#Enterprise & Consumer IT

Explore tagged Tumblr posts

Text

#christopher pike#pike#Star Trek#st snw#star trek strange new worlds#horses#Why does literally every Enterprise capitan like horses to some degree#picture of a star trek character with a caption from somewhere else on the internet#I’m on a roll with these mostly because these silly little science guys consume my every waking thought

186 notes

·

View notes

Text

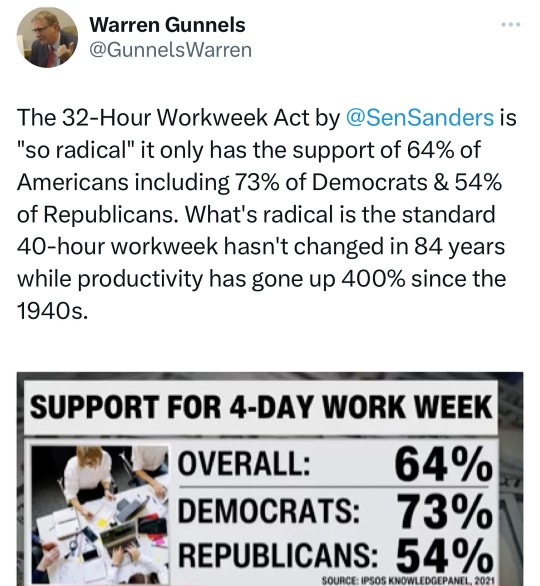

#bernie sanders#work week reduction#32-hour work week#overtime pay#productivity#technology#fair labor standards act#international examples#france#norway#denmark#germany#well-being#stress#fatigue#republican senator bill cassidy#small enterprises#job losses#consumer prices#japan#economic output#labor dynamics#artificial intelligence#automation#workforce composition

124 notes

·

View notes

Text

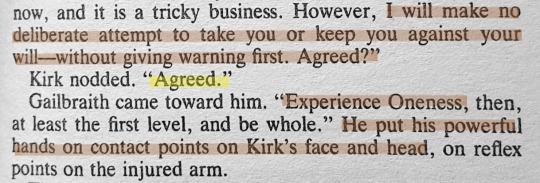

#9: Triangle

An exhausted and injured Kirk makes a dangerous deal with a hive mind entity (to be protected from a different collective consciousness that's closing in) - spock senses the danger to his t'hyla and comes running

#ngl i was shocked to see thyla in the book where kirk and spock fall in love with the same woman#as i understand it this takes place during the missing second five year mission (based on publication date and the era of uniform#they wear on the cover)#star trek#tos#books#the original series#spock#kirk#exerpt#star trek tos#spirk#triangle#this book is not what i expected (so far in a good way) tho still only half eay through#its basically two hive minds vying for power and trying to consume kirk/the enterprise and spock is trying so hard to protect kirk#absolutely fascinating

122 notes

·

View notes

Text

here's the thing about world-ending/universe-ending threats in prequels. if that is your entire focus and what all your tension hangs on, then it will not work

all of your tension cant hinge on a universe-ending threat in a prequel because we already know that that universe is going to be ok. just by virtue of being a prequel, there is already no tension there- we know the future of this story. now, you can create tension by focusing on the angle of what happens to the characters- if those characters are not also present in the content the prequel is leading up to

the universe-ending threat in season 2 of Discovery really doesnt work. right from the get-go, we know that things are going to be ok. we know the universe doesnt end here. and, by involving TOS characters, they do unfortunately eliminate some of that tension when it comes to what might happen to the characters. we know Spock doesnt die here. we know Pike and Una dont die here. the writing also doesnt leave a lot of room for me to be worried about the main cast- I honestly dont know if I think this show is capable of permanently killing off anybody on the main cast. we'll see if im proven wrong in that

to compare to another prequel series- I think s3 of Enterprise did this a lot better. we knew the Earth wasn't going to be destroyed. we knew Starfleet wasn't going to be destroyed. but the Xindi plot started with a devastating attack that killed 7 million people- something of that scale is usually the endgame, the very thing the characters are fighting to prevent, but instead it was the beginning. thats a POWERFUL way to introduce a plot like that, especially in a prequel

