#529 college savings plan

Explore tagged Tumblr posts

Text

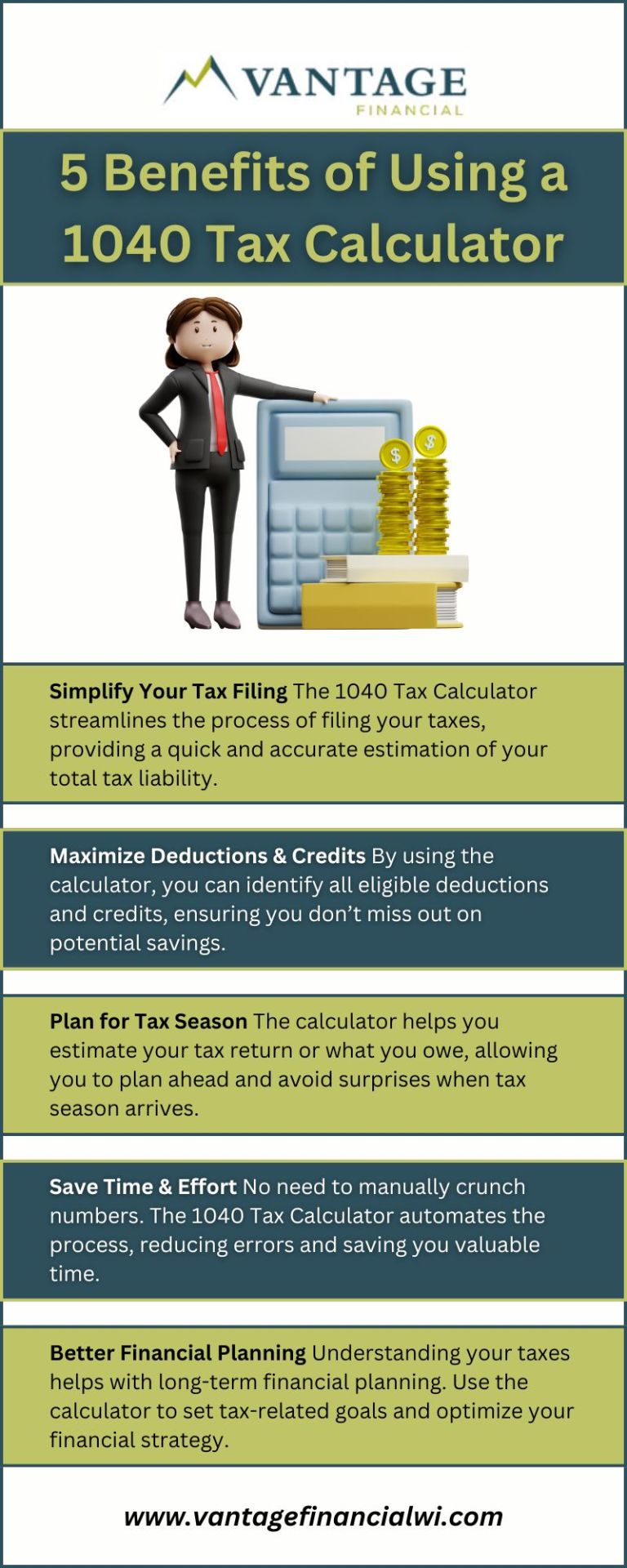

Discover how the 1040 Tax Calculator can streamline your tax filing process and help you maximize deductions. Learn how Vantage Financial Partners uses this tool to guide you through tax season with confidence and ensure you're taking full advantage of available credits and savings.

#senior wealth advisor in wisconsin#wealth management consultant#fiduciary financial planner#top rated financial planning firm#educational savings plan#529 college savings plan#financial planner in wisconsin#college savings plan#best financial advisors in wisconsin#529 plan

0 notes

Text

Kasemyer college savings

College savings plans; I have mentioned them before. My aunt very, very generously set up "one-year pre-paid tuition" plans for each kid. That was incredibly generous of her. The issue I have had is that 1) the fund managers make it absolutely as hard as possible to actually get the funds back out and b) since I'm not the one who set them up, I don't know what the fund promised my aunt when she paid. Oh, also, c) they did not show ANYWHERE on the website an accumulated value for the funds. Which is hinky as hell.

My son's was fully paid out in January, so I don't have to worry about that any more. However, I did note that the amount they paid out was only just a little bit more than she actually paid (years ago) in the first place. So - what was the fund doing with that money for those years? That it did not increase? That really is supposed to be the point; you invest it and it increases.

Aaaaanyhow. In the summer I stepped through the process of getting the first payment for my daughter's college. That they refused to pay it out until August when her bill was due to be paid by the end of July cause me some Money-shuffling-issues. Eventually they sent half (I presumed?) of the money. The remaining half to be paid for her spring semester.

Late in the summer I got a series of several emails from the fund. All of them were corporate/finance gibberish, involving terms like audit and transparency and 'changes moving forward.' It sounded VERY MUCH to me like someone had been caught doing something. And was promising crisscross applesauce not to do it again, but not saying what "it" was.

Yesterday I got the check in the mail for the second half of my daughter's savings fund. I promptly had to sit down. It was higher - several thousand dollars higher! - than the first 'half'. So, oopsies! it seemed those funds actually WERE having earnings.

I am elated that there is more funding for her than I thought there was. But, damn. I have questions.

