#Personalized Investment

Explore tagged Tumblr posts

Text

(also feel free in the tags to clarify Why you made the choice you made!! :0c)

#polls#tumblr polls#For me I think the top ones would be the House. The Money. or the Friend Group. But I ultimately might would go for the house#JUST becuase it would be my Dream House which means it would already meet mostly all of my specifications#and what I might be looking for. which would save a lot of time searching or customizing/rennovating.#Also because I could use that as a way to leave the US lol.. like .. if I get to choose my dream location.. couldnt I just choose some othe#country?? But I wonder how that works. Can you legally 100% have full ownership of a property in a country yet not be a citizen of that#country?? Would you show up and be like 'erm.. i own this house.. so i shall now live in it' and theyd be like 'uh no. you cant live here#despite owning the house. leave.' ??#So I think the initial process of 1. scraping together funds to actually MOVE myself and my most valuable belongings physically#TO another country. and 2. figuring out how to STAY in that country . might end up being difficult.. BUT. if I could just work that#part of things out then.. dream house?? security for once in my life?? stability?? :0#Though the $1mil is enticing it's also like.. I feel .. with the way housing prices are now... that's not much???#it's a lot I guess if you plan on like.. investing half the money and staying in an apartment for 5 years while you grow your wealth#or something. but if you're a 'I Need Stability NOW' ready to settle down person who would be most interested in owning a property rather#than nice clothes or a car or whatever other investments you could make then.. eh..?? It seems like unless you're okay with living in#a small town or kind of far away from the city - even some SMALL houses in majorly populated areas in the US will be like#$600.000 - $900.000 or something. like that would be MOST of my money. Which I know you could just pay partially and make#payments on it but idk.. in the option of just outright owning the house it seems like it'd end up being cheaper.#Plus I would want to own it fully asap because I'd be afraid of losing it somehow otherwise. like it being taken for medical bills or#something. which I thought was supposed to be - not IMPOSSIBLE - slightly more complicated legally if you actually have#paid off the house in full. I guess the issue then would be utilities and property tax and such. But I feel like thats overcome-able??#Like I could just stipulate that my Dream House has a little furnished addition or something and then find someone#with money and be like 'Look you can live in this extremely nice area with amazing ameneties and updated everything and ALL you have#to do is give me money to cover the utilities and property tax.'' or something like that. Like the little furnished addition is nicer#than the actual house. they have their own pool and spa and movie room or something and Ill also cook all their meals for them#or whatever (how luxurious it would be depeneds on how high the property tax actually is/how much I would need to entice them into#why it's a good deal for them to pay it for me lol). idk... something like that.. ANYWAY#I asked a few people I know though and one of them answered they'd rather have a romantic partner. the other one said they'd like#to be able to choose someone to die lol.. So I'm curious what people value the most

20K notes

·

View notes

Text

Customized Investment Portfolio Management: Tailoring Your Route to Financial Success

Understanding Investment Portfolio Management in the Digital Era

Investment Portfolio management today has moved away from standardized buy-and-hold investment strategies. In their place, any serious wealth creation requires an intelligent approach that closely dovetails with personal financial goals, levels of risk tolerance, and even movements in the market. Professional investment portfolio management services are that juncture where personal financial priorities meet expert knowledge of the market.

Personalization: The Power Behind Investment Management

Each investor comes with unique peculiarities—income levels, risk appetites, time horizons, and goals in life. Generalized investment strategies lack depth and precision to accommodate such a large number of individual needs. Customized investment portfolio management builds personalized investment roadmaps, considering aspects like:

Personal financial goals and timelines

Risk tolerance and comfort with market volatility

Current asset allocation and diversification requirements

Tax efficiency requirements

Estate planning considerations

Merits of Professional Portfolio Management

Strategic Asset Allocation

The professional portfolio managers develop the strategic asset allocation model in view of complete market analysis, together with individual investor profiles. The systematic approach maintains the optimal weight of portfolios in the course of market fluctuations.

Excellence in Risk Management

Expert investment portfolio management integrates advanced risk assessment tools with efficient strategies that shield investments against market volatility. This proactive approach preserves capital while taking advantage of growth opportunities.

Dynamic Portfolio Rebalancing

Markets change, and so portfolios need adjustments. Professional management watches the markets day and night while rebalancing investments as needed to keep desired asset allocations and risk tolerance.

