#529 plans

Explore tagged Tumblr posts

Text

Kasemyer college savings

College savings plans; I have mentioned them before. My aunt very, very generously set up "one-year pre-paid tuition" plans for each kid. That was incredibly generous of her. The issue I have had is that 1) the fund managers make it absolutely as hard as possible to actually get the funds back out and b) since I'm not the one who set them up, I don't know what the fund promised my aunt when she paid. Oh, also, c) they did not show ANYWHERE on the website an accumulated value for the funds. Which is hinky as hell.

My son's was fully paid out in January, so I don't have to worry about that any more. However, I did note that the amount they paid out was only just a little bit more than she actually paid (years ago) in the first place. So - what was the fund doing with that money for those years? That it did not increase? That really is supposed to be the point; you invest it and it increases.

Aaaaanyhow. In the summer I stepped through the process of getting the first payment for my daughter's college. That they refused to pay it out until August when her bill was due to be paid by the end of July cause me some Money-shuffling-issues. Eventually they sent half (I presumed?) of the money. The remaining half to be paid for her spring semester.

Late in the summer I got a series of several emails from the fund. All of them were corporate/finance gibberish, involving terms like audit and transparency and 'changes moving forward.' It sounded VERY MUCH to me like someone had been caught doing something. And was promising crisscross applesauce not to do it again, but not saying what "it" was.

Yesterday I got the check in the mail for the second half of my daughter's savings fund. I promptly had to sit down. It was higher - several thousand dollars higher! - than the first 'half'. So, oopsies! it seemed those funds actually WERE having earnings.

I am elated that there is more funding for her than I thought there was. But, damn. I have questions.

12 notes

·

View notes

Text

Secure Your Child's Future: Florida Prepaid's Fall Savings Incentive

As families across Florida prepare for the future, Florida Prepaid encourages them to start saving for their children's higher education costs this fall. Recent research highlights the importance of education in securing good jobs, with a staggering 85 percent of well-paying positions projected to require postsecondary education by 2031.

A $50 Gift Card Incentive

From September 3 to October 28, 2024, families who open a Florida 529 Prepaid Plan or a Florida 529 Savings Plan will receive a $50 gift card as an added incentive to kickstart their savings journey. This initiative follows the most successful Open Enrollment season in the last decade, reflecting the growing awareness among families about the importance of saving early.

Chairman of the Florida Prepaid College Board, John D. Rood, expressed enthusiasm for the momentum surrounding the college savings programs. “We want to ensure more Floridians enjoy the peace of mind that comes with saving early,” he said. The two plans provide flexibility and affordability, allowing families to craft a personalized college savings strategy.

Benefits of Florida Prepaid Plans

Florida Prepaid stands out as the largest and longest-running prepaid college program in the nation, having helped over 1.2 million families save for college since its inception in 1987. With over 626,000 students having utilized their plans, the program demonstrates a successful track record in supporting educational aspirations.

Why Choose Florida Prepaid?

Lock in Today’s Prices: Families can secure current plan prices to cover future tuition and fee costs, with prepaid plans starting as low as $34/month for newborns—making it the most affordable option in a decade.

Flexible Savings Options: The Florida 529 Savings Plan is a tax-free investment option that can be used for qualified education expenses nationwide, including read more

#Florida Prepaid#college savings#529 plans#education costs#higher education#family savings#job market#savings incentives#Florida families#LoveWellington#WellingtonLiving#WellingtonNeighborhoods#WellingtonLifestyle#ExploreWellington

0 notes

Text

From the moment our little ones are born, we dream big for them. College may seem far away, but the journey to securing their future starts today. 🌟✨

When my first child was born, I remember holding her tiny hand and promising to give her the world. As she grew, so did my understanding of what it takes to make that promise a reality. College savings felt overwhelming, but I knew starting early was key.

We explored different options, from 529 plans with their tax advantages to Coverdell ESAs that even covered K-12 expenses. Each plan had its own benefits, but they all shared one common goal: giving our children the best possible start in life.

Now, as I watch her prepare for college, I feel a sense of accomplishment. Every dollar saved, every automated contribution, every wise investment choice – they’ve all brought us to this moment. It wasn’t always easy, but knowing she has the financial support she needs for her education makes it all worthwhile.

