#tfsa account

Explore tagged Tumblr posts

Text

#RRSP#rrsp account#TFSA#tfsa account#LIRA#RSP#registered retirement saving plan#Tax-Free Savings Account#tax free investment account#Locked-in retirement account#locked in retirement income fund#retirement accounts#best retirement accounts#Types of retirement accounts

0 notes

Text

Throwing up

#yknow that thing where you do crazy amounts of research because you feel like youll miss something important?#like youll miss onething so common everyone else knows about it#in all the GODDAMN research. the books. the online lessons. the videos. THE PERSONAL FINANCE FOR DUMMIES BOOK. FOR DUMMIES.#never in my life did anyone tell me about my tax free savings account SECRET ABILITY#if youre money was in your tfsa. even after you take it out. it stays tax free.#IF YOU USE YOUR TFSA MONEY TO BUY INVESTMENTS. YOU DONT PAY TAX ON THE INCOME YOUD GET FROM THE INVESTMENTS YOU BOUGHT#it keeps its tax free status even when its out of that account???? fucks sake#im still doing research but its looking to be true. or at least a semblance to that.#i fucking hate this. its that whole you missed something so common that everyone knows even though its never come up in your life

2 notes

·

View notes

Text

Video: Canadian Taxation on Investments

I had a viewer question about #tax #rates on #Canadian vs. #foreign #dividends and which #account #minimizes tax #withholding on foreign dividends (#RRSP vs. #TFSA vs. #non-registered or #cash accounts), as well as the rates at which various #dividend #income is taxed. The video covers the entire Canadian #taxation system for context, and answers the question for tax #efficiency. The…

View On WordPress

#account#canadian#cash#dividend#dividends#efficiency#foreign#income#minimizes#nonregistered#rates#rrsp#tax#taxation#tfsa#withholding

0 notes

Text

Unlocking the Benefits of a Tax-Free Savings Account (TFSA)

A Tax-Free Savings Account (TFSA) is a smart way to grow your savings without paying taxes on your earnings. Whether you're saving for a big purchase, retirement, or an emergency fund, a TFSA offers flexibility and tax-free growth. Learn how to maximize your contributions, avoid common mistakes, and make the most of this powerful savings tool. Start growing your wealth today-tax-free!

0 notes

Text

I'm trying to transfer some money out of an account so I can close it but the bank keeps rejecting it or saying that I've requested the withdrawal be cancelled. I also got an email saying I requested information on a cancelled/rejected withdrawal (I didn't???) but that the cancelled/rejected withdrawal was successful (it wasn't???)

and now I have to wait until january to sort this out bc customer service is closed and these transfers take 5-7 business days and there are not 5 business days left in this calendar year

#i just want to move my tfsa to a bank that sucks less#and this is just proves i'm right to want to close this account

0 notes

Text

Inslyf Unlocks Your Financial Potential - Dive into the World of TFSA!

Your financial journey should be as unique as you are. Inslyf's deep dive into Tax-Free Savings Accounts (TFSA) opens up a world of possibilities for smart and tax-efficient growth. Discover how Inslyf can help you maximize your savings potential, providing a roadmap to financial freedom that's tailored to your individual goals. It's not just about investing; it's about investing intelligently. Let Inslyf guide you toward a future of financial abundance.

0 notes

Text

The TFSA Advantage in Mississauga with Top Choice Insurance

In the dynamic landscape of Mississauga's financial prowess, Tax-Free Savings Accounts (TFSAs) stand out as a cornerstone for achieving financial security and growth.

These accounts offer residents a unique opportunity to grow their savings without the burden of taxation, presenting a pathway toward financial freedom.

Understanding TFSA Plans in Mississauga

TFSA Plans in Mississauga have become a vital component of financial planning. These accounts allow individuals to invest without incurring taxes on capital gains, dividends, or interest earned within the account.

Mississauga residents are leveraging TFSA Plans as a strategic tool for both short-term goals and long-term wealth accumulation.

Benefits of Tax-Free Savings Accounts

The appeal of Tax-Free Savings Accounts lies in their flexibility and tax advantages. Mississauga residents appreciate the ability to contribute annually, the absence of withdrawal penalties, and the potential for tax-free growth.