The Gainers Advantage in Portfolio Management

Data-Driven Investment Decisions

Leading analytics and market intelligence help The Gainers make better investment decisions. Evidence-based decisions incorporate human judgment and technological innovation to pursue the most productive exploitation of opportunities while efficiently mitigating risks.

All-Inclusive Investment Strategy

Portfolio management at The Gainers involves:

In-depth financial analysis

Custom investment plans

Periodic portfolio reviews

Risk assessment and management

Tax-efficient investment strategies

Client-Centric Approach

Each portfolio is accorded due attention and customized to suit the individual client's needs. This alone can ensure that investment strategies meet financial goals.

Advanced Portfolio Management Technologies

The Gainers uses cutting-edge technologies in portfolio management and offers the following:

Real-time portfolio monitoring

Aggressive deployment of risk analytics

Performance attribution analysis

Auto-rebalancing capability

Comprehensive reporting system

Professional Expertise and Market Acumen

The members of the investment team at The Gainers bring multiple decades of experience collectively in the following areas:

Market analysis and trend identification

Risk management strategies

Asset allocation optimization

Alternative investment evaluation

Global market opportunities

Creating Long-Term Investment Success

At its very core, portfolio management is a multidisciplinary activity that requires patience, discipline, and expertise. The Gainers' approach focuses on:

Building sustainable, long-term wealth

Ensuring stability of the portfolio

Capturing market opportunities

Limiting downsides

Ensuring tax efficiency

The Right Choice

Portfolio management is one of the major decisions of financial planning. The Gainers stands apart through its:

Proven investment competencies

Sophisticated use of technology

Thorough risk management

Consultative service delivery

Transparency in communication

Investment Excellence Through Customization

The future of investment portfolio management is customization. The Gainers provides this through:

Customized investment strategies

Professional portfolio management

Periodic performance appraisal

Proactive risk mitigation

Open communication

Investors requiring professional portfolio management services shall find that an ideal blend of expertise and technology at The Gainers, complemented by personal service, forms a strong base for long-term investment success and security.

The Gainers can introduce people who are willing to take it to the next level in investment to a custom portfolio management solution tailored to financial objectives by offering comprehensive wealth management.

#customized portfolio#investment strategies#financial goals#risk tolerance#market opportunities#personalized investment

0 notes

Text

Just who are you, Councilor Medarda?

#i did not like her s2 arc so i am copium and living in s1 painter mel#mel medarda#arcane#my art#i have a LOT of thoughts on her and i wish she remained like. a normal person and not...whatever the magical stuff happened#it didnt develop smoothly enough for me to feel invested and left me just kind of. confused.#& i think that forgetting about Mels painting is leaving a huge interesting level to her character because art as a whole#can be used as a metaphor for the image for others to perceive vs how we perceive it ourselves...so for mel it would be herself#with the others perception being all of piltover. her mother. jayce. vik. lest. they all see her differently and mel herself i think#presents a different woman than what she is inside in favour of being 'diplomatic' and 'moving forward'#anyway thats just me rambling i jsut think there was a lot of melon left to thump in terms of her character#i loathe her trading in her signature colours for her mothers in the end

2K notes

·

View notes

Text

i have been trying to figure out why the whole 'fae god' and katniss everdeen things with kendrick lamar on here were bothering me, and i think i finally put it into words.

most posts like that are probably coming from well-meaning white people (i am also partially a White People, to be clear), who otherwise dont really listen to rap. they cannot find a way to 'relate' to this black man who sings largely about issues that affect the black community– and rather than try and meet him where he is, they have to fit him into these little tumblr cultural boxes before he can be 'palatable' to them.

they have to shave off the rougher/more abrasive aspects of his work and activism because it makes them uncomfortable, that way they can pigeonhole him into something that allows them to enjoy his work without the critical analysis that MUST come with it

he is not your fae god, he is not a YA protagonist, he is not a little gremlin or a cinnamon roll or a blorbo. He is a human being with opinions and beliefs that deeply permeate his work, and to ignore that truth is to ignore the entire point. PLEASE try to engage with artists' work outside of the lens of tumblr fandom, and i mean that as nicely as possible. you are doing YOURSELF a disservice

#kendrick lamar#to clarify#i am a white person that isnt super familiar with rap culture as a whole#but thats more because im like that with literally every musician#half the time i can barely even name the lead singers of some of my favorite bands#i also only really learned of kendrick through the context of the disses he released last year#but the way people were reacting had me incredibly intrigued#so i DUG. i watched reaction videos. i watched people dissect the lyrics and explain#i watched FD signifiers breakdown of the whole history of the beef#and because of that ive been following the story as it developed#because i find kendricks cultural influence astonishing#and it makes me sad to see people just. ignore the history and culture of the conflict#while claiming to be invested in whats happening

1K notes

·

View notes

Text

I'm in many leftist spaces and I've seen many goyim in these spaces complaining about how often jews talk about leftist antisemitism.

