#Insured Canada

Text

TFSA Investment- A Tax-Free Savings Benefit

In Canada, people prefer to have a tax-free money-saving solution. According to the Canada Revenue Agency report, nearly 15.3 million Canadians invested in TFSA in 2019. Moreover, there are around 22.3 million TFSAs, which means each Canadian has around 1.5 TFSAs. Since this is one of the most popular investment options, people like to invest in a Tax-free investment account. However, according to TFAS advisors in Toronto, this plan offers more than only tax-free savings.

The TFSA holds complex investment products such as exchange-traded funds, mutual funds, and equities. The products help to maximize your investment, and all earnings will be tax-free. So, if you want tax-free savings but are still determining whether the product is the right fit, here's what a TFSA investment advisor in Canada says.

What is TFSA?

The Canadian government introduced this personal saving system TFSA (Tax-Free Saving Account), in the 2008 budget. This savings account is to help people save money for different purposes. You can begin contributing to a TFSA as of January 2, 2009, and the accumulations are tax-free. A TFSA can comprise a mix of asset classes, including funds, equities, treasuries, GICs, and mutual funds.

Any Canadian citizen who reaches 18 on any date throughout a calendar year is eligible to make deposits in TFSA. The "contribution room" of the TFSA holder starts to grow at that point. This refers to the discrepancy between the exact worth contributed and the total maximum deposit permitted.

If you fall short of your annual contribution cap, the shortfall is carried over to the subsequent year. This further added to your earned income. INSUREDCAN, a TFSA investment advisor in Canada, explains how TFSA works if you still have doubts.

How Much Investment Should I Make in TFSA?

As per the TFSA advisor in Toronto, for 2023, the annual maximum TFSA investment for each person is set at $6,500. The yearly maximum donation limit originally was as follows:

1. $5,000 from 2009 to 2012

2. $5,500 in 2013

3. $10,000 in 2015

4. $5,500 in 2016

5. $6,000 from 2019 to 2022

The subsequent year's TFSA contribution ceiling will be increased by any carried-over unused investment space from the previous year. Therefore, a calendar year's worth of withdrawals will result in more contribution space the following year.

What are The Benefits of TFSA?

With a TFSA, you may save money in qualified assets and see it grow tax-free lifetime. In a TFSA, dividends, earnings, and investment income are tax-free for life. In addition, you can take any number of tax-free withdrawals from your TFSA investments anytime for any reason.

Additionally, you can add the money you withdraw back into your TFSA. You must do it next year to avoid it affecting your contribution room. Some other significant benefits of TFSA by TFSA investment advisors in Toronto are as follows:

Withdrawals are Not Mandatory

These tools are excellent for massive products but also a terrific method to make long-term investments. For example, if you started a TFSA after getting a new car or house, you could seek a long-term investment vehicle. Let investment grow if you don't have any major expenses planned shortly.

Withdrawal Doesn’t Affect Benefits

The performance of a TFSA will not generally impact your eligibility for income-tested government benefits, which is also important from a tax viewpoint. Although it may not be a selling factor for many investors, this might save the lives of limited income seniors who get benefits with strict claw-back clauses.

Effective Tax Strategy for Real Estate Planning

Although no one loves to talk about it, it might be crucial if you want to safeguard the financial prospects of your family members. Upon the demise of the account owner, distributions from a TFSA may be paid to a beneficiary—whether a family member or friend—without triggering any tax consequences.

Your Spouse/Law Partner Can Contribute

Contributions to TFSAs are made with post-tax money. The TFSA of a spouse or common-law partner may receive contributions, according to the TFSA investment advisor in Toronto. To increase your payments, you may make a TFSA contribution to the spouse's or common-law partner's account.

Will the TFSA Account Closed If I Leave the Country?

After creating the TFSA, you can still leave the TFSA account open and pay no taxes on any earnings or withdrawals in Canada. You may not be able to make contributions to your TFSA. However, you are still allowed to make contributions during the year that you changed residences. You should have been aware of a 1 % penalty fee. You have to pay this penalty every month that a prohibited non-resident contribution stays in the TFSA.

