#TFSA investment

Explore tagged Tumblr posts

Text

Investors: A Guide to Earning $1,000 Monthly in Retirement

"Learn how to create a steady monthly passive income of $1,000 for your retirement using Granite Real Estate Investment Trust and a Tax-Free Savings Account. Discover effective investment strategies and financial planning for long-term financial security."

Retirement income

Monthly passive income

Granite Real Estate Investment Trust

TFSA investment

Dividend stocks

Retirement planning

Investment strategy

Financial goals

Stock market opportunities

Wealth building

#Retirement income#Monthly passive income#Granite Real Estate Investment Trust#TFSA investment#Dividend stocks#Retirement planning#Investment strategy#Financial goals#Stock market opportunities#Wealth building

1 note

·

View note

Text

Throwing up

#yknow that thing where you do crazy amounts of research because you feel like youll miss something important?#like youll miss onething so common everyone else knows about it#in all the GODDAMN research. the books. the online lessons. the videos. THE PERSONAL FINANCE FOR DUMMIES BOOK. FOR DUMMIES.#never in my life did anyone tell me about my tax free savings account SECRET ABILITY#if youre money was in your tfsa. even after you take it out. it stays tax free.#IF YOU USE YOUR TFSA MONEY TO BUY INVESTMENTS. YOU DONT PAY TAX ON THE INCOME YOUD GET FROM THE INVESTMENTS YOU BOUGHT#it keeps its tax free status even when its out of that account???? fucks sake#im still doing research but its looking to be true. or at least a semblance to that.#i fucking hate this. its that whole you missed something so common that everyone knows even though its never come up in your life

2 notes

·

View notes

Text

I've been really stressed about financial stuff again (don't want to move back in with the parents vs. literally might not be able to afford rent within 100km of the city AND there's only one house in a reasonable distance (....1.5hr drive) I can afford, and I'd have to Hunger Games style fight and kill every other millennial at the open house so I uh, bought a lottery ticket and then made an account on my bank's investing app (it's like a baby version that teaches you how to trade and stuff). Idk how worth-it investing will be since I'm not like, throwing thousands of dollars into it, but meh, might as well try a little and see what the return is.

#i have 2 tfsa's that my bank is investing for me#but they're really not growing as much as i hoped they would#so im like....maybe i can channel my Tech Bro energy here lol#i want a house but if i can't get a house i want to at least have an apartment for the next year so i don't have to move in with my parents

3 notes

·

View notes

Text

Starting now, every time Chai brings back that post about the modern day caste system, I'm going to post a screenshot of my TFSA.

1 note

·

View note

Text

Video: How to Start Investing

I get asked very often about how to start #investing. Make sure you #start #early and as soon as possible. Find an #investingthesis, get your #riskprofile so you know what to invest in, and then use #ETFs in a #TFSA or #RRSP #account in a #lowcost #brokerage to start making #monthly #contributions. The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in…

View On WordPress

#account#analysis#ASAP#brokerage#contributions#early#ETFs#goals#investing#investingthesis#limitorder#lowcost#market#marketorder#monthly#riskprofile#rrsp#start#taxbracket#taxes#tfsa#wealthsimple

0 notes

Text

0 notes

Text

#RRSP#rrsp account#TFSA#tfsa account#LIRA#RSP#registered retirement saving plan#Tax-Free Savings Account#tax free investment account#Locked-in retirement account#locked in retirement income fund#retirement accounts#best retirement accounts#Types of retirement accounts

0 notes

Text

Plenty of Options for Financial Planning in Canada

Whether you use an investment firm or rely on the services available at your local bank or credit union, a lot of us have someone we commonly refer to as our "financial advisor".

It's a generic term and is broadly used, but for most of us it means someone who "handles our investments". The actuality is that the scope of investment products and services they offer as well as their level of professional training and experience varies greatly.

Some of us only rely on an advisor to invest our TFSA or RRSP and meet with them very infrequently, or simply review the statements that show up in the mail from time-to-time. Others depend on their advisor for a lot more than investing and seek advice on retirement planning, tax strategies, saving for a home, and many other issues.

Regardless of the scope or frequency of the service your financial advisor provides, the basic fact is that you are putting a lot of trust (and a lot of cash!) in their hands.

Accordingly, you should be carefully evaluating your initial decision and also monitoring their service on an ongoing basis. Despite the considerable consequences of their job performance on your future, a lot of us spend more time choosing our mobile phone plan than we do the "expert" who manages our life savings.

