#wealth management consultant

Explore tagged Tumblr posts

Text

#wealth management#wealth management company#wealth management consultant#wealth management service#wealth management services#Wealth Management

0 notes

Text

The Importance of Financial Advisory Services: Secure Your Future with Zenith Financial

In today’s fast-paced world, managing finances can be overwhelming. Whether it’s planning for retirement, saving for your child’s education, or building wealth, having a solid financial strategy is crucial for long-term success. This is where professional Financial Advisory Services come into play. At Zenith Financial, we offer expert financial guidance to help you navigate the complexities of personal finance and achieve your financial goals.

Why Financial Advisory Services Matter

Financial advisory services provide tailored advice and strategies based on your individual circumstances. A professional financial advisor helps you understand your current financial situation, identifies potential risks, and recommends personalized strategies to optimize your financial health. From investment planning to tax strategies and retirement savings, advisors are trained to offer comprehensive guidance that ensures your financial future is secure.

Zenith Financial: Your Trusted Financial Partner

At Zenith Financial, we believe in empowering our clients with the knowledge and tools to make informed financial decisions. Our expert advisors take the time to understand your unique financial needs and create a customized plan that aligns with your goals. Whether you're looking to build wealth, protect your assets, or plan for a comfortable retirement, we offer a wide range of services to meet your needs.

Expert Advice for Every Stage of Life

No matter where you are in your financial journey, Zenith Financial is here to help. Our Financial Advisory Services are designed to guide you through every stage, from young professionals just starting out to retirees managing their legacy. With a focus on sustainable financial growth and risk management, we provide peace of mind, knowing that your future is in good hands.

Get in touch with Financial Advisor Companies today and take the first step toward a secure financial future!

#Financial Advisor Companies#Personal Financial Advisor#Wealth Management Advisor#Financial Advisory Services#Aet a financial advisor#retirement financial advisor#private wealth management#investment financial advisor#wealth management consultant#Zenith Financial