12 notes

·

View notes

Text

Secure Your Child's Future: Florida Prepaid's Fall Savings Incentive

As families across Florida prepare for the future, Florida Prepaid encourages them to start saving for their children's higher education costs this fall. Recent research highlights the importance of education in securing good jobs, with a staggering 85 percent of well-paying positions projected to require postsecondary education by 2031.

A $50 Gift Card Incentive

From September 3 to October 28, 2024, families who open a Florida 529 Prepaid Plan or a Florida 529 Savings Plan will receive a $50 gift card as an added incentive to kickstart their savings journey. This initiative follows the most successful Open Enrollment season in the last decade, reflecting the growing awareness among families about the importance of saving early.

Chairman of the Florida Prepaid College Board, John D. Rood, expressed enthusiasm for the momentum surrounding the college savings programs. “We want to ensure more Floridians enjoy the peace of mind that comes with saving early,” he said. The two plans provide flexibility and affordability, allowing families to craft a personalized college savings strategy.

Benefits of Florida Prepaid Plans

Florida Prepaid stands out as the largest and longest-running prepaid college program in the nation, having helped over 1.2 million families save for college since its inception in 1987. With over 626,000 students having utilized their plans, the program demonstrates a successful track record in supporting educational aspirations.

Why Choose Florida Prepaid?

Lock in Today’s Prices: Families can secure current plan prices to cover future tuition and fee costs, with prepaid plans starting as low as $34/month for newborns—making it the most affordable option in a decade.

Flexible Savings Options: The Florida 529 Savings Plan is a tax-free investment option that can be used for qualified education expenses nationwide, including read more

#Florida Prepaid#college savings#529 plans#education costs#higher education#family savings#job market#savings incentives#Florida families#LoveWellington#WellingtonLiving#WellingtonNeighborhoods#WellingtonLifestyle#ExploreWellington

0 notes

Text

From the moment our little ones are born, we dream big for them. College may seem far away, but the journey to securing their future starts today. 🌟✨

When my first child was born, I remember holding her tiny hand and promising to give her the world. As she grew, so did my understanding of what it takes to make that promise a reality. College savings felt overwhelming, but I knew starting early was key.

We explored different options, from 529 plans with their tax advantages to Coverdell ESAs that even covered K-12 expenses. Each plan had its own benefits, but they all shared one common goal: giving our children the best possible start in life.

Now, as I watch her prepare for college, I feel a sense of accomplishment. Every dollar saved, every automated contribution, every wise investment choice – they’ve all brought us to this moment. It wasn’t always easy, but knowing she has the financial support she needs for her education makes it all worthwhile.

To all the parents out there, remember: it’s never too early to start saving. Every little bit counts, and the sooner you begin, the more your savings will grow. Let’s give our children the future they deserve. 🌍💖

Read the Full Article now: Click Now

#CollegeSavings #529Plans #FutureInvestments #ParentingJourney #EducationMatters

0 notes

Text

Leveraging a 529 Plan: Investing in Real Estate for Your Child's College Years

Written by Delvin As college tuition costs continue to rise, parents are constantly seeking creative ways to save for their child’s education. One strategy gaining popularity is using a 529 Plan to purchase an investment property that can be rented out to cover housing expenses during their college years. In this blog post, we will explore how parents can utilize a 529 Plan for buying an…

View On WordPress

#529 Plan#College Savings Plan#dailyprompt#Financial#Financial Freedom#Financial Independence Retire Early#Financial Literacy#FIRE#Generational Wealth#knowledge#money#Money Management#Moneymaking#Passive Income#Personal Finance#Real Estate#Rental Properties#Wealth

1 note

·

View note

Text

529 College Savings Plans

A 529 college savings plan is a tax-advantaged investment account designed to help families save for future education expenses, such as tuition, fees, books, supplies, and room and board. Here are some key points to know about 529 college savings plans: Tax advantages: Contributions to a 529 plan grow tax-deferred, which means you don’t have to pay federal taxes on the earnings as long as the…

View On WordPress

0 notes

Text

Investing 101

Part 4 of ?

What to Buy

I've been procrastinating this post because I have a broker who provides buying/selling recommendations to me as I'm not an expert. Having said that, I can provide some information.

The first decision to make is whether to buy stocks or bonds. I explained the difference between the two in previous posts but I should add a caveat. Normally bonds are considered a safe but lower return investment to balance your portfolio and reduce risk. The moves by the Fed to control inflation however have raised interest rates on bonds to levels not seen in >40 years. For the first time in a long time, very safe bonds (ex. US Treasuries) are yielding more than equities and you can lock in those rates for a long time. Normally I'd advise a young person to avoid any bonds, but this is a strange time and some bonds would be a good investment for almost anyone. As with stocks, you can buy individual bonds or a bond fund.

What is a fund? Let's imagine that you want to own a basket of tech stocks (or bank stocks or consumer goods stocks, etc.). You could research various companies and make your purchases or you could buy a mutual fund. Mutual funds are actively managed investment pools with specific investment philosophies (ex. focused on tech stocks) - you purchase shares in the fund and the fund manager uses your money (and the $$ of other fund investors) to buy/sell shares in accordance with the philosophy/purpose of the fund. Actively managed means that there is a management team doing investment research and then buying and selling shares. Of course the management team costs money and they deduct their fee from the earnings pool prior to distributing the fund's earnings back to the owner/investors of the fund. Fund managers argue that their active management improves your earnings while lowering your risk. Detractors argue that management fees are too expensive and over the long run, investors can do better on their own (more on that later). Management fees aren't regulated (that I'm aware of) so investors have to be cautious - some funds have very expensive management fees while others are more frugal. Morningstar is a great resource for researching investments of all types, including funds.

