#private credit

Explore tagged Tumblr posts

Text

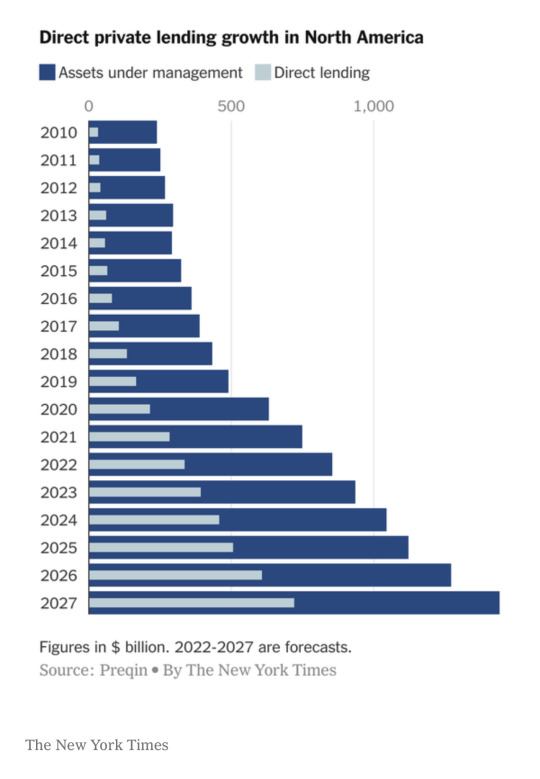

Public refinancings can save companies up to 300 basis points

Private credit’s “golden era” may face strain amid a resurgence in the broadly syndicated loan market, as increased competition drives down returns, according to a report from @MoodysInvSvc

https://www.bloomberg.com/news/articles/2024-03-05/moody-s-says-private-credit-returns-will-be-pressured-by-banks?utm_source=website&utm_medium=share&utm_campaign=twitter via @markets #pd #mergers #acquisitions #deals #lbo #mergerarb #fund #investor #IPO #PrivateEquity #buyouts #MandA #PE #investments #MergerArb #VC #credit #loan

3 notes

·

View notes

Text

2024 Tokenization Boom: A New Era for Real-World Assets

In 2024, the landscape of real-world asset (RWA) tokenization is experiencing a transformative shift, marking a significant milestone in the financial industry. Tokenization converts physical assets like real estate, commodities, and art into digital tokens on a blockchain, enhancing liquidity, accessibility, transparency, and security. This revolutionary technology makes high-value assets more accessible to a broader range of investors. As we explore the current state and future prospects of tokenization, it is clear that this technology is set to reshape the global financial ecosystem significantly.

Tokenization is predicted to be a multi-trillion-dollar opportunity by 2030, with market estimates suggesting it could reach up to $16 trillion. The United States is leading this revolution, followed by countries like Singapore, the United Kingdom, Switzerland, India, and Luxembourg.

The total value locked in tokenized assets has surged to $10.53 billion, with major financial institutions launching tokenized investment products. This signals a major inflection point for the industry, underscoring the significant role tokenization will play in the future of finance.

The benefits of tokenization are extensive. It allows for fractional ownership, increasing liquidity and enabling investors to buy and sell portions of an asset. This democratizes investment opportunities and bridges the gap between traditional and digital financial markets. Tokenization also reduces transaction costs by eliminating intermediaries and automating processes through smart contracts.

As regulatory frameworks evolve and technology advances, tokenization is set to revolutionize the financial industry. Intelisync provides cutting-edge RWA tokenization services to help you navigate and capitalize on this financial Learn more....

