#financial regulation failures

Explore tagged Tumblr posts

Text

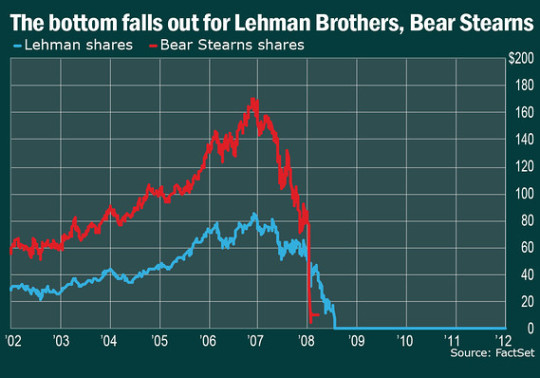

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges. ll. Background of the 2008 Market Crash A. Economic conditions leading up to the crash Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

#2008#bankruptcy#credit default swaps#crisis#derivatives#financial collapse#fraud#government bailout#investigation#lending practices#mortgage-backed securities#regulation#regulatory failure#risky loans#Silicon Valley Bank#subprime mortgages#systemic risk#United States

11 notes

·

View notes

Link

will it lead to financial melt down if there r gonna b more banks to n shutdowns within next few weeks? Silicon Valley Bank's shutdown is the US' largest failure since Washington Mutual went bust in 2008 during the financial crisis.

#New York regulators close Signature Bank#second US bank failure in days after SVB collapse#will it lead to financial melt down if there r gonna b more banks to n shutdowns within next few weeks?

0 notes

Text

How To Write ASPD / Psychopathy

half educational, half ramble. dedicated to the creepypasta fandom.

(check out my how-to-write bipolar + ticci toby here)

What is ASPD?

Antisocial Personality Disorder (ASPD) is characterized by a disregard for others rights and feelings. It's a personality disorder, which means the mindsets and behaviours associated with this condition are deeply ingrained and maladaptive.

The current DSM-5 diagnostic criteria states that to be diagnosed with ASPD, a patient needs to have a long-term (occurring since at least age 15), consistent, and persistent history of three or more of the following:

failure to conform to social norms; repeatedly breaking rules/laws that may be grounds for arrest

deceitfulness; lying, tricking others for personal gain

impulsivity or a failure to plan ahead

irritability and aggression; fighting, hostility, outbursts

reckless disregard for the safety of self or others

irresponsibility; repeated failure to comply to work or financial obligations

lack of remorse; being indifferent to or rationalizing having mistreated or hurt others

ASPD, by definition, can only be diagnosed in people who are 18+. Minors cannot have ASPD due to treatment and intervention reasons. A minor who exhibits traits of ASPD will be diagnosed with Conduct Disorder.

At it's core, though it may seem like people with ASPD are just hostile and insensitive and rude, is a defense mechanism formed in childhood, typically in response to an abusive environment. Self-preservation and a "dog eat dog world" mindset are very common in those with ASPD. Everything is about doing what it takes to retain social dominance, control, and ultimately safety. Boredom and risk-taking is also very common in people with ASPD, and many people with this condition have never had proper, healthy influences in childhood to teach them proper manners, social norms, morals, or how to regulate their emotions and aggression.

It is a chronic condition that affects about 1-3% of the population. Its very prevalent in the prison population as well. ASPD not only causes a person to potentially cause harm to others, but is a condition that very negatively impacts the patients themselves.

(Note: The term "sociopathy" is typically used to refer to an extreme presentation of ASPD. "Psychopathy" may sometimes be seem as a very very extreme presentation of ASPD)

What is Psychopathy?

Psychopathy refers to a set of traits/issues that might be seen in patients. It is NOT a diagnosis. If psychopathic traits cause dysfunctional behaviour in an individual, they will most likely be diagnosed with ASPD.

Psychopathy is now most commonly used in research settings to use it as a term that describes certain patterns and behaviours. It is something professionals study, not diagnose.

The traits related to psychopathy are:

manipulative behaviour; superficial charm, persistent lying, deceiving others

grandiose sense of self

lack of remorse or guilt; lack of empathy, callousness, shallow emotional expressions

reckless lifestyle; need for stimulation, parasitic (constantly takes from others), lack of realistic long-term goals, impulsivity

antisocial behaviour; poor behavioural control, early behavioural problems, trouble with the law in youth

Not all psychopathic people fit the criteria for ASPD, not all are disordered by their traits, and not all people with ASPD are considered psychopathic. But there is a very big overlap.

Psychopathy is typically only recognized in a forensic or research setting. It is often wrongfully used in the media to describe people who are serial killers, abusive, or used to dehumanize others.

Personally, I believe that media and creators need to move away from the terms psychopath/sociopath. They have far too much negative connotation that only exists to demonize people who suffer with unconventional traits. If you want to write psychopathy correctly, do your research on what it looks like in its presentation, and just drop the label.

What are some harmful tropes with ASPD/Psychopathy in media?

ASPD and Psychopathy have been tossed around in many different settings as ways to cheaply create an evil villain, or a cold calculated monster, or a reckless criminal. There has been only one instance in my lifetime of watching hundreds of movies and shows that I have seen an accurate, humanizing portrayal of ASPD. (That show is House MD by the way, I highly recommend if you want to see good representation).

So what are some of the tropes to acknowledge and avoid?

1. Psychopathic serial killer

Have you seen American Psycho? Great movie. Don't do that. While the character Patrick Bateman is commonly associated with the terms "narcissist" and "psychopath", he also is a satirical character who is a very dramatized and exaggerated presentation of some psychopathic traits.

I will be honest. A lot of real-life serial killers do suffer from various mental health conditions, but correlation is not causation. In the Creepypasta fandom we are surrounded by different characters who are almost all serial killers, and people like to make things easy and just throw the label of "psychopath" onto them and call it realistic. This is very cheap, and very harmful.

If you want to write a psychopathic serial killer character, then acknowledge how harmful, fear-mongering, and dehumanizing this trope is towards people who actually suffer from these traits.

2. ASPD synonymous with abusive behaviour

ASPD is a disorder that does cause people to do and say things that will harm others in some way. Cluster B personality disorders are commonly seen as 'social disorders', as in they cause dis-order in interpersonal relationships, and in response to society. Borderline personality disorder (BPD) for example may cause somebody to threaten harm to themselves in response to percieved abandonment, or to have intense fights due to emotional dysregulation.

