#Property ownership

Explore tagged Tumblr posts

Text

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

1K notes

·

View notes

Text

Hey y'all's in the state of Kansas DO NOT, UNDER ANY CIRCUMSTANCES, RENT FROM EUCALYPTUS REALTY or ANY Property owned by LEW MCGINNIS

First, my experience with them;

I had a 6 month lease filed with an apartment building that ended in October 2021, I signed the paper confirming I would be out in october, I moved out in october 2021. I had an eviction filed against me November 4th, 2021. I just found out they succeeded in filing an eviction against me. I was not contacted regarding this at all, even though they had my active phone number on file and had called me after I moved regarding paperwork on an old roommate who'd moved earlier in the year. They filed an eviction on me, for an apartment I was not living in, after my lease had ended, and made zero attempt at contacting me. I did not find out until attempting to rent a house with a friend. Noone has answered the phone for me, or for the new renting agency, and my application is going to be denied. All because of an eviction filed against me. For an apartment I did not live in anymore. After my lease had ended. What should I do now? I would try to pay anything they're trying to charge if I could get them on the phone. It's not like I can fight it in court, they already won. Everything I'm reading just says "ask the owner nicely to get it removed" and I don't think that's possible now given what I've found since looking into them.

Because HERE'S what I found after a little digging;

The owner is a real estate person based out of Oklahoma, and owns multiple properties in Topeka, Emporia, and Wichita (I found the number 35 in Topeka, but I couldn't verify that or tell you how many in the other two cities) . I'm finding all these news artical now about how he's filed the most evictions out of any realitor in my county, how his properties have major upkeep issues (my apartment had a hole through the glass back door that was never fixed, and I have video I can dig up of a leak in my ceiling from the apartment above me pouring water into my bathroom multiple times a day. Not leaking, or dropping, POURING, and it only got fixed cause I was lucky enough to run into the handyman and speak with him myself, and I'm even luckier he was there to run into) how he's had mold outbreaks in both Topeka and Emporia due to maintenance neglect, literal tax evasion on those Emporia properties , bribing tenants for good reviews in Wichita (he later refused to pay), rent hikes (the whole reason I didn't renew my lease is because of a 100$ rent hikes + new fees), bedbug and roach issues among other things.

This feels completely unfixable. I'm going to have to grovle at this man's feet to fix the fact that HE EVICTED ME FROM AN EMPTY APARTMENT AFTER MY LEASE HAD ENDED and even then it's not gaurinteeed.

Y'all's should boost this cause I don't want anyone else in ks to get stuck dealing with this shit

Don't rent from Eucalyptus Realty or Lew McGinnus

#anti capatilism#america#kansas#rent#renting in kansas#capatilism#landlords#psa#psa Kansas#please boost this is important#anti landlord#socialism#communism#politics#housing#housing crisis#rent crisis#rent hikes#property management#property ownership#eucalyptus realty#bad landlords

41 notes

·

View notes

Text

Insurance: Protecting Your Real Estate Investment

When you purchase a home or any piece of real estate, it's a significant investment, both financially and emotionally. You spend countless hours searching for the perfect property, secure a mortgage, and go through the intricate process of closing the deal. While you're likely aware of the importance of homeowner's insurance, there's another type of insurance that often goes overlooked but plays a vital role in safeguarding your investment: title insurance.

What is Title Insurance?

Title insurance is a specialized form of insurance that protects homeowners and lenders from financial losses related to defects in a property's title. A property's title is a legal document that establishes ownership and the right to use and possess the property. It also includes any claims or liens against the property, such as unpaid taxes, mortgages, or easements.

When you buy a property, you want to be certain that the seller has a clear and marketable title, which means there are no legal issues that could affect your ownership rights. Title insurance ensures that you are protected if any hidden title defects or legal problems arise after the purchase.

Why Do You Need Title Insurance?

Protection Against Unknown Title Issues: Title insurance provides you with protection against any undiscovered title problems that may arise in the future. Even a meticulous title search can't guarantee that every potential issue will be uncovered. Title insurance offers peace of mind, knowing that you won't be financially responsible for addressing these issues.