This versatile financial tool caters to diverse financial objectives, from saving for a down payment on a home to supplementing retirement income.

Tailored TFSA Solutions in Mississauga

Providers like Top Choice Insurance understand the unique financial needs of Mississauga's residents. They offer a spectrum of TFSA Plans, each tailored to suit various risk appetites and financial goals.

These plans empower individuals to invest confidently while ensuring their money grows tax-free, aligning with their specific aspirations.

Securing Financial Futures

Mississauga residents recognize the importance of securing their financial futures. TFSA Plans play a pivotal role in this endeavor, serving as a means to accumulate wealth while mitigating tax implications.

With knowledgeable guidance and robust TFSA options, individuals can optimize their savings, thereby unlocking the pathway to financial independence.

The Role of Top Choice Insurance

Top Choice Insurance is a trusted name in Mississauga's financial landscape. Beyond their expertise in insurance, they offer comprehensive TFSA solutions tailored to the unique needs of the community.

Their commitment to empowering individuals with financial tools, such as TFSA Plans, underscores their dedication to the financial well-being of Mississauga's residents.

Conclusion

Mississauga's journey toward financial freedom is intricately tied to the strategic utilization of Tax-Free Savings Accounts. The versatility, tax benefits, and tailored solutions of TFSA Plans empower residents to take charge of their financial destinies.

Providers like Top Choice Insurance stand as pillars of support, guiding residents toward informed financial decisions and offering TFSA Plans that align with their aspirations. Their commitment to the community's financial empowerment cements them as a trusted partner on the path to achieving financial goals.

As Mississauga continues to evolve, the utilization of TFSA Plans emerges as a pivotal strategy for residents to secure their financial future. Embrace the opportunities presented by Tax-Free Savings Accounts, partner with a reliable institution like Top Choice Insurance, and embark on the journey toward financial freedom and prosperity.

0 notes

Text

Discover the Tax-Free First Home Savings Account, your intelligent route to owning a home. Uncover the benefits in this comprehensive blog. Read more.

0 notes

Text

Does anyone know why this lady conducting an interview on CBC (talking about TFSA accounts) is fully just waving around a third party wireless Wii Nunchuk controller.

Is it a stim toy?

Is she controlling something with it? It really doesn't seem like it, but maybe in other segments it's used to control whats shown on monitors or something.

"Comments are turned off"

They're suppressing conversation about which Wii game made the best use of the Nunchuk controller.

Personally I would vote for Kororinpa (a motion controlled Monkey Ball style game where you tilt the world to roll marbles). In multiplayer it has one player use the Wiimote and the other player uses the Nunchuk. Which saves you from needing two Wiimotes (with two sets of charged batteries), but also tethers you together. It makes the experience a little more intimate.

53 notes

·

View notes

Text

I have sorted and whittled down 1791 images to 1087 that need to be sorted. That 1087 are all DGS fanart, which must now be sorted by placement in the timeline, characters, ships, and whether or not it's a comic.

A problem for tomorrow, which will hopefully not take too long. I have other things to do tomorrow like call the bank.

Finding out a decade after I left Lore that one of the Mirror Realm themes is an arrangement of Senbonzakura while I've got my OST playlist on shuffle while sorting fanart to calm myself down enough to sleep is sure.

Well it's an Emotion.

#sg.txt#turns out you need to call the stupid bank in order to set up a tfsa??#and also i need to set up a general investing account#and a stupid rrsp i guess. also stick some money in my savings + adjust my checking account#i should also redo my financial spreadsheet tbh. it's a bit wack and doesn't track everything#follow that bitchesgetriches tutorial that looked interesting. see what that does#also fingers crossed turnabout ballroom comes in tomorrow#so i can do a border run tomorrow afternoon and go pick up my packages#i got two books and some stickers waiting for me.... i deserve them after all the bullshit of the past couple weeks#also set up my alt account properly because tumblr glitches#can never trust tumblr lmao#oh yeah and the klint zine comes out tomorrow hopefully :) that'll be good!!!

3 notes

·

View notes

Text

As Canadians continue to grapple with a cost-of-living crisis, one in three reports being in “bad” or “terrible” financial shape, a new poll has found.

