#fiduciary financial planner

Explore tagged Tumblr posts

Text

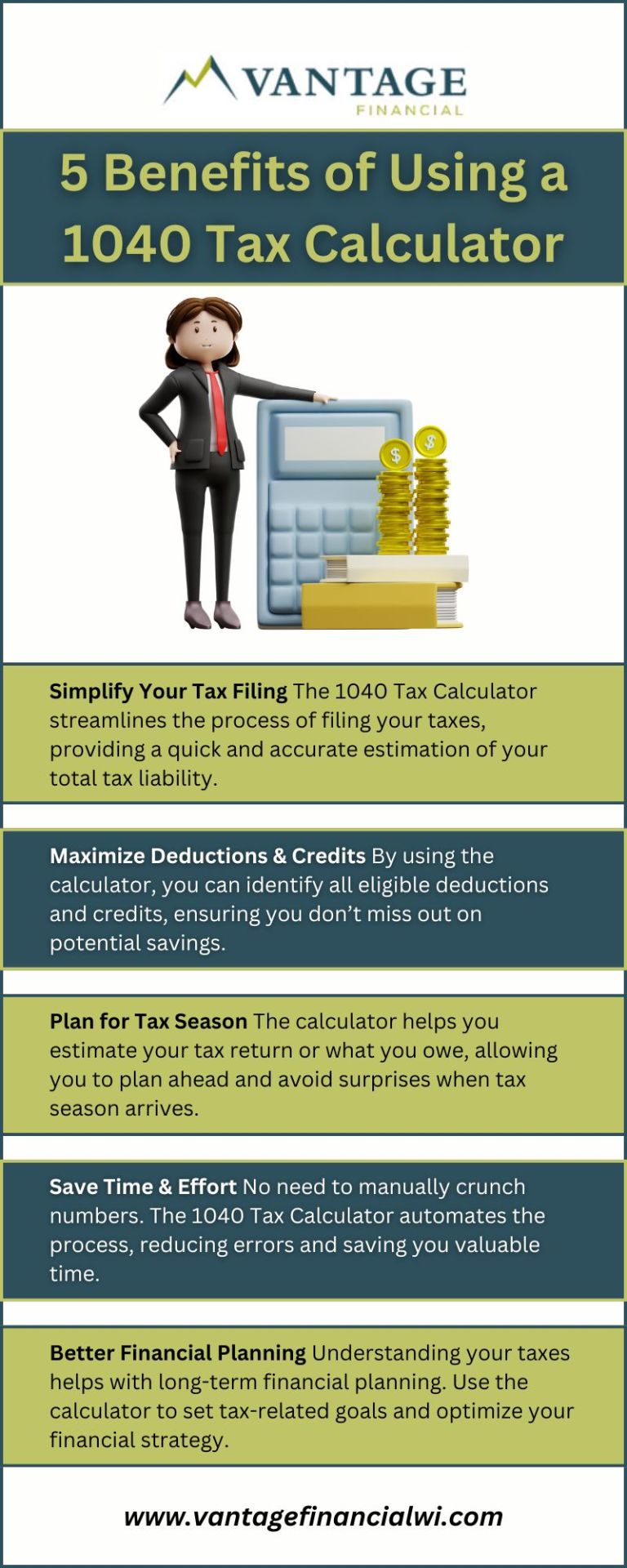

Discover how the 1040 Tax Calculator can streamline your tax filing process and help you maximize deductions. Learn how Vantage Financial Partners uses this tool to guide you through tax season with confidence and ensure you're taking full advantage of available credits and savings.

#senior wealth advisor in wisconsin#wealth management consultant#fiduciary financial planner#top rated financial planning firm#educational savings plan#529 college savings plan#financial planner in wisconsin#college savings plan#best financial advisors in wisconsin#529 plan

0 notes

Text

Smart financial decisions lead to long-term success. Discover the real impact of expert guidance from a financial advisor in California. From investment strategies to retirement planning, professional advice ensures a secure future. Explore the benefits of wealth management in California and make informed financial choices today!