An alternative to a Mutual Fund is an Index or Exchange Traded Fund. These funds are designed to mirror the composition and performance of an entire stock exchange (ex. NASDAQ). So if the NASDAQ goes up 10pts today, the related Index or Exchange traded fund will also go up 10pts. This is a low cost way to invest in the performance of the overall market. Many advisors recommend these investments for superior long term growth. These funds aren't actively managed by a human, but their low cost makes them a winner.

Speaking of humans, AI managed funds are increasingly a hot topic. I may own some of these funds and not even know it, but I'm not seeking AI management. In fact, automated trading can be problematic and cause 'flash crashes' for the market when every AI algorithm tries to sell at the time.

Target Date funds are another kind of mutual fund which is increasingly popular in 401Ks and 529 college savings plans. A target date fund is designed to manage risk and volatility with a specific life goal in mind. For example, you might establish a goal retirement date of 2040 and buy a Target Date fund for that year. The 2040 fund will automatically invest in higher risk/higher return equities in the first 20 years and gradually shift more of the portfolio to lower risk investments (like bonds) as your target date approaches.

Money market funds are a very low risk way to earn better returns on your emergency fund cash than allowing it to wallow in a bank savings account. A money market is a kind of mutual fund, but it owns very safe investments - the odds are very small that you'd lose money and instead you'll have a very liquid, safe investment that you can use in case of emergency.

What about individual stocks? Some investors follow the simple strategy of buying the stocks of companies whose products they know and admire. Ex, "I like my iPhone so I'm going to buy Apple stock." In >30 years of investing I have never purchased an individual stock. My rationale is that there is an entire industry of very smart people who do nothing but research and invest. The odds that I can outsmart them and pick a company which everyone else has undervalued are small. If I've read about it in the Wall Street Journal, so has everyone else and the opportunity to buy something cheap is long gone. In my opinion, buying individual stocks is like going to Vegas - of course you will hear stories of big winners, but in general the house (full time investment professionals) always wins. For a non-professional like me, the odds of selecting individual stocks and assembling a winning portfolio over the long term aren't in my favor.

17 notes

·

View notes

Text

9 Best 529 College Savings Plans | Top Options for 2025

In this article, I will discuss the best 529 College Savings Plans available today. These plans are an excellent way to save for higher education, offering tax benefits, flexible investment options, and low fees. Whether you’re a parent, grandparent, or guardian, understanding the top 529 plans can help you make the most of your college savings strategy. Key Points & Best 529 College Savings…

0 notes

Text

Treasurer Stacy Garrity: Mobile App Access for PA 529 GSP Account Owners Now Available

The PA 529 Guaranteed Savings Plan can now be accessed via the READYSAVE 529 app Harrisburg, PA — Pennsylvania Treasurer Stacy Garrity today announced that families saving with the PA 529 College and Career Savings Program’s Guaranteed Savings Plan (GSP) can now access their account anytime and anywhere with the READYSAVE 529 mobile app. “I’m thrilled this smartphone app is now available to…

0 notes

Text

Smart Money Moves for Your Grandkids

Want to leave wealth for your grandkids? Start here: ✅ Open a high-yield savings account in their name ✅ Fund a 529 college savings plan ✅ Gift assets strategically to avoid tax burdens ✅ Invest in life insurance for long-term security ✅ Create an estate plan to protect and transfer your wealth

Small steps now = a lifetime of impact! 🪜✨

0 notes

Text

At Vantage Financial Partners, we provide personalized wealth management services tailored to your unique financial goals. Our expert advisors help you navigate investments, retirement planning, and estate management to secure your financial future. Trust us to guide you every step of the way.

#wealth management consultant#top rated financial planning firm#529 college savings plan#fiduciary financial planner#college savings plan#educational savings plan#senior wealth advisor in wisconsin#529 plan#best financial advisors in wisconsin#financial planner in wisconsin

0 notes

Text

529 plan

I am once again trying to arm-wrestle the drat-blasted website for my kids’ college savings plans* into paying out a distribution. This particular savings plan does NOT want to actually pay back the money that was saved up. Which is - insane? That is the singular and only purpose of this account. Pay college expenses. The first time I tried to get a distribution for my son I ended up on hold for an hour before I got hold of an angry call center employee. Not sure how long this issue will take - but I’m not feeling happy.

* This is a usa thing, a savings plan that gives a slight tax advantage for putting money away for college early.

9 notes

·

View notes

Text

How Estate Planning Can Help You Reduce Taxes & Maximize Inheritance

Estate planning isn’t just about creating a will—it’s a strategic process that helps secure your financial legacy while minimizing tax liabilities. Without proper estate planning, your heirs may face unnecessary tax burdens, reducing the wealth you intended to pass down. Let’s explore how smart estate planning can help you reduce taxes and maximize inheritance for your loved ones.