The Angus Reid Institute surveyed 1,600 Canadians across the country in March, and found 40 per cent are drawing money from accounts they normally try not to touch in order to make ends meet. Thirty-five per cent also said they’ve deferred a recent contribution to their RRSP or TFSA account.

“For one-in-ten, the situation has been so difficult they’re either borrowing from friends and family (13 per cent), selling assets (11 per cent), or seeking out a bank loan (8 per cent),” reads an April 6 release from Angus Reid.

Almost 70 per cent of Canadians reported cutting back on discretionary spending in recent months, which is 14 points higher than reported around this time last year, the institute said.

The federal government tabled its 2023-2024 budget last month with a promise to cut more than $15 billion in spending, and deliver on measures that reduce costs for lower-income Canadians. [...]

Continue Reading.

Tagging: @politicsofcanada

122 notes

·

View notes

Text

New Year, Fresh Start

Daily Reflection Monday, 1 January, 2024

Things I'm Grateful For:

Having my ever-growing to-do list written down in my planner, so I don't have to forget those things I need to do.

Highlights:

Since I was up past midnight with friends, I made a final "fuck it, I'm staying up all night." After everyone logged off, I had a spurt of productivity and got a bunch of little odds and ends taken care of.

Even if it only really amounts to $1 per day, I enjoy the feeling like I'm setting myself up for success when I transfer some money into my investment account each month. Because January has 31 days, I transferred $31 this time. It's in a TFSA so I won't be taxed on what the money earns, and it's a zero-commission account, so everything that is put into that account will be mine when I withdraw it.

I didn't get everything on my to-do list done for the day, but I still managed to do quite a bit! I don't mind carrying over two tasks, especially when one of them is 90% done.

Challenges:

I couldn't get my money stuff taken care of when I first wanted to because my bank's online portal was down for maintenance. Bit of a nuisance, even though it's not really a huge deal--I don't have to deal with my money at 4:00am, it can wait until a more reasonable hour.

I accidentally ended up napping in the middle of the day. I laid down around 11:00am, and then dozed off and slept until about 2:30pm. So that took a chunk of time away from me that I could have used, but after an all-nighter, three and a half hours won't ruin everything.

Emotions:

I feel like an asshole, and a terrible friend. A friend of mine is going through a rough patch because a woman ran a red light the other day and fucked up his car. He's going through the process of trying to get proof for his insurance that he wasn't at fault, and trying to figure out what's going to happen to his car (he spent all his savings on it less than two months ago, and the odds are pretty much 50/50 that it could be written off). I fully understand that he needs to vent, but I just really don't like listening to that kind of thing. I want to just go and tune him out so it feels like a win-win (he gets to vent, I don't have to actually listen), but that also feels like a terrible thing to do.

The shoes I ordered with my Christmas money are supposed to be here tomorrow, according to FedEx. It's hard to say how accurate that is though, as it's been "we have your package" since the 28th, with the order itself placed on the 25th. If it's not in tomorrow, Wednesday would also work. I just want them in before I go back to school on Thursday.

Lessons Learned:

For all that my friends are usually there for me when I need it (even though I will rarely ask for help), I'm not great at doing the same for them. I think that's part of why I don't ask for help; I don't want to be one of those people who ask for help all the time but never offer anything in return. I want it to be fairly balanced, and unfortunately, holding back on my end is how I can help keep it that way.

Today's To-Do List:

Completed

Readjust the cat feeder to dispense at night.

Reorganize phone apps.

Find new wallpapers for my phone and laptop.

Divide my second student loan disbursement into GICs.

Pay board.

Clean out my D&D binder and prepare for the new campaign.

Renew my FitBit Premium membership.

Add $31 to my investment account.

Give the cats baths.

Put together the grocery list.

Uncompleted

Clean out my school binder and prepare for the new semester.

Finish catching up on laundry.

Tomorrow's To-Do List:

Buy a mirror that hangs off the door for my bedroom.

Buy a notebook to start a commonplace book.

Get groceries.

Nana's housework.