#financial planning#indian financial advisor near me#wealth management california#fiduciary wealth advisor#certified estate planner california#nri financial planning#financial advisor in california#financial advisor in usa

0 notes

Text

Why a Fiduciary Financial Planner is Essential for Your Financial Future

In today’s complex financial landscape, having a trusted advisor can make a world of difference. A Fiduciary Financial Planner is a professional who prioritizes your best interests, providing unbiased advice tailored to your unique financial situation. This commitment to fiduciary duty is especially important for individuals and families looking to secure their financial future.

What is a Fiduciary Financial Planner?

A Fiduciary Financial Planner is someone who is legally obligated to act in your best interests. Unlike some advisors who may have conflicts of interest, fiduciaries must prioritize your financial well-being above all else. This level of accountability ensures that the advice you receive is truly in your favor, whether you’re planning for retirement, managing investments, or navigating complex financial decisions.

Why You Should Consider a Fiduciary Financial Planner

Unbiased Guidance: Because fiduciary planners are not tied to any financial institution, they can offer objective advice. This means you get recommendations based solely on what will benefit you, rather than what might generate a commission for the advisor.

Personalized Financial Strategies: A good fiduciary planner will take the time to understand your individual goals, values, and circumstances. They can create a tailored financial plan that aligns with your aspirations — whether that means saving for retirement, funding education for your children, or building a legacy.

Legacy Wealth Management: For many, creating a legacy is a top priority. A fiduciary planner can help you craft a comprehensive legacy plan, ensuring that your wealth is passed down according to your wishes. This may involve estate planning, trusts, and tax strategies to maximize the impact of your wealth on future generations.

Support for Seniors: Finding the best financial advisor for seniors is crucial as they navigate unique financial challenges. A fiduciary financial planner understands the specific needs of older clients, including retirement income planning, healthcare costs, and long-term care options. Their expertise can help seniors achieve financial security and peace of mind.

Tools for Financial Success

To aid in effective financial planning, many fiduciary financial planners utilize tools like the valuation stock calculator. This tool allows clients to assess the potential worth of their investments, providing valuable insights for decision-making. By understanding the current value of assets, you can make informed choices about buying, selling, or holding investments.

Building a Financial Partnership

Working with a fiduciary financial planner isn’t just about receiving advice; it’s about forming a financial partnership. This collaborative relationship empowers you to take control of your financial future. Your planner will guide you through various stages of life, helping you adjust your strategies as your circumstances change. This ongoing support is crucial for maintaining financial health over time.

Questions to Ask When Choosing a Fiduciary Financial Planner

When searching for the right fiduciary planner, consider asking the following questions:

What are your qualifications and experience? Look for credentials such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst), which demonstrate a commitment to professionalism and ethics.

How do you charge for your services? Understanding the fee structure is essential. Fee-only planners typically charge based on a percentage of assets under management or flat fees, avoiding potential conflicts associated with commissions.

Can you provide client references or testimonials? Hearing from current or former clients can give you insights into the planner’s approach and effectiveness.

What is your investment philosophy? Make sure their investment strategies align with your risk tolerance and financial goals.

Conclusion

A Fiduciary Financial Planner offers invaluable support for anyone looking to secure their financial future. Whether you’re a senior seeking tailored advice or someone interested in legacy wealth management, a fiduciary can provide the expertise and accountability you need. By prioritizing your best interests and employing effective tools, they help you navigate life’s financial complexities.

If you’re ready to take control of your financial journey, consider reaching out to a fiduciary financial planner today. Your future self will thank you!

0 notes

Text

5 Steps to Finding Your Perfect Fiduciary Financial Advisor

https://sfamga.com/ - Dive into our concise infographic and discover the essential steps to identify a fiduciary financial advisor tailored to your needs. From defining your financial goals to understanding fee structures, our guide ensures you make informed decisions. Partner with Security First Asset Management and take the guesswork out of financial planning. See the fiduciary difference for yourself.

For more information, read our blog. - https://sfamga.com/finding-a-financial-advisor-working-under-the-fiduciary-standard/

1 note

·

View note

Text

Website : https://www.humaninvesting.com

Address : 525 3rd St. Suite 200, Lake Oswego, OR 97034

Phone : +1 503-905-3100

We serve the pursuits of individuals, families, and companies with tailored financial planning and advice.

#financial planner#fiduciary financial advisor#retirement plan services#retirement planning#wealth managemen

1 note

·

View note

Text

Financial Literacy: Begins w/ basic budgeting skills & ends w/ freq. monitoring of investment objectives. Begins w/ accepting that we all must accept our own responsibility in the process. http://colleenbooks.com, send email and I'll provide free short article about this topic.