ASPD in particular may cause someone to be insensitive towards others problems, lack morality, be aggressive or hostile, put others down, or get into reckless situations. This is why they are disorders. Because they cause significant and serious problems in the persons life.

It is not pretty, and it's not fair, and yes, people with disorders may cause harm to others due to behaviours associated with their condition. But there is a difference between causing harm, and abusing another person.

Lying to someone is not inherently abusive. Being reckless is not inherently abusive. Being an insensitive asshole is not inherently abusive. To not understand the nuance and the complexity of these situations is to completely demonize and stigmatize a serious mental health condition. You don't call people with BPD abusive for their actions inherently, because you acknowledge they are hurting and only doing what they know to cope with this hurt. Of course it's unhealthy. That's what a disorder is. That does not make someone abusive by default. Anyone with any condition, even neurotypical people can be abusive.

3. Cold, emotionless robot

People with ASPD can and do feel emotion. People with psychopathic traits can and do feel emotion. They get sad, disappointed, disgusted, happy, excited, jealous, hurt, angry. There is nothing in the ASPD criteria that states anything about emotional presentation or experience.

In psychopathy, it is mentioned that there may be a shallow emotional expression. This may also be present in ASPD. This means that while a person will feel emotions, it is either beat down or brushed off, or completely repressed. The emotional repression may come from childhood abuse where they were punished for expressing emotions, or expressing emotions had caused them harm.

Lacking emotions/emotional expression is instead highly linked to Schizoid Personality Disorder, and is apart of the criteria for said disorder.

Media protraying people with ASPD/psychopathy as cold, emotionless, calculating robots is another trope used to dehumanize people with mental health issues. It's used to make people with ASPD seem evil or not having feelings that could be hurt. In reality, nearly everything a person with ASPD does, is their dysfunctional way of protecting themselves from being hurt.

People with ASPD may lack the emotional capacity for things such as empathy and remorse, though. Its common that they are unable to care for, or feel upset for others suffering. They may also be unable to feel guilt. This criteria is seen in about 51% of people with ASPD and is associated with more extreme presentations.

Do you headcanon anyone to have ASPD?

Yes, but I don't like to use the label on them. I do write a lot of antisocial mindsets into my headcanons for Ticci Toby, and I heavily write ASPD into my OC, Tobin.

For Toby, his presentation of ASPD comes in the form of rebellion, not understanding/following social norms, recklessness, and a strong desire for power, dominance, and control. I write this as his subconscious response to the trauma he faced in childhood. As a child Toby was constantly put down and made to feel small and powerless at the hands of his father. In order to make sure his father abused only him and not his mother and sister, Toby would act out and be a troublemaker. I think that he would have a lot of ASPD behaviours and views on the world.

For my OC Tobin, he's pretty similar in presentation in regards to power/control, and not following social norms. He is very prone to justifying and rationalizing his behaviours to the point he doesn't feel remorse for the harm he causes. Tobin grew up in a very unstable and abusive environment where, like Toby, he did what he needed to do to get by. He never learned proper morals, norms, regulation, etc. But Tobin does care about others. He takes care of his little sister, and loves his girlfriend, and is very protective. Tobin is still a complex human being with more to him than just being an antisocial insensitive prick.

How can I write a character with ASPD?

Do proper research. Not on Reddit, or Quora, or WebMD. I mean go find trusted, scholarly articles and read real scientific papers and studies on ASPD. Do research into how/why it forms, the mindsets, the symptoms and their presentation, the neuroscience even.

Humanize your characters. While it's fun to throw around a bunch of negative and toxic traits to a character you want people to see as 'bad', it's lazy character development. Give them good, positive traits as well. People are very complex, and nobody will fit in to the mold of good or bad. Make them human enough where someone wont look at your character with ASPD and assume everyone with ASPD are monsters.

But also, don't water down the disorder. ASPD does cause harm to the patient and the people in their life. I've seen it a lot where people will try to fight against stigmatization by completely glamorizing the disorder. "People with ASPD aren't inherently bad! They don't actually hurt others or act hostile or say insensitive things"... Yes we do. And it causes many problems. And that is why its a disorder.

Personally I don't like to throw the ASPD label onto my characters even if I do write them to have ASPD because I feel like it just boxes them in. If you write a character with ASPD, try doing it in a way where a professional would be able to tell they have ASPD without you even mentioning the label.

Remember that ASPD is COMPLEX. It varies vastly in its presentation, its a disorder that is life-consuming and the dysfunctional beliefs and behavioural patterns are deeply ingrained and consistent throughout many different areas in someones life. It's a label to describe preexisting issues. It's something that is highly associated with childhood trauma, and drug addiction, and general suffering for the person dealing with their own chaotic mind.

The biggest problem I see that frustrates me is the way people throw around the terms "psychopath" and "sociopath", especially when someone just wants to add a layer of edginess onto their character. Remember that you are dealing with a condition that real people suffer from every day. If you can't handle it respectfully, and if you would demonize someone with ASPD in real life for acting as your character does, just don't write it in. Keep the label separate. We don't need any more stigmatization and misinformation.

I know this was very long, but it's such a multifaceted and complex issue and I've seen it enough times in the fandom to be frustrated enough to write this. If you have any questions, want more advice or information, please feel free to ask away in my ask box 🔥

#tombtalk#creepypasta#creepypasta fandom#creepypasta headcanon#ticci toby#clockwork#ticci toby headcanons#creepypasta ticci toby#jeff the killer#creepypasta jeff the killer#eyeless jack#creepypasta art#creepypasta headcanons#creepypasta oc#creepypasta fanfiction#aspd#antisocial personality disorder#cluster b#writeblr

553 notes

·

View notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

252 notes

·

View notes

Note

Your tags on the 'hormones' post are illuminating! I can only imagine how hard it is to keep desperate, entitled people from hurting themselves when their need is so high for help but their finances (or reluctance to trust Big Medicine) relegate them to seeking that help from supplements. It's kind of how I feel about pet products: I was the lead on customer care for a Big Brand for like 4 years and I'm scarred for life. All that to say, your viewpoint on it is one I tend to look for when I see those essential oils/vitamin/fad supplements posts come around so thanks for sharing!

Yeah, even when they can be really self-righteous and weird about it, it's hard to not still think of people deep in the alternative medicine bog as victims. Despite largely being a monetary grift that at best does very little and at worst poisons you, miracle supplements are still an accessible grift to most people. In America particularly where healthcare is hidden behind not just financial but often also bureaucratic barriers, it's easy to lose faith in the system and turn to something that promises to fix what ails you and all you have to do is drive to the crunchy grocery store once a month and pay them $50.