To all the parents out there, remember: it’s never too early to start saving. Every little bit counts, and the sooner you begin, the more your savings will grow. Let’s give our children the future they deserve. 🌍💖

Read the Full Article now: Click Now

#CollegeSavings #529Plans #FutureInvestments #ParentingJourney #EducationMatters

0 notes

Text

The 529 Plan

In America, most of us are aware of “529 Plans.” A plan that allows you to invest in the college education of your child and not pay taxes on it if I remember correctly. I had one such plan for each of my children. I was in the hospital over the last weekend. I know. I spent New Year’s Eve in a hospital bed. I’m okay now after having a procedure done yesterday, New Year’s Day, and I was released…

View On WordPress

0 notes

Link

1 note

·

View note

Text

Exploring 529 College Savings Plans: Investing for Education Expenses

Written by Delvin As the cost of higher education continues to rise, planning for future education expenses has become a top priority for many families. One valuable tool available to parents and guardians is the 529 College Savings Plan. In this blog post, we will delve into the world of 529 plans, exploring their benefits, how they work, and why they are a smart investment strategy for funding…

View On WordPress

#529 Plans#Blogging#dailyprompt#Financial#Financial Literacy#knowledge#money#Personal Finance#Tax Advantages for 529 plans#Understanding 529 Plans

1 note

·

View note

Text

The biggest tragedy of oot is that link needs fucking parents and there is literally no one who is capable of filling that role in his life. Maybe Impa, but by the time the game ends the only other competent adults in the game, Darunia and Nabooru, have no idea who Link is, and every other adult is either unfit to raise a child (Ganondorf, Ingo, due to being evil), incapable of raising a child (the Deku Tree, due to being dead) or it'd be weird like if Talon adopted him (due to it being implied Link later marries Malon). It's debatable at best whether or not Navi is an adult in the first place, she reads like an older child to me, but it doesn't matter cause she either abandoned Link at the end of the game making her an unfit parent due to her abandoning him or she was actually mortally wounded and left Link to go die somewhere else like a goddamn cat or something making her incapable of raising him due to being dead.

I could parent him.

#oot#tloz#twilight princess schmilight princess#you cannot look me in the eyes and tell me#that the least emotionally available zelda and the most emotionally needy link#both got together#and more importantly STAYED TOGETHER#if link eventually married anyone from oot it was malon#and even that's a stretch#you generally shouldn't marry your childhood sweetheart#and you REALLY shouldn't marry your adoptive sister even if you're a ten year old who#moonlighted as a 17 year old and is now 10 again and have#been adopted by the only adult in hyrule#who is even kind of capable of taking care of a child#and even then this is pre adult timeline talon so he's not THAT good at it#but you got to know your new adoptive sister as a 17 year old also but now that you're ten again#and getting adopted by her father it pushes that right back into incest territory#no you stop that#I want to put money in a 529 plan for his college education#I wanna go to his ocarina recital with a video camera