2. Safeguarding Your Investment: Your home is likely one of the most significant investments you'll ever make. Title insurance helps protect your investment by minimizing the risk of unexpected title disputes that could result in financial loss or even the loss of your property.

For more information visit → learnwithvm.com

#Title Insurance#Real Estate Investment#Homeownership#Property Ownership#Title Issues#Legal Protection#Lender's Policy#Owner's Policy#Real Estate Closing#Title Search#Title Defects#Mortgage Protection#Hidden Title Problems#Clear Title#Real Estate Transaction#Title Company#Title Examination#Title Policy#Title Search Process#Closing Costs

2 notes

·

View notes

Text

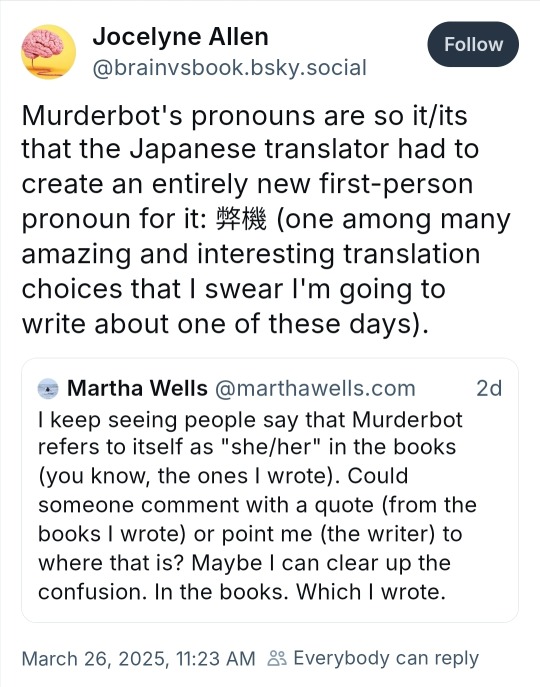

Bring this back

39K notes

·

View notes

Text

(also feel free in the tags to clarify Why you made the choice you made!! :0c)

#polls#tumblr polls#For me I think the top ones would be the House. The Money. or the Friend Group. But I ultimately might would go for the house#JUST becuase it would be my Dream House which means it would already meet mostly all of my specifications#and what I might be looking for. which would save a lot of time searching or customizing/rennovating.#Also because I could use that as a way to leave the US lol.. like .. if I get to choose my dream location.. couldnt I just choose some othe#country?? But I wonder how that works. Can you legally 100% have full ownership of a property in a country yet not be a citizen of that#country?? Would you show up and be like 'erm.. i own this house.. so i shall now live in it' and theyd be like 'uh no. you cant live here#despite owning the house. leave.' ??#So I think the initial process of 1. scraping together funds to actually MOVE myself and my most valuable belongings physically#TO another country. and 2. figuring out how to STAY in that country . might end up being difficult.. BUT. if I could just work that#part of things out then.. dream house?? security for once in my life?? stability?? :0#Though the $1mil is enticing it's also like.. I feel .. with the way housing prices are now... that's not much???#it's a lot I guess if you plan on like.. investing half the money and staying in an apartment for 5 years while you grow your wealth#or something. but if you're a 'I Need Stability NOW' ready to settle down person who would be most interested in owning a property rather#than nice clothes or a car or whatever other investments you could make then.. eh..?? It seems like unless you're okay with living in#a small town or kind of far away from the city - even some SMALL houses in majorly populated areas in the US will be like#$600.000 - $900.000 or something. like that would be MOST of my money. Which I know you could just pay partially and make#payments on it but idk.. in the option of just outright owning the house it seems like it'd end up being cheaper.#Plus I would want to own it fully asap because I'd be afraid of losing it somehow otherwise. like it being taken for medical bills or#something. which I thought was supposed to be - not IMPOSSIBLE - slightly more complicated legally if you actually have#paid off the house in full. I guess the issue then would be utilities and property tax and such. But I feel like thats overcome-able??#Like I could just stipulate that my Dream House has a little furnished addition or something and then find someone#with money and be like 'Look you can live in this extremely nice area with amazing ameneties and updated everything and ALL you have#to do is give me money to cover the utilities and property tax.'' or something like that. Like the little furnished addition is nicer#than the actual house. they have their own pool and spa and movie room or something and Ill also cook all their meals for them#or whatever (how luxurious it would be depeneds on how high the property tax actually is/how much I would need to entice them into#why it's a good deal for them to pay it for me lol). idk... something like that.. ANYWAY#I asked a few people I know though and one of them answered they'd rather have a romantic partner. the other one said they'd like#to be able to choose someone to die lol.. So I'm curious what people value the most

