#auditing company

Explore tagged Tumblr posts

Text

The Indian Partnership Act of 1932 is a piece of legislation that controls how partnerships are formed and run in India. It offers a framework for the legal rights, obligations, and liabilities of people running partnership businesses. The purpose of the act was to establish and codify Indian partnership law.

Key features of the Indian Partnership Act of 1932

Definition of Partnership:

According to the legislation, a partnership is a relationship between individuals who have decided to split the earnings of a firm that is run by all of them together or by any one of them acting alone.

Formation of Partnership:

It describes the steps involved in creating a partnership, such as the need for an agreement, the minimum and maximum number of members, and the significance of splitting gains and losses.

Rights and Duties of Partners:

The legislation outlines the responsibilities and rights of partners, including their obligations to act loyally and in good faith as well as their rights to take part in the company's management and split profits and losses.

Registration of Firms:

The act emphasizes the importance of registering a partnership firm. While registration is not mandatory, it provides certain legal benefits, including the ability to sue third parties and fellow partners.

Dissolution of Partnership: The act details the various circumstances under which a partnership may be dissolved, such as by mutual agreement, on the death of a partner, or by court order.

Liabilities of Partners: It talks about how partners in a partnership have unlimited responsibility, meaning that the firm's obligations and liabilities can be settled with the partners' personal assets.

Minor's Position in Partnership: The act deals with the capacity of a minor to become a partner, specifying the limitations on a minor's rights and liabilities in the partnership.

Over time, changes have been made to the Indian Partnership Act of 1932 to ensure that it remains compliant with evolving legal requirements and commercial practices. It is essential to give India's partnerships a legal foundation and give direction to people and organizations working together on economic projects.

Pros and cons of partnership Firm Registration

Pros:

1. Legal Recognition:

Prospective Rights: The partnership gains legal status through registration, enabling it to bring lawsuits against other partners and third parties in the event of a disagreement.

Evidence of Existence: A registered firm has a legal document (the partnership deed) that serves as evidence of its existence and the terms of the partnership.

2. Credibility and Trust:

Business Credibility: Getting registered can help the partnership seem more credible to suppliers, consumers, and financial institutions.

Building Trust: It may instill confidence in clients and partners, as they can verify the legal status and authenticity of the partnership.

3. Access to Legal Remedies: Unregistered partnerships might not be able to access certain legal remedies and benefits that are available to registered partnerships.

4. Tax Benefits: Registered firms may be entitled to specific exemptions or deductions, as well as particular tax benefits. 5. Continuity: Registration can ensure continuity, especially in cases of changes in partners or other structural modifications.

Cons:

1. Cost and Formalities:

There are costs associated with the registration process, including fees and expenses related to drafting and notarizing the partnership deed. The registration process involves formalities and paperwork, which can be time-consuming and may require professional assistance.

2. Public Disclosure:

The relationship details become public information after they are registered, which may not be ideal for people who value their privacy.

3. Limited Liability Concerns:

Partners in an unregistered firm also have unlimited liability, but registration doesn't provide protection against personal liability.

4. Flexibility and Informality: Registration may impose certain obligations and restrictions, limiting the flexibility that unregistered partnerships may enjoy. Unregistered partnerships can be less formal in their operations, which may be an advantage for some businesses.

5. Limited Legal Advantages: Unregistered partnerships still have some legal status and rights, although the benefits of registration may be limited.

The choice to register a partnership firm is ultimately based on several variables, such as the type of business, the partners' preferences, and the financial and legal ramifications of doing so. It is advisable to get advice from financial and legal experts to make an informed decision that takes into account the unique conditions of the partnership.

Key Elements of Partnership Registration In India

1. Partnership Deed:

Creation: The first step is to draft a partnership deed, which is a written agreement outlining the terms and conditions of the partnership.

Contents: Information including the company name, partner names and addresses, the type of business, capital contributions, profit-sharing percentages, and other pertinent clauses are usually included in the partnership deed.

Stamp Duty: The non-judicial stamp paper on which the partnership deed is executed is required, and the stamp duty payable is determined by the capital contribution of the partners.

2. Application for Registration:

Form: Form 1, the application for the registration of the partnership firm, must be completed by partners and submitted.

Information Required: The application contains information on the firm, including its name, address, and any duration, as well as the partners' names and contact information.

Attachment of Documents: Along with the application, a copy of the partnership deed and an affidavit stating that all the information provided is true and genuine must be submitted.

3. Payment of Fees:

Registration Fee: Partners need to pay the prescribed registration fee based on the state in which the firm is registered.

Stamp Duty: There can be additional stamp duty required for the registration procedure on top of the stamp duty on the partnership deed.