The thing is that this is the consequence of claiming to be advocates or in support of another group of people - when you ostensibly prove you aren't for us, we're going to be harsher than we are to people who never pretended in the first place.

For an analogy, here's a similar situation: I am harsher toward "pro-trans" people who are transphobic than I am to people who are not. This is because the pro-trans person told me they were better than that. I am already aware that the anti-trans person is going to be anti-trans. Their anti-transness is self-evident. What isn't self-evident is a person who claims to be pro-trans and then proves otherwise.

This post is addressed toward leftist spaces because I occupy these spaces the most. It makes me wonder just how safe I am in these spaces when leftist begrudgingly acknowledge that this conversation keeps happening. I feel like a lot of leftists treat those of us who open these conversations like we're an "I left the left" rightist when... Most of us are still in leftist spaces. We have not left the left and through pretending we have, you absolve yourself the feeling of responsibility.

#jumblr#jewish politics#leftist antisemitism#personal thoughts tag#and personally... if i wasn't a leftist i wouldn't bother talking about the antisemetism in these spaces. because i wouldn't care.#and i wouldn't care this much because i wouldn't be a leftist#i've been hesitant to make this post but i think about this a lot. because i care about what many leftists claim to fight for#i need to make it clear that i have never left the left. so i will continue to be harsh to it#look maybe it's the autism or whatever but i am more inclined to criticize and critique things i actually CARE about#if i don't criticize something that means i don't think it's worthy enough to think about deeply#that's why i could criticize america from sun up to sun down and still not be done ranting#and that's because i care enough about this place to actually form opinions about it. i have emotional investment in it. same with the left

686 notes

·

View notes

Note

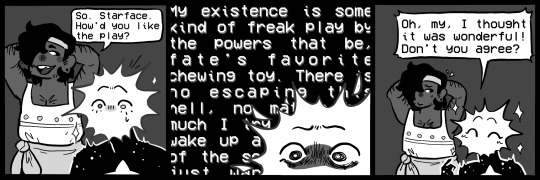

You mentioned the king likes poetry, would he try to take Loop to any plays? How does that go down?

It goes about just as well as you'd expect.

Loop is spiraling but they're being very brave about it <3

Bonus:

#it never happens au#in stars and time spoilers#isat spoilers#in stars and time#isat#isat au#isat king#isat the king#king isat#the king isat#pre wish king#isat boniface#isat bonnie#isat nille#isat petronille#loop isat#isat loop#after The Last Post i thing the king deserves to chill. have some popcorn.#nille and bonnie are really invested in the play#the person that sat behind bonnie was gonna complain about their hat blocking the view#but one look from nille shut them up

549 notes

·

View notes

Text

financial literacy⋆.ೃ࿔*:・✍🏽🎀

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

WHAT IS FINANCIAL LITERACY ;

financial literacy is handling ur money wisely. the google definition of financial literacy is the ability to understand and apply different financial skills effectively, including personal financial management, budgeting, and saving.

ALL ABOUT BUDGETING ;

when u hear the word "budget" its rly easy to think "omg limiting belief" or think of it in a negative light but a budget is just a plan on how u manage ur money. its not always constrictive and negative like u may or may not think of it to be.

budgeting : keeping track of how much $ ur bringing in and how much ur spending…💬🎀

planning a budget is ez pz. you can use some paper and sparkly pink gel pens to create an adorable budget, or u can download different sheets online and just have your budget digitally. theres a plethora of resources out there so just choose whichever is easier for u.

something else that i learned about during this course was the 50:30:20 rule. its called the 50:30:20 rule because 50% of ur money goes towards ur needs, 30% goes towards wants and 20% goes towards ur savings. and this isnt concrete, its just a good framework and u can adjust to ur own specific needs and goals.

for example if u manifested $4000. ur 50% would be $2000, ur 30% would be $1200 and ur 20% would be $800…💬🎀

HOW DO U KNOW WHAT UR NEEDS/WANTS ARE ;

things like ur rent and groceries are ur needs and things like vacations and going out with ur girls are wants. and to apply the 50:30:20 rule you first have to...

