#Commodities

Explore tagged Tumblr posts

Text

Robin Wall Kimmerer, Braiding Sweetgrass

413 notes

·

View notes

Text

as a communist i do not care abstractly about questions like "will i be able to acquire this commodity at exactly the same rate in exactly the same locations" because the way they reach distribution centers is premised on exploitation, violence, and in many cases genocide

those people matter to me, the people whose lives were transformed into cogs for profit. for extraction. thats the relationship i want to change.

if that means less bananas fine. if it means more bananas fine. bananas arent the aim. emancipation is.

source

403 notes

·

View notes

Text

'The taxes you pay for the war To fight for peace is to fight against dear life'

French Communist Party poster (c. 1930).

105 notes

·

View notes

Text

Fantasy Worldbuilding Questions (Trade, Commerce, and Industry)

Trade, Commerce, and Industry Worldbuilding Questions:

What is the primary currency in this world? Does each region have its own?

What is the standard (such as the gold standard) by which currency is valued?

Who has more relative trading power and why? Which commodities are valued the most?

Who is paid the most because their labor is valued highest? Who is paid the least? Or is labor compensated equally (and do pay grades vary by region)?

Where are the biggest centers of trade and industry? Why are they in these locations?

Where are the main trading routes and what are landmarks or places of interest along their way?

When was this world most or least prosperous, and why?

When business is conducted, what are the customs, signs of trust (like signatures on Earth), formalities?

Why is a specific trade more common than others (what context underpins it)?

Why are certain trades growing or waning in popularity?

❯ ❯ ❯ Read other writing masterposts in this series: Worldbuilding Questions for Deeper Settings

#worldbuilding#writeblr#fiction writing#writing tips#writing advice#novel writing#writing#trade#industry#fwq#currency#finances#landmarks#least prosperous#commerce#commodities#how is labor valued

55 notes

·

View notes

Text

The Roller Coaster Continues - Watch This Crazy Move

Being that the threat of tariffs is not having the same impact it initially did, what is behind the most recent crazy moves in the stock market?

Watch Today's Free Video

3 notes

·

View notes

Text

China Strikes Back

Responding to the US tariffs, China has made its move by introducing tariffs on about $22 billion worth of US goods, including agricultural commodities.

A brief analysis of losers and gainers, as always.

First, I believe China will make a significant move towards self-sufficiency in all major crops, including soybeans, corn, and wheat.

Second, let’s analyse the situation by product. In 2024, China imported a record 105.03 million metric tons of soybeans. The US supplied 22.13 million tons of these imports, while Brazil was China’s largest soybean supplier with 74.65 million tons. As mentioned above, I expect China to import more from Brazil while also increasing its local production.

Corn. In 2024, China's corn imports experienced a significant decline, totalling approximately 13.77 million metric tons-a 49% decrease compared to the previous year. The US supplied 2 million tons of corn to China, comprising roughly 14.5% of China's total corn imports. Brazil took the lead, with China importing 6.5 million tons of Brazilian corn. Meanwhile, this presents a good opportunity for Ukraine to increase its share of Chinese imports if ceasefire talks proceed.

Wheat. In 2024, China's wheat imports totalled approximately 11 million metric tons, reflecting a 7% decrease compared to the previous year. Australia, the US, and Canada were the main suppliers. I presume Canada may gain a greater share of the market, potentially taking over the US’s share, which amounted to 1.9 million metric tons in 2024.

#imstory #import #china #usa #brazil #ukraine #australia #corn #wheat #soyabeans #fertilizers #fertilisers #canada #tariffs #agricommodities #trump

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#india#vessel#nola#imstroy#china#australia#canada#ukraine#soya beans#agribusiness#commodities#trade war#trump tariffs#tariffs#america

3 notes

·

View notes

Text

GOLD (XAU/USD) Market Update:

Gold has reached $2642, poised for further upside.

Uptrend Targets:

$2650-55 (initial resistance)

$2662 (next resistance)

Downtrend Support:

$2630-28 (initial support)

$2620 (key support)

Buying Opportunity:

Buy on dips towards $2630-28

Hold for $2655-62

Trading Strategy:

Long positions above $2642

Stop-loss below $2620

Risk Management:

Set stop-loss orders according to market volatility.

Monitor gold's movement closely and adjust trading strategies accordingly.

#usdjpy#nasdaq#sp500#commodities#eurusd#economicdata#dowjones#crudeoil#stock market#financial freedom#xauusd#forex#best expert advisor#best forex ea#best forex robot#trader

5 notes

·

View notes

Text

Our premium account management services can help you maximize your returns! 📈

Are you ready to take your investments to the next level? Look no further! Our experienced account management services are designed to provide great outcomes and offer the following benefits:

💸 Monthly minimum return of 50%: Our careful investing plans will produce outstanding returns.

🤝 Profit Sharing: We provide a fair profit-sharing structure where you keep 80% of the earnings and our skilled account manager gets only 20%. 🔒 Regulated Broker: Our services are completely regulated, assuring the greatest levels of transparency and security.

🚀 Same Day Payout: No more waiting for your hard-earned cash. We provide same-day payments, giving you immediate access to your earnings.

🔄 Copy Trading: Learn from successful traders' trades and easily replicate their strategies.

📞 Contact us for further information:

Ms. Shilpa phone number: +91 8184975350

#forex market#forextrader#forextrading#forex expert advisor#forex broker#forexinvesting#forexgroup#gold trading#xauusd#eurusd#gbpusd#commodities#indianmarket#stockmarket#stock market#profits#investment#crptocurrency#cryptotrading#mutual funds#index funds#visakhapatnam#gujarat#mumbai#delhi#lucknow#ahmedabad#investors#finance#business

2 notes

·

View notes

Note

Mogwai seems the happiest recently. Looks like she finally got some…

She looked pretty subdued at Disney in the video that her mother posted. I'm sure being stalked didn't help, but none of the people in her teacup besides her BIL seemed too engaged.