Of course, the people refusing to regulate dietary supplements are the exact same ones refusing to do anything about the medical insurance industry, cashing out on both ends of the problem. It takes complete advantage of how many hurdles you have to go through by design, and that doesn't even touch on the shaky faith many minorities have in particular surrounding medicine for completely different systematic and legislative failures. Historic trauma (from James Sims' experiments, to Tuskegee, to Henrietta Lacks, and everything in between) combined with an enduring and overwhelming dismissal by doctors regarding symptoms has sown mistrust in pharmaceutical medicine among many black americans, leaving their communities particularly vulnerable to miracle cure grifts (irish sea moss is a big one right now). The proliferation of wellness MLMs among church congregations also helps to easily seed these beliefs in many minority communities, where community pressure is high and language/economic barriers make researching the claims a hurdle itself.

We often think of gaunt white women with birkenstocks and an ominous rictus as who mostly falls into the alternative wellness pit but that's honestly because they're usually the ones selling it on social media. Their audience, the ones who came to me showing me their tiktoks and asking if I sold this miracle pill, were largely minorities over 50 years old, usually women. The people who slip through the medical cracks the most.

And like... it's not going to change unless the process of getting proper healthcare stops being the arcane fucking ritual it's become, and education for doctors of all economic classes becomes more accessible. And unfortunately, as I post this on Jan 21 2025, I know it will only get worse before it gets better.

59 notes

·

View notes

Text

My mom comes over a couple of times a week to help me keep the apartment tidy and to body-double so I can focus on work.

"Mind if I open this?" she asked me this morning, holding up an envelope I'd tossed onto a pile of clutter the week before. I hadn't opened it because I already knew what it was—the decision of my appeal against being judged "medically ineligible" for permanent disability benefits, which are almost double what I get now and would cover rent and food. Absolutely everyone, from disabled advocacy groups to the legal aid lawyer who helped prep me for the hearing, told me that there was basically no chance I'd get deemed eligible on the first appeal. Normally it takes 2 or 3 application-appeal cycles (9-10 months each) for people to get into the program.

"Go ahead," I told her, and then turned back to other work. I've got a lot to do given how well my Kickstarter is doing, whether it's setting up the behemoth new printer I got off Kijiji for 10% of its original value, to scheduling work meetings with my newly-hired personal assistant. I've always got so much on my plate, and the number of hours in the day I can focus on it is countable on my hand that's missing fingers. And I'd love to get a sewing pattern out for my "just the sleeves, please" costume idea out in enough time for people to use it for Halloween, but I still need to make mock-ups and hire someone who's used to producing digital sewing patterns.

"I think," Mom said quietly, leafing through the letter, "that you won."

The letter ends like this:

Conclusion: The Panel finds that the Appellant meets the definition of "severe handicap" as is set out in the Regulation and therefore reverses the Director's decision.

Yeah. It means I won.

The benefits program will require another eight weeks to double-check my financial eligibility using information they already have, and to process my new program status to reflect an increased benefit rate and a different health insurance program.

Right now I'm really feeling this line from Komarr, by Lois McMaster Bujold: "But do you know--well, of course you could, but… the business with [throwing yourself at] the brick wall. Failure, failure was grown familiar to me. Comfortable, almost, when I stopped struggling against it. I did not know achievement was so devastating."

It felt like my whole life ended in a flaming wreck when I had to give up counselling. I lost part of who I was when I did that, and spent years telling myself I'd pull up my socks at any minute and go right back to it. But the truth is, I am not capable of doing that job as well as it needs to be done, and it's one of those jobs where you half-ass things at the peril of the vulnerable people who trust you.

And what if... the worst had happened, and I lost it all, and then in clawing my way out of the pit, trying to get purchase on absolutely any kind of survival I could, I found my way to something new and solid and real. What if it was okay after all?

I'm still having trouble believing it, but the letter keeps saying what it said.

I'm gonna go sew things, and see if it feels any more real in the morning.

187 notes

·

View notes

Note

Modern AU head-canons for these Dune characters:

Feyd Rautha

Glossu Rabban

Piter de Vries.

ohh okay this is interesting. I am not really that used to headcannons/ AUs, as I'm honestly new to engaging with fanfic in general so my apologies in advance if it doesn't totally fit, but here are my headcannons and ideas for how I'd do a modern AU with these characters.

Feyd Rautha:

Feyd Rautha is the heir apparent to a large spice mining company- in this case, you could substitute an oil or mining company for modern AU. The company culture is highly toxic, but Feyd likes that. He's known to churn through interns and keeps a non-existent sleep schedule.

His overall dynamic is finance bro meets basically any character from succession (think a slightly more financially literate Roman Roy). He buys luxury items just to fit in, however he has just enough taste so that it actually works. He considers most of these purchases a waste of money, but also his right and/or part of the job as heir.

As part of the Baron's inner circle, he has knowledge of most of the company's inner workings and takes great personal pride in digging up as much information as possible on the people he doesn't already control. He will often go to conferences and events just to get a read on competition. He secretly longs for someone to take that kind of an interest in him, but no one has just yet- many still think that he's too young and unpredictable to inherit.

After all- there is that rumor that he tried to kill the Baron.

Glossu Rabban

If Feyd is the more of a Roman Roy, Rabban is Conor. He had ambitions at the company which ended in failure, and has been reassigned to lobbying. Rabban is attempting to trade off of his industry connections to get into politics, if he can. He's aware his current position is tenuous at best and that he might need to make his own career. As the family industry is regulated, everyone basically hates this pipe dream of a career ambition. His moves are too obvious and clumsy, and he often tries to influence someone only to find that Feyd has already discussed the business with them. He's not a total failure, but his family just doesn't appreciate any success outside of financial success.

Piter de Vries

Piter is a math genius that works in data modeling and analytics. The Barron and Feyd love that he makes them money, however he's abrasive personality wise. He's known to use a myriad of drugs recreationally and at work, just because solving the same problems sober is too boring for him. The company has tried to hire assistants that can help him or at least explain his reports palatably, but he insists on doing the work himself and his own data models for fun in C. Not C++, C. The entire department rests on his shoulders and the Baron is weighing if Piter is worth putting up with. He gets the work of a department done on one salary, but also insists on making MILF jokes about lady Jessica basically any time she's within his zip code.

Would love to know your thoughts <3 Thanks for this ask!