20K notes

·

View notes

Text

Handling taxes in real estate can be a complicated process. Whether you’re buying, selling, or investing, the financial and legal aspects of real estate transactions can impact your bottom line.

0 notes

Text

Pune Property Card Online – Importance, How to Register & Apply

Owning the best property or still looking to own one? The Pune Property Card is a crucial document you just can't ignore. Issued by the Pune Municipal Corporation (PMC), this card acts as official proof of ownership and simplifies property transactions. Whether you're buying, selling, or applying for a loan, having a Property Card ensures transparency and legal security.

In this blog, we'll explore all the aspects

What is the Pune Property Card?

The Pune Property Card is an official document issued by the Pune Municipal Corporation (PMC) that confirms property ownership and its details. It serves as a legal record and includes crucial property-related information such as:

Property size

Location

Market value

Survey number

Having this card is essential for ensuring legal proof of ownership, preventing fraud, and enabling seamless property transactions.

Why is it Important?

Here are some key reasons why this Card is important:

Legal Proof of Ownership

Prevents Fraud

Simplifies Processes

How to Register for Pune Property Card

If you are a property owner in Pune and need to register for a Property Card, these steps will help you:

Visit PMC’s Official Website

Fill Out Property Details

Upload Required Documents

Pay Registration Fees (if applicable)

Submit the Application

How to Apply Online

The Pune Municipal Corporation has made it easier to apply for a Property Card online. Just follow these simple steps:

Go to the PMC Website

Create an Account

Log in & Fill the Application Form

Upload Scanned Documents

Pay Online

Get a Reference Number

Important Tips

To ensure a smooth application process, keep these important tips in mind:

Double-check details: Enter accurate property and personal details to avoid rejections or delays.

Have documents ready: Ensure all necessary documents are available before starting the application process.

Stay updated: Keep your property records and PMC details up to date to avoid future issues.

Conclusion

The Pune Property Card is an essential document for property owners, ensuring smooth and secure transactions. It serves as official proof of ownership, prevents fraudulent activities, and simplifies the buying or selling process.

If you’re planning to buy or sell property in Pune, make sure to apply for your Property Card online. With a hassle-free digital process, you can safeguard your investment and enjoy a stress-free property experience.

To know more about real estate and the real estate world let BeyondWalls help you with that! It’s the best property site in India.

#real estate#Developers#Beyoundwalls#pune#Pune Property#Card Online#Register#property ownership#home loan

0 notes

Text

But when you realize very deeply that inheriting property is as destructive as psychological inheritance, then you will set about helping your children to be free from both forms of inheritance. You will educate them to be completely self-sufficient, not to depend on your own or other people’s favour, to love their work, and to have confidence in their capacity to work without ambition, without worshipping success; you will teach them to have the feeling of cooperative responsibility, and therefore to know when not to cooperate. Then there is no need for your children to inherit your property. They are free human beings from the very beginning, and not slaves either to the family or to society.