I think where Enterprise's Xindi plot also got it right was having such a strong focus on the characters. I found a lot of the tension for me personally hinged on seeing just how far the Enterprise crew- especially Archer- would go. how far they wound bend their morals. how much they would break them. for me, thats the real tension in that season. I know the Earth will be fine, but I dont know how far Archer will go to ensure it. innocent people are killed. prisoners are tortured. civilians are attacked and robbed and left stranded. so, while I know ultimately that the Earth is going to survive this and the crew will succeed, im still hooked and asking what comes next because I want to see what this crew will do next. I want to see how far they'll go

im not organizing this as well as I could honestly im just slapping my thoughts at the wall but yeah. as much as I really am enjoying Discovery- its a good show, its not a very good prequel. so far I would consider Enterprise the better prequel series. interested to see where things go now that its not so hindered- 930 years into the future is far beyond anything we've seen from any Trek series so far, so theyre no longer confined by having to be a prequel. looks like we'll finally get to boldly go where no man has gone before!

#star trek: discovery#star trek: enterprise#again I want to emphasize that I really like Discovery#and im thoroughly enjoying myself#but I enjoy being critical of the things I consume#so yeah. good show not a very good prequel

3 notes

·

View notes

Text

People You Want To Know Better (Tag Game)

Thanks for tagging me @bludsfinest!!

Last Song: You Know What They Do to Guys Like Us in Prison by My Chemical Romance

Currently Watching: Lost (season 1), Agents of Shield (season 1), Enterprise (season 3), Teen Titans (season 4)

Currently Reading: Red Hood and the Outlaws vol 4, Batgirls vol 2, Tim Drake: Robin #4, Son of Neptune by Rick Riordian (rereading it!). I also just finished Self Made Boys by Anna-Marie McLemore last night!

Latest Obsession: been really getting back into Lost lately since I started rewatching it! but also batfam has kinda taken over my entire being in the last couple months haha

Tagging: @cawgeyamas @iveofficiallygonemad @timeforsomethrillingheroicsblog @white-weasel if you would like!

#thanks so much for the tag!#as you can probably tell by my current reading and watching I’ve lately been jumping around with the media I consume lol#although enterprise and teen titans have been a bit slow going for me#and lost and aos I watch with my bf#but mostly I’ve been reading lately#lots of comics#and I tend to jump around cause there’s so many characters that I want to know better#personal#self made boys was for my family book club and I have Thoughts but I probably wouldn’t have picked it up if it wasn’t for the book club#which honestly is why I like the book club so much cause I’ve been reading a lot of different things that normally wouldn’t catch my eye or#id dismiss as not for me

6 notes

·

View notes

Text

#Challenging Big Enterprise#Consumer Advocacy#Corporate Accountability#Corporate Ethics#Corporate Responsibility#Ethical Business Practices#Exposing Big Corporations#facts#Fighting Corporate Exploitation#Holding Corporations Accountable#life#Podcast#Realist Juggernaut Mission#serious#Small vs. Big Business#straight forward#Transparency in Business#truth#Truth in Business Practices#upfront#Post navigation

0 notes

Text

The United States wearable technology market size is projected to exhibit a growth rate (CAGR) of 17.10% during 2024-2032. The increasing awareness and focus on personal health and fitness, continuous improvement in sensor technology, the incorporation of artificial intelligence (AI) and machine learning (ML), and the rising popularity of corporate wellness programs represent some of the key factors driving the market.

#United States Wearable Technology Market Report by Product (Wrist-Wear#Eye-Wear and Head-Wear#Foot-Wear#Neck-Wear#Body-Wear#and Others)#Application (Consumer Electronics#Healthcare#Enterprise and Industrial Application#and Region 2024-2032

0 notes

Text

Miracle, or marginal gain?

New Post has been published on https://thedigitalinsider.com/miracle-or-marginal-gain/

Miracle, or marginal gain?

From 1960 to 1989, South Korea experienced a famous economic boom, with real GDP per capita growing by an annual average of 6.82 percent. Many observers have attributed this to industrial policy, the practice of giving government support to specific industrial sectors. In this case, industrial policy is often thought to have powered a generation of growth.