4. Submission to the Registrar of Firms:

Regional Registrar: The completed application, along with the necessary documents and fees, is submitted to the Registrar of Firms in the region where the business is located.

Verification: The Registrar may verify the documents and, if satisfied, enter the details in the Register of Firms.

5. Certificate of Registration:

Issuance: The Registrar issues a Certificate of Registration following a successful registration. This certificate is evidence of the partnership's existence.

Validity: In general, the certificate is valid for the time frame specified in the partnership agreement.

6. Public Notice:

Optional Public Notice: Although it is not required, partners may decide to notify the public and prospective stakeholders about the partnership's creation by placing an announcement in the local newspaper.

7. PAN and TAN Application:

PAN and TAN: For taxation purposes, partnerships must get a Permanent Account Number or PAN. The partnership needs to obtain a TAN (Tax Deduction and Collection Account Number) if it is required to deduct taxes at source.

8. Bank Account:

Bank Account Opening: Partners should use the Certificate of Registration and other required paperwork to open a bank account in the partnership's name.

9. Compliance and Renewal:

Annual Filing: As long as the partners keep correct financial records and follow tax requirements, there is no need for an annual file.

Renewal: Generally speaking, the partnership registration is good for the time frame given in the partnership agreement. Partners may need to renew the registration if there are any modifications or if the collaboration lasts longer than expected.

#company registration in kochi#tax consultancy#partnership firm registration#accounting consultancy#financial consultancy#GST registration#auditing company#cost accounting services#ISO registration#UAE Vat Registration in kochi#legal advisory services

0 notes

Text

Understanding VAT Returns in Saudi Arabia : An Overview for Beginners

Starting a business in Saudi Arabia or already operating one there? It is crucial to know about VAT or Value-Added Tax to ensure the success and growth of your company.

This blog will be a complete beginner’s introduction to VAT returns in Saudi Arabia, including what they entail, why they are important, and how to claim them.

By the end of this post, you should have a better understanding of how VAT returns can benefit your business and how to successfully claim them.

What exactly are VAT returns?

VAT returns allow businesses to lower their tax bill by recovering back VAT paid on specific costs. There are two forms of VAT returns in Saudi Arabia: input VAT and export VAT returns.

Input VAT returns are available for purchases of goods and services used in the manufacture or sale of taxable products or services.

whilst export VAT returns are available for enterprises that export goods or services outside of the Gulf Cooperation Council (GCC) territory.

What is the significance of VAT return?

VAT returns may have a big influence on a company’s bottom line. Businesses can minimize their tax bill and enhance their cash flow by claiming back VAT paid on costs. This can help organizations stay competitive and reinvest in their growth and development.

How can businesses claim VAT returns in Saudi Arabia ?

Businesses in Saudi Arabia must satisfy certain requirements and follow particular processes in order to claim VAT returns. Businesses, for example, must keep sufficient documentation to support refund claims, file refund applications within particular time constraints, and follow VAT requirements.

In Saudi Arabia, beginners may find getting VAT returns complicated and time consuming. That is why it is critical to seek the advice of a top accounting firm in Riyadh, Saudi Arabia that has worked with firms similar to yours and can give customised solutions to assist you maximise your VAT return advantages.

Who has to file VAT returns in Saudi Arabia?

Every taxable person registered under KSA VAT law must file the VAT returns in Saudi Arabia either monthly or quarterly, depending on their annual turnover.

Even if a taxable person has no transactions during a tax period, they are still required to submit a “Nil” return for that time period.

Types of VAT returns in Saudi Arabia

https://arabianaccess.com/blog/wp-content/uploads/2023/05/Types-of-VAT-returns-in-Saudi-Arabia.jpg

KSA VAT involves the filing of VAT returns for a particular tax period, which may be either monthly or quarterly.

Monthly VAT returns

Monthly VAT return filing is a legal requirement for companies with annual sales of over SAR 40 million.

Between the first and the last day of the month after the conclusion of the tax period, the taxpayers must submit their monthly VAT returns. Taxpayers must submit their March VAT returns between April 1 and April 30, for instance.

Quarterly VAT returns

Companies with yearly sales of SAR 40 million or less can file quarterly tax returns.

The first and last days of the month after the end of the quarter are when taxpayers can submit their quarterly VAT returns.

For instance, taxpayers must submit their VAT returns between January 1 and January 31, for the quarter from October to December.

What Indians should know about “expat tax” in Saudi Arabia?

https://arabianaccess.com/blog/wp-content/uploads/2023/05/What-Indians-should-know-about-expat-tax-in-Saudi-Arabia.jpg

Are you an Indian expat operating a business in Saudi Arabia and seeking VAT returns to reduce your tax obligations?