The main problem with evaluating a financial advisor is lack of knowledge. It is easy for us to judge the quality of food and service at a restaurant and make a decision if we will return, but it's a lot more difficult when it comes to a financial advisor.

Another factor clouding the issue is the confusing hodgepodge of names used to describe financial service providers — (certified) financial planner, investment advisor, financial advisor, financial coach, money coach, etc. Although there are a number of recognized accreditations for investment advisors in Canada, the degree of experience, expertise and qualifications varies greatly.

Whether you have had the same advisor for years or are just now looking for your first, you need to ensure they are offering value for your money. A good advisor is an invaluable resource for those of us who don't have the time or specialized knowledge to manage our finances on our own. However, depending on an advisor also means that you owe it to yourself to carefully evaluate their service and performance on a regular basis.

Financial advisors usually focus on investing while a financial planner takes a more holistic approach. The scope of their services may include budgeting, saving for a home, investing, insurance, etc. Retirement planning in Canada is a complicated issue and people often turn to a financial planner for advice in this area. The Enriched Academy coaching program goes one step further and adds in an education component, so you not only get expert advice and a comprehensive plan, but you also learn to manage your own finances — for life!

There are lots of options to help you manage your money, but it isn’t always clear what each one does, and more importantly, which one is right for you?

A good place to start is to dig into the fees you are paying and what sort of returns you have been getting? High MER fees on mutual funds held in a TFSA or RRSP and compounded over the years can really dig into your retirement fund and aren’t usually justified by the returns on those mutual funds.

You can also evaluate their service on a more basic level — Do they offer all the products and services you require? Do they keep in contact and remember you and your situation? Do they readily and clearly answer your questions.... even "prickly" ones about annual returns and fees? A good advisor should pass your "stress test" with flying colours.

Your main considerations for what sort of financial advice and support you need should be how much knowledge and time you have and the degree you would like to be involved. You could leave it completely up to someone else, and even though they may have a fiduciary duty to act in your best interest, it’s too much of a leap of faith for most of us. We work hard for our money and want to have some ability or knowledge to assess whether it is being managed effectively and within our expectations for risk and return.

If you are reading this article, chances are you are leaning towards educating yourself and taking a more DIY approach. DIY investment planning in Canada is a popular approach, but many Canadians routinely supplement their own knowledge with that of a professional. Some issues like tax planning can be highly specialized and demand expert level knowledge and experience.

Whether you choose a full-service financial planner or decide to go it on your own with a purely DIY approach, make sure to regularly evaluate the risks and rewards/benefits of how you manage your investments and adjust as required — complacency and/or procrastination can be costly!

0 notes

Text

TFSA investment advisor in Toronto

A tax-free saving account is best if you want to grow your money without paying taxes. According to the TFSA investment advisor in Toronto, this savings account helps you increase your money faster. In addition, individuals do not need to pay on the income they earn through the account.

0 notes

Text

TFSA Investment- A Tax-Free Savings Benefit

In Canada, people prefer to have a tax-free money-saving solution. According to the Canada Revenue Agency report, nearly 15.3 million Canadians invested in TFSA in 2019. Moreover, there are around 22.3 million TFSAs, which means each Canadian has around 1.5 TFSAs. Since this is one of the most popular investment options, people like to invest in a Tax-free investment account. However, according to TFAS advisors in Toronto, this plan offers more than only tax-free savings.

The TFSA holds complex investment products such as exchange-traded funds, mutual funds, and equities. The products help to maximize your investment, and all earnings will be tax-free. So, if you want tax-free savings but are still determining whether the product is the right fit, here's what a TFSA investment advisor in Canada says.

What is TFSA?

The Canadian government introduced this personal saving system TFSA (Tax-Free Saving Account), in the 2008 budget. This savings account is to help people save money for different purposes. You can begin contributing to a TFSA as of January 2, 2009, and the accumulations are tax-free. A TFSA can comprise a mix of asset classes, including funds, equities, treasuries, GICs, and mutual funds.

Any Canadian citizen who reaches 18 on any date throughout a calendar year is eligible to make deposits in TFSA. The "contribution room" of the TFSA holder starts to grow at that point. This refers to the discrepancy between the exact worth contributed and the total maximum deposit permitted.

If you fall short of your annual contribution cap, the shortfall is carried over to the subsequent year. This further added to your earned income. INSUREDCAN, a TFSA investment advisor in Canada, explains how TFSA works if you still have doubts.

How Much Investment Should I Make in TFSA?