Bottom Line

So, this is all about TFSA and how it benefits you to grow your money without paying taxes. The best thing is that TFSA assets can be used as security and loans. However, the TFSA is not for non-residents of Canada. If you leave the country and are no longer a Canadian, you'll be able to manage TFSA but not be able to contribute further to the TFSA account.

For more updates or information about TFSA, contact us. INSUREDCAN is a TFSA investment agent advisor in Toronto who guides you to get the right saving options.

#TFSA Investment Advisor in Toronto#TFSA Investment Advisor#TFSA Investment Advisor in CANADA#TFSA Investment Advisor in Ontario#Insured Can#Insured Canada

0 notes

Text

The federal government unveiled details about its highly anticipated Canadian Dental Care Plan (CDCP) earlier on Monday.

The CDCP is a $13-billion insurance program that will start covering most basic dentistry costs next year for uninsured Canadians with a household income under $90,000.

That's about nine million Canadians, according to the federal government. In its current form, the plan is expected to cost the federal treasury about $4.4 billion per year.

Continue Reading

Tagging @politicsofcanada

#cdnpoli#canada#canadian politics#canadian news#dental care#dental insurance#canadian dental care plan

214 notes

·

View notes

Note

Not an Aro-culture-is thing but I do have a question you might be able to answer? Is there an aromantic/asexual term for this: AroAce but if I wasn’t I would be gay? It might just be homoplatonic or homoaesthetic but idk if there was a term for it that relates to being AroAce. Thanks! <3

possibly you might vibe with oriented aroace labels, like gay aroace? i'll put this out there for other folks to consider as well, but I feel like oriented terminology sounds the most applicable from my POV.

#und3rw0r1d-unkn0wn#not aro culture#aro#aromantic#actually aro#actually aromantic#ask#mod axel#sorry we've vanished. we are Fuckin Unwell physically + emotionally tbh#also if the medical industry + the medical insurance industry could Please consider working that would be great#also if canada could pls not be on fire. don't have the spoons to research what's going on but i suspect there's the usual human fuckery#the air quality here is miserable for an area that doesn't really tend to get wildfires#(though fun fact! my fuckin grandpa almost managed to start one by having angry-style dementia and insisting it was fine that he burned log#and then dumped the ashes literally into some fuckin forest undergrowth WITHOUT TELLING PPL until it started smoking the next day.#the area was under a burn ordinance [aka burning shit is illegal due to fire risk])#fun fact: you are not immune to thinking it will never happen to *you* in what is truly a game of chance#yes you might be *more cautious* than the average person. means fuck all when the conditions are perfect for any small thing to cause#big shit#... yeah i'll leave that as a tag for me to be confused by later

151 notes

·

View notes

Text

*Covered in blood and shaking* I finally got ahold of a new doctor

#it is genuinely like pulling fucking teeth trying to get healthcare in this province#and that's a good analogy for canada too because our dental care is crazy#just realized i'm going to lose my insurance within the year if i graduate. .....shit.

8 notes

·

View notes

Text

okay we are trying to stay positive </3 I called them and they said they might have just received it this morning, they just need to check their stock for their day and they’re gonna call me back, if not they’ll try and let me know where I can pick it up 😭🙏

#PLEASE PLEASE PLEASE OUGHHHHH#so I can at least have enough to figure out how to get it in Canada#not looking good though… probably gonna have to wait a while to get a prescription in Canada#I saw various things but either I gotta get on my wife’s insurance or wait til I’m officially a resident to get a primary doctor and THEN#I can sign up w the local lgbt center to get trans healthcare#tho once I sign up that will only take a few days to get hrt but yeah </3 everything else before then is gonna be rough

9 notes

·

View notes

Text

i love to say "if california wasn't so expensive" as if where im living right now isn't both more expensive and less accessible than ANY city in california or almost the entire country of america