Did it, though? An innovative study by four scholars, including two MIT economists, suggests that overall GDP growth attributable to industrial policy is relatively limited. Using global trade data to evaluate changes in industrial capacity within countries, the research finds that industrial policy raises long-run GDP by only 1.08 percent in generally favorable circumstances, and up to 4.06 percent if additional factors are aligned — a distinctly smaller gain than an annually compounding rate of 6.82 percent.

The study is meaningful not just because of the bottom-line numbers, but for the reasons behind them. The research indicates, for instance, that local consumer demand can curb the impact of industrial policy. Even when a country alters its output, demand for those goods may not shift as extensively, putting a ceiling on directed growth.

“In most cases, the gains are not going to be enormous,” says MIT economist Arnaud Costinot, co-author of a new paper detailing the research. “They are there, but in terms of magnitude, the gains are nowhere near the full scope of the South Korean experience, which is the poster child for an industrial policy success story.”

The research combines empirical data and economic theory, using data to assess “textbook” conditions where industrial policy would seem most merited.

“Many think that, for countries like China, Japan, and other East Asian giants, and perhaps even the U.S., some form of industrial policy played a big role in their success stories,” says Dave Donaldson, an MIT economist and another co-author of the paper. “The question is whether the textbook argument for industrial policy fully explains those successes, and our punchline would be, no, we don’t think it can.”

The paper, “The Textbook Case for Industrial Policy: Theory Meets Data,” appears in the Journal of Political Economy. The authors are Dominick Bartelme, an independent researcher; Costinot, the Ford Professor of Economics in MIT’s Department of Economics; Donaldson, the Class of 1949 Professor of Economics in MIT’s Department of Economics; and Andres Rodriguez-Clare, the Edward G. and Nancy S. Jordan Professor of Economics at the University of California at Berkeley.

Reverse-engineering new insights

Opponents of industrial policy have long advocated for a more market-centered approach to economics. And yet, over the last several decades globally, even where political leaders publicly back a laissez-faire approach, many governments have still found reasons to support particular industries. Beyond that, people have long cited East Asia’s economic rise as a point in favor of industrial policy.

The scholars say the “textbook case” for industrial policy is a scenario where some economic sectors are subject to external economies of scale but others are not.

That means firms within an industry have an external effect on the productivity of other firms in that same industry, which could happen via the spread of knowledge.

If an industry becomes both bigger and more productive, it may make cheaper goods that can be exported more competitively. The study is based on the insight that global trade statistics can tell us something important about the changes in industry-specific capacities within countries. That — combined with other metrics about national economies — allows the economists to scrutinize the overall gains deriving from those changes and to assess the possible scope of industrial policies.

As Donaldson explains, “An empirical lever here is to ask: If something makes a country’s sectors bigger, do they look more productive? If so, they would start exporting more to other countries. We reverse-engineer that.”

Costinot adds: “We are using that idea that if productivity is going up, that should be reflected in export patterns. The smoking gun for the existence of scale effects is that larger domestic markets go hand in hand with more exports.”

Ultimately, the scholars analyzed data for 61 countries at different points in time over the last few decades, with exports for 15 manufacturing sectors included. The figure of 1.08 percent long-run GDP gains is an average, with countries realizing gains ranging from 0.59 percent to 2.06 percent annually under favorable conditions. Smaller countries that are open to trade may realize larger proportional effects as well.

“We’re doing this global analysis and trying to be right on average,” Donaldson says. “It’s possible there are larger gains from industrial policy in particular settings.”

The study also suggests countries have greater room to redirect economic activity, based on varying levels of productivity among industries, than they can realistically enact due to relatively fixed demand. The paper estimates that if countries could fully reallocate workers to the industry with the largest room to grow, long-run welfare gains would be as high as 12.4 percent.

But that never happens. Suppose a country’s industrial policy helped one sector double in size while becoming 20 percent more productive. In theory, the government should continue to back that industry. In reality, growth would slow as markets became saturated.

“That would be a pretty big scale effect,” Donaldson says. “But notice that in doubling the size of an industry, many forces would push back. Maybe consumers don’t want to consume twice as many manufactured goods. Just because there are large spillovers in productivity doesn’t mean optimally designed industrial policy has huge effects. It has to be in a world where people want those goods.”