Seeking a nearby tax accountant in Riyadh, Saudi Arabia?

The Saudi government imposes an “expat levy” on all foreign employees and their families living in Saudi Arabia. Foreigners working in Saudi Arabia are subject to a flat tax rate of 20% on their earnings. As an Indian working in Saudi Arabia, you may be subject to this expat tax.

However, the Saudi Arabian government does provide several exemptions and discounts for expatriates. In addition, you may be eligible for a tax-free personal allowance, which is currently set at SAR 18,750 per year.

Furthermore, certain expenses related to your job, such as housing and school costs, may be tax deductible.

For the purpose of correctly calculating taxes due, it’s critical to maintain precise records of all income and expenses throughout the year.

Moreover, it’s also important to keep in mind that tax laws and regulations in Saudi Arabia might change regularly. Therefore, expats should keep up with any modifications that might affect their tax obligations.

Many expats in Saudi Arabia decide to work with an expat tax advisor in Riyadh, who can offer advice on their unique tax position in order to help ensure compliance with tax rules and regulations. An experienced tax expert may guide expats through the complexities of the tax code and reduce their tax bill.

Maximizing Your Business’s VAT Return Benefits

Businesses in Saudi Arabia can employ a variety of tactics to maximise their VAT refund benefits. Here are some pointers to get you started:

Maintain correct records – Maintaining proper records is critical for obtaining VAT refunds. Businesses should keep adequate paperwork, such as invoices and receipts, to support their refund claims.

Be careful of the deadlines – It is critical to file your VAT refund applications within the time limitations indicated to prevent losing your refund advantages.

Work with an accounting company – Collaborating with an accounting firm that has expertise dealing with Saudi Arabian companies can provide you the direction and assistance you need to get the most out of your VAT refund.

Review your business operations – It’s crucial to assess your operations to make sure you’re utilizing all of your prospects for a VAT refund. For instance, companies may be entitled for export VAT refunds if they export products or services outside of the GCC.

It’s important to remember that tax laws can be complicated, and your unique situation may affect the specific rules and regulations.

It’s always advantageous to consult with a trained tax return accountant in Riyadh, Saudi Arabia who can provide you with advice on your tax responsibilities and assist you to reduce your tax payment.

In conclusion, VAT returns may be a useful tool for Saudi Arabian companies.

By understanding VAT returns, their significance, and how to apply for them, businesses can strengthen their financial position and remain competitive.

Reach out to a top accounting firm in Riyadh, Saudi Arabia, like Arabian Access, which can provide service even as an accountant for the self-employed in Riyadh, Saudi Arabia.

Get the guidance you need from us if you’re new to the subject and want to learn more about VAT returns in Saudi Arabia.

#auditing#Auditing Company#Auditing Firms#Auditing Services#Internal Audit#Value Added Tax#Expat tax#Export VAT returns#Financial Analysis#Monthly returns#Quarterly returns#VAT returns

0 notes

Text

Did you know that India's dairy market is projected to reach $124.93bn in 2023? That's a growth of over 8% from 2022!

The Indian #dairy market is one of the most dynamic and fastest-growing in the world. Learn more about this exciting market in our latest article.

Click the link to read the full article and learn more about the future of the dairy business in India. - https://www.instagram.com/p/CvZLae8v80L/?img_index=1

#research gates#researchers#market researchers#qualitative research#action research#operations research#quantitative and qualitative research#consumer research#audit company#experimental research#market research analyst#business research#Research Consultants#Researchers#market research consultants#Market Researchers#Audit Company#Auditing Company#Company Audit#mystery shopping#secret shopper

0 notes

Text

"you ever read fanfiction and there's something so absurdly specific that it must come from the author's real life experience." me when i write one of those fire lord zuko fics but instead of just saying "paperwork" i write full financial statements for different departments and act like thats normal to write in a fanfiction.

#cal.ibrations#zuko reads fn military-adjacent companies 10-ks#actually now i think about it does the fn have established accounting principles. they give me the vibe everyone is committing crazy fraud#zuko and establishing FNGAAP#zuko & bringing swords to an audit.

191 notes

·

View notes

Text

I just think that if you pay a subscription for a service it should be illegal to then have pop-ups asking you to pay for more stuff. I want to kill intuit with hammers

#this is about quickbooks#intuit most evil of companies#unfortunately if you want to have your accounting work with pretty much any other person#like accountants or tax people#you just....have to have intuit!#and every time I log in they're like WOUDL YOU LIKE TO PAY A MILLION DOLLARS TO HAVE US DO YOUR TAXES#no intuit I would not!#I have your stupid service so I can have smart humans do my taxes!#I guess I could personally do my accounting by hand#but....my god I would fuck up so much#the ONE year I did my own taxes I got audited lol#(this is not to scare people about doing their own taxes - if you have a normal ass job you can do it)#(my taxes are decently complicated)#(and pls use the government's new service instead of evil intuit's dark patterning)#lauren says things#anyway

64 notes

·

View notes

Text

Dead man walking...