0 notes

Text

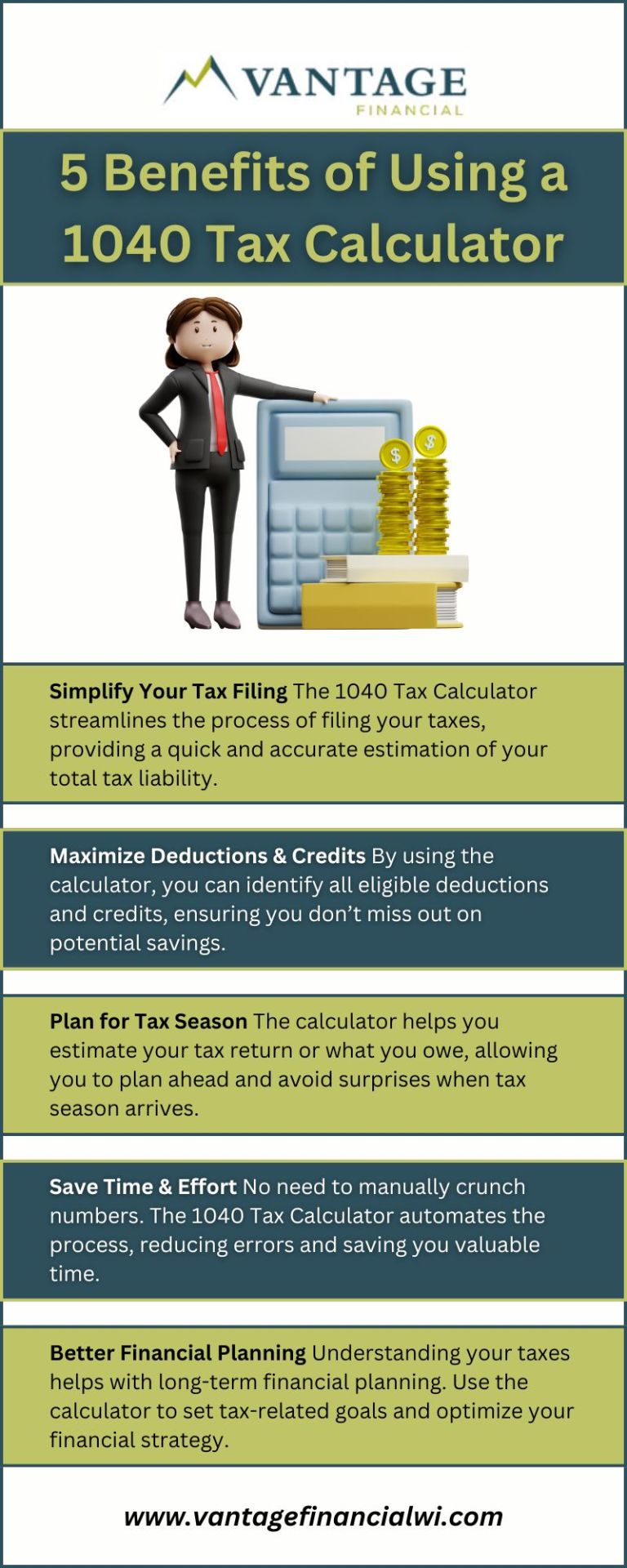

Discover how the 1040 Tax Calculator can streamline your tax filing process and help you maximize deductions. Learn how Vantage Financial Partners uses this tool to guide you through tax season with confidence and ensure you're taking full advantage of available credits and savings.

#senior wealth advisor in wisconsin#wealth management consultant#fiduciary financial planner#top rated financial planning firm#educational savings plan#529 college savings plan#financial planner in wisconsin#college savings plan#best financial advisors in wisconsin#529 plan

0 notes

Text

How Wealth Management Consultants Help Clients Achieve Long-Term Financial Goals?

Wealth management consultants play a pivotal role in helping clients achieve their long-term financial goals by providing personalized strategies, expert advice, and ongoing support. These professionals offer a comprehensive approach to managing wealth, ensuring that clients are on the right track to secure their financial future, whether it involves saving for retirement, funding a child's education, or building a legacy. Here's how wealth management consultants assist in achieving long-term financial goals:

Tailored Financial Planning

The first step in helping clients reach their long-term goals is to understand their specific financial situation and aspirations. Wealth management consultants begin by assessing the client's current financial state, including income, expenses, assets, and liabilities. They also take the time to understand the client's long-term objectives—whether it’s a comfortable retirement, purchasing a home, or establishing a charitable foundation. This personalized approach allows the consultant to craft a financial plan that aligns with the client's needs and timeline.

By setting clear, achievable financial goals, a consultant provides a roadmap that outlines the steps needed to reach those objectives. This includes setting short-term milestones that contribute to the long-term vision, and helping clients stay focused and motivated.

Investment Strategy and Asset Allocation

A key aspect of long-term financial success is having a well-thought-out investment strategy. Wealth management consultants help clients develop an investment portfolio that aligns with their risk tolerance, time horizon, and financial goals. They emphasize the importance of asset allocation—distributing investments across various asset classes (stocks, bonds, real estate, etc.) to balance risk and reward.

A diversified investment strategy reduces the impact of market fluctuations, increases the potential for long-term returns, and ensures that the portfolio remains resilient over time. Wealth management consultants regularly monitor and adjust the portfolio to adapt to changes in the market and the client’s evolving needs.

Tax Optimization and Planning

Tax efficiency plays a crucial role in achieving long-term financial goals, as excessive taxes can erode wealth over time. Wealth management consultants assist clients in creating tax-efficient strategies to minimize tax liabilities. They recommend tax-deferred accounts (such as IRAs and 401(k)s), tax-free accounts (like Roth IRAs), and strategies like tax-loss harvesting to maximize after-tax returns.