9 notes

·

View notes

Text

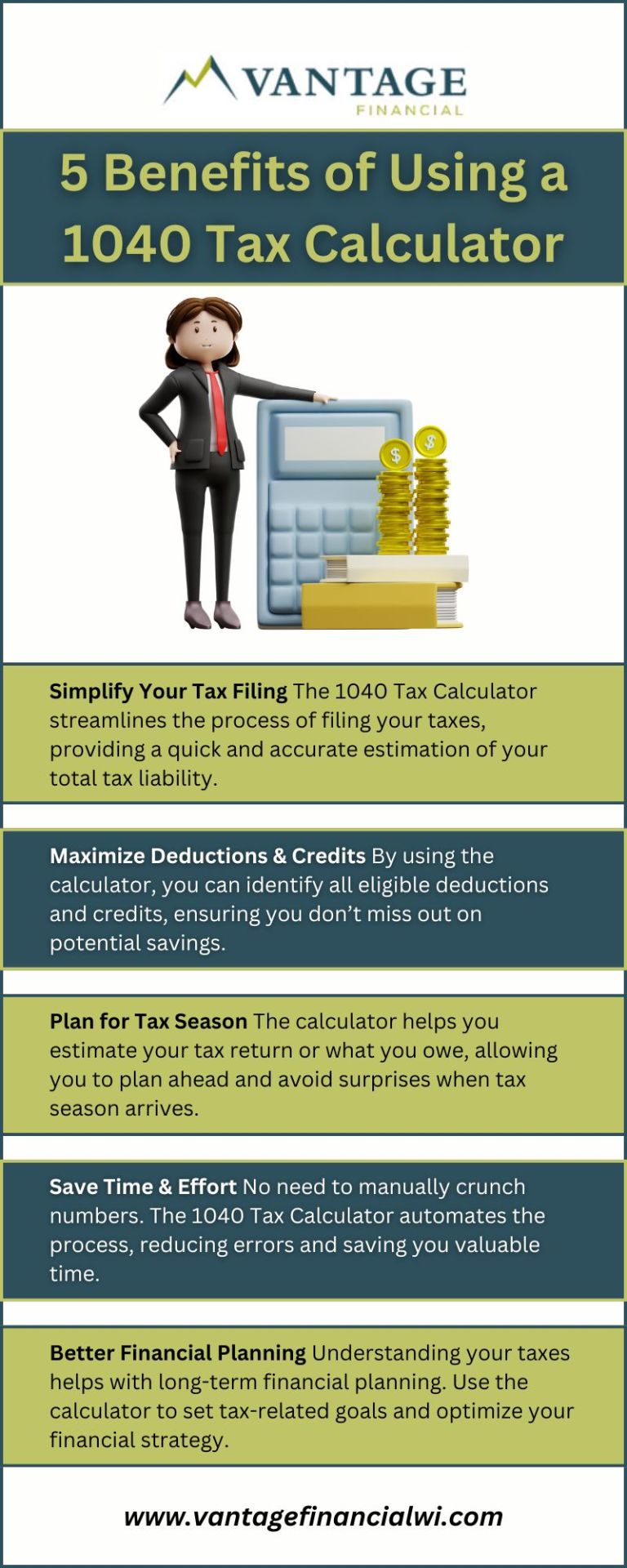

Discover how the 1040 Tax Calculator can streamline your tax filing process and help you maximize deductions. Learn how Vantage Financial Partners uses this tool to guide you through tax season with confidence and ensure you're taking full advantage of available credits and savings.

#senior wealth advisor in wisconsin#wealth management consultant#fiduciary financial planner#top rated financial planning firm#educational savings plan#529 college savings plan#financial planner in wisconsin#college savings plan#best financial advisors in wisconsin#529 plan

0 notes

Text

Five Small Tips You Can Save Thousends Of Dollars

#01 Plan 529#02 Purchased Index Funds#03 Saving Account#American citizen#big business#CD shares#Deposit Certificate#Five Small Tips You Can Save Thousends Of Dollars#How To Open The 529 Plans#information#money offers#open a savings account#Privet Saving#safe index fund S&P500#smartphone#stock market#student&039;s parents#What Is A Savings Account#What Is S&P500

0 notes

Text

Planning for College Expenses with a 529 Plan

How a 529 plan can help you prepare for various college expenses, including tuition, room and board, textbooks, and other education-related costs.

#best financial planning services in ct for indians#financial advisor in connecticut#indianfinancialadvisor#indianfinancialadvisorny#finance#financial advisor in massachusetts#financialplanning#financial advisor for indian families in ct#indianfinancialadvisorinct#indianfinancialadvisorma#529 plan

0 notes

Text

OneNorthStar: Navigating Financial Success

OneNorthStar, a reputable financial advisory firm, is dedicated to guiding individuals and businesses toward financial prosperity. With a commitment to personalized service and a team of seasoned financial advisors, OneNorthStar strives to meet the diverse needs of its clients.

Comprehensive Financial Planning: At the core of OneNorthStar's offerings is comprehensive financial planning. The firm works closely with clients to understand their unique financial goals, risk tolerance, and time horizon. This collaborative approach allows for the creation of tailored strategies that encompass investment planning, retirement planning, risk management, tax optimization, and wealth preservation.

Investment Planning Expertise: OneNorthStar's team of experienced financial advisors excels in crafting investment portfolios that align with clients' objectives. By assessing risk tolerance and financial circumstances, the firm constructs diversified portfolios incorporating stocks, bonds, mutual funds, and other instruments. The goal is to optimize returns while managing risk, ensuring a solid foundation for long-term financial growth.