Credit @saintmeghanmarkle

#misery loves company#royalty is not celebrity#merch your royalty#just call me harry#using your office for personal gain#can't buy credibility#lies and the lying liars who tell them#unsussexful#grifters gonna grift#irs audit archewell#surrogacy isn't a crime but lying is#meghan markle is a liar#meghan markle is a bully#traitor prince#reddit#SaintMeghanMarkle

21 notes

·

View notes

Text

Tell me you're a Nepo baby without telling me you're a Nepo baby.

North West was chosen over other kids who auditioned to play young Simba at The Lion King's 30th Anniversary at the Hollywood Bowl (25 May 2024) x

#I am so mad for the other kids who deserved this opportunity more#why does she look so lost on that stage#WTH is she wearing#I love the lion king cartoon and ive seen the live performance of the musical and the kids there are super talented and not like this#if youre going to use your nepo card at least be good#this family annoys me to no end#there are clips of the other kids that auditioned and they are deserve this more#just google the youbg simba performances from the west end and broadway for reference#Supposedly it's the same company that produced The Lion King show and the Kardashian Show#the lion king#nepo baby#Kardashians#north west#Kanye west#kim kardashian#mine

31 notes

·

View notes

Text

mainly incoherent thoughts from watching that clip of angela in that true crime show that was going around but one thought that i can structure is. you're telling me that grace chasity is not the first role where angela giarratana played a horny 18 year old girl who convinced her peers to lure a guy out to get revenge on him, the end result being that guy is killed

#angela giarratana#grace chasity#my posts#could probably dig for more similarities between those two roles#idk how starkid casting auditions work even with actors already within the company#I know from getting the npmd bonus features that apparently they still have to send in self tapes (joey's reading for peter)#did the lang bros already know that angela has already played an 18 yr old murderer before casting her as grace?#was that part of their consideration at all?#im not really into true crime but i am a simp for angela and ive been watching available short films she's been in#and that episode was free to watch and just out there so i did see it#and hooh boy. even after watching that clip i was not prepared. i dont wanna be weird. but i AM a simp

33 notes

·

View notes

Text

Accounting outsourcing services in India

We provide the best Accounting outsourcing services in India and MAS is the top outsourcing and Bookkeeping service Companies in India Accounting Outsourcing Services in India | Accounting Services in India | Bookkeeping | Outsourcing Company

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

7 notes

·

View notes

Text

help I have an audition in 19 days and my song is ready and I'm working on my monologue (I've barely looked at it it's getting there) but I just found out there's a dance call and I'm freaking out my dance abilities are... questionable (I've been doing it on and off since I was 3 I can dance well if I know the choreography but I'm really bad at picking up choreography quickly) please help I need it my plan is to start learning a lot of choreography the week before my audition but I genuinely don't know how difficult it'll be in the audition (I should be fine I know there are other people in the company with little to no dance experience and I have a lot but I'm freaking out)

#help I'm freaking out#if I don't get the audition I'll end up in a different part of the company with worse funding#but I know I can probably get it based on singing and acting because I'm good at those#it's just dance because I'm closer to being a double and a half threat than a triple threat#I have had dance calls before but for those they actually told me they were happening more than 19 days before the audition#so I was able to prepare accordingly

14 notes

·

View notes

Note

I'm REALLY curious who else read those parts and made it to the final rounds. We know the actor who played Jonah was a Louis finalist, but we don't know any other Lestats, right? It does sound from what Rolin has said like both Jacob and Sam were the frontrunners from their first auditions, and if that's true, he must have been so relieved when they had amazing chemistry with each other lol. It's just interesting b/c they clearly looked at a wide range of known and much lesser known actors.

Interesting too to think about who else read for Armand and Claudia (both times).

Oh! I don't think I even knew Thomas Antony Olajide was a finalist for Louis! That's so interesting and its awesome that they still managed to pull him in for a role - he was really good as Jonah! It's such a record scratch though to even consider him as Louis, because I honestly can't imagine anyone but Jacob in the role now, haha.

And yeah! Rolin says on the IWTV podcast that they got it down to about ten actors for both Louis and Lestat, but it does sound like Jacob and Sam were both frontrunners from the start. Mark even says in that same ep that he remembers Rolin saying Sam would be hard to beat after seeing his first audition and that no one ever did.