#accountingacademic#accounting academic#accounting#studyblr#college#productivity#study#daily reflections#january#2024#january 2024

2 notes

·

View notes

Text

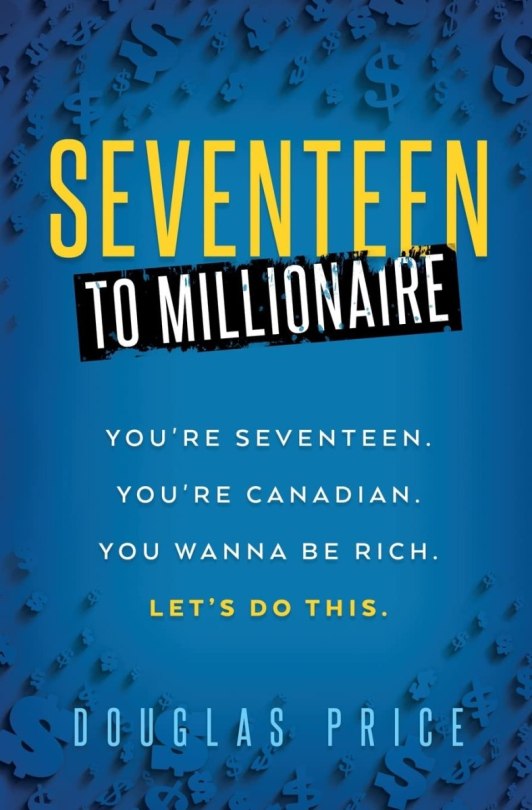

"Seventeen to Millionaire" by Douglas Price

Financially sound advice for teenagers! #books #bookreview #reading #readerviews

Seventeen to Millionaire Douglas PriceIndependently Published (2023)ISBN: 978-1778059209Reviewed by Diana Coyle for Reader Views (08/2023) Author Douglas Price, who wrote “Seventeen to Millionaire,” offers sound advice to seventeen-year-olds coming of age to open a Tax-Free Savings Account (TFSA). This is suggested to help them start saving money without being taxed on anything that accrues in…

View On WordPress

2 notes

·

View notes

Text

Video: How to Start Investing

I get asked very often about how to start #investing. Make sure you #start #early and as soon as possible. Find an #investingthesis, get your #riskprofile so you know what to invest in, and then use #ETFs in a #TFSA or #RRSP #account in a #lowcost #brokerage to start making #monthly #contributions. The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in…

View On WordPress

#account#analysis#ASAP#brokerage#contributions#early#ETFs#goals#investing#investingthesis#limitorder#lowcost#market#marketorder#monthly#riskprofile#rrsp#start#taxbracket#taxes#tfsa#wealthsimple

0 notes

Note

honestly i’m not too sure? i read the shadow market stories as they were coming out and i low key skipped a few cause they were a little boring. i did read the last two stories that way and it was fine (i did miss parts of jessa development tho). i don’t completely remember but i think it should be fine to read them without all the other stories? as long as you read the last two in order

also omg this is iz btw!! i’m the anon from before but i’m un-anoning myself <3 i barely use my account (you can probably tell by my old username) but i’ve had nothing to do this summer and it’s bringing my tsc obsession back. feel free to message me about the books if you’d like!!

omg hey! welcome out of the confines of anonymity! I'm Wren (just realized my name isn't even in my bio, whoopsies). This blog goes in and out of service all of the time so I fully feel you

good to know. I didn't want to mess it up. I think I'm just gonna read those two tonight then and peruse the others at another time. I truly need to get my hands on TFSA anyway cause I miss Simon. Oh and TLH boxset is arriving tomorrow!

2 notes

·

View notes

Text

Creating Your Financial Future in Ontario: From Arrival to Retirement

Table of Contents

Introduction

Importance of Early Retirement Planning for Newcomers

Understanding Pension Plans in Ontario

Canada Pension Plan (CPP)

Old Age Security (OAS)

Workplace Pensions

Personal Savings Plans

Questions to Ask About Workplace Pension Plans

FSRA’s Role in Educating Newcomers

Steps to Secure a Financially Stable Retirement

Conclusion

Introduction

You've just arrived in Canada, and retirement might be the last thing on your mind. Moving to a new country comes with numerous challenges—finding a place to live, learning new customs, and starting a career. However, financial security is something that takes years to build, and the decisions you make today will shape your future.