#writers of tumblr#womenempowerment#authors#money#investors#financial planners#financial planning#fiduciary

0 notes

Text

Financial Life Designs

Fiduciary Financial Advisor

Audrey Wehr Jones, CFP, President of Financial Life Designs LLC, began her financial career in 1994. She soon realized her clients' financial situations demanded a deeper and more comprehensive understanding and began her studies to become a Certified Financial PlannerTM professional, earning her CFP designation in 1999. In March 2010 she founded her independent firm, Financial Life Designs, specializing in helping women in transition. She has been featured in a Wall Street Journal blog and was a guest advisor on “Your Money” Sirius XM satellite radio program. Audrey also enjoyed helping future planners by serving as an Adjunct Faculty Lecturer for California Lutheran University.

Business Hours: Mon - Fri: 9am - 5pm

Contact Name: Audrey Wehr Jones, CFP®

Tyler Jones

Contact Info:

Financial Life Designs

Address: 1540 International Pkwy STE 2000, Lake Mary, FL 32746, USA

Phone: +1 407-590-9372

Mail: [email protected]

Website: https://www.financiallifedesigns.net/

Find Online:

Facebook: https://www.facebook.com/FinancialLifeDesigns/

LinkedIn: https://www.linkedin.com/company/financial-life-designs-llc/

Keywords:

life designs, for life designs, netlearning lifespan, lifespan netlearning, life designs inc, good life designs, holistic financial advisor, estate planner, financial advisor, fee only financial planner, financial advisor for business owners, estate planning, retirement planner, holistic financial planning, hourly financial advice, financial planning for women, hourly financial advisor, fee only financial advisor, retirement planning, financial planner, lifespan netlearning, retirement advisor, financial planner for women, financial planning

#life designs#for life designs#netlearning lifespan#lifespan netlearning#life designs inc#good life designs#holistic financial advisor#estate planner#financial advisor#fee only financial planner#financial advisor for business owners#estate planning#retirement planner#holistic financial planning#hourly financial advice#financial planning for women#hourly financial advisor#fee only financial advisor#retirement planning#financial planner#retirement advisor#financial planner for women#financial planning

2 notes

·

View notes

Text

What to look for when choosing a Personal Financial Planner

Finding the right personal financial planner is crucial for your financial success. Here’s what to consider when selecting one:

Qualifications – Look for credentials like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst).

Fee Model – Some planners charge hourly rates, flat fees, or commissions. Ensure their structure aligns with your needs.

Experience – Choose a personal financial planner with experience handling financial situations similar to yours.

Fiduciary Responsibility – Ensure they have a legal obligation to act in your best interest.

Personalized Approach – A great planner tailors advice to your specific financial goals and lifestyle.

A personal financial planner can be a game-changer in your financial journey, helping you create a plan that grows and adapts to life’s changing circumstances.

0 notes

Text

What Is Fiduciary Financial Planning? A Guide for St. Paul Residents

Financial planning is an essential aspect of securing a stable future, but not all financial advisors operate under the same ethical standards. If you are a resident of St. Paul, Minnesota, understanding fiduciary financial planning can help you make informed decisions about your financial future. A fiduciary financial planner is legally obligated to act in your best interest, ensuring transparency, trust, and a client-first approach to financial advising. This article will explore what fiduciary financial planning is, why it matters, and how it can benefit residents of St. Paul.

Understanding Fiduciary Financial Planning

Fiduciary Financial planning refers to a professional relationship where a Financial advisor is bound by law to act in the best interests of their clients. Unlike brokers or commission-based advisors, fiduciaries must prioritize the client’s financial well-being over their own profits. This means they must provide unbiased advice, disclose any conflicts of interest, and recommend products that align with the client's financial goals rather than those that generate the highest commission.

For St. Paul residents, this distinction is crucial. Many financial advisors operate on commission-based structures, which can lead to recommendations that may not always be the most beneficial for clients. By choosing a fiduciary financial planner, individuals ensure they receive objective, conflict-free financial advice tailored to their needs.