I'd love to know who was up for Armand and Claudia too. At least for s2 Claudia, I'm lowkey inclined to think the shortlist was entirely or predominantly British given the four auditions sound like they were on the same day, in-person in London and it was such a quick turn around for casting, but who knows with Bailey.

Armand I am soooo curious about, because I can't tell how broad they went for that role? Louis and Claudia were obviously very deliberately written as Black, but I don't know if Armand was (at least in s1) written as South Asian? They've definitely made that more central to his character in s2 as we've gotten to know him better in the context of the show, but with how he's written in s1, it'd be interesting to know if they were thinking as specifically about race for his character as they were for the others (and also who Assad [who's also literally perfect in the role] was up against).

#it's soooo interesting to think about#the theatre company i work at doesn't do auditions at all#so i don't really get to see any of that#(it has like#a feeder + pathways program)#(and a very healthy stable of actors some who've literally been with the company since the early 90s)#but i hear a lot of the actors horror stories about auditioning for shows / tv / movies#even commercials sometimes#and i am just like#how do you put yourself through this lmao#it sounds excruciating#iwtv cast#welcome to my ama

7 notes

·

View notes

Text

I Changed My Thesis

Originally, my history BA thesis was going to be deconstructing the Starz/Sky TV collaboration Penny Dreadful.

I changed it.

I had been forcing my way through the show to make notes for my work, but then one day I started thinking about Bill Gunn’s ‘Ganja and Hess’ way too much and it changed my whole concept.

Now, I’ll be writing my thesis on linguistic violence against women and the monstrous feminine in horror, examining terminology used against women and how those words are contextualized historically within horror as a genre.

There’s a lot of material to cover in this paper, as I already have over 50 sources, but to give an idea of what I’m looking at, the following are the movies I’ll be using for the paper:

Am I Quiet Enough For You Yet? Audition (1999) Last Night in Soho (2021)

...Will Still Become a Wolf When the Autumn Moon is Bright Ginger Snaps (2000) The Company of Wolves (1984)

I Drank All the Blood That I Could Ganja and Hess (1973) A Girl Walks Home Alone at Night (2014)

Holy Water Cannot Help You Now Def By Temptation (1990) Possession (1981)

They Come to Drink, They Come to Dance, to Sacrifice a Human Heart The Lure (2015) She-Creature (2001)

Burned But Not Buried This Time The Craft (1996) The VVitch (2015)

So stay tuned for ‘At Least You’ll Sanctify Me When I’m Dead: A History of Linguistic Violence Against Women and the Monstrous Feminine Within Horror’.

This is gonna be fun.

#linguistic violence#monstrous feminine#psychokillers#audition 1999#audition#last night in soho#good for her horror#female killers#werewolves#lycanthropy#ginger snaps#ginger snaps 2000#the company of wolves#vampires#ganja and hess#a girl walks home alone at night#demons#def by temptation#possession#mermaids#siren#the lure#the lure 2015#she creature#she creature 2001#witchcraft#witches#the craft#the vvitch#final girls in film

74 notes

·

View notes

Note

please do gebura from project moon 🙏 please and thank you

Can Gebura perform a…

#rko auditions#gebura#project moon#library of ruina#lobotomy corporation#sephirah#disciplinary team#limbus company#gebura lor#gebura lobcorp#lor#lobcorp#lor polls#Lobcorp polls#fandom polls#polls#tumblr polls#character polls#poll time#wrestling polls#poll blog#poll game#hyper specific poll#submissions#submitted

15 notes

·

View notes

Text

someone stop me pls

#second version of a poll where i forgot to include an option for me to monitor the results#to be completely honest my only worry would be gas but i could carpool i’m friends with some people involved in the company#or i could MAKE friends#shakespeare#william shakespeare#theatre#theater#plays#auditions