Wealth Management Beyond Investments: The firm goes beyond traditional investment planning, offering comprehensive wealth management services. This encompasses a holistic approach to financial well-being, including estate planning, tax strategies, and ongoing portfolio monitoring. OneNorthStar understands that financial success extends beyond investment returns, incorporating a broader perspective to safeguard and enhance clients' wealth.

Client-Centric Approach: OneNorthStar prides itself on its client-centric philosophy. The firm values open communication, transparency, and building long-lasting relationships. Client testimonials underscore the positive impact of the firm's guidance on financial outcomes, reinforcing OneNorthStar's reputation for reliability and excellence.

Educational Resources: Recognizing the importance of financial literacy, OneNorthStar provides educational resources to empower clients in making informed decisions. Whether through articles, webinars, or one-on-one consultations, the firm aims to enhance clients' financial knowledge and confidence.

Fascinated by the power of money

Vikram is fascinated by the power of money and deeply believes that everyone should have lots of it. That’s why he started onenorthstar to transform people’s financial future. Supported by his amazing family, today Vikram shoulders the challenges in people’s journeys to financial freedom through ONS. So that every person experiences financial well-being, and has the opportunity to create more of their life.

Contact US

Need financial advice from Vikram?

Connect today!!

Advice Session available in: 1 on 1 in person. Online video meetings.

T: +1 203-343-0880 E: [email protected] A: 80 Fourth St, Stamford, CT 06905

#Portfolio Manager#Financial Planning#Retirement Planning#Roth 401K#401K#IRA#403B#Investment Management#529 plan#brokerage account#Tax efficiency#Legacy Creation#Financial Planning Services#Financial Advisors#Financial Planning Firm#Finance Blogs#Post Retirement Plans

1 note

·

View note

Text

529 College Savings Plans

A 529 college savings plan is a tax-advantaged investment account designed to help families save for future education expenses, such as tuition, fees, books, supplies, and room and board. Here are some key points to know about 529 college savings plans: Tax advantages: Contributions to a 529 plan grow tax-deferred, which means you don’t have to pay federal taxes on the earnings as long as the…

View On WordPress

0 notes

Text

"It was a Thursday" a love confession far from perfect // 529 words

It was not supposed to happen like this. They both had waited so long, it was going to be special. Possibly on the weekend trip they had carefully planned and made up excuses to justify sharing a bed. Or maybe it was going to happen after breakfast, on their walk back to the hotel.

They were waiting. Regulus was certain they both figured it out at the same time — no doubt late compared to the rest of their friends. But it was a Tuesday, and the weather was horrible and his hair just didn’t look right. That was no way to confess his love to one James Potter.

But today, a Thursday, with an okay weather, exams around the corner, when both of them were upset was definitely worse.

Regulus couldn’t even remember what they were even fighting about, let alone how it turned into both of them screaming and blowing up on each other. There was nothing left to be said.

It was James who broke the silence. “I’m done, Reg,”

He was going to be sick. “What does that even mean?” Regulus’ voice broke.

“I won’t fight anymore,” James responded.

Regulus turned his face, the thought of watching James leave was unbearable. “So you’ll just go?” He could barely get the words out.

“Look at me.” James took a step closer.

“No.” Regulus' eyes shut his eyes as he felt James’ hands squeeze his arms. Why did he have to be this gentle even when he was breaking Regulus’ heart?

James released his grip and softly brushed the side of Regulus’ arm with his thumb. “Please, look at me.”

Regulus obliged. James’ eyes were just as teary-eyed as his own. Was it just as tormentful for James to watch him?

“Why are you crying if I’m the one who has to watch you leave?” There was no venom in Regulus’ tone, and sadness seemed too insignificant of a word at the moment. Ache. That was closer.

James’ hands traveled to his face, and god, were they were warm. One last kiss of the sun on his skin before winter came. He would miss it. They were so close to having it all, then Regulus snapped, said something wrong, and he didn’t even remember it. He couldn’t stop as his sharp words attacked until it was too late, he had crossed a line. James would-

“I love you.”

What?

“I love you.” James repeated, loudly. “I’m not leaving.”

“Yo- you said you were done.”