#metaverse development company#blockchain development companies#web3 development#blockchain development services#metaverse game development#24/7 Market Access#Access to Real-World Yields#Asset Classes in Tokenization#Benefiting Blockchains#CeFi and DeFi tokenization#CeFi-Based Tokenization Protocols#Commodities#Common Combinations#Credit & Loans#Current Trajectory#DeFi protocols#DeFi-Based Tokenization Protocols#Diverse Asset Classes#Dominance of the U.S.#Emerging Trends#Enhanced Liquidity#Ethereum’s Prominence#Fractional Ownership#Leading Geographies#Leading Geographies in Tokenization#Less Popular Asset Classes#Performance of DeFi Protocols#Popular Asset Classes#Private Credit#Real Estate

1 note

·

View note

Text

#Private Alternative Real Estate Investments#real estate debt funds#alternate real estate investment#alternative real estate investment#real estate investment fund#bridge lending#hard money#private credit#private lending#debt investment in the current market#Debt Investments#real estate debt

0 notes

Text

Albert Wesker in Resident Evil Remastered (2002)

#crimson's gifs: resident evil#resident evil#re#Resident Evil 1#RE1#Resident Evil 1 Remastered#RE1R#Resident Evil Remastered#Albert Wesker#Albert Wesker (RE1)#Wesker#One of the most interesting things I noticed studying the game and the appearences of Wesker throughout is that when it comes to him#He only seems to be fixated on Chris#Hes a lot more confrontational and engaged when Chris confronts him#Notice the little smirk he makes before he turns around to greet Chris at the private residence#With Jill hes more focused on the tyrant and practically bored but hes a lot more gleefully insane (and emotional) when its Chris#Really set up the whole Chris Fixation wesker has quite well imo#I dont like wesker that much personally and yall already gathered i HATE Chris' character but I have to give credit when its due#Its a shame they kinda wasted it#If they are remaking 5 I hope they expand on that more#The post credits in 4r of Wesker watching Chris in Revelations on the screen was another good setup#CVX hooks onto RE1R perfectly and that 4r cutscene also hooks onto that great its just that re5 kinda drops the ball a lil#Because Wesker is blindsided by Chris when thats supremely out of character for the man absolutely obsessed with him#To not know where he is at all times#I kinda believe he only took Jill to make sure Chris would find him eventually#Anyways this is the last character focused set. Last ones are just alternative outfits now which is just Jills 3 alts and cowboy rebecca

214 notes

·

View notes

Text

Terry-Thomas | selected filmography + PSAs | 1936-1966

Once in a Million 1936

It's Love Again 1936

For Freedom 1940

Under Your Hat 1940

If You Don't Save Paper (PSA) 1948

Copy Book Please (PSA) 1948

A Date with a Dream 1948

The Brass Monkey 1948

Helter Skelter 1949

Melody Club 1949

What's Cooking? (PSA) 1951

Private's Progress 1956

The Green Man 1956

Brothers in Law 1956

Lucky Jim 1957

The Naked Truth 1957

Blue Murder at St Trinian's 1957

Happy Is the Bride 1958

Too Many Crooks 1959

Carlton-Browne of the F.O. 1959

I'm All Right Jack 1959

School for Scoundrels 1960

Make Mine Mink 1960

A Matter of WHO 1961

Bachelor Flat 1962

Kill or Cure 1962

It's a Mad, Mad, Mad, Mad World 1963

How to Murder Your Wife 1965

Those Magnificent Men in Their Flying Machines 1965

La Grande Vadrouille 1966

#Terry-Thomas#THERE IS A LIMIT OF 30 GIFS#to be clear he did WAY more than this#man has over 100 credits to his name#to say nothing of tv appearances and basically paving the way for the Goon Show and Monty Python#there's so much dude#I don't think this man ever slept#Melody Club#The Brass Monkey#Helter Skelter#Private's Progress#The Naked Truth#Kill or Cure#British actors#English actors#my gifs#How to Murder Your Wife#Those Magnificent Men in Their Flying Machines#Make Mine Mink#School for Scoundrels#Brothers in Law#Lucky Jim#Boulting Brothers#Peter Sellers#Eric Sykes#Joyce Grenfell#prolific

68 notes

·

View notes

Text

At long last, a meaningful step to protect Americans' privacy

This Saturday (19 Aug), I'm appearing at the San Diego Union-Tribune Festival of Books. I'm on a 2:30PM panel called "Return From Retirement," followed by a signing:

https://www.sandiegouniontribune.com/festivalofbooks

Privacy raises some thorny, subtle and complex issues. It also raises some stupid-simple ones. The American surveillance industry's shell-game is founded on the deliberate confusion of the two, so that the most modest and sensible actions are posed as reductive, simplistic and unworkable.