21 notes

·

View notes

Text

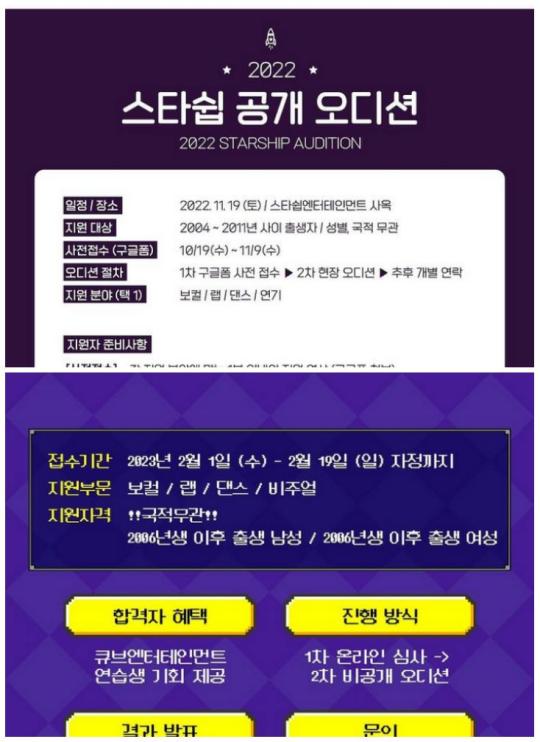

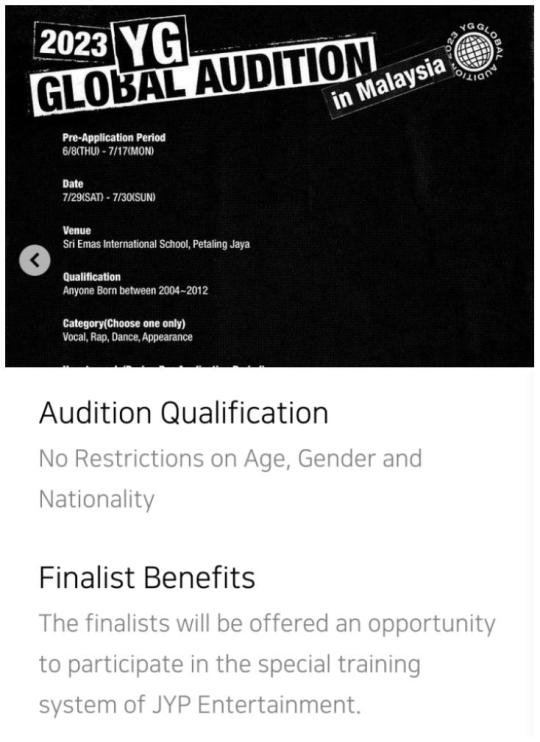

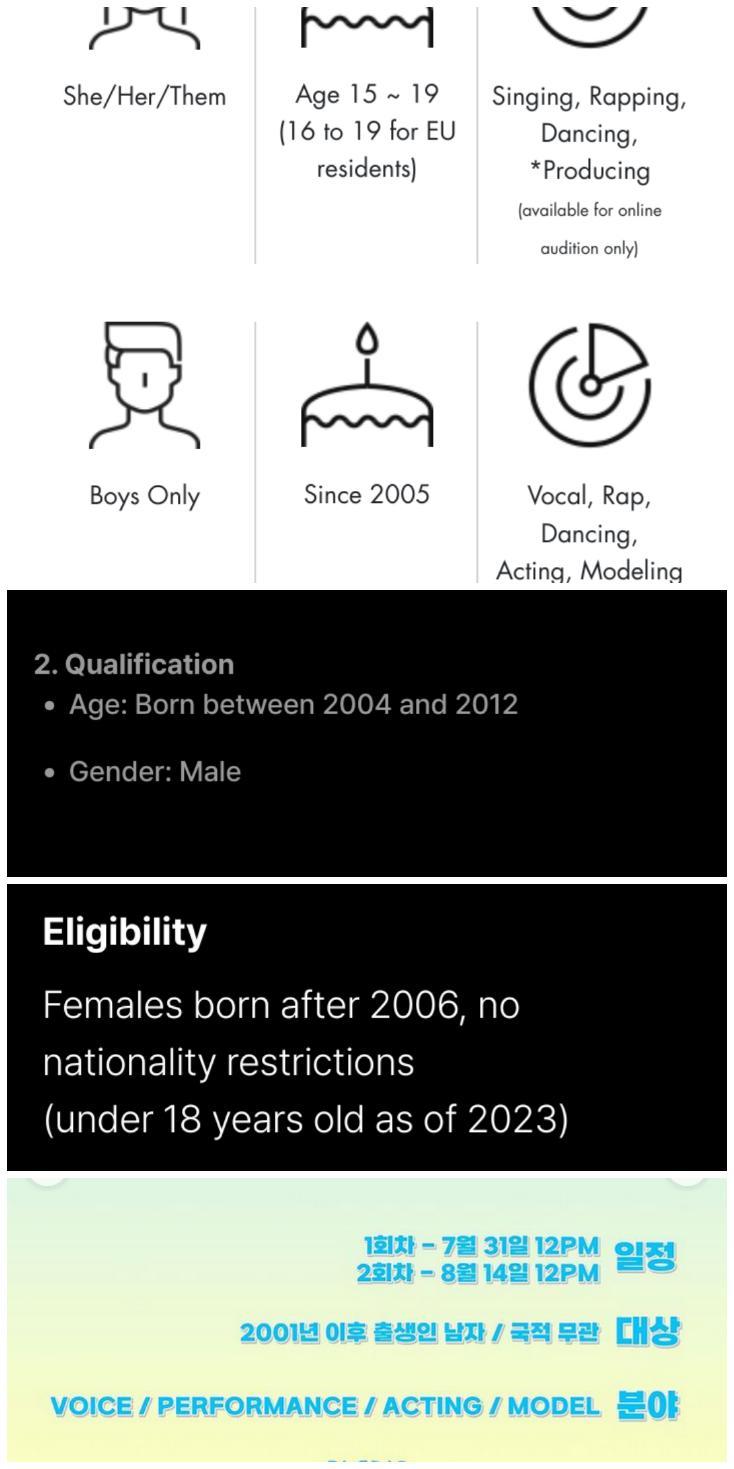