“Fighting. I was done fighting, Reg.” James chuckled as he moved his feet close enough that the point of their shoes were touching. “I could never be done with you.”

Regulus felt as if he was drowning and had finally caught some air. They were okay. James wasn’t leaving. James loved him. James loved him?

“You love me?”

“Actually, I’m in love with you.” James whispered as he lifted Regulus’ face slightly. “And I’m sorry. I shouldn’t have gotten that upset, you were already stressed and I knew it but I just couldn’t keep my mouth shu-”

“I love you too.”

“You do?”

“In love, actually.” Regulus said, allowing a small smile to form.

There was no perfect breakfast, no perfect weather, no perfect sunrise. It was a Thursday, with an okay weather, exams around the corner, both of them upset, and yet, they loved each other. Any day together would be lovely as long as that one truth remained.

#okay so if u see a mistake#no u didnt#i just wanted to get smth out today#so theres no reread or i will hate it#so enjoy babesss#and if u didnt#damn idk what to tell u#this is tumblr#just scroll past#marauders fic#james potter x regulus black#james and regulus#james potter#james x regulus#regulus x james#regulus and james#regulus black#regulus arcturus black#regulus black x james potter#jegulus#jegulus microfic#hp marauders#starchaser#sunseeker#james fleamont potter#rab#fjp#marauders#harry potter#marauders era

205 notes

·

View notes

Text

secret lover

character: mitsuya

content: fluff, gn reader

synopsis: mitsuya seems to have gotten into a relationship and the boys are determined to get him to confess who his secret lover is

wc: 529

hello! i’m somewhat back so have this short drabble i thought of because im having mitsuya brainrot <33 my skills are rusty so im sorry if its wonky,, hope you enjoy!!

“C’mon mitsuya just tell us who the lucky person is and we’ll leave”

“Yeah mitsuya it wouldn’t hurt to tell us y’know, your BEST friends”

“Guys i genuinely have no idea what you’re talking about. Just go home already.” mitsuya said, backing up into a corner by his friends, to which mikey pouted, draken and baji scoffed, and pehyan pointing an accusatory finger at him,

“Nuh uh, i saw you holding hands with someone after school when you said you were too busy to hang out with us.”

Mitsuya sighed, sweat collecting along his hairline. It was because of that accusation that caused the rest of the toman founders to storm into his club room, demanding who this secret someone was that was causing him to be ‘too busy’ to hang out with the boys.

“It’s not like we’re gonna freak out that you’re in a relationship mitsuya, just tell us.” draken calmly said.

“The bigger question is why are you here draken. You’re not the typa guy to hound on me like this.”

“I’m curious. And also so that these two idiots don’t do anything stupid.” draken explained, head tilting to refer to both mikey and baji.

Just as mitsuya was about to defend himself once again, the doors to the club room swung open revealing an exasperated student, clutching onto their shirt buttons.

“Taka-kun! This is an emergency! My shirt button popped out and i can’t possibly walk around school with my chest exposed for the whole world to see!” you cried, hoping to be met with the open arms of your boyfriend, but soon stopped in your tracks seeing your purple haired lover being cornered by four other boys.

“Uh- am I interrupting something here..?” you asked slowly, confusion evident on your face. The toman founders turned their attention from you to the poor boy cornered in between them. Said boy was flushed, his face and ears turning a light pink colour, eyes casting downward in hopes of avoiding the other boys’ gazes.

“So, taka-kun, mind introducing who this lovely person is?” baji teased, wrapping his arm around mitsuya’s shoulder and directing him to you.

Mitsuya clears his throat, removing baji’s arm and walking towards you, his shaking arm wrapping around your waist tightly, almost as if to ground and calm himself down.

“This is y/n, y/n these are my friends. Now come with me, lemme fix your shirt for you.” mitsuya guides you to his work table while he turns his head behind to mouth a ‘get out’ to his friends. The boys snickered before they finally left the club room and flustered mitsuya alone.

“I’m sorry taka-kun, i didn’t know your friends were here.” you apologised to your boyfriend, a cute pout making its way to your lips. To which mitsuya chuckled and placed a gentle kiss on your lips.

“That’s alright my love, i was gonna have to introduce you to them sooner or later.” mitsuya smiled at you and gave you a small pat on your head. Although, it wasn’t the way mitsuya was planning on introducing you to his friends. He was definitely going to kick their asses later.

reblogs are highly appreciated!!