55 notes

·

View notes

Text

By now, every pundit in America has their own 2024 election take, mostly confirming their prior opinions. Every Republican has a take, too, which is that Americans voted resoundingly for — well, for whatever policy that Republican cares about, from opposition to transgender rights to support for prayer in schools. And of course, progressives, especially younger ones, have every right to feel afraid, angry, or alienated. But the data tells a specific story, not a choose-your-own-adventure. And that is that swing voters voted mostly out of economic insecurity and discontent. They actually liked Kamala Harris more than Donald Trump (Harris’ favorability was 48 percent, compared to 44 percent for Trump). But Harris was the incumbent, and incumbents don’t win elections when people think the economy is bad. This is not just an American phenomenon. As the Financial Times reported, in every developed country in the world, the incumbents lost this year. This is unprecedented. If, like me, you’re being kept awake at night thinking about this election, this explanation helps. Yes, people were willing to put up with Trump’s criminality, coup attempts, and extreme xenophobia, and that is still terrible. Many were also on board with scapegoating immigrants for our economic woes, which is as factually preposterous as it is morally offensive. But they didn’t vote for MAGA. They didn’t vote against women, or wokeness, or coastal elites, or climate regulation, or government regulation in general, or queer people. Not directly, anyway. They voted against the incumbent party, like every other developed country in the world this year. The shock waves from the Covid-19 pandemic — inflation, empty shelves, housing prices — are global, and this is a global trend. Everywhere in the world, voters have chosen to throw the bastards out because of the economy. In fact, if you look closely at the Financial Times data, Trump actually did worse than most other non-incumbents. Yes, he won a clear victory. But it was not as big a victory as parties in France, Italy, or even New Zealand. [...] So what happens when the emperor is revealed to have no clothes — or even worse, the garb of the same financial “elites” he claims to be against? Obviously, the MAGA faithful will stay with Trump no matter what — after all, his failure to bring about revolution in 2017 spawned the QAnon conspiracy theory, which said he was really about to do it, any day now. But the economic voters that gave him his victory could abandon Trump if he can’t deliver results. And he cannot. While Trump is busy trying to throw his enemies in jail, he has no plan — not even “concepts of a plan” — for the kitchen-table concerns that actually put him into office. Maybe, just maybe, voters will see they’ve been conned. That is the best we can hope for.

Jay Michaelson for Rolling Stone on Donald Trump and how he'll make America worse off (11.11.2024).

Jay Michaelson wrote in Rolling Stone that some of who voted in Donald Trump due to “muh economy” or “muh grocery costs” could be in for a shock.

#Jay Michaelson#Rolling Stone#Donald Trump#Opinion#2024 Presidential Election#2024 Elections#Economy

35 notes

·

View notes

Text

How we ended in the darkest timeline

I actually wanted to talk a bit more about the French Revolution, but given recent events, I fear like I need to talk about this for now. Mainly because over the weekend I had so many talks about this, and have reached the point where I just need this blog to link back to.

You know how people keep joking about how we ended up in the darkest timeline, right? Well, what can I say? It is probably right. And by now I can tell you pretty definitely why.

Now mind you, like with everything there is a multitude of reasons for this. Technically we can go and say: Yes, we are here because colonialization happened - and it would not be wrong. We can also say that it is because of Napoleon, and because the failure of the French Revolution - and that would not be entirely wrong either. And we absolutely have to also say, that a bit reason is that instead of fighting fascism everyone decided after WWII, that fighting communism would be so much more important.

But I think a lot of the stuff we deal with right now is very much linked to one specific thing: The 2008 financial crisis - and the lack of regulation that lead up to it.

This is the moment where I am gonna tell you to watch The Big Short. I know most of you have probably not done that before. Because the movie feels like Oscar bait and also, who wants to watch a 2 hour movie about the financial market, but trust me on this: The movie is actually made really well and explains what happened back then very, very well and in a way that at least hits my autistic humor very well.

But basically, you need to understand two things: For the longest time the financial market really only traded companies and investments into them. But at some point during the late 70s and early 80s someone realized that there is something they were not trading on: depts. Because obviously most credits are given out by the banks and the financial industry. Not really investments, because there is a promise this stuff gets paid back eventually. And so they started trading depts with each other.

If you do not see the problem with this, let me explain: If you buy the dept someone has with another company, you basically are just making a bet with them the long way around. If you buy a dept, you bet that the person will pay the debt back - if you sell it, you kinda are betting against it.

There is a lot of weird financial tooks for this kinda stuff, but this is what it comes down to. The financial market became more and more a big ass casino, only that other than any other gambling it was not treated as this - and the money they were using on gambling was actually money that did not belong to them.

Because here is the thing: The main players in the financial market are either banks or groups that invest for their customers. While in the second case the people at least are fully aware of the fact that the financial institution will trade with their money, a lot of bank customers are not really aware of this. Sure, they kinda know that when they keep their money at the bank they might get interest, but most of them do not understand why. Because really, it does never get fully explained to them, that the bank will use that money to trade and invest with it.

And this is kinda part of the issue.

See, what happened in 2008 was, that the banks traded with indexes (so basically bundles) of thousands and thousands of house mortgages. And in those bundles were so called sublime mortgages, which is financial speak for "dog shit mortgages we knew the people taking them out would be unable to pay, but we didn't give a fuck". And a lot of those mortgages were due in 2008, which is why those indexes failed in 2008, resetting their value to close to 0. But the banks had spend money on those indexes as if they had an actual value. Especially because it was always the common wisdom, that mortgages were one of the most secure financial tools.

So. Now, what happens when you spend money on something that you think is an investment, but turns out to be completely worthless? Eh?

Yeah, exactly, you just threw a lot of money into the wind. And that money now was GONE. The big financial companies were just out of money. The money had simply disappeared, which is always what happens when a financial bubble burst.

See, financial bubbles happen when people overestimate how much something is going to be worth. They expect something to raise in value, so that when it ultimately fails a lot of people have put money into it which will just be GONE.

Gone, baby, gone.

But again: The money the banks had been using was mostly not their money. It was the money of their customers. Some of whom understood that risk. Many of them did not. So basically, if you had any of your money on the bank, this money technically still belonged to you - but it was not there. And of course there were also literally hundred-thousands of people working for those companies, who were now out of money.

And this is where we come to the reason why we are living in the darkest timeline.

I know it sounds cynical coming from a lefty like me, but sadly... Yeah, Obama was a big, big reason of why it came to this. While this happened towards the end of the Bush administration, for the most part it was Obama dealing with the fall-out.