Hmn.

#anon#anon ask#anon answered#jenna ortega#happiness#or not#a penny for your thoughts#commodities#disney

1 note

·

View note

Text

That's right - it's the summer of sales. 50% off all objects, items, game units, and things of that nature.

Peace to all within the summer kingdom.

youtube

22 notes

·

View notes

Text

After putting Wisp back together, he wanted to give me some furniture, either something I don't have yet, or something pricey.

I chose the former, and you'd never be able to guess what he gives me;

Yes, a toilet.

And I figure I might as well say it for Wario;

So Ein Wisp! (So Ein Mist!)

#animal#crossing#new#horizons#animal crossing#new horizons#acnh#funny#acnh funny#ac funny#ac wisp#acnh wisp#this ones in the toilet#totally unexpected#commode#commodities#cute#silly#that's our wisp#casper would probably approve#toilet#toilet humor

2 notes

·

View notes

Text

Are We At The “Sweet Spot” to Buy Gold, Silver, and Bitcoin?

Charlotte of Investing News and Chris discussed how the stock market and precious metals will behave going into the end of the year. “I can have a bearish outlook on the markets yet still be in positions. I follow the trends, not opinions, news, projections, etc. No one knows what will happen. I let the charts paint the picture, analyze the information, invest accordingly, and manage the risk.”

Watch Today’s Free Video Here

2 notes

·

View notes

Text

Gold Prices Hold Near One-Month Highs Amid Fed Rate Cut Speculation: Market Insights and Analysis

In the dynamic world of commodities trading, gold prices have recently been a focal point, with bullion prices hovering close to one-month highs and nearing the pivotal $2,400 per ounce mark. This surge comes amidst mounting speculation that the Federal Reserve will embark on interest rate cuts as early as September, a move aimed at bolstering economic recovery amidst persistent global uncertainties.

Gold's Resilience in Current Market Dynamics

Spot gold, a reliable indicator of market sentiment, experienced a slight dip of 0.3% in Asian trading, settling at $2,384.47 per ounce. Similarly, August gold futures saw a marginal decrease of 0.2%, trading at $2,392.55 per ounce. Despite these minor corrections, the overall sentiment remains bullish, underpinned by investor optimism fueled by expectations of monetary easing by the Fed.

Broader Metals Market Movements

Alongside gold, other precious metals also displayed mixed movements. Platinum futures declined by 0.6% to $1,039.25 per ounce, reflecting varied investor sentiment within the sector. Silver futures followed suit with a 1% drop to $31.370 per ounce, illustrating divergent market dynamics in the precious metals arena.

Impact of Dollar Weakness on Metal Prices

A significant factor influencing these movements was the weakening of the US dollar, which hit a near one-month low. The inverse relationship between the dollar and commodity prices was evident as the dollar's depreciation bolstered demand for commodities priced in USD, including gold and silver.

Copper's Surprising Rally

Contrary to the downward trend in precious metals, copper futures on the London Metal Exchange surged by 1% to $9,983.0 per ton. This unexpected rally underscores copper's critical role as an industrial metal, influenced by global economic indicators and infrastructure developments.

Market Outlook and Strategic Considerations

Looking ahead, market participants are closely monitoring upcoming economic data releases and Federal Reserve announcements for further clues on interest rate adjustments. The prospect of lower interest rates typically supports non-interest-bearing assets like gold, enhancing its appeal as a safe-haven investment during uncertain economic times.

Stay Informed with Spectra Global Ltd

For comprehensive insights into market trends, strategic trading opportunities, and expert analysis on commodities and forex trading, visit Spectra Global Ltd. Our platform equips traders with the tools and information needed to navigate volatile markets effectively.

#GoldPrices#FederalReserve#InterestRateCuts#Commodities#MarketAnalysis#PreciousMetals#Copper#Silver#Platinum#TradingInsights#MarketOutlook

2 notes

·

View notes

Text

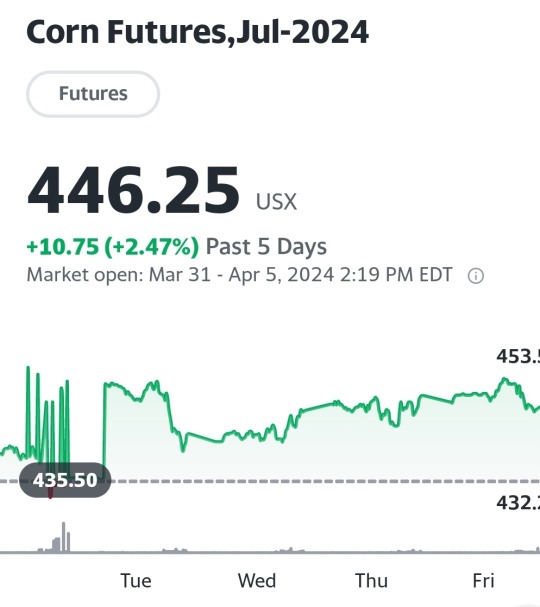

I've been periodically updating my profile photo to show the increasing price of corn 'futures'. Just cause

3 notes

·

View notes

Text

#commoditymarket#commoditytrading#commodities#stock trading#investing stocks#gold trading#trading for beginners#tradingtools#trading books#trading course#trading stocks#tradingcommunity#tradingstrategy#tradingtips#forex education#forexmarket#forextrading#forex#forexlifestyle

3 notes

·

View notes

Text

Artículos de cuero, mercadillo, Montevideo, 2022.

Being marketed to local buyers and not tourists, for the market was not in an area frequented by tourists.

8 notes

·

View notes