Place-based policy

Costinot and Donaldson both emphasize that this study does not address all the possible factors that can be weighed either in favor of industrial policy or against it. Some governments might favor industrial policy as a way of evening out wage distributions and wealth inequality, fixing other market failures such as environmental damages or furthering strategic geopolitical goals. In the U.S., industrial policy has sometimes been viewed as a way of revitalizing recently deindustrialized areas while reskilling workers.

In charting the limits on industrial policy stemming from fairly fixed demand, the study touches on still bigger issues concerning global demand and restrictions on growth of any kind. Without increasing demand, enterprise of all kinds encounters size limits.

The outcome of the paper, in any case, is not necessarily a final conclusion about industrial policy, but deeper insight into its dynamics. As the authors note, the findings leave open the possibility that targeted interventions in specific sectors and specific regions could be very beneficial, when policy and trade conditions are right. Policymakers should grasp the amount of growth likely to result, however.

As Costinot notes, “The conclusion is not that there is no potential gain from industrial policy, but just that the textbook case doesn’t seem to be there.” At least, not to the extent some have assumed.

The research was supported, in part, by the U.S. National Science Foundation.

#Analysis#approach#Asia#author#california#China#consumers#data#double#doubling#dynamics#economic#Economics#economy#effects#Engineer#engineering#enterprise#Environmental#Experienced#Ford#form#Foundation#Full#Giving#Global#global trade#Government#growth#hand

0 notes

Text

youtube

Credit Report Woes? Here’s How to Fight Back and Win

🔥 Fixing Your Credit Report: The Ultimate Battle Plan 🔥

If you’ve ever tried to fix your credit report, you know it can feel like a never-ending battle. You dispute errors, wait for responses, and sometimes…nothing happens. 😑 But don’t worry, we’ve got your back! Today, we’re breaking down the process, tackling common issues like the Metro 2 method, and showing you how to dispute like a pro.

First Hurdle: Getting All Your Reports

Ever tried to pull your credit reports and only got one? Frustrating, right? 😤 One of our members ran into this issue while helping his brother. After requesting his reports, only one showed up. Turns out, if something’s in dispute, it might block you from getting the others.

🛑 Heads Up: If you can’t access all your reports, it’s time to pick up the phone and call the credit bureaus directly. Sometimes, that’s the only way to get what you need.

The Metro 2 Method: Worth the Hype?

The Metro 2 method has been making waves lately, but does it really work? Our member jumped on the bandwagon, only to find that most of his disputes were still coming back as verified. 😩

⚖️ Real Talk: Metro 2 isn’t the law. That means if the credit bureaus don’t play ball, you’re out of luck. No legal recourse, no big wins. If you’re serious about fixing your credit, focus on what the law actually says. That’s where the real power lies.

How to Dispute Like a Boss

Get the Right Reports: Skip the third-party sites and go straight to annualcreditreport.com or the bureaus themselves. You’ll get more info, which means more ammo to dispute errors.

Don’t Skimp on Details: When you find an error, go all in. Whether it’s a charge-off that still shows a credit limit or something else, your evidence needs to be bulletproof. 🛡️

Double-Check with a Second Report: After your first dispute, get another report. Compare the results and see if the credit bureaus made any sneaky changes. This is where you can catch them slipping!

Go Big or Go Home: If your disputes aren’t fixed after two rounds, it’s time to get serious. Send an intent to sue letter. It’s a power move that shows you mean business and might just get the results you want. 💼

The Final Step: Legal Action

When all else fails, you have the right to sue. Under the Fair Credit Reporting Act, you can go after the credit bureaus for willful non-compliance. And trust us, those cases can bring in some serious cash. 💰

🔥 Pro Tip: If you’re ready to take legal action, consider hiring a lawyer. A strong case with solid evidence can lead to major payouts, especially if the inaccuracies have cost you financially.

The takeaway? Don’t let the credit bureaus push you around. With the right strategy and a little persistence, you can fix your credit report and hold these companies accountable. It’s time to fight back and win! ✊

#disputeprocess #CreditDisputeStrategies #CreditScoreImprovement

0 notes

Text

I think what's fascinating about this whole Unity debacle is how clear it makes something.