As per the TFSA advisor in Toronto, for 2023, the annual maximum TFSA investment for each person is set at $6,500. The yearly maximum donation limit originally was as follows:

1. $5,000 from 2009 to 2012

2. $5,500 in 2013

3. $10,000 in 2015

4. $5,500 in 2016

5. $6,000 from 2019 to 2022

The subsequent year's TFSA contribution ceiling will be increased by any carried-over unused investment space from the previous year. Therefore, a calendar year's worth of withdrawals will result in more contribution space the following year.

What are The Benefits of TFSA?

With a TFSA, you may save money in qualified assets and see it grow tax-free lifetime. In a TFSA, dividends, earnings, and investment income are tax-free for life. In addition, you can take any number of tax-free withdrawals from your TFSA investments anytime for any reason.

Additionally, you can add the money you withdraw back into your TFSA. You must do it next year to avoid it affecting your contribution room. Some other significant benefits of TFSA by TFSA investment advisors in Toronto are as follows:

Withdrawals are Not Mandatory

These tools are excellent for massive products but also a terrific method to make long-term investments. For example, if you started a TFSA after getting a new car or house, you could seek a long-term investment vehicle. Let investment grow if you don't have any major expenses planned shortly.

Withdrawal Doesn’t Affect Benefits

The performance of a TFSA will not generally impact your eligibility for income-tested government benefits, which is also important from a tax viewpoint. Although it may not be a selling factor for many investors, this might save the lives of limited income seniors who get benefits with strict claw-back clauses.

Effective Tax Strategy for Real Estate Planning

Although no one loves to talk about it, it might be crucial if you want to safeguard the financial prospects of your family members. Upon the demise of the account owner, distributions from a TFSA may be paid to a beneficiary—whether a family member or friend—without triggering any tax consequences.

Your Spouse/Law Partner Can Contribute

Contributions to TFSAs are made with post-tax money. The TFSA of a spouse or common-law partner may receive contributions, according to the TFSA investment advisor in Toronto. To increase your payments, you may make a TFSA contribution to the spouse's or common-law partner's account.

Will the TFSA Account Closed If I Leave the Country?

After creating the TFSA, you can still leave the TFSA account open and pay no taxes on any earnings or withdrawals in Canada. You may not be able to make contributions to your TFSA. However, you are still allowed to make contributions during the year that you changed residences. You should have been aware of a 1 % penalty fee. You have to pay this penalty every month that a prohibited non-resident contribution stays in the TFSA.

Bottom Line

So, this is all about TFSA and how it benefits you to grow your money without paying taxes. The best thing is that TFSA assets can be used as security and loans. However, the TFSA is not for non-residents of Canada. If you leave the country and are no longer a Canadian, you'll be able to manage TFSA but not be able to contribute further to the TFSA account.

For more updates or information about TFSA, contact us. INSUREDCAN is a TFSA investment agent advisor in Toronto who guides you to get the right saving options.

#TFSA Investment Advisor in Toronto#TFSA Investment Advisor#TFSA Investment Advisor in CANADA#TFSA Investment Advisor in Ontario#Insured Can#Insured Canada

0 notes

Text

I have sorted and whittled down 1791 images to 1087 that need to be sorted. That 1087 are all DGS fanart, which must now be sorted by placement in the timeline, characters, ships, and whether or not it's a comic.

A problem for tomorrow, which will hopefully not take too long. I have other things to do tomorrow like call the bank.

Finding out a decade after I left Lore that one of the Mirror Realm themes is an arrangement of Senbonzakura while I've got my OST playlist on shuffle while sorting fanart to calm myself down enough to sleep is sure.

Well it's an Emotion.

#sg.txt#turns out you need to call the stupid bank in order to set up a tfsa??#and also i need to set up a general investing account#and a stupid rrsp i guess. also stick some money in my savings + adjust my checking account#i should also redo my financial spreadsheet tbh. it's a bit wack and doesn't track everything#follow that bitchesgetriches tutorial that looked interesting. see what that does#also fingers crossed turnabout ballroom comes in tomorrow#so i can do a border run tomorrow afternoon and go pick up my packages#i got two books and some stickers waiting for me.... i deserve them after all the bullshit of the past couple weeks#also set up my alt account properly because tumblr glitches#can never trust tumblr lmao#oh yeah and the klint zine comes out tomorrow hopefully :) that'll be good!!!