1. Understanding Estate Taxes

Estate taxes, also known as death taxes, are levied on the assets transferred after a person’s passing. While federal estate taxes only apply to estates exceeding a certain threshold (which changes over time), many states also impose their own estate or inheritance taxes. Strategic estate planning ensures your assets are structured to minimize these taxes, preserving more of your wealth.

2. Utilizing Trusts to Reduce Tax Liabilities

Trusts are one of the most effective estate planning tools for tax reduction. Here’s how they work:

Revocable Living Trusts: Helps avoid probate but doesn’t provide tax benefits.

Irrevocable Trusts: Removes assets from your taxable estate, reducing estate taxes.

Charitable Trusts: Allows you to donate to charity while reducing tax burdens.

Generation-Skipping Trusts: Pass assets to grandchildren while avoiding estate taxes twice.

By placing assets into trusts, you control their distribution while significantly reducing estate taxes.

3. Gifting Assets to Lower Tax Burden

The IRS allows individuals to gift up to a certain amount annually (without triggering gift taxes). By gifting assets while alive, you can reduce the overall size of your taxable estate. This method also allows you to support your heirs financially while avoiding higher estate taxes later.

4. Taking Advantage of Tax-Free Inheritance Strategies

Life Insurance Policies: Proceeds from life insurance are typically tax-free to beneficiaries. Placing the policy in an irrevocable life insurance trust (ILIT) ensures the payout isn’t counted as part of your taxable estate.

529 College Savings Plans: These accounts provide tax-free growth and withdrawals for education expenses, making them an excellent way to pass wealth while avoiding taxes.

Retirement Account Planning: Properly structuring IRAs and 401(k)s can help heirs minimize tax liabilities upon inheritance.

5. Charitable Giving for Tax Benefits

If you plan to support charitable causes, charitable remainder trusts (CRTs) and donor-advised funds offer ways to donate while receiving tax deductions. These strategies can help reduce taxable income while benefiting organizations you care about.

6. Updating Your Estate Plan Regularly

Estate tax laws frequently change, and failing to update your estate plan can lead to missed opportunities for tax savings. Regular reviews with an estate planning attorney ensure you take advantage of the latest tax reduction strategies.

Final Thoughts

Estate planning is essential for preserving wealth, reducing taxes, and ensuring your loved ones receive your intended inheritance. By incorporating trusts, gifting strategies, charitable giving, and tax-efficient asset transfers, you can protect your legacy and maximize the financial benefits for your heirs.

If you haven’t started estate planning, now is the time! Consult an experienced estate planning attorney to create a strategy that works for you.

📞 Need help with estate planning? Contact us today to secure your future!

#EstatePlanning #WealthPreservation #TaxPlanning #Inheritance #FinancialPlanning

0 notes

Text

Returning to Canada After Working in the U.S.: A Comprehensive Guide to Navigating Retirement Accounts, Tax Implications, and Financial Planning

Every year, countless Canadians cross the border to pursue professional opportunities in the United States. The allure of higher salaries, large corporations, and a different pace of life can be compelling. Over time, many of these Canadians sink their roots in the U.S.—buying property, starting families, and building retirement accounts like 401(k)s or IRAs. They might also open 529 plans for their children’s education, along with other U.S.-based investments. However, circumstances change. Whether due to shifting personal priorities, the pull of extended family in Canada, or the desire for universal healthcare, a substantial number of these Canadian expatriates eventually consider returning home.

But moving back across the 49th parallel isn’t as simple as hiring a moving truck and changing your mailing address. One of the most pressing and complex aspects of this transition involves Canada U.S. tax planning and how you manage your U.S.-held assets—particularly retirement accounts, college savings plans, and other investments. Ensuring you can optimize and preserve the wealth you’ve built in the United States requires strategic thinking and often the expertise of a cross-border financial advisor who specializes in cross-border wealth management.

This blog aims to shed light on the unique challenges and opportunities Canadians face as they return home from the U.S. We’ll cover the intricacies of retirement accounts, educational savings plans, and the myriad of tax considerations you need to navigate. We’ll also explore why working with a specialized advisor is often the critical key to mitigating taxes and securing your financial future. If you’re a Canadian preparing to make the journey back home, keep reading—you’ll find valuable insights and resources that could save you both money and headaches down the line.

Reasons Canadians Are Heading Back to the Great White North

Before diving into the nitty-gritty of retirement account management and tax considerations, it helps to understand why so many Canadians choose to move back. The “push” and “pull” factors vary greatly, but they often include:

Healthcare and Social Benefits Canada’s universal healthcare system is a significant attraction, especially for those who’ve grown tired of navigating the complex private insurance landscape in the U.S. The idea of returning to a single-payer system can be comforting for families looking at long-term health costs.

Family and Cultural Ties Over time, the emotional pull of family and friends can become stronger. Canadians might miss the familiar culture, the changing seasons, the social norms, or simply the comfort of home. Grandparents, siblings, and extended families also factor heavily into the decision, especially if children are involved.

Political and Social Climate While this reason is more subjective, some Canadians find that living in the U.S. long-term doesn’t align with their values or preferred political climate. Returning to Canada can feel like a move toward greater societal alignment.

Career Changes After achieving certain career milestones in the U.S., some find similar or even better professional opportunities in Canada. Remote work, international company expansions, or entrepreneurial ventures also provide reasons to relocate.

Cost of Living and Lifestyle Depending on where you live in the U.S., housing, education, and healthcare costs might be high. While major cities like Toronto or Vancouver also come with hefty price tags, many parts of Canada offer a more affordable and laid-back lifestyle.