The entire C-suite of every company on earth are idiots.

That's not hyperbole, they are people serially uninterested in becoming informed and constitutionally incapable of hearing they're wrong about something. They build a thick shell of unreality and assure themselves they can direct any human venture even if they know nothing of how the enterprise in question works or how its' customers interact with it.

They had it. They were THE tool for learning to build games and even worked for larger projects. Producers and consumers alike knew Unity as a trusted albeit occasionally teased household name.

And they fucked their institutional trust like a university of Florida fraternity pledge strung out on something called "gator blood" fucks a supermarket turkey.

And it isn't even just Unity - look at Twitter, the smoking ruin of something once synonymous with the digital commons. It isn't just Twitter - look at grocery prices.

Our "business leaders", our "movers and shakers" don't know what they're doing. An MBA is taken as a stand-in for competence and knowledge. Because the neo-feudal overlords can never hear no.

The enshittification continues.

19K notes

·

View notes

Text

Facial Recognition Market : Global Opportunity Analysis and Industry Forecast, 2023-2032

According to a new report published by Allied Market Research, titled, “Facial Recognition Market,” The facial recognition market was valued at $5.5 billion in 2022, and is estimated to reach $24.3 billion by 2032, growing at a CAGR of 16.4% from 2023 to 2032.

A system that can recognize a human face from a digital photo or video frame using a database of faces is known as facial recognition. It works in a series of complex processes that include detecting facial features in images, video clips, multiple camera views, and three-dimensional (3D) data, analyzing the image by analyzing the geometry and expression, and recognizing the image to recognize the person. It is largely used to identify users through identification (ID) verification services, and it automatically groups people into different categories based on things like age, gender, and weight. Moreover, it could rectify blurred image in order to accurately analyze and identify people. By minimizing unnecessary human interaction, it improves security maintenance efficiency and helps to avoid crimes. Additionally, it enables people to secure their documents and data stored online or on computers using network access control that supports facial recognition. Furthermore, it is integrated with banking, airport, and border control biometric and attendance systems.

Furthermore, utilizing current cameras and surveillance equipment, facial recognition technology may be quickly deployed. The use of facial recognition technologies is anticipated to increase as security technology advances to enable effective surveillance systems to track crimes, frauds, and terrorist activities. During the upcoming period, this is anticipated to drive the facial recognition market.

Additionally, factors such as increasing need for effective video surveillance systems and rising government and military investments on facial recognition primarily drive the growth of the facial recognition market. However, concern over privacy and data security hampers market growth to some extent. Moreover, IoT and smart device adoption that works seamlessly is expected to provide lucrative opportunities for market growth during the forecast period.

On the basis of application the access control dominated the facial recognition market share in 2022, owing to increasing integrated with smartphones, tablets, and smart locks to provide seamless access control in residential, commercial, and hospitality settings. Furthermore, the need for heightened security measures in residential, commercial, and public settings is a significant driver for facial recognition in access control. However the security and surveillance segment is expected to be the fastest growing, owing to real-time identification and alerts, making surveillance more proactive. Furthermore, the rising concern over security threats, terrorism, and public safety issues is a significant driver for the adoption of facial recognition technology in surveillance.

Region-wise North America dominated the facial recognition market size in 2022, owing to the growing adoption of advanced technological solutions such as AR (Augmented Reality) and VR (Virtual Reality) solutions across end-user industries, such as media & entertainment, retail, and financial sectors, contributing toward a major trend in the North America region. However Asia-Pacific is expected to be the fastest growing region in the market, owing to the rise in the use of automated systems from unlocking mobile phones to checking in for flights to making payments with the use of AI to match live images of a person for verification against a database of photographs.

