

A seizure and sale of First Republic by the Federal Deposit Insurance Corp. could come as soon as this weekend, the people said.

The San Francisco-based bank has teetered for weeks following the March 10 failure of fellow Bay Area lender Silicon Valley Bank. The SVB meltdown spurred panicky First Republic customers to pull around $100 billion in deposits in a matter of days.

The stock has lost some 97% of its value since.

(…)

A seizure and sale of First Republic would cap the astonishing collapse of a lender that was, until recently, the envy of finance. With some $233 billion in assets at the end of the first quarter, it would be the second-largest bank to fail in U.S. history.”

“The Federal Deposit Insurance Corp. has asked banks including JPMorgan Chase & Co., PNC Financial Services Group Inc., US Bancorp and Bank of America Corp. to submit final bids for First Republic Bank by Sunday after gauging initial interest earlier in the week, according to people with knowledge of the matter.

The regulator reached out to banks late Thursday seeking indications of interest, including a proposed price and an estimated cost to the agency’s deposit insurance fund. Based on those submissions Friday, the regulator invited some firms to the next step in the bidding process, the people said, asking not to be named discussing the confidential talks.

(…)

JPMorgan is among a small number of giant banks that have already amassed more than 10% of nationwide deposits, making the firm ineligible under US regulations to acquire another deposit-taking institution. Authorities would have to make an exception to allow the country’s largest bank to get even bigger.”

5 notes

·

View notes

Text

THE NEXT TIME banks need a bailout, they’ll have a new argument for why it’s necessary: national security.

In recent months, the Pentagon has moved to provide loans, guarantees, and other financial instruments to technology companies it considers crucial to national security — a step beyond the grants and contracts it normally employs. So when Silicon Valley Bank threatened to fail in March following a bank run, the defense agency advocated for government intervention to insure the investments. The Pentagon had even scrambled to prepare multiple plans to get cash to affected companies if necessary, reporting by Defense One revealed.

Their interest in Silicon Valley Bank stems from the Pentagon’s brand-new office, the Office of Strategic Capital. According to the Wall Street Journal, the secretary of defense established the OSC in December specifically to counteract the investment power of adversaries like China in U.S. technologies, and to secure separate funding for companies whose products are considered vital to national security. It enjoys special authority to use loans and guarantees not normally available to the Defense Department to attract private investment in technology.

#Twitter#Pentagon#National security#Threat#Senate intelligence#The intercept#Silicon valley bank#March#Defense one#Office of Strategic capital#Wall Street journal#Osc#December#China#U. S.#Defense department

2 notes

·

View notes

Text

Theory Alone Does Not Pay Bills

Theory Alone Does Not Pay Bills What is it really worth? Mr Market doesn’t care what I think. There is reason that the Silicon Valley Bank saga was important, it shed light on the fact that banks have a lot of assets (commercial real estate), which, in theory, are worth $xxx. They are allowed to value these assets using theory. Based on ‘theory,’ they are able to lend 10-11x of $xxx to Jae’s Rib…

View On WordPress

0 notes

Text

6 Lessons YOU Can Learn from the Silicon Valley Bank Crash

Keep reading.

If you found this helpful, consider joining our Patreon.

16 notes

·

View notes

Text

Silicon Valley’s Bank (SVB) Collapse

The hard-hit tech sector first made information in past due 2022 and early 2023 with mass layoffs.

What is Silicon Valley Bank?

SVB become founded in 1983 and become the sixteenth largest U.S. Bank before its collapse. They specialized in financing and banking for challenge capital-sponsored startup corporations — mainly technology organizations. Venture capital companies did enterprise there as well as several tech executives.

Why have banks, such as Silicon Valley Bank, failed in 2023?

The collapse happened for multiple reasons, including a lack of diversification and a classic bank run, where many customers withdrew their deposits simultaneously due to fears of the bank’s solvency. Many of SVB’s depositors were startup companies. They deposited large amounts of cash from investors because the tech was in high demand during the pandemic, said Jay Jung, founder and managing partner of Embarc Advisors.

0 notes

Text

I have written an article about the reason for Silicon Valley Bank's collapse

1 note

·

View note

Text

What the SVB Failure Teaches us About Investment Banking (Encore)

SVB sign in front of Silicon Valley Bank headquarters in Santa Clara, California. (Minh Nguyen, via Wikimedia Commons, licensed under CC BY-SA 4.0) The Silicon Valley Bank collapse brings with it memories of the wider 2008 economic crisis. Jeet Heer and John Nichols from The Nation join us to discuss the 2018 bank deregulations that set the stage for this moment and the risky investment strategy…

View On WordPress

#bailout#bank deregulation#Bernie Sanders#bonds#collapse#Congress#depositors#deregulation#Elizabeth Warren#FDIC#financial crisis#insurance#investment#investment capital#long term bonds#Silicon valley#Silicon Valley Bank#SVB#taxpayer

0 notes

Text

BancShares Acquires Silicon Valley Bank | A Strategic Move

Silicon Valley Bank (SVB), a US bank that went out of business, is selling its assets and loans to First Citizens BancShares. People were worried about the safety of other lenders when Silicon Valley Bank went bankrupt earlier this month. This caused bank stocks all over the world to drop sharply.

People in Europe worried about the strength of the big Swiss bank Credit Suisse sped up a deal for its rival UBS to buy it.

Even though bank stocks were higher when the market opened on Monday, the markets have remained nervous.

The shares of Germany’s Deutsche Bank fell by 14% at one point on Friday, but then they started to go up again. When trading began on Monday, they went up by about 3%.

There was a rush on the bank this month, so US regulators took over Silicon Valley Bank. Soon after, Signature Bank, another US bank, closed its doors.

This was the biggest bank failure in the US since the financial crisis in 2008.

0 notes

Text

The Silicon Valley Bridge Bank (SVB) Fiasco

The Silicon Valley Bank (SVB) collapse is a devastating reminder of the potential consequences of mismanagement and fiscal irresponsibility, as well as a story of what could happen if financial organizations aren’t as carefully managed as they should be. In 2016, SVB collapsed as a result of a $6.4 billion loan gone wrong and the failure of the institution’s leadership to properly manage its…

View On WordPress

#Bank Collapse#Banking#FDIC#Lehman Brothers#Silicon Valley Bank#Stock Market#SVB#us equity#US Equity Market#US Fed#us market#US stock market#us stocks

0 notes

Text

First Republic Collapse Was Caused By Interest-Only Jumbo Loans

Generous Interest-Only Jumbo Loans To Super Wealthy Customers Is What Drove First Republic Over The Cliff It appears the First Republic collapse was caused by the bank giving out attractive multi-million dollar interest-only jumbo loans to wealthy clients. The failed bank sold loans with rock bottom interest rates to rich clients. Several of these clients included Goldman Sachs President John…

View On WordPress

#banking#banks#failed banks#First Republic Bank#First Republic Bank Collapse#First Republic Collapse#interest only loans#jumbo loans#mortgage fraud#mortgages#real estate#Signature Bank#Silicon Valley Bank

0 notes