— J. Krishnamurti

#Property Ownership#Property#Education#Parenting#Philosophy#Psychology#Krishnamurti#Freedom#jiddu krishnamurti

0 notes

Text

link: https://bsky.app/profile/brainvsbook.bsky.social/post/3llc72lyhu22j

google translate defaulting to chinese at first

okay but for those of us with interests in both the murderbot and the daomu biji fandoms this is kinda hilarious

(english-side-only really, i get that the kanji and hanzi are completely different)

our good (air)ship murderbot! thanks google

#murderbot#the 'our' marker option as an implied holdover from company ownership is a genius choice#insight into murderbot's view of its own personhood#simultaneously an independent being and 'liberated' machine property

8K notes

·

View notes

Text

What is a Conveyance Deed Importance in Property Ownership Transfers

When you buy or sell property, the transfer of ownership is not just a handshake or an informal agreement. It requires a formal legal process that ensures both the buyer and seller are protected. Central to this process is the conveyance deed, a document that forms the backbone of property transactions. Whether you’re purchasing a home, leasing land, or even gifting a property to a loved one, understanding the conveyance deed is essential.

When you buy or sell property, the transfer of ownership is not just a handshake or an informal agreement. It requires a formal legal process that ensures both the buyer and seller are protected. Central to this process is the conveyance deed, a document that forms the backbone of property transactions. Whether you’re purchasing a home, leasing land, or even gifting a property to a loved one, understanding the conveyance deed is essential.

Definition and Scope of a Conveyance Deed

A conveyance deed is a legal document used to transfer ownership, title, and rights of a property from one person (the transferor or seller) to another (the transferee or buyer). It acts as proof of the transfer and ensures the legal ownership of the property is granted to the buyer.

While many people associate a conveyance deed with a sale, it is important to note that the term covers a wide variety of property transfers. Whether the transfer occurs as a sale, a gift, an exchange, or even a lease, the document used to formalize the transfer falls under the umbrella of a conveyance deed.

For example:

If you receive a property as a gift, the gift deed formalizing this transfer is a type of conveyance deed.

Similarly, when property rights are exchanged or leased, the legal documents executing these transactions also qualify as conveyance deeds.

In essence, any deed that facilitates the lawful transfer of ownership, title, or interest in a property qualifies as a conveyance deed.

Conveyance Deed vs. Sale Deed

One common misconception is equating a conveyance deed with a sale deed. Although a sale deed is a type of conveyance deed, it is specific to transactions involving the sale of property.

Think of the conveyance deed as a larger category or umbrella term. While a sale deed deals exclusively with sales, other deeds such as gift deeds, exchange deeds, or lease deeds fall under this broader category.So, the conveyance deed is the main concept that governs all property transfers.

Key Components of a Conveyance Deed

For a conveyance deed to be valid, it must include the following essential elements:

Description of the Property: The deed must detail the property being transferred, including specific boundaries, dimensions, and any unique features that define the property.

Names of All Parties: The document must clearly identify the current owner (transferor) and the new owner (transferee).

Previous Ownership History: A comprehensive record of all previous titleholders ensures clarity and prevents disputes over ownership.

Rights Associated with the Property: The deed must specify any rights that come with the property.

State of Delivery: Confirmation that the property has been physically handed over to the new owner is essential.

Consideration Clause: This includes details about the consideration received for the transfer. Consideration could be monetary (sale price) or non-monetary (gift or exchange).

Terms and Conditions: Any conditions specific to the transaction, such as payment schedules, liabilities, or usage restrictions, must be clearly outlined.

Signatures and Witnesses: Both the buyer and seller must sign the document in the presence of at least two witnesses, whose signatures also serve to validate the deed.

What Is The Process of Executing a Conveyance Deed?

Executing a conveyance deed involves several legal steps. Here’s a summary:

Drafting the Deed: The deed is prepared by a legal professional, ensuring it adheres to state laws and includes all essential details.

Payment of Stamp Duty and Registration Fees: The buyer must pay the required stamp duty and registration charges, which vary by state.

Registration at the Sub-Registrar’s Office: The deed is signed by both parties in the presence of witnesses and then registered at the local sub-registrar’s office. This step ensures the legal transfer of ownership.

Delivery of Possession: After the registration, the seller formally hands over possession of the property to the buyer, completing the transfer.

Why is a Conveyance Deed Crucial?

Without a properly executed and registered conveyance deed, the buyer does not have legal ownership of the property, even if payment has been made. In legal terms, the absence of a conveyance deed can lead to:

Disputes over ownership.