See, the government at the time had three options:

Do nothing. Accept that the money is gone and deal with the consequences. Build something new from the ashes.

Give out some securities for the private people who lost their money. Basically some form of check to get back up to amount X of money that you lost becuase of the banks, but prosecute the people in finance, who had messed it up. Also create laws to control the financial market and trade volume, as well as the size of banks.

Save the banks by basically paying their depts for them.

The administration decided to choose Option 3. They saved the banks to save the people's finances and all those jobs bound to the banking industry.

There were no laws. No controls. No checks and balances. And there was basically no prosecution of the people who had let this happen - partly because they did not care, and partly because they were dumb fuckers.

And pretty much everything that has happened since is in some way connected to that. Literally everything!

I mean, if you want to know what I mean with that? The MCU exists because of the 2008 banking crisis! Yeah, the fucking Marvel Cinematic Universe. The reason that streaming is fucked and your favorite shows get cancelled after one or two seasons is heavily connected to the 2008 financial crisis.

The 2008 financial crisis is also connected to the surge in right wing politics all around the world. Because the financial crisis did not only hit the USA, but the rest of the world as well. A lot of people lost their jobs because of it, and because the financial industry did not get controlled and from this learned that they could fuck up however much they liked ("too big to fail") the gap between the rich and poor got worse. Which then the right wingers used to make people angry against minorities.

And of course because all of this started with unrealistic sets for mortages, mortages were suddenly much harder to get and it ended up pretty much impossible to afford a home - just as most of millenials were leaving school.

After all: Nobody really understood, what happened during the financial crisis. Because most people stop following any explanation as soon as they hear stuff like "shorts" and "sublime mortages". So it was much easier to think that the reason that you lost your job and could no longer afford a home was because some immigrant took it, rather than that some white collar idiots at wallstreet made some trades that you could not even begin to understand.

But yeah, tl;dr: Obama decided to save the banks, put in no controls, and with this fucked pretty much both Millennials and everyone who came after us over. And everyone else - every other world leader - pretty much just went with it and did the same in their own country. Danke, Merkel, as we Germans would say.

This is also what started the Occupy Wallstreet Movement, which was trying to get SOME accountability, but in the end pretty much failed.

If I asked you to guess how many people got prosecuted because of the shit back then, I can guarantee you, that you would not guess right. Because literally everyone I have asked, said some number between 20 and 100, realizing very well that it was probably not the thousands actually at fault, but not being able to grasp the reality. One. There was one person actually prosecuted because of it.

These people destroyed our futures, they fucked us over, and they got away with it.

And you and I, we deserve to be angry about it.

Especially because it is happening again right now. There is not just one other bubble, but a couple of bubbles right now. And chances are that they will pop very soon. Fuck, I am writing this on Monday early afternoon German time. Chances are that by the time this goes online some might have started popping, because of the Trump administration's inability to deal with shit. And let's face it, the Trump administration is not gonna be capable of dealing with this, when it goes into freefall.

#history#financial industry#financial crisis#2008 financial crisis#explained#housing market#the big short#ai bubble#tech bubble

12 notes

·

View notes

Text

Jim Morin, Miami Herald

* * * *

LETTERS FROM AN AMERICAN

December 17, 2024

Heather Cox Richardson

Dec 18, 2024

Yesterday, Trump gave his first press conference since the election. It was exactly what Trump’s public performances always are: attention-grabbing threats alongside lies and very little apparent understanding of actual issues. His mix of outrageous and threatening is central to his politics, though: it keeps him central to the media, even though, as Josh Marshall pointed out in Talking Points Memo on December 13, he often claims a right to do something he knows very little about and has no power to accomplish. The uncertainty he creates is key to his power, Marshall notes. It keeps everyone off balance and focused on him in anticipation of trouble to come.

At the same time, it seems increasingly clear that the wealthy leaders who backed Trump’s reelection are not terribly concerned about his threats: they seem to see him as a figurehead rather than a policy leader. They are counting on him to deliver more tax cuts and deregulation but apparently are dismissing his campaign vows to raise tariffs and deport immigrants as mere rhetoric.

As the promised tax cuts are already under discussion, interested parties are turning to deregulation. Susanne Rust and Ian James of the Los Angeles Times reported on Sunday that on December 5, more than a hundred industrial trade groups signed a 21-page letter to Trump complaining that “regulations are strangling our economy.” They urged him to gut Biden-era regulations and instead to “partner” with manufacturers to create “workable regulations that achieve important policy goals without imposing overly burdensome and impractical requirements on our sector.”

They single out reductions in air quality, water quality, chemical, vehicle, and power plant environmental regulations as important for their industries. They also call for ending the “regulatory overreach” of the Biden administration on labor rules, saying those rules “threaten the employer-employee relationship and harm manufacturers’ global competitiveness.” They want an end to “right-to-repair” laws, a loosening of the rules for how and when companies need to report cyber incidents, and the replacement of mandated consumer product safety rules with “voluntary standards.”

They also call for cuts to the Biden administration’s antitrust efforts and for looser corporate finance regulations. On December 12, Gina Heeb reported in the Wall Street Journal that Trump’s advisors are exploring ways “to dramatically shrink, consolidate or even eliminate the top bank watchdogs in Washington,” including the Consumer Financial Protection Bureau and the Federal Deposit Insurance Corporation (FDIC).

As Catherine Rampell explained in the Washington Post today, Congress created the FDIC in 1933 to protect bank deposits so that a bank’s customers can trust that mismanaged banks won’t lose their money. The FDIC also oversees those banks so that they are less likely to get into trouble in the first place. Congress created the system after people rushing to get their money out before a collapse actually created the very collapse that they feared, with one bank failure creating another in a domino effect that dug the economy even further into the crisis it was in after the Great Crash.

But the insurance money for those banks comes from fees assessed on the banks themselves, so abolishing the FDIC would save the banks money.

When he learned that Trump’s advisors are eyeing cuts to the FDIC, Princeton history professor Kevin Kruse commented: “When I lecture about New Deal banking reforms, I note that some of the key measures—like Glass Steagall—were repealed by the right with disastrous results like the 2008 financial meltdown, but ha ha, no one will ever be stupid enough to kill FDIC and bring back the old bank runs.”

Ben Guggenheim of Politico was the first to report that twenty-nine Republican members of Congress are also quick off the blocks in getting into the act of promoting private industry, calling for the incoming president to end the program of the Internal Revenue Service that lets people file their taxes directly without using a private tax preparer. Other developed countries use a similar public system, but in the U.S., private tax preparers staunchly opposed the public system. When more than 140,000 people used the IRS pilot program this year, they saved an estimated $6.5 million. Republicans called for its end, warning it is “a threat to taxpayers’ freedom from government overreach.”