Understanding these motivations is crucial for shaping your financial strategy. For instance, if you’re moving primarily for family reasons and healthcare benefits, you’ll need to consider how to manage U.S. retirement accounts so they support you effectively in Canada. If you’re relocating for a career change, you’ll need to examine how your new income streams interact with your existing 401(k), IRA, and other assets. Each reason carries unique financial implications.

The Importance of Proper Planning for Returning Canadians

Relocating across international borders is never a simple endeavor, and it becomes more intricate when you’ve lived for years, or even decades, in the United States. By the time you decide to move back, you’ve probably accumulated a mix of:

U.S. retirement accounts (401(k)s, IRAs, Roth IRAs)

Educational savings plans (529 plans)

Stock options or other employment-related assets

Real estate holdings (primary residence or investment properties)

Checking and savings accounts at U.S. banks

Credit history anchored in the U.S. financial system

On top of these, you’ll face the complexities of tax residency. When you depart the U.S. and re-establish residency in Canada, you must adhere to tax regulations in both countries. This is where Canada U.S. tax planning becomes a critical exercise. Managing the timing of your move, the status of your U.S. accounts, and the rules for reporting foreign assets to the Canada Revenue Agency (CRA) all require attention to detail.

Without proper planning, you risk double taxation, penalties, or suboptimal investment choices that might erode your wealth. For instance, certain distributions from your 401(k) could be taxed differently if you withdraw after becoming a Canadian resident. Similarly, your U.S.-based mutual funds or 529 plan investments could trigger unexpected tax consequences in Canada, where the CRA views some of these funds differently than the Internal Revenue Service (IRS) does.

Understanding the Basics of Canada-U.S. Taxation

One of the most confusing elements of returning to Canada revolves around the interplay between Canadian and American tax laws. Both countries employ residency-based taxation for individuals—meaning your tax obligations generally follow your primary country of residence. However, the U.S. also taxes its citizens on worldwide income regardless of residency. As a Canadian citizen (and a non-U.S. citizen), once you relinquish your U.S. residency status, you typically won’t be subject to U.S. taxes on worldwide income. Yet, you may still have obligations on income derived from U.S. sources.

Tax Treaty: Canada and the U.S. have a comprehensive tax treaty designed to prevent double taxation and clarify each country’s rights to tax certain types of income. This treaty addresses everything from dividend income to retirement account distributions.

Departure Tax: When you cease to be a Canadian resident (in the scenario of moving to the U.S.), you might be subject to departure tax on certain capital gains. The reverse can also come into play; if you maintained some ties in Canada during your U.S. residency, your tax residency status might be complicated. Consulting a cross-border financial advisor ensures you correctly identify your residency timeline and obligations.

Foreign Reporting Requirements: Once you return to Canada, you’ll have to disclose foreign property or assets on specific tax forms if their value exceeds certain thresholds. Similar rules apply in the U.S., with forms like the FBAR (Report of Foreign Bank and Financial Accounts) for non-resident Canadians who still hold U.S. accounts or property.

This patchwork of regulations underscores the complexity of Canada U.S. tax planning. Getting it right can save you not just money but also time and stress. Underreporting or misreporting can lead to substantial penalties, so it’s best to approach this step with care and, ideally, with professional guidance.

Dealing with U.S. Retirement Accounts

Arguably, the most significant financial question for returning Canadians is: “What do I do with my U.S. retirement accounts?” Over the years, you may have contributed to a 401(k) through your employer, rolled over old employer plans into an IRA, or even set up a Roth IRA. Each account type has its own set of rules and implications once you become a Canadian resident again. Let’s examine these in more detail.

1. Leaving Your 401(k) in the U.S.

Some people opt to leave their 401(k) assets where they are, especially if the plan has strong investment options and relatively low fees. Most 401(k) administrators will allow you to maintain your plan even if you no longer work for the employer—provided your account meets certain minimum balance requirements (often around $5,000). If you keep your 401(k) in the U.S.:

Tax Implications: You will be taxed on distributions according to U.S. tax laws, typically with a 20% withholding tax on withdrawals if you’re under 59½ (unless you meet certain exceptions). Under the tax treaty, you can often claim a foreign tax credit in Canada for the tax paid to the U.S. However, you must report these distributions on your Canadian tax return.

Logistical Challenges: Some plan administrators are reluctant to maintain accounts for non-residents, although many do accommodate Canadians. You need to ensure your plan will allow you to keep your investments, especially if you change your address to a Canadian one.

2. Rolling Over into an IRA

If you have multiple 401(k)s from different employers, consolidating them into an IRA might simplify management. IRAs often offer more investment options, and the fees can be lower (or at least more transparent).

Tax Benefits: IRAs maintain tax-deferred (or tax-free for Roth IRAs) growth, similar to 401(k)s. Distributions are subject to the same cross-border tax treaty provisions as 401(k) distributions.

Access Issues: Some brokerage firms prefer not to deal with Canadian residents due to regulatory hurdles. You’ll need to ensure the firm you choose will accommodate a Canadian address.