#they're not kidding about the canadian housing crisis babes!!!#it's not so much the prices as much as bcuz the land we built on isnt like.... able to be “changed” in the way that mainland is#they physically cannot build outwards and grow the location even if people move here. it's a limited amount of space and its expensive#and a lot of canadian land is protected under government acts so it isnt as simple as like moving 300km to the west#because there ISNT 300k to the west. there isnt anything there. its either all isolated forests or oceans#vs america which as i understand it has towns and land avaliable everywhere. small towns are a THING and they arent EXPENSIVE#moving to a small town “because its cheaper” is laughable here#probably why america is a much more sucessful country than canada in terms of global reach and economic growth#so basically the main issue is immigration and american health insurance being slightly crazy#and also Money#txt

7 notes

·

View notes

Text

i wish ppl would stop talking abt canadian healthcare like it’s some sort of utopian socialist system because liek. it’s not. categorically, canadian healthcare is not free

yeah I can show up to the hospital with a broken arm and get it fixed without paying but you know what WASN’T free? the physiotherapy I had to go to in order to regain the ability to use my arm. nor the prescription medications to manage my chronic pain or various mental illnesses. nor the physio my dad needed to get after he was pumped full of drugs during recovery from cancer that gave him nerve pain. nor his chiropractic visits. nor my eyeglasses or his lasik. yeah, I can go to the hospital and enroll in their dbt program, but the waitlist is TWO AND A HALF YEARS LONG. people can and have killed themselves waiting for care here. but don’t worry, medical assistance in dying is totally covered! your landlord won’t upgrade your inaccessible apartment and disability pay has you orders of magnitude below the poverty line? no problem! oh, no, we’re not going to give you a rent suppliment. have you considered state sponsored suicide?

#mads.txt#i have to pick up my antidepressants tmrw and im mad about it.#hopefully the pharmacist will be nice again and undercharge me#also this is a very limited perspective on the issue. i didnt even get to talking about insurance#most of the people i know have had to choose between rent food or the medications that keep them from death but yeah we're sooo good#canada has 'we're not as bad as america'd our way into a liberal capitalist hellscape