But for all their faith that Trump will deregulate the economy, economic leaders seem to think his other promises were just rhetoric.

Brian Schwartz of the Wall Street Journal reported Sunday that business executives have been lobbying Trump to change his declared plans on tariffs. The president-elect has vowed to place tariffs of 25% on products from Canada and Mexico, and of an additional 10% on products from China. He claims to believe that other countries will pay these tariffs, but in fact U.S. consumers will pay them. That, plus the fact that other countries will almost certainly respond with their own tariffs against U.S. products, makes economists warn that Trump’s plans will hurt the economy with both inflation and trade wars.

Schwartz reported that some companies and some Republicans are hoping that Trump’s tariff threats are simply a bargaining tactic.

Trump supporters say something similar about his vow to deport 11 to 20 million undocumented immigrants, hoping he won’t actually go after long-term, hardworking undocumented people. On December 10, Jack Dolan reported in the Los Angeles Times that the resort town of Mammoth Lakes, California, depends on migrant labor, and on December 15, Eli Saslow and Erin Schaff of the New York Times reported the story of an undocumented worker brought to the U.S. as an infant, who is now trying to figure out his future after his beloved father-in-law voted for Trump. Two days ago, CNN reported on Trump-supporting dairy farmers in South Dakota who depend on undocumented workers, insisting that Trump will not round up undocumented immigrants, no matter what he says.

One person who is not discounting Trump’s threats is Senate minority leader Mitch McConnell (R-KY). McConnell will give up his leadership position in January and has told his colleagues he feels “liberated.”

McConnell appears to be taking a stand against Trump’s expected appointee for secretary of the Department of Health and Human Services, Robert F. Kennedy Jr. Kennedy speaks often against vaccines, and after the New York Times reported that the lawyer working with Kennedy to vet potential HHS staff petitioned federal regulators to take the polio vaccine off the market, McConnell—a polio survivor—warned: “Efforts to undermine public confidence in proven cures are not just uninformed—they’re dangerous. Anyone seeking the Senate’s consent to serve in the incoming administration would do well to steer clear of even the appearance of association with such efforts.”

McConnell has also been vocal about his opposition to Trump’s isolationism. He is a champion of sending military support to Ukraine and, after he steps down from the leadership, will chair the Senate Appropriations Subcommittee on Defense, the subcommittee that controls military spending. “America’s national security interests face the gravest array of threats since the Second World War,” McConnell says. “At this critical moment, a new Senate Republican majority has a responsibility to secure the future of U.S. leadership and primacy.”

McConnell will also chair the Rules Committee, which gives him a chance to stop MAGA senators from trying to abandon the power of the Senate and permit Trump to get his way. McConnell has said that “[d]efending the Senate as an institution and protecting the right to political speech in our elections remain among my longest-standing priorities.”

That last sentence identifies the current struggle in the Republican Party. McConnell is showing his willingness to prevent Trump and MAGA Republicans from bulldozing their way through the Senate in order to undermine the departments of Justice, Defense, and Health and Human Services, among others. But when he talks about “protecting the right to political speech in our elections,” he is talking about protecting the Supreme Court’s 2010 Citizens United decision that permits corporations and wealthy individuals to flood our elections, and thus our political system, with money.

It is those corporations and wealthy individuals who are now lining up for tax cuts and deregulation, but who don’t want the tariffs or mass deportations or isolationism Trump’s “America First” MAGA base wants.

Trump and his team have been talking about their election win as a “mandate” and a “landslide,” but it was actually a razor thin victory with more voters choosing someone other than Trump than voting for him. He will need the support of establishment Republicans in the Senate to put his MAGA policies in place.

At yesterday's press conference, he appeared to be nodding to McConnell when he promised: “You’re not going to lose the polio vaccine. That’s not going to happen.” McConnell’s fierce use of power in the past suggests that the Senate’s giving up its constitutional power to bend to Trump’s will isn’t likely to happen, either.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Jim Morin#Miami Herald#autocracy#oligarchy#Letters From An American#Heather Cox Richardson#SCOTUS + Citizens United#corrupt SCOTUS#corrupt government#MAGA senators#TFG press conference#attention grabbing threats#lies

13 notes

·

View notes

Text

Among President Donald Trump’s major preoccupations throughout the 2024 campaign was an oft-repeated desire to “demolish” the “deep state.”1 He aims to reduce not only the army of civil servants throughout the federal government but also the volume of regulation.

Frustration with the sheer volume and scope of federal regulation is understandable. Over the decades, the Code of Federal Regulations has mushroomed to over 180,000 pages.2 Regulations affect how virtually everything is produced or delivered in our economy. In some cases, their complexity, especially when layered on top of local rules, can make it difficult to build new and much-needed infrastructure, such as transmission power lines.

At the same time, however, regulations keep our food supply, automobiles, financial markets and institutions, pharmaceuticals, and workplaces safer, our environment cleaner, and our financial markets and instruments more transparent than they otherwise would be. That’s because the market can “fail” in various ways: Private companies do not fully internalize the costs their activities may impose on others. Without regulation, consumers may not be fully informed about the risks of the products and services they buy. Private markets alone are likely to underinvest in so-called public goods. Over many decades, Congress has enacted a growing number of statutes requiring federal agencies to mitigate these market failures. Notably, many of the rules that conservatives now attack—those addressing environmental and workplace externalities—have been issued by agencies that were created and under statutes passed with the support of a Republican president, Richard Nixon. (See table below.)

12 notes

·

View notes

Note

Re-evidence of defense contractors influencing U.S. Foreign Policy, the massive lobbying they do, the connections they have with various top level officials like Dick Cheney, blatant corruption with Raytheon and Qatar. And to clarify they are not starting wars for profit they are taking advantage of the underlying conditions to advance their financial interests. Obviously they are not puppet masters behind the scenes but to deny their influence is really perplexing.

So...lobbying and political connections that amount to...not much? Selling the things that they...already produce? They do...exactly what other industries and sectors do...and yet that somehow makes them this nebulous group of war profiteers? Even though, unlike many other industries, arms exports are strictly controlled requiring high-level government negotiations to set up export contracts under International Traffic in Arms Regulations. Even though unlike other industries, the defense industry typically operates under a monopsony purchasing environment? This to me, sounds like a clear case of double standards.