3 notes

·

View notes

Text

KIMMY'S DIGITAL DIARY

October 20, 2024

dear diary,

i'm now 26 years old and my age is starting to get real serious. when the sun finds the same position in the sky as it did when i was born it feels like a rebirth. i've learned so much about myself in the past year and i've decided i wasn't showing up for myself the way i said i would.

i wasn't showing up as the dream girl i know i can be so it's time to make some changes financially, mentally, physically and spiritually. i have a new budget set and i've finally set up a TFSA and started putting money into my investment portfolio again. this is what i'm calling paying myself first and investing in myself (literally)

my wardrobe is in need of a grown woman makeover so it's time for some thrift hauls and experimenting with pinterest boards.

i also bought myself a macbook (finally!!) so i can be frequently post on tumblr and connect with my audience(you lovely people) more.

im so happy to be here and can't wait to see what this year has in store

Xoxo

Kimmy

song of the week

what's in?

budgeting - paying yourself first by investing for your future

pilates classes 3 times/wk along with 2 days of strength training

reading 1 book a week

eating a healthy meal 3 times a day (no skipping breakfast!!)

daily journaling + gratitude

what's out?

spending recklessly

staying home and not socializing

not reading outside of social media

lying to yourself

#it girl#that girl#self care#dream girl#pink pilates princess#kimmys digital diary#digital diary#whats in#affirmations#seriously showing up for myself now#no more excuses#winter arc#girlblogging#becoming that girl#lock in#Spotify

12 notes

·

View notes

Text

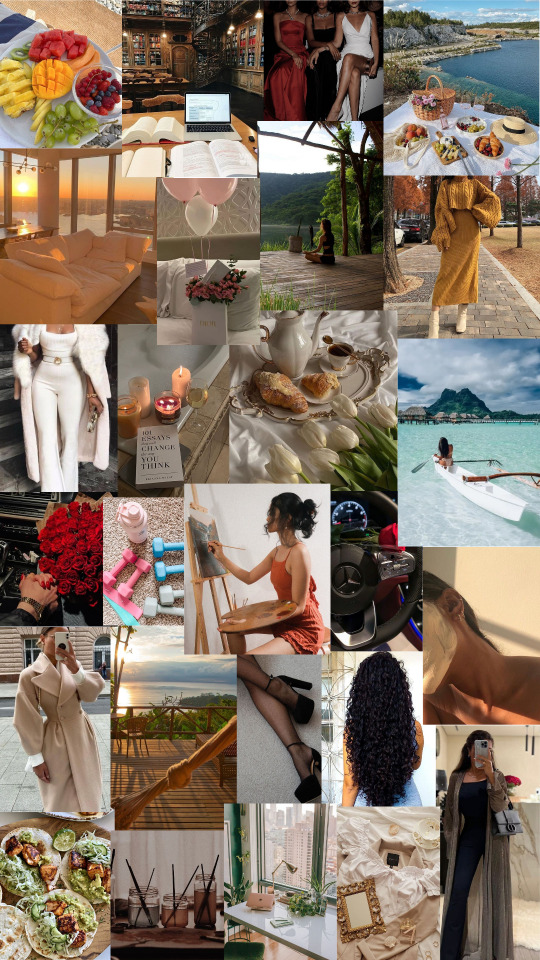

Jan. 1st 2022: Goals & Vision board

Fitness: Strong & healthy

Daily movement (yoga/dance) 20 min

Walk 1hr 5x / week

Resistance training 3x / week

Nutrition: Listen to what my body needs

More whole & anti-inflammatory foods

Weekly meal prepping

Veggies & protein with each meal

Self-care: Pampering the self

Skincare (consistent with morning and night routines)

Haircare (style curls weekly,

Spa nights every 2 weeks (nails, baths, scrubs, waxing, masks, trim hair, etc)

Aesthetics: more bold, more creative, more Me.

New hairstyle 2x / month

Same clothes, new outfits 2x / month

Step up eyebrow & lip game

Financial: Money is a tool, not the goal

Finish e-com modules by March 1

Remote part-time through Act

Learn to invest with TFSA

Academics: I am smart. Now I gotta be disciplined.