The good news is that Canada offers various retirement savings options and pension programs to help individuals prepare for a secure future. This blog explores the key pension plans available in Ontario and how newcomers can take advantage of these opportunities. Whether you’ve migrated through Canada immigration services like Wave Visas or sought guidance from the best immigration consultant in Delhi, understanding pension benefits should be an essential part of your financial planning.

Importance of Early Retirement Planning for Newcomers

Retirement may seem distant, but a well-structured plan ensures financial independence in later years. Smart decisions about savings and investments can lead to a comfortable and stress-free retirement, allowing you to enjoy the life you envision—whether it’s spending time with family or pursuing hobbies you love.

Understanding Pension Plans in Ontario

Ontario offers multiple retirement benefits that provide financial support in later years. These pension programs include:

1. Canada Pension Plan (CPP)

A mandatory government pension funded by contributions from employees, employers, and the self-employed.

Contributions are made throughout your working life, and benefits are received upon retirement if eligibility criteria are met.

The amount of pension received depends on factors such as contribution period, earnings, and the age at which you start receiving payments.

2. Old Age Security (OAS)

A government-funded benefit that provides monthly payments to eligible seniors aged 65 and above.

Unlike CPP, eligibility is based on the length of residence in Canada rather than work history.

3. Workplace Pensions

Many employers in Canada offer workplace pension plans, which can significantly enhance retirement savings. These include:

Defined Benefit Pension Plans: Provide a predetermined monthly payout based on salary and years of service.

Defined Contribution Pension Plans: Contributions are invested, and payouts depend on investment performance.

If you receive a job offer, it’s important to ask about workplace pension options and whether your employer matches contributions.

4. Personal Savings Plans

Beyond government and workplace pensions, individuals can enhance their retirement savings through personal plans such as:

Registered Retirement Savings Plan (RRSP): Contributions are tax-deferred, meaning taxes are paid upon withdrawal, typically during retirement when tax rates may be lower.

Tax-Free Savings Account (TFSA): Contributions are made with after-tax income, but withdrawals remain tax-free, making it a flexible option for savings.

Questions to Ask About Workplace Pension Plans

If you are joining a new employer, consider asking the following:

Does your company offer a workplace pension plan?

Does the company match employee contributions?

How can you maximize pension benefits?

FSRA’s Role in Educating Newcomers

The Financial Services Regulatory Authority of Ontario (FSRA) plays a vital role in ensuring the fair administration of pension plans. FSRA provides educational resources, oversees compliance with pension regulations, and helps newcomers understand their pension rights.

1. Overseeing Pension Plans

FSRA ensures that pension plans comply with Ontario’s Pension Benefits Act, safeguarding employees' retirement savings.

2. Providing Educational Resources

FSRA offers online guides to improve financial literacy, helping newcomers navigate pension options and make informed decisions.

Steps to Secure a Financially Stable Retirement

Understand Your Pension Eligibility: Check if you qualify for CPP, OAS, or workplace pensions.

Start Saving Early: Contribute to RRSPs and TFSAs to grow your retirement fund.

Maximize Workplace Pensions: If offered, take full advantage of employer-matched pension contributions.

Stay Informed: Use FSRA resources to understand your rights and optimize your savings.

Seek Expert Advice: Consulting financial advisors or experts from Wave Immigration Consultant can help tailor a retirement strategy based on your specific needs.

Conclusion

Building financial security in Canada starts from day one. Whether you’re new to the country through Wave Visas, an experienced worker, or just beginning your career, taking proactive steps toward retirement planning can make a significant difference. By understanding available pension plans, maximizing employer contributions, and leveraging personal savings accounts, you can set yourself up for a secure and fulfilling retirement.

Planning today means securing a better tomorrow. Start your journey towards financial independence in Canada now!

Corporate Office : 2nd Floor, Right Side, Building No. 5, Kehar Singh Estate Westend Marg, Lane No. 2, Saidulajab, Saket New Delhi 110030.

#consultant service#immigration services#wavevisas#visa#consultant#canada immigration#canadaimmigration

0 notes