Inquiry Before Buying: https://www.alliedmarketresearch.com/request-sample/794

The facial recognition market was significantly impacted by the COVID-19 pandemic. The popularity of facial recognition systems in many industries was fueled by the growing emphasis on contactless technology and the necessity for touchless identification techniques. Facial recognition offers a practical and hygienic substitute to conventional authentication techniques like fingerprint scanning or PIN entry because it avoids physical contact. Facial recognition technology is now more in demand in sectors like healthcare, banking, retail, and transportation. Additionally, the outbreak created interest in facial recognition as a substitute authentication technique by driving demand for touchless and contactless technologies. Without requiring physical touch or the use of communal surfaces, facial recognition offers a hygienic and practical approach to identify people. Due to this, new approaches have been developed and implemented into operation that aim to increase the accuracy of facial recognition in situations where people are wearing masks, such as algorithms that can evaluate additional facial traits or blend facial recognition with other biometric modalities.

Key Findings of the Study

By technology, the 3D segment led the facial recognition market in terms of revenue in 2022.

By application, the security and surveillance segment is anticipated the fastest growth for facial recognition market forecast.

By end user, the retail and e-commerce dominated the facial recognition market growth.

By region, North America generated the highest revenue for facial recognition market analysis in 2022.

The key players profiled in the facial recognition industry analysis are NEC Corporation, Aware, Inc., Cognitec Systems Gmbh., Thales, Fujitsu, Facephi, Nviso, Onfido, Daon, Inc., and Facefirst. These players have adopted various strategies to increase their market penetration and strengthen their position in the facial recognition industry.

About Us: Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

0 notes

Text

0 notes

Photo

Nvidia has announced the availability of DGX Cloud on Oracle Cloud Infrastructure. DGX Cloud is a fast, easy and secure way to deploy deep learning and AI applications. It is the first fully integrated, end-to-end AI platform that provides everything you need to train and deploy your applications.

#AI#Automation#Data Infrastructure#Enterprise Analytics#ML and Deep Learning#AutoML#Big Data and Analytics#Business Intelligence#Business Process Automation#category-/Business & Industrial#category-/Computers & Electronics#category-/Computers & Electronics/Computer Hardware#category-/Computers & Electronics/Consumer Electronics#category-/Computers & Electronics/Enterprise Technology#category-/Computers & Electronics/Software#category-/News#category-/Science/Computer Science#category-/Science/Engineering & Technology#Conversational AI#Data Labelling#Data Management#Data Networks#Data Science#Data Storage and Cloud#Development Automation#DGX Cloud#Disaster Recovery and Business Continuity#enterprise LLMs#Generative AI

0 notes

Text

Human Events: John Stossel: 'The Economy Needs no Conductor'

Source:The FreeState There’s been this endless debate in America in the last few years about what creates economic and job growth. Is it the private sector or public sector. Does government actually create any jobs, well the answer to that question is yes. In the sense that they create government jobs that can contribute to private sector job growth, by rewarding contract to the private sector…

View On WordPress

#American Capitalism#American Economy#Consumer Demand#Economic Growth#Isabel Sawhill#Job Growth#John Stossel#Private Enterprise#Private Sector#Public Sector#Role of Government#Ron Haskins

0 notes

Text

DP X DC

At a Wayne Enterprises Networking Gala:

Bruce: So about that new employee, there’s been a lot of talk…you mentioned he’d be in attendance this evening?

Lucius: ah, Mr Fenton I presume? Yes, he’s fantastic really.

Bruce: So I’ve heard. Where’s the man hiding? I haven’t managed to bump into him yet.

Lucius: Mr Fenton has been squandered away to the children’s table I believe.

Bruce: the children’s table…?

Lucius: *points* there, the tallest one.

Bruce trained his gaze in the direction Lucius pointed, to come face to face with the peculiar sight of a wiry, 20-something year old, back haired, blue eyed man consumed in a heated argument with a chubby 6 year old girl in piggy tails.

Bruce: that’s-

Lucius: Yep, you’re gonna hate him. Best go introduce yourself!

#danny phantom#dp x dc#dp writing prompts#dannyfenton#danny fenton is a little shit#dp#bruce wayne#batfam

3K notes

·

View notes

Text

Harnessing AI and Knowledge Graphs for Enterprise Decision-Making

New Post has been published on https://thedigitalinsider.com/harnessing-ai-and-knowledge-graphs-for-enterprise-decision-making/

Harnessing AI and Knowledge Graphs for Enterprise Decision-Making

Today’s business landscape is arguably more competitive and complex than ever before: Customer expectations are at an all-time high and businesses are tasked with meeting (or exceeding) those needs, while simultaneously creating new products and experiences that will provide consumers with even more value. At the same time, many organizations are strapped for resources, contending with budgetary constraints, and dealing with ever-present business challenges like supply chain latency.