♡ calculate ur needs, wants and savings budget

♡ compare ur expenses to ur budget

the way u do this is to subtract your expenses from your budget. this is your budget balance. if your budget balance is zero or positive, that means you are living within your means and have some extra money. if your budget balance is negative, that means you are spending more than you should and may have a budgeting problem.

let me know if u guys want more content about this cuz i had a lot of fun writing this…💬🎀

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

666 notes

·

View notes

Note

20. What chapter does your OC get the most personal character development?

I don't know if its the MOST, but a big moment comes in Book 4!

Bonus doodles because you can pry the adeuce + yuu + grim friendship dynamic from my cold, dead hands

After getting talk down to for four books straight, Erin was under the impression that she didn't have anyone to support her. It was just her and a dire beast that most certainly wasn't growing on her (denial) against a school of magic and mental health crises.

In books 1 and 2, Yuu (or Erin, in this case) helped Ace and Deuce with their own problems. In Book 2, they aided in the Spelldrive investigation to benefit themselves.

It wasn't until the end of Book 4 when Ace and Deuce abandoned their vacation plans to try and help rescue them from Scarabia that she started to reconsider. Even if they shrugged it off because their vacations were boring anyway, they still hopped on public transportation and went out of their way to try to help. You don't just do that unless you care.

Saying goodbye was suddenly going to be a lot harder.

(Tldr; Book 4 was when Erin started to consider the possibility of staying in Twisted Wonderland. Prior to that, she was determined to get back to her world. Grim's abduction in Book 6 furthers that narrative)

#getting to go into more of erin's personal journey in twisted wonderland is fun#twisted wonderland#twst#twisted wonderland fanart#twst fanart#erin#twst yuu#ramshackle prefect#twst grim#ace trappola#twst ace#deuce spade#twst deuce#cheekindraws#btw the black and white doodles was how i was supposed to do this but then i got invested and they have color now#why do i do this to myself

303 notes

·

View notes

Text

Understanding Portfolio Management Services: A Guide for Investors

Understanding Financial Decision-Making

Today, most people are overwhelmed by making the right investment decisions. There is much complexity involved in making one's financial decisions in this high-tech financial world. In such a situation, portfolio management services aim to be a guiding light for investors who are sailing through murky waters in a constantly changing market. So, what do such services represent, and how may they help you? Let's take a closer look at this sensitive and ultra-vital aspect of contemporary investment.

What Are Portfolio Management Services?

Portfolio management is essentially the art and science of making decisions about investment mix and policy and matching investments to objectives, asset allocation for both individuals and institutions, and balancing risk against performance. Portfolio management services or PMS is professionally offered investors with customized investment strategies and ongoing management of their financial assets.

It would be like having a good captain at the helm of your investment ship, charting out the best course through calm seas and stormy weather. Portfolio management services are not just picking individual stocks or bonds but represent a holistic approach to wealth management, not only considering your financial goals but also your tolerance for risk and current market conditions as well.

How Do Portfolio Management Services Work?

Portfolio management in this aspect is self-systematic and dynamic. Here is a preview of how these services characteristically work:

Evaluation

This starts with gaining an intimate understanding of your financial situation, goals, and risk tolerance. This is an important step for tailoring the strategy to suit you in the best possible way.

Asset Allocation

In this process, portfolio managers determine the right mix of assets—what stocks, bonds, real estate, etc., help you achieve your desired objectives with fewer risks.

Security Selection

Within each asset class, specific securities are selected because of their growth and income-generating characteristics or other factors relevant to your strategy.

Monitoring and Rebalancing

It keeps a watchful eye on and rebalances your portfolio to achieve your desired asset allocation as well as account for any changes within the market or your overall finances.

Reporting and Communication

It provides you with continuous updates and reports, so you are better informed about the performance of your portfolio and all about actions taken on your behalf.

This is not a one-time affair but the process of a cycle of review, adjustment, and fine-tuning.

Advantages for Various Types of Investors

Portfolio management services are not for one type or model; rather, they cater to a wide range of investors with various needs and goals.

For Individual Investors

If you are an individual investor, PMS can offer you:

Professional advice and market guidance you would otherwise not have accessed

Save time by outsourcing daily investment management

Emotional discipline will be managed in case of market volatility and avoid any impulsive decisions

Tailor-made strategies, which evolve in tandem with you amidst changing times and scenarios.