Heck, I have my problems with the defense industry and the contracting world, and I encourage transparency and anti-corruption efforts in the defense industry (and I wish we had more firms so we didn't have the Big Six - the Cold War ending gutted the defense industry which stifles creativity and innovation), but where are they "set(ting) defense policy, establish(ing) security partnerships, or do(ing) anything that would actually create the conditions for larger wars." That's what I was asking for - proof that a defense contractor contributed to creating a war so they could increase their market share. You've admitted that they're not "puppet masters," so I don't really see your point other than "they happen to manufacture arms and people buy them to later kill other people with."

If your objection is just a moral "I don't think they should make money selling defense equipment," sorry, but that's simply not realistic. Sure, it'd be nice to not ever have a need for defense equipment, but I think the past fifteen years have proven that the absence of robust defense industrial base actually incentivizes further conflict as aggressive actors take advantage of geopolitical weakness. The anemic nature of the European defense market directly contributed to the failure to deter Russia from their expansionist gains. China's industrial capacity has lent it highly aggressive territorial actions out of the belief that other Asian nations simply won't risk opposing them. State manufacturing has proven to not be as effective, either from a cost or a quality perspective. So the arms industry is here to stay.

If the objection is "industry uses lobbying to promote electoral candidates which end up advancing their interests," well, unfortunately that's simply a large bugbear in the US electoral system. Heck, the defense industry isn't even the greatest offender - healthcare is by far the largest lobbying sector in the United States. And as I mentioned before, the defense industrial sector typically operates under constraints that are quite restrictive compared to other sectors.

So if anything is "perplexing," it's this perpetual conspiracy theory that the defense industry, despite actually being quite modest compared to other sectors, is somehow this great big boogeyman. I mean, it's not particularly perplexing to *me* since if there's one thing I understand quite well, it's the contempt that outsiders have toward the profession of arms, but from an objective standpoint, yeah, it'd be pretty baffling.

-SLAL

13 notes

·

View notes

Text

[...] the bill, as it stands, "criminalises and regulates constitutionally acceptable behaviours" and introduces elements of moral policing. The representatives highlight concerns about autonomy and choice, particularly regarding adult consenting cohabitation, commonly referred to as "live-in relationships". They assert that the bill's provisions would erode the hard-won rights of women and undermine their struggles for equality within both domestic and public spheres.

Critics point out that while the bill claims to offer uniformity across religious lines, it disproportionately targets the Muslim minority community, criminalising aspects of their personal and marital practices without adequately incorporating positive and progressive elements from Muslim family law. The bill's focus on rectifying perceived defects in Muslim law while ignoring similar issues within Hindu family laws has raised concerns about bias and selective application. “Majorly, it seeks to introduce changes in the provisions that are perceived as defective in the Muslim law, such as unequal inheritance, polygamy and the practice of halala ( by which a person can only remarry his divorced spouse after she has married someone else, consummated the marriage and thereafter obtained a divorce). In one sense the Bill has terminated the application of Muslim family law and has further criminalised the Muslim man and woman. Ironically, the Bill has not incorporated positive and progressive aspects of Muslim law such as the compulsory payment of mehr by the husband to the wife which provides financial security of the wife, nikahnama (marriage contract) which allows for the spouses to add legally binding conditions that are mutually acceptable, and a 1/3 limit rule for willing away property. Had the intention of the Bill genuinely been to bring about gender justice, such provisions could have been extended to women of all communities,” an excerpt from the statement reads.

Furthermore, the bill's silence on critical issues such as custody, guardianship, and adoption of children, as well as the rights of queer and transgender persons within families, has been deemed unacceptable by the women's groups. They argue that the bill's failure to address these issues reflects a lack of inclusivity and consideration for marginalised communities. Of particular concern is the retention of archaic provisions, such as the restitution of conjugal rights, which has been challenged for its constitutional validity. Critics argue that such provisions perpetuate gender-based violence and undermine fundamental rights, including the right to live with dignity and freedom of choice. The groups also maintain that this law denies or takes away fundamental rights.

Even the existing provision of women's right to reside in their matrimonial homes has been taken away. “Thus rights to equality, right to live and livelihood and to live with dignity, right to freedom of speech and expression, freedom of conscience and right to freely profess, practice and propagate religion, have become casualties under this Bill,” the statement reads.

49 notes

·

View notes

Text

TD Bank is the 10th-largest bank in the country – but for a while was the No. 1 choice for criminal organizations laundering drug money, according to federal prosecutors.

The bank's $3 billion plea deal shocked the finance world but prompted a U.S. senator to slam the Justice Department for "absurd legal gymnastics" that she says were too soft on executives.

For years, the bank prioritized growing its profits without investing in mandatory precautions to prevent cartels and other organized crime groups from using its systems to launder money, allowing crooks to shuffle $671 million in secretive transfers that should have been flagged and reported to authorities – sometimes with the help of corrupt bank employees, according to the plea agreement.

"By making its services convenient for criminals, TD Bank became one," Attorney General Merrick Garland told reporters in October, announcing the bank's guilty plea.

CHINESE MONEY LAUNDERING CRIMINALS TEAM UP WITH MEXICAN CARTELS TO MENACE US, OFFICIALS WARN CONGRESS

"TD Bank also became the largest bank in U.S. history to plead guilty to Bank Secrecy Act program failures, and the first U.S. bank in history to plead guilty to conspiracy to commit money laundering," he added. "TD Bank chose profits over compliance with the law – a decision that is now costing the bank billions of dollars in penalties."

At the time, he said the investigation was ongoing and warned that more charges could be coming.

An admitted international money launderer in another case, Da Ying Sze, a 45-year-old from New York, bribed bank employees with almost $60,000 in gift cards. He pleaded guilty in his own case to a conspiracy that laundered $653 million on behalf of criminals in the U.S., China and Hong Kong.

Some of it was drug money. And $470 million went through TD Bank, according to federal prosecutors.

For almost a decade – between January 2014 and October 2023 – the bank failed to comply with mandatory anti-money laundering regulations that required it to flag suspicious transactions, according to court documents. Instead of updating their system to keep up with emerging technology, bank officials saved money by leaving an outdated anti-money laundering program in place.

The anti-money laundering program was known to executives and so ineffective that employees joked about it, according to federal prosecutors.

"These failures enabled, among other things, three money laundering networks to launder over $600 million in criminal proceeds through the Bank between 2019 and 2023," federal prosecutors wrote in court documents. "These failures also created vulnerabilities that allowed five Bank store employees to open and maintain accounts for one of the money laundering networks."