❥ masterlist

requests are closed!!

#tokyo revengers#tokyo revengers fluff#tokyo revengers x reader#mitsuya#mitsuya fluff#mitsuya x reader#mitsuya drabbles#mitsuya imagines#mitsuya oneshot#tokyo revengers oneshot#tokyo revengers drabbles#tokyo revengers imagines#mitsuya takashi#mitsuya takashi fluff#mitsuya takashi x reader#mitsuya takashi oneshot#mitsuya takashi imagines#mitsuya takashi drabbles

1K notes

·

View notes

Text

Leveraging a 529 Plan: Investing in Real Estate for Your Child's College Years

Written by Delvin As college tuition costs continue to rise, parents are constantly seeking creative ways to save for their child’s education. One strategy gaining popularity is using a 529 Plan to purchase an investment property that can be rented out to cover housing expenses during their college years. In this blog post, we will explore how parents can utilize a 529 Plan for buying an…

View On WordPress

#529 Plan#College Savings Plan#dailyprompt#Financial#Financial Freedom#Financial Independence Retire Early#Financial Literacy#FIRE#Generational Wealth#knowledge#money#Money Management#Moneymaking#Passive Income#Personal Finance#Real Estate#Rental Properties#Wealth

1 note

·

View note

Text

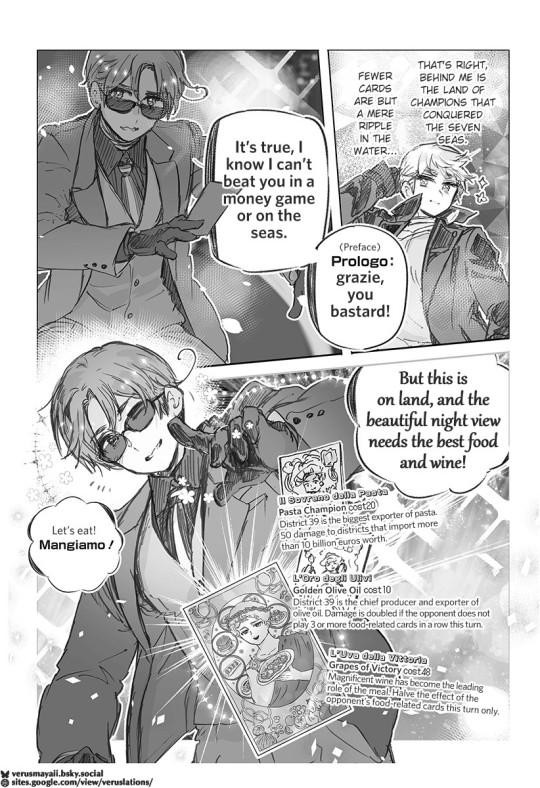

Hetalia Gangsta 536, 537, 528, 529 (verusmayaii)

Translated by verusmayaii!

Sum: a flashback to the axis strategizing shortly before russia's turn and a flashback to england's night before featuring the uk brothers;

Come get your food england and uk brothers fans

First chapter 1-2

Prev chapter 24-25

considering welsh history and how much the welsh hate england, I was so psyched to see wales ganging up on england too! you get him wales!

never heard of this tbh

yoooo so idk what happened but it seems all of Verus' translations are gone from bluesky now and their google site link is down. I remember reading them some time ago so I know they existed, and I was panicked that they were gone for good! but I heard from a friend that they've actually been uploaded to some manga sites and I was able to get it from there! thank you caprisat and xEscapex, we're forever in your gratitude 😭🙏

idk what the story is but I hope Verus is still okay with me reposting their translations here. I'm sure if they didn't want me to anymore they'd let me know. I sent them a new message anyway, hopefully they respond.

I think probably they don't plan on translating any more chapters, so this may be the last gangsta post here. hopefully hetascanlations comes back around or another translator rises and if not maybe I'll give it a shot but idk I'm working on a lot of projects rn.

#hetalia#hetalia official#hetalia gangsta#hetalia world stars#hetalia scotland#hetalia northern ireland#hetalia wales#hetalia uk brothers#aph scotland#aph northern ireland#aph wales#aph uk brothers

81 notes

·

View notes