Two pillars of the American surveillance industry are credit reporting bureaux and data brokers. Both are unbelievably sleazy, reckless and dangerous, and neither faces any real accountability, let alone regulation.

Remember Equifax, the company that doxed every adult in America and was given a mere wrist-slap, and now continues to assemble nonconsensual dossiers on every one of us, without any material oversight improvements?

https://memex.craphound.com/2019/07/20/equifax-settles-with-ftc-cfpb-states-and-consumer-class-actions-for-700m/

Equifax's competitors are no better. Experian doxed the nation again, in 2021:

https://pluralistic.net/2021/04/30/dox-the-world/#experian

It's hard to overstate how fucking scummy the credit reporting world is. Equifax invented the business in 1899, when, as the Retail Credit Company, it used private spies to track queers, political dissidents and "race mixers" so that banks and merchants could discriminate against them:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

As awful as credit reporting is, the data broker industry makes it look like a paragon of virtue. If you want to target an ad to "Rural and Barely Making It" consumers, the brokers have you covered:

https://pluralistic.net/2021/04/13/public-interest-pharma/#axciom

More than 650,000 of these categories exist, allowing advertisers to target substance abusers, depressed teens, and people on the brink of bankruptcy:

https://themarkup.org/privacy/2023/06/08/from-heavy-purchasers-of-pregnancy-tests-to-the-depression-prone-we-found-650000-ways-advertisers-label-you

These companies follow you everywhere, including to abortion clinics, and sell the data to just about anyone:

https://pluralistic.net/2022/05/07/safegraph-spies-and-lies/#theres-no-i-in-uterus

There are zillions of these data brokers, operating in an unregulated wild west industry. Many of them have been rolled up into tech giants (Oracle owns more than 80 brokers), while others merely do business with ad-tech giants like Google and Meta, who are some of their best customers.

As bad as these two sectors are, they're even worse in combination – the harms data brokers (sloppy, invasive) inflict on us when they supply credit bureaux (consequential, secretive, intransigent) are far worse than the sum of the harms of each.

And now for some good news. The Consumer Finance Protection Bureau, under the leadership of Rohit Chopra, has declared war on this alliance:

https://www.techdirt.com/2023/08/16/cfpb-looks-to-restrict-the-sleazy-link-between-credit-reporting-agencies-and-data-brokers/

They've proposed new rules limiting the trade between brokers and bureaux, under the Fair Credit Reporting Act, putting strict restrictions on the transfer of information between the two:

https://www.cnn.com/2023/08/15/tech/privacy-rules-data-brokers/index.html

As Karl Bode writes for Techdirt, this is long overdue and meaningful. Remember all the handwringing and chest-thumping about Tiktok stealing Americans' data to the Chinese military? China doesn't need Tiktok to get that data – it can buy it from data-brokers. For peanuts.

The CFPB action is part of a muscular style of governance that is characteristic of the best Biden appointees, who are some of the most principled and competent in living memory. These regulators have scoured the legislation that gives them the power to act on behalf of the American people and discovered an arsenal of action they can take:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

Alas, not all the Biden appointees have the will or the skill to pull this trick off. The corporate Dems' darlings are mired in #LearnedHelplessness, convinced that they can't – or shouldn't – use their prodigious powers to step in to curb corporate power:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

And it's true that privacy regulation faces stiff headwinds. Surveillance is a public-private partnership from hell. Cops and spies love to raid the surveillance industries' dossiers, treating them as an off-the-books, warrantless source of unconstitutional personal data on their targets:

https://pluralistic.net/2021/02/16/ring-ring-lapd-calling/#ring

These powerful state actors reliably intervene to hamstring attempts at privacy law, defending the massive profits raked in by data brokers and credit bureaux. These profits, meanwhile, can be mobilized as lobbying dollars that work lawmakers and regulators from the private sector side. Caught in the squeeze between powerful government actors (the true "Deep State") and a cartel of filthy rich private spies, lawmakers and regulators are frozen in place.