19 notes

·

View notes

Text

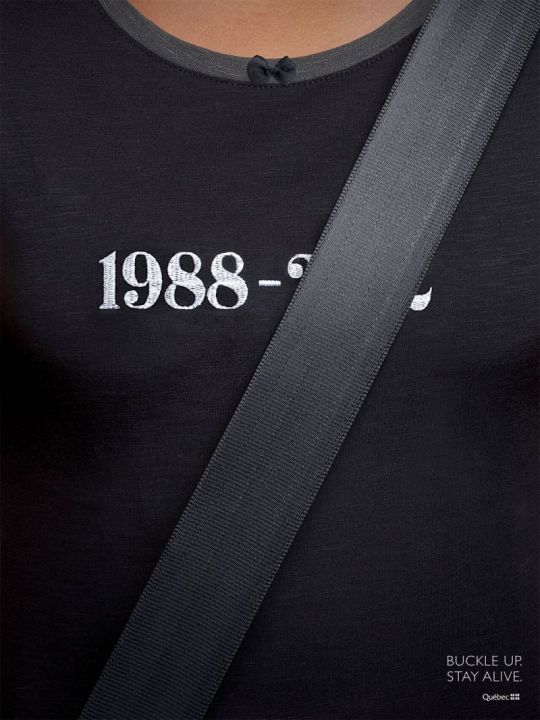

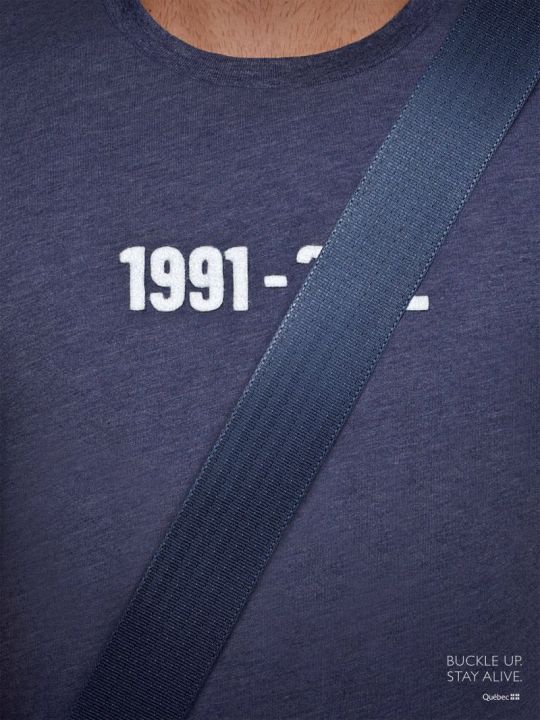

LG2 (Canada) for Quebec Automobile Insurance Society

10 notes

·

View notes

Text

btw if y'all ever have questions about the coding for a medical bill you receive or anything like that, i'd be more than happy to take a look at it. like i can't give you Official Legal Advice or whatever but i can at least give it a once-over

#only in the US sadly… pretty sure canada uses the same codes but i'm not positive#i can also help you with enrolling in health insurance if you're confused about that! i have helped several people with that#blabs

6 notes

·

View notes

Text

Is Term Life Insurance A Good Idea To Invest?

Getting term life insurance is a question of debate for individuals. A massive population in Canada is still not aware of insurance plans and how these policies work. At the same time, some people are unwilling to purchase a term life insurance plan due to high costs.

Having term life insurance in Toronto is worth it to provide financial security to your family. The term life insurance plan can overcome outstanding debts, personal expenses, family finance requirements, and more. It's a smart investment to enjoy financial freedom and help to combat sudden accident loss. Read on to know more about term life insurance and whether it is worth it.

What exactly is the term life insurance?

The term life insurance is one of the simplest forms of life insurance that lets you save money for the family or nominee you selected in unforeseen cases. An individual must pay for 10-30 years of term life insurance in Toronto. In case the policyholders die during policy time the beneficiary will receive cash benefits.

In short, term life insurance investment makes sense if you want to be financially secure for a set period. With a term life insurance policy, your investment will be summed up as death benefits for the nominee. This means beneficiaries will get large death benefits.

Who should buy a term life insurance plan?

It's a basic life insurance plan ideal for everyone, especially families. Individuals contributing finance to meet financial requirements or having parents dependent on them must opt for term life insurance in Toronto. It ensures financial safety for the families after the demise of an individual.

What if someone has pre-existing medical conditions?

A person having a pre-existing medical condition can also get term life insurance. Moreover, individuals can also get insurance from a term life insurance agent in Toronto without any medical examination. However, you still need to answer numerous health-related questions and are likely to pay a high premium.

Benefits of investing in term life insurance

Term life insurance in Toronto is an excellent investment option if you want to support the financial requirements of your loved ones after a sudden demise. Another perk of investing in term life insurance policies than other insurance policies is as follows:

● Low premiums : Term life insurance premium is comparatively less expensive than permanent or other insurance policies. That's because the term life insurance agents in Toronto assume you have less risk of death since you will be insured for a limited time. Individuals can enjoy a low premium policy if they purchase it at a younger age.

● Flexibility of period : Another great advantage of opting for term life insurance in Toronto over others is people can choose the period or how long they need to be insured. For instance, if you need life insurance for around 20 years, term life insurance gives you the flexibility to get insured for a particular period.

● Convert into permanent insurance : Once a term life insurance policy comes to maturity, individuals can close it. They can convert to permanent life insurance coverageif they need to extend the policy further.

Tax-free income benefits

Individuals can yield tax-free income by claiming on the maturity of a term life insurance policy. Moreover, the beneficiary will also receive tax-free income for a particular period after your death.

How the term life insurance policy rates decided in Canada

In Canada, the policy rates will be calculated on certain factors such as personal characteristics, policy length, and coverage amount selected by the individual.