For Institutional Investors

In this regard, pension funds or endowments are going to have an advantage at the points of:

Rationalized approaches to risk management

Enhanced access to investments

Compliance

Customized reporting and analytics

PMS appropriate for investors having diverse risk appetites.

Risk-avoidance investors would focus on capital protection and income generation.

Aggressive investors could focus on growth-end strategies.

Balanced investors who want to find a middle ground that may offer growth potential with manageable risks.

Why Consider Portfolio Management Services?

Well, now that we have all of that behind us, let's discuss why you may consider these services for your own financial journey. Since awareness is power in this world, negotiating this maze of finance can be dizzying.

The investment world continues to grow more complex by the day. From the myriad of choices an individual has when it comes to investments, changes in market trends, and a constant stream of news, it's a rearview look in the mirror that may overwhelm someone. Portfolio management services can be one kind of compass in these convolutions, trying to cut through all the noise and zero in on what really matters for the future of your finances.

Features: Benefits

Consider all of the following when you evaluate the benefits versus drawbacks of PMS:

Tailor-made investment solutions

Portfolio diversification through multiple asset classes

Professional risk management

Better performance on investments

Periodic rebalancing of portfolios

Assets that were otherwise inaccessible

What are the potential outcomes? You may become more peaceful, better managed personal finances, and greater probabilities of winning with your long-term financial goals.

Conclusion: Charting Your Pathway to Financial Victory

Some investments are like a tall sea, but portfolio management services are like the wind blowing into your sail that pushes you to meet those financial targets. Such professionalism helps you dive through the waters of markets with more confidence and probably far better outputs with professional experience, customized strategies, and management.

Whether you are entering the investing world for the first time or hoping to tweak one you already have, consider what you might do in order to entirely take advantage of portfolio management services. You'll thank yourself for this step into a more secure and more prosperous future.

Most importantly, there's hardly any easy road to financial success, but having your right guide on how and when to choose between directly attaining it will always chart your course to reach your desired destination. And then, why not start exploring your options today?

#Portfolio Management#Financial Services#Investment Strategy#Wealth Management#Financial Coaching#The Gainers#Personalized Investment

0 notes

Note

I feel like for Dorian and Astarion to become parents it would have to be an accident. Like, dorian finding it in the trash or some magical nonsense they find making one pop out of thin air. both of which I imagined seeing your funny comic XD (your art is precious by the way)

oh 100%, i was thinking today that they probably wouldn’t try and have one on purpose but maybe after several decades of therapy it wouldn’t be a nightmare if it happened unintentionally

anyway i pulled this out of somewhere and i hate it

#ramble#bg3#baldur's gate 3#astarion#tavstarion#the idea of them accidentally conjuring a person somehow is very funny#i regret starting this as a joke because now i’m invested#although iirc neil newbon said he thinks he’d have children and i feel like i trust him#also before you say this is too mean. did you play the game

3K notes

·

View notes

Text

Itachi & Kisame 🔥🌊

#naruto#itachi uchiha#kisame hoshigaki#fanart#Very funny that I'm not personally invested in the Uchihas yet drew two in quick succession#they're everywhere!!!

354 notes

·

View notes

Text

ᴡʜᴀᴛ'ꜱ ᴍɪɴᴇ ɪꜱ ʏᴏᴜʀꜱ ᴛᴏ ʟᴇᴀᴠᴇ ᴏʀ ᴛᴀᴋᴇ, ᴡʜᴀᴛ'ꜱ ᴍɪɴᴇ ɪꜱ ʏᴏᴜʀꜱ ᴛᴏ ᴍᴀᴋᴇ ʏᴏᴜʀ ᴏᴡɴ. [look after you x landoscar]

#i'm completely normal about these pics#not at all losing my mind over the fact that the universe keeps aligning them like it has a personal investment in their lore#from rfm karting days to mcl golden days#might switch up some pics later but this is what i've got for now IF anyone wants to yell at me about it you're more than welcome#f1 web weaving#landoscar

190 notes

·

View notes

Text

I think it would really benefit people to internalize that mental illnesses are often chronic and not acute. Some of us will never be able to jump the hurdle of managing illness, much less sustaining a sense of normalcy. Many of us will never "recover," will never manage symptoms, will never even come close to appearing normal - and this is for any condition, even the ones labeled as "simple" disorders or "easy-to-manage" disorders.

It isn't a failure if you cannot manage your symptoms. It isn't a moral failure, and you aren't an awful person. You are human. There's only so much you can do before recognizing that you cannot lift the world. Give yourself the space to be ill because, functionally, you are.