Inability to mortgage or sell the property in the future.

Risk of fraud or encumbrances tied to the property.

Moreover, a conveyance deed protects both parties. For buyers, it confirms that the seller has transferred all rights and authority over the property. For sellers, it signifies that they are no longer liable for the property or any disputes arising from it.

Conclusion

In real estate transactions, a conveyance deed isn’t just a document—it’s your legal shield. It secures the transfer of property, clarifies ownership rights, and prevents future legal complications.

Whether you’re a first-time buyer, a seasoned investor, or someone inheriting property, understanding the significance of a conveyance deed can save you from unnecessary risks.

Remember, real estate is one of the most significant investments you’ll make in your lifetime. Ensure it’s protected by executing and registering a conveyance deed with care and precision. If you have questions, consult an experienced property lawyer or a real estate agent to guide you through the process.

0 notes

Text

An open letter to the U.S. Congress

Pass the Stop Wall Street Landlords Act

15 so far! Help us get to 25 signers!

The housing crisis in our nation is reaching unprecedented levels, making homeownership increasingly out of reach for many hardworking individuals and families. A major contributor to this crisis is the unchecked activity of Wall Street firms and institutional investors who are treating homes as mere speculative assets, driving up prices and pricing out potential homebuyers. We cannot stand idly by as private equity giants and corporate landlords continue to exploit the housing market for their own profit, at the expense of our communities. The Stop Wall Street Landlords Act seeks to put an end to this predatory behavior by implementing sensible regulations and disincentives for large investors to hoard single-family homes. This legislation represents a critical step towards restoring balance and fairness to the housing market, ensuring that homes are available and affordable for those who need them most. I strongly urge you to support this bill and prioritize the needs of everyday Americans over the greed of wealthy investors. Our constituents deserve the opportunity to build equity and achieve the dream of homeownership without being priced out by exploitative corporate tactics. Together, we can take meaningful action to address this crisis and make housing more accessible for all.

▶ Created on October 23 by Jason

📱 Text SIGN PNJEQK to 50409

#jason#PNJEQK#Housing#Economy#Community#Affordability#Equity#Regulation#Real estate#Family support#Property ownership#Market fairness#Economic justice#Tenant rights#Investment reform#Financial stability#Wealth distribution#Corporate power#Responsible lending#Investor accountability#Corporate landlords#Single-family homes#Home affordability#Housing crisis solutions#Wall Street intervention#Real estate reform#Financial exploitation#Private equity regulation#Congressional action#Stop Wall Street Landlords Act

0 notes

Text

Commercial Real Estate Tokenization is revolutionizing how investors access property ownership through blockchain technology. This presentation, prepared by BlockchainX, will explore the concept of tokenizing commercial real estate, explaining how it works and its benefits for both investors and property owners.

check out us : https://www.blockchainx.tech/real-estate-tokenization/

0 notes

Text

Your Guide to Securing a Golden Visa for Property Owners in Dubai

The Golden Visa is a long-term investment visa and is a kind of residency by investment program. It was introduced in the year 2019. The UAE Golden Visa allows for a 10-year residency and another variant of 5 years for those planning for a short-term residency. It is an initiative to attract talent and foreign investment to the country. The Dubai Golden visa gives you many privileges like long-term residency, working, studying and more advantages. The UAE Golden visa is granted to only those people who fall under any of the 7 categories which we can discuss later in this blog. In this blog, we are mainly discussing the Golden Visa for Property Investors.

Benefits of Golden Visa

Getting a UAE Golden Visa by investing in real estate gives many advantages. Here are some benefits of Golden Visa for real estate investors:

Long-term residency in UAE up to 10 years

You can sponsor your family for the same period.

Sponsor up to 3 maids and drivers

Entry visa valid for 6 months with multiple entries to proceed with residence issuance

Stay outside the UAE for more than 6 months, the residency visa will be valid

Sponsor for residence

Special discounts on cars, loans and other banking services.