Or, at least, they were. The CFPB's discovery that it had the power all along to curb commercial surveillance follows on from the FTC's similar realization last summer:

https://pluralistic.net/2022/08/12/regulatory-uncapture/#conscious-uncoupling

I don't want to pretend that all privacy questions can be resolved with simple, bright-line rules. It's not clear who "owns" many classes of private data – does your mother own the fact that she gave birth to you, or do you? What if you disagree about such a disclosure – say, if you want to identify your mother as an abusive parent and she objects?

But there are so many stupid-simple privacy questions. Credit bureaux and data-brokers don't inhabit any kind of grey area. They simply should not exist. Getting rid of them is a project of years, but it starts with hacking away at their sources of profits, stripping them of defenses so we can finally annihilate them.

I'm kickstarting the audiobook for "The Internet Con: How To Seize the Means of Computation," a Big Tech disassembly manual to disenshittify the web and make a new, good internet to succeed the old, good internet. It's a DRM-free book, which means Audible won't carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#privacy#data brokers#cfpb#consumer finance protection bureau#regulation#regulatory nihilism#regulatory capture#trustbusting#monopoly#antitrust#private public partnerships from hell#deep state#photocopier kickers#rohit chopra#learned helplessness#equifax#credit reporting#credit reporting bureaux#experian

310 notes

·

View notes

Text

Headcanon that most demon royalty goes to some fancy private/finishing school. But that Stolas was homeschooled with a private tutor. It was one of the very very few requests his dad granted him and for years it was a tressure memory, one of the few times he /got to choose/ one of the few times his dad /listened/ to him. Only to realize when he enters society that it was another isolation tactic. That everybody had already spent years forming social alliances and building their reputations and social credit. And that there was no room for him to break into those circles, that he /did not know/ the proper unspoken social rules. That his wife has spent years building her clout and that he is once again. Alone.

#helluva boss#stolas goetia#stella goetia#Other demon royality#Listen I dont know anything about the world building in helluva boss or if they have any type of schools at all#I am basing this off of other dramas involving rich kids there's always a private school social credit is everything#And stolas has such perfect weird home school kid who does not know how to act around people because they've just never socialized ever#And I love the angst of dtolas's life being a compounding series of isolation and misreading situations only to realize#What was wrong way too late but still clinging to the good memory because that's all he has#And it pairs well with Stella being an excellent socialite#And the angst of stolas being like okay yay! Time to attend events i can do this i might even make friends!#Only to realize he /cant/ and forget friends or allies this means he has no one he can lean on to help with the abuse Stella deals out#Owl in a cage is a very telling song#Vassago once again in the corner vibrating because he'd love to be friends! He volunteers pleaseeee#Stolas gaining a reputation for being really fucking weird but really good at his job and for thinking he's too good to talk to anyone here#Because he never fucking talks to anyone#I imagine the first few years stolas was out in society were filled with just. So many painfully awkward conversations until he just#Stopped trying because what was the point

29 notes

·

View notes

Text

makes me want to explode whenever i see someone use art in something they’re posting like “idk who the artist is sorry :(“ THEN DONT FUCKING USE IT!!!!!!!

#mono’s stuff#like sharing that in a private thing is one thing. posting this to your moodboard making blog with no credit is a shitty move i think

32 notes

·

View notes

Note

“Why is your gay hand, spread gayly over your gay boyfriends gay gapping hole are you in a gay relationship with gay feelings.”

oh u mean this one

#this is an original quote jenna said almost a year ago#credits to jenna#asks for becki#bakudeku mention#i cropped jenna out of the screenshot bc her acc is now private and she's not into mha anymore. just so ppl don't bug her about it lol

96 notes

·

View notes

Text

Bank Turmoil Is Paving the Way for Even Bigger ‘Shadow Banks’

The market for loans from non-bank firms like Apollo and Blackstone is booming. A crisis in regional lenders could accelerate it.

https://www.nytimes.com/2023/05/06/business/dealbook/bank-crisis-shadow-banks.html?searchResultPosition=5 #private_equity #privatedebt #privatecredit #debt #loans #Banking #investor #ennovance

#privateequity#ennovance#chemicals#investor#economy#loan#debt#equity#pe#investors#private credit#private debt#central banking#banking#credit#shadow banking

14 notes

·

View notes

Text

i find it funny when people cite my own moash theories or meta on my posts as if i’ve never heard of them or thought of that.