The Importance of Fiduciary Duty

A fiduciary duty is the highest standard of care in financial advising. It ensures that your financial planner is legally and ethically required to act in your best interest, rather than simply selling products or services that may benefit them more than you. This standard includes:

Transparency: Fiduciary financial planners must fully disclose any potential conflicts of interest.

Loyalty: They must prioritize your financial goals and needs above their own financial gain.

Prudence: They must provide careful, well-researched financial advice based on your specific situation.

Why St. Paul Residents Should Consider Fiduciary Financial Planning

St. Paul is home to a diverse community with varying financial needs, from young professionals to retirees looking to manage their assets wisely. Here’s why fiduciary financial planning is especially beneficial for St. Paul residents:

1. Retirement Planning and Social Security

One of the biggest concerns for retirees is ensuring they have enough money to support themselves throughout their golden years. Fiduciary financial planners can help St. Paul residents optimize their retirement savings, navigate 401(k) and IRA distributions, and make informed decisions about claiming Social Security benefits. Many individuals are also unaware that Social Security Income can be taxable, depending on their overall income level. A fiduciary financial planner can help minimize tax liabilities while maximizing retirement income.

2. Tax Planning Strategies

Effective tax planning is another crucial aspect of fiduciary financial planning. Whether it’s minimizing capital gains taxes, managing required minimum distributions (RMDs), or strategically using tax-advantaged accounts, a fiduciary advisor can provide tailored strategies to help St. Paul residents retain more of their hard-earned money.

3. Investment Management Without Conflicts of Interest

Many financial advisors are incentivized to recommend investment products that may generate higher commissions for them rather than the best returns for clients. Fiduciary financial planners, on the other hand, choose investments based solely on their clients' risk tolerance, financial goals, and time horizons. They offer personalized, conflict-free investment strategies that align with long-term objectives.

How to Choose a Fiduciary Financial Planner in St. Paul

If you’re considering Fiduciary financial planning in St. Paul, here are some key factors to consider when selecting the right advisor:

Check Their Credentials: Look for certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), which indicate a high level of expertise and ethical standards.

Ask About Compensation: Fiduciaries typically operate on a fee-only basis rather than earning commissions. This structure ensures that their advice remains unbiased.

Verify Their Fiduciary Status: Not all financial advisors are fiduciaries. Ask whether they are legally required to act in your best interest at all times.

Assess Their Experience: Look for advisors with a proven track record in areas relevant to your financial needs, such as retirement planning, tax strategies, or wealth management.

The Long-Term Benefits of Fiduciary Financial Planning

Choosing a fiduciary financial planner isn’t just about avoiding conflicts of interest—it’s about securing a financially sound future. With expert guidance, you can:

Build Wealth Strategically: By making well-informed investment choices tailored to your financial goals.

Reduce Tax Liabilities: Through proactive tax planning that minimizes your overall tax burden.

Enjoy a Secure Retirement: With optimized retirement income, including Social Security and pension planning.

Make Confident Financial Decisions: Knowing that your advisor is legally bound to act in your best interest.

Final Thoughts

For St. Paul residents seeking financial security and peace of mind, fiduciary financial planning offers a trustworthy and transparent approach to managing wealth. Whether you’re planning for retirement, optimizing tax strategies, or investing for the future, working with a fiduciary financial planner ensures that your best interests always come first. By choosing a fee-only, fiduciary financial advisor, you can rest assured that your financial future is in capable and ethical hands.

0 notes

Text

Best Financial Advisors in Austin, TX: Your Guide to Smart Money Management

Financial planning is crucial for securing your future, whether you’re looking to grow your wealth, prepare for retirement, or navigate complex investment opportunities. If you're searching for the best financial advisors in Austin, TX, you need professionals who offer personalized strategies and expert guidance.

Why You Need a Financial Advisor

Managing your finances on your own can be overwhelming. A qualified financial advisor can help you with:

Investment strategies tailored to your goals

Retirement planning to ensure long-term security

Tax-efficient wealth management

Budgeting and debt reduction strategies

Estate and legacy planning

Working with a trusted financial advisor ensures that your money is working for you efficiently and securely.

Qualities to Look for in the Best Financial Advisors in Austin, TX

Not all financial advisors offer the same level of service. When selecting the right expert for your needs, consider:

Fiduciary Responsibility – Ensure your advisor acts in your best interest rather than selling commission-based products.