By considering the long-term tax implications of investments and income, consultants help clients keep more of their earnings, which accelerates wealth accumulation and supports their ability to reach financial goals faster.

Retirement Planning

For most clients, a comfortable retirement is one of their most significant long-term financial goals. Wealth management consultants specialize in retirement planning, helping clients estimate how much money they will need to maintain their desired lifestyle in retirement. They recommend appropriate retirement accounts and investment vehicles that maximize retirement savings, such as 401(k)s, IRAs, or pensions, depending on the client’s situation.

By taking into account factors like life expectancy, inflation, and healthcare costs, wealth management consultants provide strategies to ensure that clients accumulate sufficient funds for retirement and can draw from them in a tax-efficient manner when the time comes.

Estate and Legacy Planning

Another important area of long-term financial planning is estate and legacy management. Wealth management consultants help clients plan how their assets will be distributed after their death, ensuring that their wealth is passed on according to their wishes. They work with estate planning attorneys to set up trusts, create wills, and minimize estate taxes, which can significantly impact the inheritance left to beneficiaries.

By establishing a comprehensive estate plan, wealth management consultants help clients preserve their wealth for future generations and ensure that their legacy is protected. Additionally, they advise clients on philanthropic giving, helping them make charitable donations in a tax-efficient way if leaving a charitable legacy is part of their long-term goals.

Ongoing Monitoring and Adjustments

Achieving long-term financial goals requires flexibility and periodic adjustments. Life events, changes in income, market conditions, or shifts in goals may require updates to a financial plan. Wealth management consultants provide ongoing monitoring of clients’ financial situations and adjust strategies accordingly. Regular check-ins ensure that clients stay on track, providing the opportunity to make modifications that keep the plan aligned with their evolving goals.

Conclusion

Wealth management consultants provide invaluable guidance in achieving long-term financial goals by creating personalized financial plans, implementing investment strategies, optimizing taxes, and offering retirement and estate planning advice. With their expertise, clients can navigate the complexities of wealth management with confidence, knowing they have a dedicated professional to guide them through every step of the process. By taking a holistic approach, wealth management consultants ensure that clients are well-prepared for both the present and the future, helping them achieve their financial dreams and secure long-term success.

0 notes

Text

Trust & Estate Management

Looking for professional guidance on wealth management and securing your monetary legacy? Our custom-designed techniques help you hold, protect, and develop your property. As specialists, we create tailor-made economic plans to meet your unique dreams. Whether it is estate-making plans, asset safety, or retirement earnings strategies, our team guarantees your wealth is in a hit palms. We recognize minimizing risks and maximizing returns at the same time as thinking about your lengthy-term desires. Connect with us these days for a consultation and learn how to obtain monetary peace of mind.

0 notes

Text

Understanding Risk Tolerance In Wealth Management

Risk tolerance is a fundamental concept in wealth management, crucial for crafting a personalized financial strategy that aligns with your goals and comfort level. Understanding your risk tolerance helps ensure that your investment portfolio is designed to meet your financial objectives while allowing you to sleep well at night. Here’s a deep dive into what risk tolerance is, why it matters, and how it’s assessed in the wealth management process.

What is Risk Tolerance?

Risk tolerance refers to the degree of variability in investment returns that you are willing to withstand. It is essentially how much risk you can take in pursuit of your financial goals. Risk tolerance is influenced by various factors, including your financial situation, time horizon, investment goals, and personal comfort with uncertainty.

Types of Risk Tolerance

Risk tolerance can generally be categorized into three levels:

Aggressive: Investors with high-risk tolerance are willing to accept significant fluctuations in their investment value for the potential of higher returns. They are comfortable with market volatility and typically have a long-term investment horizon.

Moderate: Investors with a moderate risk tolerance seek a balance between risk and return. They are willing to accept some level of market volatility but prefer a more stable investment approach. Their portfolios usually contain a mix of growth-oriented and income-generating assets.