#i was the first moash 4 dustbringer person that was my theory#b/figr gets a lot of the credit bc she expanded on it and posted it to reddit afterward#and i can’t really prove it bc we talked about it together on a private server before either of us posted it#and that server has since been nuked#but my tumblr post predates her reddit post if anyone actually cares#i don’t normally mind when people attribute it to bfigr bc she did really take it and run with it#and i adopted a couple other theories and played around with other ideas#but i don’t like when people comment it on my posts as if i’ve never heard of it#like it was MY idea

22 notes

·

View notes

Text

you're in the wind; i'm in the water

nobody's son, nobody's daughter

#lucy doodles#arts arcanum#my art#brandon sanderson#cytoverse#skyward#skyward brandon sanderson#defiant#skyward spin#jerkface#spinface#jorgen weight#spensa nightshade#hands#so many hands#based on some bases by @/K_MB001 on twitter#their acc is private but its the only credit i can locate so#lucy does an art trend#please dont let this flop#im actually really proud of this#so theres that#they are so eberything to me#digital art#artists on tumblr#fanart

116 notes

·

View notes

Text

y'all i did NOT just buy the persona 3 stage play dvds on ebay just so i could translate all the shinjiham moments 😭😭😭

#shinjiham#foolmoon#persona 3#persona 3 the weird masquerade#mine#personal#note: asked the person who posted them on yt if i could translate them and she privated them so. yeah#don't expect anything from me for a bit#also someone take away my credit card i have bills to pay i can't believe i've done this#i can't believe no one stopped me#i can't believe my partner encouraged me#anyway. what it's like to be an adult with enough money to spend on ur special interest sometimes

23 notes

·

View notes

Text

Aromantic and asexual Alastor icons

Feel free to use, no credit neded.

The first one with logo, second is logo-free.

#alastor#hazbin hotel#hazbin alastor#aromantic#aro pride#asexual#aroace#ace pride#You don't need to fuck/fell to be fabulous#aroace alastor#feel free to use#no credit needed#Enjoy#My edit#If you want more edit ask me in private#Free to use

121 notes

·

View notes

Note

What a difference in the two interviews - Duchovny's in 1997 and Anderson's in 1998.

Duchovny was super arrogant and pretentious, thinking he was the King of Cocada Preta, trying to pass himself off as an intellectual, bored with fame. Winona Ryder never came out to David because she was much more famous at the time.. Thankfully, in the years that followed, he had to tone it down. Less Duchovny, much less…

Anderson, on the other hand, looked like a working mother, working non-stop to support her daughter, zero glamor, a bit depressed, like a middle-aged woman broken by life.

And in none of the interviews did the geniuses who interviewed them talk about Mulder and Scully, who were the soul of the show.

I'm slowly working on a progress-through-Season-8-based-on-the-burnt-out-interviews post, so this was timely. :DD

To be fair, David was suffering. Both of them were. The X-Files was simply a job to DD and GA; and they coped with its insane hours and insane stresses differently. For Gillian, she internally imploded: eating disorders, panic attacks, anxiety so bad she wouldn't wish it on her worst enemy. She was afraid to put a foot wrong because she'd gotten pregnant so early on and could have threatened the longevity of the show; but she kept putting a foot wrong due to a shoot-from-the-hip personality. Then she was a divorced co-parent trying to do everything herself. David, meanwhile, didn't have that stress; but instead of marrying quick to escape the unbearable loneliness (like Gillian did), he tried to escape by getting outward attention... or through porn, joking in Playboy that his favorite pornstar had gotten him through some very, very lonely days. He also outsourced constantly, making connections with other entertainers and etc. to try to establish himself in Hollywood away from the show. Part of that persona-- that he had everything together and was living the dream-- was part and parcel of selling himself to the business for, in turn, more work.

Secondly, DD WAS arrogant. It wasn't until AA that he learned gratitude, per his own words. Until that time, he'd overachieved into such heights of success that he, naturally, developed an ego. But that wasn't enough-- it never is-- and he kept devising other ways to get attention. Per his old interviews, he described being 'shocking' or 'funny' or etc. as a way to keep others' eyes (and attention) on himself. He always feared they'd lose interest in him and walk away, otherwise (still does.)