3. Taking a Lump-Sum Distribution

Another route—though often not the most tax-efficient—is withdrawing your retirement savings as a lump sum when you leave the U.S. This can lead to significant taxes and possible penalties, especially if you’re under 59½ and don’t qualify for an exception. Even if you’re above 59½, lump-sum distributions can push you into a higher tax bracket, both federally and at the state level (if applicable). Furthermore, Canada will likely tax you on the withdrawal as well, albeit with potential foreign tax credits offsetting some of the burden.

4. Transferring to an RRSP

Occasionally, Canadians consider transferring U.S. retirement assets to their Canadian RRSP (Registered Retirement Savings Plan). While direct transfers are not typically allowed, there is a provision under the Canada-U.S. tax treaty permitting a deduction for contributions to an RRSP when you withdraw from a U.S. retirement plan, subject to specific conditions. This is a complex maneuver and not always feasible. It requires careful calculation and coordination with a cross-border wealth management professional who understands both Canadian and U.S. regulations thoroughly.

Handling 529 Plans and Other Education Savings

If you have children, you may have set up a 529 plan while living in the United States to save for their education. These plans offer tax-free growth on contributions, provided the funds are used for qualified educational expenses, and many states also allow a tax deduction or credit for contributions at the state level.

Once you move back to Canada, the taxation of a 529 plan becomes murky. The CRA does not recognize the 529 plan as a tax-advantaged account. While the U.S. continues to treat qualified withdrawals as tax-free, Canada might view the growth portion as taxable if you or your child is a Canadian resident at the time of withdrawal. The exact treatment can depend on factors such as:

Whether the child attends a U.S. or Canadian educational institution

The residency of the plan beneficiary and the plan owner at the time of withdrawal

The type of investment growth within the plan

One common approach is to continue using the 529 plan if the child intends to study in the U.S., as withdrawals would still be tax-free under U.S. law, and you might be able to navigate Canadian tax rules favorably. However, if the child studies in Canada, you could run into complexity regarding the growth portion.

In certain cases, it might be advantageous to collapse the 529 plan before becoming a Canadian resident again. You could reallocate the funds to a different type of account or use them for qualified expenses if your child is already in or near college age. But you risk forfeiting the plan’s tax-free growth and possibly paying penalties on non-qualified withdrawals. This is a prime example of why working with a cross-border financial advisor is essential. They can help you weigh the trade-offs between keeping the 529 plan active, withdrawing some or all funds, or transitioning to a Canadian RESP (Registered Education Savings Plan).

The Role of a Cross-Border Financial Advisor

If you’re sensing a recurring theme here, you’re not mistaken: cross-border finances are complicated. From determining the optimal time to withdraw or roll over U.S. retirement assets to strategizing the best approach for 529 plans, countless variables come into play. Each choice has implications not only for your taxes but also for your long-term financial health.

A cross-border financial advisor specializes in exactly these situations. They bring expertise in cross-border wealth management, ensuring that your strategies align with regulations on both sides of the border. Here are some reasons why engaging a specialist is often crucial:

Holistic View of Your Finances A general financial advisor in Canada might understand Canadian accounts and tax laws thoroughly but may lack detailed knowledge about U.S. retirement accounts, IRS regulations, and the complexities of the tax treaty. A true cross-border specialist sees the bigger picture.

Tax Mitigation Strategies With insights into Canada U.S. tax planning, a cross-border advisor can help you structure withdrawals, rollovers, and transfers in ways that minimize your overall tax burden. They might recommend staggering withdrawals over multiple years or combining them with certain deductions to optimize tax outcomes.

Compliance with Reporting Requirements Cross-border transactions often trigger additional reporting requirements in both countries. A specialized advisor can guide you through forms like the T1135 in Canada or the FBAR in the U.S., ensuring you remain compliant and avoid penalties.

Investment Diversification Advisors with cross-border expertise can also suggest investment vehicles that complement each other under both sets of regulations. They might recommend holding specific asset classes in either Canadian or U.S. accounts to take advantage of different rules for dividends, capital gains, or interest income.

Estate Planning Estate planning becomes more complex when you have assets in multiple countries. A cross-border financial advisor can work with legal professionals to ensure that your estate plan is valid in both jurisdictions and that your loved ones won’t face unnecessary taxation or administrative hurdles.

Key Tax Mitigation Strategies

The core of Canada U.S. tax planning revolves around employing strategies that reduce or defer taxes while complying with both countries’ regulations. Below are some key methods:

Timing Your Move If possible, schedule your move at a time that optimally aligns with your tax situation. This might involve waiting until after year-end if you expect a high income in the U.S. for that calendar year, or strategically retiring in Canada if certain benefits or credits apply.

Strategic Withdrawals If you plan to take distributions from your 401(k) or IRA before moving back to Canada, coordinate the timing to avoid higher tax brackets. Remember that once you’re a Canadian resident, those distributions will also be reported in Canada—though the tax treaty can help mitigate double taxation.

Foreign Tax Credits Proper use of foreign tax credits is essential. By filing the right forms, you can offset Canadian taxes with the U.S. taxes you’ve paid (and vice versa), ensuring you’re not taxed twice on the same income. A cross-border specialist can help you optimize these credits.

Roth Conversions Converting a Traditional IRA to a Roth IRA might make sense if you anticipate a lower tax rate in the current year and higher in the future. However, once you move to Canada, the CRA may or may not offer favorable treatment of a Roth IRA’s tax-free distributions. Consult an advisor to see if this aligns with your long-term plans.