Conservative: Investors with low-risk tolerance prioritize the preservation of capital over potential growth. They prefer investments with minimal risk, even if it means lower returns. Conservative investors often have shorter time horizons or are nearing retirement, where stability is crucial.

Why Risk Tolerance Matters

Understanding your risk tolerance is vital for several reasons:

Portfolio Design: Your risk tolerance directly influences the composition of your investment portfolio. A well-aligned portfolio will have an appropriate mix of stocks, bonds, and other assets that match your comfort level with risk.

Financial Goals: Risk tolerance must be balanced with your financial goals. For example, if you’re saving for retirement decades away, you might tolerate more risk to achieve higher returns. However, if your goal is short-term, such as buying a house in a few years, a conservative approach may be more suitable.

Emotional Comfort: Investing involves ups and downs, and understanding your risk tolerance helps you stay emotionally comfortable during market fluctuations. A mismatch between your risk tolerance and your portfolio can lead to anxiety and potentially poor investment decisions, such as selling during a market downturn.

Assessing Risk Tolerance

Wealth managers use a variety of methods to assess your risk tolerance. These include:

Questionnaires: Many wealth managers use detailed questionnaires that ask about your investment experience, financial goals, time horizon, and reactions to hypothetical market scenarios. These help gauge your comfort level with different types of risk.

Behavioral Analysis: Some wealth managers also consider your past investment behavior, such as how you reacted during market downturns or periods of high volatility.

Financial Analysis: Your financial situation, including income, expenses, savings, and obligations, also plays a role in determining your risk tolerance. A wealth manager will analyze these factors to ensure your investment strategy is financially feasible and aligned with your risk tolerance.

Adjusting Over Time

Risk tolerance isn’t static; it can change over time due to life events, changes in financial circumstances, or evolving financial goals. For instance, as you approach retirement, your risk tolerance may decrease, prompting a shift to a more conservative investment strategy. Regular reviews with your wealth consultant in Fort Worth, TX help ensure your portfolio remains aligned with your current risk tolerance.

Balancing Risk and Reward

In wealth management, the goal is to balance risk and reward. By understanding your risk tolerance, a wealth manager can design a portfolio that seeks to maximize returns within your comfort zone. This balance helps you achieve your financial goals while minimizing stress and the likelihood of making impulsive decisions during market fluctuations.

Conclusion

Understanding risk tolerance is a crucial step in successful wealth management. It allows you and your wealth manager to create a portfolio that not only aligns with your financial goals but also suits your comfort level with risk. Regularly assessing and adjusting your risk tolerance ensures that your investment strategy evolves with your life circumstances, helping you stay on track to meet your long-term financial objectives.

0 notes

Text

Expert Wealth Management by Surana Consultancy in Kolkata: Secure Your Financial Future

Surana Consultancy in Mumbai offers expert wealth management to secure and grow your financial future.

#Wealth management services#Wealth management solutions#Wealth management consultant#Top wealth management firms near me#Wealth management advisor#Best wealth management practices

0 notes

Text

Elevate your financial future with our comprehensive wealth management services. Gain personalized guidance and strategic insights to optimize your investments, protect your assets, and achieve your financial goals. Experience peace of mind knowing that your wealth is in expert hands. Partner with us to unlock a path to financial success and prosperity. Achieve your financial goals with expert Financial Planning and Wealth Management services.

#Wealth Management Companies#Wealth Management Services#Financial Planning And Wealth Management#Wealth Management Advisor#wealth management consultant#financial investment planning#personal wealth management#Financial Planning Wealth Management#wealth management planning

0 notes

Text

Find the Best Finance Companies in Florida

Find the best finance companies in Florida and startups to work only at Edify Financial Consulting Group. We continuously strive to provide the best possible experience for all our clients at every stage of their financial journey. We build and strengthen successful long-term relationships with each of our clients by providing superior, personalized financial services.