If you are planning to start a business in UAE, then you can sponsor a particular number of visas for employees

Eligibility Criteria For UAE Golden Visa Real Estate Investors

The UAE Golden Visa offers a great opportunity for real estate investors. If you buy property in the UAE, you might qualify for a long-term visa without needing a local sponsor. This visa lets you live, work, and invest in the UAE for an extended period. A 10-year Golden Visa is the option for property investors. The property value needed to qualify may vary, but investing in real estate could open the door to these long-term visas. This makes it easier for foreign investors to manage their property investments and enjoy living in the UAE. When your visa expires, you can renew it easily, allowing for long-term stability in your investment and residency.

Requirements For Golden Visa For Real Estate Investors:

Investment Value: You need to spend at least 2 million AED on property.

Type of Property: You can Invest in industrial, commercial, or residential properties.

Ownership: You must own the whole property yourself.

Financial Stability: You need to prove the financial stability and lack of financial liabilities.

Also, read “UAE Golden Visa For Business Investors and Entrepreneurs” for detailed information regarding who is Eligible for a golden visa.

How to apply for a UAE Golden Visa?

Applying for a Property Investor Golden Visa is not a complicated task if you have all the necessary documents. Still, people consider applying for a Golden Visa as a complicated task. Intellect Chartered Accountants simplifies the entire Golden Visa Process, thereby ensuring you receive the visa on time specified by us. Intellect Chartered Accountants is the leading chartered accountants and auditors in Dubai having 21+ years of management experience, and has a dedicated team for Golden Visa Services. Our team of experts takes care of the document verification and coordinates with government agencies.

UAE Golden Visa Process For Real Estate Investors:

Step 1: Checking Eligibility

The first step to applying for a UAE Golden Visa is to check whether you meet the basic eligibility criteria, that is whether you have a property in UAE worth AED 2M.

Step 2: Collect Required Documents

Copy of property deed or ownership title

Passport copy with a minimum validity of 6 months

Proof of Investment: There should be a document showing the value of the property. It should be at least AED 2M.

Marriage Certificate: Either husband or wife can be on the title deed. In this case, the marriage certificate needs to be attested by Foreign Affairs. One will be the visa holder and the other will be the sponsor.

Health Insurance: There should be a valid UAE health insurance certificate

Passport size photo

Step 3: Apply online or through an authorized Golden Visa service provider

If you have all the above mentioned documents you can apply for a Golden Visa either yourself or make it simple by choosing an experienced Golden Visa Service in Dubai.

Step 4: Medical Test

Before the Golden Visa is processed you will need to undergo a medical examination, which is the basic requirement for all residency visas.

Step 5: Pay the fees

The final step of the Golden Visa application is to pay the stipulated fees which include medical examination fees, processing fees and visa issuance fees.

After successfully submitting the Golden Visa application, you may need to wait 2-4 weeks to receive it.

Contact Our Team:

You can contact Intellect Chartered Accountants for Golden Visa Services, our team will assist you from visa application to completion stage.

Website:https://intellectca.ae/

Phone/Whatsapp: +971 42229911

Email: [email protected]

If you are interested in a golden visa for real estate investors, then apply for the UAE Golden Visa straight away and get the most from the long-term residency visa.

0 notes

Text

Squatters Take Over Multimillion-Dollar Hollywood Hills Mansion

In a stark contrast between wealth and desperation, a multimillion-dollar mansion in the Hollywood Hills has become the target of squatters, sparking concern among residents and local officials. The sprawling four-story home, reportedly owned by John Powers Middleton, whose father owns the Philadelphia Phillies, has been vacant for nearly a decade. In the past year, squatters and graffiti…

#graffiti#graffiti taggers#have-nots#haves#John Powers Middleton#MsDadeCounty#Multimillion-Dollar Hollywood Hills Mansion#property ownership#Squatters#Squatters Take Over Multimillion-Dollar Hollywood Hills Mansion

0 notes

Text

To alleviate financial pressure and repay debt, Brown sold several properties and he and his family moved into a one-bedroom unit in a property he owned, while he worked a 100-hour week in his business for nominal wages.

"Westpac: The Bank That Broke the Bank" - Edna Carew

0 notes

Text

0 notes