OPINION: CHINESE ILLEGAL BORDER CROSSINGS SPIKE BY 7,000%. ONLY CHINA KNOWS WHY

Those five corrupt employees helped criminal organizations launder $39 million to Colombia through nearly 200,000 ATM withdrawals.

Even with the massive corporate fine and an "asset cap" that places a tight restriction on the bank, Sen. Elizabeth Warren, D-Mass., blasted the Justice Department for "legal gymnastics" that let top executives off the hook.

"The way that DOJ structured the plea agreement ensures that TD Bank will not face the full range of penalties that Congress has enacted for banks that engage in criminal money laundering," she wrote in a public letter to Garland.

"These shocking failures enabled three separate money laundering syndicates to launder more than $670 million through the bank between 2019 and 2023," she continued. "The magnitude of the dollar value of these illicit transactions is dwarfed only by the obviousness of the criminal activity."

In all, criminal organizations laundered more than $670 million, according to authorities, and the total fines were set at $3 billion.

Without consequences for the executives, she argued, banks can just write off billion-dollar government fines as a business expense in the future.

The bank did not immediately respond to requests for comment.

The bank's CEO, Bharat Masrani, told The Associated Press that steps were being taken to fix the deficiency and end the corruption after the bank pleaded guilty last month.

"We know what the issues are, we are fixing them," he said. "As we move forward, we’re ensuring that this never happens again, and I’m 100% confident that we get to the other side and emerge even stronger."

To address the money laundering problem, the bank says it began a multi-year security boost that included hiring dozens of new leaders and hundreds of experts on money laundering prevention and fighting financial crime.

12 notes

·

View notes

Note

Hi there! I was wondering, would you know where I could find anything on like, social taboos involving marriage? I wanted to know if there's anything in the sagas or maybe in archaeology/anthropology that touches on forbidden unions. I know the goddess Lofn is cited as one who grants permission to such people to be together, but I wanted to know if we have anything on what these forbidden unions could look like? Off the top of my head, I imagine feuding families to be a good start, but I can't find much else on the subject. Thank you!

Marriages in Old Norse society were arranged by families (usually between the prospective husband and the father or other male relative of the prospective bride), and more for political and economic reasons than for personal ones. Some people were married specifically because their families were feuding, to bring the feud to an end (often the people involved wanted out but failure to retaliate could have consequences; uniting the families could end the feud in a way that saved face. In Old English a woman who is married into an enemy family for this reason is called freoðu-webbe, 'frith weaver'). Frands Herschend went as far as proposing to see women in Iron Age Scandinavia generally as hostages (in the sense that Freyr and Njörðr are hostages in Ynglinga saga). If the sagas are relatively accurate there does seem to have been an understanding that the family should be arranging things such that the woman is happy with the result, but they weren't legally obligated to.

In this kind of situation, a marriage that's forbidden would be basically any that either side of the family, especially the woman's closest male relatives, opposes. The reasons were probably diverse and personal, and not generally based on widespread taboos. Most of it probably had to do with money and social hierarchy.

Feuding certainly played a role here, or rather we should say relations based in reciprocity, whether positive or negative, did. As I said, marriages were sometimes arranged specifically to bring hostile families into a single family and end the conflict, but if one side thought they had the upper hand and stood to gain by continuing the hostilities then they would surely not permit such a marriage. Marriages might also be arranged out of obligation to more powerful people.

In fact, it might be possible to frame any actual social or legal prohibitions on marriage that did exist as protections for the woman from being married off to someone she didn't want, rather than restrictions on her freedom, because she hardly had any. We can surely consider divorce in a similar way, which was permitted in certain circumstances.

The main restriction that we do have evidence for is marrying someone who is too close a relation. There were probably situations where the financially or politically advantageous thing to do is to get two close cousins married to each other and it may have actually happened, but it's illegal in the laws we have a record of. This may have been less regulated in heathen times.

Of course, there could have been culturally-assumed restrictions that weren't formally prohibited in the law. There's speculation that, while a Nordic man marrying a non-Norse woman was not uncommon, happening the other way around was not generally permitted. This is supposedly reflected in the mythology, where the male gods marry jötunn women but the goddesses do not marry jötunn men. However, there is archaeological evidence from the Vendel period that contradicts this (the book I'm getting this from is over 20 years old, so by now there could be contradictory evidence from the Viking age too, but I'm not sure), so if there was ever such an ethnic taboo it must have either not been universal, or developed later. I'll also remind that there is a contradiction in the mythology as well; Gefjun isn't described as marrying a jötunn but she does have kids with one, which scholars do typically count as a violation of an ethnic taboo, sometimes as grounds to reject the myth itself as "impossible" (Lindow's description).

A lot of this may have varied by class. We mostly know about the land-owning class. It's hard to say whether poorer people would have even less freedom over whom they married because of their dependence on land-owners, or if they had more freedom because there was less social and financial stake in it. It seems likely that their marriages weren't as regulated, but their ability to actually move from place to place was the major limiting factor.

I'm not aware of any sources for it, but I have no trouble believing that illegal or otherwise unsanctioned marriage happened. The thing that kept people in line was inheritance. So if people were in a position where they could turn down their inheritance (whether because they had another source of resources or because their families were so poor their inheritance was negligible anyway), and could have a place to live, they could probably just do what they wanted.

So I think for the most part, if we were to picture Lofn's intercession as historical events, we might picture the site of those intercessions as kind of distant from the actual marriage, like opening opportunities to get by while forgoing one's inheritance, or unexpected changes elsewhere in the social network. Or a simpler example would be a woman successfully convincing her father, brother, or other male representative to let her do what she wanted.

This is a little out of step with Snorri's etymological explanation of Lofn's name as related to 'permission' but as I explained here I think the actual etymological meaning of her name was 'hope'.

Of course a lot of heathens read Lofn's description in the Edda as affirming of marriages that deviate from gender and sexual norms, which the text does in fact leave room for but probably isn't what Snorri had in mind. There's a lot of room for speculation about how this may have been relevant in pre-Christian times but it would be difficult to move it beyond speculation.

Unfortunately quite a lot of this is already pretty speculative, because of how much later our sources concerning marriage are than the time when Lofn may have actually been recognized. Frankly, the same applies to our sources for Lofn, and the time when she may have been recognized. If I'm right about the etymology of her name then I think it's at least a partial vindication of Snorri but that does not necessarily mean that his description of her is entirely reliable.

35 notes

·

View notes