#mental health#mental health advocacy#like... anxiety and depression are often concieved of as simple and easy to manage...#...but that isn't the case for so many of us. anxiety and depression just have a lot more research invested into them...#...and while i wish this were the case for literally every other condition it does alter people's perception of you to some extent...#...so while this is NOT solely about anxiety or depression it includes us...#...my anxiety and depression and PTSD have *destroyed* my life. this is chronic and will probably be life-long...#...and that isn't my fault. i've done the fucking work but guess what? that doesn't account for the fact that I Am Just ILL#the least we can do for each other is to be compassionate#be compassionate to those who cannot heal. be compassionate to the people who can't manage their lives. this world is scary enough#recognize that management of symptoms is something not all of us can do - even IF their condition is labeled as 'easy to manage'#i allowed myself to feel angry that i can't heal 'normally' and that was unfair as fuck toward myself#and i NEED people to internalize this so that MAYBE this could help somebody else who is where i was#i NEED them to understand that it's okay that they are where they are - sometimes shit just doesn't turn out how you expect or want#don't beat yourself over you being a person. you are struggling enough. you deserve to rest. just rest please#and just... give yourself space

2K notes

·

View notes

Text

The Eagles were given the mandate of heaven tonight to make the Chiefs meet their maker 🙏🙏

231 notes

·

View notes

Text

American jews 🤝 Israeli jews

"holy shit, I'm so scared for you in your country - it isn't as bad for me in mine!"

#jumblr#jewish politics#antisemitism tw#personal thoughts tag#help why are they/we like this!!!#specifying american vs israeli because i am american and interact with a lot of israelis if i'm interacting with people online or whatever#also. i'm scared for french jews - i don't know many personally but france is........ absolutely infuriating#if the french government said they are investing €55B to space programs to find the Jewish Space Lasers I wouldn't be shocked#i would be more shocked that they haven't already tried to find those mythical space lasers before

651 notes

·

View notes

Text

financial literacy continued⋆.ೃ࿔*:・👛💵

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

HOW TO SAVE MONEY ;

automatically deposit a certain percentage of ur income into ur savings account so that u dont even have to think about it

to do something more FUN tho, (at least in my opinion) is to make a challenge where u have to save every $10 dollar bill, or $20 dollar bill or whatever. just something to make saving money seem like a game if u wanna have some fun with it.

EMERGANCY FUND ;

most experts will tell u that ur emergency fund should be 3-6 months of ur needed expenses. so calculate ur needed expenses and multiply that by 6 to figure out how much you'd need to have in ur emergency fund.

PAYING YOURSELF FIRST ;

you should always put urself first in every single situation including financially. so to pay urself first simply means to put ur future and needs before anything else. FOR EXAMPLE... let's say u wanna buy an ipad by the end of the year, an ipad is $345.

lets also say that u get paid weekly, so you'd divide $345 by the number of weeks in a year (52) you'd get 6.6. so you'd have to save roughly $6-$6.50 a week which isnt a lot at all. and you'd be getting what u want.

INTEREST AND CREDIT ;

interest is like a reward that the bank gives you for trusting them to look after your money. the more money you have in your account, and the longer you keep it there, the more interest you can earn…💬🎀

so the bank calculates interest as a percentage of the total amount in a bank account. so if the bank pays a 1% interest you'll earn $1 for every $100 in ur bank account over the course of a year. so if u have $500 in ur account you'll get $5. its not a lot, but interest builds on itself.

credit is the ability of the consumer to acquire goods or services prior to payment with the faith that the payment will be made in the future…💬🎀

for example missing payment deadlines can negatively affect ur credit score. why is this important? if u wanna go to college and wanna use student loans, u might not be able to if ur credit history is bad. as ur credit history grows you'll get a credit score. the higher ur score, the better ur credit is.

BUILDING CREDIT ;

get a secured card. a secured credit card is a special type of credit card with a down payment. when you open the card, you will give the credit card company a deposit to hold. it can be as little as $100. the company holds the money for you and gives you a credit card with a line of credit equal to your deposit

sign up for victoria's secret direct paper mailers. you'll get a coupon each month for 1 free panty for every purchase. when u go to the mall, get urself a panty and a sweet treat 🧁 (DO NOT PUT ANYTHING ON THE CARD THAT U CANT IMMEDIATELY PAY OFF)

and then go home and pay ur credit card bill off, and then dont use it again until the next month.

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

833 notes

·

View notes