Businesses and their success are defined by the sum of the decisions they make every day. These decisions (bad or good) have a cumulative effect and are often more related than they seem to be or are treated. To keep up in this demanding and constantly evolving environment, businesses need the ability to make decisions quickly, and many have turned to AI-powered solutions to do so. This agility is critical for maintaining operational efficiency, allocating resources, managing risk, and supporting ongoing innovation. Simultaneously, the increased adoption of AI has exaggerated the challenges of human decision-making.

Problems arise when organizations make decisions (leveraging AI or otherwise) without a solid understanding of the context and how they will impact other aspects of the business. While speed is an important factor when it comes to decision-making, having context is paramount, albeit easier said than done. This begs the question: How can businesses make both fast and informed decisions?

It all starts with data. Businesses are acutely aware of the key role data plays in their success, yet many still struggle to translate it into business value through effective decision-making. This is largely due to the fact that good decision-making requires context, and unfortunately, data does not carry with it understanding and full context. Therefore, making decisions based purely on shared data (sans context) is imprecise and inaccurate.

Below, we’ll explore what’s inhibiting organizations from realizing value in this area, and how they can get on the path to making better, faster business decisions.

Getting the full picture

Former Siemens CEO Heinrich von Pierer famously said, “If Siemens only knew what Siemens knows, then our numbers would be better,” underscoring the importance of an organization’s ability to harness its collective knowledge and know-how. Knowledge is power, and making good decisions hinges on having a comprehensive understanding of every part of the business, including how different facets work in unison and impact one another. But with so much data available from so many different systems, applications, people and processes, gaining this understanding is a tall order.

This lack of shared knowledge often leads to a host of undesirable situations: Organizations make decisions too slowly, resulting in missed opportunities; decisions are made in a silo without considering the trickle-down effects, leading to poor business outcomes; or decisions are made in an imprecise manner that is not repeatable.

In some instances, artificial intelligence (AI) can further compound these challenges when companies indiscriminately apply the technology to different use cases and expect it to automatically solve their business problems. This is likely to happen when AI-powered chatbots and agents are built in isolation without the context and visibility necessary to make sound decisions.

Enabling fast and informed business decisions in the enterprise

Whether a company’s goal is to increase customer satisfaction, boost revenue, or reduce costs, there is no single driver that will enable those outcomes. Instead, it’s the cumulative effect of good decision-making that will yield positive business outcomes.

It all starts with leveraging an approachable, scalable platform that allows the company to capture its collective knowledge so that both humans and AI systems alike can reason over it and make better decisions. Knowledge graphs are increasingly becoming a foundational tool for organizations to uncover the context within their data.

What does this look like in action? Imagine a retailer that wants to know how many T-shirts it should order heading into summer. A multitude of highly complex factors must be considered to make the best decision: cost, timing, past demand, forecasted demand, supply chain contingencies, how marketing and advertising could impact demand, physical space limitations for brick-and-mortar stores, and more. We can reason over all of these facets and the relationships between using the shared context a knowledge graph provides.

This shared context allows humans and AI to collaborate to solve complex decisions. Knowledge graphs can rapidly analyze all of these factors, essentially turning data from disparate sources into concepts and logic related to the business as a whole. And since the data doesn’t need to move between different systems in order for the knowledge graph to capture this information, businesses can make decisions significantly faster.

In today’s highly competitive landscape, organizations can’t afford to make ill-informed business decisions—and speed is the name of the game. Knowledge graphs are the critical missing ingredient for unlocking the power of generative AI to make better, more informed business decisions.

#adoption#advertising#agents#ai#AI systems#AI-powered#applications#artificial#Artificial Intelligence#Business#Capture#CEO#chatbots#collaborate#Collective#Companies#comprehensive#consumers#data#effects#efficiency#enterprise#Environment#factor#Full#game#generative#generative ai#Graph#how

0 notes