Experience and Credentials – Look for Certified Financial Planners or Chartered Financial Analysts with proven expertise.

Comprehensive Services – A good advisor should provide services beyond investment management, including estate planning, tax strategies, and risk assessment.

Transparent Fees – Understand how your advisor gets paid, whether through fees, commissions, or a mix of both.

Client Reviews and Reputation – Read testimonials and check for any regulatory complaints to ensure you’re working with a reputable firm.

How Hamilton Financial Planning Stands Out

If you're looking for trusted financial guidance, Hamilton Financial Planning provides personalized financial solutions designed to help you achieve financial security. Their team specializes in customized financial plans that align with your unique goals and lifestyle. Visit their website at Hamilton Financial Planning to explore their services.

The Benefits of Working with a Local Financial Advisor

Choosing a local financial advisor in Austin, TX, has unique advantages:

Understanding of Local Market Trends – Advisors familiar with the Texas economy can provide region-specific insights.

Personalized Service – Face-to-face meetings help build strong, long-term relationships.

Community Trust and Networking – Established local firms have strong reputations within the community.

Financial Planning for Different Life Stages

The best financial advisors in Austin, TX provide tailored solutions for every stage of life:

Young Professionals – Budgeting, debt management, and investment planning

Mid-Career Professionals – Retirement planning and wealth accumulation

Pre-Retirees and Retirees – Income planning and estate management

Business Owners – Tax strategies and succession planning

Start Your Financial Journey Today

Finding the right financial advisor is the first step toward financial freedom. With expert guidance, you can create a comprehensive financial plan that meets your short-term and long-term goals. If you're searching for the best financial advisors in Austin, TX, consider Hamilton Financial Planning for reliable and customized financial solutions.

0 notes

Text

At Vantage Financial Partners, we provide personalized wealth management services tailored to your unique financial goals. Our expert advisors help you navigate investments, retirement planning, and estate management to secure your financial future. Trust us to guide you every step of the way.

#wealth management consultant#top rated financial planning firm#529 college savings plan#fiduciary financial planner#college savings plan#educational savings plan#senior wealth advisor in wisconsin#529 plan#best financial advisors in wisconsin#financial planner in wisconsin

0 notes

Text

Planning for your future is one of the most important decisions you can make, and a Certified Estate Planner in California can help you secure your legacy with confidence. Estate planning is not just for the wealthy—it’s a vital step to ensure your assets are distributed according to your wishes while minimizing tax burdens and legal complexities.

#financial planning#indian financial advisor near me#fiduciary wealth advisor#financial advisor in california#wealth management california#nri financial planning#estate planning california#certified estate planner california

0 notes

Text

Fiduciary Financial Services: What It Means and Why It Matters for Your Wealth

Many individuals are seeking professional guidance to manage their wealth effectively, and that's where fiduciary financial services come into play. You may have heard of the term "fiduciary" before, but do you know what it really means and how it can impact your financial well-being? As you navigate the complex world of wealth management, it's imperative to understand the importance of fiduciary financial services and how they can help you achieve your long-term financial goals. You deserve to have a financial advisor who puts your interests above their own, and that's exactly what a fiduciary financial advisor does.

So, what does a fiduciary financial advisor do? In essence, a fiduciary financial advisor has a responsibility to act in your best interest, providing unbiased advice and guidance to help you make informed decisions about your wealth. This means that they must prioritize your needs above their own, avoiding any conflicts of interest that may arise. You can trust that a fiduciary financial advisor will work tirelessly to help you achieve your financial objectives, whether you're looking to grow your wealth, plan for retirement, or protect your assets.

In the matter of wealth management, fiduciary advisors play a vital role in ensuring that your interests are protected. You want to work with an advisor who is committed to providing advice that is in your best interest, without any hidden agendas or biases. Fiduciary advisors are dedicated to helping you make smart financial decisions, and they will take the time to understand your unique needs and goals. You can rely on their expertise and guidance to help you navigate the complexities of wealth management, and make informed decisions that align with your values and objectives.

So, how do you identify a fiduciary advisor? You can start by looking for certifications such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations. You can also check if the advisor is a member of a professional organization, such as the National Association of Personal Financial Advisors (NAPFA). Additionally, you can ask questions during your initial consultation to ensure that the advisor is committed to acting in your best interest. You want to work with an advisor who is transparent, trustworthy, and dedicated to helping you achieve your financial goals.