11.0 CGPA in all classes

Study 2hr/day Monday-Friday (not including watching lectures)

Complete assignments & papers in advance

Personal Enrichment: Stimulate the mind

Read 1 book / month (any genre)

Study Italian

Research topic of interest & record thoughts monthly

Wellness & Creativity: For the Soul

Journaling 10min / night

Morning meditation 10min / day

Canva or watercolour 1hr / week

Social media: Connection vs Disconnection

Limit unnecessary screen time 2hr / day

Use apps more intentionally

Unfollow / unfriend accounts, pages & people that no longer align with me

Adult things : Miscellaneous

Move back near university

Take driving exam

Get new passport

Get life insurance

Relationships :

Maintain firm boundaries

Invest in healthy, respectful, balanced connections

Release those (family, friends, etc.) that do disturb my peace

21 notes

·

View notes

Text

Also my aunt tried to convince me last night that I should get a GIC with her bank because "rates are really good right now!!" but uh. I think she and I are investing vastly different amounts of money here...

#the 2k at the top is what i would invest#aka the grand total of my retirement fund#like $110 is.... absolutely not worth even the trouble of switching my tfsa to them lol#it would grow faster if i just keep making my paltry monthly payments into it instead of investing#man so much of financial advice is a scam if you have less thank 10k in your account#love my aunt dearly but she has been upper middle class for too long lol

0 notes

Text

New Year, Fresh Start

Daily Reflection Monday, 1 January, 2024

Things I'm Grateful For:

Having my ever-growing to-do list written down in my planner, so I don't have to forget those things I need to do.

Highlights:

Since I was up past midnight with friends, I made a final "fuck it, I'm staying up all night." After everyone logged off, I had a spurt of productivity and got a bunch of little odds and ends taken care of.

Even if it only really amounts to $1 per day, I enjoy the feeling like I'm setting myself up for success when I transfer some money into my investment account each month. Because January has 31 days, I transferred $31 this time. It's in a TFSA so I won't be taxed on what the money earns, and it's a zero-commission account, so everything that is put into that account will be mine when I withdraw it.

I didn't get everything on my to-do list done for the day, but I still managed to do quite a bit! I don't mind carrying over two tasks, especially when one of them is 90% done.

Challenges:

I couldn't get my money stuff taken care of when I first wanted to because my bank's online portal was down for maintenance. Bit of a nuisance, even though it's not really a huge deal--I don't have to deal with my money at 4:00am, it can wait until a more reasonable hour.

I accidentally ended up napping in the middle of the day. I laid down around 11:00am, and then dozed off and slept until about 2:30pm. So that took a chunk of time away from me that I could have used, but after an all-nighter, three and a half hours won't ruin everything.

Emotions:

I feel like an asshole, and a terrible friend. A friend of mine is going through a rough patch because a woman ran a red light the other day and fucked up his car. He's going through the process of trying to get proof for his insurance that he wasn't at fault, and trying to figure out what's going to happen to his car (he spent all his savings on it less than two months ago, and the odds are pretty much 50/50 that it could be written off). I fully understand that he needs to vent, but I just really don't like listening to that kind of thing. I want to just go and tune him out so it feels like a win-win (he gets to vent, I don't have to actually listen), but that also feels like a terrible thing to do.

The shoes I ordered with my Christmas money are supposed to be here tomorrow, according to FedEx. It's hard to say how accurate that is though, as it's been "we have your package" since the 28th, with the order itself placed on the 25th. If it's not in tomorrow, Wednesday would also work. I just want them in before I go back to school on Thursday.

Lessons Learned:

For all that my friends are usually there for me when I need it (even though I will rarely ask for help), I'm not great at doing the same for them. I think that's part of why I don't ask for help; I don't want to be one of those people who ask for help all the time but never offer anything in return. I want it to be fairly balanced, and unfortunately, holding back on my end is how I can help keep it that way.

Today's To-Do List:

Completed

Readjust the cat feeder to dispense at night.

Reorganize phone apps.

Find new wallpapers for my phone and laptop.

Divide my second student loan disbursement into GICs.

Pay board.

Clean out my D&D binder and prepare for the new campaign.

Renew my FitBit Premium membership.

Add $31 to my investment account.

Give the cats baths.

Put together the grocery list.

Uncompleted

Clean out my school binder and prepare for the new semester.

Finish catching up on laundry.

Tomorrow's To-Do List:

Buy a mirror that hangs off the door for my bedroom.

Buy a notebook to start a commonplace book.

Get groceries.

Nana's housework.

#accountingacademic#accounting academic#accounting#studyblr#college#productivity#study#daily reflections#january#2024#january 2024

2 notes

·

View notes

Text

@kikirikina1 @krisymiriam @krispybluebirdstarlight

CRA actively in search of individuals who day commerce investments in TFSAs - financialserviceslife

2 notes

·

View notes