Partial Transfers to RRSP If you meet the treaty conditions, you might be able to transfer some of your U.S. retirement funds into an RRSP without incurring immediate taxes. This can be beneficial if you want to consolidate your retirement savings within Canada.

Double Check State Taxes If you lived in a state with high income taxes (e.g., California or New York), consider whether a timely move to a no-tax or low-tax state (e.g., Florida, Texas) before returning to Canada might help. This could reduce your final state tax liability.

Real Estate Considerations

Beyond retirement accounts, many Canadians returning from the U.S. also own property there—be it a primary residence or rental properties. Managing these assets becomes another layer of complexity.

Selling vs. Renting: Should you sell your U.S. home or convert it into a rental property for future income? Selling might incur capital gains tax in the U.S., but you may qualify for the primary residence exclusion if you meet specific criteria. Renting the property requires you to file ongoing U.S. tax returns declaring rental income.

State-Specific Laws: Some states have additional taxes or regulations on non-resident property owners. If you retain property in California, for instance, you might face state income tax obligations even after you move.

Canadian Reporting: If you keep U.S. property, you’ll need to report this as a foreign asset to the CRA once you’re a Canadian resident again. Ongoing rental income must be reported to Canadian tax authorities, potentially offset by foreign tax credits for any U.S. tax paid.

Balancing these considerations often calls for a specialist in both U.S. and Canadian real estate tax law, which is another reason to work with a cross-border financial advisor who has access to a network of relevant professionals—such as cross-border real estate agents or tax attorneys.

Banking and Credit History

Re-establishing your financial life in Canada often involves reintegrating into the Canadian banking system and rebuilding a Canadian credit history. While your U.S. credit history may not be fully transferable, many Canadian banks and financial institutions have programs for newcomers or returning Canadians. Key points to consider include:

Bank Accounts It’s wise to open a Canadian bank account before you officially move back, if possible. This helps facilitate money transfers and allows you to pay any Canadian bills as soon as you arrive.

Transferring Money Be mindful of currency exchange rates and wire transfer fees. Specialized foreign exchange services often offer better rates than large banks.

Credit Cards Your Canadian credit history may need to be rebuilt, especially if you’ve been out of the country for a long period. However, some Canadian banks will consider your U.S. credit score if you have an existing relationship with them.

Keeping a U.S. Bank Account Maintaining a U.S. bank account can be helpful for paying any remaining bills, receiving refunds, or managing rental income if you keep property in the U.S. Ensure the bank allows accounts for non-U.S. residents.

Healthcare and Social Benefits: Another Layer of Complexity

One of the reasons you may be moving back is for Canada’s healthcare system. But remember, eligibility for provincial healthcare typically begins after a waiting period (often three months, depending on the province). If you’ve kept your Canadian provincial coverage active while in the U.S. (which is not usually the case if you’ve been a non-resident), then reactivating might be simpler. Otherwise, you should plan for private health insurance during any interim period.

For seniors, coordinating retirement benefits from both the Canada Pension Plan (CPP) and U.S. Social Security can be complex. Canada and the U.S. have a totalization agreement to prevent double payment of pension contributions and to help you qualify for benefits in both countries, depending on your work history. You should investigate whether you’re eligible for benefits from either system, or both, and how to apply.

Best Practices for a Smooth Transition

By this point, you might be feeling overwhelmed. Rest assured, many Canadians have made this journey back home successfully. The following best practices can help smooth your path:

Plan Early Ideally, begin planning at least 12 months before your anticipated move date. This gives you ample time to consult with a cross-border financial advisor, evaluate your retirement accounts, and organize your tax strategies.

Document Everything Keep meticulous records—tax returns, account statements, property deeds, immigration documents, etc. Detailed documentation is invaluable if the CRA or IRS has questions about your residency status or your accounts.

Coordinate with Employers If you’re moving for a job in Canada, negotiate your relocation package to include any cross-border financial assistance or tax equalization benefits. Also, clarify your final pay, bonuses, and stock options from your U.S. employer.

Seek Specialist Help From tax attorneys to financial advisors, building a trusted team of cross-border experts can save you significant stress and money. Look for professionals certified in both Canada and the U.S. and with a proven track record in cross-border wealth management.

Stay Updated Tax laws and regulations can change. Treat your move as an ongoing process, with periodic reviews of your financial strategy to ensure it remains aligned with current rules and your life goals.

Review Estate Plans Don’t forget to update wills, powers of attorney, and beneficiary designations. Moving countries can invalidate certain legal documents, and you need to ensure your estate plans reflect your new residency.

Working with a Cross-Border Financial Advisor: A Real-World Example

Consider the example of Mark and Sarah, a Canadian couple who lived in California for a decade. Mark contributed to a 401(k) and an IRA, while Sarah, self-employed, set up a Solo 401(k). They also opened a 529 plan for their son. When Mark got a job opportunity in Toronto, they decided it was time to move back to Canada.

Retirement Accounts: Mark and Sarah consulted a cross-border financial advisor who helped them determine that leaving Mark’s 401(k) in the U.S. was the best short-term option due to its low fees and excellent fund choices. The advisor also suggested consolidating Sarah’s Solo 401(k) into a Roth IRA to lock in tax-free growth—something Sarah did while still a U.S. resident to minimize complications later.

529 Plan: Their son wanted to attend a university in the U.S., so keeping the 529 plan intact made sense. The advisor also cautioned them on Canadian tax implications of the growth portion, guiding them on how to minimize any CRA taxation.