#finance companies in Florida#top finance companies in florida#wealth management consultant#best financial services companies in usa

0 notes

Text

An experienced wealth management advisor assists you in preserving and growing your wealth. Providing comprehensive solutions tailored to your specific goals, their expertise extends to tax planning, risk management, and investment strategies. Wealth management consultants craft plans for long-term financial security, legacy planning, or asset diversification. Making informed decisions, optimizing resources, and adapting to changing market dynamics are all made possible by their experience. Let our best wealth management firms in Norfolk VA guide you through the complexities of wealth management and help you secure your financial future.

1 note

·

View note

Text

Are you looking for a qualified financial advisor to help you manage your investments, reduce taxes, plan for retirement, strategize for family wealth, plan your estate, and manage your income and distributions? Visit The Strategic Wealth Advisors in Florida, United States! Our team of experts is dedicated to helping you achieve your financial goals. We provide personalized strategies tailored to your unique needs and circumstances. Contact us today to learn how we can help you achieve financial success!

#strategies wealth advisor#certified financial planner#personal financial advisor#wealth management service#investment management services#wealth management consultant#retirement planning strategies

1 note

·

View note

Text

#Wealth Management#wealth management company#wealth management services#wealth management service#wealth management consultant

0 notes

Text

The Importance of a Personal Financial Advisor for Your Financial Growth

Managing personal finances can be overwhelming, especially when striving to achieve long-term financial goals. That’s where Zenith Financial’s Personal Financial Advisor comes in, offering tailored strategies to secure your financial future.

A personal financial advisor is your partner in building wealth, minimizing risks, and optimizing investments. They assess your financial situation, understand your goals, and create a customized plan that aligns with your aspirations—whether it’s buying a home, planning for retirement, or funding your child’s education.

At Zenith Financial, we emphasize personalized service. Our advisors don’t just manage numbers; they manage lives. We provide expert guidance on budgeting, investment planning, tax strategies, and wealth management to ensure your hard-earned money works efficiently for you.

In today’s fast-changing economic environment, having a trusted advisor by your side ensures you’re prepared for uncertainties. Our advisors stay updated on market trends, helping you make informed decisions and stay ahead financially.

Take control of your finances today with Zenith Financial. With our expert advisors, achieving financial freedom is no longer a dream—it’s a plan. Connect with us to explore how our personalized financial solutions can transform your financial journey.

#Zenith Financial#Wealth Management Advisor#Personal Financial Advisor#Financial Advisory Services#Aet a financial advisor#retirement financial advisor#private wealth management#investment financial advisor#wealth management consultant#recommended financial advisors#money management companies#personal finance consultant#financial planning advice#financial management companies#independent investment advisor

1 note

·

View note

Text

At Vantage Financial Partners, we provide personalized wealth management services tailored to your unique financial goals. Our expert advisors help you navigate investments, retirement planning, and estate management to secure your financial future. Trust us to guide you every step of the way.

#wealth management consultant#top rated financial planning firm#529 college savings plan#fiduciary financial planner#college savings plan#educational savings plan#senior wealth advisor in wisconsin#529 plan#best financial advisors in wisconsin#financial planner in wisconsin

0 notes

Text

Unlocking Wealth Potential: Comprehensive Wealth Management Course

Wealth management has become one of the most promising career options out there and for this reason, plenty of people are now days opting for this career option. If you are also looking for any promising career option that you can pursue then you can also consider choosing this particular career path.

0 notes

Text

Maximize Your Wealth with Expert Management Consulting

Unlock your financial success's potential with our professional wealth management consulting. Professional consultants of OTE are ready to provide you with individualized reports on how to reach your financial objectives. We offer our clients Investment Services and Pension Services which offer complete solutions as per your requirement. We take this opportunity to assure you that we can help steer you toward financial success. Book your wealth management consultation session now and avoid insecurity and doubt about the financial future.

0 notes