The benefits of fiduciary financial services for your long-term wealth are numerous. By working with a fiduciary advisor, you can ensure that your wealth is managed with your best interests in mind. You can trust that your advisor will provide personalized guidance and support to help you achieve financial success, and protect your wealth from potential risks. Whether you're just starting to build your wealth or you're nearing retirement, fiduciary financial services can help you achieve your goals and secure your financial future. You can learn more about Fiduciary Financial Services and how they can benefit you.

Now that you understand the importance of fiduciary financial services, it's time to take the next step. You can schedule a consultation with a fiduciary advisor to discuss your unique needs and goals. Don't wait any longer to secure your financial future – take control of your wealth today. Contact Encompass Financial to learn more. Encompass Financial, 12636 High Bluff Dr #110, San Diego, CA 92130, United States. For appointments, please visit: https://encompassfinancial.net.

0 notes

Text

I assemble a financial team.

What would you do if you won the lottery? I aim to find a financial advisor who is designated as a certified financial planner and will act as a fiduciary, offering advice that’s in my best interest not based on commissions.

0 notes

Text

Who Should You Talk To About Retirement Planning? | Smarter Feds

Retirement planning can feel overwhelming. With so many factors to consider – savings, investments, healthcare, and more – it's crucial to seek guidance from qualified professionals. Here's a breakdown of who can help you navigate your retirement journey:

1. Financial Advisor:

Expertise: A financial advisor is a broad term encompassing various professionals, including Certified Financial Planners (CFPs) and Chartered Financial Analysts (CFAs).

Services: They can provide comprehensive financial planning, including:

Investment strategies: Portfolio diversification, asset allocation, and investment selection.

Retirement income planning: Social Security, pensions (like Federal Employees Retirement System - FERS), and other income sources.

Tax planning: Minimizing your tax burden in retirement.

Estate planning: Ensuring your assets are distributed according to your wishes.

Considerations:

Fees: Fees can vary significantly, so understand the advisor's fee structure upfront.

Fiduciary Duty: Ensure your advisor acts as a fiduciary, meaning they are legally obligated to put your best interests first.

2. Employee Benefits Counselor:

Expertise: If you're a federal employee, your employee benefits counselor is a valuable resource.

Services: They can provide information on:

Federal Employees Retirement System (FERS): Understanding your pension benefits, including fers beneficiary options and retirement eligibility.

Thrift Savings Plan (TSP): Maximizing your TSP max contribution and investment options, including federal employee tsp matching.

Federal Employees Health Benefits (FEHB): Choosing the right health insurance plan for your needs in retirement.

Life insurance: Evaluating your life insurance needs and available options.

3. Tax Advisor:

Expertise: A tax advisor, such as a Certified Public Accountant (CPA) or an Enrolled Agent, can help you:

Minimize your tax liability: Identify tax-advantaged retirement savings options and optimize your tax deductions.

Understand the tax implications: Of retirement income, Social Security, and other income sources.

Plan for potential tax changes: That may impact your retirement income.

4. Estate Planning Attorney:

Expertise: An estate planning attorney can help you:

Create a will: Ensure your assets are distributed according to your wishes.

Establish a trust: Protect your assets and minimize estate taxes.

Plan for long-term care: Ensure you have the resources to cover long-term care expenses.

5. Social Security Administration:

Expertise: The Social Security Administration provides valuable information on:

Social Security benefits: Understanding your eligibility and maximizing your benefits.

Retirement planning resources: Accessing online tools and calculators.

Finding the Right Professional:

Referrals: Ask for referrals from friends, family, or colleagues.

Online research: Read reviews and compare qualifications of different professionals.

Consultations: Schedule initial consultations with several professionals to find the best fit for your needs and personality.

Remember: Retirement planning with Smarter Feds is a continuous journey. Regularly assess your plan and make adjustments as necessary to stay aligned with your retirement goals.

#fers annuity training workshops jacksonville#retirement#thrift savings plan - tsp training orlando#fers firefighter retirement training

0 notes

Text

With our dedicated team of experts, we are driven to provide tailored solutions that empower our clients to achieve their financial goals with greater confidence and success.

0 notes