Tax Planning: By reviewing the timing of their move, their advisor recommended Mark and Sarah finalize their move in early January. This approach prevented them from straddling two tax years in both countries, substantially simplifying their returns.

Credit and Banking: With the advisor’s guidance, Mark kept his U.S. bank account for ongoing mortgage payments on their rental property in California, and Sarah opened a high-interest savings account in Canada to start rebuilding her Canadian credit.

This real-world scenario highlights the value of professional guidance in making crucial financial decisions at every step, from the micro-level details of which retirement accounts to keep to the macro-level timing of the move itself.

Conclusion

The decision to move back to Canada after years or even decades in the United States is both exciting and daunting. The emotional aspects—returning to familiar surroundings, reuniting with loved ones, accessing Canada’s social benefits—often overshadow the financial intricacies. Yet it’s precisely the financial side of the move that can have the most far-reaching consequences if handled poorly.

From how to manage your 401(k)s and IRAs to the best approach for your 529 plans, the need for Canada U.S. tax planning cannot be overstated. You have to navigate two sets of tax codes, two sets of financial regulations, and a complex tax treaty that attempts to reconcile the two—sometimes successfully, sometimes with grey areas. Missteps can lead to double taxation, steep penalties, or suboptimal decisions that erode the savings and investments you’ve worked so hard to accumulate.

This is why a cross-border financial advisor is such a critical ally. A professional specialized in cross-border wealth management can guide you through retirement account decisions, set up or wind down educational savings plans, coordinate real estate transactions, and ensure you stay on the right side of reporting requirements. They can also provide counsel on estate planning, ensuring your assets pass seamlessly to beneficiaries whether they reside in Canada, the U.S., or elsewhere.

Ultimately, the smoother your financial transition, the easier it will be to embrace your new (or renewed) life in Canada. Instead of worrying about the complexities of tax treaties and cross-border accounts, you can focus on what truly matters—reconnecting with family and friends, exploring professional opportunities in Canada’s thriving cities, and re-establishing yourself in a place you once called home. With careful planning, the right expert guidance, and an informed approach to each step in the process, you’ll be well on your way to a successful and financially sound homecoming. Safe travels, and welcome back!

0 notes

Text

What Does It Really Mean to Be Tax-Advantaged or Pre-Tax?

What Does It Really Mean to Be Tax-Advantaged or Pre-Tax?

When it comes to financial planning and investments, you’ve likely come across terms like "tax-advantaged" and "pre-tax." These phrases are commonly used in discussions about retirement accounts, health savings plans, and certain types of investments. But what do they really mean, and how can they benefit you? yatharva.com

Understanding Tax-Advantaged Accounts

A tax-advantaged account is any financial account that provides tax benefits, either in the form of deferred taxes or tax-free growth. The goal is to minimize the amount of taxes you pay over time, allowing you to keep more of your money working for you.

There are two primary types of tax advantages:

Tax-Deferred Accounts – Taxes on earnings and contributions are delayed until funds are withdrawn.

Tax-Free Accounts – Contributions may be taxed upfront, but withdrawals (including gains) are tax-free if certain conditions are met.

Pre-Tax vs. After-Tax Contributions

Pre-Tax Contributions – When you contribute pre-tax dollars, you reduce your taxable income for the year, lowering your immediate tax burden. However, you will pay taxes when you withdraw funds in retirement.

After-Tax Contributions – These contributions don’t reduce your taxable income, but qualified withdrawals are often tax-free, depending on the account type.

Examples of Tax-Advantaged Accounts

401(k) & Traditional IRA – Contributions are pre-tax, reducing taxable income. Taxes are paid when withdrawals are made in retirement.

Roth IRA & Roth 401(k) – Contributions are made with after-tax dollars, but withdrawals (including growth) are tax-free in retirement.

Health Savings Accounts (HSAs) – Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free.

529 College Savings Plans – Contributions may not be federally tax-deductible, but growth and withdrawals for education expenses are tax-free.

Choosing the Right Tax-Advantaged Strategy

The best tax-advantaged approach depends on your financial goals, income level, and tax situation. Pre-tax contributions can be beneficial if you expect to be in a lower tax bracket in retirement. Meanwhile, after-tax (Roth) contributions can be more advantageous if you anticipate higher taxes in the future.

Additionally, utilizing multiple tax-advantaged accounts can help diversify your tax liability and maximize your wealth over time.

Final Thoughts

Understanding tax-advantaged and pre-tax strategies can help you make informed decisions about your savings and investments. By leveraging these financial tools effectively, you can reduce your tax burden and grow your wealth more efficiently. Whether you’re planning for retirement, healthcare, or education, knowing how to take advantage of tax benefits is key to long-term financial success.

Would you like to add specific examples or a legal perspective to this article?

1 note

·

View note

Text

I don’t know, man, my theory of college savings is that there is an economy

now, matt levine, what does that mean? surely there's no context in which that sentence by itself—

Anyway this article stressed me out a lot:

and surely nothing can—

Most parents typically worry about funding 529 college savings plans, brokerage accounts or high-yield savings vehicles for their kids. Now, a subset are eschewing the old ways, pushing instead to pile up enough Bitcoin to help their children in the years ahead.

—never mind! what the fuck!

1 note

·

View note