1. The coverage amount you opted :

Total coverage amount means the sum assured an individual wants their beneficiaries to receive. For instance, if someone chooses coverage of around $250,000, their beneficiary will receive $250,000 as one tax-free payment. The more coverage a person opts for, the more their nominee will receive after the policyholder's demise. However, if someone wants maximum death benefit from term life insurance in Toronto, they need to pay a higher premium.

For instance, if anyone has opted for a $250,000 coverage amount, the individual needs to pay a sum of $24.00/month. Likewise, if someone wants coverage amount of $50,000, an individual needs to pay a sum of $39.99/month.

2. Insurance policy length selected

The length of policy means how long a person needs to cover from the current age. If someone's coverage extends after a certain period, they must pay more monthly.

Suppose a person purchases term life insurance in Toronto at the age of 20 and needs coverage for up to 30 years; they need to pay more than if they opt to extend coverage for 10 years. To clarify, a $350,000 20-year life insurance in Toronto would cost an average of $34.77/month, whereas a term life insurance of $350,000 for 30 years would cost around $51.02/month.

3. Personal characteristics of an individual

In general terms, personal characteristics refer to age, health, gender, and others that show how riskier someone is to get insured. The premium of the policy will be calculated on these characteristics.

Age: The premium amount of term life insurance in Toronto increases according to age. For instance, if someone purchases an insurance policy at the age of 45 and is likely to die during a 30-year term, they have to pay a big premium amount. But if they purchase the same policy at 20, they will likely pay less.

Health: If someone is suffering from a deadly disease or any other pre-existing medical condition that increases the risk of death, such as heart problems, diabetes, and more, they need to pay a high premium to the term life insurance agent in Toronto for policy.

Risky Hobbies: Individuals playing risky sports or involved in risky jobs where accident risks are high can opt for a term life insurance policy at a higher premium.

Bottom Line

Term life insurance in Toronto gives financial security to the family after your death. It helps your family to reduce the stress of financial requirements. Moreover, the sum assured amount can be beneficial to meet your family person's requirements. Hence, investing in RBC term life insurance in Toronto is essential.

Still Two Minds on Term Life Insurance?

Let's connect quickly with our term life insurance agent in Toronto. INSUREDCAN is here to answer your queries and help you find the best term life insurance to secure your family's future.

#Term Life insurance In Toronto#Term Life insurance In Ontario#Insured Canada#Term Life insurance In CANADA#Business

0 notes

Text

The New Democratic Party and a group of labour unions are calling on the federal government to change Canada’s employment insurance rules so that new parents, especially new mothers, are not denied regular EI benefits if they get laid off.

In a letter sent Thursday to Randy Boissonault, Canada’s employment minister, and NDP MP Daniel Blaikie, along with the Canadian Labour Congress, Unifor and the Canadian Union of Public Employees, are demanding an end to “gender discrimination” in the program.

A copy of the letter shared with Global News stated: “Under the current EI Act, special and regular benefits can be combined up to a 50-week maximum. Using qualifying hours for regular benefits reduces what you can claim in maternity and parental benefits, and vice-versa.

“This means that women who have a baby and access maternity benefits lose their protection in the event of a lay-off,” the letter to Boissonnault reads.

Continue Reading

Tagging @politicsofcanada

#cdnpoli#canada#canadian politics#canadian news#labour unions#NDP#employment insurance#gender discrimination#parental leave#layoffs