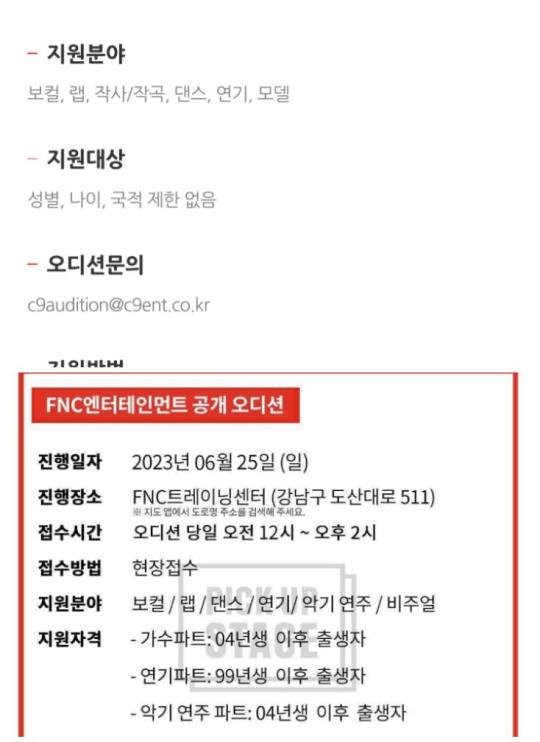

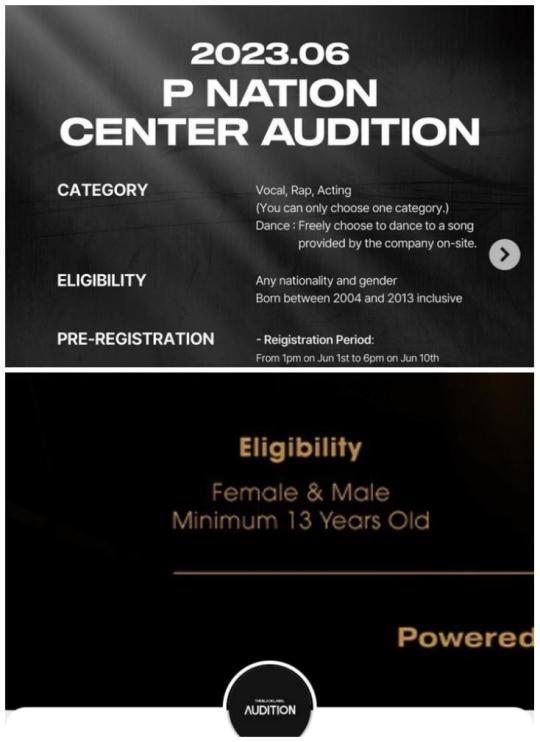

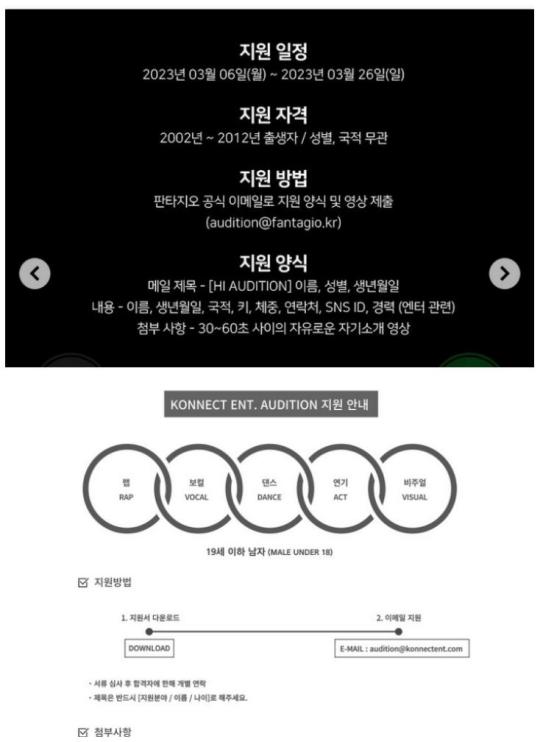

kpop auditions age brackets:

(all info sourced from official pages (ig, audition page on company website))

starship: born 2004-2011 (2022 audition)

cube: born 2006 onwards (2023 audition)

sm: born 2004-2012 (2023 global audition)

wake one: no restrictions (2023 online audition)

yg: born 2004-2012 (2023 global audition in malaysia)

jyp: no restrictions (2023 online audition)

hybe:

- hybe x geffen: only girls ages 15~19, eu residents 16~19 (2023 global girl group audition)

- bighit music: only boys born after 2005 (2023 online audition)

- ador: only boys born 2004-2012 (2023 audition)

- source music: only girls born after 2006 (2023 daily audition)

- pledis: only boys born after 2001 (2022 last member audition)

c9: no restrictions (2023 online audition)

fnc: (singers) born after 2004 (2023 open auditon)

yuehua: no restrictions (2023 online audition)

ist: born 2004-2011 (2023 global audition)

woollim: born before 2012 (woollim x play with me club 2023 new member audition)

mystic: born 2004-2011 (2023 online audition)

p nation: born 2004-2013 (2023 center audition)

black label: minimum 13 years old (2023 the first thailand audition)

top media: born 2006-2012 (2023 audition face to face)

maroo: only boys born 2001-2009 (2022 story audition)

fantagio: born 2002-2012 (2023 fantagio audition)

konnect: boys under 18 (2023 audition)

#i am only using official sources so if i didn't find anything but some random blogs that's why some companies aren't mentioned#or i run out of space#kpop auditions#mellobs

44 notes

·

View notes

Text

୨୧⋆。˚ ⋆ ⠀⠀⠀ ASTELLA’S AUDITION : 2016 !

In 2016, Heejin was under the Entertainment company “Bubble Entertainment” she was scouted and chosen to be a trainee under the company.

She wanted to be a vocalist, that being her strong suit and so she covered the song “One Way Love” by Hyolyn, and was immediately accepted. The directors at the time loved her and her youthfulness look but she held a strong voice that they were looking for for quite a while.

Heejin did not know if she would debut as a soloist or under a group or as a soloist, she didn’t care as long as she got to debut. Every trainee knew that Heejin was the favorite, she got a lot of special treatment from the higher ups at the time. She ended up debuting a year later with the group Promise, known as Paradise now.

She left the group abruptly in 2021, also severing her contract with Bubble, making her a free agent for any company.

୨୧⋆。˚ ⋆ ⠀⠀⠀ ASTELLA’S AUDITION : 2021 !

After leaving Bubble Entertainment and Promise, Starship Entertainment set their eyes on her, thus causing her to audition once more, this time for the first time in 5 years she was doing that.

She didn’t think she would go back to the industry after her fiasco with her former company. But she went with it and did a cover of “Blueming” by IU, and just like the first time, she was accepted.

Now that she’s apart of Starship, she’s had a comeback with the song “Nobody Knows” and is set to do another comeback in the 4th quarter of 2024.

#◟ ⋆ ◟ ⋆ 𝐂𝐎𝐌𝐏𝐋𝐄𝐗 𝐈𝐒 𝐎𝐕𝐄𝐑𝐑𝐀𝐓𝐄𝐃 › heejin kwan !#◟ ⋆ 𝐂𝐎𝐌𝐏𝐋𝐄𝐗 𝐈𝐒 𝐎𝐕𝐄𝐑𝐑𝐀𝐓𝐄𝐃 › development !#◟ ⋆ 𝐂𝐎𝐌𝐏𝐋𝐄𝐗 𝐈𝐒 𝐎𝐕𝐄𝐑𝐑𝐀𝐓𝐄𝐃 › pre-debut !#fictional idol community#fictional idol oc#kpop oc#fake kpop addition#fake kpop gg#fake kpop girl group#fake kpop group#fake kpop member#fake kpop oc#fake kpop soloist#fake kpop company#fake kpop idol#fake oc#fictional kpop community#fictional kpop idol#fictional kpop oc#fictional idol group#◟ ⋆ 𝐂𝐎𝐌𝐏𝐋𝐄𝐗 𝐈𝐒 𝐎𝐕𝐄𝐑𝐑𝐀𝐓𝐄𝐃 › audition !

12 notes

·

View notes