That mindset, he's stated here and there, was a result of habits he'd formed in his childhood-- the middle child caught in a turbulent divorce: father suddenly gone, mother heartbroken, and older brother and younger sister taking sides. He had to become intermediary for his siblings and shoulder-to-lean-on for his mother. He became his mother's pride and joy: a shy kid who thought he wasn't a looker when he was younger, who transferred to a better school on a scholarship, who was "captain of the basketball team and the baseball team and a straight-A student, and I was in my last year of high school, and I'd applied to four schools–Harvard, Yale, Princeton and Brown–and I got into all of them." Who was, in short, an over-achiever; and became arrogant because he achieved everything through his own efforts. But he was also a kid who fainted in senior year, breaking his front teeth, because the stress was too much.

And he was also a man who spent long hours overworked on a show he wasn't particularly passionate about. One who spent long, isolated hours alone (in the bathtub) in Vancouver when not working. And one who always had to be "on" when he was out with his friends or spotted by people on the street. Further, no one wanted (wants) to hear the rich and successful complain about the hardships of their success. So, he turned on the charm for attention, instead; and resented having to "sell himself" for people to care about his work. And his performance, on and off screen, earned him fifteen years of public backpatting and"Fox Mulder"ing everywhere he went.

He didn't deal with the stress perfectly, and created his own problems that had to be worked through later on. But Gillian did, as well (per her own words); and they've both owned up to their mistakes and have, seemingly, moved on from the past.

Lastly, there are other interviews where his truer self comes through: those are sadder, pre-marriage; or more stable and happy, post-marriage. Gillian had happy interviews, too; but her life was much more accelerated than his (marriage, pregnancy, divorce on close heels), and thus sounded more burnt out than he was.

I don't like to pit or compare faults because I'm sure they both handled global fame and nonstop work better than a lot of people would have (David was rock-bottom depressed and Gillian was afraid she'd quite literally go insane; but they made it.) And there are always interviews where he looks like a cherub and she a hag, or he an arrogant scumbag and she a hard-done-by saint. Neither were either.

About the Winona Ryder speculation:

Even in interviews from the early days, DD kept personal details close to the chest, not referring to romantic partners as "my girlfriend" unless his significant other had an established public persona (or an upcoming project.) The person he spoke the most about was Tea-- and that was after their marriage, and only during interviews to promote their next tv series or movie. Tea was a talker, and she didn't mind when he talked about her; so, she rubbed off on David for a good chunk of their relationship-- even after the rehab stint-- until their divorce. (Now, she's taken a vow of silence and enforces it strictly with Tim Daly, as stated by both.)

I'm not up-to-date on Winona, but I'm sure the relationship wasn't serious enough for either to really acknowledge it. She looked happy in their picture together; and I don't think she's the type to deny a relationship because it might not be advantageous to her "brand." But what do I know? XDD

Those are my thoughts, anyway~ :DDD

#asks#anon#thanks for droppin in¬#he DOES sound arrogant at times-- because he was arrogant#however: I've dived down so many rabbit holes; and found you will always find an ugly side to any person#I'm more interested in a person's growth or change#and we can see he has grown because of his actions towards GA#championing her rights to equal pay in the Revival#(though I wouldn't have judged him if he sat that out; just as I wouldn't judge her if the shoe were on the other foot)#and stating he won't do the files without her (though he IS interested in the series now that he's gotten distance-- again-- from it)#he gave her her due on the show; he gave her her credit; he praised her work-- in short: he showed gratitude for their friendship#Gillian has moments of carelessness that border on thoughtlessness#and family struggles and conflicts that she took accountability for#both were fallible and acted out in different ways (privately v. publicly)#we're all fallible. we're human#but are we all responsible? do we take accountability? do we change? do we even want to?

23 notes

·

View notes

Text

#kip sabian#marq quen#isiah kassidy#private party#aew#all elite wrestling#aewedit#wrestlingedit#wrestling#night gifs#its the confused way he looks at them and the way he slides after that ddt for me tbh lmao#hes so funny i love him so#my beloved#kip in a box#(rp blogs dont reblog; saving and other personal use with tag credits is fine)

23 notes

·

View notes