82 notes

·

View notes

Text

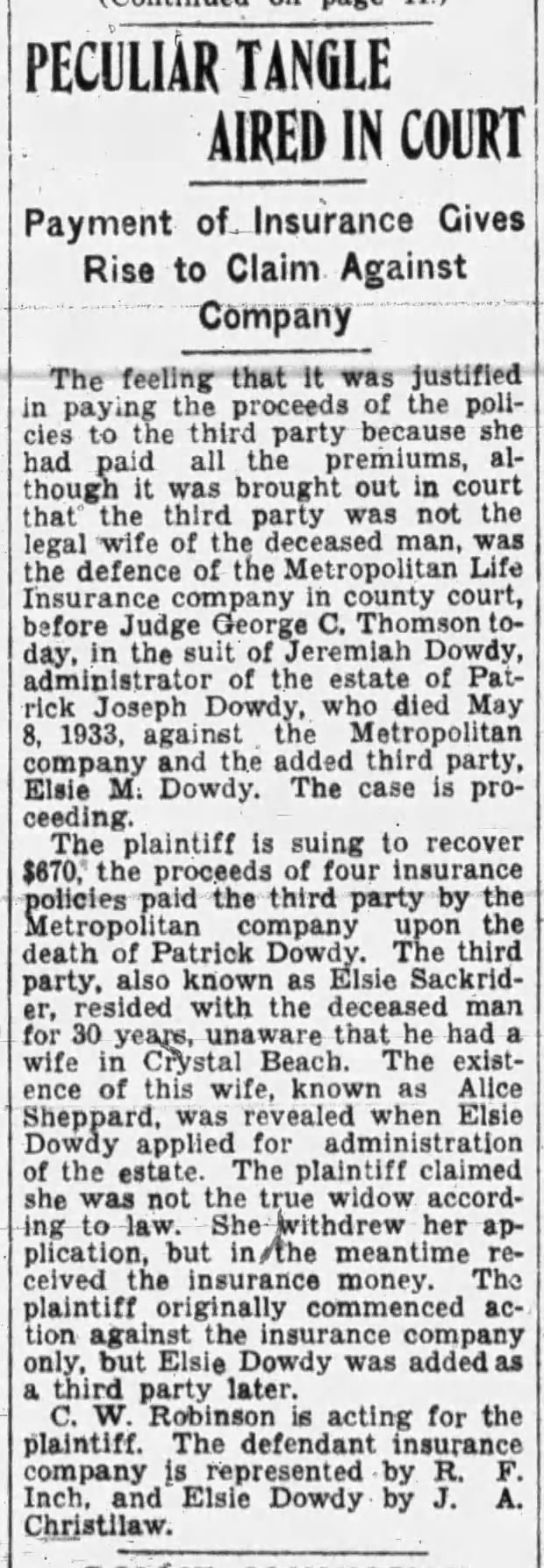

"PECULIAR TANGLE AIRED IN COURT," Hamilton Spectator. March 14, 1934. Page 7.

---

Payment of Insurance Gives Rise to Claim Against Company

----

The feeling that it was justified in paying the proceeds of the policies to the third party because she had paid all the premiums, although it was brought out in court that the third party was not the legal wife of the deceased man, was the defence of the Metropolitan Life Insurance company in county court, before Judge George C. Thomson today, in the suit of Jeremiah Dowdy, administrator of the estate of Patrick Joseph Dowdy, who died May 8, 1933, against the Metropolitan company and the added third party, Elsie M. Dowdy. The case is proceeding.

The plaintiff is suing to recover $670, the proceeds of four insurance policies paid the third party by the Metropolitan company upon the death of Patrick Dowdy. The third party, also known as Elsie Sackrider, resided with the deceased man for 30 years, unaware that he had a wife in Crystal Beach. The existence of this wife, known as Alice Sheppard, was revealed when Elsie Dowdy applied for administration of the estate. The plaintiff claimed she was not the true widow according to law. She withdrew her application, but in the meantime received the insurance money. The plaintiff originally commenced action against the insurance company only, but Elsie Dowdy was added as a third party later.

C. W. Robinson is acting for the plaintiff. The defendant insurance company is represented by R. F. Inch, and Elsie Dowdy by J. A. Christilaw.

#hamilton#county police court#civil suit#suing#marriage law#insurance company#great depression in canada#bigamous marriage

2 notes

·

View notes

Text

Happy Memorial Day Weekend!

#memorialday#memorialdayweekend#happymemorialday#celebrate#remember#honor#realtor#realestate#realty#realestateagent#realestatebroker#investment#realestateteam#property#broker#mortgage#buyorsell#forsale#consultant#loanofficer#mortgagebroker#homeinspection#insurance#ceo#owner#business#graphicdesign#usa#canada#uk

2 notes

·

View notes

Text

🌟 Discover the Power of an RRSP in British Columbia! 🌟

Are you looking to secure your financial future? An RRSP (Registered Retirement Savings Plan) is a fantastic way to save for retirement while enjoying some amazing tax benefits. Here’s what you need to know:

💡 What is an RRSP?

An RRSP is a retirement savings account that offers tax-deferred growth on your investments. Contributions you make are tax-deductible, which means you can reduce your taxable income and potentially get a bigger refund! 🎉

📈 Benefits of an RRSP:

Tax Savings: Contributions lower your taxable income.

Tax-Deferred Growth: Your investments grow without being taxed until withdrawal.

Retirement Security: Provides a steady income during retirement.

🔍 How Does It Work?

Contribute Regularly: Make regular contributions to maximize your savings.

Invest Wisely: Choose from a variety of investment options like Mutual Funds, Bonds, and GIC.

Withdraw Smartly: Plan your withdrawals strategically to manage your tax impact.

🏦 Why Choose Brace Financial Services?

At Brace Financial, we’re here to guide you every step of the way. Our experts will help you create a personalized RRSP strategy that fits your financial goals. Let's secure your future together! 💪

#bracefinancialservices#finance#financialadvisor#financialfreedom#canada#financial services#financialplanning#life insurance#surrey#financialwellness#RRSP#RetirementPlanning#TaxBenefits#FinancialFreedom#BraceFinancialServices#InvestSmart#RetirementSavings#SecureFuture#WealthManagement#TaxDeferredGrowth#FinancialAdvisor#PlanForTomorrow#SavingsGoals#BritishColumbia#CanadaFinance

2 notes

·

View notes

Text

#insurance#finance#investment#savings#insurance broker#life insurance#personal insurance#lifestyle#finances#money#canada

2 notes

·

View notes

Text

And maybe you'll be like "but if you don't trust businesses, how can you trust welfare?"

I fucking don't. My mom trying to get on food stamps fucked me up because a lady I never met without my permission got my SSN from my mom and started editing my files. My heart still races to this very second whenever I think about it, it kinda messed me up bad and I'll never ever ever see any kind of recourse

And I'm terrified that I'm gonna lose my medicaid just cause I inherited some money from my grandpa

And I've never even applied for disability cause it kinda doesn't matter finding out if I'd qualify or not cause of my depression, when the rules are so restrictive I don't know if I've even be allowed to keep my house

I do not fucking trust these things on a personal level. I feel like out of a lot of people I have the most to fear from them cause I'm on the edge of having things work, and that gets you punished

...but I need medicaid in order to have insurance (and when you strip out the finance side of medicaid, I love medicaid... they're honestly incredible insurance... I just... I just... dental is like 90% of why medicaid is so important to me, ever since I found out this state pays for it I've actually been able to do cleanings which is important to me cause I can't always get myself to brush)

And I think things like disability and food stamps are pretty damn important on a personal level, and honestly are also good for the economy cause they get people spending... it's practically a free cash infusion into the economy, cause these are people who need to buy stuff

There's just so much important stuff welfare does that it's worth dealing with government

No, what I want is more accountability so if someone gets my SSN from a 3rd party like my mom they're held to HIPPA styles standards where that's not ok to access my files without my permission (She changed my fucking address and tried to get medicaid to investigate me for fraud! Never even met me)

Like have some accountability there and in every situation

Secondly I want less punitive focused rules. I'd frankly prefer bezos get on disability than smack down some poor sod cause they got $2000 in the bank or cause their friend lets them live with them for free

If there's gonna be a cut off on these programs, it needs to be a solid step above the poverty line, cause... by definition I assume poverty line denotes kinda the minimum expected income people can reasonably live off of, and if you take away benefits people are gonna lose a chunk of money to covering that stuff themself, so you need a buffer before you kick people off

I don't fucking trust the government for a second, I've actively been fucked by them and on a personal level I avoid everything but medicaid and only that cause everything but the money is pleasant to deal with and I kinda need it (honestly if I was rich I'm not even kidding that I'd rather give medicaid like $400 a month than some insurance company, I sincerely like them as insurance)

But I'd trust them a lot more if they were less punitive, less out to hunt me down and gut me cause someone handed me a fiver or cause I started to get on my feet, and if government employees had concrete rules they had to follow that were actually transparent and enforced

Like 90% of my problems with welfare go away if they're held accountable and there's less "catch the welfare cheats" mentality going around

I don't trust the government in the slightest, but sadly there some jobs it kinda has to do, so I'd just rather force it to be an open book where the public can keep an eye on it and if they step out of line there's consequences (sort of like I don't trust most mega corps but happen to sometimes need stuff from them... did you know literally every cell service provider has been illegally selling shit like your location data to random people like bounty hunters, and the FCC just slapped them with a fine that's 0.02% of their yearly incomes and debated even doing that? I even can offer a source on that)

...I don't trust much of any authority cause they constantly fail me and kinda screw me. Don't trust doctors either, but I still gotta go to them, you know? ...they're just... they're real bad at listening... so many systems need systemic change

(You know who I really don't trust is the cops. I could point to so many examples. My uncle doesn't trust cops either, and he's an ex Fire and SWAT paramedic, he worked with them and we still got into a long conversation where he basically tore into them far better than I can)

(I don't trust authority that's not accountable)

#anyway; if I'm a lousy cheat or whatever least they can do is give me a gun so I can solve that problem#shit makes me wish I was canadian so I could take advantage of their sick implementation of assisted suicide#what should be a system that gives people a choice about the quality of their life; and I don't think should be relegated to terminal illne#...there was... think he was dutch; had been burned by his girlfriend all over his body; was in constant pain#and he ended up using assisted suicide in the end cause he was just in constant agony... think that's his choice to make#but of course the canadian system concretely pushes people; mostly the poor and disabled; to kill themselves#not theoretically; as in literally says word for word to them 'you should really kill yourself; just sign here'#it's sick; it truly is#but for any americans that want to dunk on it; I'm telling you we're no better#we have the exact same miserable desperation and people (again; mostly poor and disabled) into despair#only difference is we don't offer assisted suicide#the underlying issues in the US and canada are so damn similar; so much of what's happening ends up being the same#you can't act smug just cause you only make people want to die instead of also offering to help#that's like saying that you're the good guy cause while you did everything you could to drive someone to the brink#get them fired; slash their tires; just cartoon level villain stuff to personally harass this person... at least you won't hand them rope#we have such similar systemic issues to canada; and I am explicitly telling you that like the people in canada that have said#'I can't take it anymore; disability doesn't cover my expenses and I can't get any help... I'm at my wits end so I'm gonna go die'#I'm telling you that I feel that same way; just without any eugenics agency I can call up#I'm really working to get things stable; but it feels like I'm teetering on the edge of falling into permanent failure#and... and I'll actually tell you the amount even though I don't like to mention money... makes me feel guilty#my gramps left me $27k; which sounds like a lot; but I got 20 windows that need redoing (house has a lot of windows)#...if they ended up being 1k each; that's most of the money gone; if they end up being more...#and I got a whole lotta other stuff I've been putting off like plumbing around here; need to replace that faucet#it's an amount of money that helps; but it's an amount of money that isn't gonna last#...that's like a year of bills; and my mom already needs me to pay like $400 to the propane bill since she got behind#I want to use it to... to try and really get my feet on the ground; but it might loose me my insurance... it makes me want to die#and not to be a selfish bastard; but if I could I'd like to try and take and invest a bit to maybe build some passive income#given that... that a job never seems to work out for me cause I fucking suck and cause like... my insomnia has me up at 5:30 am right now#mm tag so i can find things later

3 notes

·

View notes